| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indonesia Book Paper Market Size 2024 |

USD 60.25 Million |

| Indonesia Book Paper Market, CAGR |

3.82% |

| Indonesia Book Paper Market Size 2032 |

USD 81.31 Million |

Market Overview:

The Indonesia Book Paper Market is projected to grow from USD 60.25 million in 2024 to an estimated USD 81.31 million by 2032, with a compound annual growth rate (CAGR) of 3.82% from 2024 to 2032.

Several factors are propelling the growth of Indonesia’s book paper market. The country’s rising literacy rates and growing middle-class population have led to increased consumption of books, particularly in the educational and professional segments. Government initiatives aimed at improving access to education such as the nationwide school rehabilitation program and digital curriculum upgrades have significantly boosted demand for printed learning materials. Additionally, the expansion of the local publishing industry with content tailored to regional cultures and languages has created new opportunities for book paper suppliers. Technological advancements in offset and digital printing have improved production efficiency and reduced costs. The surge in children’s books and exam preparation guides has also contributed to sustained demand for high-quality book paper across both public and private school systems.

Indonesia’s book paper market demonstrates notable regional variations shaped by population density, economic development, and educational infrastructure. Urban centers like Jakarta, Surabaya, Medan, and Bandung remain key demand zones due to their concentration of schools, universities, and active publishing houses. These cities support high-volume consumption through large-scale textbook printing and retail book markets. In contrast, rural and remote provinces—such as those in Eastern Indonesia—face challenges related to infrastructure and logistics, limiting immediate access to printed books. However, ongoing government investments in education equity, including the “Smart Indonesia Program” and expanded school outreach in Papua and Maluku, are gradually bridging this gap. Regional printing collaborations and mobile libraries are further enhancing book accessibility and encouraging market participation across underserved areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Indonesia Book Paper Market is projected to grow from USD 60.25 million in 2024 to an estimated USD 81.31 million by 2032, with a compound annual growth rate (CAGR) of 3.82% from 2024 to 2032. driven by rising demand for educational and professional books across both public and private institutions.

- The Global Book Paper Market is projected to grow from USD 10,203.76 million in 2024 to USD 14,364.15 million by 2032, with a CAGR of 4.37%, driven by increasing demand for printed educational materials and books worldwide.

- National programs such as “Merdeka Belajar” and the BOS scheme are significantly boosting textbook distribution, thereby supporting consistent demand for book paper.

- Urban centers like Jakarta, Surabaya, Medan, and Bandung account for the highest consumption, supported by strong publishing infrastructure and high literacy levels.

- Local publishers are increasingly producing culturally and regionally relevant content, driving demand for diverse grades and sizes of book paper.

- Advancements in digital and offset printing are enhancing production efficiency and enabling cost-effective short-run printing for self-published and regional content.

- Market growth faces challenges such as volatile raw material prices, underdeveloped rural logistics, and rising preference for digital content in higher education.

- Government investments in infrastructure and education outreach programs are improving book access in remote areas, creating new opportunities for regional expansion.

Market Drivers:

Expanding Education Sector and Government Initiatives

One of the primary drivers of the Indonesia book paper market is the continued expansion of the country’s education sector. With a population exceeding 270 million and a growing youth demographic, the demand for educational resources remains high. Government initiatives for example, the “Merdeka Belajar” (Freedom to Learn) policy and the School Operational Assistance (BOS) program have significantly increased the distribution of textbooks and learning materials across both urban and rural regions. These initiatives underscore the government’s commitment to improving literacy and education access nationwide, thereby driving consistent demand for book paper used in textbooks, workbooks, and teacher manuals.

Rising Literacy Rates and Middle-Class Growth

Indonesia has witnessed a steady improvement in literacy rates over the past decade, which has coincided with the emergence of a more educated and economically empowered middle class. This demographic shift has translated into a growing appetite for printed books, spanning academic texts, religious publications, novels, and self-help literature. The middle-class population increasingly values education, career development, and leisure reading, fueling demand for high-quality printed materials. As a result, the consumption of book paper has risen, particularly in urban areas where bookstores, educational institutions, and publishers are densely concentrated.

Digital Publishing Synergy and Printing Technology Advancements

While digital content is gaining ground globally, Indonesia’s publishing landscape continues to rely significantly on physical books. This is particularly true in the education sector, where tangible learning materials remain preferred by both educators and students. At the same time, advancements in printing technology—especially digital and offset printing—have enabled publishers to produce books more efficiently and cost-effectively. These technologies support on-demand printing and reduce wastage, helping to manage fluctuating demand while maintaining quality. The synergy between digital publishing workflows and improved printing methods has further strengthened the outlook for book paper consumption in Indonesia.

Local Publishing Industry Expansion and Cultural Content Development

Indonesia’s publishing industry has become more dynamic in recent years, with a noticeable emphasis on local content development. Independent publishers and educational content creators are increasingly producing books that reflect Indonesia’s diverse cultural heritage, regional languages, and social narratives. For example, PT Kepustakaan Populer Gramedia (KPG) has expanded its catalog to include storybooks and educational materials tailored to various provinces and ethnic groups. This trend supports the localization of educational materials and storybooks, particularly in provinces with unique linguistic and cultural identities. As publishers tailor content to regional needs, the demand for varied grades and formats of book paper is increasing. Government support for domestic publishing and national book fairs is also fostering the growth of small and medium-sized enterprises in the sector, further reinforcing the need for a stable and scalable book paper supply chain.

Market Trends:

Shift Toward Sustainable Paper Sourcing

A prominent trend shaping the Indonesia book paper market is the growing emphasis on sustainable and eco-friendly paper sourcing. For instance, Environmental awareness among consumers, educators, and policymakers has intensified, encouraging the adoption of Forest Stewardship Council (FSC)-certified and recycled paper products. As global scrutiny increases over deforestation and carbon emissions, Indonesian paper manufacturers are investing in sustainable forestry practices and renewable energy usage. Publishers, particularly those involved in educational and children’s books, are increasingly selecting suppliers that comply with international environmental standards. This trend is reinforcing transparency and accountability in the local book paper supply chain.

Resilience of Printed Books Amid Digital Growth

Despite the expansion of digital learning tools and e-books, the demand for printed books remains resilient in Indonesia. For instance, a 2023 survey conducted by Indonesia’s Ministry of Education and Culture found that a majority of students and teachers continue to prefer printed textbooks due to their benefits in clarity, retention, and ease of use. This preference is further amplified in regions with limited digital infrastructure, where physical books are essential for uninterrupted learning. The tactile experience, permanence, and cultural value associated with printed books continue to influence buyer behavior, supporting a steady demand for book paper, particularly in K–12 and vocational education segments.

Growth in Self-Publishing and Independent Printing

Indonesia is experiencing a notable rise in self-publishing and small-scale independent printing, driven by the accessibility of print-on-demand platforms and online distribution networks. Aspiring authors, educators, and content creators are leveraging digital tools to publish localized stories, academic resources, and niche-interest books without relying on traditional publishing houses. This shift has increased the demand for short-run, customizable printing solutions, requiring versatile and cost-efficient grades of book paper. The flexibility offered by modern printing presses allows quick turnaround times and smaller print volumes, encouraging experimentation and innovation in book production formats.

Increased Participation in International Book Trade

Indonesia’s involvement in international book fairs and publishing collaborations has also impacted the domestic book paper market. The country’s designation as a guest of honor at major events like the Frankfurt Book Fair in recent years has elevated the visibility of Indonesian literature on the global stage. This has led to a surge in translation projects and overseas demand for Indonesian publications, driving growth in both export-oriented printing and local print runs. The rise in demand for bilingual books, export-ready formats, and premium-quality paper has compelled Indonesian printers and paper manufacturers to enhance product offerings to meet international publishing standards.

Market Challenges Analysis:

Volatility in Raw Material Prices

One of the significant restraints facing the Indonesia book paper market is the volatility in the prices of raw materials, particularly wood pulp. Indonesia relies heavily on both domestic forestry resources and imported pulp to meet its paper production needs. Fluctuations in global pulp prices, driven by supply chain disruptions, international trade dynamics, and environmental regulations, directly impact production costs. For instance, according to Asia Pulp & Paper (APP)’s sustainability report, the company faced increased costs not only due to international pulp price hikes but also because of higher freight and logistics expenses linked to pandemic-era supply chain disruptions. This instability creates pricing uncertainty for publishers and printing companies, making it difficult to forecast expenses and maintain profitability in large-scale book printing projects.

Infrastructure and Distribution Limitations in Rural Areas

Although Indonesia’s major urban centers benefit from well-developed logistics and publishing infrastructure, rural and remote regions continue to face significant challenges in the distribution of printed books. Poor road connectivity, limited warehousing, and inadequate retail networks hinder timely access to educational materials. These logistical barriers restrict the reach of the book paper market in underdeveloped areas, despite strong government efforts to expand educational access. The high cost of transportation and limited printing capacity in remote locations further constrain demand for book paper across the archipelago.

Digital Substitution and Changing Consumer Preferences

While the preference for printed books remains strong in Indonesia, the gradual shift toward digital education tools and e-learning platforms poses a long-term challenge. Educational institutions, particularly in higher education and urban private schools, are increasingly adopting digital formats to reduce printing costs and offer interactive content. This transition, supported by government initiatives promoting digital literacy, may gradually reduce reliance on printed textbooks and learning materials. Adapting to this digital shift without compromising the relevance of physical books will be critical for the sustainability of the book paper market.

Environmental Compliance and Regulatory Pressures

Stricter environmental regulations regarding deforestation, waste management, and emissions control are placing additional compliance burdens on paper manufacturers. While necessary for sustainable growth, these regulations often require substantial capital investments in greener production technologies, which can strain smaller producers. Balancing compliance with profitability remains a key challenge for the sector.

Market Opportunities:

The Indonesia book paper market presents substantial opportunities driven by the country’s expanding educational sector and increasing literacy rates. With a population exceeding 270 million and a significant proportion being young learners, there is a consistent demand for educational materials, including textbooks and workbooks. Government initiatives aimed at improving education access further bolster this demand, creating a favorable environment for growth in the book paper industry. The national budget allocation for education continues to rise annually, supporting large-scale textbook procurement and distribution. Furthermore, the government’s push for regional curriculum development has created increased demand for locally printed educational content, opening up new opportunities for paper suppliers and publishers.

Additionally, the rise of self-publishing and independent authorship in Indonesia contributes to the market’s expansion. The availability of digital platforms and print-on-demand services empowers local writers to publish their works, increasing the consumption of book paper. Moreover, Indonesia’s rich cultural diversity and multilingual population create a unique demand for books in various languages and dialects, further stimulating the need for diverse book paper products. This trend is particularly evident in children’s literature and folklore-based publications, which are gaining popularity across provinces. Coupled with growing participation in domestic and international book fairs, these dynamics are amplifying visibility and demand for Indonesian-authored content, reinforcing the long-term potential of the book paper market.

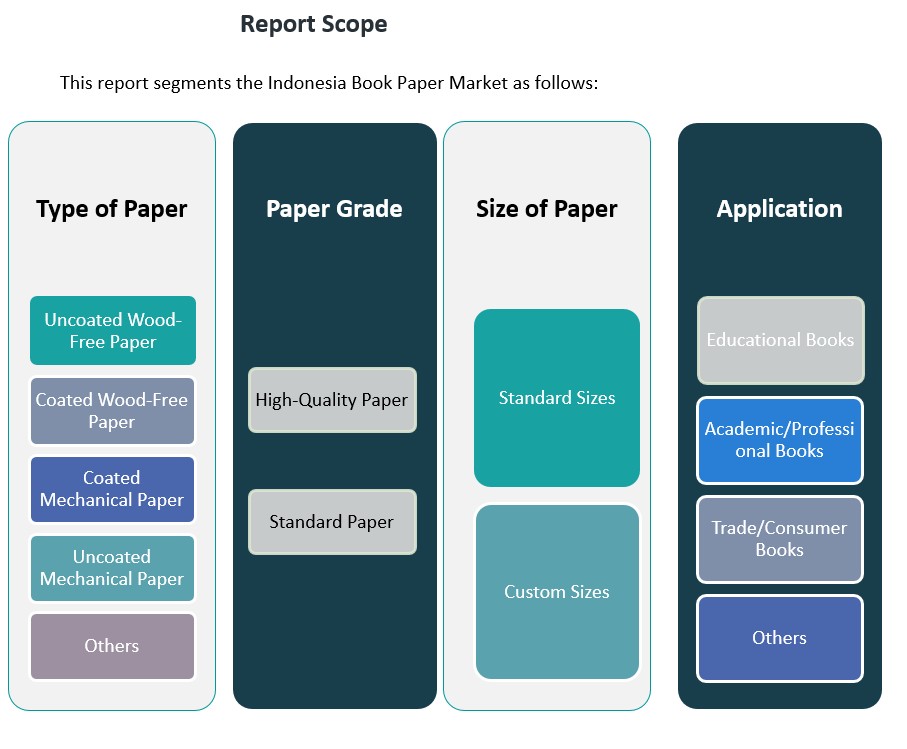

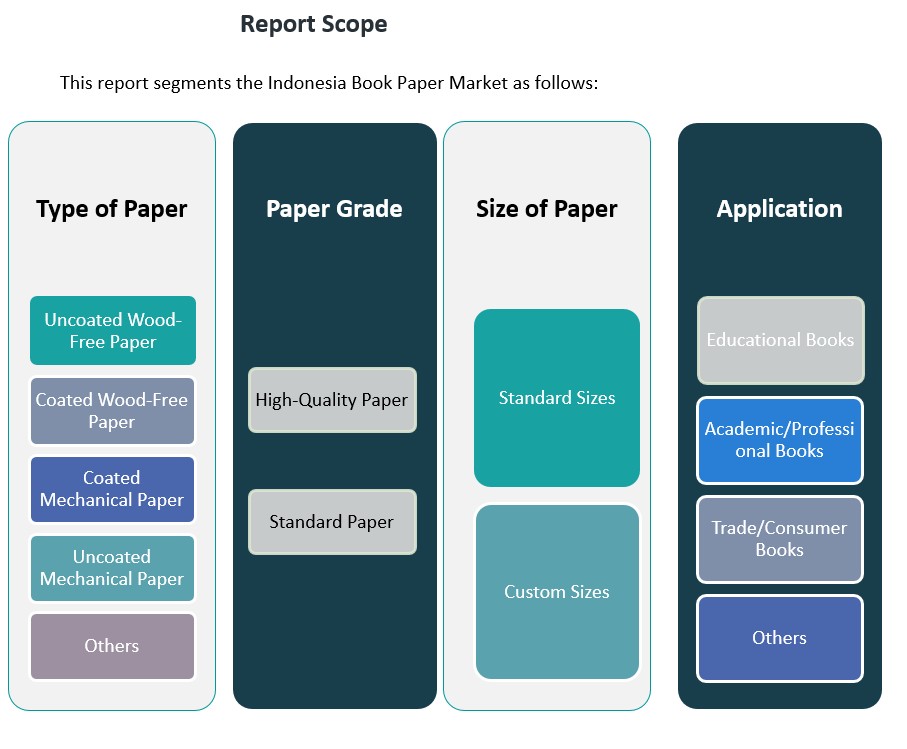

Market Segmentation Analysis:

The Indonesia book paper market is segmented by type, paper grade, paper size, and application, each contributing distinctly to the overall demand.

By types of paper, uncoated wood-free paper holds a dominant share, driven by its wide use in educational and professional publishing due to its readability and print clarity. Coated wood-free and mechanical papers are gaining traction in segments that demand higher visual appeal, such as consumer and illustrated books. Uncoated mechanical paper is commonly used for mass-market paperbacks and budget-friendly publications, while the “Others” category includes specialty grades used in niche publications and artistic formats.

By paper grade, standard paper remains the most widely used due to its cost-effectiveness and suitability for large-volume textbook and workbook printing. However, high-quality paper is gaining relevance in academic and professional publications, trade books, and premium educational materials, where durability and print resolution are essential.

By size, with standard sizes (such as A4 and B5) dominating due to printing and binding efficiencies. Custom sizes are increasingly used by independent publishers and self-publishing platforms that cater to niche and artistic content needs.

By application, educational books account for the largest share of consumption, supported by Indonesia’s national curriculum and government-backed textbook programs. Academic and professional books follow closely, fueled by growing higher education enrollment and certification training. Trade and consumer books—including fiction, non-fiction, and children’s literature—reflect rising middle-class literacy and leisure reading trends, while the “Others” category includes religious texts, reference materials, and limited-edition works.

Segmentation:

By Type of Paper:

- Uncoated Wood-Free Paper

- Coated Wood-Free Paper

- Coated Mechanical Paper

- Uncoated Mechanical Paper

- Others

By Paper Grade:

- High-Quality Paper

- Standard Paper

By Size of Paper:

- Standard Sizes

- Custom Sizes

By Application:

- Educational Books.

- Academic/Professional Books

- Trade/Consumer Books

- Others

Regional Analysis:

The Indonesia book paper market exhibits significant regional disparities, influenced by factors such as population density, economic development, educational infrastructure, and publishing activities. Java, the most populous and economically advanced island, dominates the market, accounting for approximately 60% of the national demand. This dominance is attributed to the concentration of educational institutions, publishing houses, and printing facilities in cities like Jakarta, Surabaya, and Bandung. The high literacy rates and robust educational infrastructure in Java further bolster the demand for book paper.

Sumatra follows, contributing around 20% to the market share. The island’s growing urban centers, such as Medan and Palembang, have seen increased investments in education and publishing, driving the demand for book paper. Sumatra’s strategic location and improving logistics also facilitate the distribution of printed materials to neighboring regions.

Kalimantan and Sulawesi collectively account for approximately 15% of the market. While these regions have smaller populations compared to Java and Sumatra, ongoing government initiatives aimed at enhancing educational access and infrastructure are expected to stimulate growth in the book paper market. The development of new educational institutions and the expansion of existing ones in these areas contribute to the rising demand.

The remaining 5% of the market is distributed among the eastern provinces, including Bali, Nusa Tenggara, Maluku, and Papua. These regions face challenges such as limited infrastructure and lower literacy rates, which hinder the growth of the book paper market. However, targeted government programs aimed at improving education and literacy are gradually creating opportunities for market expansion in these areas.

Key Player Analysis:

- Asia Pulp & Paper

- PT Indah Kiat Pulp & Paper Tbk

- PT Kertas Nusantara

- PT Pindo Deli Pulp & Paper

- Korindo Group

Competitive Analysis:

The Indonesia book paper market is moderately consolidated, with a mix of domestic producers and international players competing across various segments. Leading companies such as PT Indah Kiat Pulp & Paper Tbk (APP Group) and PT Pindo Deli Pulp and Paper Mills dominate the market due to their extensive production capacity, integrated supply chains, and strong distribution networks. These firms supply a significant portion of book-grade paper for educational and commercial printing. Smaller local manufacturers and specialized paper converters also contribute to the competitive landscape by catering to niche and regional demands. Competition is driven by factors such as pricing, product quality, environmental certifications, and delivery reliability. As demand grows for sustainable and high-performance paper, companies are increasingly investing in eco-friendly technologies and innovation. Strategic partnerships with publishers and government printing agencies are further enhancing market position, making differentiation essential for long-term success.

Recent Developments:

- In January 2024, PT Riau Andalan Paperboard International, a subsidiary of Asia Pacific Resources International Limited (APRIL Group), commenced commissioning its new USD 2.3 billion paperboard manufacturing plant in Indonesia. This significant move brings the facility closer to full-scale commercial production, anticipated later in 2024. The launch of this new plant underscores APRIL Group’s strategy to diversify into high-value-added paper products and drive sustainable business growth, leveraging its position as a fully integrated producer of fiber-based consumer goods.

- In April 2024, PT Pabrik Kertas Indonesia (PT Pakerin), a major player in the Indonesian paper market, awarded an order to international technology group ANDRITZ to modernize two existing OCC (old corrugated containers) lines at its Surabaya mill. This modernization aims to enhance pulp quality and enable PT Pakerin to produce more competitive packaging products, reflecting ongoing investment in technology upgrades within the Indonesian paper sector.

- In March 2024, Asia Pulp & Paper (APP) Group entered into a strategic partnership with Garuda Indonesia, the national airline, to support Indonesia’s low-carbon development goals. Through this collaboration, Garuda Indonesia will incorporate eco-friendly packaging products-such as cutlery and food and beverage packaging-made from paper materials supplied by APP’s Enza and Foopak brands. This initiative is designed to reduce plastic waste and promote sustainable practices in the aviation sector

Market Concentration & Characteristics:

The Indonesia book paper market is moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of 2,595 in 2023, reflecting a shift from a more fragmented structure in 2017 when the HHI stood at 1,350. This indicates a trend toward consolidation, where leading firms are capturing larger market shares, potentially influencing pricing and competitive dynamics. The market is characterized by a blend of large-scale integrated paper manufacturers and numerous small to medium-sized enterprises (SMEs). Major players benefit from economies of scale, extensive distribution networks, and established relationships with publishers and educational institutions. Conversely, SMEs often specialize in niche segments, offering customized solutions and catering to regional demands. The coexistence of these entities fosters a competitive environment that encourages innovation and responsiveness to market needs. Furthermore, the market exhibits a strong linkage with the educational sector, where government policies and curriculum changes significantly impact demand patterns. The emphasis on improving literacy rates and educational outcomes continues to drive the consumption of book paper, particularly in the production of textbooks and academic materials. This interdependence underscores the market’s sensitivity to policy shifts and educational reforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type of paper, paper grade, size of paper, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Indonesia book paper market is projected to witness steady growth over the forecast period.

- Expansion of national education initiatives will support increased demand for printed learning materials.

- Growing participation in higher education will elevate the need for academic and professional publications.

- The rise of self-publishing and independent authorship will encourage demand for customizable book paper formats.

- Regional content development in local languages will stimulate printing activity across diverse provinces.

- Sustainability trends will accelerate the shift toward environmentally certified and recycled paper.

- Ongoing infrastructure development in remote areas will enhance accessibility and distribution efficiency.

- Innovations in printing technologies will improve cost-effectiveness and production flexibility.

- Strengthened collaboration between publishers and local manufacturers will improve market responsiveness.

- Increased exposure to international publishing standards will drive improvements in quality and competitiveness.