Market Overview

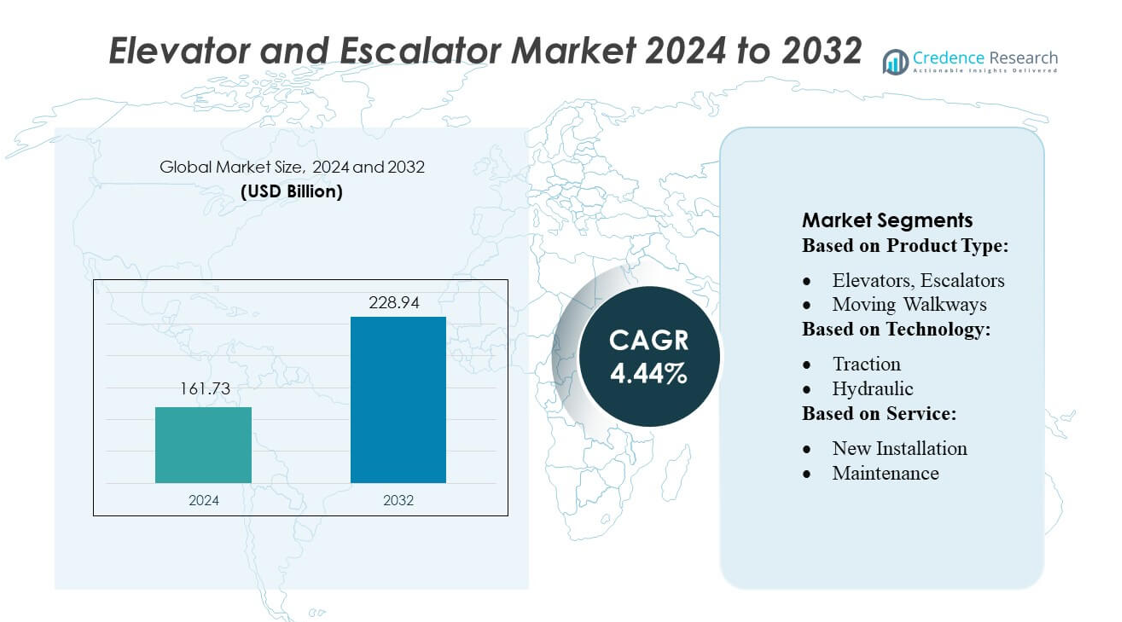

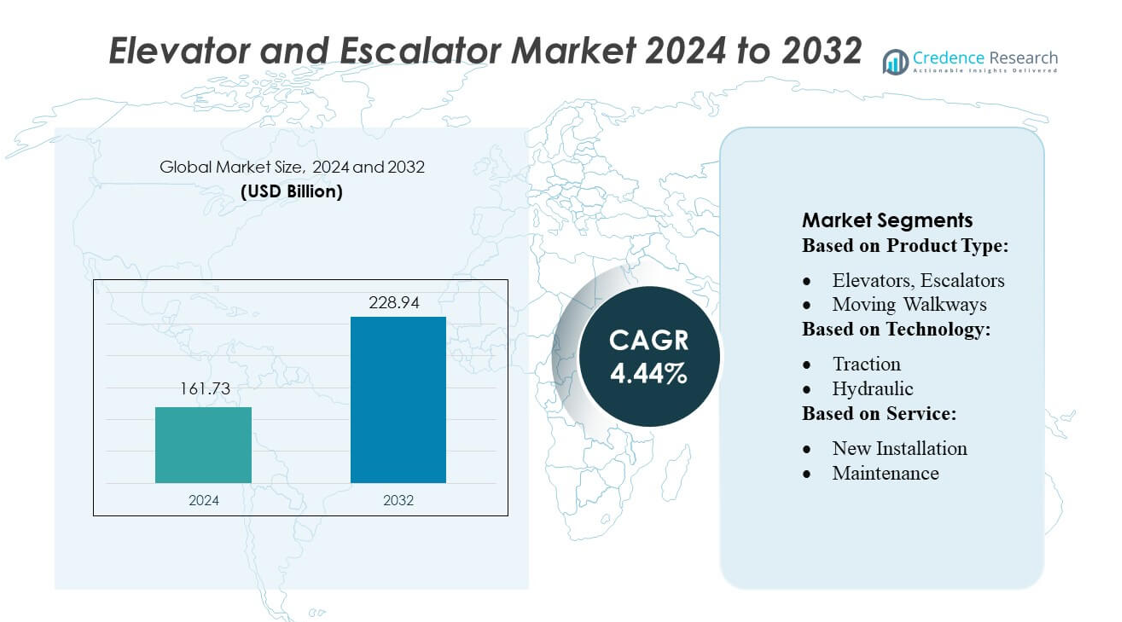

Elevator and Escalator Market size was valued USD 161.73 billion in 2024 and is anticipated to reach USD 228.94 billion by 2032, at a CAGR of 4.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Elevator and Escalator Market Size 2024 |

USD 161.73 billion |

| Elevator and Escalator Market, CAGR |

4.44% |

| Elevator and Escalator Market Size 2032 |

USD 228.94 billion |

The elevator and escalator market is dominated by established global players that include Otis, Kone, Schindler, Thyssenkrupp, Mitsubishi Electric, Hitachi, Fujitec, Hyundai Elevator, Toshiba Elevators and Building Systems, and SJEC, each leveraging strong portfolios in new installations, modernization, and digitally enabled maintenance services. These companies compete by advancing energy-efficient technologies, high-speed vertical mobility solutions, and IoT-driven predictive maintenance platforms. Asia-Pacific leads the global market with an estimated 55% share, driven by rapid urbanization, extensive high-rise residential development, and large-scale metro and airport projects across China, India, and Southeast Asia. Strong construction activity and continuous infrastructure expansion reinforce the region’s dominant position.

Market Insights

- The global elevator and escalator market reached USD 161.73 billion in 2024 and is projected to hit USD 228.94 billion by 2032 at a 4.44% CAGR, driven by rising urban density and continuous investment in vertical mobility solutions.

- Market growth is propelled by rapid infrastructure development, smart building adoption, and surging demand for energy-efficient, high-speed systems across commercial, residential, and transit segments.

- Key trends include the shift toward IoT-enabled predictive maintenance, touchless control technologies, and modernization services, with elevators holding the dominant product segment share due to high installation volumes.

- Competitive dynamics are shaped by global leaders like Otis, Kone, Schindler, Thyssenkrupp, and Mitsubishi Electric, who strengthen their positions through digital service platforms and advanced traction technologies.

- Asia-Pacific accounts for about 55% of the regional market, driven by China and India’s construction boom, while restraints include high installation costs, regulatory compliance requirements, and maintenance-intensive legacy systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

Elevators dominate the market, accounting for over 60% of global revenue, driven by rapid urbanisation, high-rise residential development, and expanding commercial infrastructure. Their strong demand stems from improved safety standards, energy-efficient designs, and smart control systems that enhance passenger flow in dense urban environments. Escalators follow as the second-largest segment, supported by rising installations in transit hubs and shopping complexes. Moving walkways maintain a niche share, primarily in airports and large commercial spaces, where they support seamless passenger mobility.

- For instance, Azabudai Hills Mori JP Tower, Toshiba supplied 8 double-deck cabs, each rated for 34 passengers and a total load of 4,500 kg, moving at 360 m/min.

By Technology:

Traction technology leads the segment with more than 70% market share, supported by its superior energy efficiency, higher load capacity, and suitability for mid- to high-rise buildings. The adoption of regenerative drives and advanced motor systems further accelerates its demand in commercial and mixed-use towers. Machine-Room-Less (MRL) systems also grow steadily as space-saving solutions for modern buildings. Hydraulic elevators retain relevance in low-rise applications, while vacuum/pneumatic systems hold a small yet expanding share due to their eco-friendly installation and minimal maintenance needs.

- For instance, KONE’s UltraRope® carbon-fiber hoisting rope reduces the elevator moving mass. In a 500-meter travel, the rope itself weighs significantly less than a conventional steel rope, resulting in a total moving mass reduction of up to 60% (approximately 14,000 kg).

By Service:

Maintenance and repair services hold the dominant share at approximately 45–50%, driven by the expanding global installed base and mandatory safety compliance requirements. Continuous lifecycle support, predictive maintenance technologies, and remote monitoring capabilities reinforce this segment’s leadership. New installations contribute strongly as urban infrastructure, smart cities, and commercial developments grow. Modernisation services also gain traction as ageing elevator fleets in developed regions require upgrades for energy efficiency, safety enhancements, and digital control integration.

Key Growth Drivers

Rapid Urbanization and High-Rise Construction

Rapid urbanization and the expansion of high-rise residential and commercial buildings significantly drive demand for elevators and escalators. Governments worldwide continue to invest in smart cities, transit hubs, and mixed-use developments, pushing developers to adopt vertical mobility solutions to optimize space and improve accessibility. Emerging economies in Asia-Pacific contribute heavily, as urban population density rises and infrastructure projects accelerate. The need for efficient vertical transport systems within skyscrapers, metro stations, malls, and airports strengthens market growth across both new installations and modernization requirements.

- For instance, Schindler 5500 MRL elevator features a regenerative drive that achieves about 30% lower energy use compared to traditional systems. The drive uses a “Clean PowerFactor 1” design that can feed energy back into the building’s power grid.

Increasing Focus on Safety, Efficiency, and Automation

Rising safety standards and the demand for energy-efficient technologies fuel widespread adoption of advanced elevator and escalator systems. Manufacturers increasingly integrate regenerative drives, destination control systems, IoT-enabled predictive maintenance, and touchless interfaces to enhance performance and reduce operational costs. Automation-supported uptime improvements appeal strongly to building owners, especially in commercial complexes and public facilities. As end users prioritize reliability and optimized traffic flow, these innovations accelerate replacement cycles and boost modernization spending, creating steady growth across mature and developing markets.

- For instance, Fujitec’s PM gearless machine in its GLFV-D series uses a PWM converter that returns regenerated power during full-load downward travel — this reduces power consumption by about 35% compared to systems without the converter.

Expanding Infrastructure Investments Across Transport & Public Facilities

Global infrastructure expansion—particularly in metro rail networks, airports, and public transportation terminals—drives substantial demand for escalators, moving walkways, and heavy-duty elevators. Governments allocate large budgets to modernize transportation systems and improve commuter flow, requiring robust mobility solutions. New metro corridors in Asia, Europe, and the Middle East create sustained procurement cycles for high-capacity equipment. Increasing footfall in transit hubs amplifies the need for durable, low-maintenance systems, positioning escalators and moving walkways as essential assets in long-term infrastructure planning.

Key Trends & Opportunities

Adoption of IoT, Predictive Maintenance, and Smart Building Integration

The market is witnessing strong momentum in IoT-enabled monitoring systems that enhance equipment uptime and reduce service costs. Predictive maintenance uses real-time analytics to detect component wear and prevent failures, offering building owners operational savings and improved safety assurance. Integration with smart building platforms allows centralized control, energy optimization, and automated crowd management. This creates opportunities for manufacturers to offer subscription-based digital services, strengthening long-term customer relationships and differentiating portfolios in a highly competitive market.

- For instance, Hitachi’s Super HERIOS remote-intelligent observation system monitors elevator door operations at a precision of 0.1 mm, enabling detection of minute anomalies in real time.

Growing Demand for Sustainable and Energy-Efficient Solutions

Sustainability initiatives and regulatory pressure encourage adoption of green technologies such as regenerative braking, efficient traction systems, LED-based lighting, and standby modes. Building developers increasingly seek eco-friendly mobility solutions to meet green certification standards like LEED and BREEAM. Manufacturers responding with low-carbon materials and energy-saving designs gain competitive advantage. As urban centers commit to net-zero goals, demand for environmentally responsible elevators and escalators continues to rise, opening opportunities in both new installations and modernization projects.

- For instance, Otis’ Gen2® Comfort elevator supports a maximum load of 2,000 kg, travels up to 3.0 m/s, and can serve 50 stops, making it well-suited for mid-rise residential buildings.

Modernization Opportunities in Aging Infrastructure

A significant installed base of aging elevators and escalators—especially across North America, Europe, and parts of Asia—presents robust modernization opportunities. Building owners prioritize upgrades to improve energy efficiency, safety compliance, ride quality, and digital connectivity. Modernization often requires shorter installation times and lower operational disruptions, making it an attractive alternative to full equipment replacement. With safety codes tightening and asset reliability becoming mission-critical in dense buildings, modernization is emerging as one of the fastest-growing service segments globally.

Key Challenges

High Installation and Maintenance Costs

The elevator and escalator market faces cost-related challenges, as advanced technologies, premium materials, and specialized labor significantly increase capital expenditure. Building owners in developing markets often delay installations or choose lower-spec equipment due to budget constraints. Additionally, routine maintenance requires skilled technicians and expensive spare parts, increasing lifecycle costs. These financial pressures can slow adoption rates, particularly in low-income regions and smaller commercial buildings, limiting market penetration despite rising urban development.

Supply Chain Constraints and Skilled Labor Shortage

Global supply chain disruptions, fluctuating raw material prices, and component shortages affect production cycles and project timelines. Manufacturers often face delays in sourcing critical parts such as motors, controllers, and electronics, impacting delivery schedules. Additionally, the industry suffers from a persistent shortage of trained installation and maintenance professionals, especially as systems become more digital and complex. This skills gap increases service downtime, raises labor costs, and constrains the market’s ability to meet growing demand for high-performance solutions.

Regional Analysis

North America

North America holds around 20% of the global elevator and escalator market, driven by strong modernization activity across commercial buildings and public infrastructure. The United States leads demand as aging systems require upgrades to energy-efficient and connected technologies. Urban redevelopment projects, rising renovation cycles, and adoption of smart maintenance solutions support steady growth. Canada contributes through investments in residential high-rise construction and public transit expansion. The region focuses heavily on safety compliance, sustainable operations, and improved vertical mobility solutions, helping maintain a stable market position. Modernisation and repair services form a significant share of overall revenue.

Europe

Europe accounts for roughly 25% of the global market, supported by advanced regulatory standards, strong modernization needs, and consistent adoption of energy-efficient technologies. Countries such as Germany, France, Italy, and the United Kingdom drive demand through modernization of aging structures and expansion of commercial and public infrastructure. The region sees growing installation of smart elevators equipped with predictive maintenance and digital control systems. High urban density and stringent safety frameworks encourage replacement and retrofit projects. While new installations grow moderately, modernization generates the largest revenue share, maintaining Europe’s strong position in the global market.

Asia-Pacific

Asia-Pacific dominates the global elevator and escalator market with an estimated 50–60% share, driven by rapid urbanization, large-scale residential construction, and massive infrastructure investments. China remains the largest contributor, followed by India, Japan, and Southeast Asian countries. High-rise housing demand, metro rail expansion, and airport development significantly boost installation volumes. The region increasingly adopts smart, energy-efficient, and machine-room-less elevators. Growing middle-class populations and expanding commercial real estate further accelerate growth. Asia-Pacific remains the fastest-growing and most dynamic regional market, supported by continuous new-build activity and long-term modernization prospects.

Latin America

Latin America holds approximately 5–7% of the global elevator and escalator market, driven by urban growth and modernization of residential and commercial buildings. Brazil and Mexico dominate the regional demand through large population centers and infrastructure development plans. Economic recovery and investment in housing, retail, and public transportation systems are encouraging steady installation growth. The region sees rising interest in modernization services as older systems require upgrades for safety, efficiency, and reliability. Although growth is moderate compared to Asia-Pacific, Latin America shows stable long-term potential supported by urban expansion and improved building standards.

Middle East & Africa

The Middle East & Africa region captures roughly 6–8% of the global market, with demand centered in Gulf countries such as the UAE, Saudi Arabia, and Qatar. Large infrastructure projects, smart-city developments, and high-rise commercial buildings drive installations. Africa contributes through rising urban housing needs and expanding retail and hospitality sectors. Modern, energy-efficient systems and premium-grade solutions are in high demand in the Middle East, while Africa sees steady growth in basic installations. Although smaller in scale, the region is experiencing sustained investment that supports long-term market expansion.

Market Segmentations:

By Product Type:

- Elevators, Escalators

- Moving Walkways

By Technology:

By Service:

- New Installation

- Maintenance

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the elevator and escalator market features major global players such as Toshiba Elevators and Building Systems Corporation, Hyundai Elevator Co., Ltd., Kone Corporation, SJEC Corporation, Schindler Group, Fujitec, Hitachi, Ltd., Otis Elevator Company, Mitsubishi Electric Corporation, and Thyssenkrupp AG. The elevator and escalator market remains highly dynamic, driven by continuous technological innovation, strong service capabilities, and expanding global footprints. Companies compete by enhancing product efficiency, safety, and reliability while integrating smart technologies such as IoT-enabled predictive maintenance, destination control systems, and energy-efficient traction solutions. Modernisation services form a major strategic focus as aging infrastructure across developed and emerging markets requires upgrades to meet current safety and sustainability standards. Manufacturers also strengthen competitiveness through long-term service contracts, partnerships with real estate developers, and investments in advanced manufacturing. The rise of high-density urban development and megaproject construction supports demand, pushing industry players to innovate in high-speed, machine-room-less, and eco-efficient vertical mobility systems. Overall, competition is shaped by product differentiation, digital capabilities, maintenance networks, and the ability to deliver reliable, lifecycle-focused solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Toshiba Elevators and Building Systems Corporation

- Hyundai Elevator Co., Ltd.

- Kone Corporation

- SJEC Corporation

- Schindler Group

- Fujitec

- Hitachi, Ltd.

- Otis Elevator Company

- Mitsubishi Electric Corporation

- Thyssenkrupp AG

Recent Developments

- In August 2025, Rocket Lab boosts US investments to expand semiconductor manufacturing capacity and supply chain security for space-grade solar cells and electro-optical sensors, supported by Trump Administration award.

- In May 2025, Malaysian company SMD Semiconductor opened a new R&D Innovation Hub in Wales to collaborate with UK companies on designing next-generation semiconductor chips. The hub is co-located with the Compound Semiconductor Applications (CSA) Catapult near Newport.

- In April 2025, KONE was awarded a contract to supply 131 escalators and four autowalks for five stations on the Grand Paris Express Line 15 West. This project, which will begin operation in 2031, aims to improve commuter travel by creating a circular metro line around Paris, shortening travel times for residents in the Île-de-France region.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Service and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as urbanization accelerates and high-rise construction increases.

- Demand for smart, connected elevators using IoT and AI will rise across commercial and residential buildings.

- Modernisation of aging equipment will become a major revenue driver in both advanced and emerging markets.

- Energy-efficient and eco-friendly elevator technologies will gain strong adoption due to sustainability mandates.

- High-speed and machine-room-less elevators will see wider deployment in dense urban centers.

- Predictive maintenance solutions will replace traditional service models and improve operational efficiency.

- Infrastructure expansion in developing regions will create new installation opportunities.

- Digital twin and remote monitoring technologies will enhance safety, reliability, and lifecycle management.

- Public-sector investments in metro, airport, and institutional projects will support long-term demand.

- Competition will intensify as manufacturers focus on innovation, service offerings, and regional expansion.