Market Overview

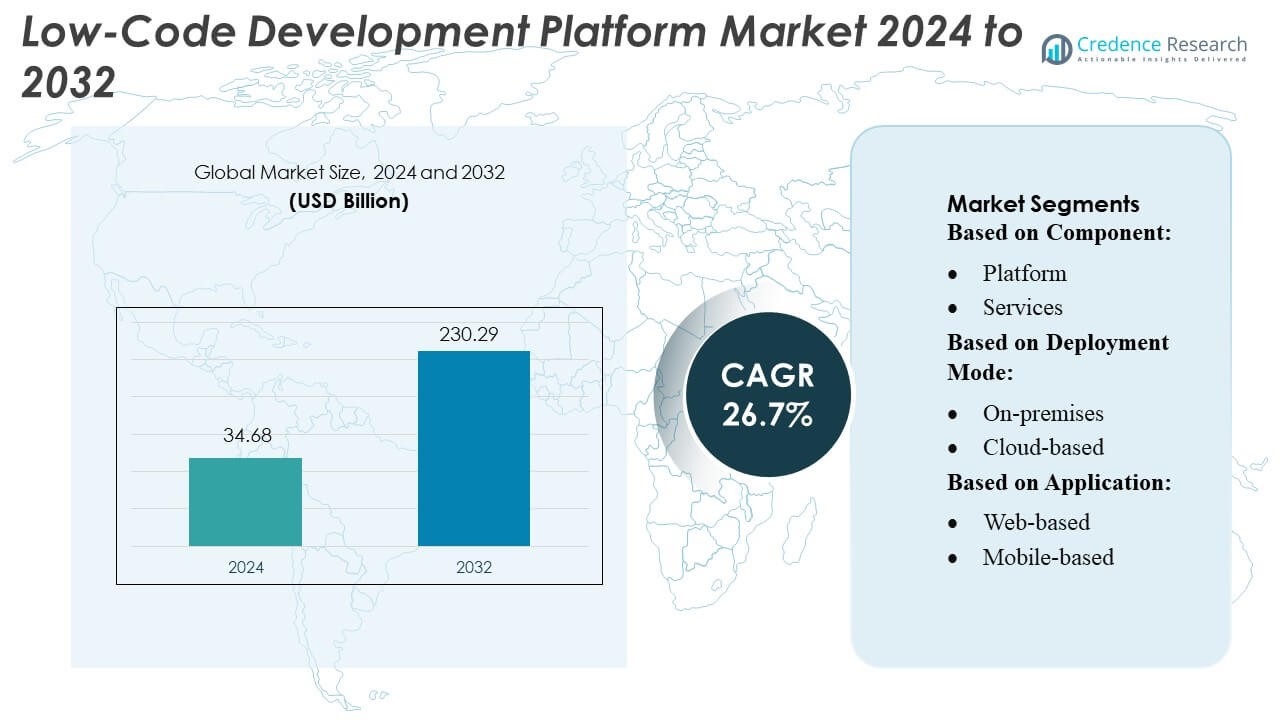

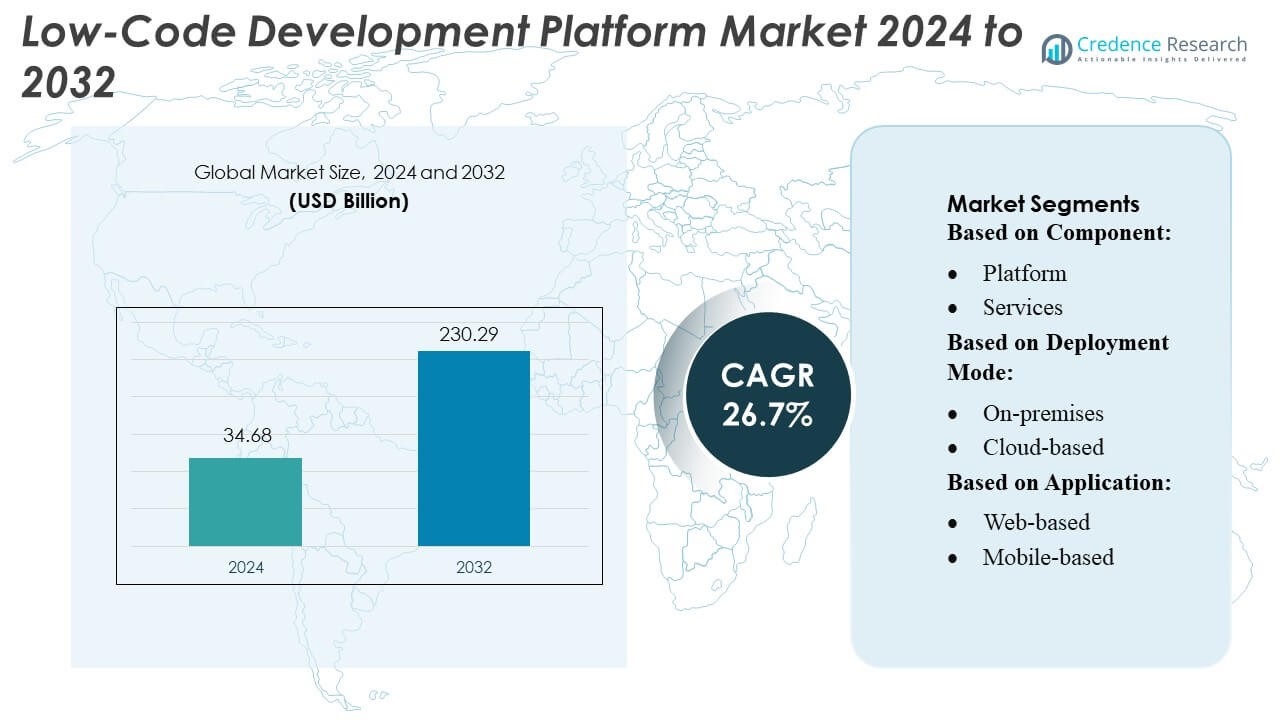

Low-Code Development Platform Market size was valued USD 34.68 billion in 2024 and is anticipated to reach USD 230.29 billion by 2032, at a CAGR of 26.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low-Code Development Platform Market Size 2024 |

USD 34.68 Billion |

| Low-Code Development Platform Market, CAGR |

26.7% |

| Low-Code Development Platform Market Size 2032 |

USD 230.29 Billion |

The Low-Code Development Platform market is dominated by leading players such as Microsoft Corporation, Salesforce.com, OutSystems, Mendix Technology BV, Oracle Corporation, ServiceNow, Pegasystems Inc., Fujitsu, LANSA INC., and Nintex UK Ltd. These companies focus on innovation, AI integration, cloud-based services, and strategic partnerships to enhance platform capabilities and meet evolving enterprise needs. Microsoft and Salesforce are particularly strong in providing scalable, user-friendly platforms with extensive ecosystem support, while OutSystems and Mendix emphasize rapid application development and cross-platform compatibility. North America emerges as the leading region, accounting for approximately 36% of the global market share, driven by early adoption of cloud technologies, robust IT infrastructure, and high demand across sectors such as finance, healthcare, and retail. The region continues to set the pace for technological advancement and enterprise digital transformation initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Low-Code Development Platform Market size was valued at USD 34.68 billion in 2024 and is expected to reach USD 230.29 billion by 2032, growing at a CAGR of 26.7% during the forecast period.

- Market growth is driven by increasing demand for rapid application development, digital transformation initiatives across enterprises, and the shortage of skilled software developers.

- Key trends include the integration of AI and automation, rising adoption of cloud-based platforms, and growing usage among SMEs for cost-effective and scalable solutions.

- The market is highly competitive, led by Microsoft, Salesforce, OutSystems, Mendix, Oracle, ServiceNow, Pegasystems, Fujitsu, LANSA, and Nintex, with a strong focus on innovation, partnerships, and cross-platform compatibility.

- North America dominates the regional market with approximately 36% share, while web-based and cloud-deployed applications are the leading segments, supported by high adoption across finance, healthcare, and retail industries.

Market Segmentation Analysis:

By Component

The platform segment dominates the Low-Code Development Platform market, accounting for approximately 55–60% of the overall component revenue. Its growth is driven by the increasing demand for rapid application development, enabling organizations to reduce coding efforts and accelerate digital transformation. Services, including consulting, integration, and support, complement platforms by ensuring seamless implementation and scalability, but their individual shares remain smaller. Adoption is particularly high among enterprises seeking to modernize legacy systems, with platform providers offering pre-built modules and drag-and-drop interfaces that significantly cut development time and costs.

- For instance, Microsoft’s low‑code offering (Microsoft Power Platform) reportedly supports over 48 million monthly active users as of 2024, and enterprises such as Rabobank have built more than 2,500 apps using the platform — a clear demonstration of widespread adoption of drag‑and‑drop, pre‑built component‑based development.

By Deployment Mode

Cloud-based deployment leads the Low-Code Development Platform market, holding a market share of nearly 65–70%, fueled by the growing preference for flexible, scalable, and cost-efficient solutions. Cloud deployment allows organizations to quickly access and manage applications without heavy infrastructure investment, supporting remote collaboration and real-time updates. On-premises deployment maintains a smaller share, primarily adopted by highly regulated industries requiring stringent data control. The rising adoption of hybrid and multi-cloud strategies further accelerates cloud-based solutions, while strong vendor support and subscription-based pricing models reinforce market expansion.

- For instance, Fujitsu recently adopted Azure Arc to unify and manage 134 previously on‑premises servers within its hybrid cloud environment, enabling streamlined governance and more efficient infrastructure operations.

By Application

Web-based applications dominate the market with an estimated share of 50–55%, driven by increasing demand for cross-platform accessibility and real-time collaboration. Mobile-based applications are gaining traction due to the surge in smartphone usage and the need for on-the-go enterprise solutions. Desktop and database applications contribute smaller portions, primarily for specialized or legacy workflows. The growth of web and mobile segments is fueled by trends in digital transformation, low-code adoption for rapid prototyping, and the need for user-friendly interfaces that reduce dependency on traditional coding skills.

Key Growth Drivers

- Increasing Demand for Rapid Application Development

The rising need for accelerated application development is a primary driver of the low-code development platform market. Enterprises are seeking solutions that reduce coding complexity and development time, enabling faster time-to-market. Low-code platforms allow non-technical users and professional developers to collaboratively build applications using visual interfaces, pre-built components, and drag-and-drop functionality. This capability is particularly critical for organizations undergoing digital transformation, as it allows them to meet dynamic business needs efficiently, improve operational agility, and reduce reliance on extensive IT teams.

- For instance, Mendix’s community of more than 300,000 developers has created over 950,000 applications across more than 4,000 enterprises in 46 countries — a clear indicator of broad adoption and developer productivity at scale.

- Digital Transformation Initiatives Across Industries

Digital transformation initiatives are fueling adoption of low-code platforms across multiple sectors, including banking, healthcare, and retail. Companies are leveraging these platforms to modernize legacy systems, integrate enterprise applications, and automate workflows. The demand for flexible, scalable, and cost-effective development tools aligns with organizational goals of operational efficiency and enhanced customer experience. Low-code solutions enable organizations to respond quickly to market trends, launch new digital services, and support omnichannel strategies, strengthening their competitive advantage in rapidly evolving business environments.

- For instance, Oracle reports that over 21 million applications have been built globally on APEX by more than 850,000 developers, demonstrating broad adoption across sectors.

- Shortage of Skilled Developers

The global shortage of skilled software developers has accelerated the adoption of low-code platforms. Organizations face challenges in recruiting and retaining experienced coding professionals, making low-code solutions an attractive alternative. These platforms reduce the need for extensive programming knowledge, allowing business users and citizen developers to contribute to application creation. By democratizing development, enterprises can bridge resource gaps, accelerate project delivery, and optimize IT budgets. This trend is particularly evident in SMEs and large organizations seeking to scale digital initiatives without over-reliance on specialized development talent.

Key Trends & Opportunities

- Integration of AI and Automation

The integration of artificial intelligence (AI) and automation into low-code platforms presents significant opportunities. AI-driven features, such as predictive analytics, intelligent workflows, and automated testing, enhance platform efficiency and decision-making capabilities. Organizations can leverage these functionalities to improve application performance, reduce human error, and accelerate development cycles. The trend is expected to drive adoption across sectors, enabling companies to innovate rapidly while reducing operational costs. Additionally, AI-powered recommendations and code suggestions empower non-technical users, expanding the platform’s usability and market reach.

- For instance, Westpac, a client of Pegasystems, has executed over 50 million ‘next-best-action’ conversations monthly across 18 channels using Pega’s AI suite. This specific case study demonstrates the capability of Pega’s platform to deliver highly personalized, AI-driven customer engagement at an immense scale within a single enterprise.

- Expansion of Cloud-Based Low-Code Solutions

Cloud deployment is a key trend shaping the low-code market. Cloud-based platforms offer scalability, flexibility, and lower infrastructure costs, enabling organizations to access applications from anywhere. The increasing adoption of hybrid and multi-cloud strategies further enhances opportunities for vendors to provide versatile solutions. Cloud-based low-code platforms also facilitate collaboration across distributed teams, improve integration with SaaS applications, and support subscription-based pricing models. As businesses prioritize remote work and digital services, cloud-based low-code adoption is expected to accelerate, driving overall market growth.

- For instance, Visual LANSA 16 (announced for release in mid‑2025) introduces native REST API support, enabling organizations to modularize legacy back‑ends and connect business logic with modern frameworks like React or Vue — facilitating hybrid cloud modernization.

- Growing Adoption in SMEs

Small and medium-sized enterprises (SMEs) are increasingly adopting low-code platforms to enhance agility and reduce development costs. With limited IT resources, SMEs benefit from visual development interfaces and pre-configured templates that streamline application creation. This segment represents a significant opportunity for vendors to tailor cost-effective, easy-to-use solutions that cater to smaller organizations’ unique requirements. Growing awareness of digital transformation benefits and the need to compete with larger enterprises are further driving adoption among SMEs, expanding the addressable market and increasing demand for low-code offerings.

Key Challenges

- Data Security and Compliance Concerns

Data security and regulatory compliance remain major challenges for low-code adoption. Organizations dealing with sensitive information, such as financial or healthcare data, must ensure platforms adhere to strict security standards. The risk of data breaches, unauthorized access, or inadequate encryption can hinder adoption, particularly in highly regulated industries. Vendors must implement robust security protocols, compliance frameworks, and role-based access controls to mitigate risks. Balancing ease of use with stringent security requirements is critical to maintaining user trust and ensuring long-term adoption.

- Integration with Legacy Systems

Integrating low-code platforms with existing legacy systems is a persistent challenge. Many enterprises rely on older applications that are not easily compatible with modern low-code solutions, requiring complex customization or middleware. Poor integration can result in data silos, operational inefficiencies, and increased project timelines. Vendors and organizations must invest in robust APIs, connectors, and integration strategies to ensure seamless interoperability. Successfully addressing this challenge is essential for maximizing the value of low-code platforms and achieving consistent enterprise-wide adoption.

Regional Analysis

North America

North America leads the Low-Code Development Platform market, holding approximately 35–38% of the global market share. The region’s growth is driven by high adoption among enterprises seeking digital transformation, strong IT infrastructure, and the presence of major platform vendors. Organizations across finance, healthcare, and retail are increasingly leveraging low-code solutions to accelerate application development and enhance operational efficiency. Additionally, the shortage of skilled developers and the demand for rapid deployment of innovative digital solutions further propel market adoption. The U.S. dominates regional growth, supported by favorable regulatory frameworks and advanced cloud-based platform offerings.

Europe

Europe accounts for an estimated 25–28% of the global low-code market, driven by the rising demand for agile digital solutions across enterprises and government sectors. Organizations in the U.K., Germany, and France are increasingly adopting low-code platforms to modernize legacy systems and improve business agility. Cloud-based deployment and strong support for digital transformation initiatives contribute to steady growth. Regulatory compliance and data privacy frameworks, such as GDPR, influence platform selection, prompting vendors to offer secure, compliant solutions. SMEs in the region are also accelerating adoption, seeking cost-effective development tools to remain competitive in evolving markets.

Asia-Pacific

Asia-Pacific is emerging as a high-growth market, capturing approximately 20–22% of the global share. Rapid digital transformation, increasing smartphone penetration, and government initiatives promoting technology adoption are key growth drivers. Countries such as China, India, and Japan are witnessing rising demand for low-code platforms to enable rapid application development and streamline business operations. Cloud-based solutions and mobile application development are particularly popular, supporting scalable, cost-effective deployments. The region’s expanding IT services sector, coupled with the shortage of skilled developers, further drives adoption among enterprises seeking to accelerate digital initiatives and improve customer engagement.

Latin America

Latin America holds roughly 8–10% of the global low-code development platform market, driven by growing digital transformation initiatives in countries like Brazil and Mexico. Organizations are adopting low-code solutions to improve operational efficiency and enhance customer experience amid limited IT resources. Cloud-based platforms are increasingly favored for their cost-effectiveness and scalability, while SMEs show strong adoption due to ease of use and low implementation costs. Market growth is supported by regional technology investments, rising awareness of agile development benefits, and efforts to modernize legacy systems. However, slower cloud infrastructure expansion and data security concerns slightly constrain growth.

Middle East & Africa

The Middle East & Africa region represents approximately 5–6% of the global market, with growth fueled by government-led digital initiatives, smart city projects, and increased enterprise adoption of cloud solutions. Countries such as the UAE, Saudi Arabia, and South Africa are leveraging low-code platforms to accelerate application development and improve public and private sector efficiency. Market expansion is supported by cloud deployment trends and demand for rapid digital transformation in industries like banking, healthcare, and logistics. Challenges such as limited technical expertise and concerns around regulatory compliance and data security moderately restrain growth, while awareness and infrastructure improvements are creating new opportunities.

Market Segmentations:

By Component:

By Deployment Mode:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Low-Code Development Platform market is highly competitive, with key players including Microsoft Corporation, Fujitsu, Salesforce.com, Inc., Mendix Technology BV, Oracle Corporation, Pegasystems Inc., LANSA INC., OutSystems, ServiceNow, and Nintex UK Ltd. The Low-Code Development Platform market is highly competitive, driven by continuous innovation and technological advancements. Vendors focus on enhancing platform capabilities through AI integration, advanced analytics, and cloud-based services to meet evolving enterprise demands. Emphasis on intuitive, user-friendly interfaces, scalability, and cross-platform compatibility enables faster application development and improved operational efficiency. Companies are also investing in industry-specific solutions, robust customer support, and regional expansion to strengthen market presence. Market growth is fueled by increasing adoption among SMEs and large enterprises seeking rapid, secure, and cost-effective digital transformation solutions across diverse sectors, fostering an environment of continuous differentiation and strategic collaboration.

Key Player Analysis

- Microsoft Corporation

- Fujitsu

- com, Inc.

- Mendix Technology BV

- Oracle Corporation

- Pegasystems Inc.

- LANSA INC.

- OutSystems

- ServiceNow

- Nintex UK Ltd

Recent Developments

- In July 2025, Wix.com and Alibaba.com did announce a strategic partnership aimed at helping digital entrepreneurs and small businesses expand their global presence. The collaboration provides several key benefits for users of both platforms.

- In June 2025, BigCommerce partnered with Feedonomics and the AI search engine Perplexity to help merchants improve their visibility in AI-driven search results. This integration, announced through a partnership with Perplexity, allows merchants to optimize product data for intelligent search experiences, which is crucial as consumer shopping habits evolve towards AI-powered discovery.

- In April 2025, WooCommerce expanded its partnership with Affirm Holdings, a U.S.-based financial technology company, to launch Affirm’s flexible payment options in the United Kingdom.

- In June 2023, Tata Consultancy Services launched TCS Dexam, a data exchange and marketplace platform on Google Cloud. The platform aims to enable secure and efficient data sharing by providing a framework for enterprises and their partners to democratize, monetize, and commercialize data, while ensuring compliance with privacy and security regulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of low-code platforms is expected to accelerate across enterprises of all sizes.

- Cloud-based deployments will continue to grow faster than on-premises solutions.

- Integration of AI and machine learning will enhance automation and application intelligence.

- Mobile and web applications will dominate new development projects.

- SMEs will increasingly leverage low-code solutions for cost-effective digital transformation.

- Demand for citizen developers and user-friendly interfaces will rise.

- Vendors will focus on industry-specific solutions to address niche requirements.

- Hybrid and multi-cloud strategies will drive platform scalability and flexibility.

- Security and compliance features will become critical differentiators for adoption.

- Strategic partnerships and acquisitions will shape competitive positioning and market expansion.