Market Overview

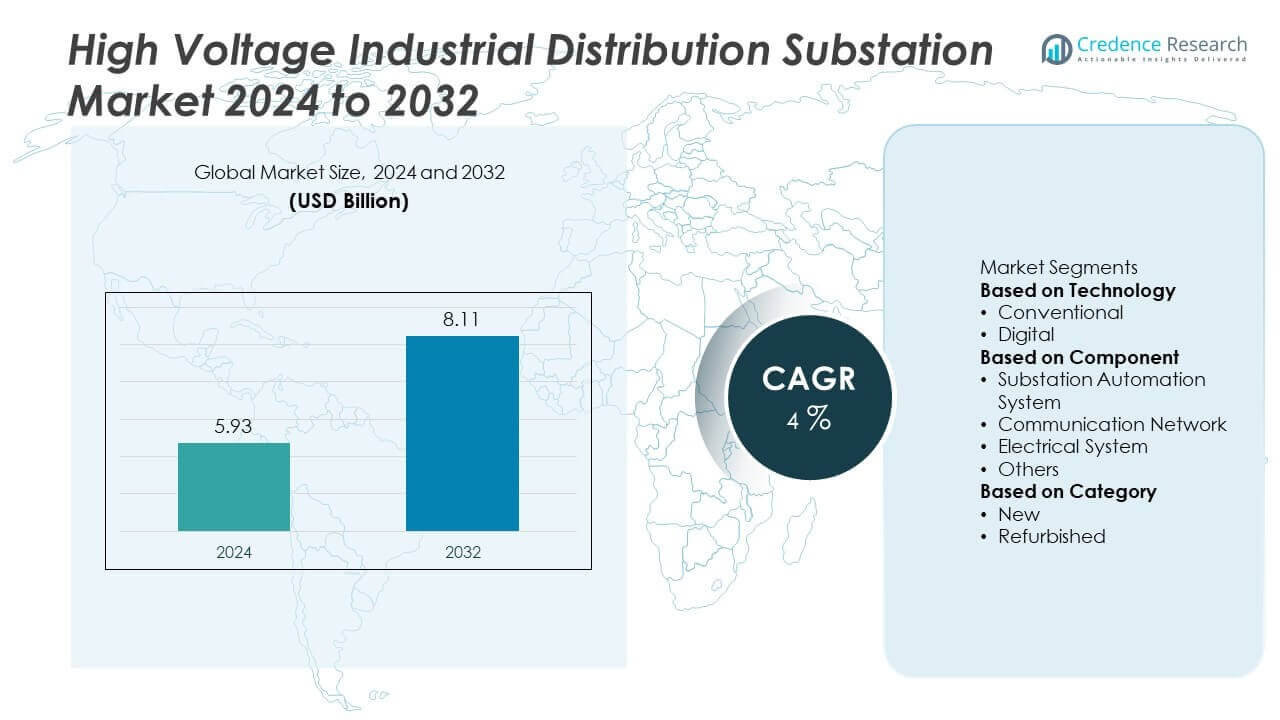

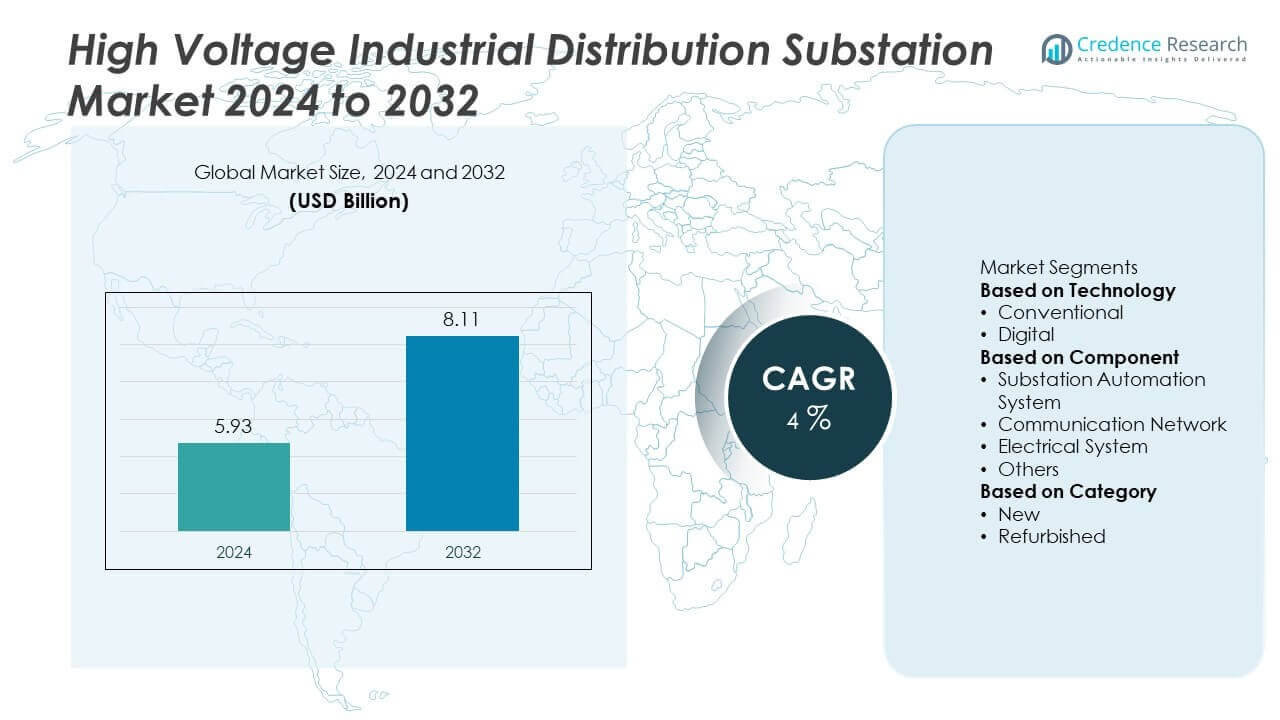

The global High Voltage Industrial Distribution Substation Market was valued at USD 5.93 billion in 2024 and is projected to reach USD 8.11 billion by 2032, growing at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Industrial Distribution Substation Market Size 2024 |

USD 5.93 Billion |

| High Voltage Industrial Distribution Substation Market, CAGR |

4% |

| High Voltage Industrial Distribution Substation Market Size 2032 |

USD 8.11 Billion |

High Voltage Industrial Distribution Substation Market grows with rising demand for reliable and efficient power distribution across industrial sectors. Expansion of manufacturing, oil & gas, and data centers drives installation of modern substations to ensure uninterrupted power.

High Voltage Industrial Distribution Substation Market shows strong growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, supported by rapid industrial expansion and grid upgrades. North America leads with extensive investment in grid modernization, automation, and renewable integration projects. Europe focuses on decarbonization, smart grid deployment, and replacement of aging substations with advanced digital solutions. Asia-Pacific is the fastest-growing region due to large-scale infrastructure development, manufacturing expansion, and government-backed electrification programs in countries like China and India. Latin America and the Middle East & Africa see rising demand from oil & gas, mining, and utility sectors, supported by capacity expansion projects. Key players shaping the market include ABB, Eaton, Hitachi Energy, General Electric, and Rockwell Automation, focusing on advanced switchgear, control systems, and monitoring technologies to improve energy efficiency, reliability, and operational safety across diverse industrial applications.

Market Insights

- High Voltage Industrial Distribution Substation Market was valued at USD 5.93 billion in 2024 and is projected to reach USD 8.11 billion by 2032, growing at a CAGR of 4%.

- Rising industrial power demand and infrastructure expansion drive strong adoption of high voltage substations globally.

- Market trends highlight digital substations, integration of IoT-based monitoring, and smart grid technologies improving operational reliability.

- Competitive landscape features ABB, Eaton, Hitachi Energy, General Electric, and Rockwell Automation focusing on automation, advanced switchgear, and control systems.

- High installation costs, complex maintenance, and regulatory compliance challenges act as restraints in cost-sensitive markets.

- North America leads with strong investment in grid modernization and renewable integration, while Europe focuses on decarbonization and upgrading aging substations.

- Asia-Pacific emerges as the fastest-growing region with rapid industrialization, government-led electrification, and manufacturing sector expansion supporting substation deployment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Reliable Industrial Power Supply

High Voltage Industrial Distribution Substation Market grows with rising need for stable and uninterrupted electricity in energy-intensive industries. Manufacturing plants, mining sites, and data centers require high-voltage substations to maintain efficient operations and prevent costly downtime. It enables safe power distribution and supports large-scale equipment loads. Industrial expansion in emerging economies drives installation of new substations. Rising automation and electrification of production processes further strengthen demand. Investment in industrial infrastructure upgrades ensures long-term market growth.

- For instance, Eaton is a major supplier of electrical equipment in India, with its products—including gas-insulated switchgear—installed in a variety of large-scale industrial projects, such as steel complexes, across the country.

Expansion of Renewable Energy and Grid Modernization

High Voltage Industrial Distribution Substation Market benefits from increasing integration of renewable energy into power grids. Substations are crucial for connecting wind, solar, and hydro plants to industrial facilities. It helps manage load fluctuations and maintain grid stability. Governments invest in modernizing transmission and distribution networks to support energy transition goals. Adoption of smart substations with real-time monitoring and remote-control capabilities gains momentum. These upgrades improve energy efficiency and reduce transmission losses.

- For instance, Hitachi Energy partnered with Statnett to deliver eco-efficient grid connection solutions in the greater Oslo area, using SF6-free gas-insulated switchgear to enhance electricity supply reliability and availability. The project supports Norway’s grid expansion to meet the growing electricity demand from Oslo’s population, which is expected to increase by 33% by 2030.

Rising Investment in Infrastructure and Electrification Projects

High Voltage Industrial Distribution Substation Market grows with large-scale infrastructure development across transportation, oil & gas, and utilities. Electrification of remote regions and industrial corridors boosts demand for high-capacity substations. It supports power distribution for construction, railways, and heavy manufacturing projects. Governments and private players fund grid extension to meet rising electricity demand. Substations with advanced protection systems improve reliability and reduce outages. These investments create sustained growth opportunities for equipment suppliers.

Technological Advancements in Substation Automation

High Voltage Industrial Distribution Substation Market benefits from innovations in automation, digital monitoring, and IoT integration. Smart substations allow predictive maintenance and real-time fault detection, improving operational efficiency. It reduces downtime and lowers maintenance costs for industrial operators. Digital twin technology and SCADA systems enhance visibility and control. Adoption of compact, modular designs helps optimize space and installation time. These advancements make substations more cost-effective and attractive for industrial users.

Market Trends

Market Trends

Adoption of Smart and Digital Substations

High Voltage Industrial Distribution Substation Market shows a strong shift toward smart and digital solutions. Utilities and industries deploy substations with advanced sensors, IoT connectivity, and real-time monitoring. It enables predictive maintenance, reduces downtime, and improves system reliability. Digital substations allow faster fault detection and remote control operations. Integration with SCADA and digital twin technology strengthens grid management. Growing need for operational efficiency drives investments in these intelligent systems.

- For instance, in April 2025, KEC International, in partnership with Siemens, announced the commissioning of a new 220 kV & 400 kV digital substation in Navsari, Gujarat, for Power Grid Corporation of India (PGCIL).

Integration with Renewable and Distributed Energy Sources

High Voltage Industrial Distribution Substation Market trends highlight the role of substations in integrating renewable power. Industries require flexible systems that handle variable generation from wind and solar plants. It supports grid stability by balancing supply and demand. Hybrid substations with energy storage compatibility gain popularity. Distributed energy resources create need for compact, modular substations closer to load centers. This trend supports decarbonization efforts and enables efficient power delivery.

- For instance, General Electric Grid Solutions has supplied advanced technology, such as 765 kV Gas-Insulated Substation (GIS) bays, to Power Grid Corporation of India (PGCIL) to help strengthen the transmission network in Rajasthan for the evacuation of renewable energy from solar parks.

Growing Use of Compact and Modular Designs

High Voltage Industrial Distribution Substation Market is witnessing demand for space-saving and modular solutions. Prefabricated substations reduce installation time and improve project flexibility. It allows easier expansion and upgrades as power demand grows. Compact gas-insulated switchgear (GIS) is favored in urban and industrial settings with space limitations. Modular designs lower construction costs and minimize disruption to ongoing operations. This trend supports faster deployment in both new and retrofit projects.

Focus on Energy Efficiency and Sustainability

High Voltage Industrial Distribution Substation Market experiences rising focus on reducing energy losses and environmental impact. Manufacturers develop equipment with low-loss transformers and eco-friendly insulating gases. It helps industries meet sustainability targets and lower operating costs. Substations with advanced cooling and efficient components improve performance. Demand grows for systems that minimize greenhouse gas emissions and comply with strict regulations. Sustainability initiatives strengthen the case for upgrading aging infrastructure with greener technologies.

Market Challenges Analysis

High Installation and Maintenance Costs Limiting Adoption

High Voltage Industrial Distribution Substation Market faces challenges due to significant capital investment required for equipment, civil work, and installation. Industries must allocate large budgets for transformers, switchgear, and protection systems, which impacts adoption in cost-sensitive regions. It becomes difficult for small and medium enterprises to justify upgrades despite efficiency benefits. Ongoing expenses for inspection, testing, and periodic replacement of components add to operational costs. Skilled labor requirements further increase installation and maintenance expenditure. These financial constraints delay modernization of aging infrastructure and limit large-scale deployment.

Complexity of Grid Integration and Regulatory Compliance

High Voltage Industrial Distribution Substation Market is impacted by technical and regulatory hurdles associated with grid integration. Substations must comply with stringent national and international standards, which lengthen project timelines. It requires detailed engineering, permitting, and coordination with utilities, adding complexity to project execution. Integration with renewable and distributed energy resources demands advanced control systems and grid synchronization solutions. Cybersecurity risks from digitalization create additional compliance obligations. Delays in regulatory approvals and interoperability issues can slow project completion and affect return on investment.

Market Opportunities

Expansion of Industrialization and Electrification Projects

High Voltage Industrial Distribution Substation Market holds strong opportunities driven by rapid industrial growth and infrastructure development worldwide. Expanding manufacturing hubs, mining operations, and processing plants require reliable power distribution systems. It supports electrification projects in remote and rural areas, enabling continuous industrial operations. Rising demand for data centers and large-scale logistics facilities also drives substation installations. Governments invest heavily in grid modernization to meet rising energy consumption and ensure supply reliability. Industrial users seek customized substations with higher efficiency and automation capabilities to minimize downtime. These factors create sustained demand for advanced distribution substations.

Integration of Smart Technologies and Renewable Energy

High Voltage Industrial Distribution Substation Market benefits from growing adoption of digital technologies and renewable integration. Industries deploy IoT-enabled monitoring, automation, and predictive maintenance systems to improve operational efficiency. It allows real-time performance tracking and faster fault detection, reducing unplanned outages. Growth of renewable energy projects such as wind and solar farms drives need for substations that manage variable power flows. Hybrid substations with energy storage capabilities gain popularity for grid stability. Manufacturers focus on modular and compact designs to meet space and cost constraints. Rising focus on energy efficiency and sustainability enhances the adoption of next-generation substations.

Market Segmentation Analysis:

By Technology

High Voltage Industrial Distribution Substation Market is segmented by technology into air-insulated substations (AIS) and gas-insulated substations (GIS). AIS dominates due to its cost-effectiveness, simplicity, and ease of maintenance, making it widely used in industries with large open spaces. GIS is gaining traction in urban and space-constrained areas where compact designs are necessary. It offers superior reliability, lower maintenance needs, and enhanced safety for high-density installations. Industries with critical operations prefer GIS for its ability to operate under harsh environmental conditions with minimal risk of failure. Rising focus on efficiency and system reliability continues to support growth across both technologies.

- For instance, Hitachi Energy delivered a grid integration solution, including a 220 kV gas-insulated substation with power transformers, to connect the 250 MW Gulf of Suez 1 wind farm to Egypt’s national power grid. This project, located in the Gulf of Suez region rather than the Suez Canal Economic Zone, enabled a reliable power supply to support the country’s energy infrastructure and renewable energy goals.

By Component

High Voltage Industrial Distribution Substation Market by component includes transformers, switchgear, circuit breakers, busbars, protection and control systems, and others. Transformers account for the largest share as they play a crucial role in voltage regulation and ensuring stable power delivery. Switchgear and circuit breakers see strong demand due to rising need for fault protection and load management in high-capacity systems. It benefits from growing integration of smart relays and digital control systems for improved monitoring and automation. Busbars and auxiliary equipment support overall substation reliability and performance. Investments in advanced protection systems enhance grid safety and minimize outage risks.

- For instance, CG Power and Industrial Solutions announced a capacity expansion plan, including increasing power transformer production at its Malanpur unit by 10,000 MVA, taking the capacity from 25,000 MVA to reach 35,000 MVA. This was in part to meet growing demand from industrial clients.

By Category

High Voltage Industrial Distribution Substation Market by category is divided into new installations and retrofit projects. New installations dominate in developing regions where industrialization and infrastructure projects drive demand for greenfield substations. Retrofitting projects are increasing in mature markets where aging infrastructure requires modernization to meet efficiency and safety standards. It supports replacement of outdated equipment with advanced, digitally enabled systems. Growing emphasis on energy efficiency and regulatory compliance boosts upgrades of legacy substations. Modular and pre-assembled substations gain popularity for faster deployment and reduced construction time. Both categories are expected to see consistent growth driven by rising power demand across industries.

Segments:

Based on Technology

Based on Component

- Substation Automation System

- Communication Network

- Electrical System

- Others

Based on Category

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 34% market share in the High Voltage Industrial Distribution Substation Market, making it the leading regional contributor. The United States drives demand with large-scale industrial facilities, expanding data center infrastructure, and strong investment in grid modernization programs. Canada supports growth through upgrades in power distribution networks and investments in renewable energy integration. It benefits from federal initiatives encouraging advanced grid automation and reliability improvements. Rising demand from manufacturing, oil & gas, and mining sectors creates consistent need for high-capacity substations. Adoption of digital monitoring systems and predictive maintenance tools strengthens operational efficiency across facilities. Presence of major equipment manufacturers and strong after-sales support ensures steady market expansion.

Europe

Europe accounts for 27% market share supported by robust energy transition initiatives and strict reliability standards for industrial power supply. Germany, the U.K., and France lead adoption driven by modernization of aging substations and integration of renewables such as wind and solar into the grid. It benefits from EU directives focused on reducing transmission losses and improving power quality. Demand for gas-insulated substations grows in urban areas with limited space, while air-insulated systems remain common in industrial zones. The region invests heavily in smart grid solutions and remote monitoring systems to support industrial automation. Strong presence of global manufacturers and engineering firms supports widespread deployment and retrofit projects.

Asia-Pacific

Asia-Pacific captures 29% market share and is the fastest-growing regional market, driven by rapid industrialization, urban expansion, and rising electricity demand. China leads with large-scale investments in manufacturing clusters and power infrastructure projects, including ultra-high-voltage transmission lines. India follows with growing capacity additions under government programs like “Make in India” and initiatives to strengthen industrial power supply. It benefits from rising construction of gas-insulated substations in densely populated urban areas. Southeast Asian countries, including Indonesia, Vietnam, and Thailand, expand industrial parks, driving demand for compact and modular substations. Foreign direct investments and partnerships between utilities and private companies accelerate technology adoption. The region’s focus on reliability and energy efficiency drives continuous substation development.

Latin America

Latin America represents 6% market share with Brazil and Mexico being the primary markets for industrial distribution substations. Growth is fueled by investment in power infrastructure to support mining, oil & gas, and manufacturing industries. It benefits from grid expansion programs aimed at improving industrial power supply stability. Modernization projects replace aging substations with automated and digitally controlled systems. Industrial growth in Argentina, Chile, and Colombia contributes to steady demand for high-voltage equipment. Limited local manufacturing capacity creates opportunities for international suppliers to expand their presence through partnerships and service networks. Rising focus on renewable energy integration supports deployment of substations with advanced control systems.

Middle East & Africa

Middle East & Africa hold 4% market share supported by strong investment in industrial infrastructure and power generation capacity. GCC countries such as Saudi Arabia and UAE drive demand through large-scale industrial projects, petrochemical complexes, and power-intensive manufacturing facilities. It gains momentum from ongoing diversification initiatives under programs like Saudi Vision 2030, which boost construction of new substations. Africa contributes through infrastructure development in South Africa, Nigeria, and Egypt, where industrial zones require reliable power distribution. Rising adoption of pre-assembled and modular substations supports faster project execution in remote locations. Investments in grid reinforcement and renewable energy projects create long-term growth opportunities across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Competitive landscape of the High Voltage Industrial Distribution Substation Market features leading players such as ABB, Eaton, Hitachi Energy, General Electric, Rockwell Automation, CG Power, Efacec, L&T Electrical and Automation, Locamation, and Open System International competing through innovation, technology upgrades, and regional expansion strategies. These companies focus on delivering advanced substations with digital automation, smart switchgear, and grid monitoring systems to improve efficiency and reliability. Strategic investments in research and development help enhance product portfolios with solutions tailored for renewable energy integration and industrial power distribution needs. Partnerships with utilities, EPC contractors, and industrial clients strengthen large-scale deployment projects. Players emphasize modular and prefabricated substations to reduce installation time and project costs. Efforts to integrate IoT, AI-based predictive maintenance, and real-time control systems create a competitive edge in supporting grid modernization initiatives. Continuous global expansion, mergers, and service network improvements position these companies to capture demand from growing industrialization and energy transition projects worldwide.

Recent Developments

- In September 2025, Hitachi Energy, Announced a new $457 million facility in South Boston, Virginia, to manufacture large power transformers, part of a broader grid infrastructure manufacturing investment. Construction expected to start by end of 2025, operations by 2028.

- In June 2025, Hitachi Energy, Extended its service contract with Eletrobras for the Rio Madeira HVDC system, a 2,375-km link that provides 3.15 GW of power to approximately 45 million people.

- In May 2025, Hitachi Energy and Statnett, Signed contracts to deliver eco-efficient grid connection solutions in the greater Oslo area, improving reliability and availability of electricity for domestic and business users.

- In April 2025, Hitachi Energy, Selected by Adani Energy Solutions Ltd. (AESL) along with BHEL to design and deliver HVDC terminals for a 950-km, 6 GW link from Bhadla, Rajasthan to Fatehpur, Uttar Pradesh.

Report Coverage

The research report offers an in-depth analysis based on Technology, Component, Category and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for digital and automated substations will increase with grid modernization projects.

- Integration of renewable energy sources will drive investments in advanced substation infrastructure.

- Adoption of prefabricated and modular substations will rise to reduce installation time.

- Utilities will prioritize smart grid technologies for better monitoring and control.

- AI and IoT-based predictive maintenance solutions will see wider implementation.

- Expansion of industrial facilities will create steady demand for high-voltage substations.

- Governments will focus on upgrading aging transmission and distribution networks.

- Growth in electric vehicle charging infrastructure will require reliable high-voltage distribution.

- Manufacturers will invest in energy-efficient and low-loss components to meet sustainability goals.

- Emerging markets will witness rapid deployment of new substations to support urbanization and industrial growth.

Market Trends

Market Trends