Market Overview

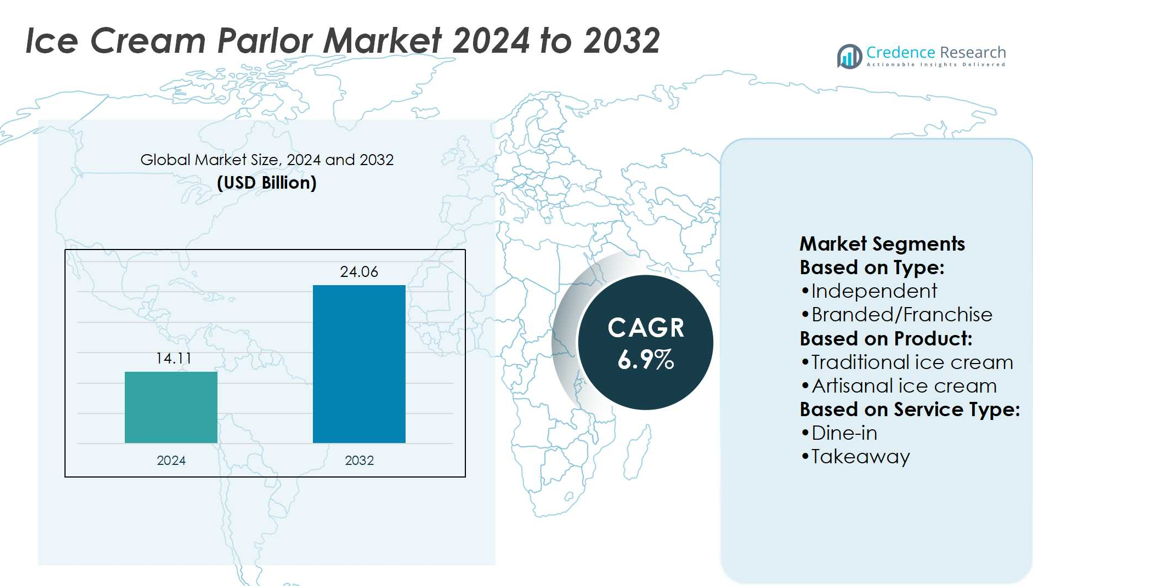

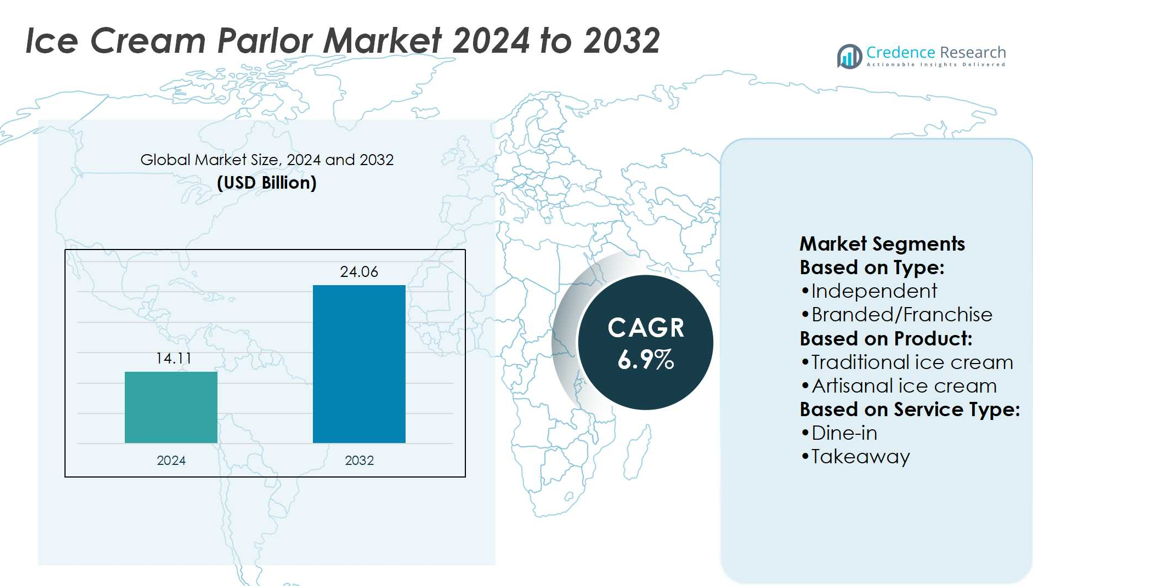

Ice Cream Parlor Market size was valued at USD 14.11 billion in 2024 and is anticipated to reach USD 24.06 billion by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ice Cream Parlor Market Size 2024 |

USD 14.11 billion |

| Ice Cream Parlor Market, CAGR |

6.9% |

| Ice Cream Parlor Market Size 2032 |

USD 24.06 billion |

The Ice Cream Parlor Market grows through strong consumer demand for premium, artisanal, and health-oriented offerings. Rising disposable incomes, urban lifestyles, and social dining preferences drive steady expansion. Parlors adapt to dietary shifts with plant-based, low-sugar, and functional varieties while leveraging experiential formats like customization and nitrogen-infused desserts to attract younger demographics. Digital platforms, delivery services, and loyalty programs enhance accessibility and engagement. Seasonal menus and limited-edition flavors boost repeat visits, while sustainability initiatives influence operations. Together, these drivers and trends position ice cream parlors as dynamic, experience-focused destinations catering to evolving global consumer expectations.

The Ice Cream Parlor Market shows strong geographical diversity, with Asia Pacific leading due to urbanization and rising incomes, followed by Europe’s artisanal traditions and North America’s established franchise presence. Latin America and the Middle East & Africa present emerging opportunities driven by retail expansion and tourism. Key players such as Baskin-Robbins, Ben & Jerry’s, Cold Stone Creamery, Dairy Queen, Haagen-Dazs, Breyers, Blue Bell Creameries, Carvel, Graeter’s Ice Cream, and Ghirardelli Ice Cream and Chocolate Shop shape competition through innovation, branding, and expansion strategies.

Market Insights

- The Ice Cream Parlor Market size was valued at USD 14.11 billion in 2024 and is expected to reach USD 24.06 billion by 2032, at a CAGR of 6.9%.

- Rising disposable incomes, premium demand, and evolving dining preferences drive consistent market growth.

- Trends highlight plant-based, low-sugar, and functional ice creams alongside experiential formats like nitrogen-infused desserts.

- Competition remains strong, with global and regional players focusing on innovation, branding, and franchise expansion.

- High operational costs, supply chain disruptions, and seasonal demand patterns act as market restraints.

- Asia Pacific leads through rapid urbanization, Europe thrives on artisanal traditions, and North America holds strong franchise presence, while Latin America and Middle East & Africa present emerging opportunities.

- Seasonal menus, digital ordering, delivery services, and sustainability practices enhance customer engagement and shape long-term industry growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Consumer Demand for Premium and Artisanal Flavors

The Ice Cream Parlor Market benefits from rising consumer preference for unique, high-quality flavors. Shoppers seek artisanal options, natural ingredients, and indulgent textures. It is driven by the shift from mass-market products to personalized experiences. Premium offerings such as organic, vegan, and locally sourced varieties increase customer loyalty. Seasonal menus and limited-edition flavors also attract repeat visits. This demand for exclusivity continues to strengthen overall market growth.

- For instance, Each French Pot batch takes about 15-20 minutes of freezing in a salt water bath held at around –20 °F, during which blades scrape frozen product from the sides of the pot to maintain density and texture.

Influence of Lifestyle Shifts and Social Experience

Changing lifestyles encourage consumers to treat ice cream parlors as social hubs. Families and young adults view parlors as casual dining and leisure spaces. It gains traction through ambiance, interior design, and community-driven marketing. Enhanced in-store experiences create strong customer engagement and longer visits. Interactive elements like self-serve toppings and customizable sundaes expand appeal. Such positioning drives consistent customer traffic and brand differentiation.

- For instance, Carvel created a first-of-its-kind billboard in Manhattan fitted with a soft-serve dispenser. That installation served more than 50 gallons of soft serve, yielding about 1,500 servings over a seven-hour period.

Expansion of Quick-Service and Franchised Outlets

The Ice Cream Parlor Market grows through rapid expansion of franchise models and quick-service outlets. It leverages standardized menus and brand recognition to capture wider audiences. Franchise partnerships lower entry barriers for entrepreneurs, supporting steady market penetration. Well-known chains dominate high-footfall urban and suburban zones. Strong supply chain networks ensure consistency across multiple outlets. This model helps brands scale efficiently while meeting consumer demand.

Innovation in Product Formats and Dietary Alternatives

Product innovation plays a vital role in market expansion. The Ice Cream Parlor Market adapts to dietary trends with low-sugar, plant-based, and lactose-free options. It integrates functional ingredients like probiotics and protein to attract health-conscious consumers. Creative formats such as rolled, nitrogen-infused, or fusion desserts enhance novelty. Technology supports consistency in texture and flavor delivery across outlets. These innovations broaden appeal, making parlors relevant to diverse demographics.

Market Trends

Growing Demand for Plant-Based and Functional Varieties

The Ice Cream Parlor Market experiences a rising trend toward plant-based and functional alternatives. It caters to lactose-intolerant and vegan consumers through dairy-free and natural ingredient options. Functional varieties include protein-rich, probiotic, and low-calorie formats designed for health-conscious buyers. Parlors introduce superfoods like matcha, chia, or acai into their offerings. Such innovations appeal to customers balancing indulgence with nutrition. This trend reflects the shift toward healthier dessert choices while sustaining indulgence appeal.

- For instance, Haagen-Dazs responded to plant-based demand by launching an oat-based frozen dessert line in Canada. Each tub in that line is 400 ml in volume. They use oats for creaminess and pea protein as the protein source in those plant-based recipes.

Emphasis on Customization and Experiential Formats

Customers increasingly seek personalized experiences within parlors. The Ice Cream Parlor Market adopts interactive formats like self-serve counters, customizable toppings, and themed sundaes. It creates opportunities for consumers to engage directly in the dessert-making process. Innovative presentation formats such as nitrogen-infused or rolled ice cream strengthen novelty appeal. The focus on unique customer experiences helps parlors stand out in competitive urban markets. This trend supports higher consumer loyalty and social media-driven brand awareness.

- For instance, Baskin-Robbins stores have installed remote sensors and WiFi-thermostats to monitor walk-in freezer temperatures. The sensors check if temperatures rise above –10 °F to –20 °F, sending alerts via mobile app to prevent spoilage.

Integration of Digital Platforms and Delivery Services

Technology adoption shapes modern ice cream parlors. The Ice Cream Parlor Market integrates online ordering, mobile apps, and third-party delivery platforms to expand reach. It ensures convenience for customers seeking premium desserts at home. Loyalty programs embedded in mobile platforms increase repeat purchases and data-driven personalization. Social media promotions and influencer collaborations also boost visibility. This digital integration enhances brand accessibility across both local and global markets.

- For instance, Blue Bell also reinstated Homemade in the Shade, which pairs Homemade Vanilla ice cream with hot fudge sauce swirl. This flavor had been off shelves for about 10 years, returning and offered in the same two sizes: pint and half-gallon.

Expansion of Seasonal and Limited-Edition Offerings

Seasonal menus and exclusive launches gain strong traction among younger demographics. The Ice Cream Parlor Market uses limited-time flavors tied to festivals, holidays, or regional traditions. It stimulates repeat visits by offering fresh and unique experiences. Collaborations with confectionery brands and local suppliers add novelty to menus. Seasonal flavors create anticipation and strengthen consumer engagement cycles. This trend sustains excitement and positions parlors as dynamic, experience-driven destinations.

Market Challenges Analysis

Rising Operational Costs and Supply Chain Pressures

The Ice Cream Parlor Market faces challenges from fluctuating costs of raw materials and utilities. It struggles with high prices of dairy, plant-based ingredients, and premium flavoring agents. Seasonal demand variations further complicate inventory planning and cost management. Energy expenses related to refrigeration and storage increase operational strain. Supply chain disruptions also impact timely sourcing of specialty products. These pressures limit profit margins, particularly for smaller and independent parlors. Businesses must adapt through efficient sourcing and waste reduction strategies.

Intense Competition and Shifting Consumer Preferences

The Ice Cream Parlor Market encounters rising competition from global chains, quick-service restaurants, and artisanal startups. It must balance traditional offerings with modern dietary demands like low-sugar or vegan options. Rapidly changing consumer tastes create challenges in product development and menu planning. Limited differentiation reduces customer loyalty in saturated urban markets. High expectations for experiential formats demand constant investment in innovation and marketing. These conditions make long-term growth difficult for less capitalized players. Parlors need strategic positioning to maintain relevance in a dynamic landscape.

Market Opportunities

Expansion Through Health-Oriented and Premium Offerings

The Ice Cream Parlor Market holds strong opportunities in health-focused and premium product categories. It can leverage rising demand for plant-based, low-fat, and functional ice cream varieties. Introducing options fortified with protein, probiotics, or natural sweeteners attracts health-conscious consumers. Premium positioning through organic ingredients, artisanal flavors, and indulgent textures supports higher margins. Growing interest in gourmet and exotic flavors also creates differentiation in competitive markets. This opportunity aligns with evolving dietary preferences while enhancing brand loyalty.

Growth Potential in Emerging Markets and Digital Channels

Emerging economies present significant room for parlor expansion. The Ice Cream Parlor Market can benefit from increasing disposable income and urbanization in Asia, Latin America, and the Middle East. It gains further reach through digital platforms offering online ordering, delivery, and loyalty programs. Collaborations with e-commerce and food delivery companies expand accessibility to new customers. Targeted marketing through social media enhances visibility and engagement with younger demographics. This multi-channel growth opportunity strengthens brand presence and supports sustainable expansion.

Market Segmentation Analysis:

By Type

The Ice Cream Parlor Market divides into independent outlets and branded/franchise formats. Independent parlors dominate in local communities by offering unique flavors and personalized experiences. It appeals to consumers seeking authenticity and artisanal creations, often tied to regional tastes. Branded and franchise outlets show strong growth due to standardized operations, wide reach, and consistent product quality. Global chains leverage supply chain efficiency and marketing power to expand rapidly across urban and suburban markets. Both formats play distinct roles, with independents driving innovation and franchises ensuring scalability.

- For instance, Dairy Queen operates more than 4,100 locations in the United States as of mid-2025. These locations include various formats—from Grill & Chill restaurants to traditional soft-serve only shops.

By Product

Traditional ice cream remains the most widely consumed product category. It sustains demand through familiar flavors, affordability, and wide consumer acceptance. The Ice Cream Parlor Market also experiences rising interest in artisanal ice cream. It attracts premium buyers with natural ingredients, seasonal fruits, and creative recipes. Artisanal formats highlight freshness and indulgence, driving strong traction in urban and affluent areas. This dual demand balances mass-market appeal with a growing segment of discerning consumers.

- For instance, Ben & Jerry’s non-dairy portfolio has grown from 1 flavour to 20 non-dairy flavours globally since its first non-dairy launch. A Ben & Jerry’s flavor guru confirmed that 70 different formulations were tested to develop the new oat base.

By Service Type

Service formats shape customer engagement and revenue models. Dine-in service remains a core driver, as parlors position themselves as social and leisure spaces. It provides an experiential setting where ambiance and presentation enhance value. Takeaway services continue to expand, fueled by consumer demand for convenience and on-the-go indulgence. Combined service formats integrate both models, allowing outlets to capture diverse customer preferences. The Ice Cream Parlor Market benefits from this flexibility, enabling parlors to adapt to varying consumer lifestyles and regional demand. This segmentation strengthens the industry’s ability to serve both traditional and modern consumption patterns.

Segments:

Based on Type:

- Independent

- Branded/Franchise

Based on Product:

- Traditional ice cream

- Artisanal ice cream

Based on Service Type:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for nearly 20% of the Ice Cream Parlor Market. The United States drives most of this share, supported by strong demand for branded franchise outlets and well-established premium chains. Canada and Mexico add to the region’s contribution, where consumer interest in convenience and indulgence remains strong. It benefits from advanced cold chain infrastructure and the growing popularity of digital ordering platforms. Health-oriented innovations such as plant-based and low-sugar ice creams continue to gain traction across the region. Competition is intense, with both global chains and local independents serving diverse customer preferences. Market maturity limits the overall growth rate, but innovation and premiumization sustain steady expansion.

Europe

Europe holds roughly 30% of the market, making it one of the largest regional contributors. Italy, France, Germany, Spain, and the UK dominate sales, reflecting the region’s deep-rooted traditions in gelato and artisanal dessert culture. The Ice Cream Parlor Market in Europe benefits from consumer preference for high-quality, natural, and organic ingredients. It also faces evolving regulations on sugar and additives, which drive the launch of healthier alternatives. Independent parlors thrive alongside well-known chains, often emphasizing locally sourced products and seasonal menus. Tourism further supports demand, particularly in Mediterranean countries where ice cream is integral to leisure dining. Growth is steady, and Europe continues to serve as a hub for innovation in artisanal ice cream.

Asia Pacific

Asia Pacific leads the global market with approximately 40% share, reflecting its large consumer base and fast-growing economies. China, India, Japan, and South Korea are major growth engines, with rising disposable income and rapid urbanization fueling demand. The Ice Cream Parlor Market here thrives on flavor experimentation and premium positioning. Younger demographics drive traffic to parlors offering novelty, customization, and experiential dining. Franchises and global chains expand quickly in tier-1 and tier-2 cities, while local parlors adapt menus to regional tastes. Digital integration through mobile apps and food delivery platforms further boosts accessibility. Asia Pacific remains the fastest-growing regional market and is expected to retain its dominance through the forecast period.

Latin America

Latin America contributes close to 6% of the Ice Cream Parlor Market. Brazil and Mexico lead the region, supported by growing middle-class spending and expansion of retail infrastructure. Independent parlors are widespread, often family-run and offering localized flavors suited to cultural preferences. It faces challenges with cold chain logistics and fluctuating input costs, but rising demand continues to push the market forward. Seasonal demand peaks during summer months, boosting sales in tourist-heavy areas. International franchises are gradually entering, bringing standardized menus and wider visibility. Latin America is still a small share of the global market, but it shows steady growth potential.

Middle East & Africa

The Middle East and Africa together account for nearly 4% of the market. The UAE, Saudi Arabia, and South Africa are the leading countries where urbanization and rising disposable incomes fuel expansion. Tourism and the growth of modern shopping malls provide high visibility for ice cream parlors in this region. It benefits from increasing demand for premium and international dessert experiences, with franchises gaining strong traction. Independent parlors continue to play a role, offering locally inspired flavors that appeal to cultural preferences. Cold chain infrastructure and operational costs remain challenges, but rising consumer interest ensures growth opportunities. The region, though small in share, shows promising expansion over the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Ice Cream Parlor Market companies include Baskin-Robbins, Ben & Jerry’s, Blue Bell Creameries, Breyers, Carvel, Cold Stone Creamery, Dairy Queen, Ghirardelli Ice Cream and Chocolate Shop, Graeter’s Ice Cream, and Haagen-Dazs. The Ice Cream Parlor Market remains highly competitive, shaped by evolving consumer preferences, innovative product development, and expanding service formats. Brands compete through strategies that emphasize premium flavors, artisanal quality, and healthier alternatives such as low-sugar or plant-based offerings. Strong franchise networks and local independents both play vital roles in maintaining market presence, with the former focusing on scalability and the latter on uniqueness and personalization. Digital integration through online ordering, delivery platforms, and loyalty programs strengthens customer engagement. Seasonal menus, experiential dining, and creative formats like nitrogen-infused or rolled ice cream further enhance differentiation. The market continues to see intense rivalry, pushing companies to innovate continuously and expand across diverse regional markets.

Recent Developments

- In February 2024, Unilever partnered with leading precision fermentation innovator Perfect Day to launch Breyers Lactose-Free Chocolate, which is composed of Perfect Day dairy protein from fermentation in the U.S.

- In 2023, Baskin-Robbins reopened its outlet in Bay City, Michigan. The store closed and was looking for new owners. Since its reopening, the business has seen massive growth and customer demand.

- In June 2023, Ben & Jerry’s came together with The Entrepreneurial Refugee Network (TERN) to craft a fresh flavor called Sunny Honey Home. This unique blend is specifically designed to raise funds and provide support for the entrepreneurial endeavors of refugees in the UK.v

- In February 2023, Cold Stone Creamery, in collaboration with Reese, launched Reese-inspired ice creams like Reese’s Take 5 peanut butter ice cream and Reese’s Peanut Butter Cup ice cream. The company also launched marshmallow-flavored ice cream.

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Service Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Ice Cream Parlor Market will expand through rising demand for premium and artisanal flavors.

- Health-conscious consumers will drive growth in plant-based, low-sugar, and functional ice cream options.

- Franchise models will strengthen global reach with standardized offerings and efficient supply chains.

- Independent parlors will continue to thrive by offering unique, locally inspired flavors.

- Digital ordering, mobile apps, and delivery services will shape future consumer engagement.

- Seasonal and limited-edition menus will create recurring demand and repeat customer visits.

- Experiential formats such as customizable sundaes and nitrogen-infused ice cream will gain popularity.

- Urbanization and rising disposable incomes in emerging markets will fuel regional expansion.

- Sustainability and eco-friendly packaging will become a priority for parlor operators.

- Continuous innovation in flavors, formats, and customer experiences will sustain competitive growth.