Market Overview

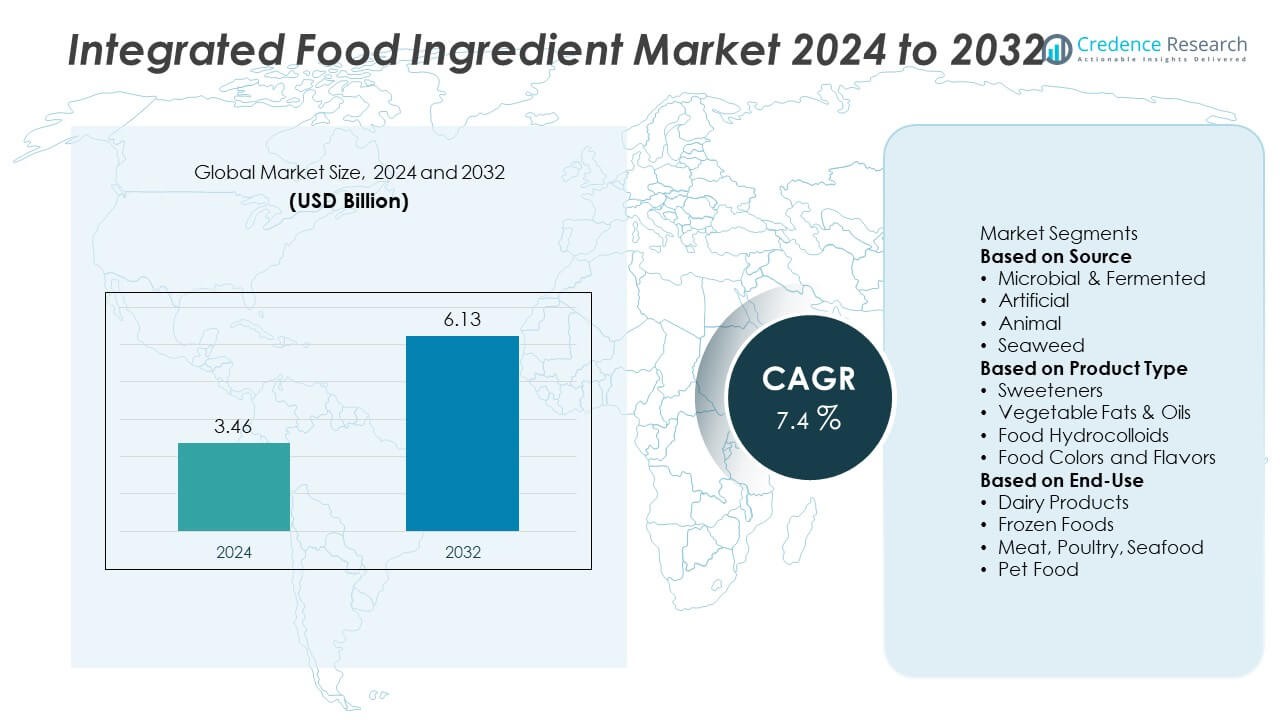

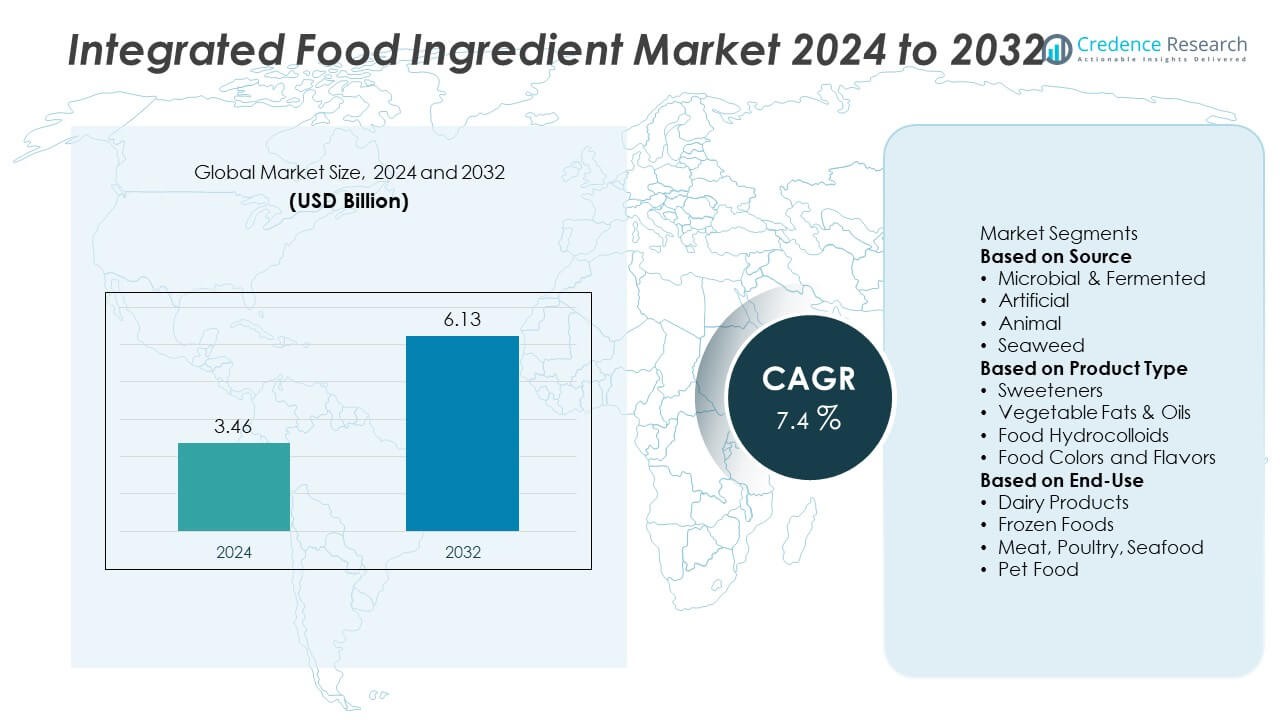

The global integrated food ingredient market was valued at USD 3.46 billion in 2024 and is projected to reach USD 6.13 billion by 2032, growing at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Integrated Food Ingredient Market Size 2024 |

USD 3.46 Billion |

| Integrated Food Ingredient Market, CAGR |

7.4% |

| Integrated Food Ingredient Market Size 2032 |

USD 6.13 Billion |

The integrated food ingredient market is led by key players including Kerry Group, BASF SE, Symrise, Archer Daniels Midland Company, Tate & Lyle PLC, Firmenich SA, Koninklijke DSM N.V., International Flavors & Fragrances Inc., Cargill Incorporated, and E. I. du Pont de Nemours and Company. These companies focus on delivering clean-label, natural, and functional ingredient solutions to meet rising demand for fortified and health-oriented foods. North America held the largest share with 34% in 2024, driven by high consumption of processed and functional foods, followed by Europe with 30% share and Asia-Pacific with 26%, supported by rapid food processing industry growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The integrated food ingredient market was valued at USD 3.46 billion in 2024 and is projected to reach USD 6.13 billion by 2032, growing at a CAGR of 7.4%.

- Rising demand for clean-label and functional ingredients is driving adoption of microbial and plant-based sources across bakery, dairy, and beverage applications.

- Key trends include innovation in fermentation technology, growth of plant-based proteins, and development of natural flavors, colors, and sugar reduction systems to meet health-conscious consumer preferences.

- The market is competitive with leading players such as Kerry Group, BASF SE, Symrise, ADM, and Cargill focusing on R&D, sustainability, and portfolio expansion to strengthen their global presence.

- North America held 34% share in 2024, followed by Europe with 30% and Asia-Pacific with 26%, while microbial and fermented sources dominated with over 40% share due to their use in clean-label and fortified product formulations.

Market Segmentation Analysis:

By Source

Microbial & fermented sources dominated the integrated food ingredient market with over 40% share in 2024, driven by rising demand for natural, clean-label ingredients that enhance texture, flavor, and nutritional value. Fermentation-derived ingredients such as enzymes, probiotics, and organic acids are widely used in dairy, bakery, and beverage applications. Their ability to improve shelf life and offer functional benefits without synthetic additives is fueling adoption. Growing consumer preference for sustainable and plant-based products further supports the use of microbial fermentation as a reliable and scalable source in ingredient manufacturing.

- For instance, Novonesis, the company formed by the merger of Chr. Hansen and Novozymes in January 2024, delivers a wide array of fermentation-derived natural food ingredients, such as probiotics, cultures, and enzymes, to dairy and beverage manufacturers seeking clean-label solutions.

By Product Type

Sweeteners led the market, capturing around 35% share in 2024, supported by growing demand for natural and low-calorie sugar alternatives. The shift toward healthier diets and rising prevalence of lifestyle diseases like diabetes are driving adoption of integrated sweetening systems in beverages, dairy products, and bakery applications. Innovations in natural sweeteners such as stevia and monk fruit are further boosting growth. Food hydrocolloids and flavors also see strong traction as they enhance product texture, stability, and sensory appeal across multiple food categories.

- For instance, Tate & Lyle launched a new campaign for its “all-Americas sourced” stevia Reb M, developed in partnership with Manus. This alliance, announced in October 2024, supports customer demand for clean-label and low-calorie product formulations in the North American beverage and bakery segments by providing a reliable and traceable supply chain.

By End-Use

Dairy products accounted for over 30% share in 2024, making it the largest end-use segment for integrated food ingredients. Manufacturers use emulsifiers, hydrocolloids, and flavor systems to improve mouthfeel, extend shelf life, and maintain product consistency in milk, cheese, yogurt, and ice cream. The growing popularity of functional dairy, such as probiotic-rich yogurt and fortified milk, further supports demand. Frozen foods and meat applications follow closely, with integrated ingredients used to enhance taste, texture, and preservation, meeting consumer demand for convenience and high-quality packaged foods.

Key Growth Drivers

Rising Demand for Clean-Label and Natural Ingredients

Consumers are increasingly seeking clean-label products made with natural, recognizable ingredients. This demand is driving food manufacturers to integrate microbial and plant-based ingredients that enhance nutritional value while avoiding artificial additives. Natural sweeteners, hydrocolloids, and plant-based colors are gaining traction across bakery, dairy, and beverage applications. Regulatory support for transparent labeling and growing health awareness further fuel this shift. As a result, manufacturers are reformulating products to meet consumer expectations for sustainability, safety, and transparency, strengthening market adoption of integrated food ingredients globally.

- For instance, Symrise reported achieving significant sales growth in 2024, reporting 8.7% organic growth to around €5 billion, and confirming continued investments in its pet food business, including the inauguration of a new production facility for palatants in Brazil during August 2023. The company had sold its natural food coloring business to Oterra back in 2021.

Growth of Functional and Fortified Foods

The popularity of functional foods enriched with vitamins, minerals, probiotics, and fibers is a major growth driver. Integrated food ingredients play a crucial role in fortification by improving texture, taste, and stability of these products. Rising prevalence of chronic diseases and consumer interest in preventive health are encouraging food manufacturers to innovate with functional formulations. Demand for fortified dairy, snacks, and beverages is surging, especially in urban markets, creating opportunities for ingredient suppliers to offer tailored solutions that address nutrition and convenience in a single product.

- For instance, DSM-Firmenich is a key supplier of probiotic cultures for the yogurt and functional beverage markets globally, drawing on its worldwide network of facilities and specialized R&D hubs, including in Switzerland. In 2024, the company continued to invest in its “Health from the Gut” portfolio, launching new innovations for probiotics and gut health.

Expansion of Processed and Convenience Food Sector

Busy lifestyles and urbanization are boosting demand for processed and ready-to-eat foods globally. Integrated food ingredients help improve shelf life, enhance flavor, and maintain consistency in packaged meals, frozen foods, and snacks. Manufacturers use emulsifiers, stabilizers, and flavor systems to meet consumer expectations for taste and texture. The rising influence of modern retail formats and e-commerce food delivery is further supporting growth. As consumption of packaged foods expands in emerging economies, ingredient suppliers are scaling production to meet growing demand and ensure reliable supply chains.

Key Trends & Opportunities

Adoption of Plant-Based and Sustainable Ingredients

The plant-based food trend is creating opportunities for integrated ingredient suppliers to develop sustainable alternatives to animal-derived components. Plant proteins, natural colors, and vegetable-based emulsifiers are increasingly used in dairy alternatives, meat substitutes, and functional beverages. Companies are investing in eco-friendly ingredient production methods and sourcing practices to meet sustainability goals. This trend aligns with growing consumer awareness of environmental impact, offering manufacturers a competitive edge by addressing both health and ethical considerations in product development.

- For instance, ADM utilizes sustainable sourcing and processing technologies for its plant-based proteins, the company has scaled back its protein expansion plans in 2023 due to market shifts and lower-than-expected demand from alternative dairy and meat substitute manufacturers.

Innovation in Fermentation and Biotechnology

Advances in fermentation technology are enabling production of highly functional ingredients, including precision-fermented proteins, enzymes, and bioactive compounds. These innovations enhance flavor, texture, and nutritional profiles while supporting clean-label claims. Biotechnology also facilitates cost-effective production and scalability, reducing reliance on traditional farming inputs. Ingredient suppliers are collaborating with food tech startups to commercialize novel solutions for alternative proteins, dairy enhancers, and low-sugar products, opening new growth avenues in specialty and functional food categories.

- For instance, Firmenich’s parent company, dsm-firmenich, is scheduled to complete an expansion of its seasoning plant in Kerala, India, which will add 15,000 metric tons of annual output capacity.

Key Challenges

High Production and Reformulation Costs

Developing integrated food ingredients that meet clean-label, functional, and sensory requirements involves significant R&D investment. Reformulating existing products to include natural or sustainable ingredients can increase production costs, impacting profit margins. Small and medium food manufacturers often face financial barriers to adopting these solutions. Ingredient suppliers must focus on offering cost-effective, scalable options that deliver consistent performance without compromising affordability for end-users, particularly in price-sensitive markets.

Regulatory and Supply Chain Complexities

Compliance with diverse international food safety and labeling regulations poses challenges for ingredient manufacturers. Variability in standards across regions can delay product launches and increase operational complexity. Additionally, fluctuations in raw material supply, particularly for natural ingredients like plant extracts and seaweed, affect availability and pricing. Ensuring consistent quality and secure sourcing while maintaining transparency throughout the supply chain is crucial to meeting regulatory and consumer expectations in the integrated food ingredient market.

Regional Analysis

North America

North America held 34% share of the integrated food ingredient market in 2024, driven by strong demand for clean-label and fortified food products. The U.S. leads adoption, with manufacturers using natural sweeteners, hydrocolloids, and flavors to meet consumer preference for healthier, minimally processed foods. Growth in functional beverages, plant-based dairy alternatives, and ready-to-eat meals supports market expansion. Canada contributes with increasing investments in food innovation and government programs promoting healthy eating. The presence of major ingredient suppliers and advanced food processing infrastructure strengthens the region’s position as a key hub for integrated ingredient innovation and product development.

Europe

Europe accounted for 30% share in 2024, supported by stringent regulations promoting clean-label and natural food solutions. Countries such as Germany, France, and the U.K. are leading adopters of microbial and plant-based ingredients to enhance transparency and sustainability. Rising consumer focus on organic, vegan, and fortified products is driving demand for natural flavors, colors, and emulsifiers. The European food industry is investing in reformulation to meet health targets such as sugar reduction and nutritional improvement. Supportive government initiatives and growing retail sales of premium and functional foods further fuel the adoption of integrated food ingredients across the region.

Asia-Pacific

Asia-Pacific captured 26% share in 2024 and is the fastest-growing region due to expanding food processing industries and rising disposable incomes. China, India, and Southeast Asian countries are witnessing growing demand for packaged and functional foods, driving ingredient usage. Urbanization and changing dietary habits are increasing consumption of fortified dairy, convenience meals, and bakery products. Local manufacturers are investing in cost-effective natural and microbial ingredients to meet consumer demand for health-focused products. Supportive government policies encouraging domestic production and food quality standards further boost market growth, positioning Asia-Pacific as a key contributor to future industry expansion.

Middle East & Africa

The Middle East & Africa held 6% share in 2024, with growth fueled by increasing demand for processed and convenience foods. Gulf countries such as Saudi Arabia and UAE are adopting integrated ingredients to enhance bakery, dairy, and beverage offerings, catering to urban consumers. Rising health awareness and demand for fortified products are driving innovation in flavors, emulsifiers, and nutritional additives. In Africa, food manufacturers are gradually adopting integrated solutions to improve shelf life and product quality. Ongoing investment in food manufacturing infrastructure and retail expansion supports market penetration across both premium and mass-market segments.

Latin America

Latin America accounted for 4% share in 2024, with Brazil and Mexico leading adoption of integrated food ingredients across dairy, bakery, and frozen food sectors. Rising consumer interest in health-oriented products and fortified foods is driving demand for natural sweeteners, hydrocolloids, and plant-based flavors. Local food processors are expanding production capacity to cater to growing demand for convenience and packaged foods. Government initiatives to improve nutritional quality in processed foods, coupled with expansion of modern retail formats, are supporting steady market growth. Economic development and urbanization are further boosting consumption of innovative and value-added food products.

Market Segmentations:

By Source

- Microbial & Fermented

- Artificial

- Animal

- Seaweed

By Product Type

- Sweeteners

- Vegetable Fats & Oils

- Food Hydrocolloids

- Food Colors and Flavors

By End-Use

- Dairy Products

- Frozen Foods

- Meat, Poultry, Seafood

- Pet Food

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the integrated food ingredient market is dominated by major players such as Kerry Group, BASF SE, Symrise, Archer Daniels Midland Company, Tate & Lyle PLC, Firmenich SA, Koninklijke DSM N.V., International Flavors & Fragrances Inc., Cargill Incorporated, and E. I. du Pont de Nemours and Company. These companies focus on developing innovative, clean-label, and functional ingredient solutions that enhance flavor, texture, and nutritional value across multiple food categories. Strategies include expanding production facilities, forming strategic partnerships with food manufacturers, and investing heavily in R&D to create sustainable and cost-efficient solutions. Players are also reformulating product portfolios to address rising demand for plant-based proteins, natural colors, and sugar reduction systems. The market is competitive, with differentiation driven by technological expertise, global distribution capabilities, and strong customer relationships. Companies are increasingly targeting emerging markets and enhancing supply chain resilience to capture growing demand for fortified and value-added foods.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kerry Group

- BASF SE

- Symrise

- Archer Daniels Midland Company

- Tate & Lyle PLC

- Firmenich SA

- Koninklijke DSM N.V.

- International Flavors & Fragrances Inc.

- Cargill, Incorporated

- I. du Pont de Nemours and Company

Recent Developments

- In June 2025, Firmenich announced a major investment in expanding its plant-based flavor and functional blends production facility in Parma, Italy, set to increase capacity by 25%, aimed at meeting rising demand for clean-label and plant-based integrated food ingredients.

- In March 2025, Cargill expanded its proprietary food stabilizer blends for bakery and dairy applications by 18%, increasing production capacity by 4,500 metric tons annually to support clean-label and functional food ingredient demand in Asia-Pacific markets.

- In 2025, Symrise presented its latest plant-based taste solutions at the Bridge2Food Course & Summit Europe 2025, showcasing innovations in dairy and culinary alternatives to address consumer demands for authentic flavors, pleasing textures, and overall stability in plant-based products

- In 2025, DSM-Niaga reported a 6% year-on-year increase in organic sales for its integrated food ingredient portfolio during H1 2025, achieving €1.686 billion in revenues.

Report Coverage

The research report offers an in-depth analysis based on Source, Product Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for clean-label and natural ingredients will continue to rise across all food categories.

- Plant-based and sustainable ingredient solutions will gain strong traction in dairy and meat alternatives.

- Fermentation technology will expand production of enzymes, probiotics, and bioactive compounds.

- Functional and fortified foods will drive growth in vitamins, minerals, and fiber integration.

- Food manufacturers will invest in reformulation to reduce sugar, salt, and artificial additives.

- Emerging markets will witness higher adoption due to rising urbanization and processed food consumption.

- Innovation in natural sweeteners and flavors will cater to health-conscious consumers.

- Partnerships between ingredient suppliers and food brands will accelerate product development.

- Regulatory support for nutritional transparency will push demand for traceable, safe ingredients.

- Digitalization and AI-driven R&D will optimize ingredient formulations and shorten time-to-market.