Market Overview:

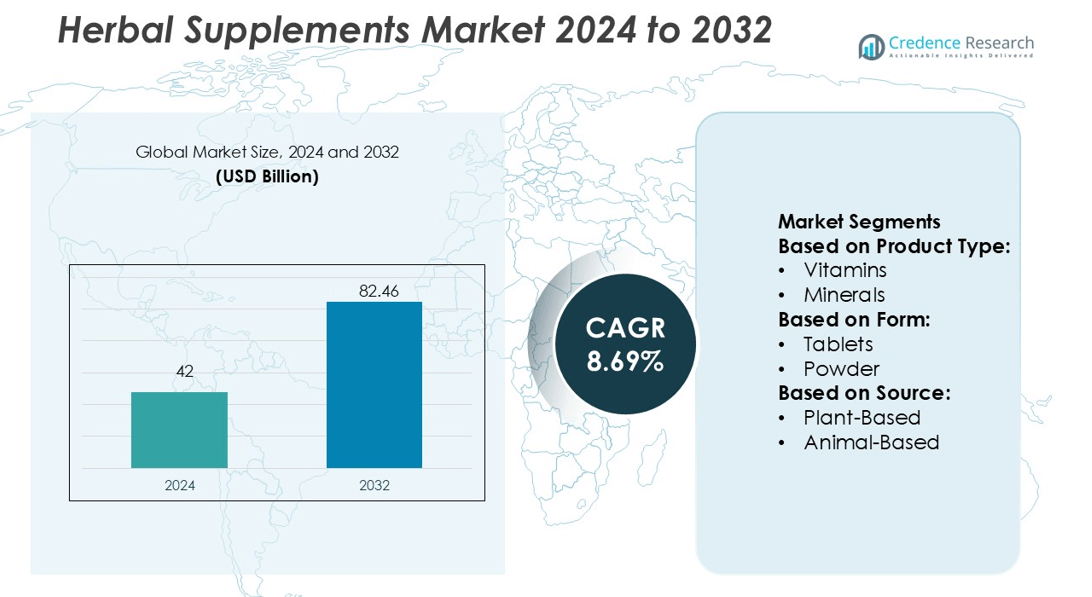

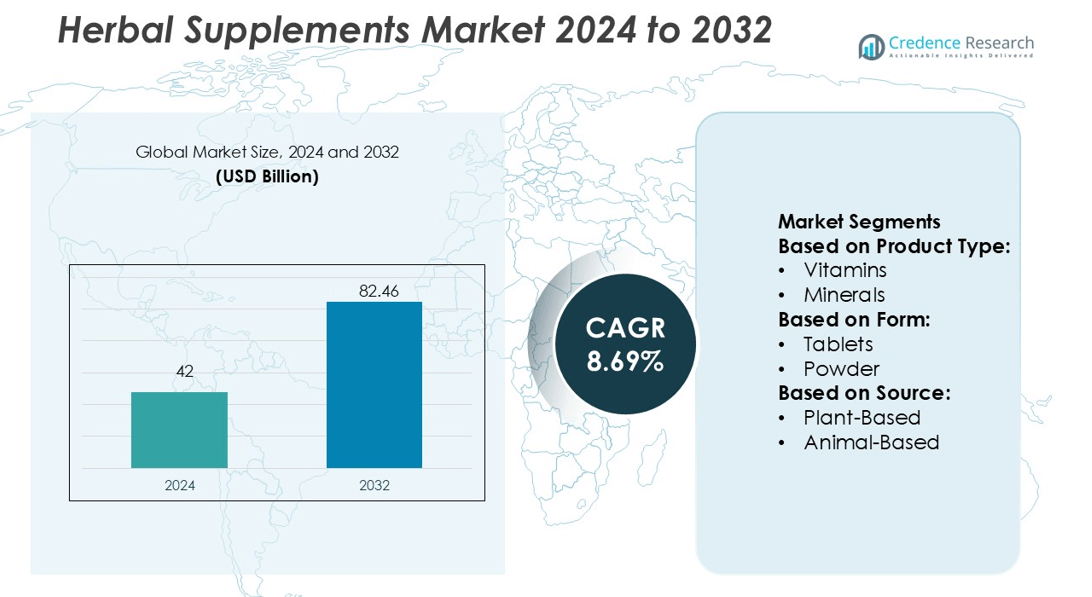

Herbal Supplements Market size was valued USD 42 billion in 2024 and is anticipated to reach USD 82.46 billion by 2032, at a CAGR of 8.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Herbal Supplements Market Size 2024 |

USD 42 billion |

| Herbal Supplements Market, CAGR |

8.69% |

| Herbal Supplements Market Size 2032 |

USD 82.46 billion |

The Herbal Supplements Market is shaped by strong competition among established and emerging companies offering diverse natural wellness solutions. Prominent players such as Gaia Herbs, Swanson, Solgar, Inc., Jarrow Formulas, Inc., Nature’s Bounty, Amway, Ancient GreenFields PVT LTD, NOW Foods, Herbalife, and Nature’s Way dominate through innovation, product expansion, and strategic marketing. These companies focus on herbal-based formulations addressing immunity, stress, and digestion to cater to shifting consumer preferences toward preventive healthcare. Asia-Pacific leads the global market with a 24.9% share, driven by traditional medicine systems, rising disposable income, and expanding local production capabilities. The region’s cost-effective manufacturing and rich herbal resources further strengthen its leadership in the market.

Market Insights

- The Herbal Supplements Market was valued at USD 42 billion in 2024 and is projected to reach USD 82.46 billion by 2032, growing at a CAGR of 8.69%.

- Rising demand for natural and preventive healthcare products is driving market growth, supported by increasing awareness of herbal nutrition and organic wellness.

- The market is witnessing trends toward clean-label, plant-based, and research-backed formulations, with digital retail platforms expanding global reach.

- Intense competition among leading players focusing on innovation, product expansion, and sustainability shapes the competitive landscape and influences pricing strategies.

- Asia-Pacific dominates the market with a 24.9% share, fueled by traditional medicine practices and cost-effective production, while the vitamins and minerals segment holds the largest product share due to widespread usage in daily health management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

In the herbal supplements market, single‑herb products lead the product‑type segment with approximately 52.6% share in 2024. This dominance occurs as consumers prefer focused botanical ingredients with defined benefits, rather than broad multicomponent formulations. The adoption of single‑herb products is driven by growing interest in targeted health outcomes—such as immunity, stress relief and digestion—and expanded availability of certified herbal extracts through wellness and e‑commerce channels. Vendors are emphasizing standardized herbals with validated bioactivity to build trust and bolster uptake.

- For instance, Swanson’s Echinacea Standardized delivers 200 mg of Echinacea angustifolia root extract (standardized to 4% echinacosides) plus 200 mg of Echinacea purpurea (aerial parts) whole herb, with lot-level QC and third-party lab verification.

By Form

In terms of product form, the capsules & tablets sub‑segment held the dominant share of about 44.6% in 2024. Tablets and capsules benefit from ease of dosing, portability and familiarity, which resonates with mainstream consumers seeking simple supplement routines. The preference for this form is also supported by manufacturers’ capacity to deliver standardized doses, ensure long shelf life and leverage existing packaging infrastructure. The wider availability through pharmacies and mass‑retail channels accelerates growth of this form segment in the herbal category.

- For instance, Jarrow Formulas, Inc. QH-absorb® ubiquinol formulation, plasma total CoQ10 levels rose from 0.70 µg/mL to 6.14 µg/mL, and reduced CoQ10 rose from 0.62 µg/mL to 5.75 µg/mL.

By Source

Within the source segment, plant‑based ingredients dominate, driven by the strong consumer demand for natural, botanical and vegan‑friendly solutions. Although distinct share numbers vary, the broader plant‑based supplements market (which overlaps with herbal) accounted for about 34% of product‑type share in 2024. The driver is the rising preference for clean‑label, ethical and sustainable wellness options among younger cohorts. Manufacturers are responding with 100% herb‑derived formulations, improved supply‑chain transparency and certifications around origin and extraction to support this shift.Top of Form

Key Growth Drivers

Rising Health Awareness and Preventive Healthcare

Increasing consumer focus on health and preventive care is significantly driving herbal supplement demand. People are shifting from synthetic medications to natural remedies for overall wellness and immunity enhancement. For instance, companies like Nature’s Bounty have launched immunity-boosting herbal blends with standardized extracts, reinforcing consumer trust. The trend spans across age groups, particularly among millennials and middle-aged populations who prefer natural health solutions. This shift boosts sales across multiple channels, including e-commerce, retail pharmacies, and wellness stores, expanding market penetration globally.

- For instance, Immune 24 Hour + softgels deliver 1,000 mg of a clinically studied form of Vitamin C (Ester-C®) per serving, which the company states “stays in your white blood cells for up to 24 hours” and lasts up to 2× longer than regular Vitamin C.

Expanding E-commerce and Digital Sales Channels

The growth of online retail platforms is enhancing accessibility and visibility for herbal supplements. Consumers increasingly purchase herbal products through digital marketplaces, benefiting from detailed product information, reviews, and doorstep delivery. For instance, Himalaya Wellness reported a 27% increase in online sales after launching its e-commerce platform with targeted digital campaigns. This expansion reduces geographic limitations, allowing global reach, and supports small and medium-sized brands to enter the market. The convenience of online access encourages repeat purchases, driving sustained market growth.

- For instance, Amway states that its online sales (via the e-commerce platform empowering its business-owners and direct customers) contributed 45% of total sales, down from 51% in FY 2023.

Government Support and Regulatory Approvals

Supportive regulations and government initiatives promoting herbal and traditional medicine contribute to market expansion. Regulatory bodies are streamlining approval processes for herbal supplements, ensuring safety and efficacy, which increases consumer confidence. For instance, Dabur India received regulatory clearance for its new herbal digestive supplement, enabling nationwide distribution. Such approvals enhance market credibility and attract international exports. Additionally, government campaigns emphasizing natural health remedies boost public awareness and adoption. These factors collectively encourage manufacturers to innovate and expand product portfolios.

Key Trends & Opportunities

Product Innovation and Formulation Advances

Herbal supplement manufacturers are increasingly developing innovative formulations to meet diverse consumer needs. This includes blends targeting immunity, stress relief, digestive health, and beauty. For instance, Amway launched a plant-based supplement combining turmeric and probiotics, offering enhanced bioavailability and efficacy. Such product innovation allows differentiation in a competitive market and encourages higher adoption among health-conscious consumers. Continued R&D investment provides opportunities for personalized supplements, nutraceutical blends, and functional foods, further expanding market potential across multiple demographics.

- For instance, NOW’s in-house laboratories perform over 31,000 analyses and tests each month on raw materials, in-process ingredients and finished goods, employing 23 high-performance liquid chromatography (HPLC) instruments, 2 ion-chromatography systems, and multiple gas-chromatography units.

Rising Popularity of Plant-Based and Organic Products

Consumers are showing a strong preference for plant-based and organic herbal supplements due to perceived safety and environmental benefits. For instance, Gaia Herbs offers certified organic supplements, attracting environmentally conscious buyers. This trend aligns with the growing vegan and clean-label movement, creating opportunities for premium product lines. Companies can leverage certifications and transparent sourcing to build brand loyalty. Increased consumer willingness to pay for high-quality, natural ingredients stimulates growth in niche segments, enhancing profitability and encouraging market entrants to adopt sustainable sourcing practices.

- For instance, Winston-Salem spans approximately 800,000 square feet, and together their HIM (Herbalife Innovation & Manufacturing) facilities produce about 47% of their “inner nutrition” products sold globally.

Digital Wellness and Personalized Nutrition

The integration of technology with wellness offers opportunities for tailored herbal supplement solutions. Personalized recommendations via apps and AI-driven platforms help consumers select supplements based on lifestyle, health goals, and genetic profiles. For instance, Nutrigenomix collaborates with supplement brands to provide gene-based product suggestions, improving efficacy. This convergence of technology and herbal wellness allows brands to engage customers more effectively, increase adherence, and enhance perceived value. The personalized nutrition trend is projected to drive premium segment growth and attract tech-savvy, health-conscious consumers globally.

Key Challenges

Quality Control and Standardization Issues

Ensuring consistency, safety, and efficacy of herbal supplements remains a significant challenge. Variability in raw materials, extraction processes, and ingredient sourcing can affect product quality. For instance, some small-scale manufacturers have faced recalls due to contamination or inaccurate labeling of herbal content. Lack of global standardization complicates cross-border trade and regulatory compliance, impacting market credibility. Companies must invest in advanced testing, GMP-certified production, and transparent quality reporting to maintain consumer trust and mitigate risks associated with substandard products.

Regulatory Complexity and Compliance Barriers

Navigating diverse regulatory frameworks across regions poses challenges for herbal supplement manufacturers. Different countries enforce varying labeling, health claims, and safety requirements. For instance, exporting an Ayurvedic supplement from India to the EU requires compliance with stringent European safety standards and documentation. Non-compliance can result in delays, fines, or market exclusion, particularly for small and mid-sized companies. Companies must maintain robust regulatory intelligence, legal support, and adaptive manufacturing processes to ensure smooth international expansion while meeting evolving local and global compliance standards.

Regional Analysis

North America

North America leads the Herbal Supplements Market with a 36.2% share in 2024. The region benefits from a strong consumer shift toward preventive health and natural remedies. High awareness of dietary supplements and an established nutraceutical industry further drive demand. The U.S. dominates due to widespread retail availability, advanced product formulations, and FDA-approved herbal supplement regulations. Increasing integration of herbal products in mainstream pharmacy chains and e-commerce platforms supports market penetration. Moreover, rising demand for organic and clean-label formulations continues to propel market expansion across North America.

Europe

Europe holds a 28.6% share of the Herbal Supplements Market, supported by strong demand for botanical and natural health solutions. Countries such as Germany, France, and the UK are major contributors due to well-established herbal traditions and consumer trust in phytomedicine. The European Medicines Agency (EMA) regulates herbal products, enhancing safety and market credibility. Rising adoption among aging populations seeking natural alternatives to pharmaceuticals further boosts sales. Additionally, growing consumer preference for plant-based wellness products contributes to Europe’s steady market growth trajectory.

Asia-Pacific

Asia-Pacific accounts for a 24.9% share of the Herbal Supplements Market and exhibits the fastest growth. The region’s dominance stems from rich traditional medicine systems like Ayurveda, Traditional Chinese Medicine, and Kampo. China, India, and Japan are key markets due to abundant herbal resources and strong local manufacturing bases. Rising disposable incomes and health awareness among urban consumers increase supplement consumption. The expansion of nutraceutical startups and government initiatives promoting traditional medicine also enhance market potential across Asia-Pacific.

Latin America

Latin America captures a 6.4% share of the Herbal Supplements Market, driven by increasing awareness of preventive healthcare and the growing middle-class population. Brazil and Mexico lead due to the popularity of traditional plant-based remedies and expanding retail networks. Consumers increasingly favor herbal supplements for immunity, digestion, and energy enhancement. Regional producers focus on using indigenous herbs such as guarana and maca root. Improved distribution through pharmacies and e-commerce platforms strengthens accessibility, supporting continuous market growth across Latin America.

Middle East & Africa (MEA)

The Middle East & Africa region represents a 3.9% share of the Herbal Supplements Market and shows steady expansion. Growing preference for natural therapies and preventive care, especially in the Gulf Cooperation Council (GCC) countries, drives regional adoption. South Africa and the UAE are key contributors, with rising herbal product imports and expanding wellness centers. Increasing consumer education and healthcare spending also enhance market penetration. Additionally, government efforts to diversify healthcare products and promote local herbal manufacturing support MEA’s long-term market growth.

Market Segmentations:

By Product Type:

By Form:

By Source:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Herbal Supplements Market features leading players such as Gaia Herbs, Swanson, Solgar, Inc., Jarrow Formulas, Inc., Nature’s Bounty, Amway, Ancient GreenFields PVT LTD, NOW Foods, Herbalife, and Nature’s Way. The Herbal Supplements Market is highly competitive, marked by continuous innovation and diversification of product portfolios. Companies focus on developing science-backed formulations, organic sourcing, and sustainable production to strengthen consumer trust and meet regulatory standards. Expansion into digital and e-commerce channels has become a key growth strategy, allowing brands to reach health-conscious consumers more effectively. Manufacturers invest in R&D to create herbal blends addressing immunity, stress, and digestive health, aligning with global wellness trends. Moreover, strategic collaborations, clean-label certifications, and region-specific product adaptations play a vital role in expanding brand presence. The competition is further intensified by increasing private-label participation and continuous product differentiation aimed at maintaining market relevance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gaia Herbs

- Swanson

- Solgar, Inc.

- Jarrow Formulas, Inc.

- Nature’s Bounty

- Amway

- Ancient GreenFields PVT LTD

- NOW Foods

- Herbalife

- Nature’s Way

Recent Developments

- In April 2025, The Vitamin Shoppe launched GLP-1 Support from Whole Health Rx was launched by the Vitamin Shoppe. The aim behind this launch was to address the health and nutritional needs of people taking GLP-1 medications for weight management.

- In February 2025, GetHealthy and Vitaboom partner to offer practitioners daily-dosed supplement packs, enhancing client convenience, compliance, and branding consumers.

- In September 2024, Tata Tea Gold unveiled a limited edition of Kumartuli-themed packs to celebrate the Durga Puja festival. The packs incorporate five symbolic elements: Dhunuchi dance, Shankho Dhwani, Dhaki, Ashtami Pujarin, and Sindoor Khela.

- In April 2024, Naturacare will be demonstrating its full manufacturing capabilities and launching four brand new products at Vitafoods Europe. The new offerings include Vital Extend, a bilayer tablet for energy and vitality; Bacti Serenity, targeting stress and gut-brain health.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for plant-based supplements will continue to rise due to health awareness.

- Companies will focus more on organic certifications to build consumer trust.

- E-commerce and online distribution will play a greater role in product sales.

- Research-backed formulations will drive product differentiation in global markets.

- Clean-label and non-GMO products will dominate future product development trends.

- The aging population will create consistent demand for herbal supplements targeting chronic conditions.

- Asia-Pacific will emerge as a key production and consumption hub for herbal products.

- Collaborations with healthcare professionals will enhance brand credibility and consumer confidence.

- Technological integration in manufacturing will improve product quality and shelf stability.

- Regulatory harmonization across regions will encourage global expansion of herbal supplement brands.