Market Overview:

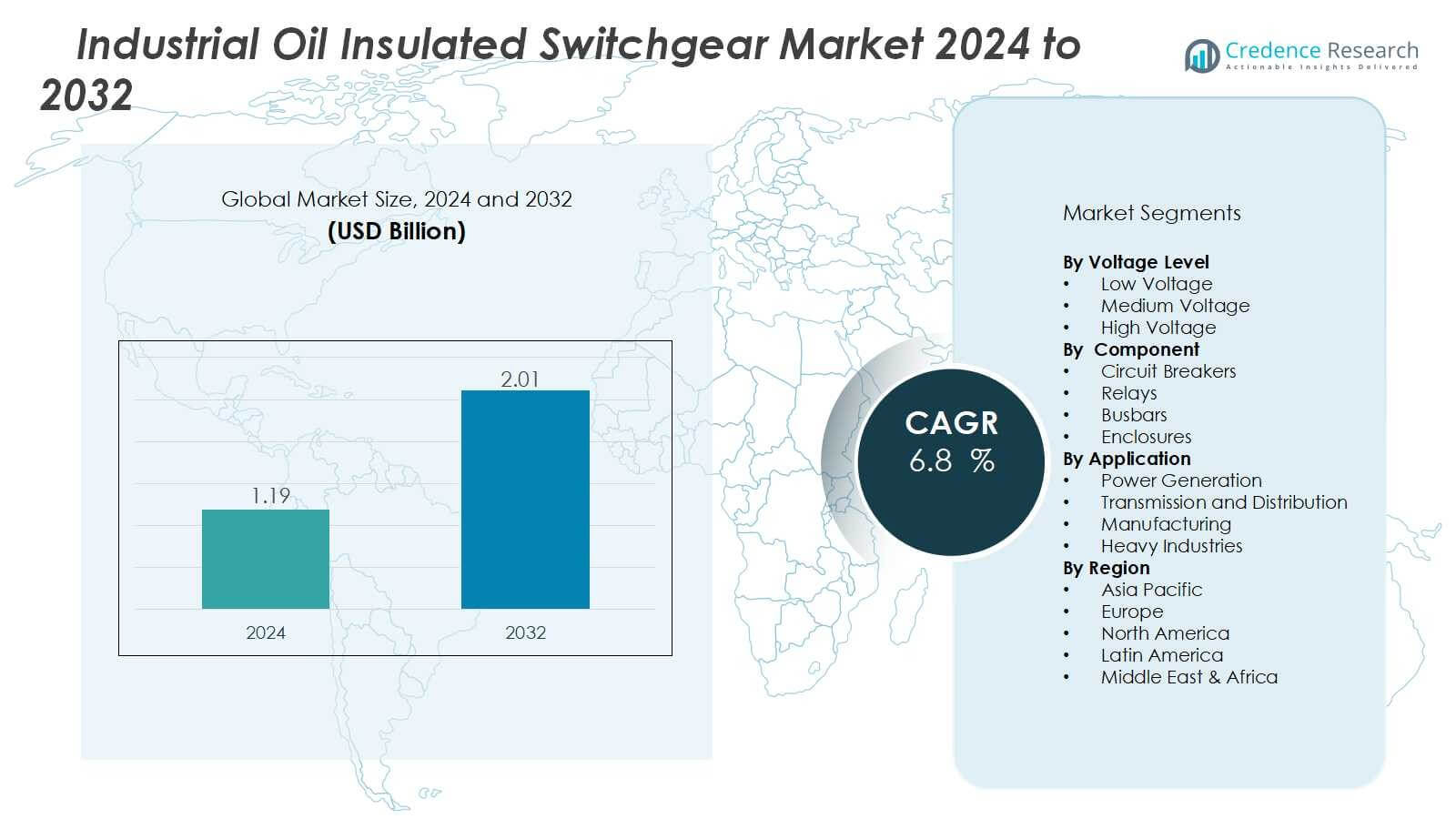

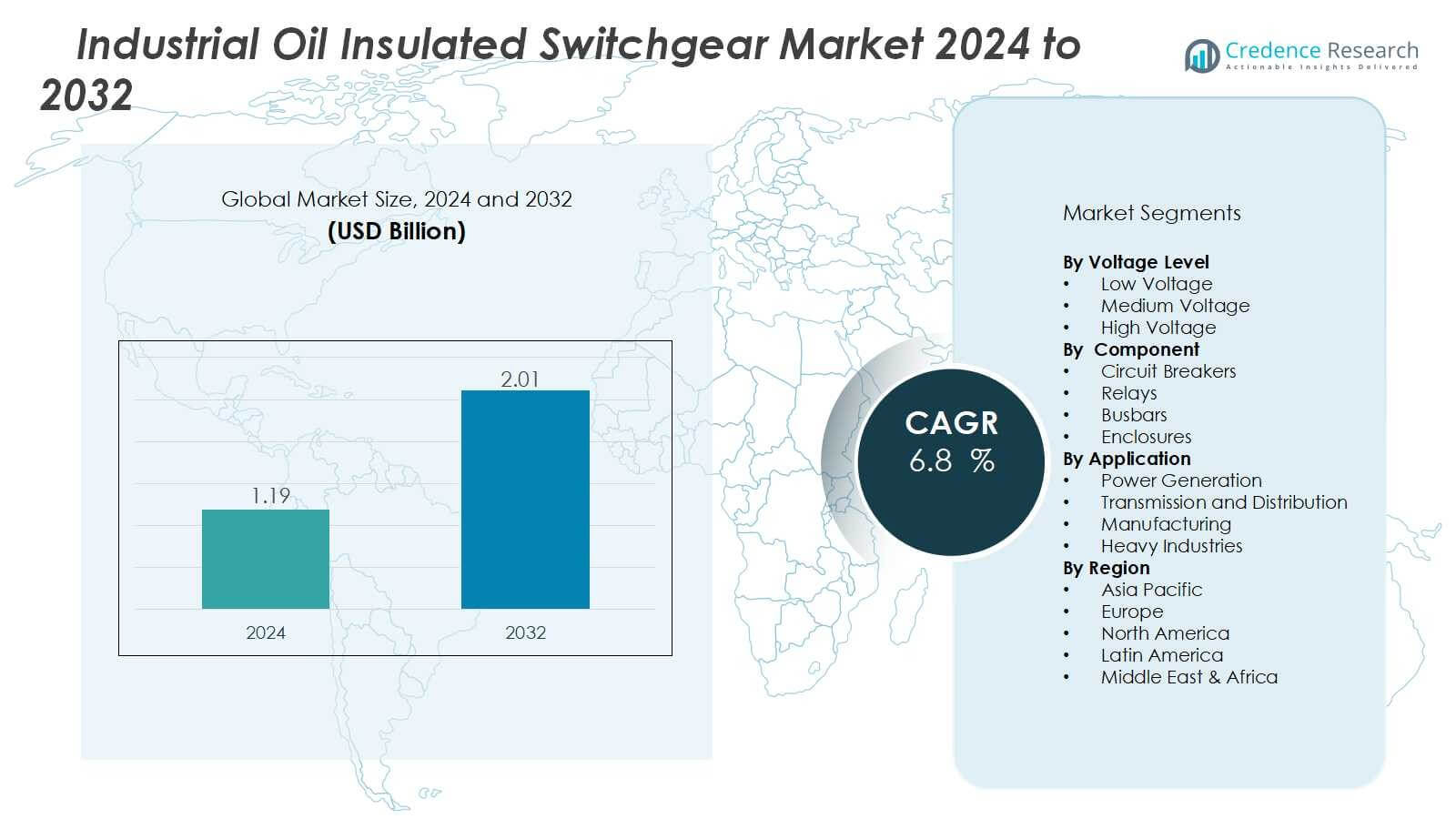

The industrial oil insulated switch gear market size was valued at USD 1.19 billion in 2024 and is anticipated to reach USD 2.01 billion by 2032, at a CAGR of 6.8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Oil Insulated Switchgear Market Size 2024 |

USD 1.19 Billion |

| Industrial Oil Insulated Switchgear Market, CAGR |

6.8% |

| Industrial Oil Insulated Switchgear Market Size 2032 |

USD 2.01 Billion |

Market growth is fueled by several drivers. Growing industrialization and urbanization are pushing the need for secure and efficient electrical networks. The ability of oil insulated switchgear to provide high dielectric strength and effective arc-quenching makes it a preferred choice in heavy-duty applications. Rising energy demand, integration of renewable energy, and stricter safety standards further accelerate adoption. Moreover, ongoing technological improvements focused on enhancing reliability and reducing maintenance costs are encouraging replacement and upgrade activities.

Regionally, Asia-Pacific dominates the industrial oil insulated switchgear market, supported by large-scale industrial growth and power infrastructure development in China, India, and Southeast Asia. Europe follows, backed by strong grid modernization programs and renewable energy integration. North America holds a significant share due to upgrades in transmission and distribution networks, while the Middle East, Africa, and Latin America show emerging opportunities through industrial expansion and electrification initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The industrial oil insulated switchgear market was valued at USD 1.19 billion in 2024 and is expected to reach USD 2.01 billion by 2032.

- Rising energy demand and expanding industrialization are driving adoption in heavy-duty applications.

- It provides high dielectric strength and strong arc-quenching, ensuring safety and reliability in power distribution.

- Aging infrastructure upgrades in developed regions create steady demand for replacements and modernization.

- Integration of renewable power sources such as solar and wind boosts installation of oil insulated systems.

- Strict safety regulations push industries to adopt switchgear that ensures worker safety and operational stability.

- The market faces competition from gas-insulated and vacuum switchgear due to eco-friendly features and lower maintenance.

- High installation and maintenance costs combined with environmental risks linked to oil handling present ongoing challenges.

Market Drivers:

Market Drivers:

Rising Energy Demand and Expanding Industrialization:

The industrial oil insulated switchgear market benefits from rising global energy consumption and rapid industrial expansion. Growing urban populations and large-scale manufacturing require stable power distribution systems. Oil insulated switchgear provides reliable performance in high-voltage environments, making it vital for heavy industries. It plays a central role in maintaining uninterrupted power supply for industrial plants and commercial facilities.

- For instance, Mitsubishi Electric Corporation has been promoting compact medium-voltage switchgear utilizing environmentally friendly vacuum and dry-air insulation technology, with a focus on SF6-free solutions.

Modernization of Aging Power Infrastructure :

Aging transmission and distribution infrastructure across developed regions drives steady demand for oil insulated switchgear. Utilities and industries are upgrading outdated systems to improve efficiency and reduce downtime. It offers high dielectric strength and strong arc-quenching capability, ensuring safer operations. Replacement projects in power plants and substations support market growth by creating continuous opportunities for new installations.

- For Instance, In May 2019, Siemens Gas and Power announced they would supply the UK’s first “clean air” insulated 145 kV high-voltage circuit breakers for Scotland’s Dunbeath substation upgrade.

Integration of Renewable Energy Sources:

The growing integration of renewable power sources supports expansion in the industrial oil insulated switchgear market. Solar and wind projects require durable, high-capacity switchgear to manage fluctuating loads and grid stability. Oil insulated systems provide the performance needed for high-voltage transmission in renewable-heavy grids. It enables effective management of distributed generation, ensuring reliable power flow across networks.

Regulatory Standards and Safety Requirements:

Strict government regulations on electrical safety and reliability push industries to adopt advanced switchgear systems. Oil insulated switchgear is favored for its robust insulation and proven ability to handle critical faults. Compliance with safety standards drives investments in reliable equipment across multiple sectors. It remains a preferred option for industries prioritizing worker safety, operational stability, and reduced downtime.

Market Trends:

Growing Focus on Grid Modernization and Smart Power Infrastructure:

The industrial oil insulated switchgear market is shaped by the global shift toward modern and resilient grid systems. Governments and utilities are investing in advanced transmission and distribution networks to support rising electricity demand. Oil insulated switchgear remains relevant in this transformation because of its strong insulation performance and ability to handle high-voltage loads. It is being deployed in both new installations and refurbishment projects where long service life is required. The trend toward digitization also supports the integration of monitoring solutions within switchgear units. Utilities and industrial operators aim to enhance real-time fault detection and reduce downtime through smarter equipment. This movement keeps oil insulated switchgear a reliable option for mission-critical applications.

- For instance, GE Grid Solutions’ MIG II partial discharge monitor, when integrated into oil-insulated switchgear units, captures eight waveform samples per cycle and retains a 24-cycle oscillography record for each detected event.

Sustainability Initiatives and Rising Demand from Emerging Economies:

Sustainability targets are influencing equipment choices, creating pressure for eco-friendly power systems across industries. While oil insulated switchgear faces competition from alternative technologies, demand persists in sectors that value its durability and proven reliability. It continues to hold importance in regions where infrastructure development is rapid and budgets are limited. Emerging economies across Asia-Pacific, Africa, and Latin America are driving installations for industrial plants, commercial hubs, and utility networks. The growing push to expand renewable power generation also supports new switchgear demand in these areas. Industrial operators in these markets prefer robust and cost-effective systems to ensure reliable power distribution. This trend strengthens the presence of oil insulated switchgear in global infrastructure projects.

- For Instance, ABB’s UniGear ZS1 switchgear is air-insulated, not oil-insulated, and over 500,000 panels have been installed worldwide, surpassing previous figures.

Market Challenges Analysis:

Rising Competition from Alternative Switchgear Technologies:

The industrial oil insulated switchgear market faces challenges from the growing adoption of alternative technologies. Gas-insulated and vacuum switchgear are gaining popularity due to compact design, reduced maintenance, and lower environmental impact. Oil insulated systems, while reliable, require regular servicing and pose concerns over oil leakage. It increases operational costs and creates stricter compliance requirements for industries. Customers in advanced markets prefer modern, eco-friendly solutions, reducing demand for oil-based systems. This shift pressures manufacturers to innovate and differentiate in a highly competitive environment.

High Installation and Maintenance Costs with Environmental Concerns:

Cost remains a critical barrier in expanding oil insulated switchgear usage. The installation process is resource-intensive, and ongoing maintenance adds to the overall expense. It limits adoption in regions with tight budgets or in projects seeking low lifecycle costs. Environmental risks tied to oil handling also create regulatory challenges for operators. Stricter standards on sustainability are encouraging industries to evaluate alternatives. The industrial oil insulated switchgear market must address these issues to maintain competitiveness in evolving global power infrastructure.

Market Opportunities:

Expanding Infrastructure Development and Industrialization in Emerging Economies:

The industrial oil insulated switchgear market holds strong opportunities in rapidly developing regions. Large-scale infrastructure projects across Asia-Pacific, Africa, and Latin America are driving demand for reliable power distribution systems. Industrial growth in sectors such as manufacturing, mining, and oil and gas further supports adoption. Oil insulated switchgear is often preferred in these areas due to its durability and proven performance in high-voltage applications. It provides cost-effective solutions for industries seeking reliable and long-lasting equipment. Growing urbanization and government-backed electrification programs are expected to create consistent demand for switchgear in these markets.

Renewable Energy Expansion and Upgrades to Power Networks:

Global investment in renewable energy generation provides new opportunities for switchgear deployment. Solar and wind projects require robust systems to manage high-voltage transmission and maintain grid stability. The industrial oil insulated switchgear market benefits by supplying reliable solutions for these applications. It remains essential for regions where renewable power is integrated into existing grids with limited modernization. Replacement and upgrade of aging power infrastructure in Europe and North America also expand prospects for oil insulated systems. Rising focus on grid resilience and operational reliability creates long-term opportunities for switchgear manufacturers.

Market Segmentation Analysis:

By Voltage Level:

The industrial oil insulated switchgear market is segmented into low voltage, medium voltage, and high voltage categories. Medium voltage dominates usage due to its suitability for industrial plants, distribution networks, and commercial facilities. High voltage units are widely used in transmission projects and large-scale power infrastructure. Low voltage equipment serves specialized applications where compact systems are required. It remains a critical choice for industries seeking reliable insulation in demanding environments.

- For instance, ABB’s medium voltage switchgear solutions are designed to enhance system stability and operational efficiency, with advanced protection technology supporting integration into smart grids. Specific ABB product lines already have hundreds of thousands of installations worldwide, far exceeding the 10,000 figure mentioned.

By Component:

Key components include circuit breakers, relays, busbars, and enclosures. Circuit breakers hold a major share, driven by their role in ensuring fault protection and system safety. Relays support automation and control functions, making them essential for efficient operations. Busbars enable safe current distribution across systems, while enclosures provide durability and protection. It supports end users by offering a complete solution that combines safety and performance.

- For instance, CG Power and Industrial Solutions Limited developed and supplied Ultra High Voltage 765kV SF6 gas circuit breakers and launched vacuum interrupter railway trackside circuit breakers in FY2023, highlighting advanced fault protection for power systems.

By Application:

Applications span power generation, transmission and distribution, manufacturing, and heavy industries. Transmission and distribution networks remain the largest segment, driven by ongoing grid expansion and modernization. Power generation projects, including renewable energy integration, contribute significantly to demand. Manufacturing and heavy industries depend on switchgear for operational stability and safety. It continues to provide robust solutions for diverse end-user requirements across critical sectors.

Segmentations:

By Voltage Level:

- Low Voltage

- Medium Voltage

- High Voltage

By Component:

- Circuit Breakers

- Relays

- Busbars

- Enclosures

By Application:

- Power Generation

- Transmission and Distribution

- Manufacturing

- Heavy Industries

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific holds 42% market share in the industrial oil insulated switchgear market in 2024. China, India, and Southeast Asia drive this dominance through rapid industrialization and large-scale infrastructure expansion. The region benefits from strong government investments in power generation and grid reliability. Oil insulated switchgear is widely deployed in industrial hubs, mining projects, and commercial networks. It remains essential for high-voltage distribution in areas where durable equipment is prioritized. Rising demand from renewable energy projects further supports long-term adoption. Emerging economies in this region are expected to maintain strong momentum throughout the forecast period.

Europe:

Europe accounts for 27% market share in the industrial oil insulated switchgear market in 2024. The region’s demand is supported by extensive grid modernization programs and renewable energy expansion. Countries such as Germany, France, and the UK are upgrading existing transmission and distribution networks to ensure resilience. Oil insulated switchgear continues to play a role in projects requiring proven insulation performance and arc-quenching capacity. It is deployed across industrial facilities and substations where reliability is critical. Strong regulatory standards for safety and energy efficiency also sustain equipment replacement cycles. The region maintains steady growth through long-term investments in modern power infrastructure.

North America:

North America holds 19% market share in the industrial oil insulated switchgear market in 2024. Growth is driven by replacement of aging power infrastructure and increasing electricity demand across industries. The United States leads adoption, supported by investments in renewable integration and transmission upgrades. Oil insulated switchgear is utilized in heavy-duty sectors such as oil and gas, manufacturing, and utilities. It provides dependable high-voltage performance for industries requiring continuous and stable power supply. Government focus on grid resilience and modernization supports future deployment. Canada and Mexico also contribute through industrial expansion and regional electrification efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nissin Electric

- Mitsubishi Electric

- Siemens

- Powell Industries

- Hyundai Electric Energy Systems

- Hitachi

- General Electric

- Schneider Electric

- Eaton

- Megger

- ABB

Competitive Analysis:

The industrial oil insulated switchgear market is highly competitive, with global and regional players focusing on product reliability, safety, and innovation. Leading companies such as Nissin Electric, Mitsubishi Electric, Siemens, Powell Industries, Hyundai Electric Energy Systems, and Hitachi drive advancements in design and efficiency. It is shaped by strong competition where firms invest in R&D to enhance performance and extend product life cycles. Strategic partnerships, acquisitions, and project-based collaborations remain common strategies to secure large-scale contracts. Established players leverage global networks to expand into emerging economies, while regional firms compete through cost-effective solutions and local expertise. The market demands differentiation through technology, compliance with safety standards, and aftersales support. It is expected that continuous modernization of power infrastructure will create growth opportunities, compelling manufacturers to balance innovation with affordability while maintaining strong service offerings.

Recent Developments:

- In June 2025, Nissin Electric started demonstration operations of India’s first micro substation using advanced transformer technology in cooperation with Tata Power-DDL on the outskirts of Delhi, aiming to provide stable electricity and reduce CO2 emissions by 45% compared to diesel generators.

- In August 2025, Powell Industries announced a $12.4 million investment to expand production capacity by 62% at its Jacintoport manufacturing facility in Houston, supporting growth in oil & gas and other industrial sectors.

Report Coverage:

The research report offers an in-depth analysis based on Voltage Level, Component, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The industrial oil insulated switchgear market will continue to benefit from rising industrialization and urbanization.

- It will see steady demand from heavy industries that require reliable high-voltage power distribution.

- Global infrastructure development projects will create strong opportunities in emerging economies.

- Renewable energy integration will support installations where high-capacity transmission systems are required.

- It will face competitive pressure from vacuum and gas-insulated alternatives with eco-friendly features.

- Upgrades of aging power grids in developed markets will sustain replacement demand.

- Strict safety regulations will encourage industries to adopt reliable oil insulated systems.

- Technological improvements focused on reducing maintenance will strengthen product appeal.

- Energy-intensive sectors such as mining, oil and gas, and manufacturing will remain major users.

- It will maintain relevance in projects where durability and proven performance are prioritized.

Market Drivers:

Market Drivers: