Market Overview

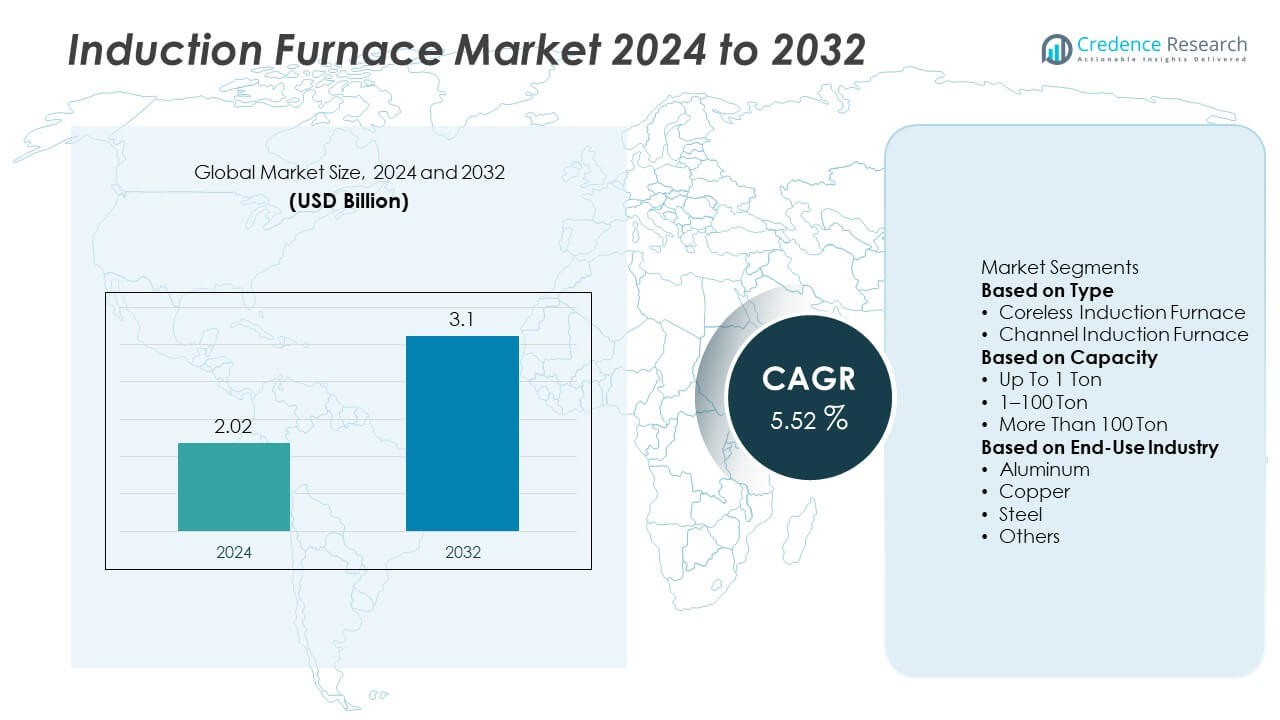

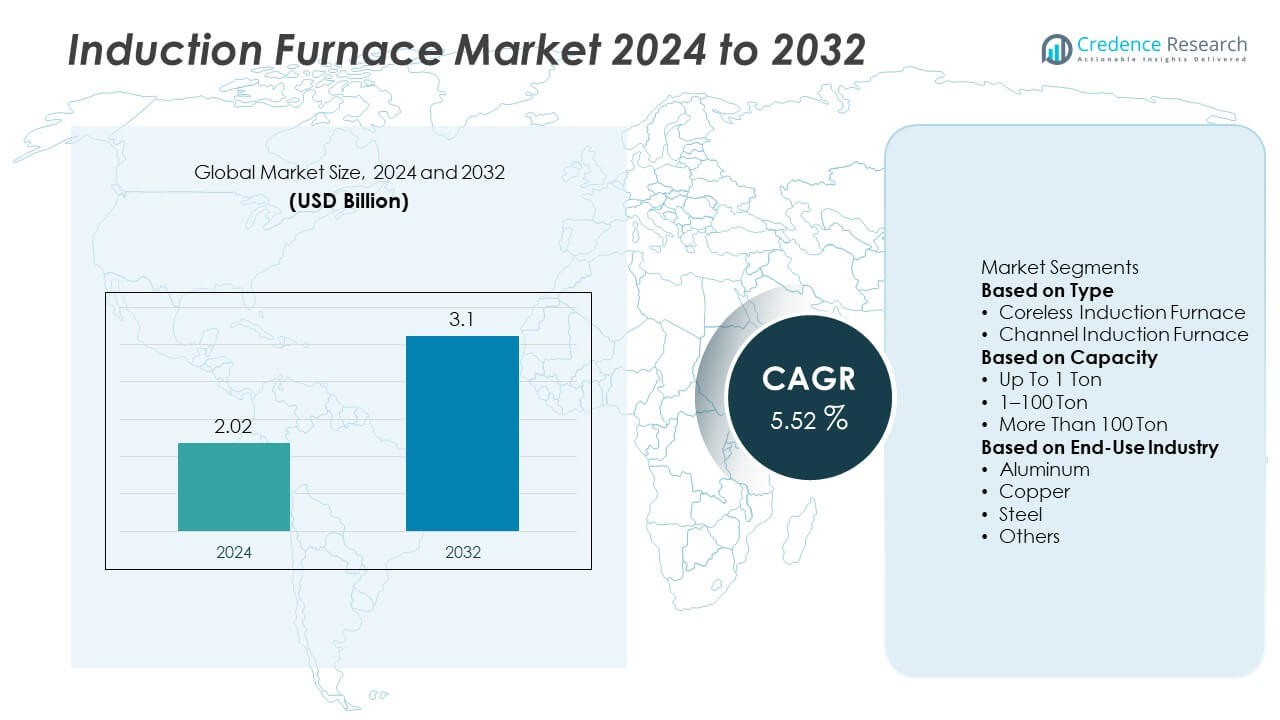

The Induction Furnace Market was valued at USD 2.02 billion in 2024 and is expected to reach USD 3.1 billion by 2032, growing at a CAGR of 5.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Induction Furnace Market Size 2024 |

USD 2.02 Billion |

| Induction Furnace Market, CAGR |

5.52% |

| Induction Furnace Market Size 2032 |

USD 3.1 Billion |

The Induction Furnace Market is led by prominent players including Inductotherm Group, Electrotherm (India) Ltd., ABP Induction Systems GmbH, OTTO JUNKER GmbH, Danieli Group, Ajax TOCCO Magnethermic Corporation, SMS Elotherm GmbH, Megatherm Electronics Pvt. Ltd., ECM Technologies, and Meltech Ltd. These companies dominate through advanced melting technologies, automation integration, and strong global distribution networks. Asia-Pacific remains the leading region with a 38.5% market share in 2024, driven by rapid industrialization, infrastructure growth, and high steel production in China and India. Europe follows with 26.7% share, supported by sustainable manufacturing and modernization initiatives, while North America holds 22.3%, driven by technological upgrades and strong demand from foundries and recyclers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Induction Furnace Market was valued at USD 2.02 billion in 2024 and is projected to reach USD 3.1 billion by 2032, growing at a CAGR of 5.52%.

- Rising demand for energy-efficient and low-emission melting systems drives adoption across steel, copper, and aluminum industries, with the steel segment holding a 71.6% share.

- Smart automation, digital controls, and IoT-enabled furnace monitoring are emerging trends improving energy use and operational safety.

- Leading players such as Inductotherm Group, Electrotherm, and ABP Induction Systems GmbH focus on product innovation, partnerships, and global expansion to strengthen competitiveness.

- Asia-Pacific leads the market with 38.5% share, followed by Europe (26.7%) and North America (22.3%), driven by industrial modernization, infrastructure growth, and increased steel recycling activities.

Market Segmentation Analysis:

By Type

The coreless induction furnace segment dominated the market in 2024 with a 67.4% share. Its dominance is attributed to superior melting speed, operational flexibility, and suitability for a wide range of metals, including steel and copper. Coreless furnaces are preferred for their efficient temperature control and faster startup compared to channel furnaces. The growing adoption of automation and digital control systems further supports demand across foundries and steel manufacturing units. The channel induction furnace segment continues to serve continuous casting and holding applications where steady operation and high energy efficiency are required.

- For instance, Inductotherm Group developed its VIP Power-Trak® series capable of melting 6,000 kg of steel per hour using a 3,000 kW power supply system. The technology integrates Precise Pour® digital controls that maintain ±5 °C temperature variation, improving consistency in molten metal quality.

By Capacity

The 1–100 ton capacity segment held the largest share of 54.1% in 2024, driven by its widespread use in medium-scale steel and alloy production. These furnaces balance melting efficiency and cost-effectiveness, making them ideal for manufacturing units requiring flexible batch operations. Growing infrastructure and automotive sector output have increased the demand for mid-range capacity units. Up to 1-ton furnaces are increasingly used in small foundries, while furnaces above 100 tons are gaining traction for large-scale steel recycling and production facilities emphasizing reduced power losses and higher yield ratios.

- For instance, Electrotherm (India) Ltd. commissioned a 40-ton medium-frequency induction furnace delivering 8,000 kW output for alloy steel production. The system achieves a melting rate of 22 tons per hour and features a closed-loop cooling circuit that reduces water use by 30 m³ per cycle.

By End-Use Industry

The steel industry segment led the market with a 71.6% share in 2024, supported by strong demand for clean, energy-efficient melting technologies in steelmaking and alloy production. Induction furnaces are widely used to produce specialty and stainless steels with precise composition control. The aluminum and copper segments also show steady growth due to rising recycling activities and lightweight material applications in transport and electrical sectors. Other end users, including precious metals and foundries, are adopting induction furnaces for consistent melting quality and low environmental impact.

Key Growth Drivers

Rising Demand for Energy-Efficient Melting Solutions

The increasing focus on energy conservation and emission reduction drives the adoption of induction furnaces. These furnaces offer higher electrical efficiency and lower carbon footprints than traditional arc furnaces. Growing government support for sustainable metal production further accelerates deployment in steel and foundry sectors. Industries prefer induction systems for their precise temperature control, faster melting cycles, and reduced operational costs, making them essential for modern manufacturing environments.

- For instance, ABP Induction Systems GmbH introduced its ECO-LINE series equipped with a 12,000 kW converter system that achieves up to 98.4% electrical efficiency. The system includes advanced heat recovery units capable of reclaiming 300 kWh per melt for reuse in plant heating.

Expansion of the Steel and Alloy Industry

The rapid expansion of the global steel and alloy industries significantly fuels induction furnace adoption. Induction furnaces provide cleaner, faster, and more uniform melting, supporting production of high-quality alloys. Rising infrastructure investments and construction activities in Asia-Pacific and the Middle East strengthen market growth. The technology’s ability to process scrap efficiently aligns with the circular economy goals of steel producers, reinforcing its market dominance.

- For instance, Danieli Group installed its “Q-ONE” digital power feeder at Shinkansai Steel’s Osaka facility, with the system operating down to 20 Hz and receiving final acceptance in 28 days.

Advancements in Automation and Digital Control Systems

The integration of automation, IoT, and digital monitoring systems enhances furnace performance and process reliability. Smart induction furnaces equipped with sensors enable real-time temperature tracking, fault detection, and predictive maintenance. These innovations improve operational safety, reduce downtime, and optimize power consumption. Manufacturers are increasingly adopting automated systems to boost productivity and quality control, driving technological advancement and fueling market growth.

Key Trends & Opportunities

Growing Use in Metal Recycling and Scrap Processing

The growing emphasis on recycling and sustainable metal production creates opportunities for induction furnaces. Their high energy efficiency and ability to process diverse scrap materials support green manufacturing goals. Rising investments in scrap-based steelmaking, particularly in China and India, promote furnace modernization and capacity expansion. This trend aligns with global initiatives aimed at reducing dependence on primary raw materials.

- For instance, modern induction furnace systems incorporate features such as advanced magnetic stirring units that ensure uniform alloy composition when melting various types of scrap. Reputable companies in the industry, like ABP Induction Systems and Inductotherm Group, supply a wide range of induction melting solutions globally

Emergence of Compact and Modular Furnace Designs

Manufacturers are developing compact and modular induction furnace systems to meet the needs of small and mid-scale foundries. These designs reduce installation space, power consumption, and maintenance costs while maintaining high melting performance. Portable configurations with improved cooling and lining materials are gaining traction. This trend supports flexible production and encourages furnace replacement across aging industrial plants.

- For instance, ABP Induction Systems GmbH offers its SMART Foundry solutions which feature various modular induction furnace options with capacities covering ranges that include 300 kg to 1,000 kg per unit (such as the FS/Smart FS series).

Key Challenges

High Initial Investment and Operating Costs

Despite their long-term efficiency benefits, induction furnaces require substantial upfront capital and maintenance investments. Smaller manufacturers often face financial constraints in adopting advanced digital and automation-integrated systems. Additionally, high electricity costs can limit profitability in regions with unstable power supply. These economic factors remain key barriers to wider market penetration, particularly in developing economies.

Limited Compatibility with Certain Metal Alloys

Induction furnaces face technical challenges when melting metals with high electrical resistivity or specific alloy compositions. Issues such as uneven heating and electromagnetic stirring can affect product quality in niche applications. The need for specialized crucibles and power tuning systems increases operational complexity. Manufacturers are investing in advanced coil designs and magnetic field control technologies to overcome these material-specific limitations.

Regional Analysis

Asia-Pacific

Asia-Pacific held the largest share of 38.5% in the induction furnace market in 2024. Strong industrialization in China, India, and South Korea drives significant demand for steel and non-ferrous metal production. Rapid urban development, infrastructure expansion, and growth in foundry industries fuel adoption across the region. Governments promoting energy-efficient manufacturing processes further support market growth. The region also benefits from local manufacturing bases, low labor costs, and increasing investment in recycling and green steel initiatives, strengthening its dominant position during the forecast period.

Europe

Europe accounted for a 26.7% share of the induction furnace market in 2024. The region’s strong focus on decarbonization and sustainable metallurgy supports rapid adoption of electric melting systems. Countries such as Germany, Italy, and the U.K. are investing in modernizing their steel production infrastructure with low-emission furnaces. Growth in automotive and aerospace manufacturing further boosts demand for high-precision alloy melting. Strict EU regulations promoting energy efficiency and circular economy practices continue to drive market expansion and technological innovation in the regional furnace manufacturing sector.

North America

North America captured a 22.3% share of the induction furnace market in 2024. The region’s growth is driven by increasing steel recycling rates and modernization of foundry operations. The United States leads due to strong demand for specialty alloys and electric arc alternatives in industrial manufacturing. Technological advancements and higher investments in smart, digitally controlled furnaces enhance operational efficiency. Additionally, ongoing infrastructure renewal projects and automotive sector recovery stimulate furnace installations, especially across medium and large-capacity categories in the region.

Middle East & Africa

The Middle East & Africa region accounted for a 7.2% share in 2024, supported by rising industrial diversification and growing non-oil sector investment. Rapid infrastructure expansion in Saudi Arabia, the UAE, and South Africa creates strong demand for steel and metal foundries. The shift toward localized manufacturing and green industrialization initiatives further accelerates furnace adoption. Governments are focusing on enhancing domestic production capacity through technology partnerships, promoting long-term market stability and moderate growth in the coming years.

Latin America

Latin America held a 5.3% share of the induction furnace market in 2024. The region’s growth is primarily led by Brazil, Mexico, and Argentina, supported by growing industrial and construction activities. Increasing demand for cost-efficient steel and aluminum recycling solutions boosts furnace adoption. Manufacturers are investing in mid-capacity induction systems to enhance production efficiency and reduce environmental impact. Supportive policies encouraging industrial modernization and renewable energy integration are expected to create new opportunities across the region’s metal and foundry sectors.

Market Segmentations:

By Type

- Coreless Induction Furnace

- Channel Induction Furnace

By Capacity

- Up To 1 Ton

- 1–100 Ton

- More Than 100 Ton

By End-Use Industry

- Aluminum

- Copper

- Steel

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Induction Furnace Market is characterized by the strong presence of key players such as Inductotherm Group, Electrotherm (India) Ltd., ABP Induction Systems GmbH, OTTO JUNKER GmbH, Danieli Group, Megatherm Electronics Pvt. Ltd., Meltech Ltd., Ajax TOCCO Magnethermic Corporation, ECM Technologies, and SMS Elotherm GmbH. These companies focus on technological advancements, energy efficiency, and automation to enhance furnace performance and reduce operational costs. Many players are investing in smart induction systems with digital monitoring and IoT-enabled control for precise melting. Strategic partnerships, capacity expansions, and product customization for steel and non-ferrous applications remain key competitive strategies. Additionally, regional manufacturers are strengthening their positions by offering localized services and cost-efficient systems, while global leaders continue to expand their footprint through mergers, collaborations, and R&D initiatives focused on sustainability and emission reduction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Inductotherm Group

- Electrotherm (India) Ltd.

- ABP Induction Systems GmbH

- Megatherm Electronics Pvt. Ltd.

- OTTO JUNKER GmbH

- Danieli Group

- Meltech Ltd.

- Ajax TOCCO Magnethermic Corporation

- ECM Technologies

- SMS Elotherm GmbH

Recent Developments

- In October 2025, ABP Induction Systems GmbH announced that it will supply two high-performance medium-frequency induction furnaces of the IFM9 type, featuring a TWIN-POWER® energy system delivering 14,000 kW.

- In September 2025, OTTO JUNKER GmbH confirmed that its JUPITER BOXLine melting plant was commissioned at a foundry in Poland, achieving a melting capacity of 750 kg and melting rate of ~1 200 kg/hr, with specific energy consumption of 549 kWh/ton for steel at 1 600 °C.

- In 2024, ABP Induction reported that its client Saint‑Gobain PAM’s foundry in Foug, France, commenced conversion from a cupola furnace to an induction furnace system. The project aims to reduce CO₂ emissions by 62% and water consumption by 80%.

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady expansion driven by the shift to energy-efficient melting technologies.

- Rising steel and alloy production will remain the core driver of induction furnace installations.

- Automation and digital integration will enhance furnace performance, monitoring, and predictive maintenance.

- Adoption of green and electric-based metallurgy will increase due to sustainability mandates.

- Manufacturers will invest more in compact, modular, and easy-to-maintain furnace systems.

- Asia-Pacific will retain its dominance due to rapid industrialization and infrastructure projects.

- Europe will expand with growing demand for low-emission and smart melting solutions.

- North America will focus on modernization of foundries and increased steel recycling rates.

- Strategic collaborations and technological upgrades will strengthen global competitiveness.

- Continuous R&D in coil design and energy recovery systems will boost future efficiency gains.