Market Overview

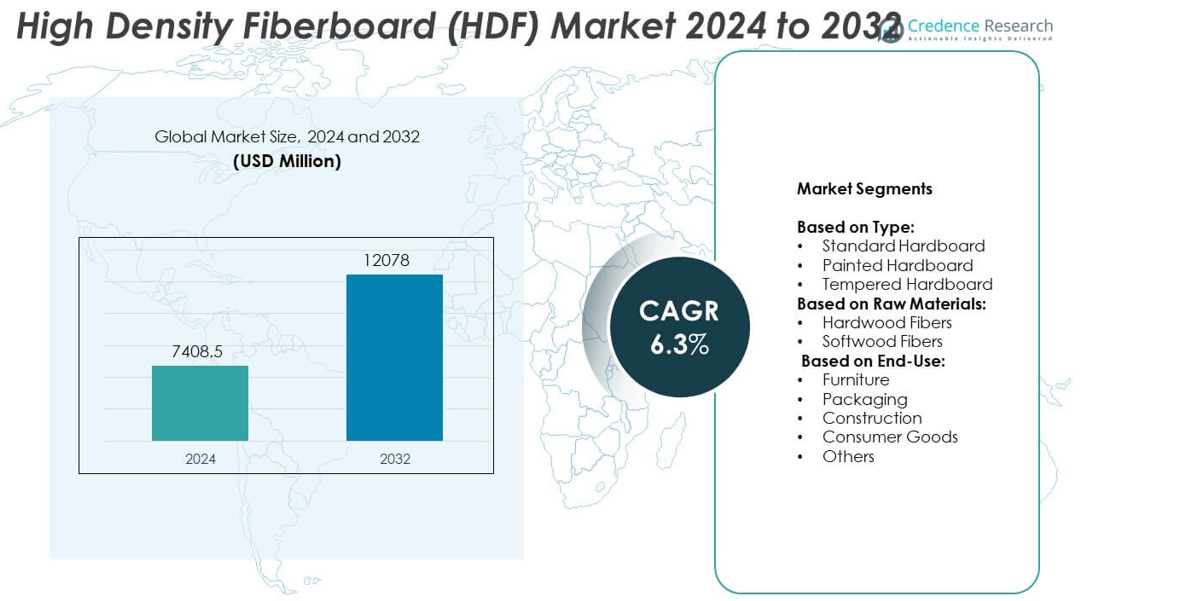

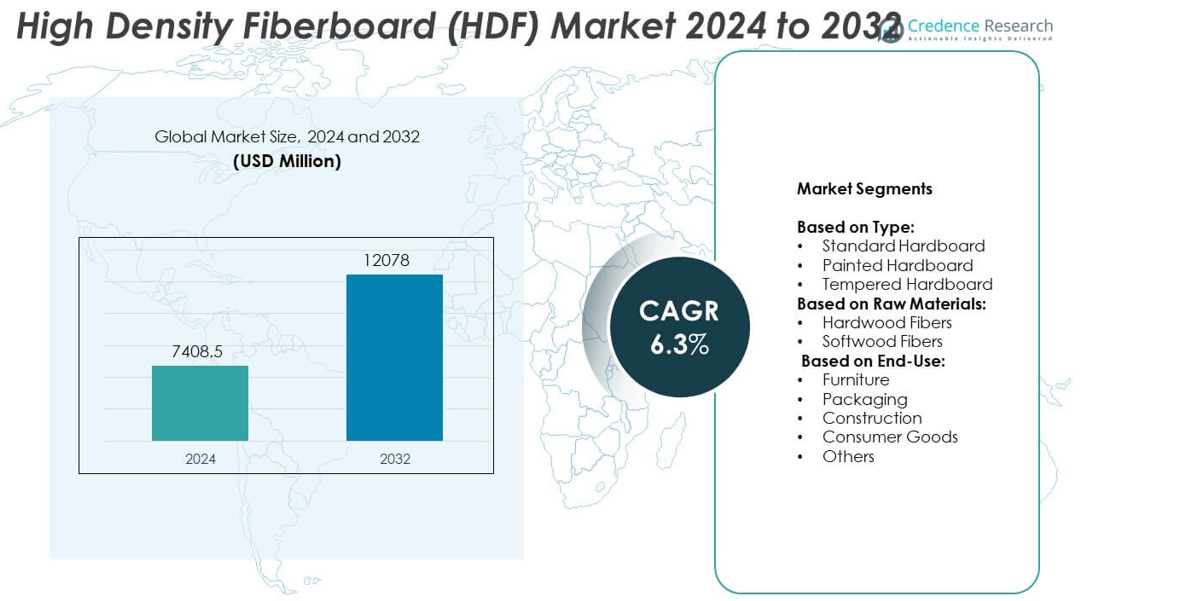

The High Density Fiberboard (HDF) Market size was valued at USD 7408.5 million in 2024 and is projected to reach USD 12078 million by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Density Fiberboard (HDF) Market Size 2024 |

SD 7408.5 million |

| High Density Fiberboard (HDF) Market, CAGR |

6.3% |

| High Density Fiberboard (HDF) Market Size 2032 |

USD 12078 million |

The High Density Fiberboard (HDF) market grows with rising demand from the furniture and construction industries, supported by its durability, smooth finish, and cost efficiency. Increasing adoption of eco-friendly and low-emission boards strengthens its position under stricter environmental regulations. Decorative finishes and customization trends drive usage in modern interiors, while advancements in manufacturing technologies improve product quality and performance. Expanding urbanization in emerging economies further boosts consumption, creating consistent opportunities for manufacturers to innovate and expand their global presence.

The High Density Fiberboard (HDF) market shows strong growth across Asia-Pacific, North America, and Europe, with emerging economies driving significant demand through construction and furniture expansion. Asia-Pacific leads in production and consumption due to rapid urbanization and large manufacturing bases. North America and Europe maintain steady demand supported by sustainable product adoption and renovation activities. Key players such as Kronospan, Greenpanel Industries, Swiss Krono Group, and Arauco focus on expanding capacity, introducing eco-friendly solutions, and strengthening regional distribution networks.

Market Insights

- The High Density Fiberboard (HDF) market was valued at USD 7408.5 million in 2024 and is expected to reach USD 12078 million by 2032, growing at a CAGR of 6.3%.

- Demand is driven by the furniture industry due to HDF’s durability, smooth surface, and cost-effectiveness, making it suitable for modular and modern designs.

- Trends highlight increasing adoption of eco-friendly, low-emission boards and decorative finishes, with consumers preferring sustainable solutions and customized interiors.

- Leading players including Masonite International, Kronospan, Greenpanel Industries, Swiss Krono Group, and Arauco compete by expanding capacity, investing in technology, and enhancing product performance.

- Challenges include raw material price fluctuations, moisture sensitivity, and competition from alternatives such as plywood and particleboard, which limit adoption in some applications.

- Asia-Pacific leads demand due to rapid urbanization, housing projects, and strong furniture production, while North America and Europe show steady growth through renovation and eco-friendly product demand.

- Latin America and the Middle East & Africa expand gradually, supported by construction projects and rising furniture consumption, offering future opportunities for market participants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand in the Furniture and Interior Industry

The High Density Fiberboard (HDF) market benefits from rising adoption in furniture and interior design. Manufacturers prefer HDF due to its smooth finish, durability, and ability to support intricate designs. It helps furniture makers meet consumer demand for cost-effective yet visually appealing products. The trend of modular furniture in urban housing boosts its utilization. Growing construction projects also increase the requirement for HDF-based panels and fittings. This demand cycle creates a consistent push for manufacturers to expand production. It strengthens the market presence across both residential and commercial applications.

- For instance, Hatil produces 48 000 furniture units per month, using engineered wood and HDF-derived particle boards in its automated factories

Sustainability and Use of Recycled Raw Materials

The High Density Fiberboard (HDF) market gains momentum from rising emphasis on sustainability. Producers are focusing on eco-friendly materials and recycled wood fibers to reduce environmental impact. It supports compliance with stricter regulations on sustainable manufacturing practices. Eco-conscious consumers drive preference for panels with reduced emissions and sustainable certification. Global retailers encourage suppliers to adopt environmentally responsible materials, reinforcing adoption. Use of advanced production processes enhances the market’s green profile. This focus on sustainability positions HDF as a long-term alternative to solid wood.

- For instance, Unilin Panels employs a world-first industrial method to recycle discarded MDF and HDF. This innovation enables the company to store 380 000 tonnes of CO₂ annually by reusing wood fibers

Advancements in Manufacturing Technologies

The High Density Fiberboard (HDF) market advances with continuous improvements in manufacturing technology. Modern machinery enables precise density control, smoother surfaces, and enhanced durability. It supports consistent product quality across large-scale production. Automation reduces costs, shortens production cycles, and improves supply capabilities. Producers invest in advanced resin formulations that improve moisture resistance and strength. The adoption of digital cutting and pressing technologies further refines customization. These technological upgrades expand the scope of HDF applications in varied industries.

Expansion in Construction and Real Estate Development

The High Density Fiberboard (HDF) market grows with the steady expansion of construction and real estate projects. Residential and commercial developments demand cost-effective and durable materials for interior applications. It provides a reliable solution for flooring, wall paneling, and doors in large projects. Developers choose HDF due to its uniform texture and resistance to warping. Rising urbanization drives steady consumption in fast-growing economies. Government infrastructure projects also expand opportunities for HDF suppliers. This wide adoption cements its role as a key material in modern construction.

Market Trends

Growing Adoption of Eco-Friendly and Low-Emission Boards

The High Density Fiberboard (HDF) market is witnessing a growing trend toward eco-friendly materials. Producers are developing boards with low formaldehyde emissions to meet stricter regulations. It supports rising consumer demand for safer indoor air quality in residential and commercial spaces. Certification standards such as CARB and E1 drive greater compliance and adoption. Global brands push suppliers to align with sustainability goals, strengthening demand for green-certified products. The trend elevates HDF’s reputation as an environmentally responsible alternative to plywood and particleboard.

- For instance, Solenis developed its Soyad adhesive line, which contains zero formaldehyde and very low volatile organic compounds. Its products meet CARB Phase 2 and LEED criteria and earned the U.S. EPA’s Presidential Green Chemistry Challenge Award

Integration of Decorative Finishes and Customization Options

The High Density Fiberboard (HDF) market benefits from increasing demand for decorative finishes. Consumers prefer panels with pre-laminated, painted, or veneered surfaces for direct application. It allows end-users to save time and reduce post-processing costs. Designers embrace HDF due to its ability to mimic natural wood grains with precision. Rising demand for personalized interiors boosts the need for customized panels. Manufacturers introduce innovative textures and shades to attract a wider customer base. This trend reinforces HDF’s role in modern furniture and interior applications.

- For instance, Evertree introduced Green Ultimate™ plant-based MDF (applicable to HDF-like uses) emitting 0.01 ppm formaldehyde, matching solid-wood emission levels

Technological Innovations for Improved Performance

The High Density Fiberboard (HDF) market evolves with advancements in technology. Producers enhance board performance through improved resin systems and advanced pressing methods. It results in higher moisture resistance, thermal stability, and better load-bearing capacity. Investments in digital and automated machinery support efficient large-scale production. Companies integrate precision cutting tools that expand design flexibility for industrial users. Technological progress increases the competitiveness of HDF against alternative engineered wood products. The trend enhances its application scope across diverse industries.

Expansion in Emerging Economies with Urbanization Growth

The High Density Fiberboard (HDF) market expands rapidly in emerging economies due to urbanization. Rapid population growth creates strong demand for affordable housing and durable interior materials. It enables HDF to gain traction in flooring, cabinetry, and wall paneling. Governments in Asia-Pacific and Latin America promote large-scale housing projects, boosting demand further. Expanding middle-class populations fuel higher spending on modern furniture and interiors. Global players invest in local manufacturing units to reduce supply gaps. This trend secures HDF’s position as a preferred choice in fast-growing regions.

Market Challenges Analysis

Volatility in Raw Material Supply and Price Fluctuations

The High Density Fiberboard (HDF) market faces challenges from unstable raw material supply and cost variations. Wood fiber availability depends on forestry regulations, environmental policies, and regional deforestation limits. It raises procurement risks for manufacturers that rely heavily on consistent supply chains. Rising global demand for wood-based products adds further pressure on raw material costs. Energy and resin prices also contribute to unpredictable production expenses. Fluctuating costs create difficulties in pricing strategies and profit margin stability. These challenges force producers to adopt tighter sourcing strategies and diversify supply networks.

Moisture Sensitivity and Competition from Alternative Materials

The High Density Fiberboard (HDF) market struggles with issues related to moisture sensitivity. Prolonged exposure to water can cause swelling, reducing product durability in humid environments. It restricts wider adoption in outdoor and high-moisture applications. Competing materials such as medium-density fiberboard, plywood, and particleboard offer comparable solutions at lower costs. Shifts in consumer preferences toward lightweight and multi-functional materials create additional competition. Manufacturers must invest in advanced treatment technologies to address performance gaps. The challenge remains significant for producers aiming to expand into new end-use sectors.

Market Opportunities

Rising Demand from Sustainable Construction and Green Building Projects

The High Density Fiberboard (HDF) market holds significant opportunity from sustainable construction initiatives. Green building certifications encourage the use of eco-friendly, recyclable, and low-emission materials. It positions HDF as a preferred alternative to traditional wood products in large projects. Growing urban development in emerging economies boosts demand for cost-effective yet durable materials. Construction companies seek HDF for flooring, paneling, and cabinetry that align with sustainability targets. Increased awareness of environmental impact drives stronger acceptance in residential and commercial sectors. These factors create steady growth avenues for manufacturers adapting to green standards.

Expansion in Innovative Furniture and Interior Applications

\The High Density Fiberboard (HDF) market benefits from growing opportunities in innovative furniture design. Rising demand for modular, space-saving, and customizable solutions pushes manufacturers to enhance HDF product lines. It provides an ideal base for decorative laminates, veneers, and high-gloss finishes. Consumers prefer versatile boards that combine durability with aesthetic appeal. Advancements in surface treatments expand usage across premium interior applications. E-commerce growth also widens the reach of furniture brands using HDF in diverse product ranges. This trend creates strong potential for manufacturers to capture new customer segments globally.

Market Segmentation Analysis:

By Type:

The High Density Fiberboard (HDF) market divides into standard hardboard, painted hardboard, and tempered hardboard. Standard hardboard dominates due to its wide use in furniture and interior applications. It offers durability, smooth surfaces, and ease of machining for large-scale production. Painted hardboard attracts demand from decorative applications, where cost-effective and pre-finished surfaces reduce processing time. Tempered hardboard secures steady growth with its higher resistance to wear, moisture, and impact. It finds preference in construction, flooring, and packaging sectors requiring superior performance. The diversity in types supports adoption across multiple industries.

- For instance, Arauco is a major global manufacturer of forest products, operating a wide range of panel production facilities across the Americas and in Europe (through its joint venture, Sonae Arauco). The company’s total annual panel production capacity is significantly larger than 5.9 million cubic meters and includes a comprehensive selection of products such as MDF, HDF, hardboard, particleboard, and plywood.

By Raw Material:

The High Density Fiberboard (HDF) market is segmented into hardwood fibers and softwood fibers. Hardwood fibers maintain dominance due to their density, strength, and ability to provide a smooth finish. It ensures higher dimensional stability, making the boards suitable for furniture and flooring. Softwood fibers are gaining attention for their cost efficiency and availability in large volumes. Producers in regions with abundant softwood reserves increasingly integrate them into production. Demand for mixed fiber solutions continues to expand as manufacturers balance quality and cost. The raw material segment strongly influences product durability and end-user adoption.

- For instance, Roseburg Forest Products manages over 600 000 acres of timberland, ensuring stable fiber supply to its manufacturing—serving furniture, construction, and industrial panel needs

By End-Use:

The High Density Fiberboard (HDF) market covers furniture, packaging, construction, consumer goods, and others. Furniture represents the largest segment due to demand for modular, durable, and affordable products. It supports applications in cabinetry, shelving, and interior fittings across residential and commercial spaces. Construction emerges as another key end-use, where HDF is used in paneling, flooring, and doors. Packaging grows steadily with industries preferring lightweight and strong boards for product safety. Consumer goods contribute to niche applications, including electronics, decorative items, and appliances. Other uses include industrial components, offering new opportunities for manufacturers to expand market reach.

Segments:

Based on Type:

- Standard Hardboard

- Painted Hardboard

- Tempered Hardboard

Based on Raw Materials:

- Hardwood Fibers

- Softwood Fibers

Based on End-Use:

- Furniture

- Packaging

- Construction

- Consumer Goods

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

The High Density Fiberboard (HDF) market in North America holds a market share of 24% in 2024, supported by strong demand across furniture, construction, and consumer goods sectors. The region benefits from established manufacturing bases, advanced technology adoption, and robust consumer purchasing power. It plays a vital role in the premium furniture market, where HDF is chosen for its smooth surface, durability, and ease of customization. Growing renovation activities and demand for modular interiors strengthen its adoption in residential spaces. Construction firms also prefer HDF panels for flooring, doors, and wall applications due to cost efficiency and consistency in performance. The presence of leading manufacturers and investments in sustainable, low-emission boards further drive growth. With rising emphasis on eco-friendly products, North America continues to expand its use of HDF in both commercial and residential applications, making it a stable and mature market.

Europe

Europe accounts for 21% of the High Density Fiberboard (HDF) market, with high penetration in the furniture and interior design industries. The region’s strict environmental regulations drive adoption of low-emission boards and recycled fiber-based products. Countries such as Germany, Italy, and France lead in production and consumption, particularly in modular and luxury furniture. It gains strong traction from eco-conscious consumers who demand certified sustainable products. The growing renovation activities in urban housing projects create steady demand for HDF panels. Rising use of advanced decorative finishes in HDF boards also meets Europe’s preference for aesthetics and functionality. The region is expected to maintain steady growth as local manufacturers integrate innovative technologies and expand into Eastern European markets.

Asia-Pacific

The High Density Fiberboard (HDF) market in Asia-Pacific dominates globally with a market share of 38%, making it the leading regional market. Rapid urbanization and population growth drive strong demand for cost-effective and durable materials. Furniture manufacturing hubs in China, India, and Southeast Asia rely heavily on HDF for cabinetry, flooring, and decorative interiors. It gains further momentum from government initiatives supporting housing development and infrastructure projects. Rising middle-class incomes increase consumer spending on modern furniture and interiors. The region also benefits from abundant raw material availability, lower production costs, and expanding export opportunities. Continuous investments in advanced production facilities make Asia-Pacific a key driver of global HDF market expansion.

Latin America

Latin America holds a market share of 9% in the High Density Fiberboard (HDF) market, supported by construction growth and expanding furniture demand. Brazil and Mexico serve as primary contributors, leveraging their industrial bases and rising consumer spending. It gains traction in affordable housing projects, where HDF offers cost-effective solutions for doors, flooring, and paneling. Packaging industries also increasingly adopt HDF boards due to their strength and durability. Local manufacturers benefit from rising government support for sustainable wood-based industries. While the market is smaller compared to developed regions, steady economic development ensures long-term growth. Regional adoption expands further as supply chains improve and global players increase their presence.

Middle East and Africa

The High Density Fiberboard (HDF) market in the Middle East and Africa represents 8% of the global share, driven by rapid construction growth and rising urbanization. Gulf countries, led by the UAE and Saudi Arabia, demand high volumes of HDF panels for real estate projects and commercial construction. It finds increasing use in doors, wall cladding, and interiors due to its cost-effectiveness and consistent quality. In Africa, rising urban populations and expanding infrastructure projects support gradual adoption. Consumer demand for affordable furniture solutions also creates steady growth prospects. The region faces challenges in raw material availability but offsets them with imports and foreign investment in production facilities. Future growth potential remains significant as governments prioritize modern infrastructure and housing development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Swiss Krono Group

- Greenpanel Industries

- Masisa

- Jiangsu Hysen International Trading Co

- Dare Wood-Based Panels Group

- Arauco

- Masonite International

- Kronospan

- Finsa

Competitive Analysis

The competitive landscape of the High Density Fiberboard (HDF) market features leading players such as Masonite International, Jiangsu Hysen International Trading Co, Greenpanel Industries, Arauco, Kronospan, Masisa, Swiss Krono Group, Finsa, and Dare Wood-Based Panels Group. These companies focus on expanding production capacity, improving product quality, and enhancing global distribution networks to strengthen their market presence. Many invest in advanced manufacturing technologies to deliver boards with higher durability, better surface finishes, and improved moisture resistance. Sustainability initiatives also play a key role, with firms developing low-emission products to comply with environmental regulations and meet consumer demand for eco-friendly solutions. Strategic mergers, acquisitions, and partnerships are common, helping companies diversify portfolios and enter new regional markets. Strong emphasis on decorative finishes and customized solutions allows them to serve diverse applications in furniture, construction, and consumer goods. Pricing strategies remain competitive, especially in emerging economies where cost-sensitive demand is rising. These players continue to balance efficiency, innovation, and sustainability to maintain leadership and expand their footprint in a growing global market.

Recent Developments

- In 2024, Masisa entered the Dow Jones Sustainability MILA Pacific Alliance Index and achieved 4th place in its sector, based on its score of 72 out of 100 in the S&P Global Corporate Sustainability Assessment (CSA).

- In 2024, Swiss Krono Group installed a new CEO, Peter Wijnbergen, effective signaling leadership transition driving strategic direction

- In 2024, Kronospan showcased its Kronodesign® Trend Collection offering innovative design solutions at the SICAM fair in Italy

Report Coverage

The research report offers an in-depth analysis based on Type, Raw Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The High Density Fiberboard (HDF) market will grow with increasing demand for modular furniture.

- Rising focus on sustainable and low-emission materials will shape production practices.

- Expansion in residential and commercial construction will continue to drive adoption.

- Manufacturers will invest in advanced surface treatments to enhance durability and design appeal.

- Emerging economies will provide strong growth opportunities through rapid urbanization.

- Digital and automated technologies will improve production efficiency and product quality.

- Global players will expand local manufacturing units to reduce supply chain challenges.

- Demand for decorative finishes and customized panels will strengthen across interiors.

- Competition with alternative wood-based products will push innovation in performance features.

- Sustainability certifications will remain crucial for gaining consumer and regulatory acceptance.