Market Overview:

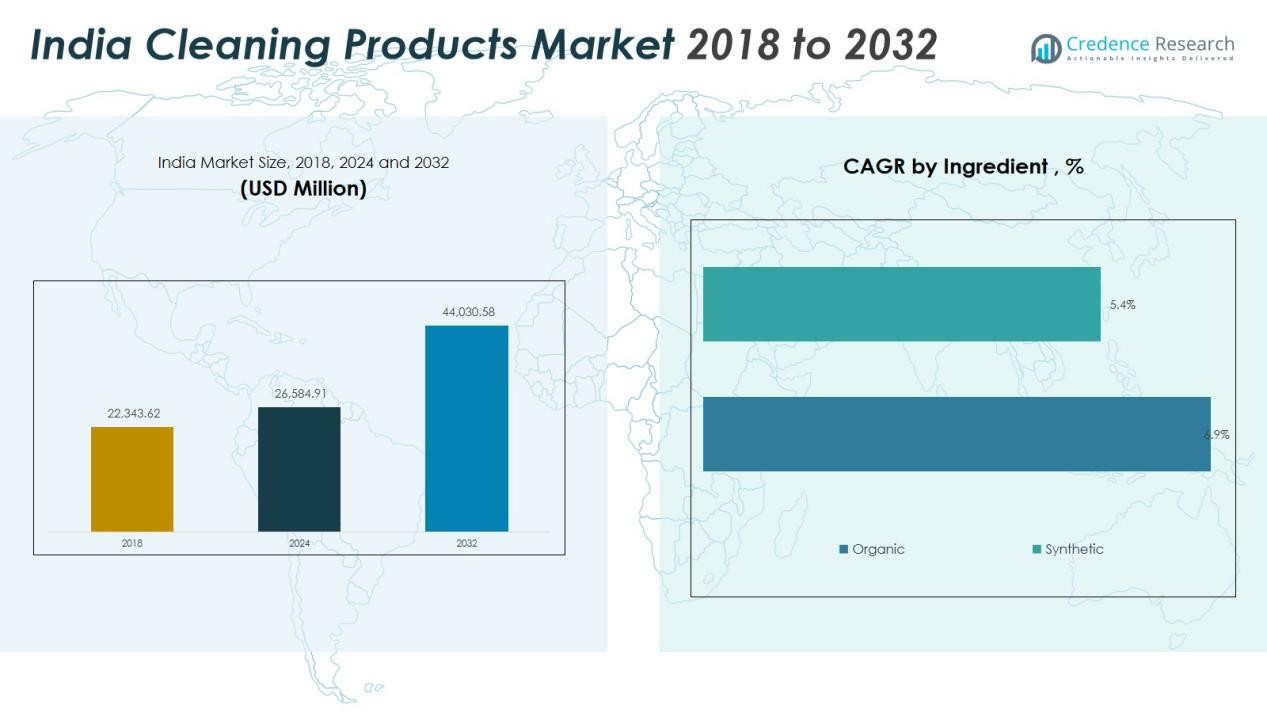

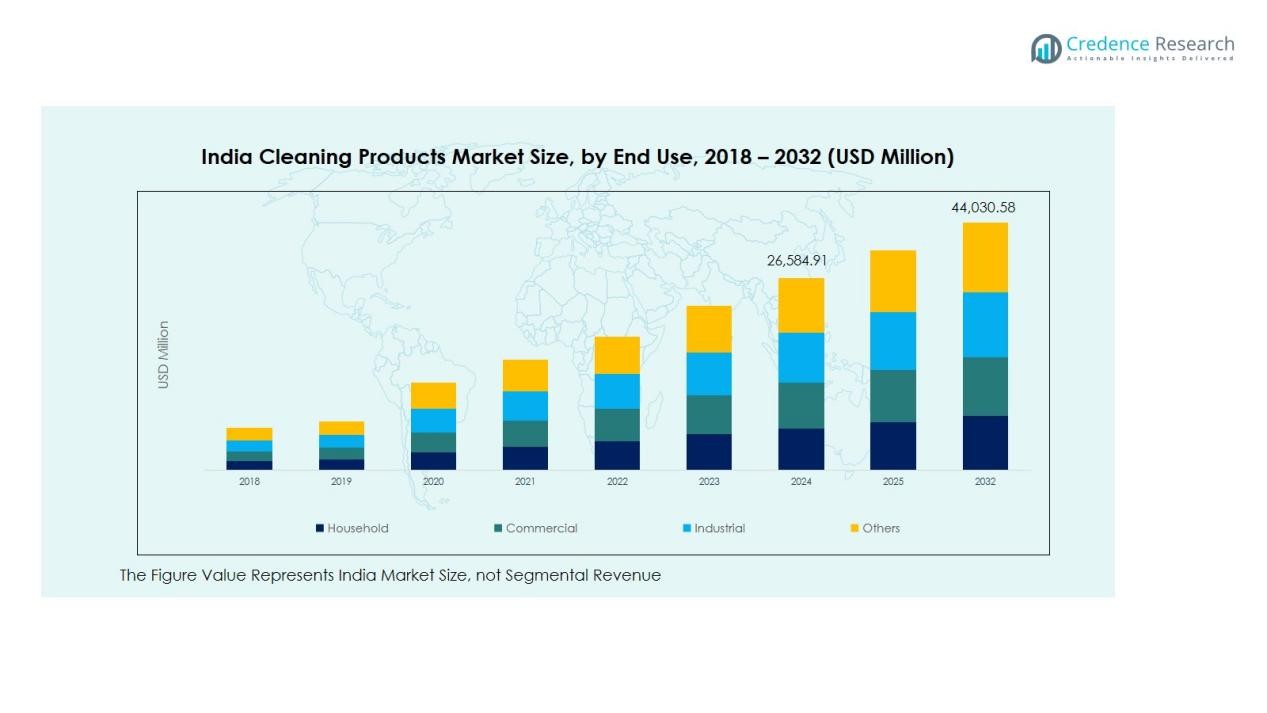

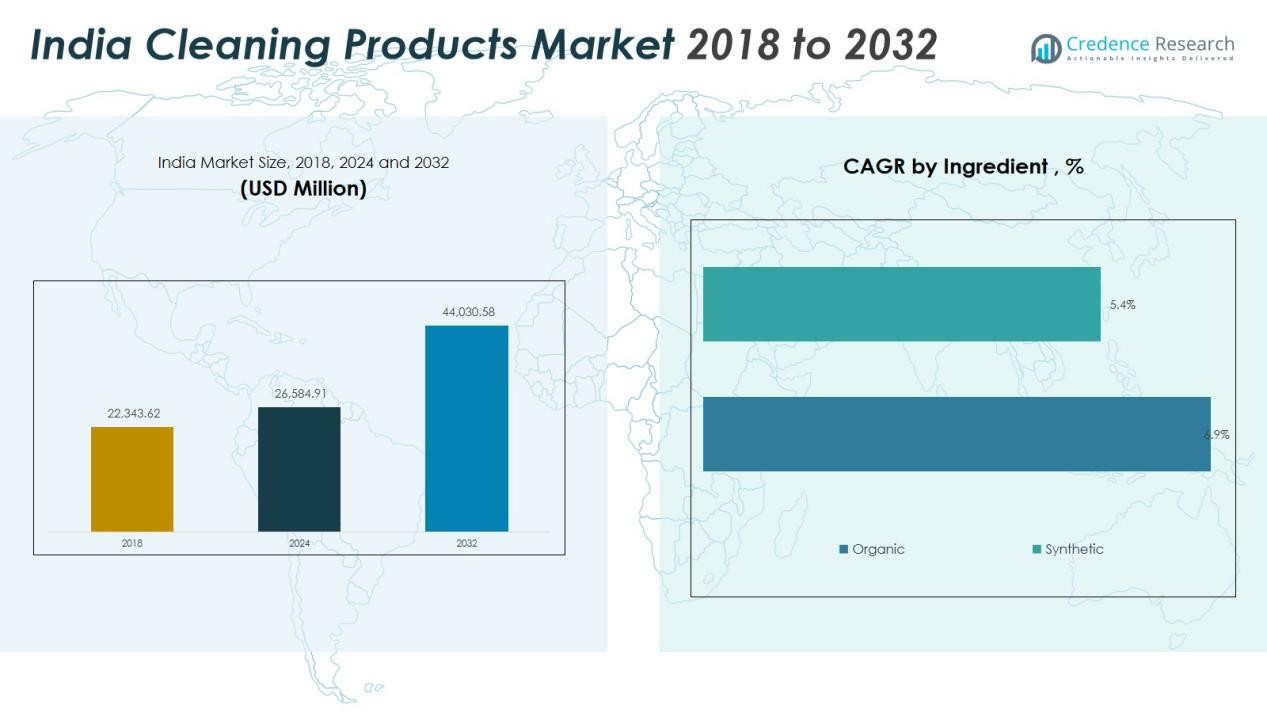

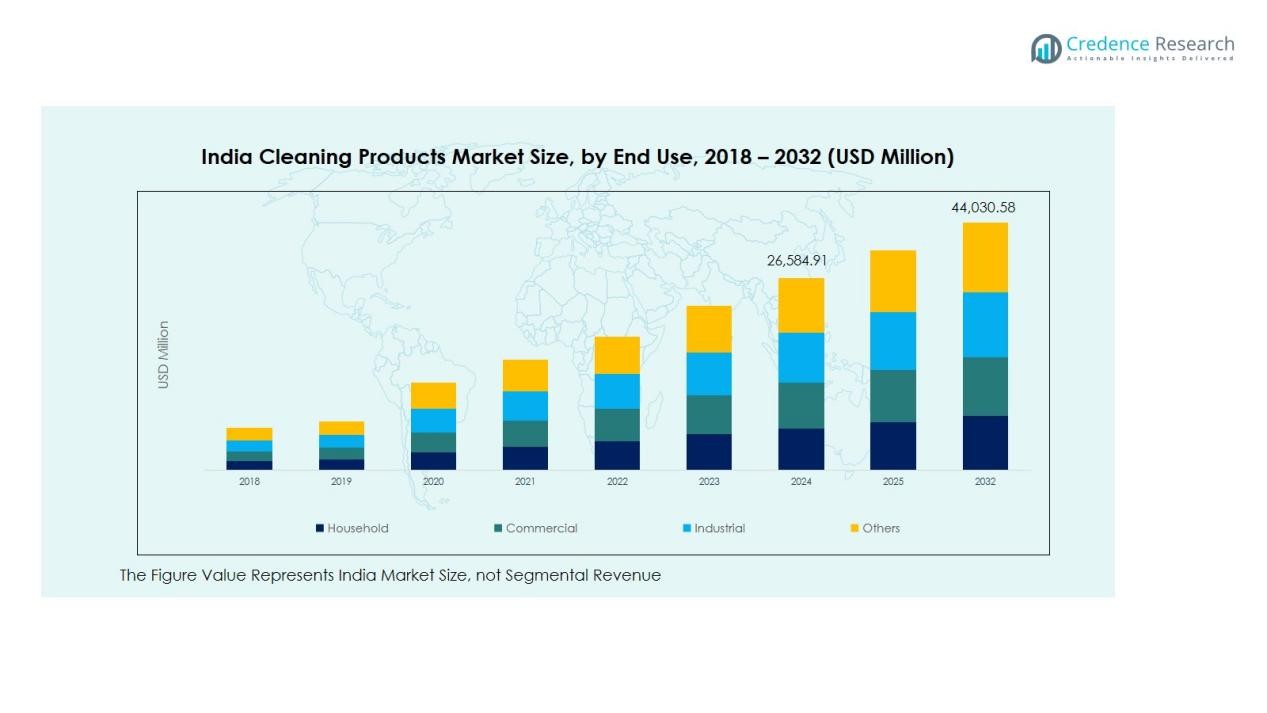

The India Cleaning Products Market size was valued at USD 22,343.62 million in 2018 to USD 26,584.91 million in 2024 and is anticipated to reach USD 44,030.58 million by 2032, at a CAGR of 6.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Cleaning Products Market Size 2024 |

USD 26,584.91 Million |

| India Cleaning Products Market, CAGR |

6.51% |

| India Cleaning Products Market Size 2032 |

USD 44,030.58 Million |

Growing health consciousness, reinforced by pandemic-driven habits, remains a major catalyst for market acceleration. Consumers increasingly prefer products with antibacterial and eco-friendly properties, while manufacturers invest in safer formulations, biodegradable ingredients, and premium segments. Rapid urbanization, improving living standards, and the penetration of modern retail formats further broaden product availability. E-commerce platforms also contribute to category growth by facilitating convenient access and promoting niche and premium cleaning brands.

Regionally, metropolitan areas such as Delhi-NCR, Mumbai, Bengaluru, and Chennai dominate market demand due to higher disposable incomes, dense populations, and faster adoption of innovative home-care products. Tier-2 and tier-3 cities are witnessing rising consumption as awareness campaigns expand and distribution networks strengthen. Rural markets demonstrate steady growth supported by increasing affordability, improved retail reach, and government initiatives focused on hygiene and sanitation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The India Cleaning Products Market reached USD 26,584.91 million in 2024 and is projected to hit USD 44,030.58 million by 2032, reflecting a strong CAGR of 6.51%, supported by rising hygiene awareness, urban lifestyle expansion, and premium product adoption.

- Metro regions collectively command the highest share, led by Delhi-NCR (18–20%), Mumbai Metropolitan Region (15–17%), and Bengaluru (10–12%), driven by higher incomes, faster acceptance of branded cleaning solutions, and strong penetration of organized retail and quick-commerce networks.

- The fastest-growing region is the tier-2 and tier-3 cluster (23–25% share), expanding rapidly due to improving distribution networks, rising affordability, growing preference for branded cleaners, and stronger e-commerce accessibility that boosts product choice and availability.

- The home-care cleaning segment leads the market with surface and floor cleaners holding 34–36% share, supported by widespread household adoption, growing demand for disinfectant-based formulations, and continuous product innovation across fragrances, multipurpose formats, and safe-chemical blends.

- Laundry-care products capture 28–30% share, benefiting from rising usage of liquid detergents, fabric conditioners, and premium washing solutions as consumers shift away from traditional powders and seek improved convenience, stain-removal performance, and machine-wash compatibility.

Market Drivers:

Rising Health and Hygiene Priorities

The India Cleaning Products Market gains strong momentum from heightened consumer focus on hygiene and sanitation. Households and institutions adopt advanced cleaning solutions to reduce infection risks and maintain safe environments. It benefits from sustained awareness campaigns that highlight the importance of routine cleaning. Demand continues to shift toward disinfectants, multipurpose cleaners, and antimicrobial solutions that ensure superior protection.

- For example, PERISAFE introduced Multipurpose Disinfectant Wipes in India in 2024, which provide a 2-in-1 germ-killing and tough mess cleaning solution, reflecting the market’s shift to multipurpose and antimicrobial products.

Expansion of Urban Lifestyles and Modern Living Standards

Urbanization fuels the adoption of efficient home-care products that support faster and cleaner household management. Consumers in metros and large cities prefer convenient, time-saving cleaning formats that deliver consistent results. It experiences rising demand for specialized surface cleaners, appliance-safe solutions, and high-performance products aligned with busy lifestyles. Growth accelerates further as organized retail channels present broader product choices and promote premium offerings.

- For example, Reckitt Benckiser’s Dettol Surface Cleanser has expanded its portfolio to include appliance-safe variants that maintain disinfecting strength while being gentle on surfaces, with product tests showing 99.9% bacteria elimination within seconds on kitchen appliances widely used in urban homes.

Innovation in Eco-Friendly and Low-Chemical Formulations

Sustainability influences purchasing decisions as consumers seek safer alternatives with reduced chemical content. It witnesses strong traction for biodegradable, plant-based, and fragrance-free formulations that minimize environmental impact. Brands invest in research to enhance product safety, improve efficacy, and strengthen regulatory compliance. Market players introduce innovations such as refill packs and concentrated solutions to reduce packaging waste and appeal to responsible consumers.

E-Commerce Growth and Strengthening Distribution Networks

Online platforms reshape demand patterns by improving product visibility and access across regions. The India Cleaning Products Market benefits from digital promotions, subscription-based supply models, and rapid doorstep delivery. It expands deeper into tier-2 and tier-3 cities through improved logistics and wider retail penetration. Stronger distribution networks enable brands to reach new customer segments and support continuous market growth.

Market Trends:

Transition Toward Premium, Specialized, and Eco-Safe Products

The India Cleaning Products Market moves toward premium and specialized solutions that support advanced hygiene needs. Consumers prefer products with stronger antimicrobial performance, faster action, and compatibility with modern home surfaces. It reflects a steady rise in demand for fragrance-free, low-toxicity, and biodegradable formulations that align with growing environmental expectations. Brands introduce concentrated liquids, refill packs, and advanced dispensing formats to improve convenience and reduce waste. Product portfolios expand to include appliance-specific cleaners, high-touch surface solutions, and sensitive-skin variants. Digital education campaigns strengthen awareness about ingredient safety and performance benefits, which encourages product trials.

- For instance, Koparo Clean’s Multi-Surface Cleaner excludes over 25 harmful chemicals and offers 85% plastic usage reduction through its refill program compared to new bottles, showcasing technological innovation and eco-conscious convenience.

Strengthening Omnichannel Presence and Technology-Enabled Engagement

Retail strategies evolve quickly as brands deepen omnichannel integration to reach broader consumer groups. The India Cleaning Products Market benefits from the strong push toward e-commerce, subscription models, and quick-commerce platforms. It gains visibility through targeted digital marketing, influencer-led promotions, and AI-driven product recommendations. Traditional retail also adapts through improved shelf placement, wider brand assortments, and regional customization of product lines. Demand rises for smart packaging features that support transparency, such as QR-based information access and sustainability indicators. Product accessibility improves across tier-2 and tier-3 cities through stronger logistics networks, which supports consistent market expansion.

- For instance, Big Basket scaled up its quick-commerce infrastructure in 2024-2025, expanding its ‘BB Now’ rapid delivery service to around 50 to 75 cities to compete with rivals like Blinkit and Zepto, with plans to increase its network of dark stores to 900 by the end of 2025.

Market Challenges Analysis:

High Price Sensitivity and Intense Competitive Pressure

The India Cleaning Products Market faces persistent challenges linked to strong price sensitivity across large consumer segments. Low-cost local brands compete aggressively with established players, which restricts premium pricing opportunities. It must address fluctuating raw material costs that influence production expenses and narrow margins. Rural markets remain highly value-driven, which limits rapid adoption of advanced or specialized formulations. Brand loyalty stays relatively weak in mass categories, and frequent promotions shape purchasing behavior. Companies must balance affordability with differentiated performance to retain market share.

Regulatory Compliance, Supply Constraints, and Environmental Concerns

Evolving regulations on chemical composition, labeling, and environmental safety create ongoing operational constraints. The India Cleaning Products Market must adjust to stricter norms that require reformulation and rigorous quality controls. It also manages supply-chain disruptions tied to packaging materials, imported raw inputs, and logistics delays. Growing scrutiny of plastic waste and chemical discharge raises pressure on brands to adopt greener alternatives. Product development cycles extend as companies work to meet sustainability expectations without compromising efficacy. Regional disparities in retail infrastructure add further complexity to consistent nationwide distribution.

Market Opportunities:

Expansion of Premium, Sustainable, and Specialized Product Lines

The India Cleaning Products Market holds strong opportunities in premium and eco-focused categories that align with rising safety and sustainability priorities. Consumers show greater interest in low-chemical, plant-based, and dermatologically safe formulations that support healthier living environments. It can gain traction by introducing appliance-specific cleaners, high-touch surface solutions, and fragrance-neutral variants designed for sensitive users. Brands that invest in ethical sourcing, refill systems, and biodegradable packaging can strengthen long-term differentiation. Demand for concentrated liquids and value-packed refills continues to expand, supported by cost efficiency and reduced waste. Innovation in product formats and ingredients remains a strategic path for capturing premium share.

Acceleration of Digital Commerce and Wider Regional Penetration

E-commerce growth creates strong opportunities for brands to reach new customers with targeted pricing, assortments, and subscription-based solutions. The India Cleaning Products Market benefits from rising adoption of quick-commerce platforms that deliver essentials rapidly to urban households. It can scale effectively through digital-first strategies, influencer partnerships, and data-driven product recommendations. Stronger logistics networks enable deeper penetration into tier-2, tier-3, and rural markets where demand for structured hygiene solutions is rising. Retail expansion in semi-urban regions supports increased visibility and trial of branded cleaning products. Companies that tailor pack sizes, fragrances, and price points for diverse geographies can unlock sustained growth potential.

Market Segmentation Analysis:

By Product Type

The India Cleaning Products Market shows strong diversity across surface cleaners, toilet cleaners, floor cleaners, glass and metal cleaners, fabric cleaners, dishwashing products, and specialized variants. Surface and toilet cleaners maintain dominant demand due to rising hygiene priorities in households and commercial spaces. It benefits from the rapid adoption of multipurpose solutions that offer convenience and broader application. Dishwashing and floor cleaning categories gain momentum through product innovations and fragrance-enhanced formulations. Premium appliance-specific cleaners also expand their presence as modern homes use more sensitive surfaces and materials.

- For instance, some Odonil Gel Pockets and Zippers are advertised to last for up to 30 days, while the Odonil Blocks can last up to 45 days.

By Ingredient

Consumer preferences shape clear segmentation between organic and synthetic formulations. The India Cleaning Products Market experiences growing interest in organic cleaners supported by awareness of skin safety and environmental responsibility. It sees steady demand for synthetic products that deliver stronger efficacy and lower price points. Brands enhance their portfolios with plant-based and low-chemical solutions that meet eco-conscious expectations. Regulatory focus on safe ingredients encourages consistent upgrades across both categories.

- For instance, Happi Planet, a homecare startup, raised INR 8.47 Crore in funding (February 2024) to expand its microbial and naturally derived surfactant-based cleaners that reduce chemical load on users and environment.

By End-use

Household, commercial, industrial, and other institutional segments create distinct demand patterns across the market. The India Cleaning Products Market secures its largest share from households that prioritize daily hygiene routines and convenient cleaning formats. It gains significant traction in commercial spaces such as offices, hospitality establishments, and retail facilities that require stringent cleanliness standards. Industrial uses expand through the need for heavy-duty cleaners suited for machinery, production floors, and regulated environments. Tailored formulations and pack-size customization support broader adoption across all end-use categories.

Segmentations:

By Product Type

- Surface cleaners

- Toilet cleaners

- Glass & metal cleaners

- Floor cleaners

- Fabric cleaners

- Dishwashing products

- Others (personal care cleaners, building cleaners, etc.)

By Ingredient

By End-use

- Household

- Commercial

- Industrial

- Others

By Price Range

Regional Analysis:

Strong Demand Concentration in Metropolitan Hubs

Major metropolitan regions such as Delhi-NCR, Mumbai, Bengaluru, and Chennai lead demand with high adoption of branded and premium cleaning solutions. The India Cleaning Products Market benefits from higher disposable incomes, faster lifestyle shifts, and wider access to organized retail in these cities. It gains momentum through strong penetration of quick-commerce platforms, supermarket chains, and specialty home-care stores. Consumers in these regions prioritize convenience, efficiency, and specialized cleaners that support modern home environments. Demand for eco-friendly and low-chemical formulations also shows strong traction in metro markets.

Expanding Consumption Across Tier-2 and Tier-3 Cities

Tier-2 and tier-3 cities show rapid market development supported by rising awareness of hygiene and improved retail infrastructure. The India Cleaning Products Market strengthens its footprint in cities such as Jaipur, Lucknow, Coimbatore, and Indore through targeted distribution and localized marketing. It benefits from growing acceptance of branded cleaners over traditional substitutes, driven by improved affordability and product availability. E-commerce access widens choices for consumers in these regions and accelerates the shift toward specialized and value-added products. Retail expansion across these emerging cities supports continued market uptake.

Steady Growth in Rural Markets Supported by Distribution Expansion

Rural regions contribute steadily to overall growth as hygiene awareness increases and government-led sanitation programs influence consumer behavior. The India Cleaning Products Market expands through small pack sizes, value-focused offerings, and wider reach of FMCG distributors. It gains traction from heightened interest in surface and floor cleaners that replace basic cleaning agents. Local manufacturing hubs and regional brands support competitive pricing that meets rural affordability levels. Strengthened logistics networks and deeper retail penetration continue to improve access, which supports long-term demand in rural markets.

Key Player Analysis:

- Hindustan Unilever Limited (HUL)

- Procter & Gamble (India) Private Limited (P&G India)

- Godrej Consumer Products Limited (GCPL)

- Reckitt Benckiser India Limited

- Jyothy Laboratories Limited

- Nirma Limited

- ITC Limited

- Dabur India Limited

- C. Johnson Products (India) Private Limited

Competitive Analysis:

The India Cleaning Products Market features a highly competitive landscape dominated by global and domestic FMCG leaders. Key players such as Hindustan Unilever Limited (HUL), Procter & Gamble (India) Private Limited (P&G India), Godrej Consumer Products Limited (GCPL), Reckitt Benckiser India Limited, and Jyothy Laboratories Limited hold strong market positions through extensive portfolios and wide distribution networks. It reflects intense rivalry driven by pricing strategies, frequent product launches, and heavy investment in marketing campaigns. Companies focus on innovation in eco-friendly formulations, surface-specific cleaners, and fragrance-enhanced products to strengthen brand differentiation. Digital channels play a central role in expanding consumer reach, while regional penetration remains a critical factor for scalability. Competitive pressure intensifies further as regional brands and private labels gain visibility through low-cost offerings and targeted local presence.

Recent Developments:

- In January 2025, Hindustan Unilever Limited (HUL) announced the acquisition of a 90.5% stake in Uprising Science Pvt Ltd, the parent company of premium beauty brand Minimalist, in a transaction valued at ₹2,670 crore.

- In October 2025, Godrej Consumer Products Limited signed definitive agreements for acquisitions in the fast-growing men’s grooming segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Ingredient, End-use and Price Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The India Cleaning Products Market will expand steadily as consumers prioritize sustained hygiene practices across households and institutions.

- Demand for eco-friendly, low-chemical, and plant-based formulations will rise as safety and environmental expectations strengthen.

- Digital commerce, quick-commerce services, and subscription models will shape purchasing behavior and improve product accessibility.

- Regional penetration will deepen in tier-2, tier-3, and rural markets through focused distribution strategies and localized product offerings.

- Brands will invest more in appliance-specific, surface-tailored, and premium cleaning solutions that support modern home environments.

- Product innovation will accelerate in concentrated liquids, refill packs, and advanced dispensing formats to reduce waste and enhance convenience.

- Marketing strategies will rely heavily on digital engagement, influencer partnerships, and data-driven consumer segmentation.

- Retail expansion through supermarkets, hypermarkets, and neighborhood stores will strengthen visibility and support wider product adoption.

- Private labels and regional players will gain stronger presence through competitive pricing and rapid adaptability.

- Sustainability, packaging reduction, and transparent ingredient communication will emerge as key differentiators guiding long-term brand loyalty.