Market Overview:

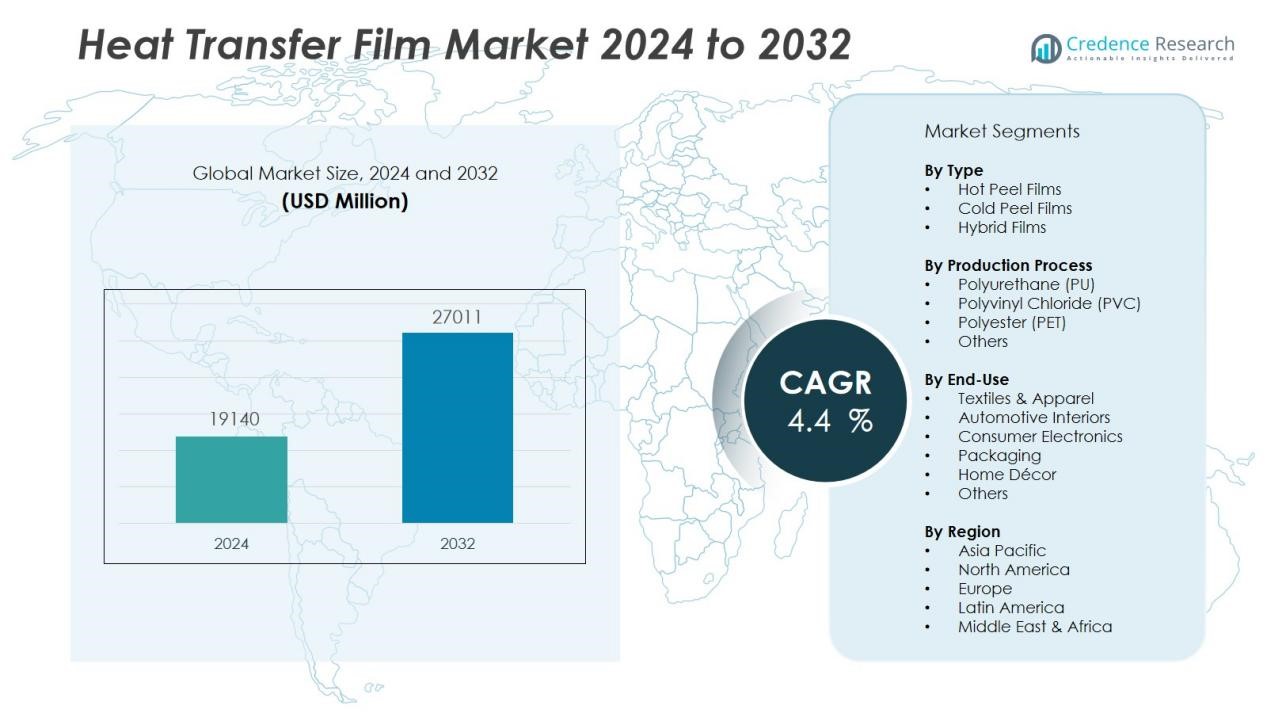

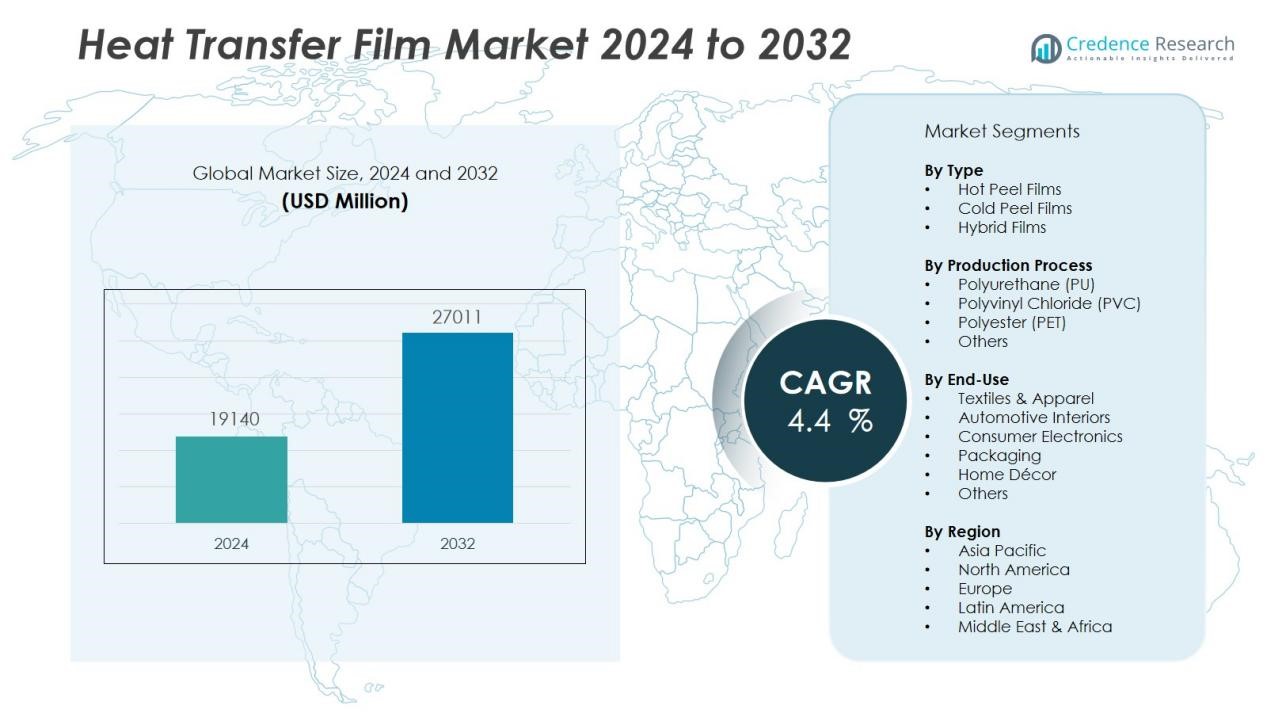

The Heat Transfer film market size was valued at USD 2800 million in 2024 and is anticipated to reach USD 3950 million by 2032, at a CAGR of 4.4 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heat Transfer film market Size 2024 |

USD 2800 Million |

| Heat Transfer film market, CAGR |

4.4 % |

| Heat Transfer film market Size 2032 |

USD 3950 Million |

Key market drivers include the rising adoption of customized and premium apparel, rapid innovation in eco-friendly and high-performance films, and the surge in digital printing technologies. Manufacturers invest in advanced polyurethane, PET, and vinyl-based films to meet industry requirements for durability, vivid graphics, and sustainability. The growing popularity of smart textiles, branding, and decorative labeling fuels additional demand, while regulatory emphasis on sustainable materials accelerates the shift toward recyclable and solvent-free films.

Regionally, Asia Pacific leads the heat transfer film market, benefiting from a robust manufacturing base, expanding textile production, and increasing adoption of digital textile printing. North America and Europe follow, supported by advanced R&D infrastructure, a strong presence of leading film manufacturers, and rising demand for value-added garment decoration and product branding. Latin America and the Middle East & Africa experience rising market penetration due to growth in local apparel and packaging industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Heat Transfer film market size was valued at USD 2800 million in 2024 and is anticipated to reach USD 3950 million by 2032, at a CAGR of 4.4 % during the forecast period (2024-2032).

- Rising consumer demand for customized and premium apparel drives strong adoption of advanced heat transfer films.

- Continuous innovation in digital printing and high-performance film materials enables sharper graphics and faster production.

- Stricter environmental regulations push manufacturers to develop recyclable, water-based, and phthalate-free film solutions.

- Asia Pacific leads with 47% share, followed by North America at 23% and Europe at 19%, reflecting strong regional production and export capabilities.

- Manufacturers face persistent challenges from fluctuating raw material prices, supply chain volatility, and regulatory compliance.

- Expanding applications in automotive interiors, electronics, and packaging open new avenues for market growth and product differentiation.

Market Drivers:

Rising Demand for Customization and Personalization in Apparel and Textiles:

The heat transfer film market benefits from the growing consumer preference for personalized and customized garments. Brands and manufacturers use heat transfer films to produce intricate graphics, names, logos, and decorative elements that appeal to a diverse customer base. It enables rapid production of unique designs for sportswear, fashion apparel, and promotional items. The market gains momentum from the shift toward small-batch production and direct-to-garment decoration, making heat transfer films an essential solution for meeting evolving fashion trends.

- For instance, Stahls’ Soft Foam Heat Transfer Vinyl, at 560–600 microns thick, adds depth and a unique matte finish to designs across 15 colors; production times are kept to just 15 seconds at 150°C, enabling rapid, tactile customization for t-shirts, caps, and more.

Advancements in Printing Technologies and Film Materials:

Continuous innovation in digital printing and film formulation drives the heat transfer film market. Manufacturers introduce high-performance polyurethane, PET, and vinyl films that offer enhanced flexibility, vivid colors, and superior wash durability. It supports the demand for sharp, long-lasting designs across a range of substrates. Improved print resolution and faster production cycles strengthen the adoption of heat transfer films in both mass production and niche applications.

- For instance, Avery Dennison MPI 1405 Premium Polyurethane Film offers a 2.0-mil (51-micron) PVC-free construction, delivering outstanding durability and easy application to textured surfaces, which enhances both flexibility and longevity for wall and vehicle graphics.

Stringent Environmental Regulations and Sustainable Product Development:

Stricter environmental standards accelerate the transition toward eco-friendly and solvent-free heat transfer films. The heat transfer film market responds with recyclable, water-based, and phthalate-free film options that reduce environmental impact. Brands prioritize sustainable decoration methods to meet regulatory mandates and appeal to environmentally conscious consumers. It fosters innovation in film chemistries and encourages industry collaboration for greener solutions.

Expanding Applications Across Automotive, Electronics, and Consumer Goods:

Beyond textiles, the heat transfer film market sees significant uptake in automotive interiors, consumer electronics, and packaging. It enables durable branding, surface protection, and decorative finishes on complex shapes and non-porous materials. The versatility of heat transfer films opens new growth avenues, supporting product differentiation and enhancing visual appeal in competitive markets. Manufacturers leverage these films to deliver value-added features across multiple industries.

Market Trends:

Adoption of Eco-Friendly and Functional Film Technologies Across End-User Segments:

The heat transfer film market witnesses a pronounced shift toward sustainable and functional film technologies across diverse end-user segments. Leading manufacturers launch recyclable, biodegradable, and water-based heat transfer films to align with global sustainability goals and meet rising regulatory standards. It supports the apparel and textile industry’s move toward circular economy models by reducing hazardous chemicals and minimizing waste. There is a steady rise in demand for films that deliver added functionalities such as UV resistance, antimicrobial protection, and high durability, enabling brands to differentiate products. Sustainable films gain traction in premium apparel, sportswear, and children’s clothing segments. Strong preference for “green” solutions encourages investments in R&D to expand the portfolio of advanced and environmentally responsible films.

- For instance, Siser introduced PureHT™, the world’s first fully compostable heat transfer material for apparel, which completely degrades within 6 months in industrial composting environments, leaving no harmful residue.

Digitalization and Customization Transforming the Competitive Landscape:

Digitalization and customization are reshaping the competitive landscape of the heat transfer film market. Manufacturers invest in advanced digital printing systems to produce high-definition graphics and enable rapid prototyping for short-run or bespoke orders. It enables quick turnaround and cost efficiency, supporting on-demand customization for both small businesses and global brands. The trend toward shorter fashion cycles and the growth of online direct-to-consumer channels amplify demand for fast, flexible decoration technologies. Integration of smart design software with heat transfer processes streamlines design-to-production workflows, allowing seamless execution of complex and multicolor patterns. These trends enhance product appeal, support brand identity, and open new opportunities for innovation in garment, packaging, and industrial applications.

- For instance, ColDesi’s DigitalHeat FX DTF-12H2 printer can deliver approximately 50 transfers per hour with vibrant color and durability for over 50 wash cycles, enabling small brands to offer professional-grade, custom apparel with minimal setup time.

Market Challenges Analysis:

Rising Raw Material Prices and Volatility in Supply Chains Affect Cost Structures:

The heat transfer film market faces persistent challenges from fluctuating raw material prices and supply chain disruptions. Volatility in the prices of key components such as polyurethane, PET, and specialty additives impacts production costs and narrows profit margins for manufacturers. It creates uncertainties in procurement and can delay delivery schedules for end users. The market must address these risks by diversifying supplier networks and investing in local sourcing strategies. Manufacturers also focus on process optimization to offset rising material expenses. Maintaining price competitiveness while ensuring product quality remains a critical challenge in dynamic market conditions.

Regulatory Compliance and Performance Limitations of Eco-Friendly Films:

Meeting strict regulatory requirements and ensuring performance parity with conventional films present ongoing hurdles in the heat transfer film market. Sustainable film alternatives sometimes fall short in terms of durability, color vibrancy, or application versatility, especially in demanding industrial and automotive sectors. It places pressure on manufacturers to balance sustainability with end-user expectations for high-quality graphics and robust adhesion. The need for continuous R&D investment strains smaller players and complicates efforts to standardize eco-friendly product offerings. Navigating evolving regulations across multiple regions further complicates compliance strategies for global market participants.

Market Opportunities:

Expansion in High-Growth End-Use Industries and Emerging Markets Creates New Demand:

The heat transfer film market finds strong opportunities in expanding its footprint across high-growth end-use industries such as sportswear, automotive interiors, and consumer electronics. Demand for premium garment decoration, branded accessories, and functional finishes continues to climb in both developed and emerging economies. It allows manufacturers to leverage evolving consumer preferences for value-added, visually distinctive products. Growth in online retail and direct-to-consumer sales further accelerates adoption of heat transfer films for small-batch and personalized orders. Emerging markets in Asia Pacific, Latin America, and the Middle East present untapped potential due to rapid industrialization and a burgeoning middle class.

Innovation in Sustainable and High-Performance Film Technologies Drives Market Differentiation:

Developing advanced, eco-friendly, and multifunctional heat transfer films offers manufacturers opportunities to differentiate and capture new market segments. It enables brands to address the growing demand for recyclable, solvent-free, and high-durability products across fashion, packaging, and industrial sectors. Technological breakthroughs in digital printing, smart materials, and specialty coatings expand application possibilities and unlock higher-value opportunities. Collaboration with apparel designers and consumer goods brands supports faster commercialization of innovative solutions. The heat transfer film market benefits from partnerships that accelerate R&D and align with shifting regulatory and consumer expectations for sustainability and performance.

Market Segmentation Analysis:

By Material:

The heat transfer film market covers a wide range of materials, including polyurethane (PU), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and others. Polyurethane films dominate due to their high flexibility, durability, and suitability for both textiles and hard surfaces. PET films gain preference in high-volume applications because of their clarity and excellent heat resistance. Polyvinyl chloride films serve niche markets requiring strong adhesion and weather resistance.

- For instance, SKC Co., Ltd.’s heat-shrinkable PET film demonstrates a controlled heat-shrinkage change of 1.5 to 3.0 units per °C in the 60–70°C range, making it suitable for high-precision industrial applications that require consistent dimensional properties at elevated temperatures.

By Type:

This market divides into hot peel and cold peel films. Hot peel films allow immediate removal of the carrier sheet after pressing, which increases productivity in apparel and promotional product manufacturing. Cold peel films require cooling before removal, which suits designs demanding sharper, more durable graphics. The segment selection depends on workflow efficiency and the final product’s durability requirements.

- For Instance, certain cold peel PET DTF films now specifically support high-resolution, sharp detail for intricate designs, such as those used in custom retail garment decoration by brands leveraging over 1,000 dpi print technology for fine line clarity.

By Application:

Heat transfer films find application in textiles, packaging, automotive, consumer electronics, and promotional products. Textiles account for the largest share, fueled by growth in custom apparel and sportswear. The liquid milk aseptic packaging market also integrates heat transfer films to provide tamper-evident seals and vibrant brand graphics. Automotive and electronics industries adopt these films for decorative trims, logo transfers, and protective overlays. Each application area demands films with specific performance attributes, driving continuous product innovation in the market.

Segmentations:

By Type:

- Hot Peel Films

- Cold Peel Films

- Hybrid Films

By Material:

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Polyester (PET)

- Others

By Application:

- Textiles & Apparel

- Automotive Interiors

- Consumer Electronics

- Packaging

- Home Décor

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific :

Asia Pacific secures 47% share of the heat transfer film market, supported by strong textile manufacturing and rapid industrialization. China, India, and Southeast Asia remain key hubs due to cost-efficient production and a large skilled workforce. The region experiences increasing investment in advanced digital printing technologies, supporting fast, customized garment decoration. It benefits from growing demand in the automotive, consumer electronics, and packaging sectors. Strategic partnerships between local converters and multinational brands accelerate technology transfer and product development. Strong regulatory support for sustainable solutions encourages the adoption of eco-friendly films. Asia Pacific’s export-oriented approach strengthens the role of heat transfer films in value-added applications.

North America :

North America holds 23% share of the heat transfer film market, led by the United States and Canada. High consumer preference for premium, customized apparel fuels demand for advanced film technologies. It leverages a well-established sportswear and promotional products sector to expand applications. The region’s mature R&D environment and collaboration with global apparel, automotive, and electronics brands foster product innovation and rapid commercialization. Regulatory focus on sustainability accelerates adoption of recyclable and solvent-free films. North America’s shift to short-run, on-demand production models expands the use of heat transfer films in niche and personalized applications.

Europe :

Europe accounts for 19% share of the heat transfer film market, driven by leading economies such as Germany, Italy, and France. The region emphasizes sustainable product development, strict regulatory compliance, and circular economy practices. It sees growing use of recyclable, water-based, and biodegradable films in both textile and industrial segments. European brands leverage heat transfer films for high-quality branding, decorative labeling, and value-added garment production. Strategic investments in green material technologies support the region’s competitive position. Europe’s export-driven manufacturing sector drives continuous adoption of advanced film solutions for diverse end-user markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Avery Dennison Corporation

- DUNMORE Corporation,

- ITW Foils,

- CFC International,

- Cricut, Inc.,

- RTape Corp.,

- Stahls’ Inc.,

- SEF Textile,

- Chemica,

- K Laser Technology Inc

Competitive Analysis:

The heat transfer film market features a competitive landscape defined by technology innovation, broad product portfolios, and global reach. Key players include Avery Dennison Corporation, DUNMORE Corporation, ITW Foils, CFC International, Cricut, Inc., RTape Corp., and Stahls’ Inc. These companies focus on advanced materials, sustainable film technologies, and rapid response to evolving customer requirements. It rewards continuous investment in research and development, allowing leading brands to offer differentiated solutions for textiles, automotive, packaging, and electronics. Strategic partnerships, acquisitions, and collaborations with apparel brands and converters help companies expand market share and accelerate commercialization of new products. High entry barriers linked to technical expertise and quality certifications sustain competitive advantage for established firms while enabling specialization in niche markets for emerging players.

Recent Developments:

- In July 2025, Avery Dennison Corporation launched its RFID-enabled In-Mold Label (IML) portfolio, which is designed for embedding into plastic items during injection molding to enable enhanced traceability, durability, and support for circular economy applications across multiple sectors.

- In April 2024, DUNMORE partnered with ICEYE for developing multilayer insulation films, enhancing capabilities for space and aerospace applications.

- In May 2025, GroupeSTAHL, the parent company of Stahls’ Inc., acquired TKO Sales Inc., a Florida-based heat transfer manufacturer, to enhance manufacturing efficiency and broaden its North American market presence.

Market Concentration & Characteristics:

The heat transfer film market demonstrates moderate concentration, with leading global and regional players commanding significant market shares through technology leadership and broad product portfolios. It features a dynamic competitive environment, characterized by frequent product innovations, strategic partnerships, and expansion into high-growth end-use industries. Major manufacturers focus on advanced materials, sustainability, and rapid response to customer design needs, while smaller firms emphasize niche segments and customization. The market rewards continuous R&D investment and supply chain agility, enabling companies to address evolving regulatory, consumer, and industry requirements. It maintains high entry barriers due to capital intensity, technical expertise, and the importance of quality certifications in serving apparel, automotive, and electronics sectors.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Manufacturers position their R&D toward eco-friendly film chemistries like water-based polyurethane, biodegradable films, and mono-PET liners to meet tightening environmental standards and consumer preferences.

- Application of digital printing methods such as UV and eco-solvent inkjet grows, supporting short-run, high-definition transfers and boosting customization efficiency.

- Firms integrate smart design platforms into their workflows to accelerate design-to-production processes and enable complex multicolour patterns on varied substrates.

- Brands explore multifunctional film variants with UV-resistance, antimicrobial finishes, and thermal regulation properties for premium textile and interior applications.

- Manufacturers drive product differentiation by developing embossable, stretchable, matte, reflective, and hybrid DTG-plus-film formats to expand design options.

- Increasing automation and Industry 4.0 integrations streamline heat transfer application operations to improve throughput and reduce lead times.

- Emerging markets in Asia Pacific, Latin America, and MEA attract investment due to rising urbanization, growing apparel output, and demand for branded goods.

- Collaborative partnerships between converters, apparel brands, and electronics OEMs help commercialize new film technologies more quickly.

- AI, IoT, and data-driven design tools find early integration into the value chain, enhancing predictive customization and operational insights.

- Film suppliers expand into industrial sectors such as automotive interiors, packaging, and consumer electronics to diversify applications and revenue streams.