| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indonesia Pea Proteins Market Size 2024 |

USD 13.57 Million |

| Indonesia Pea Proteins Market, CAGR |

11.62% |

| Indonesia Pea Proteins Market Size 2032 |

USD 32.7 Million |

Market Overview:

The Indonesia Pea Proteins Market is projected to grow from USD 13.57 million in 2024 to an estimated USD 32.7 million by 2032, with a compound annual growth rate (CAGR) of 11.62% from 2024 to 2032.

Several key factors are propelling the demand for pea protein in Indonesia. Firstly, there is a significant shift towards plant-based diets, driven by health-conscious consumers seeking alternatives to animal proteins. This is complemented by increasing awareness of the environmental benefits associated with plant-based food sources. Consumers are becoming more aware of the carbon footprint associated with meat production, further increasing the demand for plant-based protein options. Additionally, the rise in fitness and wellness trends has led to greater incorporation of pea protein in sports nutrition products. This trend is further amplified by the increasing adoption of plant-based proteins among athletes and fitness enthusiasts seeking higher protein intake without the environmental impact of animal-based sources. The versatility of pea protein, particularly in dry form, enhances its appeal across various applications, including meat substitutes, dairy alternatives, and protein-enriched snacks.

Regionally, Indonesia’s urban centers such as Jakarta, Surabaya, and Bandung are at the forefront of the pea protein market expansion. These cities exhibit a high concentration of health-conscious consumers and a burgeoning middle class with increasing disposable income. This growing consumer base is driving the demand for innovative, plant-based protein products in both the retail and foodservice sectors. The food processing sector in Indonesia, encompassing over 8,500 large and medium-sized producers, provides a robust foundation for market growth. The expansion of this sector allows for increased production of pea protein-based food products, which are becoming more widely available in local supermarkets and online platforms. Furthermore, the government’s support for plant-based food manufacturing and adherence to stringent food safety standards, such as those set by BPOM, ensures the quality and safety of pea protein products in the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Indonesia Pea Proteins Market is projected to grow significantly from USD 13.57 million in 2024 to USD 32.7 million by 2032, driven by a CAGR of 11.62%.

- The global pea proteins market is projected to grow from USD 2,229.15 million in 2024 to USD 5,618.92 million by 2032, at a CAGR of 12.25%.

- Health-conscious consumers in Indonesia are increasingly adopting plant-based diets, driving the demand for alternatives to animal proteins, particularly pea protein.

- Growing awareness about the environmental benefits of plant-based foods is boosting the preference for pea protein, as it has a lower carbon footprint compared to animal-derived proteins.

- The rise in fitness and wellness trends is also contributing to the market growth, with more athletes and fitness enthusiasts opting for pea protein as a high-quality, plant-based protein source.

- Urban centers like Jakarta, Surabaya, and Bandung are at the forefront of pea protein market expansion, supported by an increasingly health-conscious middle class.

- Pea protein is becoming a key ingredient in plant-based meat substitutes, dairy alternatives, and protein-enriched snacks, driving demand in the food and beverage sector.

- The growing popularity of plant-based diets, along with the expanding fitness culture, is propelling the adoption of pea protein in Indonesia’s sports nutrition market.

Market Drivers:

Health and Wellness Trends

The growing awareness of health and wellness among Indonesian consumers is a major driver for the demand for pea protein. As consumers become more health-conscious, they are increasingly seeking plant-based alternatives to traditional animal proteins. This trend is particularly prevalent among younger generations and urban populations who are more inclined to adopt healthier lifestyles. For instance, Burgreens, a leading vegan food enterprise in Indonesia, has successfully built its brand around serving healthy, plant-based dishes, emphasizing the nutritional benefits of alternatives like pea protein. Burgreens expanded from a single outlet in 2013 to eight outlets in Jakarta and Bali by 2023, reflecting the growing consumer shift toward healthier eating. Pea protein, known for its high nutritional value and rich amino acid profile, is an attractive alternative for individuals looking to boost their protein intake without the associated health risks of animal-based proteins, such as high cholesterol and saturated fats. This increasing preference for healthier dietary choices is propelling the demand for pea protein-based products in various food and beverage categories.

Sustainability and Environmental Awareness

Environmental sustainability is another key driver of the pea protein market in Indonesia. As consumers become more conscious of the environmental impact of their food choices, plant-based protein sources like pea protein are gaining traction due to their lower environmental footprint compared to animal proteins. The production of pea protein requires fewer resources, such as water and land, and produces fewer greenhouse gases than livestock farming. This aligns with global sustainability initiatives and resonates with Indonesian consumers who are becoming more eco-conscious. The environmental benefits of pea protein contribute to its growing popularity, especially among those who prioritize sustainable and eco-friendly products in their purchasing decisions.

Growth in Plant-Based Food Consumption

The rise in plant-based food consumption is a significant factor driving the growth of the pea protein market in Indonesia. As more people transition to plant-based diets for ethical, health, or environmental reasons, the demand for plant-based protein ingredients is increasing. Pea protein is gaining popularity as a key ingredient in meat substitutes, dairy alternatives, and other plant-based products. This is particularly evident in the growing demand for plant-based beverages, vegan snacks, and meat-free products, which often feature pea protein as a primary ingredient. For instance, companies like Green Rebel Foods have responded to this trend by launching a range of ready-to-eat frozen vegan foods and plant-based dairy alternatives, such as their Creamy Crew line, which features pea protein as a key ingredient. The increased availability and acceptance of these products are expanding the market for pea protein, especially as consumers seek products that align with their ethical and dietary preferences.

Increasing Popularity in Sports Nutrition

Pea protein is also becoming a preferred choice in sports nutrition, further driving market growth. As Indonesia experiences a growing interest in fitness and sports, the demand for high-quality protein sources for muscle recovery and performance enhancement is on the rise. Pea protein, being easily digestible and rich in essential amino acids, is an ideal option for athletes and fitness enthusiasts seeking plant-based protein alternatives. This trend is supported by the growing fitness culture in urban areas and the increasing popularity of plant-based diets among athletes who wish to avoid dairy and soy proteins. As the market for sports nutrition continues to expand, pea protein’s role in these products is set to increase, contributing to the overall growth of the market in Indonesia.

Market Trends:

Increasing Product Innovations

The Indonesian pea protein market is witnessing a surge in product innovations as manufacturers explore new ways to incorporate pea protein into a variety of food products. Companies are focusing on improving the texture, taste, and nutritional profile of pea protein to make it more appealing to a broader consumer base. Innovations include pea protein-based beverages, snack bars, plant-based meat alternatives, and dairy substitutes. For example, Green Rebel Foods, an Indonesian plant-based food company, launched its “Beefless Rendang” and “Chick’n Satay” in 2022, both made with pea protein and tailored to local tastes. This focus on product diversification is helping companies cater to different consumer preferences, including those looking for low-calorie, high-protein, and allergen-free options. As consumer demands evolve, companies are increasingly investing in research and development to create novel products that can meet the growing demand for plant-based protein sources.

Growth of E-Commerce and Online Retail

The rise of e-commerce has significantly impacted the distribution of pea protein products in Indonesia. Online platforms are providing consumers with easier access to a wide range of plant-based protein products, including those made from peas. E-commerce offers a convenient shopping experience and facilitates access to niche products that may not be available in traditional retail outlets. This shift towards online retail is particularly significant in urban areas, where consumers are increasingly using digital platforms for their grocery shopping. As the adoption of e-commerce continues to rise, manufacturers are expanding their online presence to tap into the growing demand for plant-based proteins in the Indonesian market.

Rise in Vegan and Flexitarian Lifestyles

The shift towards vegan and flexitarian diets is a prominent trend in Indonesia, contributing to the growth of the pea protein market. A growing number of consumers are adopting plant-based diets for health, environmental, and ethical reasons, making plant proteins, such as pea protein, a preferred choice. This trend is particularly noticeable among younger consumers and urban populations who are more open to experimenting with plant-based options. The increasing popularity of flexitarianism, where individuals primarily follow a plant-based diet but occasionally consume animal products, is further driving demand for versatile protein sources like pea protein. As these lifestyles gain mainstream acceptance, the market for plant-based proteins is expected to continue expanding.

Focus on Clean Label and Natural Ingredients

Consumers in Indonesia are becoming more discerning about the ingredients in the products they purchase. There is a growing demand for clean-label products that contain minimal processing and natural ingredients. Pea protein is well-positioned to meet this demand, as it is a natural, plant-based protein source that is free from artificial additives and preservatives. Manufacturers are responding to this trend by offering pea protein-based products that highlight their clean-label credentials, such as being free from allergens like soy and dairy. Ingredion’s VITESSENCE® Pulse 1803C pea protein isolate, for example, is marketed as clean-label, vegan, gluten-free, and processed without solvents, aligning with consumer demand for transparency and natural ingredients. As the clean-label movement continues to gain momentum, consumers are increasingly choosing pea protein products as part of their preference for more transparent, natural, and healthier food options.

Market Challenges Analysis:

Limited Consumer Awareness

One of the key challenges facing the Indonesia pea protein market is the relatively limited consumer awareness regarding the benefits and versatility of pea protein. While health-conscious consumers are increasingly adopting plant-based proteins, a significant portion of the population remains unfamiliar with the nutritional advantages of pea protein compared to other plant-based alternatives. Educating consumers on the health benefits, including its high amino acid profile and digestibility, remains a critical hurdle. Limited awareness of the product’s potential in various food categories, such as meat substitutes and dairy alternatives, may also slow the adoption of pea protein in mainstream diets. Overcoming this challenge requires continued investment in consumer education and marketing strategies to increase the product’s visibility and appeal.

High Production Costs

The cost of producing pea protein remains a barrier to widespread market adoption in Indonesia. While pea protein is considered a sustainable and efficient protein source, its production process can be expensive due to the advanced technology required for protein extraction and purification. For instance, extracting high-quality protein from peas involves multiple processing stages, such as dry fractionation and wet extraction, which are capital-intensive and energy-consuming. These high production costs may result in higher retail prices for pea protein-based products compared to other protein sources, such as soy or wheat. For price-sensitive consumers, especially in rural areas, this price disparity could limit the adoption of pea protein products. As a result, manufacturers face the challenge of finding ways to reduce production costs through technological innovations and scale to make pea protein products more affordable and accessible to a broader population.

Supply Chain and Raw Material Availability

The availability of high-quality peas as a raw material for protein extraction remains another challenge for the Indonesian pea protein market. Peas are not a major agricultural crop in Indonesia, which may limit the consistency and availability of a reliable supply of raw materials for production. This could lead to supply chain disruptions, fluctuations in raw material prices, and challenges in scaling production. To mitigate this issue, local pea farming efforts would need to be expanded, or Indonesia would need to rely on imports, which could add additional costs and logistical challenges. Addressing these supply chain constraints is vital for ensuring the market’s long-term growth.

Market Opportunities:

The growing shift towards plant-based diets presents a significant market opportunity for pea protein in Indonesia. As more consumers adopt plant-based or flexitarian lifestyles due to health, environmental, and ethical reasons, the demand for alternative protein sources like pea protein is on the rise. With its nutritional benefits, including high protein content, essential amino acids, and its hypoallergenic properties, pea protein is well-positioned to capitalize on this trend. The expanding market for plant-based foods, including meat substitutes, dairy alternatives, and protein-enriched snacks, presents a substantial opportunity for manufacturers to introduce innovative pea protein products that cater to the evolving dietary preferences of Indonesian consumers. This trend is expected to continue growing as the market for plant-based products gains further mainstream acceptance.

Another promising opportunity for the Indonesia pea protein market lies in the development of local supply chains. While pea protein production is currently limited, there is potential to establish domestic cultivation of peas to reduce reliance on imports and improve the sustainability of the supply chain. Local sourcing would lower production costs, making pea protein-based products more affordable and accessible to a broader consumer base. Additionally, as urban centers like Jakarta, Surabaya, and Bandung lead the demand for plant-based foods, manufacturers can expand their distribution networks to rural areas, where the growing middle class is increasingly open to alternative proteins. By tapping into both urban and rural markets, companies can capture a larger share of the expanding plant-based food sector in Indonesia.

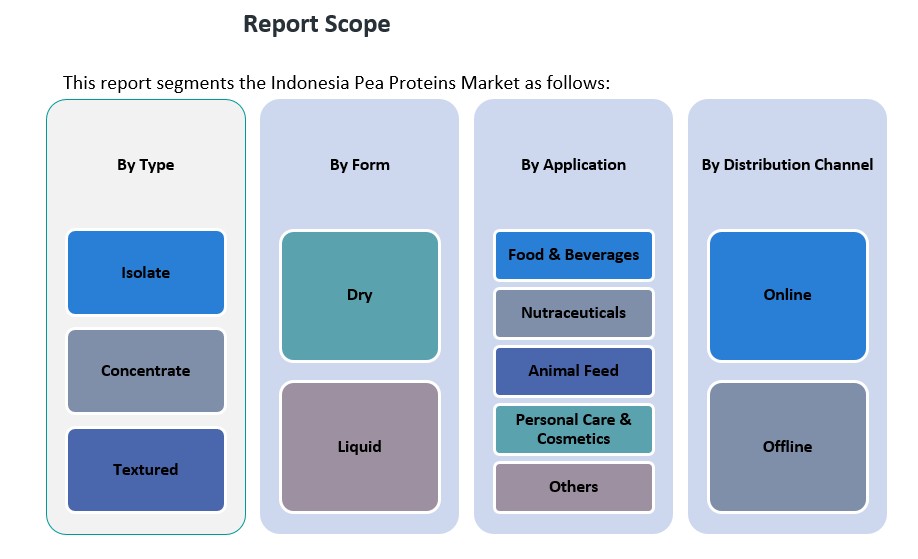

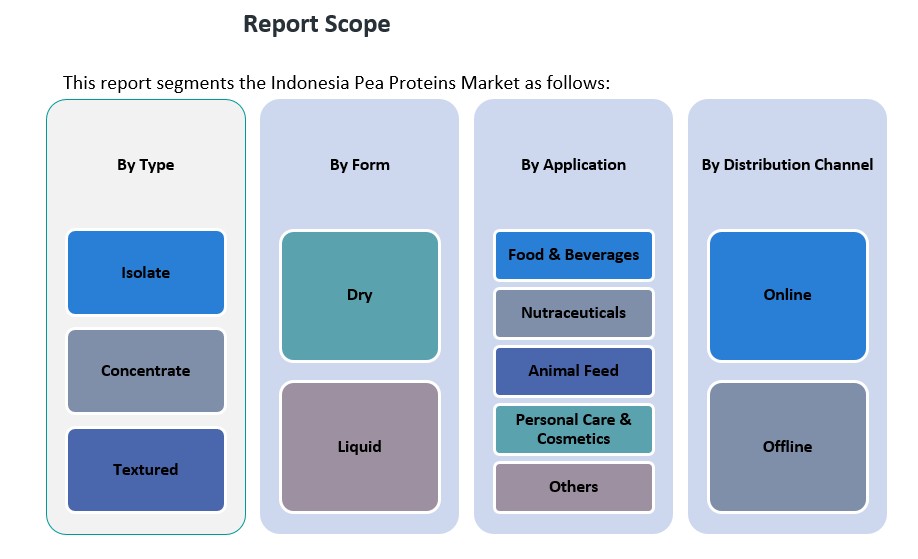

Market Segmentation Analysis:

The Indonesia pea protein market is segmented into several key categories, each contributing to the overall growth of the industry.

By Type: The market is primarily divided into isolate, concentrate, and textured pea proteins. Isolate pea protein is expected to dominate due to its high purity and protein content, making it ideal for use in sports nutrition, meat substitutes, and dairy alternatives. Concentrates hold a significant share as well, often utilized in processed food and beverages due to their cost-effectiveness. Textured pea protein, with its ability to mimic the texture of meat, is increasingly used in plant-based meat products, offering an opportunity for growth in the plant-based protein sector.

By Application: The food and beverage segment is the largest consumer of pea protein, driven by the rising popularity of plant-based diets and the demand for meat and dairy alternatives. The nutraceuticals sector also plays a key role, as pea protein is incorporated into protein supplements and functional foods. Animal feed applications are growing due to the increasing use of plant-based protein in livestock diets. The personal care and cosmetics sector, though smaller, is emerging as a niche market, with pea protein being used for its moisturizing and antioxidant properties in skin and hair care products.

By Form: The market is split into dry and liquid forms, with dry pea protein being the most widely used due to its longer shelf life and ease of storage, making it the preferred choice in most applications.

By Distribution Channel: Online distribution is seeing rapid growth, driven by the convenience of e-commerce and an expanding digital consumer base. However, offline channels, including supermarkets and specialty stores, continue to be a dominant force in the Indonesian market for plant-based products.

Segmentation:

By Type

- Isolate

- Concentrate

- Textured

By Application

- Food & Beverages

- Nutraceuticals

- Animal Feed

- Personal Care & Cosmetics

- Others

By Form

By Distribution Channel

Regional Analysis:

The Indonesian pea protein market is experiencing significant growth, driven by increasing consumer demand for plant-based protein sources. While comprehensive regional market share data specific to Indonesia is limited, key urban centers such as Jakarta, Surabaya, and Bandung are leading the adoption of pea protein products. These cities are characterized by higher levels of urbanization, greater health awareness, and a burgeoning middle class, all of which contribute to the growing popularity of plant-based diets and, consequently, pea protein.

Jakarta, as the capital city, serves as the primary economic and cultural hub, hosting a large concentration of food manufacturers, retailers, and consumers inclined towards health-conscious eating habits. Surabaya and Bandung are also emerging as significant markets due to their expanding urban populations and increasing interest in sustainable and nutritious food options. The presence of a growing middle class in these regions further supports the demand for innovative food products, including those enriched with pea protein.

The Indonesian government has been supportive of plant-based food manufacturing, implementing stringent food safety standards through the National Agency of Drug and Food Control (BPOM). These regulations ensure the quality and safety of pea protein products, fostering consumer trust and encouraging market growth. However, challenges such as limited local production of peas and competition from other plant-based proteins like soy may affect the scalability and affordability of pea protein products in certain regions.

Key Player Analysis:

- Shandong Jianyuan Group

- Fenchem Biotek Ltd.

- Ingredion Incorporated

- Roquette Frères

- Yantai Shuangta Food Co., Ltd.

- ET Chem

- Cargill, Inc.

- DuPont (IFF)

- Nutraonly (Xi’an) Nutritions Inc.

- Burcon NutraScience Corporation

Competitive Analysis:

The Indonesian pea protein market is characterized by a competitive landscape with both local and international players vying for market share. Key global suppliers of pea protein, such as Roquette Frères, Cargill, and Ingredion, have established a presence in Indonesia, leveraging their strong distribution networks and diverse product offerings. These companies capitalize on their global manufacturing capabilities and extensive R&D resources to cater to the growing demand for plant-based protein alternatives. Local companies are also entering the market, focusing on cost-effective solutions and localized production to meet the preferences of Indonesian consumers. These players often emphasize sustainability and the use of locally sourced raw materials. As the market expands, competition will intensify, with both established multinational companies and emerging local manufacturers striving to innovate and offer products that align with evolving consumer preferences for health-conscious, environmentally friendly, and affordable food options.

Recent Developments:

- In February 2024, Roquette Frères expanded its presence in the plant protein sector by launching four new multi-functional pea protein ingredients under its NUTRALYS® range. These innovations-NUTRALYS® Pea F853M (isolate), NUTRALYS® H85 (hydrolysate), NUTRALYS® T Pea 700FL (textured), and NUTRALYS® T Pea 700M (textured)-are designed to enhance taste, texture, and formulation flexibility for food manufacturers producing plant-based foods and high-protein nutritional products. This launch aims to address common challenges in plant protein applications and supports Roquette’s commitment to operational efficiency and consumer satisfaction in the global market.

- In November 2024, Ingredion Incorporated announced a strategic partnership with Lantmännen to accelerate the development of plant-based proteins, including pea protein isolates. This collaboration involves significant investment and leverages both companies’ strengths in process engineering, product development, and vertically integrated production. The partnership is expected to expand their capabilities and market reach, positioning them to deliver high-quality, sustainably sourced pea protein isolates for the evolving alternative protein market in regions such as Indonesia.

Market Concentration & Characteristics:

The Indonesia pea protein market is characterized by a low to moderate concentration, with a mix of international and emerging local players. Global companies such as Roquette Frères, Cargill, and Ingredion have established a presence, leveraging their extensive R&D capabilities and distribution networks. These multinational corporations offer a range of pea protein products, including isolates, concentrates, and textured variants, catering to the growing demand for plant-based proteins in the region. Local companies are also entering the market, focusing on cost-effective solutions and localized production to meet the preferences of Indonesian consumers. These players often emphasize sustainability and the use of locally sourced raw materials, aligning with the increasing consumer preference for eco-friendly and health-conscious products. The competitive landscape is further shaped by the rising trend of plant-based diets, which is driving innovation and product diversification among market participants. Overall, the Indonesia pea protein market presents opportunities for both established and emerging companies to capitalize on the growing demand for plant-based protein sources. The combination of global expertise and local innovation is expected to drive the market’s expansion in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for pea protein in Indonesia is expected to rise significantly, driven by the growing adoption of plant-based diets.

- The market will benefit from increasing consumer awareness about the health benefits of plant-based proteins.

- Innovations in product offerings, such as pea protein-based meat substitutes and dairy alternatives, will expand market opportunities.

- As urbanization increases, more Indonesian consumers will embrace plant-based protein options in metropolitan areas like Jakarta and Surabaya.

- The availability of pea protein products in retail and e-commerce channels will make them more accessible to a wider audience.

- Local pea protein production is anticipated to grow, reducing reliance on imports and improving cost-effectiveness.

- Regulatory support for plant-based food manufacturing will create a favorable environment for market growth.

- The rise of the flexitarian and vegan population in Indonesia will further drive demand for plant-based proteins.

- Partnerships between local producers and global companies will foster innovation and supply chain improvements.

- Sustainability concerns will drive the preference for eco-friendly protein alternatives like pea protein.