Market Overview:

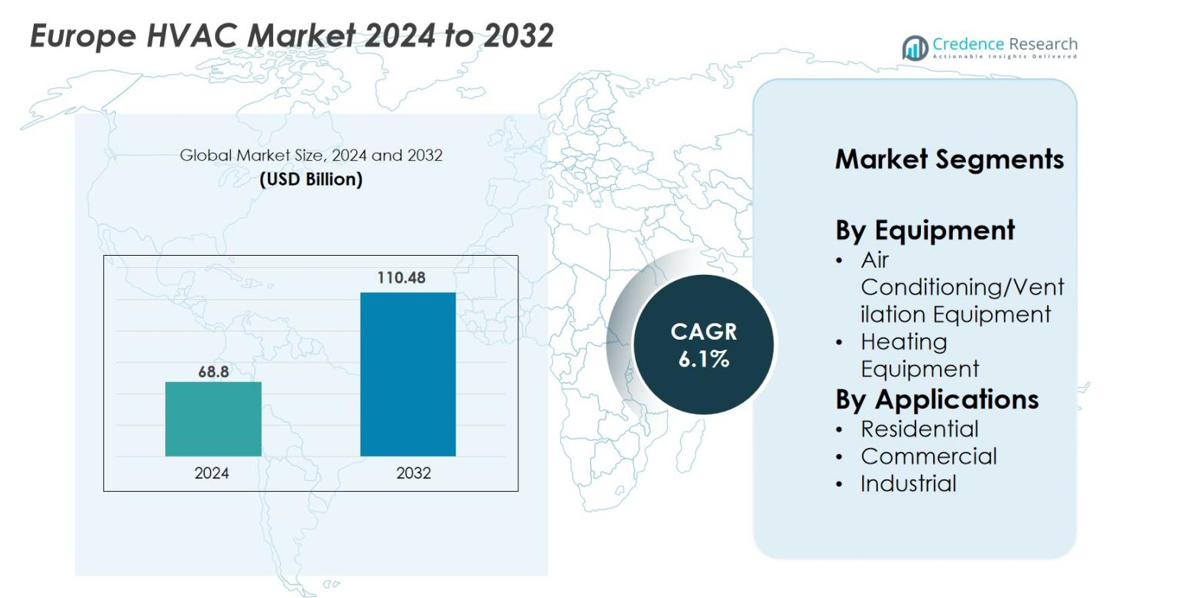

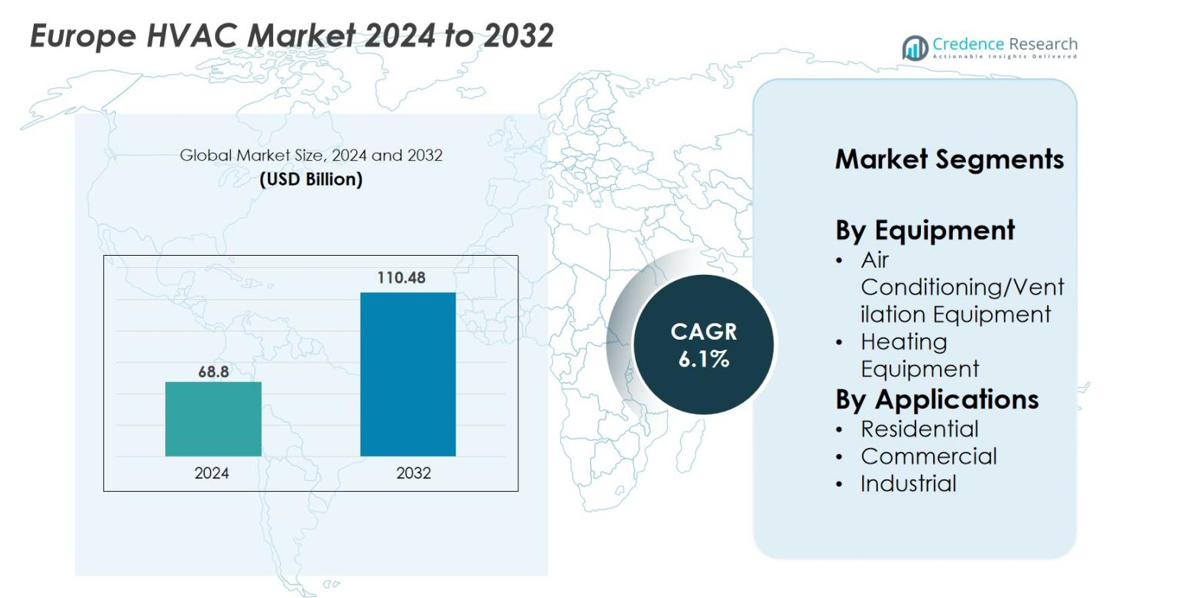

The Europe HVAC market size was valued at USD 68.8 Billion in 2024 and is anticipated to reach USD 110.48 Billion by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe HVAC Market Size 2024 |

USD 68.8 Billion |

| Europe HVAC Market, CAGR |

6.1% |

| Europe HVAC Market Size 2032 |

USD 110.48 Billion |

The Europe HVAC market is led by major players such as Daikin Industries Ltd., Robert Bosch GmbH, Carrier Global Corp., Danfoss A/S, Mitsubishi Electric Corporation, Vaillant GmbH, Alfa Laval AB, BDR Thermea Group B.V., Ariston Holding N.V., and Lennox International Inc. These companies dominate due to their advanced product portfolios, strong dealer networks, and focus on energy-efficient and smart HVAC solutions. Western Europe holds the largest regional share, commanding approximately 42% of the market in 2024, driven by stringent energy regulations, high adoption of smart technologies, and ongoing renovation and retrofit initiatives in both residential and commercial sectors.

Market Insights

- The Europe HVAC market was valued at USD 68.8 Billion in 2024 and is projected to reach USD 110.48 Billion by 2032, growing at a CAGR of 6.1% during the forecast period.

- Growing demand for energy-efficient and low-carbon HVAC technologies, driven by strict EU regulations and government incentive programs, is a major market driver across residential and commercial sectors.

- Key trends include rising adoption of smart and IoT-enabled HVAC systems, increased use of heat pumps, and integration of HVAC in smart building management systems to improve energy performance.

- The competitive landscape is led by major players like Daikin, Carrier, Robert Bosch, and Danfoss, focusing on product innovation, strategic partnerships, and sustainability initiatives to maintain market dominance.

- Western Europe holds the largest regional share at approximately 42%, while Air Conditioning/Ventilation Equipment leads with a 60% share in the equipment segment, followed by the Commercial application segment commanding around 40% of the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Equipment

The Europe HVAC market is primarily divided into two key equipment segments: Air Conditioning/Ventilation Equipment and Heating Equipment. Among these, Air Conditioning/Ventilation Equipment holds the dominant share, accounting for approximately 60% of the market in 2024. This dominance is driven by the growing demand for energy-efficient cooling solutions, especially in commercial and residential spaces. Factors such as increasing urbanization, rising temperatures due to climate change, and the need for improved indoor air quality are key drivers. Innovations in smart HVAC systems and air purification technologies are further accelerating this growth.

- For instance, Daikin Industries introduced its VRV 5 Heat Recovery system featuring R-32 refrigerant, capable of offering seasonal energy efficiency ratios (SEER) exceeding 8.5 and integrating up to 64 indoor units with precise individual control using advanced sensors

By Applications

The European HVAC market is segmented by applications, including Residential, Commercial, and Industrial. The Commercial segment leads the market with a share of around 40% in 2024. This growth is driven by the expansion of office buildings, retail spaces, and hospitality industries, which require advanced HVAC systems for maintaining optimal temperature and air quality. Additionally, the increasing focus on sustainability and energy efficiency in commercial buildings has led to the adoption of smarter, greener HVAC solutions, further propelling the demand in this segment.

- For instance, Siemens supplied its Desigo CC building management platform to The Squaire office complex near Frankfurt Airport, integrating control of more than 70,000 data points across HVAC, lighting, and safety systems to optimize indoor comfort and energy performance.

Key Growth Drivers

Rising Demand for Energy-Efficient HVAC Systems

The Europe HVAC market is significantly driven by the increasing preference for energy-efficient and environmentally sustainable systems. Government regulations such as the EU Ecodesign Directive and Energy Performance of Buildings Directive (EPBD) are encouraging the adoption of high-efficiency equipment with reduced emissions. This trend is further supported by incentives and subsidies promoting the use of renewable-based heating and cooling solutions, including heat pumps and district heating systems. Consumers are also becoming more aware of energy savings and operational cost reductions, reinforcing the shift towards advanced, eco-friendly HVAC technologies. Large-scale commercial buildings, smart homes, and infrastructure projects are increasingly integrating these solutions to meet ESG goals, creating sustained demand across the region.

- For instance, Viessmann’s Vitocal 350-A air source heat pumhas achieved a Coefficient of Performance (COP) of up to 4.4 at a 35°C flow temperature (A7/W35 conditions), enabling users to generate over four kilowatt-hours of heat per kilowatt-hour of electricity consumed under these specific test conditions

Urbanization and Infrastructure Development

Urbanization and extensive infrastructure development across Europe, especially in countries like Germany, France, and the UK, are bolstering the HVAC market. New commercial and residential buildings are incorporating modern HVAC systems as standard components to ensure thermal comfort and regulatory compliance. The rise in multi-story buildings, data centers, and healthcare facilities has created a strong demand for centralized and integrated HVAC systems. Retrofit projects in older buildings to meet updated energy efficiency targets also contribute significantly to market growth. Investments in smart cities, urban redevelopment programs, and building automation are further enhancing the need for innovative HVAC solutions that integrate seamlessly with existing and new structures.

- For instance, Mitsubishi Electric supplied its Hybrid VRF (R2 series) system to the University of Hull’s Allam Medical Building in England, delivering simultaneous heating and cooling with a combined capacity of 720 kilowatts across 5,400 square meters.

Growth of Smart HVAC Technologies

The rapid adoption of smart HVAC systems represents a major growth driver in the European market. With advancements in IoT, AI, and cloud computing, HVAC manufacturers are offering intelligent solutions that allow users to remotely monitor, control, and optimize energy use. Features such as predictive maintenance, adaptive scheduling, and real-time energy analytics are becoming standard, improving system efficiency and lifespan. These technologies are particularly beneficial for large commercial complexes, retail spaces, and public infrastructure, enabling better performance with reduced operational costs. The integration of HVAC with smart building management systems and increased consumer preference for connected environments are accelerating this shift, offering significant opportunities for technology providers and solution integrators.

Key Trends & Opportunities

Transition to Low-Carbon and Renewable HVAC Solutions

There is a growing trend across Europe toward low-carbon HVAC systems, driven by climate goals and stricter EU emission regulations. Technologies such as heat pumps, solar-driven HVAC units, and geothermal systems are gaining traction as alternatives to fossil fuel-based systems. Heat pumps are witnessing rapid adoption due to their dual functionality and improved efficiency. Governments are supporting this shift through incentives and carbon reduction targets, leading to significant opportunities for manufacturers that offer renewable and hybrid solutions. Additionally, the development of green hydrogen and advancements in natural refrigerants are broadening the scope for sustainable HVAC technologies in both industrial and residential applications.

- For instance, Vaillant’s aroTHERM plus heat pump uses the natural refrigerant R290 with a global warming potential (GWP) of only 3, while delivering supply temperatures up to 75°C and heating capacities of up to 12 kilowatts, supporting decarbonization goals for multi-family homes and public buildings.

Increasing Integration of HVAC in Smart Buildings

The integration of HVAC systems in smart buildings is creating promising opportunities across the region. Building automation systems (BAS) that combine lighting, security, and HVAC controls are becoming more common, especially in commercial and high-end residential complexes. This integration enhances energy efficiency, provides real-time performance monitoring, and enables predictive maintenance, reducing operational disruptions. The growing popularity of smart homes equipped with voice-controlled thermostats and app-based interfaces is also driving adoption. With the EU’s focus on smart city development and connected infrastructure, the demand for IoT-enabled HVAC solutions is expected to grow, fostering significant digital transformation in the sector.

Key Challenges

High Initial Investment and Operational Costs

Despite the long-term benefits of energy-efficient HVAC systems, the high upfront cost remains a significant barrier to adoption. Advanced technologies like smart HVAC, heat pumps, and integrated building systems require substantial initial investment, which is often prohibitive without financial incentives. Additionally, installation and maintenance costs are relatively high due to the need for specialized equipment and skilled labor. These financial constraints hinder market penetration in developing or cost-sensitive regions. The lack of awareness and limited financing schemes further exacerbate the challenge, making affordability a key issue for wider adoption in the HVAC market.

Regulatory Complexity and Compliance Requirements

The regulatory landscape for HVAC systems in Europe is highly complex and varies across countries, posing challenges for manufacturers and system integrators. Compliance with energy efficiency standards, refrigerant phase-out policies, and safety requirements demands constant adaptation and redesign. For international companies, navigating these regulatory differences increases operational burden and costs. Additionally, frequent updates in policies aimed at reducing greenhouse gas emissions require ongoing technological upgrades, impacting research and development timelines. This regulatory uncertainty can hinder innovation and delay product launches, making it difficult for companies to maintain competitiveness while ensuring compliance.

Regional Analysis

Western Europe

Western Europe dominates the Europe HVAC market, accounting for 42% of the total share in 2024. Key markets such as Germany, France, and the UK lead due to robust infrastructure, stringent energy regulations, and a growing demand for energy-efficient systems. These countries are rapidly adopting advanced HVAC technologies, including heat pumps and smart controls, supported by strong economic conditions and government incentives. The commercial sector, particularly office and retail spaces, drives significant installations. Additionally, the renovation of aging buildings to comply with carbon neutrality goals further stimulates growth across this region.

Northern Europe

Northern Europe holds 18% of the Europe HVAC market share in 2024. The region benefits from widespread adoption of sustainable technologies due to harsh climatic conditions and strong environmental policies. Countries like Sweden, Norway, and Denmark lead in deploying renewable energy-based heating solutions, particularly geothermal and air-source heat pumps. Government subsidies and regulatory initiatives to cut emissions drive major retrofit and replacement projects. The residential sector demonstrates high usage of underfloor heating and smart HVAC systems. Northern Europe’s commitment to sustainability and digitalization positions it as a fast-evolving market for innovative HVAC solutions.

Southern Europe

Southern Europe commands 22% of the market share in 2024, driven largely by the high demand for cooling systems in hot climates. Countries such as Spain, Italy, and Greece experience increasing HVAC installations, particularly air conditioning and ventilation systems, to combat rising temperatures. Commercial spaces and hospitality sectors are key contributors, due to growing tourism and urbanization. Energy-efficient regulation adoption is slower compared to Northern and Western Europe, but government-led incentive programs continue to boost the adoption of modern systems. The region is also witnessing rising interest in hybrid HVAC solutions compatible with renewable energy.

Eastern Europe

Eastern Europe holds 18% of the HVAC market share in 2024 and is poised for steady growth due to expanding construction and industrial sectors. Countries such as Poland, Czech Republic, and Romania are witnessing increased investments in commercial and residential infrastructure. The HVAC market here is characterized by a mix of traditional systems and emerging adoption of energy-efficient solutions. EU-backed development funds and modernization initiatives are driving improvements in building energy performance. However, cost sensitivities and regulatory inconsistencies present some challenges. The region offers promising opportunities for manufacturers offering affordable, efficient, and scalable HVAC systems.

Market Segmentations

By Equipment

- Air Conditioning/Ventilation Equipment

- Heating Equipment

By Applications

- Residential

- Commercial

- Industrial

By Geography

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

Competitive Landscape

The competitive landscape of the Europe HVAC market is highly dynamic, featuring a mix of established global leaders and strong regional players. Key companies such as Daikin Industries, Robert Bosch GmbH, Carrier Global Corp., Danfoss A/S, and Mitsubishi Electric Corporation dominate the market with comprehensive product portfolios, advanced technology offerings, and extensive distribution networks. These players focus on developing energy-efficient and smart HVAC solutions tailored to regional regulatory standards and sustainability goals. Additionally, companies like Vaillant GmbH, BDR Thermea Group, Ariston Holding N.V., and Alfa Laval AB contribute significantly through their expertise in heating and renewable-based systems. Strategic initiatives such as mergers, acquisitions, partnerships, and R&D investments are common, aimed at enhancing market presence and product innovation. For example, the integration of IoT and AI in HVAC solutions and the shift towards low-carbon equipment have accelerated competition. Regional firms also leverage government incentives and sustainability trends to expand their footprint in residential and commercial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Voltalis and Univers announced a partnership to expand smart energy flexibility solutions for commercial buildings across Europe (targeting 10-15 % cost savings).

- In June 2025, Haier Europe Appliances Holding BV (part of Haier HVAC) completed the acquisition of KLIMA Kft in Hungary (closing on June 3 2025) to expand its presence in Central & Eastern Europe.

- In February 2025, Midea Group completed the acquisition of ARBONIA climate (a division of ARBONIA AG) for an enterprise value of €760 million

Report Coverage

The research report offers an in-depth analysis based on Equipment, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for energy-efficient HVAC systems will continue to rise in response to stricter EU regulations on emissions.

- Heat pumps and renewable-powered heating solutions will become increasingly popular across residential and commercial sectors.

- Smart HVAC systems with IoT and AI capabilities will drive market transformation and operational efficiency.

- Retrofitting of older buildings to meet energy standards will generate new opportunities for HVAC upgrades.

- Integration with smart building management systems will make HVAC systems more intelligent and responsive.

- Manufacturers will focus on natural refrigerants and low-GWP alternatives to comply with environmental policies.

- Growth in urbanization and infrastructure development will support expansion in developing parts of Eastern Europe.

- Demand for centralized HVAC systems in data centers and industrial facilities will increase.

- Government incentives and funding for decarbonization projects will accelerate the adoption of sustainable HVAC technologies.

- Competition will intensify as global and regional players invest in R&D and expand their footprint across Europe.