Market Overview:

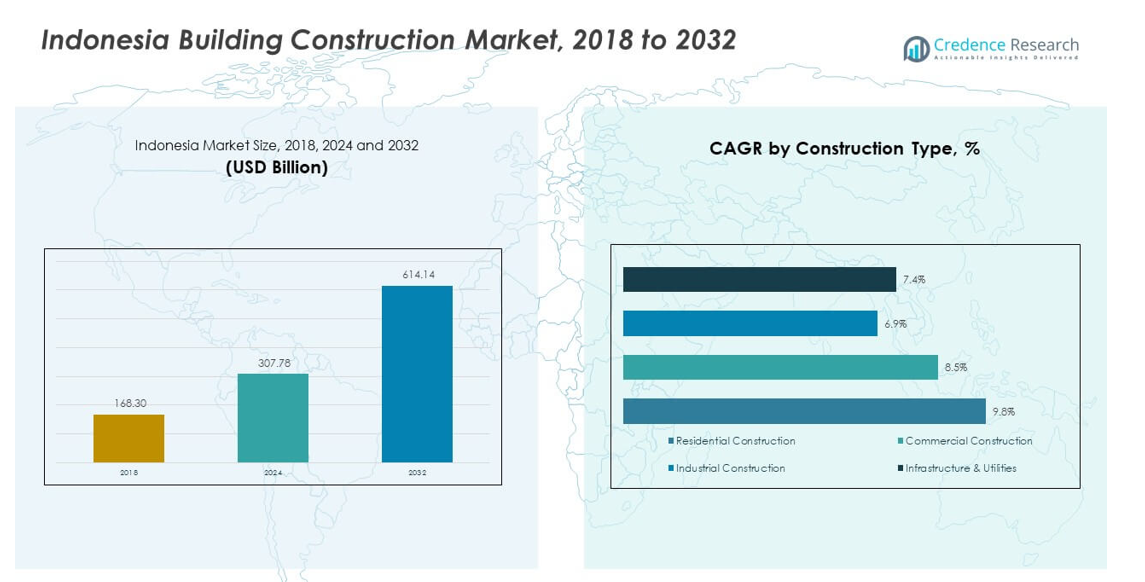

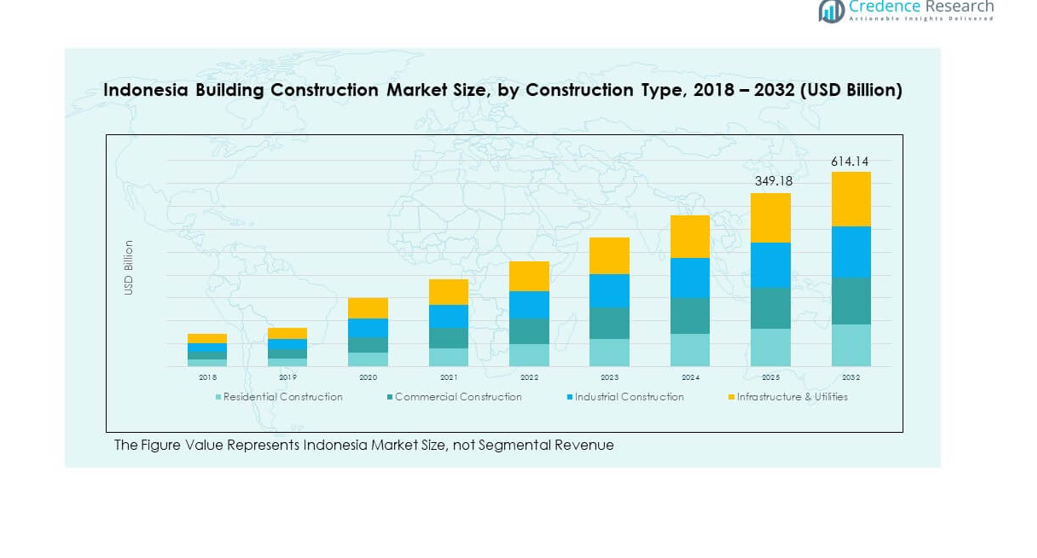

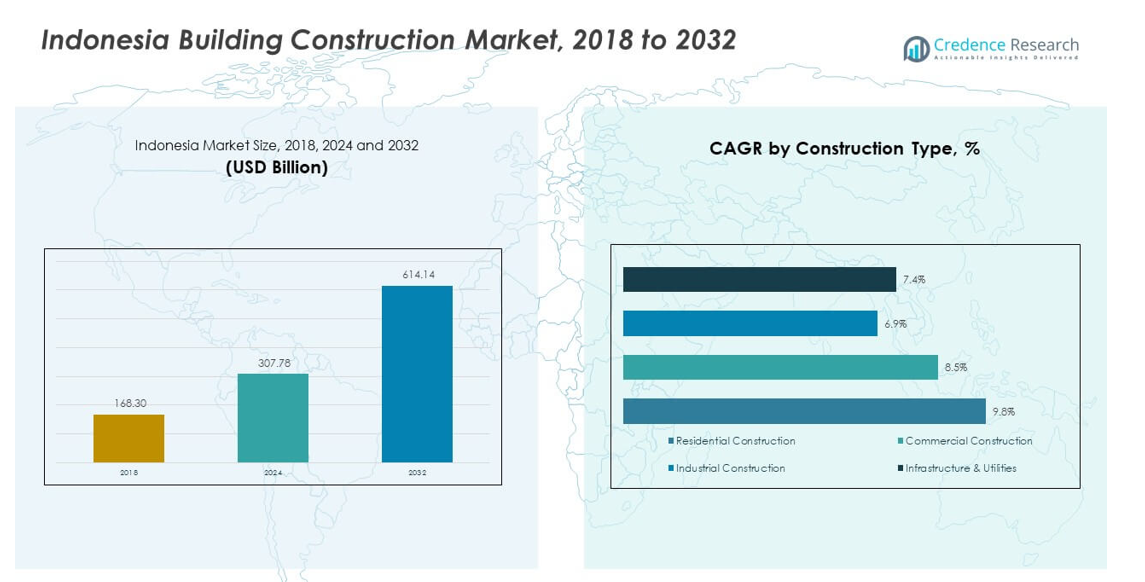

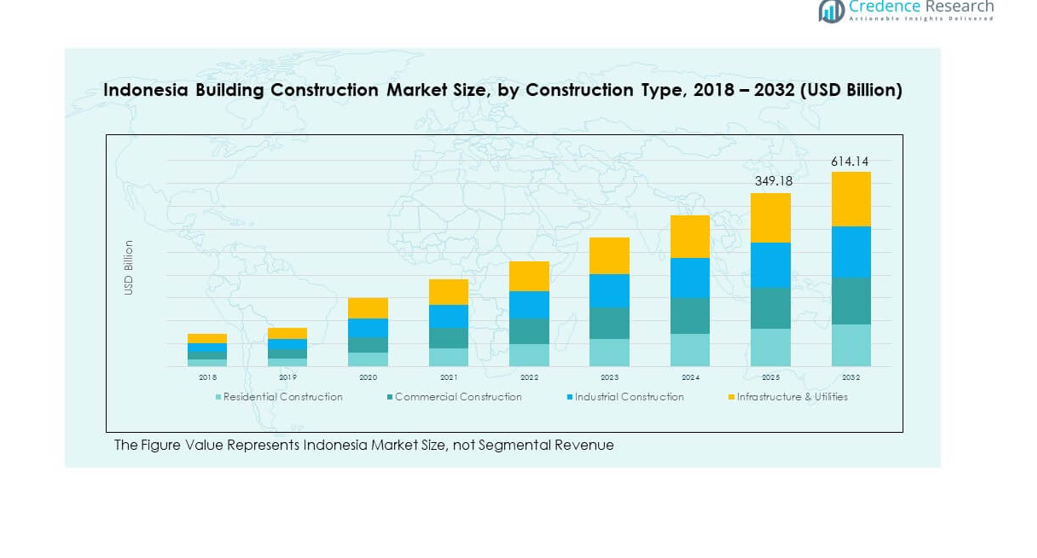

The Indonesia Building Construction Market size was valued at USD 168.30 billion in 2018 to USD 307.78 billion in 2024 and is anticipated to reach USD 614.14 billion by 2032, at a CAGR of 8.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indonesia Building Construction Market Size 2024 |

USD 307.78 billion |

| Indonesia Building Construction Market, CAGR |

8.40% |

| Indonesia Building Construction Market Size 2032 |

USD 614.14 billion |

Strong public investment in infrastructure and housing is driving market expansion. Government programs targeting affordable housing and smart city development stimulate steady demand for residential and commercial construction. Urbanisation, industrialisation, and rising middle-income populations are encouraging private developers to expand across cities. It gains further momentum from industrial estates, logistics networks, and energy projects that enhance regional connectivity and urban capacity.

Java leads the market due to its large population, developed infrastructure, and concentration of industrial zones. Major cities like Jakarta and Surabaya attract extensive investment in commercial and residential projects. Emerging regions such as Kalimantan and Sulawesi are expanding with new industrial corridors and transport developments. Kalimantan is particularly active because of the new capital city project, Nusantara, which accelerates infrastructure growth. These regional developments together support balanced construction activity across the Indonesian archipelago.

Market Insights

- The Indonesia Building Construction Market was valued at USD 168.30 billion in 2018, reached USD 307.78 billion in 2024, and is forecast to hit USD 614.14 billion by 2032, growing at a CAGR of 8.40%.

- Java leads with 54% share, supported by dense population, advanced infrastructure, and high industrial concentration, while Sumatra and Kalimantan follow with 21% and 15% shares respectively.

- Kalimantan is the fastest-growing region with 15% share, driven by the new capital city Nusantara and large-scale infrastructure projects that boost regional construction investment.

- Residential construction accounts for over 40% of total market share, reflecting demand from urban housing and affordable residential schemes nationwide.

- Infrastructure and utilities segment represents around 25% of the market, supported by ongoing transport corridors, public housing initiatives, and industrial zone development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Infrastructure Development and Urban Expansion

Rapid urbanisation and large-scale infrastructure projects are the main catalysts for growth. Government initiatives such as the National Medium-Term Development Plan focus on transport, housing, and industrial zones. Public–private partnerships accelerate major projects, improving connectivity across islands. Increased population density in key regions drives residential and commercial construction. The Indonesia Building Construction Market benefits from the country’s push for smart cities and sustainable infrastructure. It expands as foreign investors fund transport and energy hubs. Strong urban demand supports long-term industry stability. Local contractors gain from continuous project pipelines.

Government Investments and Regulatory Support for Affordable Housing

Public investment programs target affordable housing to meet rising demand from low-income households. Government-led schemes like “One Million Houses” continue to stimulate the residential sector. Tax incentives and simplified permits help local developers expand operations. The Indonesia Building Construction Market experiences steady progress through financial inclusion and mortgage accessibility. It strengthens construction activity in suburban and semi-urban regions. Infrastructure-linked housing boosts ancillary demand for building materials. Growth in labor participation supports faster project execution. Public spending sustains employment and industry output.

Industrialisation and Growing Demand for Commercial Infrastructure

Expanding industrial sectors fuel construction of factories, logistics hubs, and offices. The development of industrial estates across Java and Sumatra attracts foreign manufacturers. The Indonesia Building Construction Market benefits from demand for warehouses and retail spaces. It supports rising e-commerce operations and supply chain modernization. Business parks and special economic zones draw long-term investments. Demand for high-rise buildings grows with increased corporate expansion. Better power and transport access enhance investment appeal. These trends collectively improve Indonesia’s industrial capacity and job creation.

- For example, BSD City, developed by Sinar Mas Land, is Indonesia’s largest private planned township at over 6,000 hectares, now serving more than 450,000 people. BSD City integrates a Digital Hub for IT and logistics, winning business leadership commendations and multiple green certifications. The city’s infrastructure enables high digital adoption, supporting both residential and industrial growth with dedicated hubs and smart city principles.

Technological Advancements in Construction Materials and Methods

Innovations in prefabrication, modular design, and digital project management enhance efficiency. Construction companies use Building Information Modeling (BIM) to reduce delays and costs. Sustainable materials such as recycled concrete and green insulation gain traction. The Indonesia Building Construction Market integrates technology for faster delivery and reduced waste. It aligns with green building certification standards set by the Green Building Council Indonesia. Smart construction equipment and drones improve accuracy and safety. Adoption of automation helps firms tackle labor shortages. Efficiency-driven innovation strengthens competitiveness and investor confidence.

- For example, PT PP (Persero) Tbk uses Autodesk Construction Cloud technology, achieving a 20–25% improvement in project accuracy and 10–20% reduction in materials waste across major builds.

Market Trends

Adoption of Green and Sustainable Building Practices

Sustainability is becoming a major trend in Indonesia’s construction sector. Developers prioritize energy-efficient buildings using low-emission materials. Certification programs such as GREENSHIP influence design choices in urban areas. The Indonesia Building Construction Market aligns with climate goals and corporate ESG standards. It encourages renewable energy integration in residential and commercial projects. Green roofing, natural ventilation, and smart water systems gain momentum. Property developers use eco-labels to attract responsible investors. Sustainability becomes a key differentiator in urban development projects.

Digital Transformation and Smart Construction Technologies

Construction firms are embracing digital tools to optimize design and execution. Artificial intelligence and IoT-enabled monitoring systems improve resource use. Drones and robotics enhance site surveys and inspection accuracy. The Indonesia Building Construction Market increasingly adopts data-driven project planning. It reduces downtime and improves safety outcomes. Digital twins allow real-time performance tracking for large-scale developments. Firms invest in workforce training to manage new digital systems. These innovations redefine project efficiency and productivity benchmarks.

Growth in Mixed-Use and High-Rise Developments

Urban centers like Jakarta, Surabaya, and Medan witness increased demand for integrated developments. Mixed-use complexes combine residential, retail, and office spaces for convenience. Developers focus on vertical construction due to limited land in urban cores. The Indonesia Building Construction Market benefits from evolving consumer lifestyles. It supports the shift toward sustainable urban densification. High-rise projects create efficient land utilization in crowded cities. Mixed-use formats offer steady rental yields and attract foreign investors. Demand continues to rise as urban populations expand.

- For instance, Agung Podomoro Land’s Podomoro City Deli Medan superblock project covers 5.2 hectares and, upon completion, will feature 2,730 apartments, an office tower with 46,314 sqm net saleable area, and a retail mall offering 78,287 sqm net lettable area, positioning it as one of Sumatra’s largest mixed-use projects.

Focus on Disaster-Resilient and Climate-Adapted Design

Indonesia’s vulnerability to earthquakes and floods pushes demand for resilient designs. Construction codes now emphasize seismic-resistant structures and durable materials. The Indonesia Building Construction Market integrates adaptive planning for climate risks. It focuses on drainage systems, elevated designs, and flexible architecture. Government agencies collaborate with international partners for safety frameworks. Developers adopt early warning systems and smart monitoring solutions. Strengthening infrastructure resilience helps protect investments and lives. These measures support long-term economic and urban stability.

- For instance, Jakarta’s first seismic-isolated 25-story office tower adopted base isolation technology following ASCE 7-05 seismic design requirements, enabling significant seismic force and inter-story drift reduction in compliance with Indonesia’s most stringent earthquake safety standards.

Market Challenges Analysis

Rising Construction Costs and Supply Chain Constraints

The industry faces rising costs for raw materials such as cement, steel, and aggregates. Supply chain disruptions delay key infrastructure projects across regions. The Indonesia Building Construction Market struggles with imported material dependency. It encounters currency fluctuations affecting construction budgets and timelines. Shortages of skilled labor raise wage expenses for developers. Transportation inefficiencies between islands increase logistics costs. Contractors face thin profit margins amid price volatility. These pressures challenge timely completion of major national projects.

Regulatory Hurdles and Land Acquisition Barriers

Complex land ownership systems slow project approvals and increase uncertainty. Local zoning laws differ between regions, adding administrative burden. The Indonesia Building Construction Market experiences delays due to unclear property rights. It faces prolonged negotiation periods for public infrastructure projects. Bureaucratic procedures hinder private investment confidence. Environmental permits and safety standards require multiple clearances. Investors often adjust timelines to comply with evolving regulations. These challenges restrain large-scale expansion and regional diversification efforts.

Market Opportunities

Expansion of New Capital City and Regional Development Programs

The relocation of Indonesia’s capital to Nusantara opens vast opportunities for construction. Developers and investors target residential, commercial, and infrastructure projects. The Indonesia Building Construction Market benefits from government-led city planning initiatives. It gains from major transportation and green energy networks supporting the new capital. Public and private sector collaborations attract foreign contractors. The initiative triggers multiplier effects in East Kalimantan and nearby regions. These programs stimulate long-term regional development and modern infrastructure creation.

Rising Demand for Sustainable and Smart Urban Housing

Growing urban populations demand affordable yet technologically equipped housing. Developers adopt smart home systems and energy-efficient layouts. The Indonesia Building Construction Market aligns with sustainability-driven housing goals. It targets younger demographics seeking connected and eco-friendly living environments. The adoption of solar-ready buildings and digital energy meters enhances appeal. Partnerships with green technology firms support scalable housing solutions. This growing niche strengthens investment returns and market diversity.

Market Segmentation Analysis

By Construction Type

Residential construction holds a dominant position due to increasing urban housing demand and rising middle-class incomes. Government-backed affordable housing schemes drive new project launches in suburban and rural areas. Commercial construction is growing steadily, supported by retail, hospitality, and office developments. The Indonesia Building Construction Market benefits from industrial expansion, with factories and logistics hubs strengthening regional connectivity. Infrastructure and utilities projects, including roads, bridges, and airports, continue to receive priority investment. It reflects the country’s push for nationwide modernization and economic resilience.

- For example, PT Wijaya Karya (WIKA) was the main Indonesian contractor for the Jakarta–Bandung High-Speed Rail, which began commercial operations in October 2023, spans 142.3 km, and reduced rail travel time between the cities from over three hours to less than one hour.

By Project Size

Small-scale projects support local housing and renovation needs in growing cities. Medium-scale projects include apartment complexes and commercial centers, offering stable returns to developers. Large-scale projects dominate the market, driven by integrated townships, ports, and industrial estates. The Indonesia Building Construction Market gains momentum from public–private partnerships in mega projects. It attracts both domestic and foreign contractors, creating broad participation across scales. Balanced growth across project sizes sustains long-term construction activity and employment generation.

- For example, PT PP (Persero) Tbk served as a main contractor for the New Yogyakarta International Airport, handling ground improvement over an area of 421,169 m²; the airport officially opened in August 2020, with a terminal area of 130,000 m² and planned capacity for up to 20 million passengers annually.

By Material Type

Cement and concrete products remain the backbone of most construction activities. Steel and metal products are essential for high-rise buildings, bridges, and industrial facilities. Construction equipment and machinery adoption grows with demand for faster and safer execution. The Indonesia Building Construction Market incorporates project management and design services for precision and sustainability. It emphasizes modern planning tools and eco-friendly material use. Diversified material segments ensure resilience against supply disruptions and cost volatility.

By End User

Government projects lead in scale and value through infrastructure development and public housing. Private developers focus on residential and mixed-use communities meeting urban lifestyle needs. Real estate companies invest in commercial hubs and smart city developments. Contractors and subcontractors contribute through engineering, design, and civil works. The Indonesia Building Construction Market thrives on this ecosystem, linking public investment with private innovation. It ensures continuous project inflow and nationwide construction capability growth.

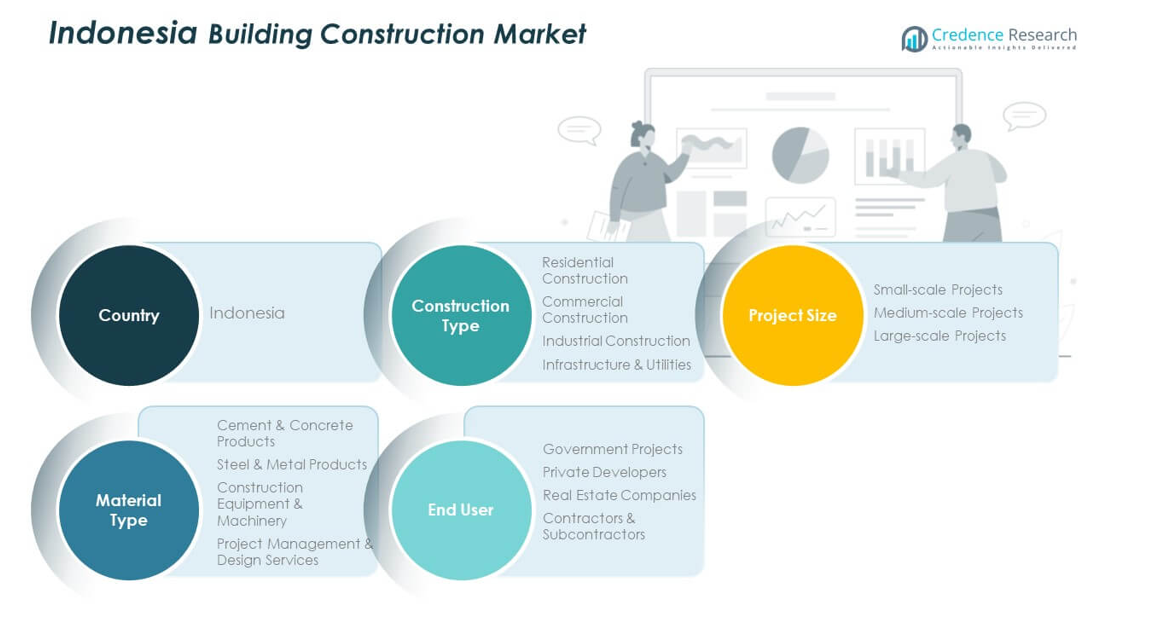

Segmentation

By Construction Type:

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure & Utilities

By Project Size:

- Small-scale Projects

- Medium-scale Projects

- Large-scale Projects

By Material Type:

- Cement & Concrete Products

- Steel & Metal Products

- Construction Equipment & Machinery

- Project Management & Design Services

By End User:

- Government Projects

- Private Developers

- Real Estate Companies

- Contractors & Subcontractors

Regional Analysis

Java dominates the Indonesia Building Construction Market with around 54% share, supported by its dense population and industrial concentration. Major cities such as Jakarta, Surabaya, and Bandung host large-scale infrastructure, housing, and commercial projects. Strong government initiatives for transit-oriented development and urban renewal sustain steady investment flow. The region’s mature logistics and workforce availability make it the core hub for developers. It benefits from rising residential demand driven by rapid urbanisation and middle-income expansion. Java’s contribution ensures a consistent pipeline of public and private sector projects across multiple construction categories.

Sumatra follows with an estimated 21% market share, driven by investments in transportation, energy, and industrial zones. Large port expansions, refineries, and renewable energy projects enhance the island’s economic importance. The Indonesia Building Construction Market expands here through increased public–private partnerships and provincial urban planning. It focuses on improving intercity connectivity and industrial estate development in North and South Sumatra. Rising real estate activities in Medan and Palembang strengthen the commercial segment. These developments create a balanced construction environment that supports regional growth and employment.

Kalimantan, Sulawesi, and Papua collectively hold about 25% share, showing significant long-term potential. Kalimantan gains traction due to the ongoing construction of the new capital, Nusantara, which triggers large infrastructure and housing projects. Sulawesi’s mining and energy sectors create demand for industrial and port construction. The Indonesia Building Construction Market gains momentum in these emerging regions through government-led decentralization and infrastructure expansion. It fosters inclusive growth by spreading development beyond Java. Improved access, energy projects, and digital infrastructure will continue to drive investment across these frontier provinces.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Indonesia Building Construction Market remains moderately consolidated, led by large state-owned enterprises with strong execution capacity. PT Wijaya Karya (Persero) Tbk holds a leading role through diversified portfolios in infrastructure, housing, and industrial projects. It emphasizes innovation in green and modular construction. PT Pembangunan Perumahan (Persero) Tbk maintains a robust pipeline across residential and commercial sectors, supported by strategic partnerships and efficient cost management. PT Adhi Karya (Persero) Tbk focuses on transportation and urban infrastructure, leveraging expertise in elevated rail and toll road projects. PT Total Bangun Persada Tbk dominates private commercial developments, specializing in high-rise and hospitality projects. PT Nusa Raya Cipta Tbk continues to strengthen its position in residential and mixed-use projects across Java and Bali. It supports growing private investments through flexible construction services and digital project management. Strong competition drives innovation, quality improvement, and wider geographic penetration within the construction ecosystem.

Recent Developments

- In November 2025, PT Wijaya Karya (Persero) Tbk the company announced a new contract to build roads for the Judicial Complex and supporting areas in the Core Government Area (KIPP) of the new capital Nusantara, strengthening accessibility to Indonesia’s new government center within the building and infrastructure construction market.

- In May 14, 2025, PT Total Bangun Persada Tbk management set a 2025 new‑contract target of IDR 5 trillion after booking IDR 5.21 trillion of new work in 2024, focusing on data centers, industrial facilities, and office buildings as key growth areas in the national building construction sector.

Report Coverage

The research report offers an in-depth analysis based on Construction Type, Project Size, Material Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Indonesia Building Construction Market is expected to expand rapidly with government-led infrastructure programs supporting long-term economic development.

- Rising urbanisation and population growth will strengthen demand for residential and commercial properties in major cities.

- Industrial expansion and new economic zones will encourage investment in logistics, factory, and port construction.

- Sustainable and energy-efficient building practices will gain prominence through green certification frameworks.

- Smart city initiatives will boost adoption of digital construction tools and connected infrastructure.

- Affordable housing development will continue to drive demand across middle- and low-income segments.

- Relocation of the national capital to Nusantara will generate extensive construction opportunities in Kalimantan.

- Increasing foreign direct investment will enhance competition and modernize construction technology.

- Public–private partnerships will diversify project financing and accelerate infrastructure delivery.

- The Indonesia Building Construction Market will evolve toward integrated, tech-driven, and sustainable development, ensuring stable growth across all subregions.