Market Overview:

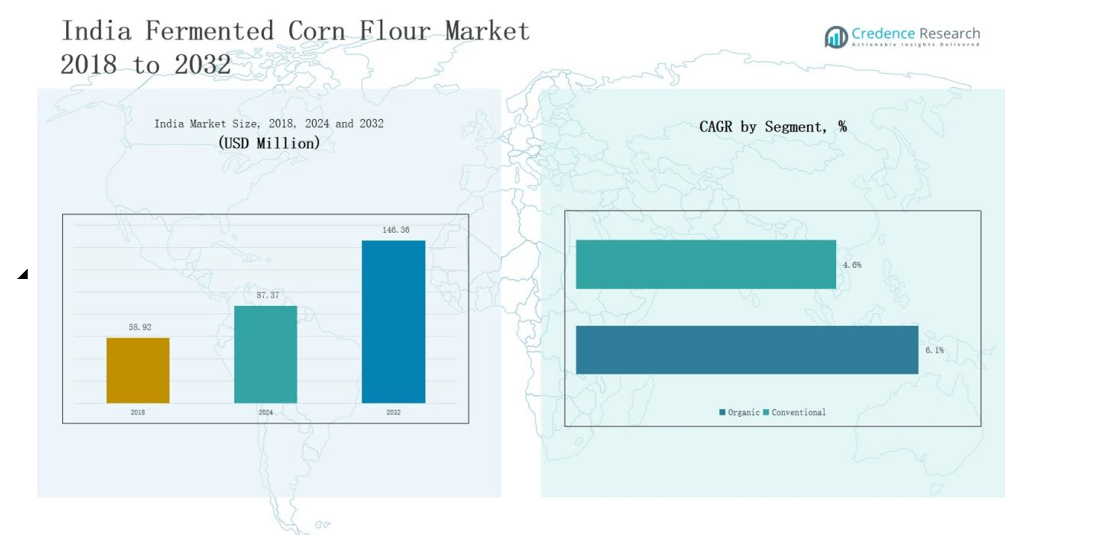

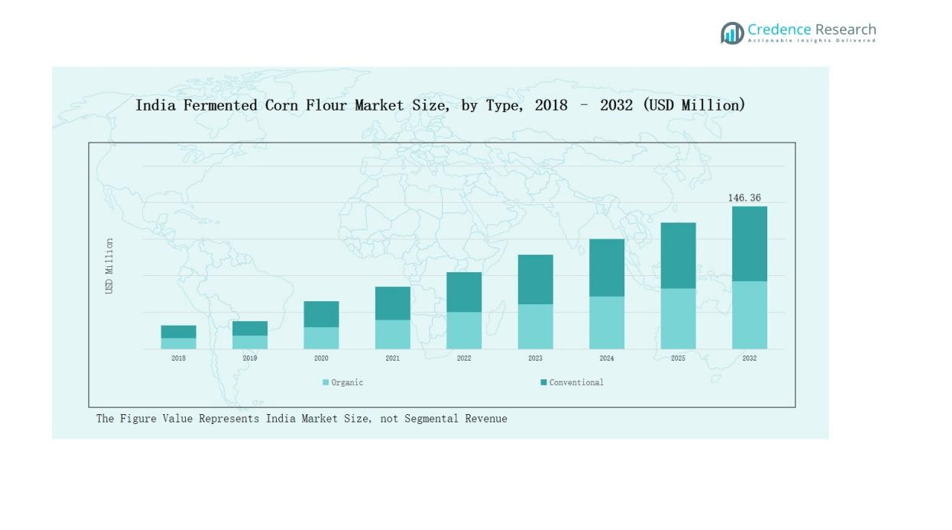

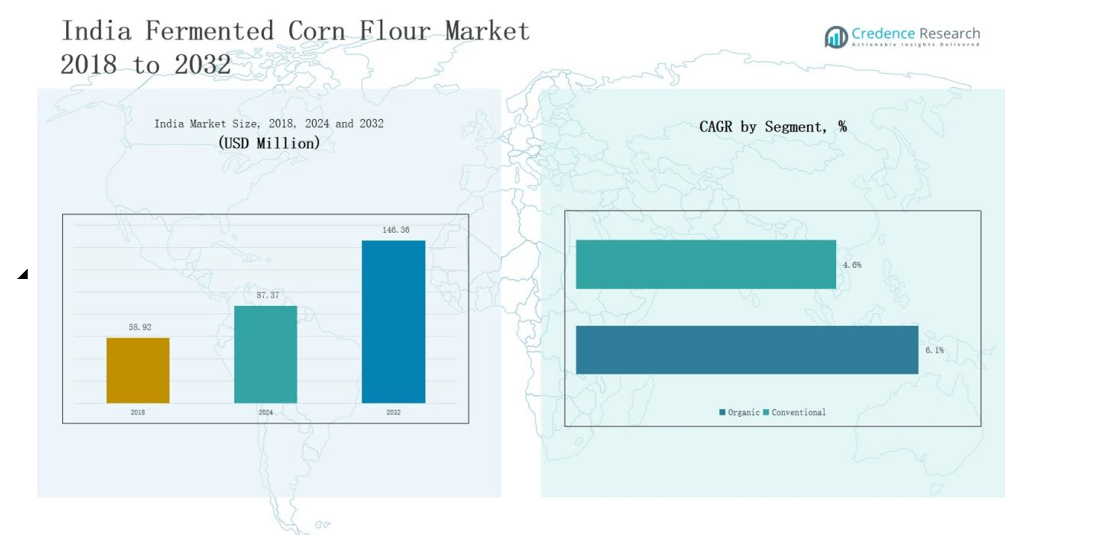

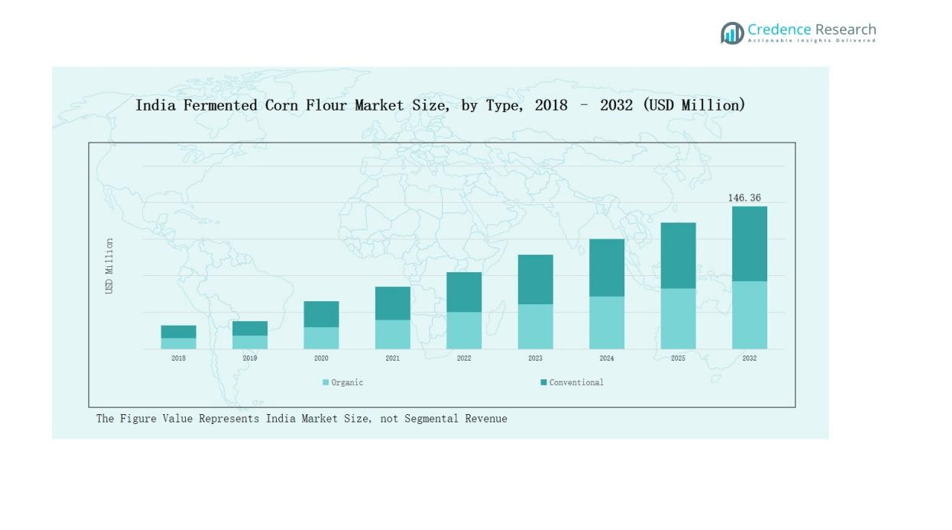

India Fermented Corn Flour Market size was valued at USD 58.92 million in 2018 to USD 87.37 million in 2024 and is anticipated to reach USD 146.36 million by 2032, at a CAGR of 6.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Fermented Corn Flour Market Size 2024 |

USD 87.37 million |

| India Fermented Corn Flour Market, CAGR |

6.20% |

| India Fermented Corn Flour Market Size 2032 |

USD 146.36 million |

The India Fermented Corn Flour Market is shaped by key players such as Prathista Industries, Mittal Cornezza, Shreeji Ingredients (Shreejicorn), Regaal Resources Ltd, Nexus Maize, CMS Industries, and Vedant Agro Foods. These companies compete by expanding product portfolios, focusing on organic variants, and strengthening distribution networks across urban and semi-urban markets. Regional players support market penetration by offering affordable conventional products to price-sensitive consumers. North India emerged as the leading region, holding 34% share in 2024, driven by strong demand from bakery, condiments, and processed food industries.

Market Insights

- The India Fermented Corn Flour Market grew from USD 58.92 million in 2018 to USD 87.37 million in 2024 and is projected to reach USD 146.36 million by 2032, at a CAGR of 6.20%.

- Organic fermented corn flour led with 58% share in 2024, supported by rising health awareness and demand for chemical-free food products, while conventional held 42% driven by affordability.

- Baked goods dominated with 46% share in 2024, followed by condiments and sauces at 24%, beverages at 18%, and others at 12% through snacks and specialty foods.

- North India commanded 34% share in 2024, driven by strong demand from bakery, condiments, and processed foods, while South India followed with 28% due to rising beverage and bakery adoption.

- West India accounted for 22% share with growth from bakery chains and foodservice outlets, whereas East India remained the smallest market at 16%, supported by traditional food and beverage demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Organic fermented corn flour led the market with a 58% share in 2024, driven by rising health awareness and demand for chemical-free food products. Consumers in urban centers are increasingly choosing organic options, supported by government initiatives promoting sustainable farming. Conventional fermented corn flour held the remaining 42% share, favored by small and medium-scale food manufacturers due to its affordability and steady supply, though its growth is slower compared to organic.

- For instance, Cargill launched its PURIS™ line of organic, plant-based ingredients, including corn-derived proteins, to meet rising clean-label demand in North America

By Application

Baked goods dominated with a 46% share in 2024, supported by rising bakery consumption and demand for better texture and nutrition. Condiments and sauces followed with 24%, driven by processed food growth and packaged product popularity. Beverages captured 18%, benefiting from innovations in health drinks and traditional fermented products. The “Others” category accounted for 12%, covering snacks and specialty foods, where plant-based innovation creates new opportunities.

- For instance, Heinz also relaunched its “Zero Added Sugar” ketchup in the U.K., aligning with consumer demand for better-for-you condiments.

Market Overview

Rising Health and Wellness Awareness

India’s growing health-conscious population is driving demand for organic and functional food ingredients, including fermented corn flour. Consumers are increasingly seeking natural, chemical-free products with digestive and nutritional benefits. The flour’s probiotic qualities and ability to enhance gut health make it attractive in daily diets. Expanding urban middle-class households with higher disposable incomes are willing to pay premium prices for healthier options. This rising preference for wellness-focused foods positions fermented corn flour as a key substitute in bakery, beverage, and condiment industries.

- For instance, ITC’s “Aashirvaad Nature’s Superfoods” line introduced high-fiber flours enriched with natural grains, catering to urban buyers willing to adopt healthier staples.

Expanding Bakery and Processed Food Sector

The Indian bakery and processed food sector is rapidly expanding, supported by urbanization and lifestyle shifts. Fermented corn flour is widely used in bread, biscuits, cakes, sauces, and packaged foods for its ability to improve flavor, texture, and shelf life. Quick-service restaurants and retail bakeries are fueling adoption by incorporating it in product innovation. The increasing popularity of western-style bakery items, alongside traditional baked goods, further strengthens demand. This robust growth in processed foods directly enhances the consumption of fermented corn flour.

Supportive Government Policies and Organic Farming Initiatives

Government policies promoting organic farming and sustainable agriculture practices are boosting the availability of organic corn. Subsidies, certification support, and farmer training programs are improving supply consistency for manufacturers. These initiatives align with India’s broader food safety and sustainability goals, creating favorable conditions for organic fermented corn flour adoption. Export-oriented policies are also opening new opportunities for Indian producers in international markets. This institutional support provides long-term stability and encourages investments across the fermented corn flour value chain.

- For instance, Sikkim, recognized as India’s first fully organic state in 2016, now exports certified organic produce to markets in Europe and the U.S., showcasing the viability of policy-driven organic transitions.

Key Trends & Opportunities

Growing Demand for Plant-Based and Functional Foods

The plant-based food movement in India is gaining momentum, creating opportunities for fermented corn flour as a core ingredient. Its ability to provide plant proteins, probiotics, and gluten-free alternatives positions it well in health-focused categories. Start-ups and established brands are using it to create snacks, beverages, and specialty foods. Consumers looking for innovative yet nutritious products are driving experiments with plant-based formulations, making fermented corn flour adoption a trend with strong long-term potential.

- For instance, Plantaway introduced India’s first 100% plant protein Chick’n Fillet made entirely from pea protein, offering 19g protein per pack with realistic taste and texture, showcasing how plant proteins are used for meat alternatives with nutritional focus.

Expansion of Online Food and Grocery Retail

commerce platforms and online grocery channels are playing a key role in market growth. Digital platforms enable wider product availability, especially for niche items like fermented corn flour, which may not be easily found offline. Growing consumer preference for doorstep delivery, subscription models, and brand-owned online stores is expanding reach. This trend benefits both large producers and regional players, providing a direct route to health-conscious urban customers. The rising penetration of digital retail significantly boosts visibility and accessibility of fermented corn flour.

- For instance, Instacart helps over 5,500 brand partners reach new customers, with programs that boost sales by more than 15% on average, supporting growth for both large and small specialty food producers through online listings and targeted advertising.

Key Challenges

Price Sensitivity and High Cost of Organic Products

Despite growing demand, the high price of organic fermented corn flour remains a barrier in India’s price-sensitive market. Many consumers continue to prioritize affordability over health benefits, limiting penetration in lower-income groups. Small food manufacturers also hesitate to adopt organic variants due to cost constraints. Balancing premium pricing with broader affordability is a critical challenge for market players. Unless addressed, high costs could restrict organic flour adoption to urban elites and slow down mass-market expansion.

Limited Consumer Awareness Beyond Major Cities

Awareness of fermented corn flour and its nutritional benefits is still largely concentrated in metropolitan and Tier-1 cities. Rural and semi-urban consumers often lack exposure to such products, restricting market reach. Limited marketing efforts and absence of strong retail penetration in these regions further slow adoption. Without targeted campaigns and distribution expansion, growth will remain uneven across geographies. Bridging this knowledge and availability gap is essential to capture the wider Indian consumer base.

Supply Chain and Quality Consistency Issues

Ensuring consistent supply and quality of fermented corn flour poses a challenge for manufacturers. Seasonal variations in corn availability and dependence on small-scale farmers often create fluctuations. Maintaining standard fermentation processes and quality across batches can also be difficult, affecting trust among food manufacturers. Logistics and storage infrastructure gaps, particularly in smaller towns, further add to the problem. Strengthening supply chains and investing in quality assurance will be vital to build confidence and expand long-term market adoption.

Regional Analysis

North India

North India accounted for 34% share in 2024, making it the leading region in the India Fermented Corn Flour Market. Strong demand from bakery and packaged food industries in states such as Punjab, Haryana, and Delhi supported this dominance. Rising health awareness and preference for organic food choices further strengthened market growth. Food processing hubs and easy access to raw corn supply also encouraged manufacturers to expand operations. Demand for condiments, sauces, and traditional snacks remained high, sustaining steady sales. With urbanization and organized retail growth, North India continues to lead consumption and production.

South India

South India captured 28% share in 2024, driven by high consumption of fermented beverages and baked goods. Cities like Bengaluru, Hyderabad, and Chennai showed strong adoption due to a larger base of health-conscious consumers. The region benefits from the rising presence of specialty food stores and modern retail formats. Strong agricultural production and investment in food processing industries further support market expansion. Demand for both conventional and organic variants is increasing, with beverages and condiments showing strong momentum. South India remains an attractive market for manufacturers targeting innovation and premium product lines.

West India

West India held 22% share in 2024, supported by strong industrial presence in Maharashtra and Gujarat. Growing bakery chains and foodservice outlets increased the use of fermented corn flour in baked goods and sauces. Rising consumer awareness of functional foods in urban areas like Mumbai and Pune created opportunities for organic products. Food manufacturing clusters in Gujarat helped strengthen supply and distribution. The region continues to balance demand between mass-market conventional products and premium organic categories. With rising disposable incomes, West India is witnessing a gradual shift toward healthier alternatives.

East India

East India accounted for 16% share in 2024, making it the smallest regional market. Limited awareness and weaker retail penetration constrained faster adoption. However, states like West Bengal and Odisha are showing growing demand through traditional food and beverage segments. The region benefits from an emerging urban middle class, though price sensitivity remains high. Small-scale food manufacturers are key contributors, using conventional flour in local products. Expansion of online food retail is helping raise product visibility, creating long-term growth potential despite current constraints.

Market Segmentations:

By Type

By Application

- Baked Goods

- Condiments and Sauces

- Beverage

- Others

By Region

- North India

- South India

- West India

- East India

Competitive Landscape

The India Fermented Corn Flour Market is moderately fragmented, with a mix of established companies and regional players competing for market share. Key participants such as Prathista Industries, Mittal Cornezza, Shreeji Ingredients, Regaal Resources Ltd, Nexus Maize, CMS Industries, and Vedant Agro Foods lead the market with diversified product portfolios and strong distribution networks. These companies emphasize innovation, focusing on organic variants and customized formulations to meet rising demand from bakery, beverage, and condiment manufacturers. Regional firms cater to cost-sensitive customers by offering conventional flour at competitive prices, ensuring broad accessibility across rural and semi-urban markets. Strategic partnerships with food processing units, investment in quality certifications, and expansion into e-commerce channels are strengthening market presence. The competitive environment is shaped by continuous product development, supply chain improvements, and efforts to balance affordability with premium quality, positioning leading players to capture both mass-market and health-conscious consumer segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In May 2023, Prathista Industries launched a new line of organic fermented corn flour, aimed at health-conscious consumers in India.

- In March 2025, Cargill and Saatvik Agro Processors jointly inaugurated a corn milling plant in Gwalior, Madhya Pradesh, India.

- In August 2025, Regaal Resources announced a ₹430 crore expansion at its Bihar plant to double maize-based specialty product output, including corn flour and gluten, while also adding herbal gulal production.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for organic fermented corn flour will rise with increasing health awareness.

- Expansion of bakery and processed food industries will drive consistent market growth.

- Beverages and condiments will emerge as strong application areas in urban markets.

- Online retail and e-commerce channels will enhance accessibility and visibility.

- Regional players will strengthen market presence with cost-effective conventional products.

- Investments in supply chain and quality certifications will improve product reliability.

- Export opportunities will expand with growing interest in organic and plant-based foods.

- Awareness campaigns will support adoption in semi-urban and rural regions.

- Strategic collaborations with food manufacturers will encourage innovation in product use.

- Rising disposable incomes will increase demand for premium and value-added variants.