Market Overview

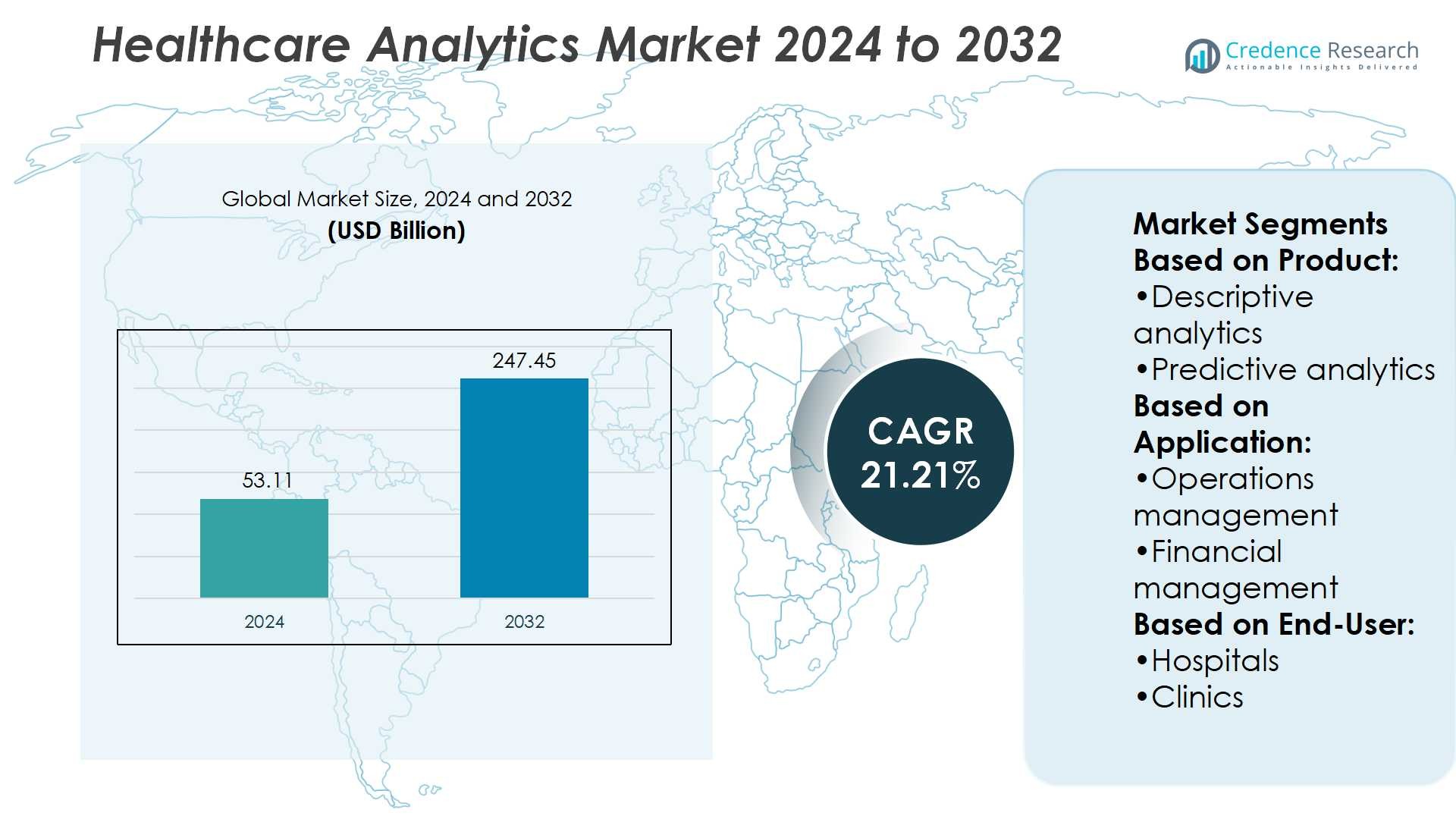

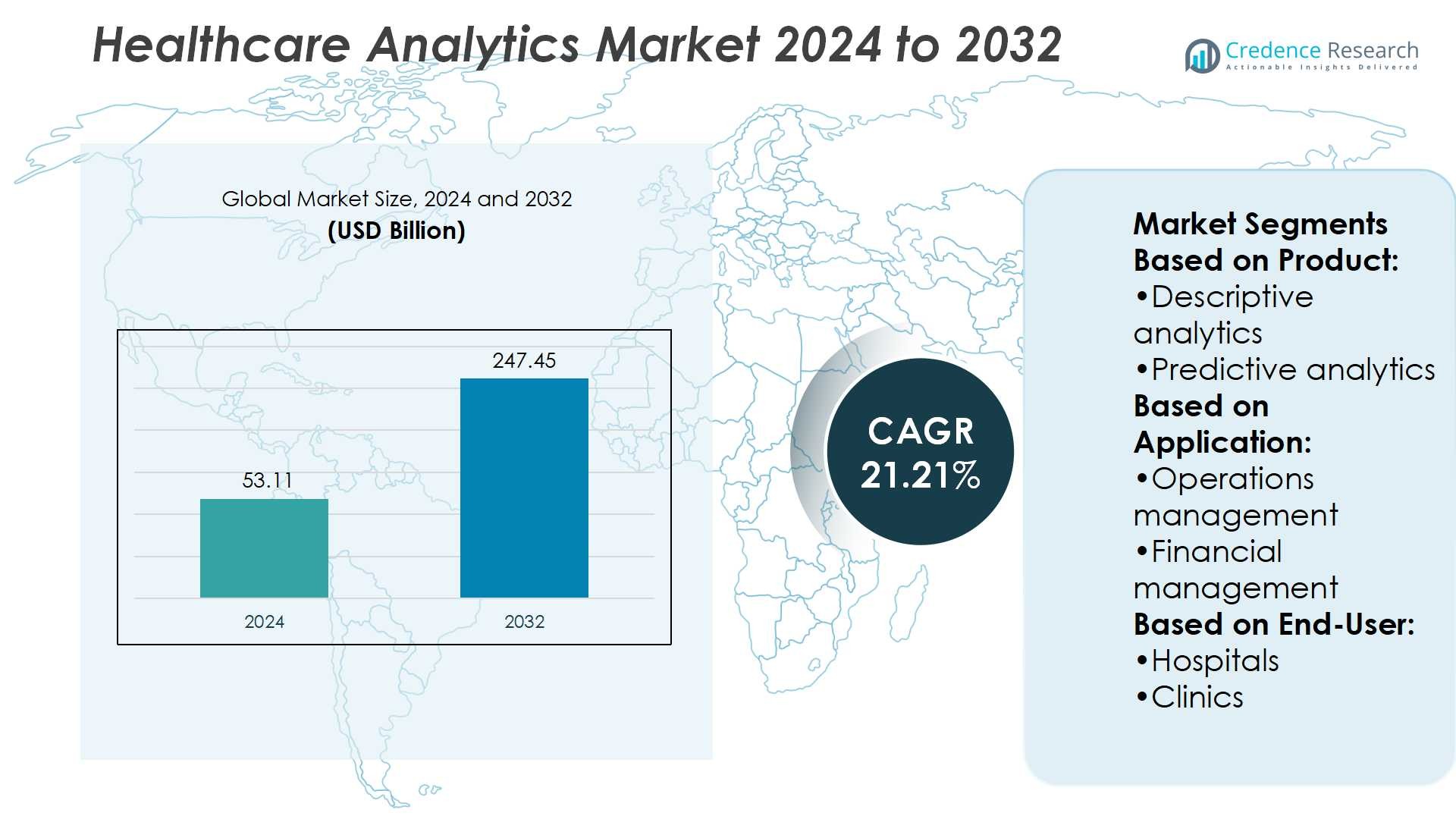

Healthcare Analytics Market size was valued at USD 53.11 billion in 2024 and is anticipated to reach USD 247.45 billion by 2032, at a CAGR of 21.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Analytics Market Size 2024 |

USD 53.11 Billion |

| Healthcare Analytics Market, CAGR |

21.21% |

| Healthcare Analytics Market Size 2032 |

USD 247.45 Billion |

The Healthcare Analytics Market grows through strong drivers such as rising demand for value-based care, cost optimization, and the integration of electronic health records with big data platforms. It supports providers in improving patient outcomes, streamlining operations, and enhancing financial performance. Predictive and prescriptive analytics enable proactive care delivery, fraud detection, and personalized treatment strategies. Key trends shaping the market include the adoption of artificial intelligence, real-time analytics, cloud-based platforms, and the rise of precision medicine. Growing focus on population health management, data security, and regulatory compliance further strengthens the role of analytics in transforming healthcare delivery worldwide.

The Healthcare Analytics Market shows strong geographical presence, with North America leading due to advanced digital health infrastructure, followed by Europe driven by regulatory support and interoperability initiatives. Asia Pacific demonstrates rapid growth fueled by large patient populations and government-led digitization programs, while Latin America and Middle East & Africa adopt analytics at a gradual pace. Key players shaping the market include McKesson Corporation, IBM Corporation, OptumHealth, Oracle (Cerner) Corporation, Allscripts Healthcare Solution Inc., and Athenahealth, Inc.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Healthcare Analytics Market size was USD 53.11 billion in 2024 and will reach USD 247.45 billion by 2032 at a CAGR of 21.21%.

- Rising demand for value-based care, cost optimization, and integration of electronic health records drive market expansion.

- Predictive and prescriptive analytics support proactive care, fraud detection, and personalized treatment approaches.

- Artificial intelligence, cloud-based platforms, real-time analytics, and precision medicine adoption define major trends.

- Competition centers on innovation, scalability, interoperability, and partnerships across providers, payers, and digital health ecosystems.

- High implementation costs, data fragmentation, and strict regulatory requirements remain restraints to broader adoption.

- North America leads the market, Europe follows with regulatory support, Asia Pacific shows rapid growth, while Latin America and Middle East & Africa expand steadily.

Market Drivers

Rising Emphasis on Value-Based Care and Cost Optimization

Healthcare Analytics Market benefits from the global transition to value-based care. Healthcare systems focus on improving patient outcomes while reducing expenses. Payers and providers rely on analytics to identify cost drivers and optimize resource allocation. It enables hospitals to forecast patient admissions and streamline treatment pathways. The approach strengthens financial performance while maintaining clinical quality. Growing adoption of accountable care models further reinforces the demand for analytics-driven solutions.

- For instance,The database is fueled by the Oracle Learning Health Network, which includes a diverse community of 176 health systems and growing.The expansion of the database is a continuous process.

Expanding Use of Predictive and Prescriptive Analytics

Predictive and prescriptive capabilities drive wider application of healthcare analytics market across the sector. Organizations apply these tools to anticipate disease outbreaks, reduce hospital readmissions, and guide personalized treatment. It supports proactive care delivery by leveraging historical and real-time data. Prescriptive models help clinicians recommend evidence-based therapies aligned with patient profiles. Insurers also deploy analytics to detect fraudulent claims with higher accuracy. The approach accelerates clinical decision-making and enhances operational efficiency.

- For instance, in Q4 2023, CPSI’s revenue cycle management (RCM) segment brought in 51.0 million—representing 60.7% of its total recurring revenue—up from 45.7 million the prior year.

Integration of Big Data and Electronic Health Records (EHRs)

Healthcare Analytics Market growth is fueled by the integration of EHRs with big data platforms. Healthcare providers capture structured and unstructured data from multiple systems. It allows for comprehensive patient records that improve care coordination. Big data tools process this information to reveal hidden clinical patterns. Improved interoperability between systems ensures seamless information sharing across networks. Regulatory support for EHR adoption further accelerates analytics-driven innovations. Enhanced data access directly contributes to improved patient outcomes.

Rising Demand for Population Health Management and Remote Monitoring

Healthcare Analytics Market expands through increasing adoption of population health management. Analytics enables identification of high-risk patient groups and effective management of chronic diseases. It helps healthcare providers design preventive strategies that reduce hospital admissions. Remote monitoring technologies combined with analytics support timely interventions for patients outside clinical settings. Employers and insurers use population insights to design cost-effective health programs. Growing reliance on digital health platforms amplifies the role of analytics in improving large-scale health outcomes.

Market Trends

Increasing Adoption of Artificial Intelligence and Machine Learning in Healthcare Analytics

Healthcare Analytics Market experiences strong momentum with the integration of artificial intelligence and machine learning. These technologies support advanced pattern recognition in clinical data and enhance predictive modeling accuracy. It empowers providers to detect diseases earlier and personalize treatment pathways. Machine learning also optimizes hospital workflows, leading to shorter wait times and reduced operational costs. Pharmaceutical firms adopt AI-driven analytics to accelerate drug discovery processes. The trend demonstrates how advanced algorithms strengthen clinical and business decisions across healthcare.

- For instance, An intelligent document processing system (IDP) can significantly reduce the time required for processing healthcare documents, decreasing manual error rates through automation. Studies show that IDP can cut processing times by as much as 80% and reduce manual errors by up to 70%.

Growing Emphasis on Real-Time Data and Cloud-Based Platforms

Healthcare Analytics Market gains traction with the rising use of real-time analytics. Providers access live patient information through cloud platforms, enabling faster interventions and improved care delivery. It enhances emergency response capabilities by supporting immediate insights into patient conditions. Cloud adoption also reduces infrastructure costs for healthcare organizations. The flexibility of remote data access supports collaboration between clinicians and specialists. Real-time monitoring strengthens both clinical decision-making and operational efficiency across healthcare systems.

- For instance, McKesson’s Business Analytics (MBA) dashboard now supports 800–1,200 daily users, with 40,000–60,000 unique users over 12 months, providing operations insights for Medical-Surgical clients.

Expansion of Personalized and Precision Medicine Through Analytics

Healthcare Analytics Market continues to advance with the rise of personalized medicine. Data-driven platforms help analyze genetic, lifestyle, and clinical information for tailored treatment. It ensures patients receive therapies best suited to their unique profiles. Precision medicine adoption relies heavily on advanced analytics to validate outcomes. Pharmaceutical firms use these tools to target patient groups with higher treatment response rates. The movement toward customization demonstrates a long-term trend that reshapes healthcare delivery worldwide.

Rising Importance of Data Security and Regulatory Compliance in Analytics Platforms

Healthcare Analytics Market growth aligns with increasing focus on data security and compliance. Healthcare organizations face stringent requirements under HIPAA, GDPR, and regional frameworks. It drives investment in secure platforms that protect sensitive patient data. Advanced encryption, blockchain, and multi-factor authentication support greater trust in analytics tools. Compliance-focused systems also reduce the risk of penalties and reputational damage. Strong governance frameworks ensure analytics adoption aligns with ethical and legal standards.

Market Challenges Analysis

Data Fragmentation, Integration Barriers, and High Implementation Costs

Healthcare Analytics Market faces persistent challenges from fragmented data sources across hospitals, insurers, and laboratories. Multiple formats and legacy systems make integration complex and resource-intensive. It limits the ability to create a unified patient record and reduces analytics accuracy. High upfront costs for software, infrastructure, and skilled personnel add financial strain on smaller providers. Many organizations delay adoption due to uncertainty over return on investment. Limited interoperability standards across regions further restrict smooth data exchange and scalability.

Privacy Concerns, Skills Shortage, and Resistance to Change

Healthcare Analytics Market growth is constrained by strict privacy regulations and cybersecurity risks. Organizations must navigate compliance with HIPAA, GDPR, and similar frameworks, which increases operational complexity. It demands continuous investment in security measures to safeguard sensitive health data. A shortage of professionals skilled in analytics and data science slows deployment of advanced tools. Cultural resistance from clinicians reluctant to rely on analytics-based decisions also creates adoption barriers. Balancing innovation with trust and compliance remains a key challenge for industry stakeholders.

Market Opportunities

Expanding Role of Advanced Analytics in Population Health and Preventive Care

Healthcare Analytics Market presents strong opportunities through population health management and preventive care strategies. Analytics platforms identify high-risk groups and predict chronic disease progression. It enables providers to design targeted interventions that lower hospitalization rates and reduce treatment costs. Governments and insurers increasingly invest in analytics to support large-scale health initiatives. Predictive models also help improve vaccination planning and resource distribution. Growing focus on preventive care ensures long-term opportunities for analytics solutions.

Integration with Digital Health, Remote Monitoring, and Telemedicine Platforms

Healthcare Analytics Market benefits from the global adoption of digital health ecosystems. Remote monitoring tools and telemedicine platforms generate real-time patient data that feeds into analytics systems. It strengthens clinical decision-making by offering timely insights into patient conditions outside traditional settings. Integration with wearable devices supports personalized care delivery and improved patient engagement. Demand for home-based care models further accelerates analytics adoption. Expanding digital health infrastructure opens new avenues for growth across healthcare ecosystems.

Market Segmentation Analysis:

By Product

Healthcare Analytics Market is segmented by product into descriptive analytics, predictive analytics, and prescriptive analytics. Descriptive analytics holds significant share by enabling providers to review historical data and measure outcomes. It helps track patient performance metrics and operational efficiency. Predictive analytics drives rapid adoption by supporting disease forecasting, readmission reduction, and risk assessment. It leverages algorithms and statistical models to guide early interventions. Prescriptive analytics continues to expand with tools that recommend optimal treatment strategies and resource allocation. Its role in precision medicine and personalized care strengthens its long-term growth potential.

- For instance, Optum Labs’ overall real-world data assets contain de-identified, longitudinal records spanning more than 300 million lives. These assets, which are updated over time, include claims, EMRs, socioeconomic data, and Medicare FFS information, supporting research and analytics.

By Application

Healthcare Analytics Market demonstrates diverse applications across operation management, financial, population health, and clinical functions. Operation management uses analytics to improve workforce planning, reduce wait times, and enhance hospital efficiency. It ensures better utilization of resources across departments. Financial applications focus on fraud detection, revenue cycle optimization, and cost management. Population health analytics plays a critical role in identifying high-risk groups and planning preventive strategies. Clinical applications deliver value by supporting evidence-based treatment, diagnostic accuracy, and real-time patient monitoring. Expanding demand across all functions highlights the versatility of analytics in healthcare operations.

- For instance, Health Catalyst explicitly states in its publications that its cloud-based DOS derives data from 125 million patients served by over 5,000 clinics and 500 hospitals.

By End-User

Healthcare Analytics Market adoption is driven by hospitals and clinics as primary end-users. Hospitals lead the segment due to their need for large-scale patient data integration and outcome tracking. It helps improve patient safety, operational productivity, and compliance with regulatory standards. Clinics adopt analytics at a smaller scale, focusing on improving diagnostic accuracy and personalized treatment. Their demand continues to grow with the rise of digital health platforms and cloud-based solutions. End-user adoption highlights the importance of analytics in strengthening both large and mid-sized healthcare organizations. Together, hospitals and clinics drive consistent expansion of analytics across the healthcare ecosystem.

Segments:

Based on Product:

- Descriptive analytics

- Predictive analytics

Based on Application:

- Operations management

- Financial management

Based on End-User:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America held the 48.0% share in 2024, making it the largest regional market. The region benefits from widespread electronic health record (EHR) adoption and strong investments in advanced analytics. It applies predictive models for patient risk management, fraud detection, and operational efficiency. Hospitals use analytics to improve workflows and patient safety. Insurers deploy tools to control costs and design value-based health plans. The Healthcare Analytics Market in North America continues to expand with a mature digital health ecosystem and advanced infrastructure.

Europe

Europe accounted for 23.0% share in 2024, supported by government-backed digital health policies and interoperability frameworks. The European Health Data Space (EHDS) and regional data protection regulations push providers to adopt secure analytics solutions. Hospitals in Germany, the UK, and France use analytics for clinical trials, treatment outcomes, and financial management. Insurers leverage analytics to streamline reimbursement and claims. Academic and research centers integrate big data tools for precision medicine initiatives. The Healthcare Analytics Market in Europe grows steadily under strong regulatory and innovation-driven support.

Asia Pacific

Asia Pacific represented 21.7% share in 2024, with strong momentum from digital health programs in China, India, and Japan. Governments invest heavily in electronic medical record (EMR) rollouts and national health databases. Providers use analytics to track large patient populations and improve resource allocation. Insurers adopt cloud-based analytics for claims and fraud detection. The region is witnessing a rapid shift toward telemedicine and remote monitoring, supported by analytics platforms. The Healthcare Analytics Market in Asia Pacific shows high growth potential due to expanding healthcare infrastructure and digitization.

Latin America

Latin America held 3.0% share in 2024, with Brazil and Mexico leading adoption. Hospitals focus on operational analytics to reduce wait times and improve efficiency. Private networks use analytics to detect fraud and manage claims effectively. Public healthcare systems pilot population health registries in urban areas. Limited resources drive demand for affordable, cloud-based solutions. The Healthcare Analytics Market in Latin America grows steadily, though slower than other regions, due to infrastructure challenges.

Middle East & Africa

Middle East & Africa captured 1.6% share in 2024, reflecting early adoption stages. Gulf countries like the UAE and Saudi Arabia lead investments in healthcare modernization and data platforms. Hospitals use analytics to improve patient flow, operational planning, and clinical performance. National governments focus on building secure data ecosystems to support analytics adoption. Academic centers collaborate on AI-driven healthcare initiatives. The Healthcare Analytics Market in Middle East & Africa expands gradually, supported by hospital upgrades and national digital health strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Oracle (Cerner) Corporation

- Change Healthcare

- OptumHealth, Inc.

- Computer Programs and Systems, Inc.

- McKesson Corporation

- Inovalon Holding Inc

- IBM Corporation

- Tenet Healthcare Corporation

- Allscripts Healthcare Solution Inc.

- Athenahealth, Inc.

Competitive Analysis

The Healthcare Analytics Market players include McKesson Corporation, IBM Corporation, OptumHealth, Inc., Allscripts Healthcare Solution Inc., Oracle (Cerner) Corporation, Athenahealth, Inc., Inovalon Holding Inc., Computer Programs and Systems, Inc., Change Healthcare, and Tenet Healthcare Corporation. The Healthcare Analytics Market is defined by strong competition and rapid technological advancements. Companies focus on delivering solutions that enhance clinical decision-making, improve operational efficiency, and optimize financial performance. Market participants invest heavily in artificial intelligence, machine learning, and cloud-based platforms to strengthen predictive and prescriptive analytics capabilities. Interoperability and data security remain critical areas of development, with firms aligning products to meet regulatory frameworks and privacy standards. The growing demand for population health management, value-based care models, and real-time patient monitoring continues to shape competitive dynamics. Vendors differentiate through innovation, scalability, and the ability to integrate seamlessly with electronic health records and digital health ecosystems. The emphasis on long-term partnerships with providers, payers, and governments highlights the market’s strategic focus on sustainable adoption and measurable outcomes.

Recent Developments

- In June 2025, Kythera Labs announced strategic partnerships with healthcare analytics firms Preverity and GAM to provide advanced data integration, de-identification, and data mastering services through its Wayfinder Platform.

- In December 2024, Tuva Health launched an analytics platform for healthcare industry. This platform is an open-source platform that is designed to improve healthcare operations.

- In October 2024, Growth.Health launched G1 Healthcare Data and Analytics Platform. This is a SaaS platform designed for healthcare companies to streamline numerous tasks in real-time.

- In May 2024, Health Catalyst launched Health Catalyst Ignite. Health Catalyst Ignite is a healthcare data and analytics platform that enhances several operations in healthcare sector.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business,product offerings, investments, revenue streams, and key applications. Additionally, the reportincludes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with greater adoption of AI and machine learning in healthcare.

- Predictive analytics will guide early disease detection and personalized treatment plans.

- Cloud-based platforms will dominate due to scalability and cost efficiency.

- Population health management will grow as providers focus on preventive care.

- Real-time analytics will enhance clinical decision-making and emergency response.

- Data security and compliance solutions will remain a top investment priority.

- Remote monitoring and telehealth platforms will drive demand for integrated analytics.

- Interoperability improvements will strengthen data sharing across healthcare networks.

- Financial analytics will gain traction for fraud detection and revenue optimization.

- Global adoption will accelerate as governments support digital health initiatives.