| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indonesia Vendor Neutral Archives (VNA) And PACS Market Size 2024 |

USD 26.85 Million |

| Indonesia Vendor Neutral Archives (VNA) And PACS Market, CAGR |

7.20% |

| Indonesia Vendor Neutral Archives (VNA) And PACS Market Size 2032 |

USD 46.83 Million |

Market Overview

Indonesia Vendor Neutral Archives (VNA) And Picture Archiving And Communication Systems (PACS) Market size was valued at USD 26.85 million in 2024 and is anticipated to reach USD 46.83 million by 2032, at a CAGR of 7.20% during the forecast period (2024-2032).

The growth of Indonesia’s Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market is driven by increasing digitalization in healthcare, rising demand for efficient data management, and government initiatives supporting healthcare infrastructure development. Hospitals and diagnostic centers are rapidly adopting VNA and PACS solutions to streamline image storage, retrieval, and sharing, which enhances clinical workflows and patient outcomes. The expanding use of imaging technologies in diagnostics, coupled with a growing focus on interoperability and long-term data accessibility, further fuels market demand. Moreover, the rising incidence of chronic diseases necessitates frequent imaging procedures, prompting healthcare providers to invest in scalable and secure archiving systems. Technological advancements such as AI integration and cloud-based PACS are emerging trends, enabling real-time access to medical images and improving diagnostic accuracy. These factors collectively contribute to a robust growth trajectory for the Indonesian VNA and PACS market over the forecast period.

Geographically, the adoption of Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) in Indonesia is concentrated primarily in urban areas, particularly in Java, where the largest healthcare facilities and hospitals are located. The demand is steadily growing in other regions such as Sumatra, Kalimantan, and Sulawesi, driven by both government healthcare initiatives and private sector investments. Key players in the Indonesian VNA and PACS market include global giants such as Fujifilm Holdings Corporation, Canon Medical Systems, GE Healthcare, Philips Healthcare, and Hitachi Healthcare, alongside regional players like INFINITT Healthcare and Konica Minolta Healthcare. These companies are focusing on providing tailored solutions to meet the needs of Indonesia’s diverse healthcare infrastructure, with an increasing emphasis on cloud-based and hybrid systems to support remote access and improve data management capabilities across the nation’s extensive network of healthcare facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Indonesia Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market was valued at USD 26.85 million in 2024 and is projected to reach USD 46.83 million by 2032, growing at a CAGR of 7.20% from 2024 to 2032.

- The Global VNA and PACS market was valued at USD 4,411.05 million in 2024 and is expected to reach USD 8,046.15 million by 2032, growing at a CAGR of 7.80% from 2024 to 2032.

- Increasing digitalization in healthcare is driving the demand for VNA and PACS solutions to improve data management and streamline clinical workflows.

- Rising incidences of chronic diseases are boosting the need for advanced diagnostic imaging, contributing to market growth.

- The shift toward cloud-based PACS and VNA solutions is a key trend, offering scalability, remote access, and cost efficiency.

- AI integration in imaging systems is enhancing diagnostic accuracy and efficiency, shaping the future of PACS and VNA technologies.

- Limited infrastructure and high implementation costs are major market restraints, particularly in rural areas.

- The market is dominated by key players like Fujifilm, GE Healthcare, Canon, and Philips, competing to offer innovative solutions tailored to Indonesia’s healthcare needs.

Report Scope

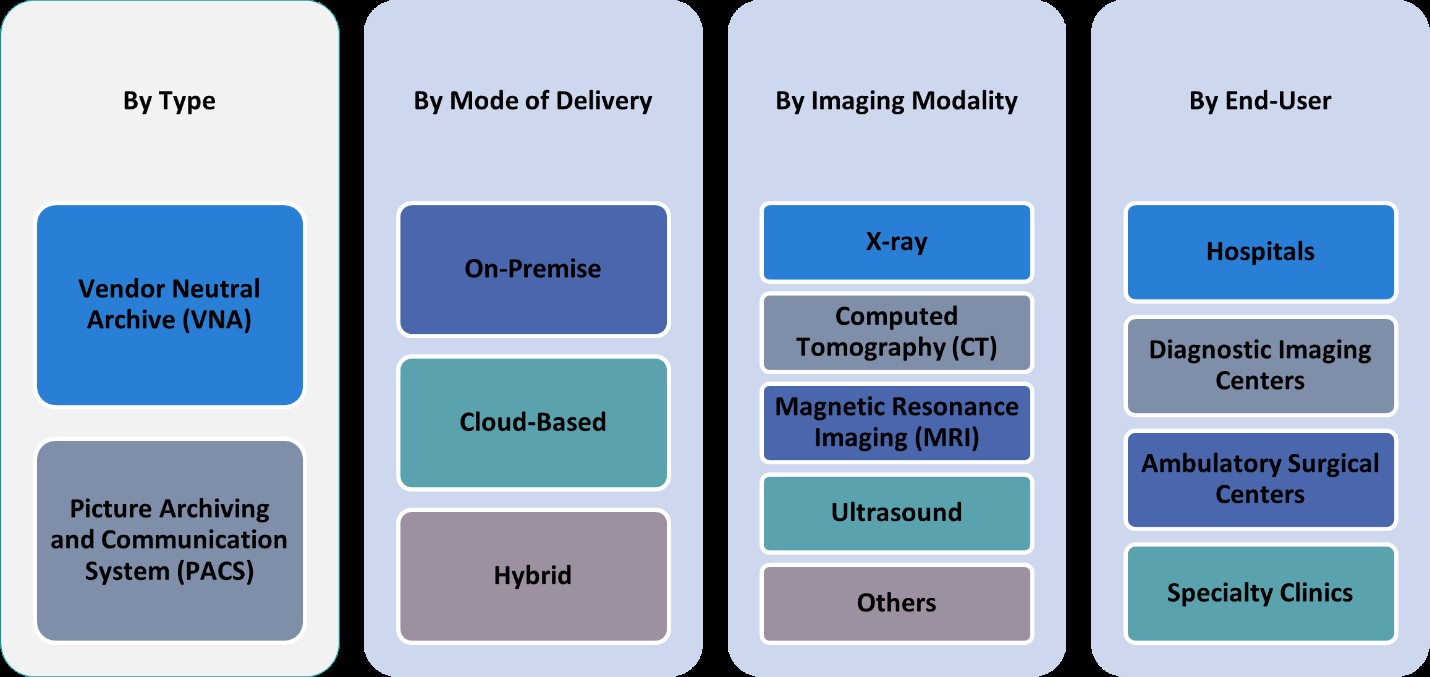

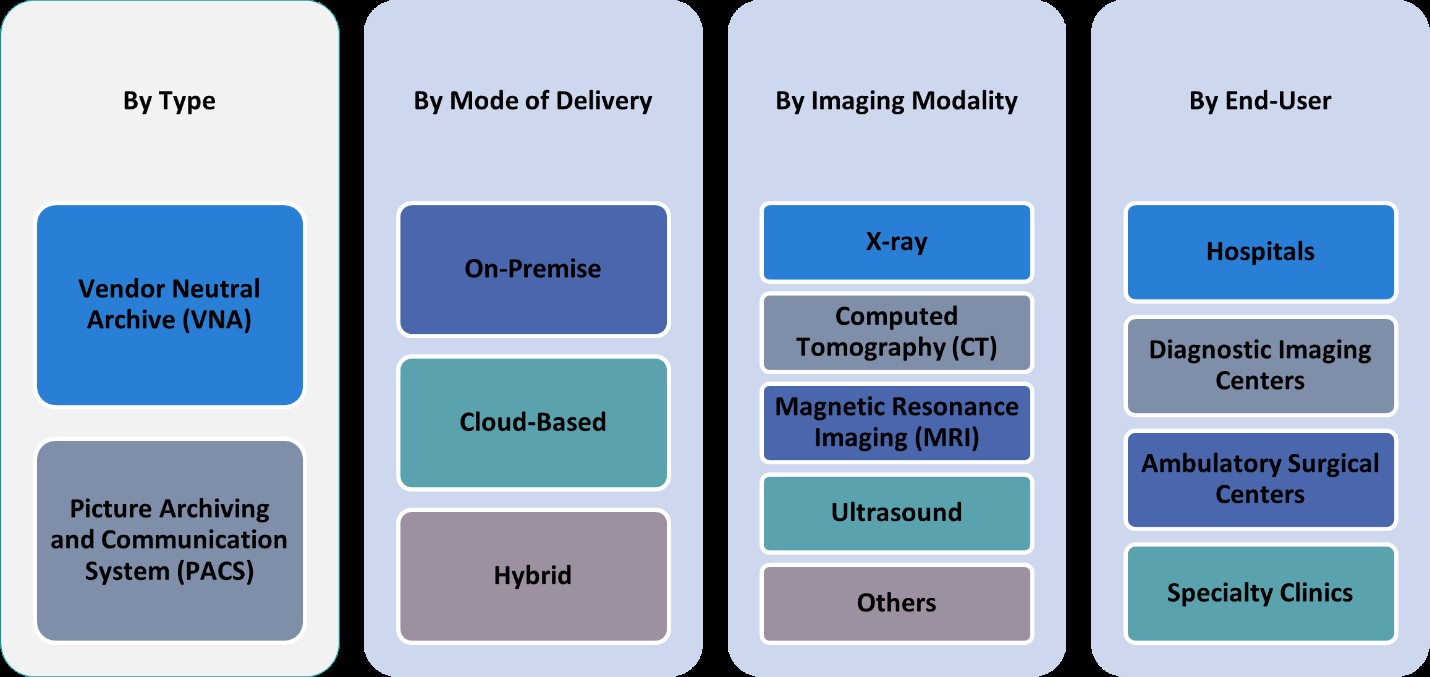

This report segments the Indonesia Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) Market as follows:

Market Drivers

Digital Transformation in Healthcare Infrastructure

Indonesia is undergoing significant digital transformation within its healthcare sector, creating a strong foundation for the adoption of VNA and PACS technologies. The government has been actively investing in the modernization of public hospitals and encouraging the implementation of Health Information Systems (HIS), Electronic Medical Records (EMR), and other digital platforms. For instance, the Indonesian Ministry of Health has launched digital health initiatives aimed at integrating electronic medical records across healthcare facilities to improve patient data accessibility. These reforms aim to improve data integration, clinical efficiency, and patient outcomes. As a result, healthcare institutions are seeking robust imaging informatics solutions that support centralized data storage and retrieval across multiple systems and facilities. VNA and PACS offer the interoperability needed for seamless communication between diverse medical imaging devices and hospital information systems, making them an essential part of Indonesia’s digital health roadmap.

Increased Incidence of Chronic Diseases and Aging Population

Indonesia is experiencing a steady rise in chronic conditions such as cardiovascular diseases, diabetes, and cancer, which require repeated and advanced diagnostic imaging for effective monitoring and treatment. Additionally, the country’s aging population is contributing to higher healthcare utilization, including increased demand for radiology services. For instance, the World Health Organization (WHO) reports that non-communicable diseases account for a significant percentage of deaths in Indonesia, highlighting the need for advanced diagnostic imaging. These trends significantly boost the need for advanced image management solutions like PACS and VNA, which facilitate timely diagnosis and reduce redundancy in imaging procedures. Hospitals and diagnostic centers are increasingly investing in these technologies to optimize workflow, enhance diagnostic capabilities, and improve patient care. This sustained demand for imaging services directly fuels the growth of the VNA and PACS market in the country.

Rising Demand for Efficient Data Management and Storage

The growing volume of diagnostic imaging data, driven by the increased use of modalities such as MRI, CT scans, and ultrasounds, is pushing healthcare providers to seek scalable and cost-effective solutions for image management. Traditional storage systems often fall short in handling large datasets, leading to inefficiencies and potential data loss. VNA and PACS systems address these challenges by offering centralized, vendor-neutral platforms that enable long-term storage, easy retrieval, and secure sharing of imaging data. This is particularly critical in Indonesia, where a large archipelago geography makes centralized access to medical images highly valuable. The ability to consolidate imaging records across multiple locations allows clinicians to access comprehensive patient histories, resulting in improved diagnosis and continuity of care.

Technological Advancements and Cloud Adoption

Rapid advancements in imaging technologies and the growing acceptance of cloud-based healthcare solutions are also key drivers of the Indonesian VNA and PACS market. Cloud-based PACS and VNA platforms offer scalability, remote access, and improved disaster recovery, making them attractive to both public and private healthcare providers. These solutions enable healthcare professionals to access imaging data anytime and anywhere, supporting collaborative diagnosis and faster decision-making. Additionally, the integration of artificial intelligence (AI) and machine learning into PACS systems is enhancing the accuracy of image interpretation and automating routine tasks. As healthcare institutions in Indonesia continue to embrace innovation and technology, the adoption of modern VNA and PACS solutions is expected to accelerate, contributing significantly to market expansion.

Market Trends

Growing Emphasis on Interoperability and Standardization

Interoperability and adherence to industry standards such as DICOM and HL7 are becoming increasingly important in the Indonesian healthcare landscape. Hospitals and diagnostic centers are prioritizing systems that can integrate seamlessly with other health IT solutions, including electronic health records (EHRs) and laboratory information systems. For instance, the U.S. Indonesia Healthcare IT Standards Workshop emphasized the need for interoperability in medical imaging systems to improve healthcare efficiency. Vendor Neutral Archives (VNA) play a critical role in achieving this objective, allowing healthcare organizations to avoid vendor lock-in and maintain long-term data accessibility. This trend is driven by a need for cohesive patient records, enhanced care coordination, and more informed clinical decisions—particularly as Indonesia moves toward nationwide health data integration efforts.

Shift Toward Cloud-Based PACS and VNA Solutions

A prominent trend shaping the Indonesian VNA and PACS market is the growing adoption of cloud-based solutions. Healthcare providers are increasingly recognizing the scalability, cost-efficiency, and remote accessibility offered by cloud platforms. For instance, the Indonesian Ministry of Health has emphasized the importance of cloud-based healthcare solutions to improve data accessibility and interoperability across medical facilities. Cloud-based PACS and VNA allow medical professionals to access imaging data from multiple locations, which is especially valuable in a geographically dispersed nation like Indonesia. These systems also support disaster recovery and reduce the need for extensive on-site IT infrastructure. As healthcare facilities aim to enhance data security and improve operational flexibility, cloud deployment models are becoming the preferred choice for modern image management systems.

Integration of Artificial Intelligence (AI) in Imaging Workflows

The integration of artificial intelligence into PACS platforms is gaining traction as a transformative trend in the Indonesian market. AI-powered tools enhance diagnostic accuracy by assisting radiologists in detecting abnormalities, prioritizing critical cases, and automating routine tasks such as image sorting and annotation. As radiology departments face growing workloads and a shortage of skilled professionals, AI-enabled PACS systems are helping improve efficiency and reduce turnaround times. This trend aligns with Indonesia’s broader digital health goals and is expected to play a significant role in elevating the standard of radiological services nationwide.

Expansion of Diagnostic Imaging Services in Rural Areas

Indonesia is witnessing an expansion of diagnostic imaging services beyond urban centers, with the government and private sector investing in healthcare infrastructure across rural and underserved regions. This decentralization is creating demand for image management systems that can operate efficiently in low-resource settings. Portable imaging devices, telemedicine platforms, and cloud-based PACS solutions are being deployed to bridge the urban-rural healthcare gap. As a result, there is an increasing need for VNA and PACS systems that support remote access and reliable data transmission, facilitating timely diagnoses and reducing the need for patient travel. This trend is expected to drive market growth and increase system adoption across the country.

Market Challenges Analysis

Limited IT Infrastructure and Technical Expertise

One of the primary challenges facing the adoption of VNA and PACS solutions in Indonesia is the limited IT infrastructure across many healthcare facilities, particularly in rural and remote areas. Despite efforts to modernize the healthcare system, many hospitals and clinics still operate with outdated hardware, insufficient network bandwidth, and inadequate data storage capabilities. For instance, Indonesia’s Central Bureau of Statistics (BPS) has reported that disparities in digital infrastructure remain a significant challenge, particularly in rural healthcare facilities. These limitations hinder the effective implementation and operation of advanced imaging systems, which require reliable connectivity and high-performance servers to manage large volumes of medical imaging data. Furthermore, the shortage of skilled IT personnel and radiology technologists familiar with VNA and PACS technologies poses a significant barrier. Healthcare providers often struggle to maintain and optimize these systems, leading to underutilization and inefficiencies. Without targeted investments in infrastructure and workforce development, the full potential of digital imaging systems may remain unrealized in many parts of the country.

High Implementation Costs and Budget Constraints

The high initial cost of implementing VNA and PACS solutions presents another critical challenge for healthcare providers in Indonesia. These systems require substantial financial investment for software licensing, hardware procurement, system integration, staff training, and ongoing maintenance. For many public hospitals and smaller private clinics operating under tight budget constraints, these costs can be prohibitive. Additionally, while cloud-based solutions offer a more scalable and cost-effective alternative, concerns about data privacy, cybersecurity, and compliance with local regulations often slow their adoption. Many healthcare institutions remain hesitant to transition to digital imaging systems due to uncertainty about return on investment (ROI) and long-term sustainability. Government support and incentive programs, while improving, are not yet sufficient to offset the financial burden for many providers. Addressing these cost-related challenges will be crucial to ensuring broader adoption and equitable access to VNA and PACS technologies across Indonesia’s diverse healthcare landscape.

Market Opportunities

The Indonesian Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market presents significant growth opportunities driven by ongoing digital transformation in healthcare and a growing emphasis on integrated health information systems. As hospitals and diagnostic centers seek to enhance clinical efficiency, reduce operational costs, and ensure long-term accessibility of medical imaging data, demand for advanced archiving and communication systems is expected to rise. The government’s continued investment in health infrastructure, along with initiatives promoting telemedicine and digital health platforms, creates a favorable environment for the expansion of VNA and PACS solutions. Additionally, the increasing prevalence of chronic diseases and the need for regular imaging diagnostics further support the adoption of scalable and interoperable systems capable of handling large volumes of imaging data across multiple healthcare facilities.

Another key opportunity lies in the growing adoption of cloud-based and AI-integrated imaging solutions. These technologies offer the potential to bridge resource gaps, especially in rural and underserved areas, by enabling remote access to imaging data and facilitating faster clinical decision-making. As healthcare providers look to modernize their IT capabilities, cloud-native PACS and VNA systems can deliver flexibility, cost-efficiency, and improved collaboration between healthcare professionals. Furthermore, there is rising interest in incorporating artificial intelligence into imaging workflows to enhance diagnostic accuracy and optimize radiology operations. Local and international vendors that offer tailored, secure, and user-friendly solutions backed by training and technical support are well-positioned to tap into this emerging demand. With a growing focus on healthcare interoperability and data-driven decision-making, the Indonesian market offers substantial long-term opportunities for vendors and service providers in the VNA and PACS space.

Market Segmentation Analysis:

By Type:

In the Indonesian healthcare imaging market, both Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) play distinct yet complementary roles. PACS currently holds a larger share of the market, primarily due to its long-standing use in hospitals and diagnostic centers for storing, retrieving, and distributing medical images. Its ability to streamline radiology workflows and enhance clinical decision-making makes it a core component in imaging infrastructure. However, VNA is gaining traction, particularly among larger healthcare networks and institutions seeking long-term data management solutions that support interoperability across different systems and vendors. As Indonesia continues to adopt more integrated healthcare models, the demand for VNA is expected to increase, driven by its flexibility and scalability. The growing emphasis on standardization, patient-centric care, and the need for seamless data exchange across facilities positions VNA as a critical solution for future-proofing imaging data infrastructure in the country.

By Mode of Delivery:

The mode of delivery for VNA and PACS solutions in Indonesia reflects a market in transition, balancing between traditional infrastructure and modern digital capabilities. On-premise deployments remain dominant, especially among public hospitals and institutions with legacy systems, due to perceived control over data security and compliance. However, cloud-based solutions are rapidly emerging as a viable and attractive alternative, offering benefits such as remote accessibility, lower upfront costs, and improved scalability. These are particularly appealing to private healthcare providers and smaller clinics looking to modernize without significant capital expenditure. The hybrid model is also gaining popularity, combining the advantages of on-premise control with the flexibility of cloud-based access. This approach is particularly relevant in Indonesia’s geographically diverse landscape, where healthcare facilities require adaptable solutions. As the country’s digital infrastructure matures and regulatory frameworks around data privacy evolve, cloud and hybrid deployments are expected to witness accelerated growth, shaping the future of imaging informatics delivery.

Segments:

Based on Type:

- Vendor Neutral Archive (VNA)

- Picture Archiving and Communication System (PACS)

Based on Mode of Delivery:

- On-Premise

- Cloud-Based

- Hybrid

Based on End- User:

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Specialty Clinics

Based on Imaging Modality:

- X-ray

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Ultrasound

- Others

Based on the Geography:

- Java

- Sumatra

- Kalimantan

- Sulawesi

Regional Analysis

Java

The Java region holds the largest market share for Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) in Indonesia, accounting for approximately 60% of the total market. Java, being the most populous island and home to the nation’s capital, Jakarta, has the highest concentration of healthcare facilities, including both public and private hospitals. These institutions are at the forefront of adopting advanced imaging technologies, driven by increased demand for diagnostic services and the region’s advanced healthcare infrastructure. Additionally, Java benefits from strong government support for healthcare modernization, making it a hub for digital health initiatives and the primary market for VNA and PACS solutions in Indonesia.

Sumatra

In contrast, the Sumatra region represents a smaller, yet growing segment of the VNA and PACS market, capturing around 15% of the total market share. Sumatra’s healthcare sector has seen gradual improvements in imaging technologies, but the adoption of PACS and VNA solutions remains slower compared to Java. Key challenges include limited IT infrastructure and fewer high-tech medical facilities. However, as the regional government continues to invest in healthcare modernization and telemedicine solutions, demand for VNA and PACS technologies is expected to rise, particularly in urban centers like Medan and Palembang. This growth presents opportunities for vendors to establish a stronger presence and cater to the expanding healthcare networks in the region.

Kalimantan

The Kalimantan region, while accounting for about 10% of the overall market share, presents a unique opportunity for growth in VNA and PACS adoption. Kalimantan’s healthcare infrastructure, although not as advanced as in Java or Sumatra, is steadily expanding, driven by both public and private sector investments. The region’s challenges include logistical difficulties and limited access to specialized medical equipment in rural areas. However, the increasing need for remote diagnostics, supported by telemedicine platforms and cloud-based PACS solutions, offers a significant growth opportunity. Healthcare providers in Kalimantan are gradually adopting cloud and hybrid VNA/PACS models due to their flexibility and lower costs, providing a foundation for future market growth.

Sulawesi

The Sulawesi region captures about 5% of Indonesia’s VNA and PACS market share, reflecting slower adoption in comparison to other regions. This can be attributed to a combination of factors, including limited infrastructure, lower healthcare spending, and challenges related to medical personnel training. However, Sulawesi’s healthcare sector is showing signs of development, particularly in cities like Makassar and Manado, which are focusing on upgrading medical facilities. As regional healthcare investments continue to expand, the demand for advanced imaging technologies is anticipated to rise, offering growth potential for VNA and PACS providers. Increased adoption of cloud and hybrid models will also facilitate market expansion in this region, as remote access and scalability become key drivers.

Key Player Analysis

- Fujifilm Holdings Corporation

- INFINITT Healthcare

- Canon Medical Systems

- Konica Minolta Healthcare

- Shimadzu Corporation

- Hitachi Healthcare

- Hologic Asia-Pacific

- Carestream Health

- GE Healthcare

- Philips Healthcare

Competitive Analysis

The competitive landscape of the Indonesia Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market is dominated by both global and regional players, each striving to offer innovative solutions to meet the country’s evolving healthcare needs. Leading players in the market include Fujifilm Holdings Corporation, INFINITT Healthcare, Canon Medical Systems, Konica Minolta Healthcare, Shimadzu Corporation, Hitachi Healthcare, Hologic Asia-Pacific, Carestream Health, GE Healthcare, and Philips Healthcare. Leading players in this space offer a range of solutions tailored to the specific needs of Indonesian healthcare providers, from large hospitals to smaller clinics. Companies are focusing on enhancing their product offerings with features such as improved image quality, seamless interoperability, and cloud-based capabilities to meet the growing demand for efficient data management. To maintain a competitive edge, many companies are integrating artificial intelligence (AI) and machine learning into their PACS and VNA systems, helping healthcare professionals improve diagnostic accuracy and operational efficiency. Additionally, there is a growing trend towards offering hybrid and cloud-based solutions, which provide flexibility, scalability, and cost savings, addressing the financial constraints often faced by healthcare institutions. As healthcare infrastructure continues to evolve across Indonesia, companies are increasingly focused on offering scalable, secure, and interoperable solutions to meet the diverse needs of the market. The competitive landscape will be further shaped by the growing demand for remote access, data sharing, and long-term data storage, pushing players to innovate continually in this sector.

Recent Developments

- In March 2024, at the European Congress of Radiology in Vienna, Philips unveiled new hardware innovations, focusing on integrating artificial intelligence into their imaging solutions to enhance diagnostic accuracy and workflow efficiency.

- In February 2024, FUJIFILM Healthcare Americas Corporation announced that it’s Synapse VNA and Synapse Radiology PACS solutions (in Asia/Oceania) were ranked #1 in the 2024 Best in KLAS Awards: Software and Services. The recognition, based on insights from KLAS Research, highlights companies excelling in improving patient care through their software and services.

- In January 2024, RamSoft (Canada) launched imaging EMR solution, named OmegaAI. The solution is a cloud-native, serverless imaging EMR software platform that consolidates VNA, Enterprise Imaging, PACS, RIS, simplified image exchange/sharing, routing & storage, a zero-footprint (ZFP) viewer, unified worklist, radiology reporting, document management, peer, patient portal, and a real-time business intelligence and analytics solution.

- In November 2023, InsiteOne (US) announced to acquire BRIT Systems cloud native RIS/PACS/VNA solution to advance imaging workflows. This acquisition will continue to focus on developing cost-effective solutions that improve operational productivity while enhancing patient care.

- In July 2023, Fujifilm Sonosite joined the newly formed Medical Imaging Division under the Advanced Medical Technology Association (AdvaMed), collaborating with industry leaders to advance medical imaging technologies.

Market Concentration & Characteristics

The market concentration of Indonesia’s Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) is moderately fragmented, with a mix of global and regional players. While large multinational corporations dominate the market, offering advanced and comprehensive solutions, regional companies are increasingly gaining traction by providing cost-effective and localized offerings tailored to the needs of Indonesian healthcare providers. The characteristics of the market are shaped by the growing demand for digitalization in healthcare, driven by both public sector investments and private healthcare facility expansions. Healthcare institutions seek solutions that enhance interoperability, improve diagnostic efficiency, and enable secure data sharing across various systems and locations. Additionally, there is a clear shift towards cloud-based and hybrid solutions, as these offer scalability, remote accessibility, and reduced upfront costs. As a result, the competitive environment continues to evolve, with companies striving to provide flexible, secure, and innovative systems that address Indonesia’s unique healthcare challenges.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Mode of Delivery, End-User, Imaging Modality and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for VNA and PACS solutions in Indonesia is expected to continue growing as healthcare facilities modernize their imaging infrastructure.

- Cloud-based and hybrid VNA/PACS solutions are likely to see increased adoption due to their scalability, flexibility, and cost-effectiveness.

- Integration of artificial intelligence and machine learning in imaging workflows will enhance diagnostic accuracy and improve operational efficiency.

- The healthcare industry’s focus on data interoperability and seamless information sharing will drive demand for advanced VNA systems.

- Increased government investment in healthcare technology will create opportunities for VNA and PACS providers to expand their market presence.

- Healthcare facilities in rural and underserved areas will gradually adopt digital imaging systems, supported by remote access and telemedicine capabilities.

- The shift towards patient-centric care will encourage the implementation of VNA and PACS to ensure easy access to patient data across multiple healthcare providers.

- Data security and compliance with regulations such as HIPAA and local data protection laws will remain a critical factor for VNA and PACS adoption.

- Local players will continue to rise in prominence, offering solutions tailored to Indonesia’s unique healthcare needs and budget constraints.

- The market will witness increased collaboration between healthcare providers and technology vendors to enhance system integration and drive operational improvements.