Market Overview

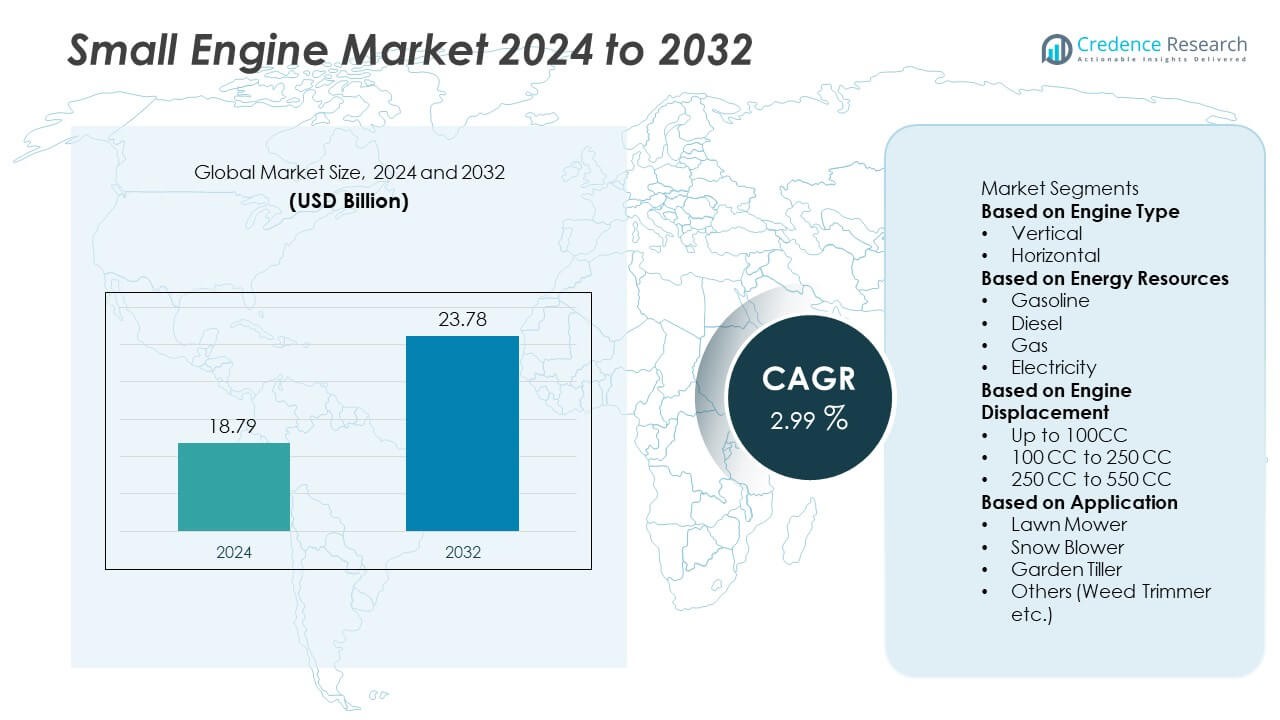

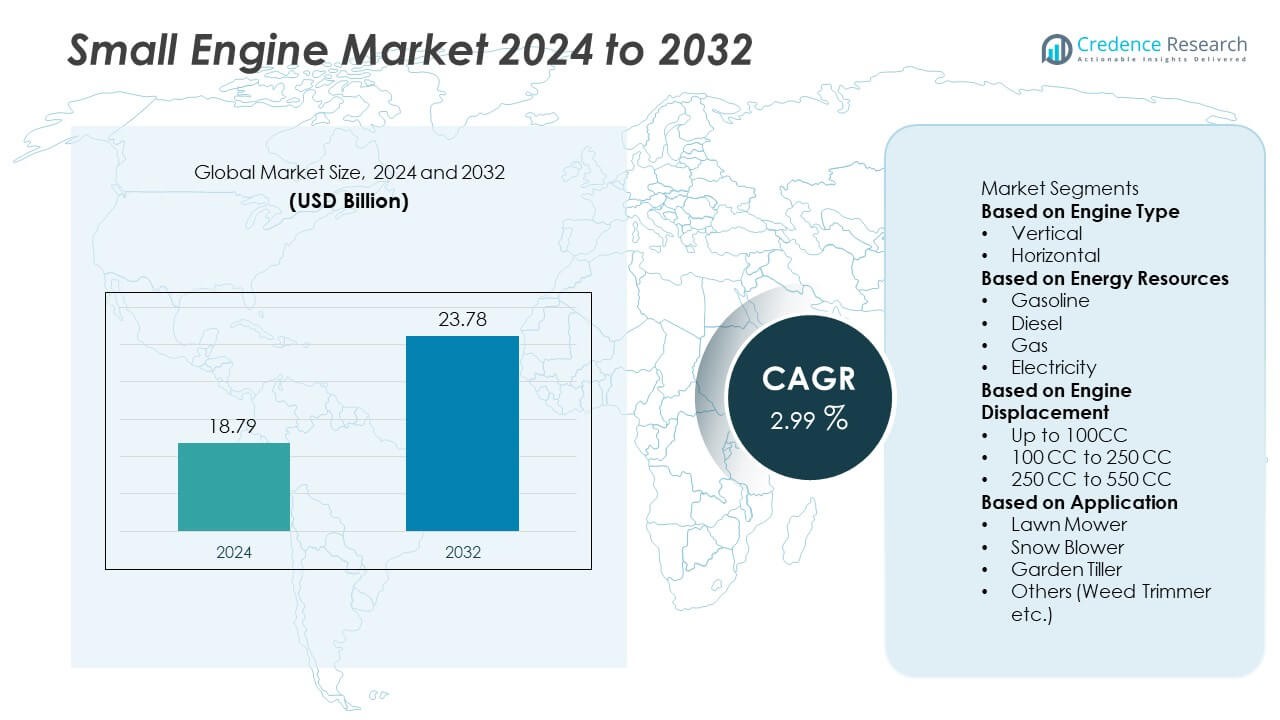

The global Small Engine Market was valued at USD 18.79 billion in 2024 and is projected to reach USD 23.78 billion by 2032, growing at a CAGR of 2.99% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Engine Market Size 2024 |

USD 18.79 Billion |

| Small Engine Market, CAGR |

2.99% |

| Small Engine Market Size 2032 |

USD 23.78 Billion |

The global small engine market is led by major companies including Briggs & Stratton Corporation, Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Kohler Co., Yamaha Motor Co., Ltd., Kubota Corporation, Loncin Motor Co., Ltd., Generac Holdings Inc., Subaru Corporation, and Fuzhou Launtop M&E Co., Ltd. These key players dominate through strong product portfolios, advanced engineering capabilities, and global distribution networks. North America led the market with a 41.6% share in 2024, driven by high demand for lawn and garden equipment and residential power tools. Europe followed with 26.8%, supported by emission regulations encouraging the adoption of efficient engines. Both regions benefit from innovation in hybrid technologies and emission-compliant designs, strengthening their leadership in the global small engine market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global small engine market was valued at USD 18.79 billion in 2024 and is projected to reach USD 23.78 billion by 2032, growing at a CAGR of 2.99% during the forecast period.

- Rising demand for outdoor power equipment, agricultural machinery, and compact construction tools is driving market growth across residential and commercial sectors.

- The market is witnessing trends such as hybrid and electric-assisted engines, IoT-enabled monitoring systems, and lightweight material innovations to improve efficiency and compliance.

- Leading players such as Briggs & Stratton, Honda, and Kohler are investing in emission-compliant technologies and digital solutions to strengthen competitiveness and meet regulatory standards.

- Regionally, North America held 41.6% share in 2024, followed by Europe with 26.8% and Asia-Pacific at 24.7%, while the 100 CC to 250 CC engine segment accounted for 46.1%, supported by strong demand in lawn care, small agricultural tools, and construction applications.

Market Segmentation Analysis:

By Engine Type

The vertical engine segment dominated the small engine market in 2024, holding a 58.3% share. Its leadership is attributed to widespread use in lawnmowers, pressure washers, and garden tractors. Vertical engines are preferred for their compact design, easy integration with cutting decks, and efficient power transmission. Manufacturers are improving durability and fuel efficiency through advanced cooling systems and precision engineering. The rising demand for residential lawn and garden maintenance equipment across North America and Europe continues to drive the dominance of vertical engines in the global small engine market.

- For instance, Briggs & Stratton Corporation introduced its 875EXi Series vertical engine, which features a 190 cc displacement and an Overhead Valve (OHV) configuration. The engine includes the patented Just Check & Add™ oil management system, which protects the engine from debris and eliminates the need for regular oil changes, requiring only an occasional top-up. The engine’s gross torque is rated at 11.87 Nm at 2,600 rpm.

By Energy Resources

The gasoline segment led the market in 2024, accounting for a 64.7% share. Gasoline engines remain the most popular due to their high power-to-weight ratio, lower initial costs, and easy refueling options. They are extensively used in portable generators, lawnmowers, and construction tools. The availability of unleaded fuel and advancements in low-emission technologies are strengthening their position. While electric engines are gaining traction for their eco-friendly operation, gasoline-powered models continue to dominate small-scale power applications across both residential and commercial sectors.

- For instance, Honda Motor Co., Ltd. developed its GX200 engine using an OHV configuration with 196 cc displacement and a maximum net output of 4.1 kW at 3,600 rpm. Its fuel consumption rate is typically 1.7 L/hour under a continuously rated load, and its transistorized ignition system reduces emissions like unburned hydrocarbons.

By Engine Displacement

The 100 CC to 250 CC segment captured a 46.1% share in 2024, driven by its versatility and balance between power output and efficiency. This range is widely used in outdoor power equipment, compact agricultural tools, and small utility vehicles. The segment benefits from technological upgrades such as improved combustion efficiency and lightweight materials. Its widespread adoption across landscaping and construction sectors supports stable market growth. Increasing demand for mid-range engines in developing regions, where compact machinery is expanding rapidly, reinforces this segment’s leading position globally.

Key Growth Drivers

Expansion of Outdoor Power Equipment Demand

Rising demand for lawnmowers, garden tractors, and pressure washers is driving the small engine market. Increasing urban landscaping activities, especially in residential and commercial sectors, are creating strong demand for reliable compact engines. The shift toward mechanized lawn maintenance in North America and Europe further supports growth. Manufacturers are focusing on durable, fuel-efficient designs to enhance productivity and reduce maintenance costs, reinforcing the widespread use of small engines in outdoor equipment applications.

- For instance, Kohler Co. launched its Command PRO EFI ECH749 vertical engine equipped with a 747 cc displacement and an integrated electronic fuel injection system. The engine delivers 26.5 hp at 3,600 rpm while cutting fuel consumption by 0.4 liters per hour compared to carbureted models, supported by a high-efficiency air filtration system rated for 250 operating hours.

Growth in Construction and Agricultural Applications

The expanding construction and small-scale agriculture sectors are major contributors to market growth. Compact engines are increasingly used in generators, concrete mixers, and tillers for portable power solutions. Emerging economies are adopting small machinery to improve operational efficiency in rural and semi-urban areas. The development of low-emission, high-performance engines enhances their suitability for heavy-duty outdoor tasks, further accelerating their adoption across various industrial applications globally.

- For instance, Kubota Corporation introduced its D902-K diesel engine featuring a 0.898-liter displacement and common-rail fuel system capable of producing 18.5 kW at 3,600 rpm. The engine is certified to meet the latest emissions standards, including EPA Tier 4 and EU Stage V, and significantly reduces black smoke to an almost imperceptible level.

Technological Advancements in Engine Efficiency

Continuous innovation in engine design and performance optimization is driving market evolution. Manufacturers are incorporating advanced combustion systems, fuel injection technologies, and digital controls to improve power output and reduce fuel consumption. Hybrid and electric-assisted small engines are emerging as sustainable alternatives, addressing emission concerns and regulatory pressures. These innovations enhance reliability and productivity while reducing operational costs, making technologically advanced small engines increasingly attractive for both commercial and residential use.

Key Trends & Opportunities

Shift Toward Electric and Hybrid Small Engines

The transition toward clean energy is creating significant opportunities for electric and hybrid small engines. Manufacturers are investing in battery-powered systems that offer zero emissions and reduced noise levels. These engines are ideal for residential applications and urban environments with strict emission standards. The development of high-capacity lithium-ion batteries and fast-charging systems further strengthens adoption. This trend aligns with global sustainability goals, opening new avenues for innovation and market differentiation.

- For instance, Generac Holdings Inc. developed its GP3000i portable inverter generator using a 149cc gasoline-powered engine, with a running output of 2,300 watts and a maximum starting output of 3,000 watts. The system operates at a low noise level, thanks to its enclosed design and economy mode, making it suitable for residential and mobile applications.

Adoption of Smart Control and IoT Integration

Smart engine technologies are gaining traction as users seek real-time performance monitoring and predictive maintenance. Integration of IoT-enabled sensors allows remote tracking of engine performance, fuel efficiency, and maintenance schedules. This innovation reduces downtime and enhances operational safety. Commercial users, particularly in agriculture and construction, benefit from optimized engine utilization and cost savings. The growing adoption of connected equipment solutions is transforming the small engine landscape toward data-driven efficiency and user convenience.

- For instance, Yamaha Motor Co., Ltd. introduced its Y-Connect platform for select motorcycles and scooters, capable of monitoring data such as fuel consumption, riding logs, and battery voltage through a smartphone app. The system transmits data via Bluetooth, enabling maintenance reminders based on mileage and other notifications.

Key Challenges

Stringent Emission Regulations and Compliance Costs

Tightening global emission standards such as EPA and EU directives pose a major challenge for small engine manufacturers. Compliance requires costly design modifications, including advanced exhaust systems and fuel controls. These regulations increase production expenses and extend product development timelines. Smaller companies face difficulties meeting these requirements while maintaining affordability. As a result, manufacturers must balance innovation with cost-efficiency to sustain competitiveness in regulated markets.

Rising Competition from Electric Alternatives

The growing availability of electric-powered tools and equipment is restraining demand for traditional combustion small engines. Electric models offer lower maintenance, reduced noise, and zero-emission benefits, making them attractive to both consumers and regulators. This shift is particularly evident in landscaping and residential power tools. To remain competitive, engine manufacturers must invest in hybrid technologies and focus on improving fuel efficiency, performance, and emissions to counter the growing influence of electric alternatives.

Regional Analysis

North America

North America dominated the small engine market in 2024, holding a 41.6% share. The region’s growth is driven by strong demand for lawn and garden equipment, portable generators, and compact construction machinery. The United States leads due to a well-established landscaping industry and high adoption of mechanized outdoor tools. Increasing investments in emission-compliant engines and the rising popularity of hybrid lawn equipment are supporting market expansion. Canada also contributes significantly, driven by the use of small engines in snow blowers and recreational vehicles, reinforcing the region’s leadership position globally.

Europe

Europe accounted for a 26.8% share in the small engine market in 2024, supported by stringent emission regulations and growing focus on energy-efficient technologies. Countries such as Germany, France, and the United Kingdom are investing heavily in low-emission and electric-powered small engines. Rising demand for garden care equipment and compact agricultural machinery contributes to steady market performance. The development of smart engine management systems and eco-friendly fuels further supports adoption. Expanding use in recreational and marine applications continues to strengthen Europe’s role in promoting sustainable small engine solutions.

Asia-Pacific

Asia-Pacific captured a 24.7% share in 2024, emerging as one of the fastest-growing regions in the small engine market. Growth is fueled by increasing agricultural mechanization, expanding construction activities, and strong demand for power equipment in China, India, and Japan. Government initiatives promoting rural development and energy-efficient machinery further accelerate adoption. Local manufacturers are focusing on affordable, fuel-efficient models to meet regional needs. Rapid urbanization and infrastructure development projects are also driving engine usage in portable generators and compact machinery, solidifying Asia-Pacific’s growing importance in the global market.

Latin America

Latin America held a 4.1% share of the small engine market in 2024, driven by expanding agricultural and construction sectors. Brazil and Mexico lead regional demand due to the growing use of compact farming machinery and portable power tools. Economic development and modernization of agricultural practices are creating opportunities for small engine suppliers. Regional manufacturers are investing in cost-effective gasoline and diesel models suited to local requirements. While import dependency and limited technological adoption remain challenges, improving distribution networks and industrialization trends continue to support steady market growth.

Middle East & Africa

The Middle East & Africa accounted for a 2.8% share in the small engine market in 2024. Growth is supported by increasing use of compact engines in construction, water pumping, and agricultural applications. The UAE and Saudi Arabia drive demand through ongoing infrastructure projects and landscaping initiatives. African nations, particularly South Africa and Kenya, are adopting small engines for irrigation and light industrial uses. Despite limited manufacturing capacity, the growing need for portable power and small-scale mechanization is creating new opportunities, supported by rising urban development and government investments.

Market Segmentations:

By Engine Type

By Energy Resources

- Gasoline

- Diesel

- Gas

- Electricity

By Engine Displacement

- Up to 100CC

- 100 CC to 250 CC

- 250 CC to 550 CC

By Application

- Lawn Mower

- Snow Blower

- Garden Tiller

- Others (Weed Trimmer etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The small engine market is characterized by strong competition among leading players such as Briggs & Stratton Corporation, Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Kohler Co., Yamaha Motor Co., Ltd., Kubota Corporation, Loncin Motor Co., Ltd., Generac Holdings Inc., Subaru Corporation, and Fuzhou Launtop M&E Co., Ltd. These companies compete through product innovation, performance enhancement, and emission compliance. Market leaders focus on developing lightweight, fuel-efficient, and hybrid-ready engines to meet evolving regulatory standards and consumer preferences. Strategic partnerships, R&D investments, and expansion into emerging markets are key growth strategies. Many manufacturers are also integrating smart control technologies and digital diagnostics to improve operational reliability and service support. The growing demand for compact and efficient power solutions across residential, commercial, and industrial applications continues to intensify competition, pushing global players to differentiate through sustainability, cost-effectiveness, and advanced engine performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Briggs & Stratton Corporation

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Kohler Co.

- Yamaha Motor Co., Ltd.

- Kubota Corporation

- Loncin Motor Co., Ltd.

- Generac Holdings Inc.

- Subaru Corporation

- Fuzhou Launtop M&E Co., Ltd.

Recent Developments

- In August 2024, Briggs & Stratton Corporation launched its Vanguard 300 single-cylinder horizontal shaft engine with a displacement of 307 cc and rated at 10.0 gross hp.

- In July 2024, Kawasaki Heavy Industries, Ltd.’s motorcycle arm conducted a public demonstration run of a hydrogen internal combustion engine motorcycle at the Suzuka Circuit, showcasing alternative fuel small-engine capability.

- In December 2023, Briggs & Stratton launched the Vanguard Lithium-Ion 48V 1.5kWh Swappable Commercial Battery (Si1.5), adding to its range of power solutions for Original Equipment Manufacturers (OEMs).

Report Coverage

The research report offers an in-depth analysis based on Engine Type, Energy Resources, Engine Displacement, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for compact and fuel-efficient engines will continue to rise across industries.

- Manufacturers will focus on developing low-emission and hybrid small engines.

- Advancements in electronic fuel injection will improve performance and efficiency.

- Integration of IoT and smart monitoring systems will enhance operational control.

- Electric and battery-powered alternatives will gain traction in light equipment.

- The agricultural and construction sectors will remain key growth drivers globally.

- Stringent emission regulations will accelerate innovation in cleaner engine technologies.

- Asia-Pacific will emerge as the fastest-growing region driven by industrial expansion.

- Companies will prioritize lightweight materials to improve durability and fuel economy.

- Strategic collaborations and R&D investments will strengthen market competitiveness.