Market Overview

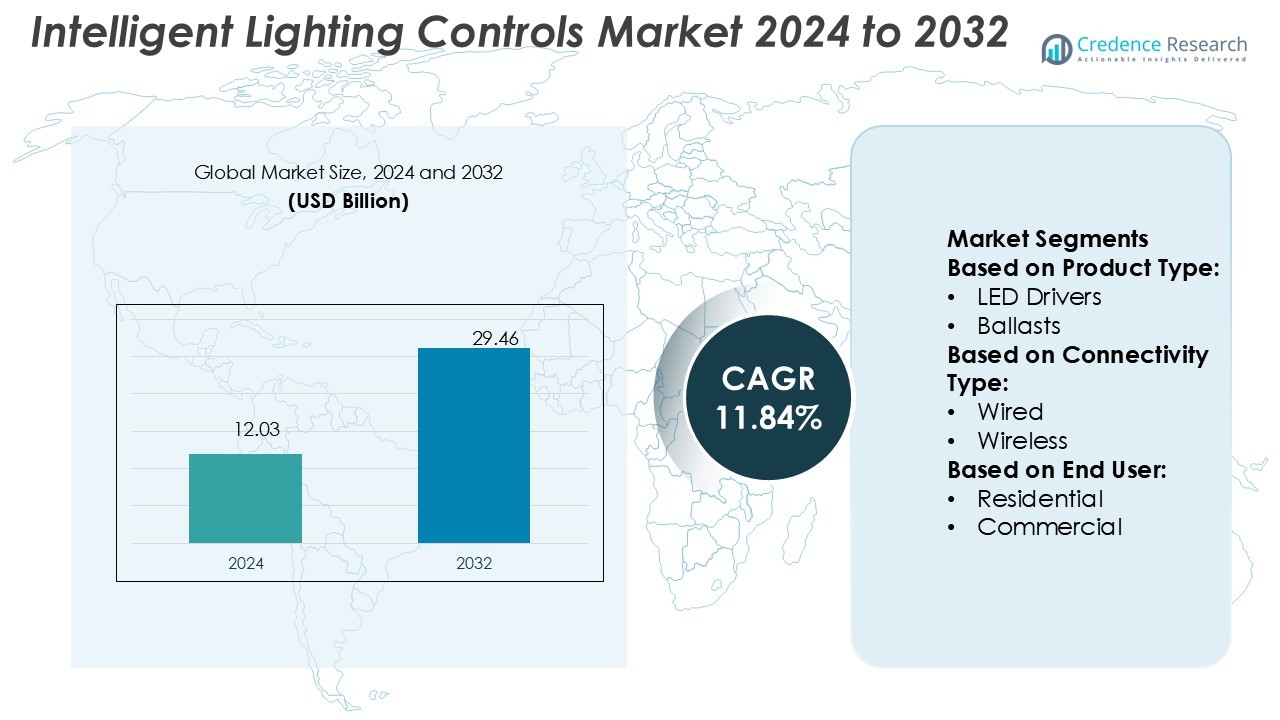

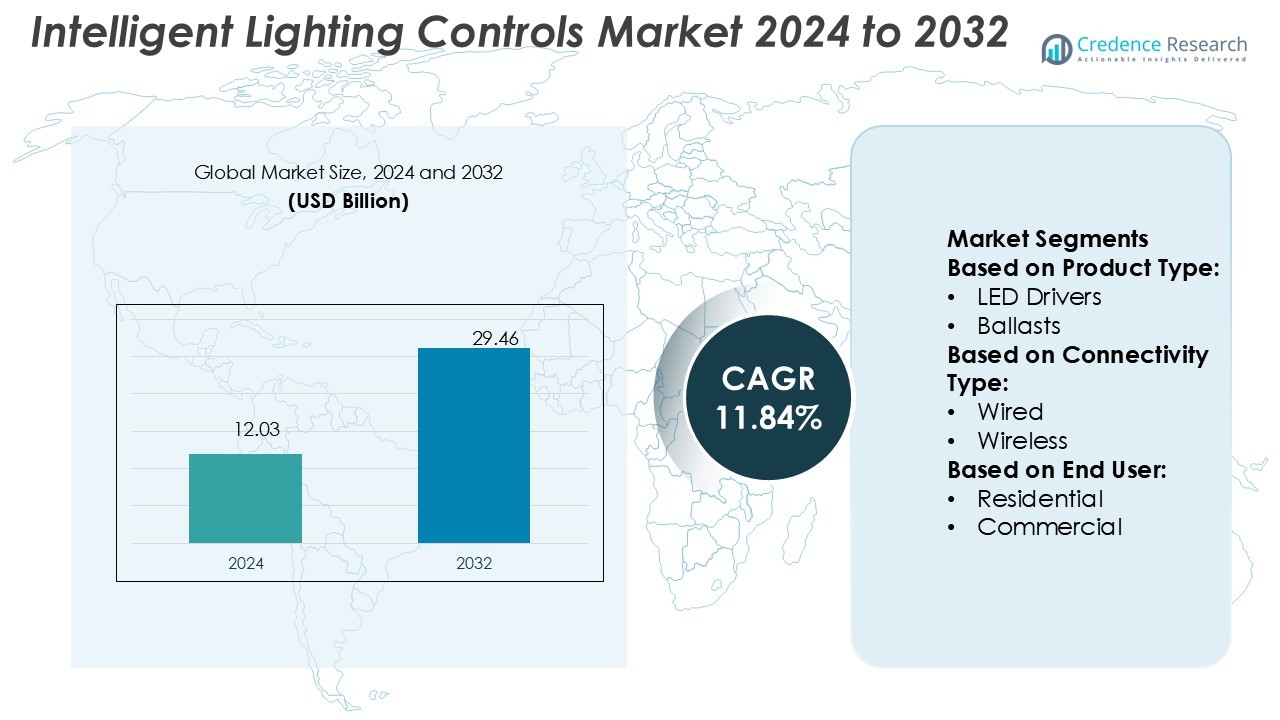

Intelligent Lighting Controls Market size was valued USD 12.03 billion in 2024 and is anticipated to reach USD 29.46 billion by 2032, at a CAGR of 11.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intelligent Lighting Controls Market Size 2024 |

USD 12.03 Billion |

| Intelligent Lighting Controls Market, CAGR |

11.84% |

| Intelligent Lighting Controls Market Size 2032 |

USD 29.46 Billion |

The intelligent lighting controls market is shaped by top players including Schneider Electric, Hubbell Incorporated, Control4 Corporation (Snap One), OSRAM Licht AG (ams OSRAM), Acuity Brands Inc., Signify (formerly Philips Lighting), Honeywell International Inc., Lutron Electronics Co. Inc., Leviton Manufacturing Co. Inc., and LSI Industries Inc. These companies drive competition through advanced LED integration, IoT-enabled systems, and wireless connectivity solutions across residential, commercial, and industrial applications. North America leads the market with a 37% share in 2024, supported by early adoption of smart technologies, strong regulatory frameworks promoting energy efficiency, and significant investments in smart city infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Intelligent Lighting Controls Market was valued at USD 12.03 billion in 2024 and is expected to reach USD 29.46 billion by 2032, growing at a CAGR of 11.84% during the forecast period.

- Market growth is driven by rising demand for energy efficiency, smart city development, and integration of IoT-enabled systems across residential, commercial, and industrial applications.

- Key trends include the dominance of wireless systems with 61% share and growing adoption of human-centric lighting, enhancing user experience in workplaces, healthcare, and homes.

- Competitive dynamics are shaped by leading players such as Schneider Electric, Signify, OSRAM Licht AG, Honeywell, and Acuity Brands, focusing on LED innovation, automation, and scalable connectivity solutions.

- North America leads with 37% market share in 2024, followed by Europe at 29% and Asia-Pacific at 24%, while sensors hold the largest product share at 34%, supported by energy regulations and demand for advanced building automation.

Market Segmentation Analysis:

By Product Type

In the Intelligent Lighting Controls Market, sensors hold the largest share at 34% in 2024. Their dominance stems from rising adoption in smart buildings and energy-efficient systems, where occupancy and daylight sensors reduce power consumption by up to 30%. LED drivers and ballasts follow closely, driven by widespread LED penetration in both retrofits and new installations. Switches, dimmers, and transmitters remain relevant but cater more to secondary use cases. The increasing focus on automation and compliance with energy regulations continues to boost sensor integration across residential and commercial projects.

- For instance, Hubbell’s AD1277 wall-switch sensor covers about 1,000 square feet (≈93 m²) and supports load capacities up to 800 W (incandescent) or 1,800 W (fluorescent at 277 V). Its adaptive firmware automatically adjusts the time delay to prevent false-OFF events, providing “install and forget” operation for maintenance-free use.

By Connectivity Type

Wireless systems lead this segment with a 61% market share in 2024, supported by the growing demand for flexibility and ease of installation. Technologies like Zigbee, Bluetooth, and Wi-Fi enable scalable and cost-effective solutions, particularly in smart homes and connected commercial spaces. Wired systems remain significant in industrial and large-scale commercial projects where stability and reliability are critical. However, the shift toward wireless is accelerated by IoT integration, rising adoption of Building Management Systems (BMS), and government initiatives promoting smart city infrastructure worldwide.

- For instance, Control4 uses its proprietary Control4 Zigbee PRO (based on IEEE 802.15.4) running at 250 kbps over the 2.405–2.475 GHz band; their ZigBee IO modules provide 2 relays, 4 contact inputs, and internal temperature/humidity sensing (5%–90%) in one compact unit.

By End-user

The commercial sector dominates with 46% share in 2024, driven by strong adoption in offices, retail complexes, and hospitality facilities. The focus on reducing operational costs, enhancing employee comfort, and meeting sustainability targets drives demand. Residential use follows, supported by rising smart home adoption and consumer preference for app-controlled and voice-enabled lighting systems. Industrial facilities leverage intelligent lighting for safety, energy management, and productivity. Highways and roadway lighting is expanding with the deployment of smart streetlights, integrated with adaptive brightness control and centralized monitoring to improve urban energy efficiency.

Key Growth Drivers

Rising Demand for Energy Efficiency

The push for sustainable infrastructure is driving strong adoption of intelligent lighting controls. Governments and organizations prioritize reducing electricity consumption in buildings, where lighting accounts for nearly 15–20% of total energy use. Advanced systems with occupancy sensors, daylight harvesting, and automated dimming help cut energy costs significantly. Businesses and municipalities are investing in these solutions to comply with green building certifications such as LEED and BREEAM. The ability to achieve measurable savings while meeting sustainability goals positions intelligent lighting controls as a key enabler of efficiency.

- For instance, An Light Bridge (nBRG 8) offers 8 RJ-45 ports to expand a wired nLight network’s reach by aggregating traffic from daisy-chained devices. For wireless installations, the nLight ECLYPSE system controller can manage up to 750 wired and/or wireless nLight devices in a network.

Smart City Development Initiatives

Global smart city projects are fueling growth in intelligent lighting controls. Municipalities deploy adaptive street lighting integrated with IoT platforms to improve safety, reduce emissions, and optimize energy consumption. Intelligent lighting systems enable real-time monitoring, fault detection, and remote control, lowering maintenance costs for city authorities. Countries in Asia-Pacific and Europe lead these initiatives, supported by government-backed infrastructure programs. The scalability of smart streetlights into larger IoT ecosystems makes them central to urban digital transformation strategies, reinforcing their role as a long-term growth driver.

- For instance, Signify has more than 156 million IoT-connected light points globally, many operating with Zigbee, Matter, Bluetooth, and Wi-Fi protocols to ensure interoperability across smart home ecosystems.

Integration with IoT and Smart Homes

The expansion of connected ecosystems is accelerating demand for intelligent lighting controls in residential and commercial spaces. IoT-enabled lighting integrates seamlessly with voice assistants, mobile apps, and building management systems, providing enhanced user experience and automation. Rising consumer preference for smart homes, particularly in developed markets, is creating consistent demand for wireless lighting controls. In commercial buildings, integration with HVAC and security systems enhances operational efficiency. The rapid penetration of IoT platforms and declining costs of connected devices are expanding adoption across multiple end-user segments.

Key Trends & Opportunities

Shift Toward Wireless Connectivity

Wireless lighting control systems are emerging as the dominant choice due to ease of installation and scalability. Technologies such as Zigbee, Bluetooth, and Wi-Fi are being increasingly adopted in smart homes, offices, and industrial spaces. This shift reduces infrastructure costs and enables greater flexibility for retrofitting older buildings. Vendors are focusing on developing interoperable solutions that support multiple protocols, addressing compatibility concerns. The growing adoption of wireless solutions also creates opportunities for service providers to offer subscription-based lighting-as-a-service models.

- For instance, Inventronics (the company that now owns the former Osram HubSense product line) offers the QBM IoT Gateway, which supports up to 200 nodes (including LED drivers and sensors) in a single qualified Bluetooth mesh network, enabling robust control in wholesale-scale lighting installations.

Focus on Human-Centric Lighting

Human-centric lighting is gaining traction as workplaces and healthcare facilities recognize its impact on well-being and productivity. Intelligent controls allow dynamic adjustment of light color temperature and intensity to align with circadian rhythms. This enhances concentration during work hours and supports relaxation in residential environments. Hospitals and eldercare centers are adopting these systems to improve patient recovery outcomes. The trend opens opportunities for manufacturers to design solutions tailored to health and wellness, expanding beyond traditional energy efficiency benefits to holistic user experiences.

- For instance, Dialight’s Vigilant® High Bay offers lumen outputs in a wide range, from approximately 11,000 to 41,300 lumens, with modern models boasting efficacies reaching up to 200 lm/W.

Key Challenges

High Initial Installation Costs

Despite long-term savings, the high upfront cost of intelligent lighting control systems remains a barrier. Expenses related to sensors, controllers, and integration with building management systems can deter adoption, particularly among small and medium enterprises. Retrofitting existing infrastructure adds further cost pressures. While government subsidies and falling sensor prices are easing the challenge, many end-users remain cautious. Vendors need to emphasize total cost of ownership (TCO) benefits and develop financing models, such as lighting-as-a-service, to overcome this adoption hurdle.

Complexity of System Integration

Integrating intelligent lighting controls with existing building automation systems poses significant challenges. Compatibility issues arise when devices operate on different communication protocols, creating risks of inefficiency and downtime. Enterprises require skilled technicians to manage installation and maintenance, adding complexity and costs. In large-scale projects, integration with HVAC, security, and IoT platforms further complicates deployment. Lack of standardized frameworks also hampers interoperability. Addressing these challenges will require industry-wide collaboration, development of universal protocols, and user-friendly plug-and-play solutions to simplify system deployment and scalability.

Regional Analysis

North America

North America dominates the intelligent lighting controls market with a 37% share in 2024. The region benefits from strong adoption of smart building technologies, stringent energy efficiency regulations, and advanced infrastructure. The United States leads demand, supported by large-scale commercial real estate projects and government incentives promoting green construction. Canada is also witnessing rapid uptake in smart residential and commercial lighting systems. Integration with IoT platforms and the rise of connected homes further enhance market growth. Investments in smart city projects, including adaptive street lighting, continue to position North America as a key revenue-generating region.

Europe

Europe holds 29% of the intelligent lighting controls market in 2024, driven by sustainability-focused policies and wide-scale deployment of energy-efficient technologies. Countries such as Germany, the United Kingdom, and France lead adoption, supported by EU directives on carbon reduction and smart city expansion. Strong emphasis on building automation and retrofitting projects accelerates integration of advanced controls across residential and commercial spaces. Growth is also supported by increased demand for human-centric lighting in workplaces and healthcare facilities. Europe’s commitment to renewable energy and green infrastructure reinforces its position as a mature and steadily expanding regional market.

Asia-Pacific

Asia-Pacific accounts for 24% of the global intelligent lighting controls market in 2024, emerging as the fastest-growing region. China, Japan, and India are driving demand with large-scale infrastructure projects, rapid urbanization, and strong government backing for smart cities. Growing adoption of smart homes and connected devices boosts residential demand, while commercial buildings and industrial facilities implement energy-efficient lighting solutions for cost savings. Wireless controls and IoT integration are expanding quickly, supported by declining device costs. Increasing investments in road and highway lighting projects further reinforce Asia-Pacific’s growth trajectory, positioning the region as a key driver of future global expansion.

Latin America

Latin America holds a 4% share of the intelligent lighting controls market in 2024, with Brazil and Mexico leading adoption. The region benefits from growing urbanization, energy conservation initiatives, and rising investments in smart infrastructure. Commercial projects such as shopping complexes, hotels, and office buildings drive demand for intelligent lighting systems. Governments are encouraging energy-efficient solutions to address rising electricity costs, particularly in urban areas. Residential adoption is also growing with increased availability of wireless and app-controlled solutions. While challenges related to infrastructure remain, Latin America shows promising potential for expansion in the coming years.

Middle East & Africa

The Middle East & Africa region represents 6% of the global intelligent lighting controls market in 2024, showing steady growth potential. GCC countries, including the UAE and Saudi Arabia, lead adoption through smart city initiatives such as NEOM and Dubai Smart City. Demand is supported by investments in commercial real estate, highways, and large-scale infrastructure projects. Africa is at an early adoption stage but is witnessing growth in urban centers, particularly in South Africa. Rising focus on energy efficiency, coupled with the deployment of LED-based smart streetlights, supports gradual expansion across this region.

Market Segmentations:

By Product Type:

By Connectivity Type:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the intelligent lighting controls market features leading players such as Schneider Electric, Hubbell Incorporated, Control4 Corporation (Snap One), OSRAM Licht AG (ams OSRAM), Acuity Brands Inc., Signify (formerly Philips Lighting), Honeywell International Inc., Lutron Electronics Co. Inc., Leviton Manufacturing Co. Inc., and LSI Industries Inc. The intelligent lighting controls market is characterized by rapid innovation, strategic partnerships, and expanding applications across residential, commercial, industrial, and roadway segments. Companies are focusing on integrating IoT, wireless technologies, and human-centric lighting to differentiate their offerings and capture market share. Mergers, acquisitions, and collaborations are common strategies to enhance product portfolios and extend geographic reach. Increasing demand for energy-efficient and sustainable solutions is pushing vendors to invest in R&D, while service-based models such as lighting-as-a-service are gaining traction. This dynamic environment fosters competition, accelerates innovation, and drives long-term market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schneider Electric

- Hubbell Incorporated

- Control4 Corporation (Snap One)

- OSRAM Licht AG (ams OSRAM)

- Acuity Brands Inc.

- Signify (formerly Philips Lighting)

- Honeywell International Inc.

- Lutron Electronics Co. Inc.

- Leviton Manufacturing Co. Inc.

- LSI Industries Inc.

Recent Developments

- In January 2025, Lutron Electronics announced the launch of its wireless RadioRA 3 lighting control system in the UK. With an array of controls, smart lighting, and automated window treatments that all communicate and coordinate with one another wirelessly.

- In October 2024, Bajaj Lighting, with over 80 years of generational expertise in lighting solutions, announced its revamped positioning under the tagline “Built to Shine.” This strategic shift is expected to drive positive impacts on business growth and reinforce Bajaj’s dominance in the lighting industry.

- In August 2024, Philips Hue ventured into affordability with the launch of the new Tento ceiling light lineup. Philips has tons of fully integrated smart lamps – and with modern LEDs, it’s not like you’ll be changing a lot of bulbs, anyway.

- In March 2024, Casambi, a smart lighting control solution provider unveiled Salvador, its latest innovation in DALI controllers. This launch marks a significant step into the wired lighting control sector, positioning the company as a major player in the mainstream lighting controls market. With Salvador, the firm enhances its portfolio, demonstrating its commitment to advanced and reliable solutions in wired lighting control.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Connectivity Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with wider adoption of smart building technologies.

- Wireless systems will continue to dominate due to scalability and ease of installation.

- Human-centric lighting will gain importance in workplaces, healthcare, and residential spaces.

- Integration with IoT platforms will enhance automation and energy efficiency.

- Smart city initiatives will drive large-scale deployment of adaptive street lighting.

- Declining sensor and control device costs will improve affordability for end-users.

- Service-based models such as lighting-as-a-service will attract new customers.

- Demand will rise in developing regions with rapid urbanization and infrastructure growth.

- Interoperability standards will improve, reducing integration complexities for enterprises.

- Sustainability goals will accelerate replacement of conventional lighting with intelligent solutions.