Market Overview:

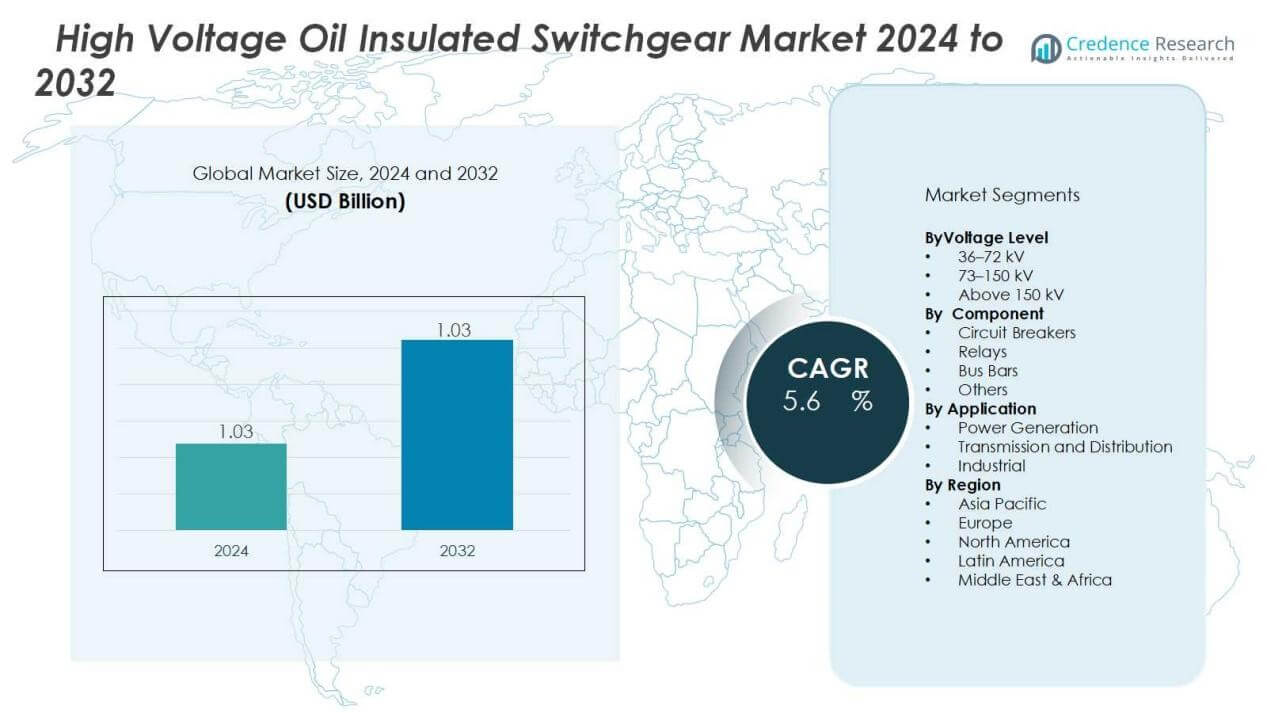

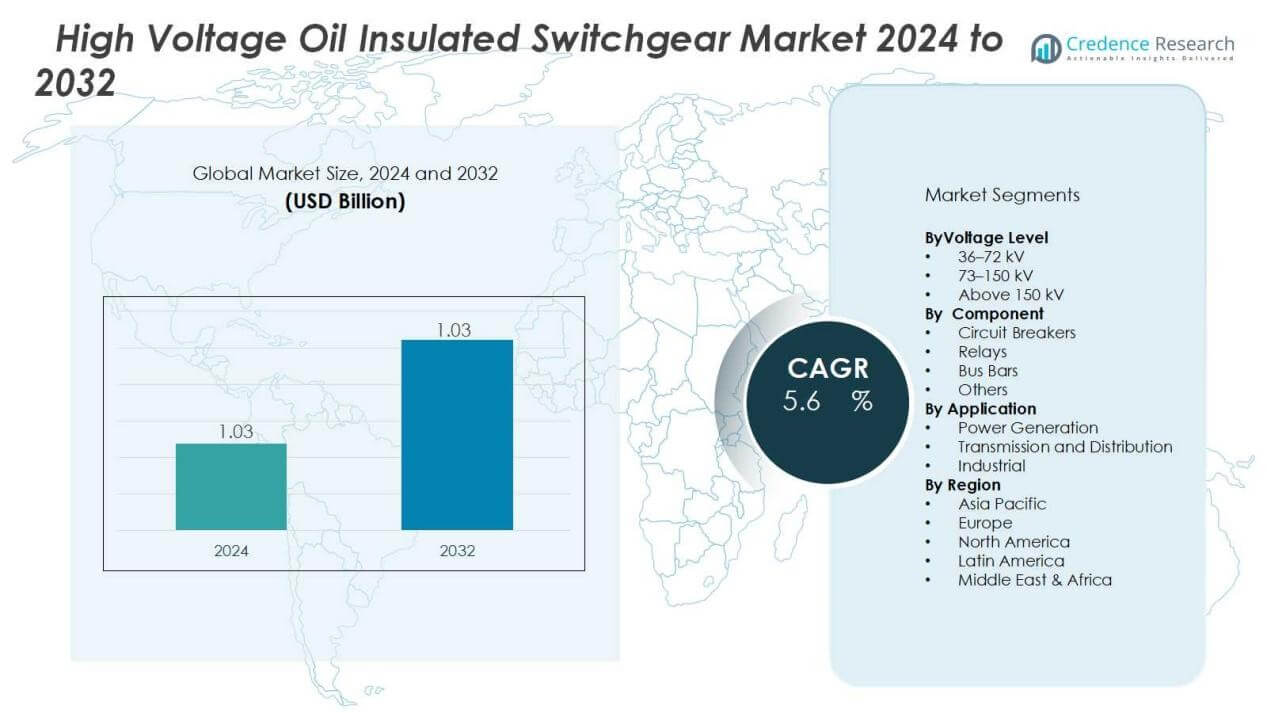

The high voltage oil insulated switch gear market size was valued at USD 1.03 billion in 2024 and is anticipated to reach USD 1.59 billion by 2032, at a CAGR of 5.6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Oil Insulated Switchgear Market Size 2024 |

USD 1.03 Billion |

| High Voltage Oil Insulated Switchgear Market, CAGR |

5.6% |

| High Voltage Oil Insulated Switchgear Market Size 2032 |

USD 1.59 Billion |

Key drivers include the reliability and proven performance of oil-insulated switchgear in handling high voltages, particularly in critical applications such as power plants and heavy industries. Growing urbanization and industrialization increase energy consumption, driving utility companies to expand high-voltage capacity. The need for equipment that ensures operational safety, cost efficiency, and fault management further boosts adoption. However, environmental concerns linked to oil-based insulation encourage innovation in eco-friendly alternatives, creating opportunities for manufacturers.

Regionally, Asia-Pacific dominates the market due to large-scale infrastructure development, high energy demand, and government-led electrification programs. North America follows with strong investments in grid modernization and renewable integration. Europe shows significant demand driven by strict reliability standards and replacement of outdated switchgear. Emerging markets in Latin America and the Middle East are also gaining traction, supported by expanding power generation projects and cross-border electricity trade.

Market Insights:

- The high voltage oil insulated switchgear market was valued at USD 1.03 billion in 2024 and is expected to reach USD 1.59 billion by 2032, growing at a CAGR of 5.6%.

- Rising demand for reliable power distribution drives adoption, with utilities relying on oil-insulated switchgear for durability and stable performance.

- A key driver is the replacement of aging transmission and distribution infrastructure, particularly in developed economies modernizing legacy grids.

- Integration of renewable energy projects such as solar and wind accelerates demand for robust, high-voltage switchgear to ensure smooth transmission.

- Challenges include environmental concerns, as oil-based insulation raises safety and sustainability risks, pushing innovation in eco-friendly alternatives.

- High maintenance costs and competition from gas-insulated and solid-dielectric technologies also limit growth, especially in price-sensitive markets.

- Asia-Pacific led with 42% share in 2024, followed by Europe at 27% and North America at 19%, reflecting strong investments and regional priorities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Reliable Power Distribution Across Expanding Grids:

The high voltage oil insulated switchgear market benefits from global growth in electricity demand. Rapid urbanization and industrialization drive investments in reliable power infrastructure. Utilities prefer oil-insulated switchgear for its proven durability and stable performance under extreme conditions. It plays a key role in maintaining grid reliability and minimizing outages during peak demand.

- In April 2021, Siemens Energy secured a contract with Finland’s transmission operator Fingrid to deliver 10 Blue gas-insulated switchgear (GIS) bays, rated up to 170 kV each, for a substation modernization project.

Ongoing Replacement of Aging Transmission and Distribution Infrastructure:

A major driver is the need to replace outdated and inefficient transmission equipment. Many developed economies are modernizing legacy grids that have exceeded their design life. Oil-insulated switchgear offers high fault tolerance and strong insulation properties, making it suitable for upgrading older systems. It supports safe operations while reducing risks of breakdowns in critical facilities.

- For instance, Stedin utility in the Netherlands has maintained and modernized around 280 bays of 50-kV oil-insulated switchgear originally manufactured by COQ (now Siemens), extending their operational life with time-based maintenance since 2013.

Integration of Renewable Energy and Expansion of Power Generation Capacity:

The global shift toward renewable energy accelerates demand for robust switchgear solutions. Large-scale solar and wind projects require stable grid connectivity and efficient fault management. Oil-insulated switchgear ensures smooth transmission of high-voltage electricity over long distances. It also supports hybrid grids where renewable sources operate alongside conventional power plants.

Growing Focus on Safety, Reliability, and Operational Efficiency in Utilities:

Utilities prioritize equipment that enhances operational safety while reducing downtime. Oil-insulated switchgear provides arc-quenching capabilities and dependable insulation for high-voltage applications. It is widely adopted in heavy industries, power plants, and high-demand sectors requiring uninterrupted power. The combination of long service life and proven reliability strengthens its role in modern energy networks.

Market Trends:

Market Trends:

Adoption of Advanced Monitoring and Automation Technologies:

The high voltage oil insulated switchgear market is witnessing strong adoption of digital monitoring and automation systems. Utilities and industries seek predictive maintenance tools to minimize downtime and improve asset management. Intelligent sensors, IoT integration, and remote diagnostics are becoming standard features in switchgear systems. These innovations help operators detect faults early and enhance operational safety. It aligns with global initiatives to create smarter grids that handle fluctuating loads efficiently. The trend also supports cost optimization by reducing manual inspections and extending equipment life cycles.

- For Instance, In April 2021, Siemens Energy was awarded a contract by Finland’s transmission system operator, Fingrid, to deliver SF6-free, gas-insulated switchgear (GIS) for the Virkkala substation, with commissioning scheduled for summer 2022.

Shift Toward Sustainable Solutions and Eco-Friendly Alternatives:

regulations are shaping the market toward greener and safer solutions. Manufacturers are focusing on reducing oil leaks and exploring bio-based insulating oils. The high voltage oil insulated switchgear market is also seeing advancements in hybrid technologies that combine oil insulation with other materials to enhance safety and efficiency. It reflects a growing emphasis on balancing performance with environmental responsibility. Demand is rising for equipment that meets stringent global standards while supporting decarbonization goals. This trend is expected to influence new product launches and design innovations across the sector.

- For Instance, Nynas introduced NYTRO® BIO 300X, a bio-based hydrocarbon insulating oil with ultra-low viscosity, which enhances transformer thermal performance and biodegradability without compromising electrical properties. Initial studies have shown up to 10 degrees Celsius better thermal performance compared to standard mineral oils.

Market Challenges Analysis:

Environmental Concerns and Stringent Regulatory Pressures:

The high voltage oil insulated switchgear market faces rising challenges linked to environmental regulations. Oil-based insulation carries risks of leakage, fire hazards, and contamination, which raise safety and sustainability concerns. Regulators in many regions are pushing utilities to adopt eco-friendly alternatives with lower environmental impact. It places pressure on manufacturers to invest in research and redesigns that meet strict compliance standards. The cost of developing greener technologies often increases operational expenses, slowing adoption among price-sensitive markets. Growing emphasis on carbon reduction further limits the acceptance of traditional oil-based systems.

High Maintenance Costs and Growing Competition from Alternative Technologies:

Maintenance and operational costs remain significant obstacles for oil-insulated switchgear. Regular inspections, oil quality checks, and leak prevention require skilled labor and high expenses. It reduces competitiveness in comparison to gas-insulated and solid-dielectric alternatives that promise lower upkeep. Industries and utilities are exploring modern solutions that provide compact design, reduced footprint, and improved reliability. The growing competition from advanced switchgear technologies threatens long-term market share. Limited modernization budgets in developing economies also hinder the widespread replacement of outdated systems, creating uneven growth prospects.

Market Opportunities:

Expansion of Power Infrastructure and Renewable Energy Integration:

The high voltage oil insulated switchgear market presents strong opportunities with rising investments in global power infrastructure. Governments are prioritizing electrification in rural and semi-urban areas, creating steady demand for high-voltage equipment. Renewable projects in solar and wind also require robust transmission networks, where oil-insulated switchgear provides reliable fault management. It remains an essential component in connecting large-scale renewable plants to existing grids. The ability to handle high voltages with proven performance makes it attractive for expanding capacity in developing economies. Growing public and private funding in energy transition further accelerates these opportunities.

Technological Advancements and Emerging Demand from Industrial Sectors:

Innovation in bio-based oils and hybrid insulation technologies creates new avenues for growth. Manufacturers are developing solutions that combine environmental compliance with operational efficiency, catering to stricter global standards. The high voltage oil insulated switchgear market is also gaining opportunities from industrial expansion in sectors such as mining, oil and gas, and heavy manufacturing. It supports uninterrupted operations where stable high-voltage distribution is critical. Growing demand from data centers, driven by digitalization and cloud adoption, also strengthens the market’s prospects. These opportunities allow suppliers to expand portfolios and capture new revenue streams in evolving energy ecosystems.

Market Segmentation Analysis:

By Voltage Level:

The high voltage oil insulated switchgear market is segmented by voltage level into 36–72 kV, 73–150 kV, and above 150 kV. The 73–150 kV category holds a dominant position due to widespread adoption in industrial and utility-scale power distribution. Equipment in this range supports large-scale urban electrification and renewable energy integration. The 36–72 kV segment grows steadily with demand from regional grids and smaller industries. Above 150 kV switchgear is gaining importance in long-distance transmission and large infrastructure projects. It ensures system stability where extremely high loads must be managed efficiently.

- For instance, ABB’s 800 kV oil insulated switchgear utilized in the Hami-Zhengzhou ultrahigh-voltage DC transmission line in China operates with a capacity of 8,000 MW, demonstrating its critical role in high-capacity, long-distance power transmission.

By Component:

Key components include circuit breakers, relays, bus bars, and others. Circuit breakers account for a significant share, driven by their role in fault management and operational safety. Relays provide critical protection and control, supporting smooth network operations. Bus bars remain essential in ensuring efficient current distribution within switchgear systems. It highlights the importance of durable components for reliable performance in demanding environments. Manufacturers are focusing on enhancing component efficiency to extend service life and reduce maintenance.

- For instance, Siemens Energy has developed the 3AP circuit breaker family, which operates reliably up to 1100 kV and features a mean time between failures (MTBF) of several thousand years, with maintenance intervals extending up to 25 years, underscoring the durability and operational safety critical for fault management.

By Application:

Applications span power generation, transmission and distribution, and industrial sectors. The transmission and distribution segment dominates due to rising demand for stable electricity supply in expanding grids. Power generation facilities adopt oil-insulated switchgear to manage high-voltage loads and maintain safety. Industrial users, including mining, manufacturing, and oil and gas, rely on it for uninterrupted operations. Growing investments in data centers also drive application in specialized infrastructure. The application diversity strengthens growth prospects across developed and developing markets.

Segmentations:

By Voltage Level:

- 36–72 kV

- 73–150 kV

- Above 150 kV

By Component:

- Circuit Breakers

- Relays

- Bus Bars

- Others

By Application:

- Power Generation

- Transmission and Distribution

- Industrial

By Region:

- North America

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific accounted for 42% market share in 2024, driven by large-scale infrastructure development. China, India, and Southeast Asian nations are investing heavily in expanding transmission networks. The high voltage oil insulated switchgear market in this region benefits from rapid industrialization and government-led electrification programs. It supports megaprojects such as smart cities, renewable energy plants, and cross-border grid connectivity. Rising energy demand from urban centers fuels continuous investments in reliable high-voltage systems. Strong manufacturing capabilities in the region also enable cost-effective production and supply chain strength.

Europe:

Europe held 27% market share in 2024, supported by ongoing replacement of aging transmission and distribution infrastructure. Countries such as Germany, France, and the UK are upgrading legacy grids to meet stricter reliability and safety standards. The high voltage oil insulated switchgear market in Europe is shaped by regulatory pressure for sustainable and eco-friendly solutions. It benefits from hybrid technologies and innovations that reduce environmental impact. Utilities across the region emphasize efficiency and long service life when adopting switchgear systems. Investments in renewable integration and interconnection projects further expand demand across European markets.

North America:

North America accounted for 19% market share in 2024, led by strong investments in grid modernization and renewable energy integration. The United States remains the key contributor, supported by large-scale upgrades to transmission networks and rising demand from heavy industries. The high voltage oil insulated switchgear market in this region benefits from advanced technology adoption and smart grid initiatives. It also supports critical infrastructure such as data centers, oil and gas facilities, and manufacturing hubs. Canada contributes with investments in renewable capacity and sustainable electrification programs. Growing focus on resilience against extreme weather further strengthens regional demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The high voltage oil insulated switchgear market is highly competitive, with global and regional players driving innovation and market expansion. Leading companies include Nissin Electric, Mitsubishi Electric, Siemens, Powell Industries, Hyundai Electric Energy Systems, Hitachi, Schneider Electric, General Electric, and ABB. These firms compete by offering advanced designs, reliable performance, and strong after-sales services to utilities and industrial users. It emphasizes product quality, safety standards, and compliance with environmental regulations to secure contracts. Strategic partnerships, R&D investments, and expansion into emerging markets are central to gaining a competitive edge. Companies also focus on integrating digital monitoring and automation features to enhance operational efficiency. The competitive environment fosters constant upgrades in technology, positioning established players to maintain leadership while creating entry barriers for smaller firms.

Recent Developments:

- In March 2025, Siemens completed its $10 billion acquisition of Altair Engineering, a company specializing in industrial simulation and AI software, strengthening Siemens’ industrial AI and digital twin capabilities.

- In September 2025, Mitsubishi Electric announced on September 11 that it would begin shipping samples of its new compact DIPIPM series power semiconductor modules from September 22, 2025, aimed at consumer and industrial equipment applications.

Report Coverage:

The research report offers an in-depth analysis based on Voltage Level, Component, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The high voltage oil insulated switchgear market will continue to benefit from rising global electricity demand.

- It will see steady adoption in developing economies where electrification and industrialization remain priorities.

- Manufacturers will focus on innovations in eco-friendly oils and hybrid insulation technologies.

- Utilities will adopt advanced monitoring and automation systems to improve reliability and reduce downtime.

- Replacement of aging infrastructure in developed economies will sustain long-term market opportunities.

- Data centers and digital infrastructure growth will drive demand for stable high-voltage distribution.

- Environmental concerns will push suppliers to align with stricter global standards and compliance frameworks.

- Partnerships and collaborations between utilities and technology providers will strengthen product innovation.

- Expansion of renewable energy projects will increase reliance on robust high-voltage transmission equipment.

- The market will remain competitive, with global players emphasizing sustainability, safety, and operational efficiency.

Market Trends:

Market Trends: