Market Overview:

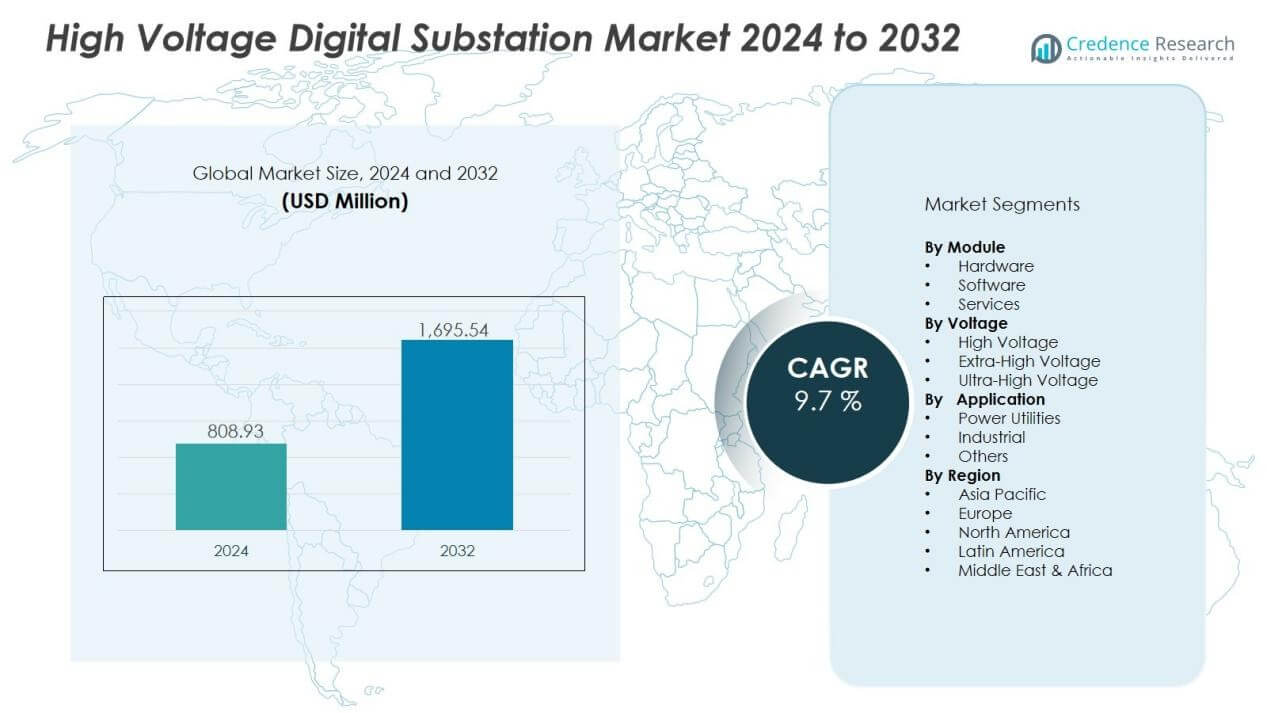

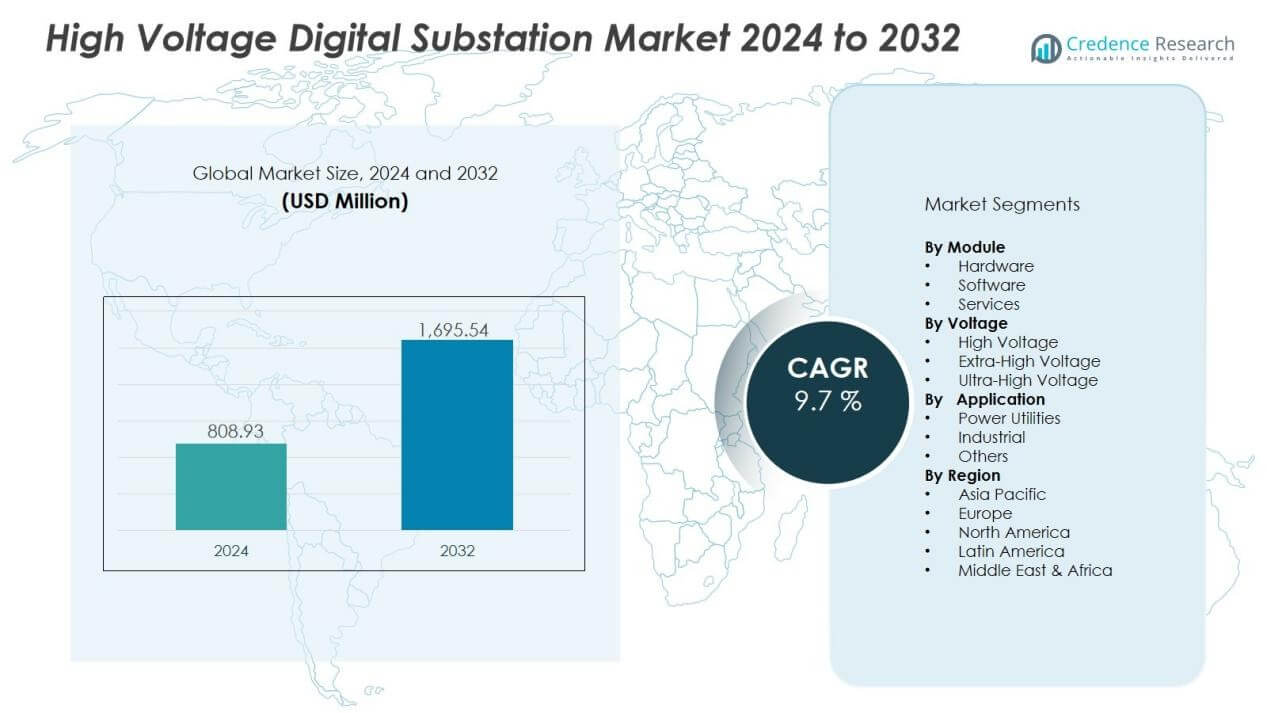

The high voltage digital substation marketsize was valued at USD 808.93 million in 2024 and is anticipated to reach USD 1,695.54 million by 2032, at a CAGR of 9.7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Digital Substation Market Size 2024 |

USD 808.93 Million |

| High Voltage Digital Substation Market, CAGR |

9.7% |

| High Voltage Digital Substation Market Size 2032 |

USD 1,695.54 Million |

Key drivers include the rising integration of renewable energy, growing electricity demand, and the push for grid reliability. Governments and utilities are investing in digital technologies to reduce downtime, optimize asset management, and meet sustainability targets. Adoption of IoT, AI, and cybersecurity solutions within substations further strengthens demand, while cost savings in operation and maintenance add strong economic benefits.

Regionally, North America and Europe remain dominant markets due to early adoption of smart grid technologies, strict regulatory frameworks, and high investment in energy transition. Asia-Pacific is set to witness the fastest growth, supported by rapid urbanization, large-scale industrialization, and government-backed renewable energy initiatives in countries such as China and India. Emerging markets in Latin America and the Middle East & Africa also present growth opportunities through infrastructure upgrades and power sector reforms.

Market Insights:

- The high voltage digital substation market was valued at USD 808.93 million in 2024 and is projected to reach USD 1,695.54 million by 2032, growing at a CAGR of 9.7%.

- Rising demand for grid modernization and reliability is a major driver, with utilities upgrading legacy systems to handle fluctuating power needs.

- Integration of renewable energy supports adoption, as digital substations enable flexible connections for wind and solar power while ensuring grid stability.

- Investments in automation, IoT, AI, and cybersecurity strengthen the market by improving real-time monitoring, predictive analytics, and decision-making.

- High implementation costs and complex integration remain challenges, particularly for utilities in emerging economies facing budget and expertise limitations.

- Cybersecurity risks and regulatory compliance barriers add further challenges, requiring utilities to adopt advanced defense systems and adhere to diverse standards.

- North America led with 32% market share in 2024, followed by Europe at 28%, while Asia-Pacific held 27% and recorded the fastest growth, driven by China and India’s smart grid initiatives. Latin America and the Middle East & Africa together accounted for 13%, supported by infrastructure modernization and renewable energy deployment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Grid Modernization and Reliability:

The high voltage digital substation market is driven by the growing need for reliable and modernized grid infrastructure. Utilities worldwide are under pressure to upgrade legacy systems that cannot handle fluctuating power demands. Digital substations provide advanced monitoring and automation features, ensuring uninterrupted supply and reduced outage risks. It enables operators to optimize system performance while lowering downtime and improving overall efficiency.

- For Instance, China’s State Grid Corporation (SGCC) completed its own first 500 kV digital substation in Feidong, Hefei, in late 2024.

Integration of Renewable Energy and Sustainable Power Solutions:

Expanding renewable energy capacity directly supports the adoption of digital substations. Wind and solar power plants require flexible grid connections to balance intermittent energy flow. The high voltage digital substation market benefits from these projects by enabling real-time control and faster fault detection. It helps utilities manage distributed generation while maintaining grid stability and aligning with sustainability goals.

- For Instance, Siemens was awarded a contract in April 2023 to supply technology for three offshore grid projects for TenneT in Germany, intended to integrate up to 6 GW (6,000 MW) of offshore wind energy once completed by 2031

Growing Investments in Automation and Smart Technologies:

Automation and digitalization remain key drivers for this market. Utilities and industries invest in intelligent substations to streamline operations and lower long-term maintenance costs. The high voltage digital substation market gains momentum through the adoption of IoT, AI, and advanced communication protocols. It provides predictive analytics, cybersecurity integration, and enhanced data sharing to improve decision-making.

Regulatory Support and Infrastructure Development Initiatives:

Government policies and regulations encourage the deployment of safer, more efficient power infrastructure. Investments in smart grids and large-scale electrification projects create opportunities for digital substation deployment. The high voltage digital substation market benefits from funding support, compliance with international standards, and regional grid expansion plans. It positions utilities to meet energy transition targets while addressing growing electricity demand worldwide.

Market Trends:

Growing Adoption of Intelligent Automation and Digital Communication Standards:

The high voltage digital substation market is witnessing a shift toward automation and advanced communication protocols. Utilities and industries are replacing legacy infrastructure with systems that follow IEC 61850 standards, enabling seamless data exchange and interoperability. Intelligent automation tools are enhancing real-time monitoring, predictive maintenance, and asset management, helping operators reduce downtime and operational costs. It supports faster fault detection, streamlined workflows, and improved decision-making through advanced analytics. Cybersecurity is also becoming integral to these upgrades, with digital substations integrating layered defense systems to secure data transmission. The market continues to expand as stakeholders prioritize operational efficiency, cost savings, and resilient energy infrastructure.

- For Instance, New York Power Authority (NYPA) has implemented IEC 61850-based automation in some of its substations, including at the 230 kV and 115 kV levels.

Increasing Integration of Renewables and Hybrid Grid Infrastructure:

Rising global renewable energy investments are creating strong demand for digital substations. Solar and wind power integration requires flexible and intelligent grid management systems, and the high voltage digital substation market plays a central role in ensuring smooth power flow. It enables operators to balance intermittent energy inputs while maintaining reliability across transmission and distribution networks. Hybrid grid models combining traditional and renewable sources are accelerating demand for scalable and adaptable substations. Governments are supporting this trend through energy transition policies and smart grid funding, which encourage rapid deployment. The shift toward electrification of transport and industries further boosts demand for digital substations capable of managing higher loads efficiently.

- For Instance, Amprion is undertaking a major grid expansion for new offshore wind farms, including projects with a transmission capacity of up to 2,000 MW each, which are scheduled for commissioning in the early to mid-2030s.

Market Challenges Analysis:

High Implementation Costs and Complexity of Integration:

The high voltage digital substation market faces challenges due to high upfront costs and complex integration requirements. Deployment involves advanced hardware, software, and cybersecurity systems, which demand significant investment. Many utilities in emerging economies hesitate to shift from traditional substations because of budget constraints and limited technical expertise. It requires specialized training and skilled workforce to manage digital platforms effectively, which increases adoption hurdles. Integration with legacy infrastructure often leads to technical issues, delays, and additional costs. These factors restrict smaller operators from embracing large-scale digital transformation.

Cybersecurity Risks and Regulatory Compliance Barriers:

Cybersecurity remains a major concern for the high voltage digital substation market, as digital systems are vulnerable to targeted attacks. Protecting sensitive grid data demands continuous monitoring, layered defense, and strong compliance measures. It creates financial and operational burdens for utilities that must invest in advanced security frameworks. Different regions also enforce varying regulatory standards, making global deployment more complex. Meeting these diverse requirements slows project execution and adds compliance costs. Limited awareness and lack of uniform global standards further challenge market expansion, especially in underdeveloped regions.

Market Opportunities:

Expansion of Smart Grid Projects and Renewable Energy Integration:

The high voltage digital substation market presents strong opportunities through the global expansion of smart grid projects. Governments and utilities are accelerating investments in renewable energy, requiring advanced substations to balance variable generation. Digital substations enable seamless integration of wind and solar power while maintaining grid stability. It supports predictive analytics, asset optimization, and real-time fault detection to ensure efficient energy delivery. Growing electrification of transport and industrial sectors further drives demand for reliable high-capacity substations. These trends create long-term opportunities for vendors offering scalable and secure digital solutions.

Rising Demand in Emerging Economies and Infrastructure Modernization:

Emerging markets in Asia-Pacific, Latin America, and the Middle East offer significant growth potential for digital substations. Rapid urbanization, industrial expansion, and government-backed infrastructure upgrades fuel adoption across these regions. The high voltage digital substation market benefits from initiatives aimed at reducing energy losses and improving power reliability. It creates opportunities for suppliers to provide cost-effective solutions tailored to local needs. International collaborations, funding programs, and technology partnerships further enhance prospects in developing economies. Vendors that deliver flexible and modular systems are well-positioned to capture growth in these expanding markets.

Market Segmentation Analysis:

By Module:

The high voltage digital substation market by module is divided into hardware, software, and services. Hardware dominates due to the demand for intelligent electronic devices, sensors, and communication networks that support grid automation. It also includes switchgear, transformers, and protection systems that form the backbone of substation operations. Software plays a vital role in managing digital platforms, enabling real-time analytics, and ensuring interoperability. Services contribute through system integration, maintenance, and cybersecurity, helping utilities achieve long-term reliability. Growing reliance on predictive analytics and digital twins further strengthens the role of both software and services.

- For instance, Schneider Electric’s MCSESM intelligent electronic device achieves a communication latency of under 4 microseconds in relay-to-relay data exchange.

By Voltage:

By voltage, the market includes high, extra-high, and ultra-high voltage substations. High voltage substations hold a significant share, serving industries and regional grids that require stable electricity supply. Extra-high voltage substations are expanding due to the need for long-distance transmission with minimal losses. It supports large-scale renewable integration and interconnection of national grids. Ultra-high voltage substations gain momentum in regions like China, where mega infrastructure projects demand higher efficiency and reduced transmission bottlenecks. Each voltage category aligns with specific transmission requirements, enabling tailored solutions across industries and geographies.

- For instance, at Johannesburg’s Sebenza substation, Hitachi ABB Power Grids commissioned Africa’s largest 132 kV gas-insulated switchgear installation featuring 38 bays of GIS to deliver reliable power to the city’s north-eastern region.

By Application:

The high voltage digital substation market by application covers power utilities, industrial, and others. Power utilities dominate, driven by large-scale electrification programs and renewable integration efforts. Industrial applications are rising in sectors such as oil and gas, mining, and manufacturing that require reliable high-capacity grids. It ensures uninterrupted supply and real-time monitoring to reduce downtime. Other applications, including transport and urban infrastructure, are adopting digital substations for resilient and efficient power networks. The growth in diverse applications highlights the adaptability and scalability of digital substation technology.

Segmentations:

By Module:

- Hardware

- Software

- Services

By Voltage:

- High Voltage

- Extra-High Voltage

- Ultra-High Voltage

By Application:

- Power Utilities

- Industrial

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe:

North America held 32% market share in 2024, followed by Europe with 28% market share. The high voltage digital substation market in these regions benefits from strict regulatory frameworks, early adoption of smart grid technologies, and high investment in renewable integration. Utilities prioritize modernization to improve reliability, efficiency, and cybersecurity of transmission networks. It gains further support from government programs aimed at reducing carbon emissions and improving power infrastructure. Europe advances with industrial automation projects and expansion of offshore wind farms. Together, these regions maintain strong demand for advanced substations to meet evolving energy transition targets.

Asia-Pacific:

Asia-Pacific accounted for 27% market share in 2024, driven by large-scale infrastructure development and rapid urbanization. The high voltage digital substation market in this region grows due to rising electricity demand, industrialization, and government-backed renewable energy projects. China and India lead with smart grid initiatives supported by state funding and international collaborations. It benefits from extensive integration of solar and wind energy into national grids. Japan and South Korea contribute through advanced digital adoption in energy-efficient networks. The region demonstrates the fastest growth rate due to its strong focus on sustainability and capacity expansion.

Latin America and Middle East & Africa:

Latin America recorded 7% market share in 2024, while the Middle East & Africa captured 6% market share. The high voltage digital substation market in these regions develops through growing energy projects, urbanization, and modernization of outdated grid systems. Governments encourage private and foreign investments to strengthen transmission and distribution networks. It offers opportunities through renewable energy deployment in Brazil, South Africa, and GCC countries. Rising demand for stable power supply in urban and industrial areas drives adoption of digital substations. Vendors focusing on cost-effective and modular solutions gain strong entry into these expanding markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB Ltd.

- General Electric Company

- Siemens AG

- Schneider Electric

- Cisco Systems Inc.

- Eaton Corporation plc

- Honeywell International Inc.

- Emerson Electric Co..

- Hitachi Energy Ltd

- Honeywell International Inc..

Competitive Analysis:

The high voltage digital substation market is highly competitive, driven by rapid digitalization and grid modernization efforts. Leading players include ABB Ltd., General Electric Company, Siemens AG, Schneider Electric, Cisco Systems Inc., Eaton Corporation plc, and Honeywell International Inc. These companies focus on delivering advanced hardware, software, and communication platforms to improve grid reliability and efficiency. It benefits from their investments in automation, IoT, AI integration, and cybersecurity solutions that support real-time monitoring and predictive maintenance. Strategic collaborations with utilities and governments strengthen their market presence, while innovation in modular and scalable systems enables them to cater to diverse regional needs. Continuous investment in R&D and expansion into emerging economies position these players to capture future growth opportunities.

Recent Developments:

- In May 2025, ABB Ltd. announced its acquisition of BrightLoop, a French power electronics innovator, expanding its off-highway vehicle and marine electrification business.

- In March 2025, General Electric Company completed the acquisition of Woodward Inc.’s gas turbine combustion parts business to strengthen its gas turbine supply chain.

Report Coverage:

The research report offers an in-depth analysis based on Module, Voltage, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The high voltage digital substation market will see rising demand from smart grid expansion and grid modernization.

- Utilities will increase investments in automation, real-time monitoring, and predictive analytics to improve efficiency.

- Adoption of renewable energy will drive deployment of digital substations to manage intermittent power generation.

- Integration of IoT, AI, and advanced communication protocols will enhance reliability and cybersecurity.

- Emerging economies will accelerate adoption through infrastructure upgrades and government-backed electrification projects.

- Vendors will focus on modular and scalable solutions to cater to diverse regional requirements.

- Growing electrification of transport and industries will increase demand for high-capacity substations.

- Collaboration between technology providers and utilities will expand digital ecosystem capabilities.

- Focus on sustainable and low-carbon energy transition will create opportunities for advanced digital solutions.

- Regulatory frameworks and standardization efforts will shape global adoption and industry practices.