Market Overview:

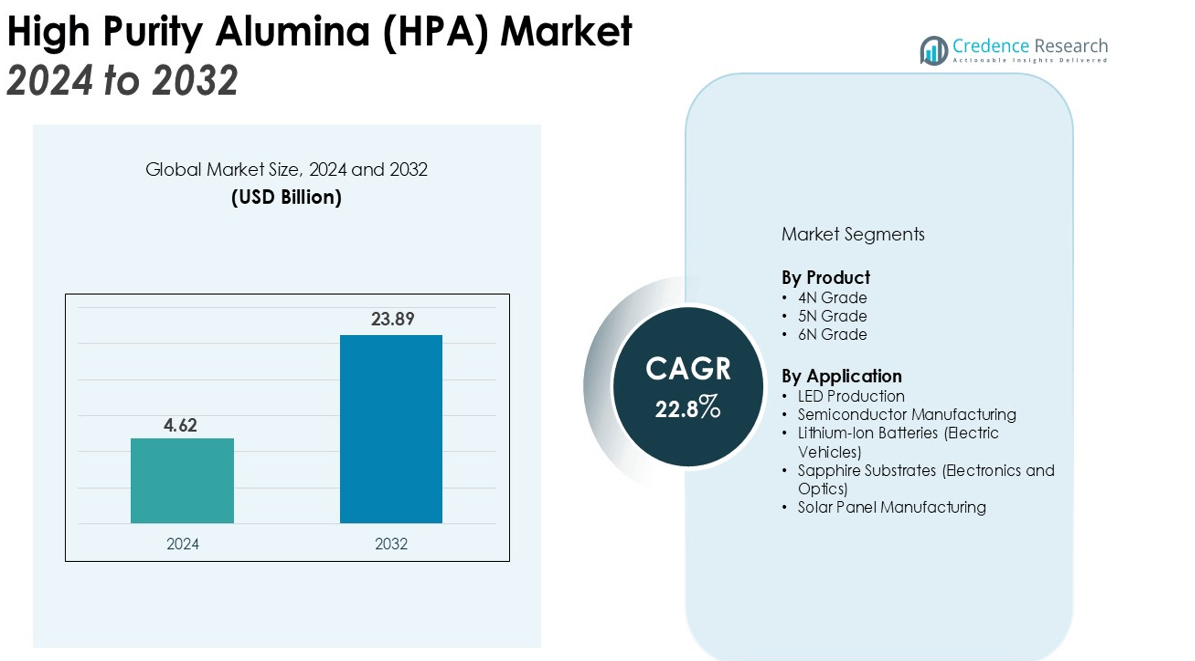

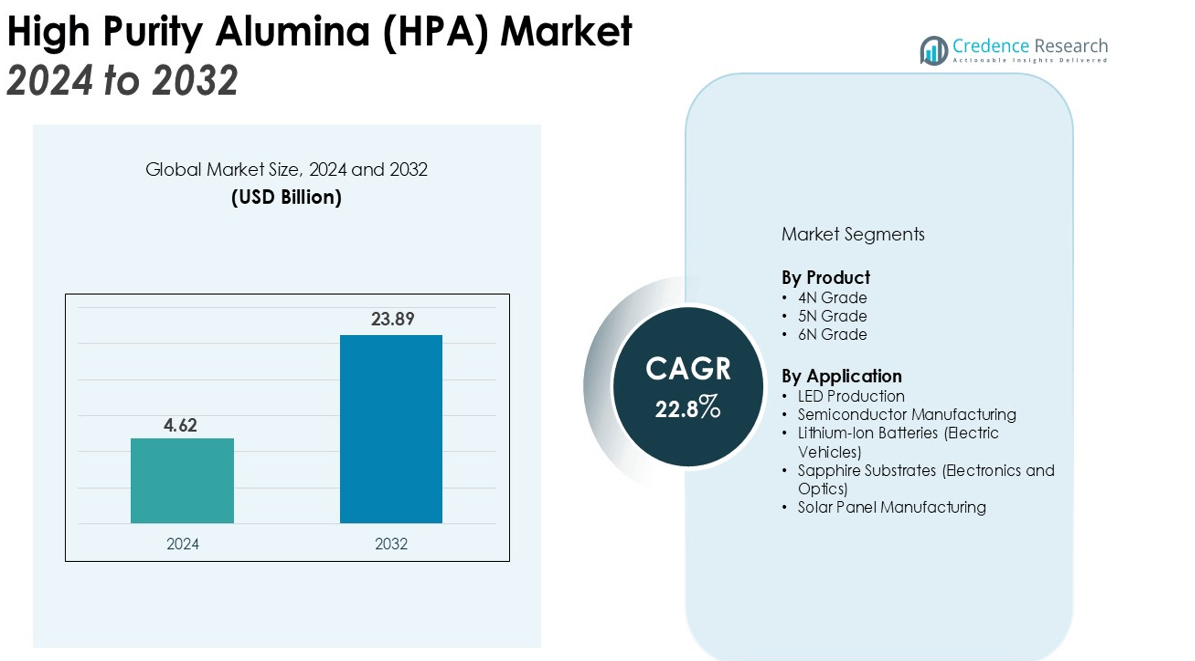

The High Purity Alumina (HPA)Market size was valued at USD 4.62 billion in 2024 and is anticipated to reach USD 23.89 billion by 2032, at a CAGR of 22.8% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Purity Alumina (HPA) Market Size 2024 |

USD 4.62 billion |

| High Purity Alumina (HPA) Market, CAGR |

22.8% |

| High Purity Alumina (HPA) Market Size 2032 |

USD 23.89 billion |

The market is driven by the growing adoption of HPA in the production of high-quality LED lighting, advanced electronic devices, and electric vehicle (EV) batteries. The shift toward energy-efficient solutions and the increasing need for high-performance materials in electronics and automotive sectors further boosts market growth. Additionally, HPA’s role in the production of synthetic sapphire for semiconductor wafers is increasingly important, as it enables superior performance in electronics. Technological advancements in production processes, such as improved refining techniques, also support the market’s expansion. The increasing focus on sustainable technologies and the growing shift towards electric vehicles (EVs) further propels demand for High Purity Alumina, particularly in battery applications.

Regionally, North America dominates the HPA market due to significant demand in the semiconductor and electronics industries, along with strong investments in research and development. Asia Pacific, particularly China, is the fastest-growing market, driven by robust industrial demand, especially in LED and battery manufacturing. Europe follows closely, with increasing use of HPA in automotive applications and renewable energy technologies.

Market Insights:

- The High Purity Alumina (HPA) market is projected to grow from USD 4.62 billion in 2024 to USD 23.89 billion by 2032, at a CAGR of 22.8%.

- The adoption of HPA in energy-efficient LED lighting systems is a major driver, with global demand for sustainable lighting solutions increasing.

- Electric vehicle (EV) battery production is creating new opportunities for HPA, particularly in lithium-ion batteries that enhance performance and stability.

- HPA’s role in semiconductor manufacturing, especially in synthetic sapphire substrates, continues to support its growth in high-performance electronics.

- Technological advancements in HPA production, including refined refining processes, are making it more accessible and cost-effective for multiple industries.

- North America leads the market with strong demand from the semiconductor, electronics, and automotive sectors, fueled by substantial investments in research and development.

- Asia Pacific is the fastest-growing region, driven by industrial demand in China and other countries focusing on LED lighting, EV production, and semiconductor manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Energy-Efficient Lighting Solutions

The growing adoption of High Purity Alumina (HPA) in the production of energy-efficient LED lighting systems is a significant driver in the market. HPA is used to produce synthetic sapphire, a critical material for LED chips, ensuring high brightness and energy savings. The global push toward reducing energy consumption and minimizing carbon footprints accelerates demand for HPA in the lighting industry. Rising government regulations favoring energy-efficient products further bolster the growth of HPA as a key material in LED manufacturing.

- For instance, Nichia Corporation’s NVSW719AC series LED, used in high-power lighting applications, can achieve a luminous flux of 742 lumens, demonstrating the high performance enabled by advanced materials.

Expansion of Electric Vehicle (EV) Battery Applications

The rapid growth of the electric vehicle (EV) market drives the demand for HPA, especially in the production of lithium-ion batteries. HPA is used to enhance battery performance by improving the conductivity and stability of the battery’s components. With increasing environmental concerns and stricter emissions regulations, the shift toward electric mobility accelerates HPA market expansion. The automotive industry’s transition to electric vehicles has created new growth opportunities for HPA, particularly in battery production.

Advancements in Semiconductor Manufacturing

HPA’s role in semiconductor manufacturing is another critical driver for its market growth. High Purity Alumina is used in the production of synthetic sapphire substrates, which are essential for semiconductor wafers. These wafers enable the production of high-performance electronics, including smartphones, computers, and other devices. The continuous demand for smaller, faster, and more efficient electronic devices directly boosts the demand for HPA in semiconductor applications.

- For instance, Kyocera mass-produces single-crystal sapphire wafers for electronic devices and meets industry demands for larger sizes. The company manufactures these substrates with a diameter of up to 8 inches.

Technological Improvements in HPA Production

Ongoing technological advancements in the production of HPA contribute significantly to market growth. New refining methods have improved the quality and yield of HPA, making it more accessible to industries requiring high-purity materials. These improvements have made HPA production more cost-effective, expanding its applicability across various industries, including electronics, automotive, and renewable energy. Enhanced production capabilities help meet the growing demand for HPA across multiple high-performance sectors.

Market Trends:

Rising Demand for Electric Vehicle (EV) Batteries and LED Lighting

The High Purity Alumina (HPA) market is witnessing a significant shift toward applications in electric vehicle (EV) batteries and energy-efficient LED lighting. With the rapid expansion of the electric vehicle industry, the demand for HPA is surging due to its use in enhancing the performance and longevity of lithium-ion batteries. HPA plays a crucial role in the production of synthetic sapphire, which is utilized in LEDs, offering energy savings and longer lifespan. Governments around the world are pushing for stricter regulations on energy efficiency, which further accelerates the adoption of LED lighting and EV technologies. This growing trend toward energy-efficient products continues to drive the demand for HPA, particularly in the automotive and lighting sectors.

- For instance, Altech’s German pilot plant is designed to produce 120kg of anode grade coated battery material per day using its proprietary HPA coating technology for silicon in lithium-ion battery anodes.

Technological Innovations in HPA Production and Applications

Technological advancements in HPA production are driving its broader adoption across various industries. The development of new refining techniques has improved HPA’s purity levels and production efficiency, reducing costs while enhancing product quality. These innovations enable the expansion of HPA’s use in high-performance sectors such as semiconductor manufacturing, where it is utilized for producing synthetic sapphire substrates. The increasing focus on sustainable and advanced manufacturing processes is shaping the future of HPA production. As industries continue to seek materials that offer superior performance and environmental benefits, HPA is becoming a key component in sectors like electronics, automotive, and renewable energy. The continued evolution of HPA production techniques supports its growing role in next-generation technologies.

- For example, Sumitomo Chemical has developed a production technology for ultra-fine α-alumina with a particle size of 150 nanometers, which is set for mass production to be used as a polishing agent for next-generation semiconductors.

Market Challenges Analysis:

High Production Costs and Supply Chain Constraints

One of the major challenges facing the High Purity Alumina (HPA) market is the high production costs associated with its refining processes. The process of extracting and refining HPA requires significant energy and advanced technologies, which can result in substantial capital expenditures. These high costs can limit the ability of smaller manufacturers to enter the market and may hinder the growth of HPA adoption in cost-sensitive industries. Moreover, the global supply chain for raw materials necessary for HPA production, such as bauxite, is subject to disruptions, leading to further cost increases and supply inconsistencies.

Dependency on Specific Applications and Market Volatility

The demand for HPA is highly dependent on specific industries such as semiconductor manufacturing, LED production, and electric vehicle battery production. A downturn in any of these sectors could significantly impact HPA market growth. The market’s reliance on technological advancements in these industries creates vulnerability to market volatility. Shifts in consumer preferences or changes in government regulations could disrupt the demand for HPA in key sectors, leading to uncertainty in future growth. Furthermore, the high competition within these sectors may place pressure on manufacturers to reduce prices, further affecting profitability.

Market Opportunities:

Expansion in Electric Vehicle (EV) Battery Manufacturing

The High Purity Alumina (HPA) market stands to benefit from the continued growth in the electric vehicle (EV) industry. With governments worldwide pushing for the adoption of cleaner, more sustainable transportation, the demand for EVs is rising steadily. HPA is crucial in the production of high-performance lithium-ion batteries, which are essential for EV energy storage. As the automotive industry shifts toward electric mobility, manufacturers are increasingly relying on HPA to enhance battery efficiency and longevity. This shift provides a significant opportunity for HPA producers to expand their presence in the rapidly growing EV sector.

Growth in Renewable Energy and LED Lighting Applications

The increasing global emphasis on energy efficiency and sustainability presents substantial opportunities for the High Purity Alumina market. HPA’s use in LED lighting technology continues to grow due to its ability to improve the energy efficiency and lifespan of LEDs. The global transition to greener technologies, such as solar and wind energy, also drives demand for HPA in the production of advanced materials and components. This trend aligns with the rising demand for energy-efficient solutions in residential, commercial, and industrial applications. As the push for sustainability continues to grow, HPA manufacturers have the opportunity to expand their market share in both LED and renewable energy sectors.

Market Segmentation Analysis:

By Product

The High Purity Alumina (HPA) market is segmented based on product types, primarily into 4N, 5N, and 6N grades. Among these, the 4N grade holds the largest share, driven by its widespread use in LED and semiconductor applications. The 5N and 6N grades, which offer higher purity levels, are increasingly in demand for more specialized applications, such as in advanced battery production and high-performance materials. As industries push for higher efficiency and performance, demand for 5N and 6N HPA is expected to grow, particularly in electronics and energy sectors.

- For instance, Altech Chemicals is constructing a plant in Johor, Malaysia, designed to produce 4,500 tonnes of 4N high purity alumina annually.

By Application

The High Purity Alumina market is widely utilized across several key applications, including LED production, semiconductor manufacturing, lithium-ion batteries, and sapphire substrates. The LED application dominates the market, owing to the growing demand for energy-efficient lighting solutions worldwide. The semiconductor industry also significantly contributes to HPA demand, with its critical role in producing high-quality wafers for electronic devices. Lithium-ion battery applications are emerging as strong growth drivers, particularly with the rise of electric vehicles (EVs) and renewable energy storage systems. HPA’s application in sapphire substrates for high-performance electronics continues to be a vital segment, with its use expanding in displays, mobile devices, and optical equipment. As demand for these technologies increases, HPA’s role in these applications is set to expand.

- For instance, specialized high-purity alumina, such as Polar Performance Materials’ 5N grade, is critical for manufacturing the sapphire substrates used in next-generation mini-LED and micro-LED displays.

Segmentations:

By Product:

- 4N Grade

- 5N Grade

- 6N Grade

By Application:

- LED Production

- Semiconductor Manufacturing

- Lithium-Ion Batteries (Electric Vehicles)

- Sapphire Substrates (Electronics and Optics)

- Solar Panel Manufacturing

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Dominance in Semiconductor and Automotive Sectors

North America holds the largest share of the High Purity Alumina (HPA) market, accounting for 35% of the global market. The U.S. and Canada are major contributors, with strong demand stemming from the semiconductor and automotive industries. The region plays a significant role in the production of electronic devices, where HPA is essential for semiconductor wafers and advanced lighting systems. The rapid growth of the electric vehicle (EV) sector in North America further supports the demand for HPA in battery production. Continuous investments in research and development, particularly in high-tech industries, ensure sustained growth for HPA applications in the region. Government regulations favoring energy-efficient solutions also contribute to market expansion in North America.

Asia Pacific: Rapid Growth Fueled by Industrial Demand

Asia Pacific holds a substantial share of the High Purity Alumina market, comprising 40% of global demand. China is the largest consumer, driven by rapid industrialization and significant investments in electronics, LED lighting, and EV production. The country’s growing emphasis on energy-efficient technologies and green energy initiatives further boosts market opportunities. Other countries in the region, such as Japan and South Korea, are also prominent consumers of HPA, particularly for use in advanced semiconductor manufacturing. As the region’s manufacturing capabilities expand, it presents a strong growth potential for HPA suppliers.

Europe: Expanding Demand in Automotive and Renewable Energy Sectors

Europe accounts for 20% of the global High Purity Alumina market, with strong demand emerging from the automotive and renewable energy sectors. The region is experiencing a shift towards electric mobility, with countries like Germany, France, and the UK adopting stringent emission regulations, leading to increased demand for EV batteries and, consequently, HPA. The growing emphasis on renewable energy solutions, such as solar and wind power, also supports market expansion. Europe’s focus on sustainability and energy efficiency drives the adoption of advanced materials like HPA, contributing to the region’s steady growth in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Almatis, Inc.

- Orbite Technologies Inc.

- HONGHE CHEMICAL

- Altech Chemicals Ltd.

- Polar Sapphire Ltd.

- FYI RESOURCES

- Alpha HPA

- Baikowski

- Nippon Light Metal Holdings Co., Ltd.

- CoorsTek Inc.

- Sumitomo Chemical Co., Ltd.

Competitive Analysis:

The High Purity Alumina (HPA) market is highly competitive, with major players like Alcoa Corporation, Hydro Aluminium, and Nippon Light Metal Co., Ltd. leading the industry. These companies focus on technological advancements, sustainable production methods, and expanding production capacities to meet the increasing demand from semiconductor, LED, and electric vehicle battery applications. New entrants are differentiating themselves through cost-effective production techniques and tapping into emerging markets, particularly in Asia Pacific, where industrial demand is growing rapidly. Strategic partnerships, acquisitions, and geographic expansions are key strategies used by market leaders to strengthen their positions. As demand for HPA continues to rise, competition will intensify, with a strong emphasis on product quality, innovation, and scalability.

Recent Developments:

- In June 2025, Almatis announced a strategic collaboration with Çimsa, a leading producer of Calcium Aluminate Cement (CAC), to combine their expertise and offer a wider range of CAC products for the refractory and building chemistry industries.

- In September 2025, Altech Batteries announced that the CERENERGY® battery prototype had reached key milestones and was undergoing performance testing.

- In May 2025, Alpha HPA announced its expansion into a new facility in Brisbane, Australia, to support its growth in the synthetic sapphire sector.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The High Purity Alumina (HPA) market will experience significant growth driven by increasing demand for energy-efficient lighting and advanced electronics.

- Rising adoption of electric vehicles (EVs) will continue to boost demand for HPA in lithium-ion batteries, creating new growth opportunities.

- Technological advancements in refining processes will enhance HPA quality and reduce production costs, expanding its applications.

- Demand for HPA in the semiconductor industry will remain strong, particularly for its use in high-performance wafers and advanced materials.

- The shift towards renewable energy sources will increase HPA usage in solar panel manufacturing, further broadening its application base.

- Increased focus on sustainability and energy-efficient solutions will drive the adoption of HPA in various green technologies.

- The Asia Pacific region will continue to be a major growth driver, with countries like China leading industrial demand for HPA.

- Strategic mergers, acquisitions, and partnerships will play a key role in strengthening the market positions of key players.

- The growing importance of HPA in the production of synthetic sapphire for high-end electronics will sustain demand across consumer electronics and mobile devices.

- Future innovations in HPA applications will enable new product development, expanding its use across diverse sectors like aerospace, automotive, and healthcare.