Market Overview

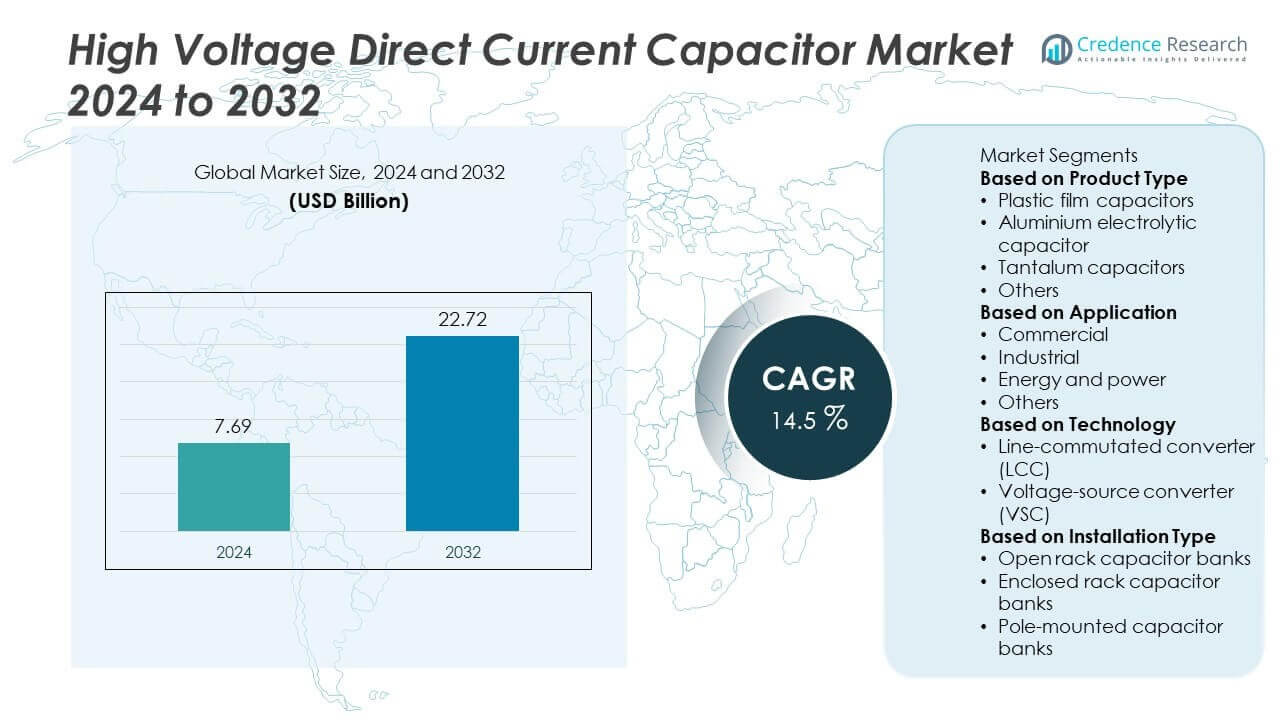

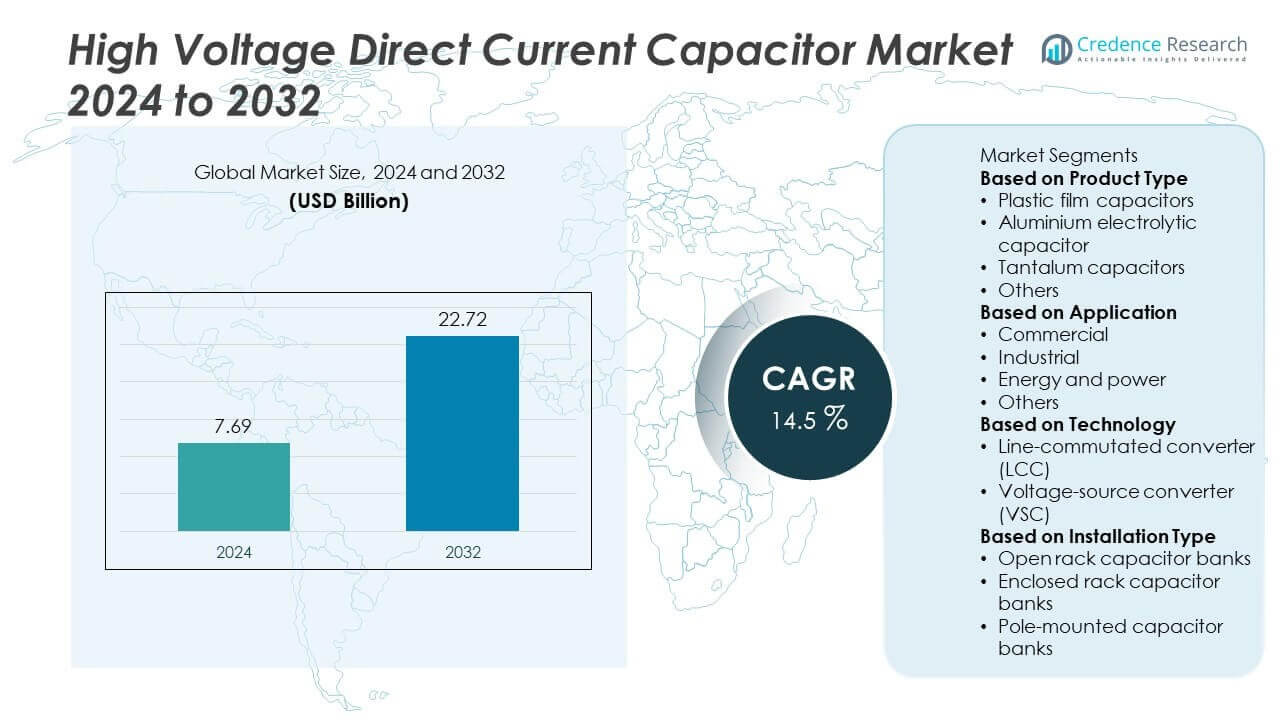

The global HVDC capacitor market was valued at USD 7.69 billion in 2024 and is projected to reach USD 22.72 billion by 2032, growing at a CAGR of 14.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Direct Current Capacitor Market Size 2024 |

USD 7.69 Billion |

| High Voltage Direct Current Capacitor Market, CAGR |

14.5% |

| High Voltage Direct Current Capacitor Market Size 2032 |

USD 22.72 Billion |

The High Voltage Direct Current Capacitor Market grows with rising demand for efficient long-distance power transmission and grid stability solutions. Governments invest in grid modernization projects to integrate renewable energy sources such as wind and solar.Geographically, the High Voltage Direct Current Capacitor Market sees strong growth across Asia-Pacific, Europe, and North America, supported by grid modernization and renewable energy integration projects. Asia-Pacific leads expansion with large-scale HVDC installations in China and India, connecting remote power generation sites to demand centers. Europe focuses on offshore wind integration and interconnection projects linking multiple national grids. North America invests in strengthening transmission infrastructure and cross-border power trading between the U.S., Canada, and Mexico. Key players shaping the market include Siemens AG, ABB Ltd, Vishay Intertechnology Inc, and Eaton Corporation PLC. These companies focus on developing advanced capacitor technologies with improved thermal performance and reliability to support high-capacity HVDC lines. Strategic collaborations, R&D investments, and participation in global infrastructure projects help them strengthen their market position and meet rising demand for energy-efficient power transmission solutions.

Market Insights

- The High Voltage Direct Current Capacitor Market was valued at USD 7.69 billion in 2024 and is expected to reach USD 22.72 billion by 2032, growing at a CAGR of 14.5% during the forecast period.

- Rising demand for efficient power transmission and grid stability solutions drives strong market growth worldwide.

- Growing integration of renewable energy sources such as solar, wind, and offshore projects fuels HVDC system adoption.

- Leading players include Siemens AG, ABB Ltd, Eaton Corporation PLC, and Vishay Intertechnology Inc, focusing on product innovation and global project participation.

- High initial investment costs and complex installation requirements create challenges for widespread adoption, particularly in developing regions.

- Asia-Pacific leads with major HVDC installations in China and India, followed by Europe with interconnection projects and offshore wind integration.

- North America continues to invest in transmission upgrades and cross-border power exchange projects, supporting long-term demand for HVDC capacitors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Efficient Power Transmission Systems

The High Voltage Direct Current Capacitor Market benefits from rising demand for efficient power transmission. Expanding power grids require capacitors to manage voltage fluctuations and ensure grid stability. It supports long-distance electricity transmission with minimal losses, making HVDC systems vital for interconnecting remote renewable energy sources. Urbanization and industrialization in developing nations increase energy demand, boosting adoption. Governments invest in grid modernization projects to handle higher electricity loads. These initiatives strengthen the market growth trajectory and improve system reliability.

- For instance, ABB supplied key technology, including converter transformers and other equipment, for the ±800 kV ultra-high-voltage direct current (UHVDC) transmission links in China.

Integration of Renewable Energy Sources into Grids

The transition to clean energy accelerates growth for the High Voltage Direct Current Capacitor Market. Solar, wind, and offshore renewable projects need reliable transmission systems to deliver power to demand centers. It helps stabilize fluctuating power outputs from renewable sources. The global push toward decarbonization encourages utilities to adopt HVDC technology. Countries set aggressive renewable energy targets, prompting large-scale grid integration. Capacitor use rises with every new HVDC transmission line project. This creates consistent long-term demand for advanced capacitor solutions.

- For instance, Siemens Energy completed the DolWin6 offshore HVDC project in Germany, connecting 900 MW of offshore wind capacity to the grid using converter stations equipped with HVDC Plus technology rated at ±320 kV, which allows for independent active and reactive power control without relying on traditional capacitor banks.

Rising Investments in Cross-Border Power Transmission Projects

The High Voltage Direct Current Capacitor Market gains momentum from large cross-border interconnection projects. Countries collaborate to share electricity across regions, ensuring supply stability. It supports energy trading and maximizes resource utilization. Investments in subsea cable projects further fuel capacitor demand. Europe, Asia, and the Middle East lead with high-capacity interconnection initiatives. Growing energy security concerns encourage governments to expand transmission infrastructure. This trend drives strong capacitor demand globally over the forecast period.

Technological Advancements and Product Innovation

Innovation plays a key role in the High Voltage Direct Current Capacitor Market. Manufacturers develop capacitors with improved thermal performance and higher voltage ratings. It ensures reliability under demanding operating conditions. Digital monitoring and predictive maintenance solutions enhance capacitor efficiency. Research efforts focus on compact designs that reduce space requirements. Leading players invest in R&D to meet stricter grid performance standards. These advancements strengthen product adoption and market competitiveness.

Market Trends

Growing Adoption of HVDC Technology for Grid Modernization

The High Voltage Direct Current Capacitor Market observes strong demand with increasing grid modernization efforts. Utilities adopt HVDC systems to improve transmission efficiency and reduce energy losses. It helps stabilize networks facing fluctuating renewable power input. Governments invest in advanced transmission infrastructure to meet rising energy demand. Urbanization and industrial development drive upgrades in power systems worldwide. HVDC technology is now preferred for interregional power transfer projects. This trend strengthens the market’s long-term growth prospects.

- For instance, Sieyuan Electric supplied ±500 kV capacitor banks with a total reactive power rating of 1,800 Mvar for the Qinghai–Henan ±800 kV UHVDC line, which transmits 8,000 MW of clean power across 1,587 km.

Rising Integration of Renewable Energy Sources

The High Voltage Direct Current Capacitor Market sees rapid growth with the expansion of renewable energy projects. Large-scale wind, solar, and offshore farms require stable grid connections. It enables smooth transmission of variable renewable power across long distances. Countries push for higher renewable energy share, boosting HVDC adoption. Capacitors play a crucial role in maintaining voltage levels in these systems. Increased investment in green energy transition supports capacitor demand. This trend aligns with global decarbonization goals.

- For instance, TDK Corporation launched its robust B3277*M series of DC-link film capacitors, which offer rated voltages up to 1,600 VDC and capacitance values up to 120 µF. These capacitors are specifically designed for demanding applications such as high-voltage converters in wind turbine and solar farm systems.

Expansion of Cross-Border Power Interconnections

The High Voltage Direct Current Capacitor Market benefits from major international interconnection projects. Countries collaborate to share electricity and optimize energy resources. It ensures stability during peak demand and enhances energy security. Subsea and underground HVDC cables expand to connect distant regions. Europe and Asia lead with multi-gigawatt projects linking national grids. This interconnection growth requires advanced capacitors to manage power flow. The trend supports continuous market development over the next decade.

Advancement in Capacitor Design and Digital Monitoring

The High Voltage Direct Current Capacitor Market experiences innovation in product design and monitoring technologies. Manufacturers focus on compact, lightweight, and thermally efficient capacitors. It helps reduce space requirements and enhances performance in harsh conditions. Integration of IoT-enabled monitoring improves predictive maintenance and reduces downtime. Research in advanced dielectric materials improves capacitor reliability. Companies invest in automation for consistent quality production. These technological upgrades strengthen market competitiveness and adoption.

Market Challenges Analysis

High Initial Costs and Complex Installation Requirements

The High Voltage Direct Current Capacitor Market faces challenges from high installation and setup costs. Large-scale HVDC projects demand significant capital, limiting adoption in budget-constrained regions. It requires specialized equipment and skilled workforce, increasing project timelines. Complex site preparation and integration with existing AC infrastructure add to difficulties. Smaller utilities often hesitate to invest due to long payback periods. These financial barriers slow the pace of adoption and delay modernization efforts.

Operational Risks and Maintenance Complexity

The High Voltage Direct Current Capacitor Market must address operational risks associated with capacitor performance. Failures can disrupt power transmission and cause costly downtime. It needs regular maintenance to ensure stability and safety. Harsh operating conditions, such as extreme temperatures, shorten equipment life cycles. Limited availability of replacement parts in some regions creates delays. Skilled personnel shortage further complicates repair and monitoring tasks. These factors increase operational costs and pose reliability concerns for end-users.

Market Opportunities

Expansion of Renewable Energy and Grid Modernization Projects

The High Voltage Direct Current Capacitor Market holds strong opportunities with rising renewable integration worldwide. Large solar and wind projects require reliable transmission systems to deliver power to cities. It ensures stable voltage levels during fluctuating energy output. Governments allocate budgets for grid modernization and interconnection projects. Smart grid initiatives also favor HVDC technology for efficient long-distance transmission. These trends create demand for advanced capacitors to support future energy networks.

Technological Innovation and Emerging Markets Growth

The High Voltage Direct Current Capacitor Market gains opportunities from continuous product innovation and growing demand in emerging economies. Manufacturers develop compact, energy-efficient capacitors with longer service life. It supports applications in offshore wind farms, subsea cables, and industrial power systems. Rising electricity demand in Asia, Africa, and Latin America fuels infrastructure investments. Expansion of cross-border power trade encourages adoption of HVDC technology. These factors open growth avenues for suppliers targeting high-potential markets.

Market Segmentation Analysis:

By Product Type

The High Voltage Direct Current Capacitor Market is segmented into plastic film capacitors, ceramic capacitors, aluminum electrolytic capacitors, and others. Plastic film capacitors dominate due to their superior thermal stability, low dielectric losses, and long service life. It is widely used in HVDC transmission systems for filtering and reactive power compensation. Ceramic capacitors see steady demand in compact systems requiring high reliability. Aluminum electrolytic capacitors serve niche applications where high capacitance density is essential. Growing demand for energy-efficient products drives innovation in film technology, expanding its adoption in grid modernization projects.

- For instance, Vishay Intertechnology released a new MKP1848H DC-link metallized polypropylene film capacitor with rated capacitance values from 1 µF to 80 µF and rated voltages from 500 VDC to 1,200 VDC, optimized for HVDC power electronics and energy storage converters.

By Application

The market is divided into commercial, industrial, energy and power, and other sectors. The energy and power segment leads due to rising grid interconnection projects and renewable energy integration. It plays a crucial role in maintaining voltage stability and reducing transmission losses in large power networks. Industrial applications, including steel manufacturing and chemical plants, drive demand for capacitors to handle high reactive loads. Commercial installations adopt HVDC solutions to ensure uninterrupted power supply for critical facilities like data centers. Growth in urban infrastructure fuels demand across multiple application segments, supporting steady market expansion.

- For instance, RTDS Technologies offers a powerful real-time digital simulator capable of modeling high-voltage direct current (HVDC) converter station designs up to and exceeding ±525 kV, which enables utilities and manufacturers to perform detailed electromagnetic transient (EMT) studies.

By Technology

The High Voltage Direct Current Capacitor Market is classified by technology into Line Commutated Converter (LCC) and Voltage Source Converter (VSC) systems. LCC technology currently holds a major share due to its suitability for bulk power transmission. It is preferred for projects with long-distance, high-capacity requirements. VSC technology grows rapidly owing to its ability to integrate renewable energy sources, support black start capability, and provide independent control of active and reactive power. The shift toward VSC is evident in offshore wind projects and urban interconnections where flexibility is critical. Ongoing technological advancements make both systems more efficient and reliable, strengthening adoption across regions.

Segments:

Based on Product Type

- Plastic film capacitors

- Aluminium electrolytic capacitor

- Tantalum capacitors

- Others

Based on Application

- Commercial

- Industrial

- Energy and power

- Others

Based on Technology

- Line-commutated converter (LCC)

- Voltage-source converter (VSC)

Based on Installation Type

- Open rack capacitor banks

- Enclosed rack capacitor banks

- Pole-mounted capacitor banks

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 25% market share in the High Voltage Direct Current Capacitor Market, driven by strong investments in grid modernization and cross-border power transfer projects between the U.S., Canada, and Mexico. The region focuses on improving grid resilience to handle rising electricity demand and renewable energy integration. It benefits from government funding under programs supporting clean energy transmission infrastructure. HVDC technology adoption grows rapidly in offshore wind projects along the U.S. East Coast. Utilities deploy advanced capacitor solutions to stabilize voltage and enhance system reliability. Presence of key industry players and ongoing technological innovations strengthen the market outlook in this region.

Europe

Europe accounts for 30% market share, making it the leading region for HVDC capacitor deployment. The European Union supports large-scale interconnection projects linking national grids to ensure energy security. It plays a key role in integrating offshore wind energy from the North Sea into mainland grids. Major countries such as Germany, the UK, and France invest heavily in renewable infrastructure, boosting demand for HVDC systems. Subsea cable projects connecting Scandinavia, the UK, and continental Europe further drive capacitor adoption. Supportive regulatory frameworks and ambitious decarbonization targets encourage ongoing technology upgrades and expansion of transmission networks across Europe.

Asia-Pacific

Asia-Pacific captures 35% market share, emerging as the fastest-growing regional market. Rapid urbanization and industrialization in China, India, and Southeast Asia fuel massive electricity demand. It drives governments to expand grid capacity and adopt HVDC technology for long-distance transmission. China leads with several ultra-high-voltage DC projects connecting remote energy resources to major consumption centers. India invests in strengthening transmission networks to accommodate renewable energy capacity additions. Rising investments from private players and international collaborations accelerate the development of advanced capacitor manufacturing facilities in this region.

Latin America

Latin America represents 5% market share, supported by gradual modernization of power infrastructure. Countries like Brazil and Chile focus on connecting remote renewable energy projects, including solar and wind farms, to urban centers. It boosts demand for HVDC transmission and capacitors to maintain grid stability. Regional initiatives to enhance cross-border electricity trading also encourage adoption of HVDC systems. Investments remain concentrated in large economies with growing industrial sectors. Development opportunities expand as more nations prioritize reliable power supply and reduce dependence on fossil fuels.

Middle East and Africa

Middle East and Africa hold 5% market share, with growth driven by rising power generation projects and grid expansion efforts. The region invests in connecting large-scale solar plants and industrial hubs through HVDC lines. It faces challenges with harsh environmental conditions, prompting demand for durable and thermally robust capacitors. Gulf countries explore cross-country interconnection projects to enhance energy security. African nations focus on electrification programs, creating new opportunities for transmission upgrades. Growing partnerships with global technology suppliers support regional capacity-building initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- Maxwell Technologies Inc

- Vishay Intertechnology Inc

- ABB Ltd

- AVX Corporation (Kyocera Corporation)

- Sieyuan Electric Co. Ltd

- Eaton Corporation PLC

- Alstom SA

- RTDS Technologies Inc.

- TDK Corporation

Competitive Analysis

Competitive landscape of the High Voltage Direct Current Capacitor Market is shaped by key players such as Siemens AG, ABB Ltd, Eaton Corporation PLC, Vishay Intertechnology Inc, Maxwell Technologies Inc, Sieyuan Electric Co. Ltd, Alstom SA, RTDS Technologies Inc., AVX Corporation (Kyocera Corporation), and TDK Corporation. These companies compete through technological innovation, extensive product portfolios, and global project participation. They focus on developing capacitors with higher voltage ratings, improved thermal performance, and compact designs to meet evolving grid requirements. Strategic partnerships with utilities and EPC contractors allow them to secure large-scale HVDC transmission projects. Continuous investment in R&D enables them to improve reliability and reduce maintenance costs, aligning with growing demand for efficient power transmission. Market players also strengthen their regional presence through mergers, acquisitions, and capacity expansions to serve diverse applications, including renewable energy integration, cross-border interconnections, and industrial power systems, ensuring long-term competitiveness and customer trust.

Recent Developments

- In April 2025, TDK began mass production of its CGA MLCC series offering 10 µF at 100 V in 3225 case size, targeting automotive applications.

- In March 2025, TDK reported record high net sales and operating profit in its Full Year FY March 2025 performance briefing; sales in passive components including film capacitors saw decline to some sectors but demand in energy applications remained strong.

- In March 2025, TDK Corporation announced it will showcase its latest technological developments including ModCap modular capacitor and high-voltage capacitors for DC link applications at APEC 2025.

- In April 2023, Siemens Energy committed to supply technology for three additional offshore grid connections in the North Sea.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Technology, Installation Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Utilities continue to expand HVDC transmission corridors to connect remote renewable projects and supply urban demand efficiently.

- Offshore wind farms and long subsea interconnector projects increase need for high-performance capacitors that can operate under harsh marine conditions.

- Voltage Source Converter technology gains wider adoption for projects requiring flexible power flow control and integration of variable renewables.

- Ultra-high-voltage DC projects above 800 kV create demand for capacitors with higher voltage ratings and improved insulation strength.

- Deployment of digital monitoring systems and predictive maintenance platforms helps operators reduce downtime and extend equipment life.

- Advancements in dielectric film materials improve thermal stability, lower power losses, and enable more compact capacitor designs.

- Manufacturers expand local production facilities in Asia, Europe, and North America to meet rising demand and shorten delivery cycles.

- Stricter grid codes and reliability standards encourage utilities to adopt capacitors with longer service life and higher fault tolerance.

- Integration of hybrid systems combining HVDC, energy storage, and FACTS devices opens new opportunities for advanced capacitor solutions.

- Growing installed base of HVDC projects boosts aftermarket services, retrofits, and replacement capacitor sales, strengthening long-term market growth.