Market Overview:

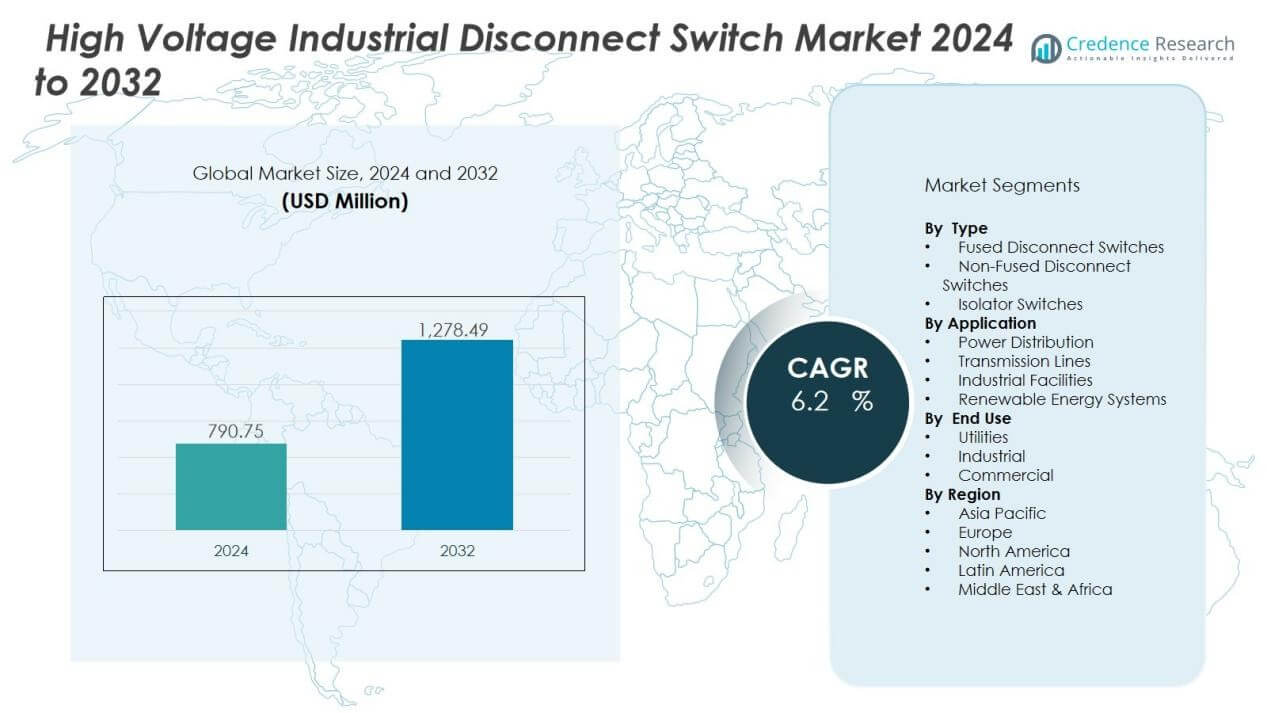

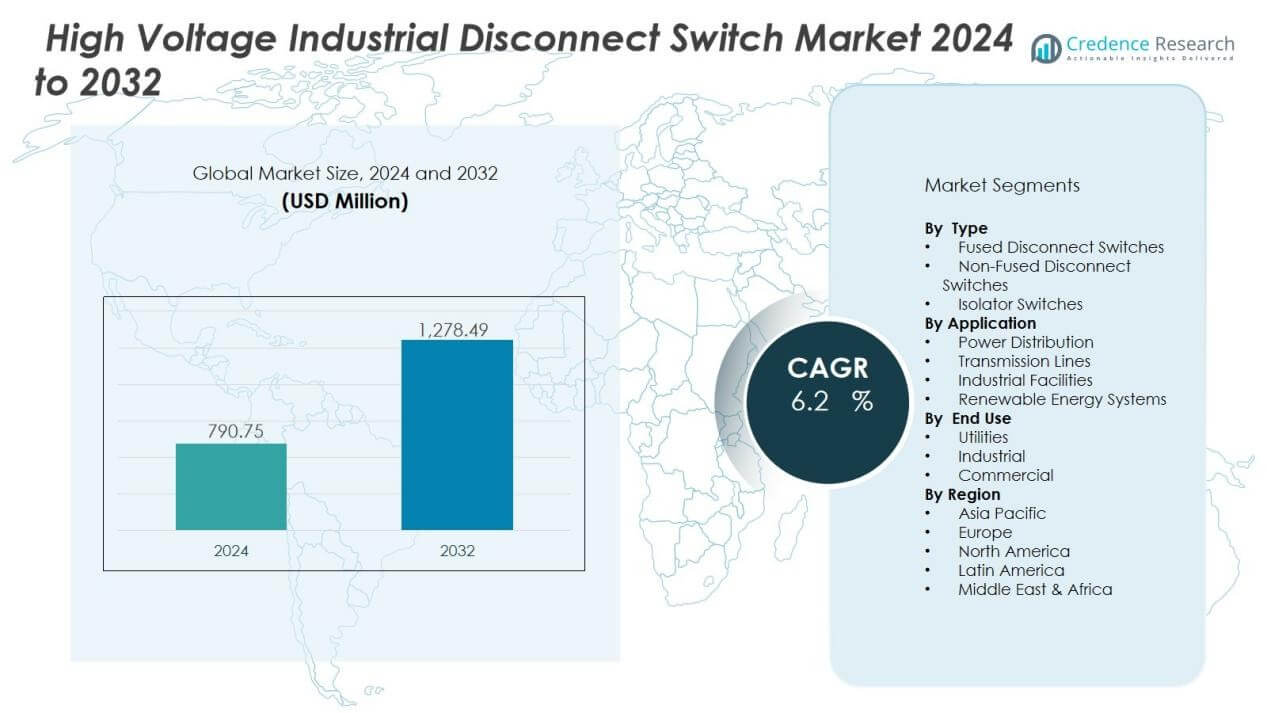

The high voltage industrial disconnect switch market size was valued at USD 790.75 million in 2024 and is anticipated to reach USD 1,278.49 million by 2032, at a CAGR of 6.2 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Industrial Disconnect Switch Market Size 2024 |

USD 790.75 Million |

| High Voltage Industrial Disconnect Switch Market, CAGR |

6.2% |

| High Voltage Industrial Disconnect Switch Market Size 2032 |

USD 1,278.49 Million |

Key drivers include the growing integration of renewable energy sources, rising electricity consumption, and stricter regulatory standards for grid safety. Industries are prioritizing advanced disconnect switches for fault protection, maintenance safety, and improved operational efficiency. The adoption of automation and digital monitoring technologies further strengthens demand, while replacement of aging infrastructure in developed economies creates long-term growth opportunities. Additionally, emerging markets are investing in robust electrical networks, further fueling demand for high voltage disconnect switches.

Regionally, North America and Europe maintain strong positions, driven by early adoption of smart grid technologies and strict safety regulations. Asia-Pacific, however, is projected to register the fastest growth, supported by rapid industrialization, urbanization, and government-led investments in renewable energy and power infrastructure in countries like China and India. Meanwhile, Latin America and the Middle East & Africa are emerging as promising markets, driven by infrastructure expansion and rising energy demand.

Market Insights:

- The high voltage industrial disconnect switch market was valued at USD 790.75 million in 2024 and is expected to reach USD 1,278.49 million by 2032, growing at a CAGR of 6.2%.

- Rising demand for grid reliability and operator safety remains a primary growth driver, with industries and utilities investing in dependable solutions to prevent faults and ensure safe operations.

- Integration of renewable energy sources such as solar and wind continues to expand demand, as disconnect switches play a vital role in grid stability and efficient power management.

- Aging infrastructure in developed economies pushes replacement demand, creating opportunities for advanced, durable, and digitally enhanced switch solutions that meet modern safety standards.

- Emerging economies, particularly in Asia-Pacific, fuel growth through industrialization, urbanization, and government-backed power distribution investments.

- High installation and maintenance costs remain a challenge, especially in price-sensitive regions where budget limitations slow adoption of advanced models.

- North America led the market with 32% share in 2024, followed by Europe at 29%, while Asia-Pacific held 27% share and is forecasted to grow fastest, with Latin America at 7% and the Middle East & Africa at 5%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Grid Reliability and Safety:

The high voltage industrial disconnect switch market is strongly driven by the need for grid reliability and operator safety. Industrial facilities and utilities require dependable equipment to isolate circuits during maintenance and faults. These switches prevent accidents, reduce downtime, and ensure smooth power distribution. It benefits operators by offering higher control over complex power systems.

- For instance, Hitachi Energy Series center-break disconnectors support a maximum voltage of 550 kV and a continuous current rating of 4 000 A, ensuring reliable isolation under extreme conditions and minimal maintenance requirements.

Expansion of Renewable Energy Integration:

The integration of renewable energy sources creates significant demand for high voltage disconnect switches. Solar and wind farms require safe and efficient connection points within transmission networks. Disconnect switches support grid stability by enabling quick isolation during power fluctuations. The market grows as governments and private players invest in large-scale renewable projects.

- For Instance, GE Vernova secured orders from the Power Grid Corporation of India for over 70 extra-high-voltage 765-kV transformers and shunt reactors, for transmission projects across India, including in Rajasthan.

Modernization of Aging Power Infrastructure:

Aging electrical infrastructure in developed regions drives replacement demand for advanced disconnect switches. Utilities focus on upgrading outdated systems to meet modern safety and efficiency standards. It creates opportunities for manufacturers offering innovative designs with enhanced durability and monitoring features. The modernization push ensures sustained adoption across industrial and utility networks.

Industrial Growth in Emerging Economies:

Rapid industrialization and urbanization in Asia-Pacific and other developing regions accelerate market expansion. Factories, commercial complexes, and infrastructure projects need robust disconnect switches for safe operations. Governments in China, India, and Southeast Asia invest heavily in power distribution networks. It reinforces the growing importance of reliable disconnect solutions in high-demand markets.

Market Trends:

Growing Shift Toward Smart and Automated Switchgear Solutions:

The high voltage industrial disconnect switch market is witnessing a clear trend toward digitalization and automation. Manufacturers are integrating smart sensors and IoT-enabled features to support predictive maintenance and remote monitoring. It allows operators to detect faults early, reduce downtime, and improve operational efficiency. Utilities and industries adopt automated disconnect switches to align with smart grid expansion and higher safety requirements. This trend also supports the growing demand for real-time data analytics in energy management. The move toward automation strengthens the market’s role in modern power infrastructure and creates opportunities for advanced product portfolios.

- For Instance, ABB outdoor disconnect switch model for 27 kV and 600 A applications is the D2RANL600L, not the D2 Series which refers to a digital timer

Rising Focus on Sustainability and Compact Designs:

Sustainability and space optimization are shaping product development across the market. Manufacturers prioritize eco-friendly materials, energy-efficient operations, and designs that reduce environmental impact. It reflects the broader industry shift toward sustainable energy practices and compliance with global regulations. Compact and modular disconnect switches are gaining traction, particularly in urban and industrial settings with limited space. These products offer easier installation, reduced maintenance needs, and improved system flexibility. The combination of sustainability and compact designs ensures long-term adoption and supports the global transition toward cleaner and more efficient power systems.

- For instance, Eaton’s Bussmann series CCP2 compact circuit protector delivers a footprint reduction of up to 69 percent compared to traditional fused disconnect solutions, enabling installation in equipment rooms with stringent space constraints.

Market Challenges Analysis:

High Installation Costs and Maintenance Complexity:

The high voltage industrial disconnect switch market faces a significant challenge from high installation and maintenance costs. Utilities and industries often hesitate to adopt advanced models due to heavy upfront investments. It becomes more difficult in developing economies where budget constraints slow infrastructure modernization. Maintenance of these switches also requires skilled professionals, adding to long-term operating expenses. Complex systems demand frequent inspections to ensure reliability and safety, increasing the total cost of ownership. This cost barrier limits faster penetration across price-sensitive regions.

Regulatory Compliance and Technical Limitations:

Strict regulatory frameworks across regions present another challenge for market participants. The high voltage industrial disconnect switch market must align with evolving international standards on safety, emissions, and performance. It often delays product launches and increases compliance costs for manufacturers. Technical limitations such as switching failures under extreme load conditions further impact adoption in critical sectors. Compatibility issues with legacy power systems create integration hurdles for utilities. These barriers force companies to invest heavily in innovation, testing, and certification to remain competitive.

Market Opportunities:

Expansion of Renewable Energy and Smart Grid Projects:

The high voltage industrial disconnect switch market holds strong opportunities in renewable energy expansion. Solar and wind farms require advanced switches to manage large-scale integration into transmission networks. It ensures safe disconnection during maintenance and enhances grid stability. Governments worldwide are funding smart grid projects, creating steady demand for intelligent switchgear solutions. Rising electrification trends and energy transition policies also accelerate adoption. This expansion allows manufacturers to innovate with sustainable and digitally enabled products tailored for renewable infrastructure.

Growing Demand in Emerging Economies and Industrial Applications:

Emerging economies present significant opportunities due to rapid industrialization and urban infrastructure growth. The high voltage industrial disconnect switch market benefits from rising investments in manufacturing hubs, commercial facilities, and transport projects. It creates strong demand for reliable power distribution equipment to maintain operational safety. Compact and modular switch designs fit well into dense urban environments, improving adoption. Increasing digitalization in industrial processes further strengthens the need for advanced disconnect switches. These opportunities position the market for long-term growth across both developed and developing regions.

Market Segmentation Analysis:

By Type:

The high voltage industrial disconnect switch market is segmented into fused, non-fused, and isolator switches. Non-fused disconnect switches dominate due to their cost efficiency and wide use in industrial and utility applications. Fused switches are preferred in environments requiring high protection against overloads and short circuits. Isolator switches gain adoption in renewable projects and large-scale substations for reliable disconnection. It reflects a balanced demand across safety-critical and cost-sensitive applications.

- For Instance, Siemens offers its SENTRON 3KF fuse switch disconnectors, which are rated up to 630A and provide overload and short-circuit protection via integrated fuses. These have been used for years in a variety of manufacturing plants across Germany and globally

By Application:

Key applications include power distribution, transmission lines, industrial facilities, and renewable energy systems. Power distribution holds the largest share, driven by ongoing grid modernization and rising electricity demand. Transmission lines adopt these switches to ensure system safety during faults or maintenance. Renewable energy integration, particularly in solar and wind farms, accelerates adoption of advanced disconnect solutions. It supports grid stability and safe operations under variable power conditions.

- For instance, solar disconnect switches with arc extinction times of 3-5 milliseconds are widely used to safely interrupt DC power in photovoltaic systems, meeting the 2023 National Electrical Code standards; these switches typically are rated for 1500VDC and breaking capacities up to 10,000A, ensuring safe grid stability under variable power conditions.

By End Use:

End-use segments include utilities, industrial, and commercial sectors. Utilities remain the primary users due to large-scale grid infrastructure and high reliability requirements. Industrial facilities invest in disconnect switches to ensure operational safety and reduce downtime in manufacturing and processing plants. Commercial users adopt compact and modular designs for urban infrastructure and buildings. It highlights diverse adoption patterns across multiple sectors, reinforcing steady growth.

Segmentations:

By Type:

- Fused Disconnect Switches

- Non-Fused Disconnect Switches

- Isolator Switches

By Application

- Power Distribution

- Transmission Lines

- Industrial Facilities

- Renewable Energy Systems

By End Use:

- Utilities

- Industrial

- Commercial

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America and Europe:

North America captured 32% market share in the high voltage industrial disconnect switch market in 2024, while Europe held 29%. These regions benefit from mature grid infrastructure and strict regulatory standards on safety and efficiency. It drives consistent demand for advanced and automated disconnect switches. Utilities and industries continue to replace aging systems with modern solutions. Smart grid investments in the United States, Canada, Germany, and France further support growth. Strong presence of leading manufacturers strengthens the competitive landscape across these markets.

Asia-Pacific:

Asia-Pacific accounted for 27% market share in 2024 and is forecasted to expand at the highest CAGR. Rapid urbanization, industrial growth, and government-led investments in power infrastructure fuel demand across China, India, and Southeast Asia. It benefits from large-scale renewable energy deployment and expansion of industrial complexes. Compact and digitally enabled disconnect switches gain traction due to space and efficiency requirements in dense urban centers. Continuous grid expansion and industrial modernization create a strong pipeline of opportunities. The region’s growth trajectory outpaces developed markets due to scale and infrastructure investment.

Latin America and Middle East & Africa:

Latin America held 7% market share in 2024, while the Middle East & Africa accounted for 5%. These regions are emerging markets with rising infrastructure projects and increasing electricity demand. It creates opportunities for manufacturers offering cost-effective and durable disconnect switches. Governments in Brazil, Mexico, GCC countries, and South Africa focus on strengthening transmission and distribution networks. Industrial expansion and renewable energy projects also contribute to demand growth. Although adoption levels remain smaller compared to other regions, untapped potential ensures long-term opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The high voltage industrial disconnect switch market is highly competitive, shaped by global leaders and regional specialists. Key players include ABB, Phoenix Contact, Emerson Electric, Eaton, Schneider Electric, Cree, Littelfuse, Nexans, and Siemens AG. It is characterized by strong investments in product innovation, digital integration, and safety enhancements. Companies focus on developing compact, durable, and IoT-enabled switches to meet modern grid and industrial requirements. Strategic collaborations with utilities and infrastructure developers strengthen market reach and accelerate adoption. Sustainability and compliance with strict safety standards remain central to competitive positioning. The market continues to evolve as players expand portfolios, strengthen distribution networks, and enhance aftersales services to maintain long-term customer trust.

Recent Developments:

- In Feb 2025, Eaton unveiled advanced smart power management solutions at Elecrama 2025, including the 9395 XR UPS system and new low- to medium-voltage switchgear for renewable energy sectors.

- In June 2025, Eaton signed an agreement to acquire Ultra PCS Limited, an aerospace systems solutions provider, for $1.55 billion, with closing expected in the first half of 2026.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The high voltage industrial disconnect switch market will see strong demand from grid modernization initiatives.

- It will benefit from expanding renewable energy integration across solar, wind, and hybrid projects.

- Manufacturers will focus on smart, IoT-enabled solutions to support predictive maintenance and remote monitoring.

- Sustainability-driven designs using eco-friendly materials will gain wider acceptance across industries and utilities.

- Industrial growth in Asia-Pacific and emerging economies will remain a major driver of new installations.

- Replacement of aging infrastructure in North America and Europe will create steady opportunities.

- Compact and modular disconnect switches will see rising adoption in urban and industrial applications.

- Collaborations between utilities and manufacturers will strengthen product innovation and distribution reach.

- Cybersecurity-enabled switchgear solutions will emerge as a key feature in digital power systems.

- It will evolve as a critical enabler of safe, efficient, and sustainable power distribution worldwide.