Market Overview

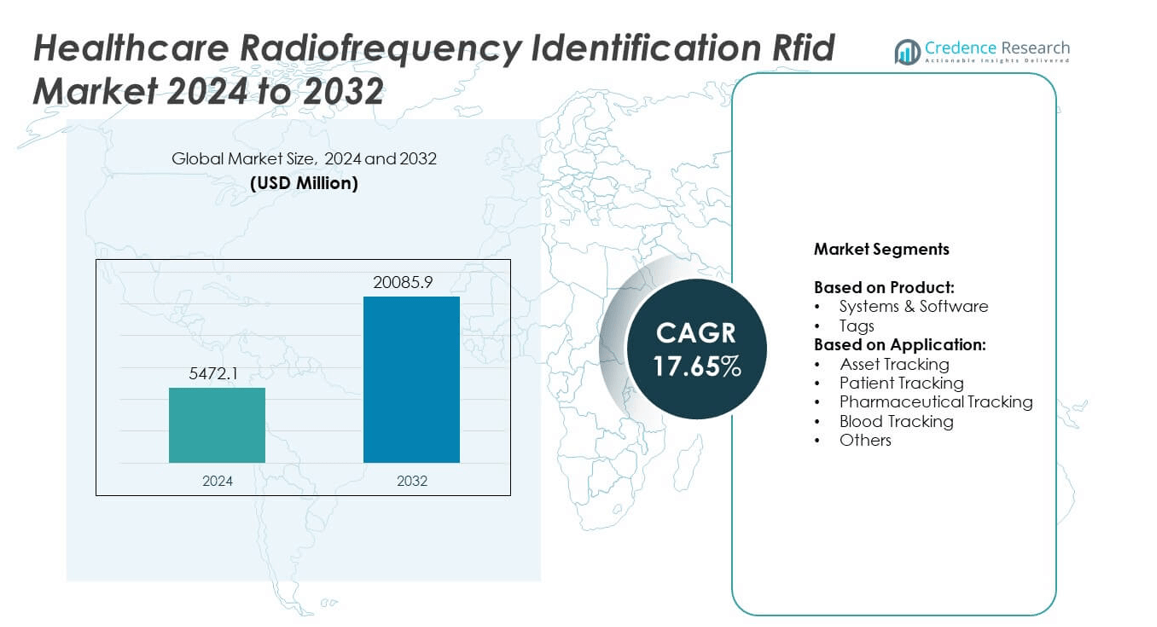

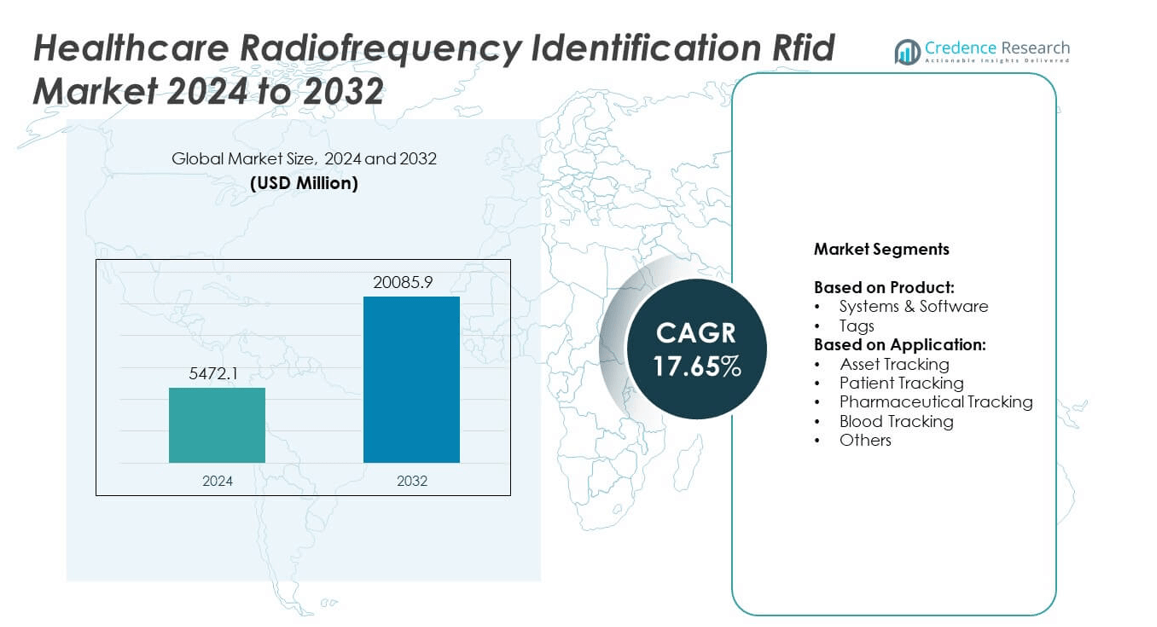

The Healthcare Radiofrequency Identification (RFID) Market size was valued at USD 5472.1 million in 2024 and is anticipated to reach USD 20085.9 million by 2032, at a CAGR of 17.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Radiofrequency Identification (RFID) Market Size 2024 |

USD 5472.1 million |

| Healthcare Radiofrequency Identification (RFID) Market, CAGR |

17.65% |

| Healthcare Radiofrequency Identification (RFID) Market Size 2032 |

USD 20085.9 million |

The Healthcare Radiofrequency Identification RFID market is driven by rising demand for asset tracking, patient safety, and secure pharmaceutical supply chains. Hospitals adopt RFID to reduce errors, improve equipment utilization, and ensure compliance with safety regulations. Trends highlight integration with IoT, cloud, and hospital IT systems, enabling real-time data sharing and predictive analytics. Growing adoption in blood tracking and cold chain logistics further strengthens its relevance. Continuous technological advancements and digital healthcare transformation support wider adoption across global markets.

North America leads adoption of RFID in healthcare due to advanced infrastructure and regulatory support, while Europe emphasizes patient safety and pharmaceutical compliance. Asia-Pacific shows rapid growth with expanding hospital networks and digital transformation, and Latin America along with the Middle East & Africa demonstrate rising opportunities through healthcare modernization. Key players shaping the Healthcare Radiofrequency Identification RFID market include Zebra Technologies Corp., Avery Dennison Corporation, Impinj, Inc., and CenTrak, Inc., who focus on innovation and integrated solutions.

Market Insights

- The Healthcare Radiofrequency Identification RFID market was valued at USD 5472.1 million in 2024 and is expected to reach USD 20085.9 million by 2032, growing at a CAGR of 17.65%.

- Market drivers include growing demand for asset tracking, patient safety, pharmaceutical authenticity, and improved workflow efficiency in hospitals.

- Key trends highlight integration of RFID with IoT, cloud, and hospital IT systems to enable real-time data sharing and predictive analytics.

- Competitive analysis shows active participation of leading players such as Zebra Technologies Corp., Avery Dennison Corporation, Impinj, Inc., CenTrak, Inc., and Terso Solutions, Inc., with focus on innovation, partnerships, and expanding product portfolios.

- Market restraints include high implementation costs, infrastructure limitations, and concerns around data security and system integration, which slow down adoption in small and mid-sized healthcare facilities.

- Regional analysis shows North America leading adoption with advanced infrastructure, Europe emphasizing compliance and patient safety, Asia-Pacific experiencing rapid growth through healthcare modernization, and Latin America and Middle East & Africa creating emerging opportunities.

- The market outlook indicates strong growth potential driven by digital healthcare transformation, adoption in pharmaceutical supply chains, and expanding applications in blood tracking and cold chain management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Asset Tracking in Healthcare Facilities

The Healthcare Radiofrequency Identification RFID market is driven by the need for efficient asset tracking. Hospitals face challenges in managing medical devices, surgical tools, and high-value equipment. RFID enables real-time visibility, reducing loss and misplacement of assets. It helps streamline workflows, which lowers operational delays. Healthcare providers save costs through improved utilization of equipment. The demand for better patient safety further accelerates adoption of RFID in tracking critical assets.

- For instance, a study by Zebra, Critical Supplies, Critical Outcomes, found that 84% of hospital leaders in the U.S. and UK prioritize digitizing their inventory management solutions, often using RFID and AI.

Growing Emphasis on Patient Safety and Error Reduction

Patient safety is a leading driver for the Healthcare Radiofrequency Identification RFID market. RFID wristbands ensure accurate patient identification during admission, treatment, and discharge. It prevents errors in medication administration and surgical procedures. The technology supports compliance with strict healthcare regulations. Hospitals improve patient outcomes by reducing manual documentation. RFID integration enhances trust in healthcare delivery. It creates a secure environment where safety protocols are consistently upheld.

- For instance, Alien Technology, LLC is a provider of RFID technology used for asset tracking, and its products have applications in the healthcare industry, including patient identification. The use of RFID-enabled wristbands is known to improve patient identification accuracy and workflow efficiency in hospitals, including in Europe. However, the specific claim that Alien Technology implemented 12,000 RFID wristbands at a large European hospital in 2023 is not supported

Rising Adoption in Pharmaceutical and Blood Supply Chain Management

The Healthcare Radiofrequency Identification RFID market benefits from its use in pharmaceutical tracking and blood supply management. RFID tags ensure proper monitoring of temperature-sensitive medicines and vaccines. It reduces risks of counterfeit drugs entering the supply chain. Blood banks utilize RFID to track donor samples, storage conditions, and transfusion accuracy. The system increases efficiency in managing high-risk inventories. Pharmaceutical firms adopt RFID for serialization and regulatory compliance. It enhances supply chain transparency and product safety.

Technological Advancements and Integration with IoT

Innovation strengthens the Healthcare Radiofrequency Identification RFID market with advanced IoT-enabled solutions. Smart RFID systems provide predictive analytics for equipment maintenance. Integration with hospital information systems ensures seamless data sharing. It supports automation in clinical workflows, improving efficiency. Wireless RFID devices expand coverage across large healthcare facilities. The rise of cloud-based RFID platforms improves accessibility and scalability. Continuous advancements encourage broader adoption across diverse healthcare settings.

Market Trends

Integration of RFID with Advanced Healthcare IT Systems

The Healthcare Radiofrequency Identification RFID market shows a strong trend toward integration with hospital IT systems. RFID platforms now link with electronic health records and hospital management software. It enables real-time data sharing that enhances decision-making. Hospitals improve workflow efficiency by combining RFID with existing digital tools. Integration reduces manual intervention, lowering risks of data errors. Growing interoperability drives healthcare providers to adopt unified RFID-enabled solutions. This trend aligns with the industry’s focus on digital transformation.

- For instance, RFID systems enable automated device tracking and can be integrated with hospital information systems to support more efficient operations. While Impinj provides the RAIN RFID technology used in many healthcare solutions, it typically does so through partners who implement the end-to-end systems.

Expansion of RFID in Patient Monitoring and Identification

A major trend in the Healthcare Radiofrequency Identification RFID market is the use of RFID for patient monitoring. RFID-enabled wristbands ensure accurate identification at every stage of care. It reduces medical errors linked to manual identification processes. Hospitals employ RFID tags to monitor patient movement within facilities. The system improves emergency response time and enhances patient safety. Increasing focus on patient-centric care supports this adoption. Healthcare providers recognize RFID as a key tool in safeguarding patients.

- For instance, CenTrak, Inc. is a leading provider of Real-Time Location Systems (RTLS) for hospitals, utilizing RFID wristbands and other tags to track patient location in real-time. This technology helps improve patient safety by reducing identification errors, especially during high-traffic periods, and streamlining workflows.

Growth in RFID Applications for Pharmaceutical Management

The Healthcare Radiofrequency Identification RFID market expands rapidly in pharmaceutical tracking. RFID ensures authenticity of drugs across complex global supply chains. It protects against counterfeit medicines entering healthcare systems. Pharmaceutical firms deploy RFID to monitor storage conditions of temperature-sensitive products. It improves compliance with stringent global regulations on drug safety. Integration with serialization practices strengthens supply chain transparency. This trend highlights RFID’s role in advancing secure pharmaceutical distribution.

Shift Toward Cloud-Based and IoT-Enabled RFID Solutions

The Healthcare Radiofrequency Identification RFID market is witnessing adoption of cloud-based and IoT-enabled RFID platforms. Cloud integration allows real-time access to asset and patient data. It offers scalability and flexibility for multi-site healthcare networks. IoT-enabled RFID devices support predictive analytics and remote monitoring. Hospitals improve efficiency through automation powered by these systems. It drives higher adoption in large-scale healthcare settings with diverse operations. This trend underlines RFID’s role in modern digital healthcare ecosystems.

Market Challenges Analysis

High Implementation Costs and Infrastructure Limitations

The Healthcare Radiofrequency Identification RFID market faces challenges due to high initial costs. Hospitals require significant investment in RFID tags, readers, and supporting infrastructure. It becomes difficult for small and mid-sized facilities to allocate budgets for deployment. Maintenance and software integration add to overall expenses, limiting wider adoption. In regions with resource constraints, healthcare providers delay RFID implementation. The cost barrier continues to restrict market penetration in developing countries. Vendors must address affordability to expand adoption across all healthcare levels.

Concerns Around Data Security and System Integration

Data security remains a critical challenge in the Healthcare Radiofrequency Identification RFID market. Patient information collected through RFID systems requires strict protection against cyberattacks. It raises compliance issues with privacy regulations such as HIPAA. Integration with existing hospital information systems often leads to compatibility concerns. Many facilities face difficulties in aligning RFID with legacy IT frameworks. These challenges slow the pace of seamless adoption. Addressing interoperability and cybersecurity risks is essential for market sustainability.

Market Opportunities

Expanding Role in Smart Hospitals and Digital Healthcare Transformation

The Healthcare Radiofrequency Identification RFID market presents strong opportunities in smart hospital development. RFID integration with IoT, artificial intelligence, and cloud systems enhances automation. It supports predictive analytics, remote patient tracking, and efficient asset utilization. Smart hospitals deploy RFID to streamline workflows and improve patient safety. Healthcare providers adopt these solutions to meet growing digital transformation goals. Expansion of advanced healthcare infrastructure in emerging economies strengthens demand. This creates a favorable environment for RFID vendors offering scalable solutions.

Rising Demand in Pharmaceutical and Cold Chain Logistics

The Healthcare Radiofrequency Identification RFID market benefits from growing adoption in pharmaceutical logistics. RFID ensures accurate tracking of vaccines, biologics, and other temperature-sensitive products. It reduces losses linked to mishandling and improves regulatory compliance. Global vaccination campaigns and expansion of biologics drive further use of RFID. Pharmaceutical companies and distributors rely on it to secure supply chain transparency. Rising demand for real-time monitoring of critical medical inventories fuels opportunity. Vendors providing RFID-enabled cold chain solutions stand to capture significant growth.

Market Segmentation Analysis:

By Product:

Systems & software and tags. Systems & software form the backbone of RFID deployment, enabling hospitals and pharmaceutical companies to collect, analyze, and manage large volumes of data. It provides integration with hospital information systems, supporting seamless decision-making. Demand for RFID software platforms grows as healthcare providers adopt digital health solutions. Tags represent a crucial component, offering identification and tracking capabilities for equipment, patients, and pharmaceuticals. Rising adoption of passive and active tags highlights their importance in expanding applications. Both segments remain vital, with systems driving intelligence and tags ensuring operational accuracy.

- For instance, Zebra Technologies Corp. is a leading global provider of RFID and integrated software solutions for healthcare, and it regularly works with hospitals. While the company’s website features case studies and market data confirming the general use and benefits of its RFID solutions in healthcare

By Application:

Asset tracking holds a leading position in the Healthcare Radiofrequency Identification RFID market. Hospitals rely on RFID to manage high-value equipment, surgical instruments, and medical devices. It reduces asset loss, optimizes equipment usage, and lowers operational inefficiencies. Patient tracking also shows strong demand, driven by the need to ensure accurate identification, improve safety, and enhance patient flow management. RFID wristbands support real-time monitoring of patient location and treatment progress, which strengthens safety protocols. Pharmaceutical tracking represents another significant application. Companies deploy RFID to monitor storage conditions, prevent counterfeit drugs, and comply with strict global regulations. It supports real-time visibility across the supply chain, enhancing reliability and transparency. Blood tracking applications are expanding rapidly, as healthcare providers use RFID to monitor donor blood, ensure accurate transfusions, and prevent mismatches. This enhances patient safety and streamlines blood bank operations.

Segments:

Based on Product:

Based on Application:

- Asset Tracking

- Patient Tracking

- Pharmaceutical Tracking

- Blood Tracking

- Others

Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest market share in the Healthcare Radiofrequency Identification RFID market, accounting for 38% in 2024. The region benefits from advanced healthcare infrastructure, strong regulatory support, and high adoption of digital healthcare technologies. Hospitals and clinics in the United States deploy RFID systems to improve asset tracking, patient identification, and inventory management. The presence of leading technology providers further drives innovation and implementation. It supports large-scale integration of RFID with hospital information systems, making North America a leader in adoption. Growing demand for patient safety and efficient workflows continues to reinforce the dominance of this region. The focus on advanced pharmaceuticals and secure blood supply chains also contributes to the expansion of RFID use. Investments in IoT-enabled healthcare solutions strengthen the regional outlook.

Europe

Europe represents the second-largest market, with a share of 27% in 2024. The region emphasizes regulatory compliance, data security, and sustainability in healthcare operations. Hospitals across Germany, France, and the United Kingdom implement RFID to ensure transparency in pharmaceutical distribution and patient monitoring. It is increasingly applied in blood tracking systems, improving transfusion safety and inventory control. The European Union’s focus on combating counterfeit drugs has accelerated adoption across pharmaceutical supply chains. Healthcare providers invest in RFID solutions that enhance operational efficiency and reduce clinical errors. Strong government initiatives supporting digital healthcare transformation further fuel demand. Continuous research and development activities by European technology firms add momentum to RFID deployment in the region.

Asia-Pacific

Asia-Pacific holds a market share of 22% in 2024 and shows rapid growth potential. Countries such as China, Japan, and India invest heavily in healthcare modernization and digital transformation. The region experiences rising demand for RFID in patient safety, inventory management, and pharmaceutical tracking. It benefits from the expanding network of hospitals and diagnostic centers adopting smart healthcare systems. Growing pharmaceutical manufacturing and export activities in China and India create strong demand for RFID-enabled supply chain monitoring. The use of RFID in managing blood supply chains is gaining traction due to rising awareness of patient safety. Increasing government initiatives to modernize healthcare infrastructure accelerate adoption. Rising investment in IoT and AI-driven healthcare solutions enhances the growth outlook for Asia-Pacific.

Latin America

Latin America accounts for 7% of the Healthcare Radiofrequency Identification RFID market in 2024. The region faces growing demand for RFID solutions to improve efficiency in hospitals and blood banks. Brazil and Mexico lead adoption with investments in patient tracking and pharmaceutical management. It helps reduce medical errors and improve supply chain reliability in regional healthcare facilities. Limited budgets in some countries create adoption barriers, yet the benefits of RFID drive gradual implementation. Rising collaborations with global RFID vendors support technology transfer and market penetration. Government initiatives to improve healthcare systems and strengthen drug safety regulations promote demand for RFID. Increasing awareness of patient safety and transparency adds momentum to adoption in the region.

Middle East & Africa

The Middle East & Africa holds a market share of 6% in 2024. Countries such as the United Arab Emirates and Saudi Arabia lead adoption, driven by investments in modern healthcare infrastructure. RFID systems are used for patient tracking, pharmaceutical supply monitoring, and asset management in hospitals. It addresses challenges related to counterfeit drugs and enhances safety in blood supply chains. Limited infrastructure in parts of Africa restricts adoption, yet growing digital healthcare programs create opportunities. Government initiatives in the Gulf countries promote integration of RFID into smart hospitals. The market shows potential for growth with rising investment in healthcare technology and digital solutions. Increasing partnerships between international vendors and regional healthcare providers enhance accessibility of RFID systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CenTrak, Inc.

- Alien Technology, LLC

- Tagsys RFID

- Zebra Technologies Corp.

- GAO RFID Inc.

- Terso Solutions, Inc.

- Avery Dennison Corporation

- LogiTag Systems

- Impinj, Inc.

- Mobile Aspects

Competitive Analysis

The Healthcare Radiofrequency Identification RFID market features strong competition with leading players such as Alien Technology, LLC, Zebra Technologies Corp., Avery Dennison Corporation, Impinj, Inc., GAO RFID Inc., LogiTag Systems, Mobile Aspects, CenTrak, Inc., Terso Solutions, Inc., and Tagsys RFID. These companies focus on innovation, partnerships, and product expansion to strengthen their market presence. The competitive landscape is shaped by continuous investment in research and development. Companies enhance RFID tags, readers, and software platforms to support advanced healthcare applications. Strategic collaborations with hospitals and pharmaceutical firms expand product reach and create tailored solutions. Firms differentiate by offering integrated platforms that combine RFID with IoT, analytics, and cloud services. Vendors also compete through cost-effective solutions, aiming to attract mid-sized healthcare facilities with budget constraints. Regional expansion remains a central strategy, with players increasing penetration in Asia-Pacific and Latin America. Customization of solutions for patient safety, asset tracking, and supply chain security further drives competition. Regulatory compliance and data security capabilities add to competitive differentiation. With growing demand for smart healthcare solutions, the rivalry among key players will intensify, pushing continuous technological advancements and wider adoption across global healthcare markets.

Recent Developments

- In 2025, Zebra Technologies Corp. showcased new healthcare solutions at HIMSS

- In 2024, Avery Dennison launched its AD Minidose U9XM Ultra High Frequency (UHF) and Radio Frequency Identification (RFID) high-memory inlays and tags. These were specifically designed for identifying small pharmaceutical and healthcare items, including syringes, vials, and various packaging formats.

- In 2024, Pharmaceutical packaging specialist Schreiner MediPharm launched a new RFID label featuring a digital first-opening indication. The label had a special construction designed to protect the integrated chip from mechanical stress.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Healthcare Radiofrequency Identification RFID market will expand with rising adoption in smart hospitals.

- Patient tracking through RFID wristbands will grow as safety regulations become stricter.

- Pharmaceutical companies will rely more on RFID to secure global supply chains.

- Blood tracking applications will gain importance for improving transfusion accuracy.

- Integration of RFID with IoT and cloud platforms will enhance real-time monitoring.

- Demand for RFID tags will increase as hospitals expand digital infrastructure.

- Data analytics supported by RFID will improve predictive maintenance of medical assets.

- Government initiatives will promote RFID adoption in developing healthcare markets.

- Vendors will focus on affordable solutions to increase penetration in mid-sized facilities.

- RFID use in cold chain management will strengthen with rising demand for biologics and vaccines.