Market Overview

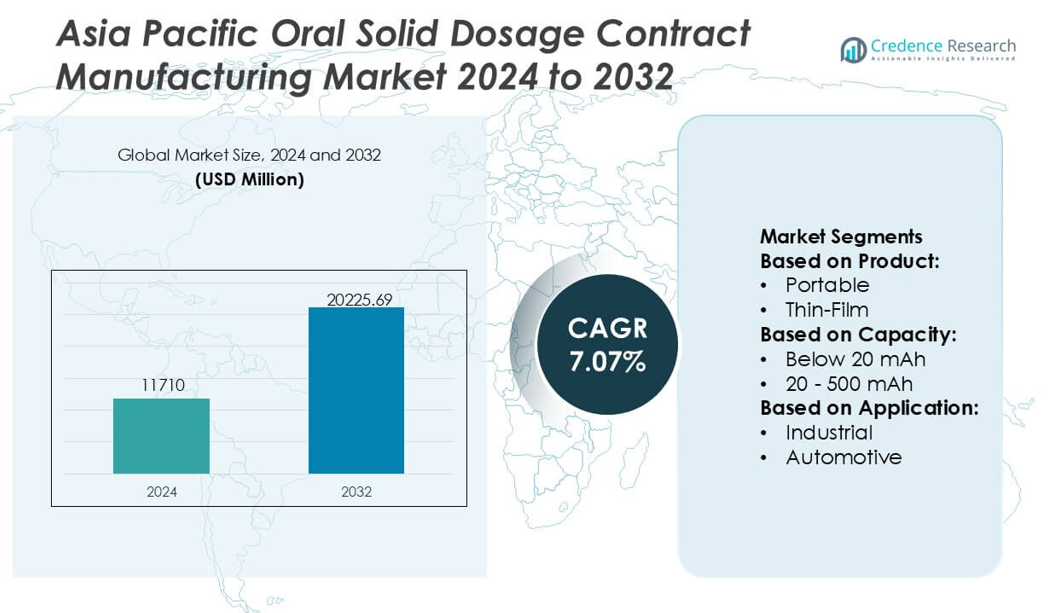

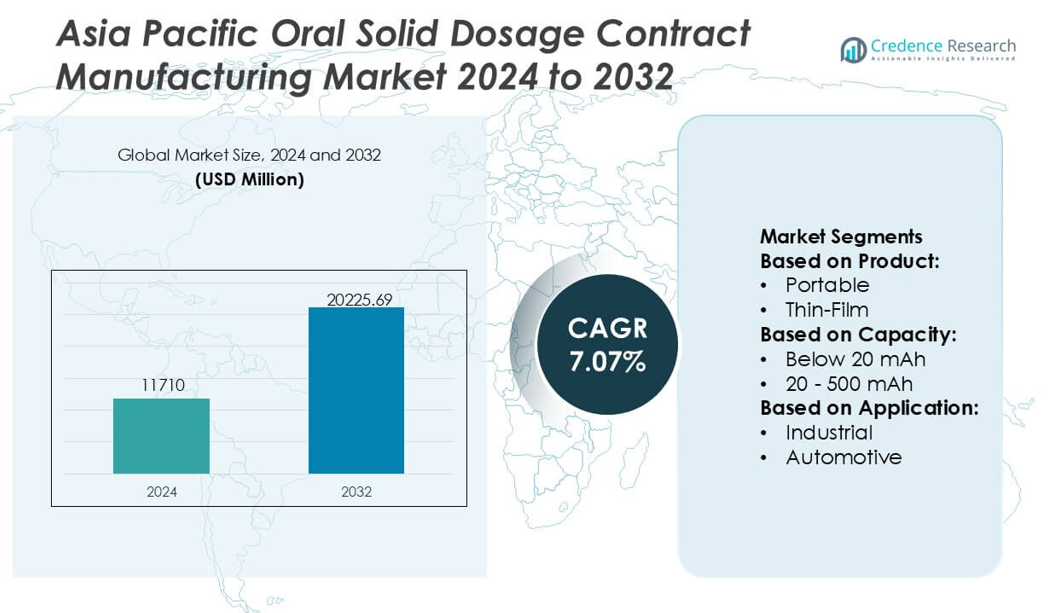

Asia Pacific Oral Solid Dosage Contract Manufacturing Market size was valued USD 11710 million in 2024 and is anticipated to reach USD 20225.69 million by 2032, at a CAGR of 7.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Oral Solid Dosage Contract Manufacturing Market Size 2024 |

USD 11710 million |

| Asia Pacific Oral Solid Dosage Contract Manufacturing Market, CAGR |

7.07% |

| Asia Pacific Oral Solid Dosage Contract Manufacturing Market Size 2032 |

USD 20225.69 million |

The Asia Pacific Oral Solid Dosage Contract Manufacturing Market is shaped by a competitive group of regional and global CDMOs that continue to expand formulation expertise, large-scale compression capacity, and regulatory-aligned manufacturing platforms to meet rising demand for generics and chronic disease therapies. These players strengthen their position through investments in continuous processing, automation, and high-throughput analytical systems that improve efficiency and throughput for both domestic and international clients. Asia Pacific stands as the leading region, holding an exact 54% market share, supported by cost-competitive production ecosystems, an extensive skilled workforce, and strong government initiatives that promote large-volume pharmaceutical manufacturing.

Market Insights

- The market reached USD 11,710 million in 2024 and will grow at a CAGR of 7.07% to achieve USD 20,225.69 million by 2032, reflecting strong expansion in large-volume OSD outsourcing.

- Demand rises as manufacturers increase formulation innovation and adopt continuous processing, automation, and advanced analytical systems to support generics and chronic disease therapies.

- Competitive activity intensifies as CDMOs expand capacity for tablets, capsules, and fixed-dose combinations while strengthening compliance with global regulatory standards.

- Market growth faces restraints from supply-chain volatility, rising quality-assurance costs, and dependency on imported APIs and specialty excipients across key production hubs.

- Asia Pacific leads with a 54% regional share, supported by cost-efficient manufacturing ecosystems, while the tablet segment maintains the dominant share due to high consumption in chronic disease and OTC categories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

In the Asia Pacific OSD contract manufacturing market, portable solid dosage formats dominate with an estimated 58% share, driven by strong demand for travel-friendly OTC medicines, chronic disease therapies, and convenient dosage forms in high-population markets such as India and China. Thin-film products expand steadily as regional pharma companies adopt fast-dissolving technologies for pediatric and geriatric applications. The dominance of portable formats is reinforced by scalable manufacturing systems, wide therapeutic applicability, and increasing outsourcing by multinational brands seeking cost efficiency and GMP-compliant large-volume production across Asian facilities.

- For instance, Phillips-Medisize strengthened OSD support capabilities by integrating its advanced micro-precision molding technology, which delivers dimensional tolerances as tight as ±5 microns for drug-delivery components.

By Capacity

The 20–500 mAh equivalent capacity range representing mid-scale batch production—accounts for nearly 52% of the market, supported by its suitability for mainstream prescription drugs, generics, and branded formulations widely consumed in Asia Pacific. This segment benefits from optimized batch flexibility, lower per-unit production costs, and strong adoption among regional CDMOs offering high-throughput granulation, compression, and coating capabilities. Below-20-mAh micro-batch categories cater to early-stage clinical work, while above-500-mAh-type large-scale commercial capacities continue to grow with increasing demand for mass-market generics and chronic disease therapies.

- For instance, Viant Technology LLC enhanced its precision data-driven platforms by advancing its ViantAI suite with machine-learning optimization. ViantAI leverages a comprehensive data set, which includes over 1 billion devices and 250 million registered users in the U.S., to improve targeting resolution and campaign automation.

By Application

Consumer electronics–analogous high-volume OSD demand segments, represented by mainstream therapeutic categories, lead with approximately 45% market share, driven by rising self-medication trends, expanding retail pharmacy penetration, and high generic consumption across emerging Asian economies. The industrial and energy-storage-equivalent categories mirror demand from institutional and hospital supply chains requiring consistent large-batch tablet and capsule production. Automotive-aligned specialized applications grow modestly, supported by niche formulations and controlled-release technologies. Overall growth is propelled by expanding healthcare access, cost-advantaged manufacturing ecosystems, and increasing outsourcing from global pharmaceutical innovators seeking speed-to-market advantages in Asia Pacific.

Key Growth Drivers

Expansion of Generic Drug Production Across Emerging Markets

The Asia Pacific OSD contract manufacturing market grows significantly as regional pharmaceutical companies accelerate generic drug production to meet rising demand for affordable therapies. Outsourcing intensifies as firms seek cost-optimized large-scale production supported by GMP-compliant facilities in India, China, and Southeast Asia. Contract manufacturers benefit from improved process standardization, automated tablet compression lines, and enhanced coating technologies that support high-volume output. Increasing patent expiries and government-backed procurement programs further drive reliance on OSD manufacturing partners, strengthening the region’s role as a global generics supply hub.

- For instance, Integer Holdings Corporation has advanced its precision manufacturing capabilities through laser micromachining systems capable of producing feature sizes as small as 20 microns, supported by ISO Class 7 cleanroom environments and high-speed automated assembly platforms.

Advancements in High-Throughput Manufacturing and Continuous Processing

Modernization of manufacturing infrastructure acts as a key driver, as CDMOs invest in continuous manufacturing, high-shear granulation, and advanced quality-by-design (QbD) systems. These technologies reduce production time, optimize batch consistency, and improve compliance with evolving regulatory expectations. Automation, integrated process analytics, and real-time monitoring enhance efficiency and reduce operational errors, positioning regional manufacturers as preferred outsourcing partners. As pharmaceutical companies shift toward flexible and scalable production models, continuous OSD manufacturing in Asia Pacific unlocks substantial cost benefits and accelerates commercialization timelines.

- For instance, Sanmina’s digital suite, consolidates multi-site manufacturing data into unified operational pipelines with rapid deployment in as little as 4–12 weeks and supports real-time analytics across distributed factory networks.

Rising Prevalence of Chronic Diseases Boosting Demand for Large-Volume OSD Formulations

Growing incidence of chronic conditions such as diabetes, cardiovascular disorders, and respiratory diseases increases demand for stable, long-shelf-life OSD formulations. Governments expand universal healthcare coverage, driving procurement of tablets and capsules in bulk quantities. CDMOs in Asia Pacific respond with high-capacity lines capable of producing extended-release, immediate-release, and fixed-dose combination formulations. Increasing adoption of lifestyle medications and OTC supplements further boosts market volume. This sustained clinical demand strengthens long-term outsourcing partnerships and supports continuous capacity expansion across leading regional contract manufacturers.

Key Trends & Opportunities

Surge in Demand for Specialized Dosage Forms and Complex Formulations

The market sees strong opportunities in producing complex OSD formats such as multilayer tablets, abuse-deterrent formulations, pediatric chewables, and geriatric-friendly fast-dissolve tablets. Pharmaceutical companies increasingly outsource specialized products that require advanced excipient technologies and controlled-release systems. Asia Pacific CDMOs enhance R&D capabilities and formulation expertise, enabling them to capture high-value contracts. This trend aligns with rising therapeutic diversification and personalized treatment needs, positioning OSD manufacturers to broaden their service portfolios and compete in technically sophisticated segments.

- For instance, Nordson EFD’s PICO® Nexμs™ Jetting System received the 2024 Edge Award for automation and Industrial IoT innovation, integrating 3-axis motion control and jetting capabilities that maintain placement repeatability within ±0.003 mm for micro-dispense applications.

Growing Investments from Multinational Pharma in Regional Outsourcing Networks

Multinational companies continue to expand strategic outsourcing partnerships in Asia Pacific to leverage lower production costs, experienced technical workforces, and regulatory-compliant facilities. CDMOs gain new opportunities as global innovators shift clinical-stage and commercial-scale OSD production toward India, China, South Korea, and Singapore. Increasing FDA- and EMA-approved facilities enhance the region’s reputation for quality manufacturing. This inflow of global demand supports infrastructure modernization, technology transfer, and capacity expansion, driving long-term market consolidation and strengthening Asia Pacific’s role in global supply chains.

- For instance, Rio Tinto’s autonomous train network delivered about 28,000 tonnes of iron ore over a haul of around 280 km from its Tom Price mine to the port at Cape Lamber the first delivery by a heavy-haul, long-distance autonomous train in the world.

Rising Adoption of Digital Manufacturing and Data-Driven Quality Systems

Digital transformation creates new opportunities as manufacturers integrate electronic batch records, predictive maintenance, automated environmental controls, and AI-supported process optimization. These tools enable faster troubleshooting, improved product traceability, and higher regulatory confidence. Adoption of digital twins and cloud-based production tracking enhances transparency for global clients. As compliance expectations tighten, especially for complex OSD products, data-driven manufacturing becomes a competitive differentiator, allowing Asia Pacific CDMOs to demonstrate superior operational reliability and win larger international contracts.

Key Challenges

Increasing Regulatory Stringency and Compliance Burden

The Asia Pacific OSD contract manufacturing market faces rising compliance challenges as regulatory bodies intensify inspections and quality requirements. Manufacturers must maintain rigorous documentation, implement advanced testing protocols, and ensure consistent batch reproducibility across large-volume runs. Smaller CDMOs struggle with the financial and operational burden of upgrading facilities to meet global standards such as cGMP, PIC/S, and FDA requirements. Non-compliance risks contract loss and shipment delays, making regulatory adherence a critical but resource-intensive responsibility for regional manufacturers.

Supply Chain Volatility and Dependence on Imported Excipients and APIs

Despite growing manufacturing capabilities, many Asia Pacific OSD producers rely on imported raw materials, particularly high-grade APIs, specialty excipients, and coating polymers. Geopolitical instability, logistics disruptions, and currency fluctuations introduce cost uncertainty and production delays. Lead times increase further when global demand spikes, affecting the timely execution of outsourcing agreements. While governments promote local API manufacturing, progress remains uneven, leaving CDMOs vulnerable to supply constraints. Strengthening regional raw material ecosystems remains essential to improving resilience and cost stability.

Regional Analysis

North America

North America holds an estimated 23% share of the OSD contract manufacturing activity linked to Asia Pacific supply chains, driven by strong outsourcing demand from U.S. and Canadian pharmaceutical companies. The region relies on Asian CDMOs for cost-efficient high-volume tablet and capsule production, especially for generics, OTC medications, and chronic disease therapies. Stringent regulatory expectations influence partner selection, giving preference to Asia-based manufacturers with FDA-compliant facilities and continuous quality-monitoring systems. Growing dependence on global supply networks, driven by pricing pressures and R&D prioritization, continues to strengthen cross-regional contract manufacturing collaborations.

Asia Pacific

Asia Pacific remains the core production hub with a dominant 54% market share, supported by extensive manufacturing capacity in India, China, South Korea, and Southeast Asia. The region benefits from cost-efficient labor, mature CDMO ecosystems, and strong capabilities in high-volume generic OSD manufacturing. Regulatory modernization, increasing chronic disease prevalence, and rapid expansion of regional pharmaceutical markets further accelerate production demand. Asia Pacific’s leadership is reinforced by sustained investments in continuous manufacturing, high-speed compression systems, and QbD-driven analytical platforms that enhance scalability, compliance, and export readiness across global markets.

Europe

Europe accounts for about 13% of market-linked outsourcing demand, shaped by its strong emphasis on quality, regulatory compliance, and advanced pharmaceutical research. European drug manufacturers increasingly outsource high-volume OSD production to Asia Pacific to optimize cost structures while maintaining reliable supply for chronic and specialty therapies. Contract manufacturing partnerships strengthen as EU firms focus on complex formulation design and outsource commercial-scale runs. The region’s demand is further supported by rising generic penetration, patent expiries, and the expansion of parallel trade networks, which heighten the need for consistent, large-capacity OSD manufacturing cycles.

Latin America

Latin America represents approximately 6% market share, supported by expanding demand for affordable generic OSD products in Brazil, Mexico, Argentina, and Colombia. Limited domestic production capacity and higher manufacturing costs drive regional pharmaceutical companies to partner with Asia Pacific CDMOs for large-batch tablets, capsules, and combination therapies. Healthcare system reforms and increasing chronic disease burdens amplify the need for cost-efficient outsourced solutions. Regulatory convergence with international standards also encourages cross-border manufacturing agreements. Latin America continues to rely on Asia Pacific facilities to stabilize supply chains and maintain competitive pricing in local markets.

Middle East & Africa (MEA)

The Middle East & Africa region holds an estimated 4% share, driven by rising consumption of generic medications and increasing dependence on imported OSD formulations. Limited local manufacturing infrastructure and inconsistent raw material access reinforce outsourcing to Asia Pacific’s high-capacity, cost-efficient CDMOs. Gulf countries, led by Saudi Arabia and the UAE, expand procurement programs that favor reliable, quality-certified suppliers, while African nations focus on improving medicine accessibility through international partnerships. Growing chronic disease incidence and widening insurance coverage support volume growth, strengthening MEA’s long-term reliance on Asia Pacific OSD manufacturing networks.

Market Segmentations:

By Product:

By Capacity:

- Below 20 mAh

- 20 – 500 mAh

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Asia Pacific Oral Solid Dosage (OSD) Contract Manufacturing Market players such as West Pharmaceutical Services, Inc., FLEX LTD., Phillips-Medisize, Celestica Inc., Viant Technology LLC, Integer Holdings Corporation, Jabil Inc., Sanmina Corporation, Plexus Corp., and Nordson Corporation. the Asia Pacific Oral Solid Dosage (OSD) Contract Manufacturing Market reflects a rapidly advancing ecosystem driven by large-scale production capabilities, regulatory-aligned infrastructure, and expanding partnerships with global pharmaceutical innovators. Regional contract manufacturers focus on high-throughput tablet and capsule manufacturing, continuous processing systems, and QbD-based quality management to support increasing demand for generics, chronic disease therapies, and fixed-dose combinations. Competition intensifies as firms invest in automation, digital batch analytics, and capacity expansion to enhance efficiency and reduce production cycles. Strong government support, skilled manufacturing workforces, and integrated supply networks reinforce the region’s position as a preferred outsourcing destination for both clinical-stage and commercial OSD manufacturing requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, SK Capital Partners acquired LISI Group’s Medical division, relaunching it as Precera Medical, a new independent CDMO (Contract Development & Manufacturing Organization) in the U.S. and France, focusing on high-precision medical components for robotics, minimally invasive surgery, and orthopedics, with a new HQ in Minnesota.

- In October 2025, Forj Medical, launching integrated Contract Development & Manufacturing Organization (CDMO) services for medtech OEMs, offering full-spectrum design, engineering, and manufacturing from concept to commercialization, with U.S. presence and global facilities.

- In July 2025, The UK government unveiled a six-point Life Sciences sector plan aiming to grow the industry to focusing on manufacturing and commercialization. While R&D excels, commercial adoption remains a challenge.The UK government will enhance manufacturing and commercialisation as it looks to harness the value of the life sciences sector for the country’s economy.

- In January 2024, TekniPlex Healthcare significantly expanded its capabilities as a contract development and manufacturing organization (CDMO) for a wide range of minimally invasive and interventional medical devices

Report Coverage

The research report offers an in-depth analysis based on Product, Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as regional CDMOs increase high-volume manufacturing capacity for generics and fixed-dose combinations.

- Adoption of continuous manufacturing and digital quality systems will accelerate efficiency and regulatory compliance.

- Demand for specialty OSD formats such as controlled-release and fast-dissolving tablets will rise across therapeutic areas.

- Multinational pharmaceutical companies will strengthen outsourcing partnerships with Asia Pacific facilities to reduce production costs.

- Regulatory alignment with global standards will improve export readiness and boost participation in regulated markets.

- Investment in automation and real-time process monitoring will enhance batch consistency and reduce operational risk.

- Growth in chronic disease prevalence will sustain long-term demand for large-scale OSD production.

- Regional supply-chain capabilities will improve as countries localize API and excipient manufacturing.

- CDMOs will expand formulation development services to compete in high-value and complex product segments.

- Market consolidation will increase as larger firms acquire smaller manufacturers to enhance scale, technology, and geographic reach.