Market Overview

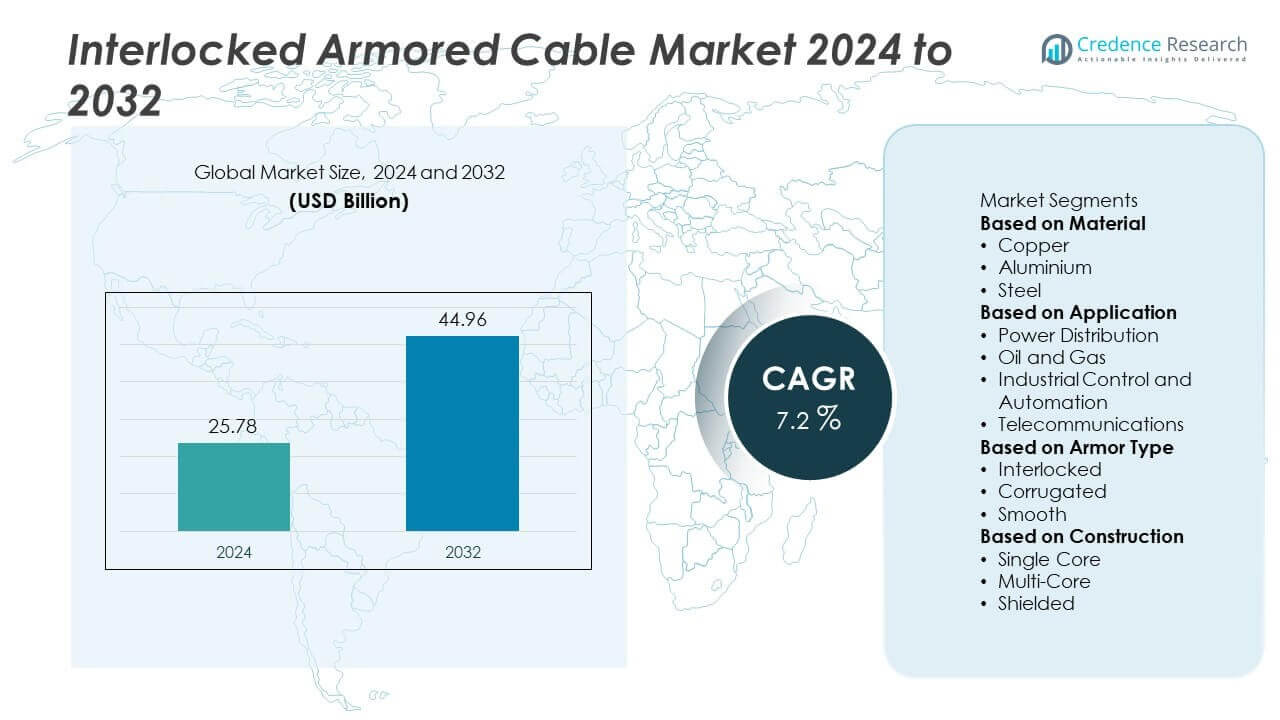

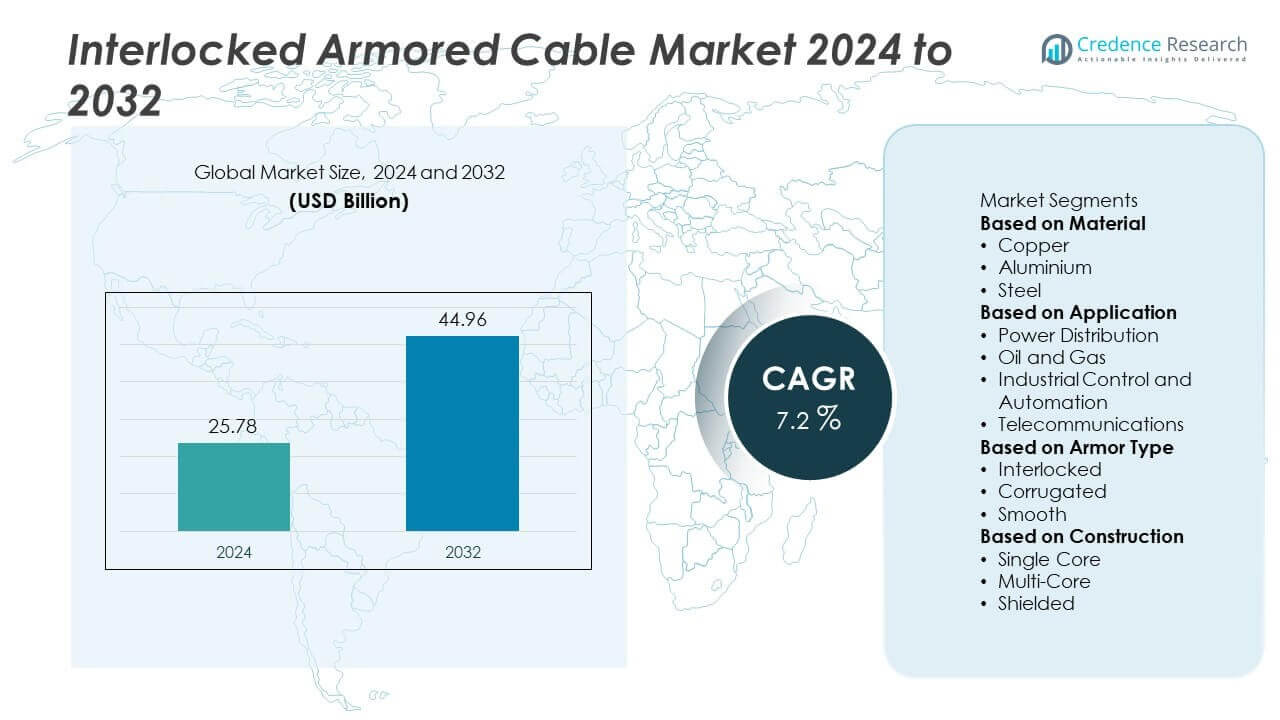

The Interlocked Armored Cable Market was valued at USD 25.78 billion in 2024 and is projected to reach USD 44.96 billion by 2032, growing at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Interlocked Armored Cable Market Size 2024 |

USD 25.78 Billion |

| Interlocked Armored Cable Market, CAGR |

7.2% |

| Interlocked Armored Cable Market Size 2032 |

USD 44.96 Billion |

The Interlocked Armored Cable Market is driven by rising demand for durable and safe cabling solutions across industrial, commercial, and residential projects. Its adoption grows with the expansion of renewable energy plants, smart grids, and large-scale infrastructure development.

The Interlocked Armored Cable Market demonstrates diverse growth across regions with unique adoption drivers. North America leads with strong demand from industrial facilities, commercial infrastructure, and renewable energy projects supported by strict safety codes. Europe follows with emphasis on sustainability, energy-efficient cabling, and compliance with stringent building regulations, while Asia-Pacific emerges as the fastest-growing region due to rapid urbanization, expanding industrial bases, and government-backed energy programs. Latin America and the Middle East & Africa show steady progress through rising electrification, infrastructure investments, and adoption in oil, gas, and mining sectors. Key players such as Nexans, Southwire Company, General Cable Technologies Corporation, and LS Cable System Ltd. focus on product innovation, regulatory compliance, and expanding global supply networks. These companies strengthen market presence by investing in R&D, offering certified fire-resistant designs, and forming partnerships to meet growing demand across diverse end-use applications worldwide.

Market Insights

- The Interlocked Armored Cable Market was valued at USD 25.78 billion in 2024 and is projected to reach USD 44.96 billion by 2032, growing at a CAGR of 7.2%.

- Rising demand for safe and durable cabling in industrial, commercial, and residential infrastructure is a major driver for market growth.

- Key market trends include growing use in renewable energy projects, expansion of smart grids, emphasis on fire-resistant certified products, and adoption in emerging economies.

- Competitive landscape features players such as Nexans, Southwire Company, General Cable Technologies Corporation, LS Cable System Ltd., and KEI Industries Ltd., who invest in innovation, compliance, and supply chain expansion.

- Market restraints include high raw material costs, price pressures in cost-sensitive regions, complex installation requirements, and regulatory differences across global markets.

- North America leads demand with strong infrastructure investments and strict safety standards, Europe emphasizes sustainable and compliant cabling solutions, while Asia-Pacific drives fastest growth with urbanization, industrialization, and renewable integration.

- Emerging opportunities lie in expanding electrification programs across Latin America and Africa, increasing renewable adoption in the Middle East, and rising investment in smart infrastructure that demands advanced armored cable solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Reliable Power Distribution in Expanding Infrastructure

The Interlocked Armored Cable Market is supported by growing demand for reliable cabling solutions in expanding infrastructure projects. Rapid urbanization and industrialization increase the need for durable wiring in commercial buildings, manufacturing facilities, and residential complexes. These cables provide enhanced mechanical protection against crushing and impact, making them ideal for challenging environments. It reduces the need for additional conduit systems, cutting installation costs and labor requirements. Governments prioritize modern power distribution networks to meet rising energy demand. This focus creates consistent opportunities for armored cable deployment in new infrastructure development.

- For instance, Nexans invested €20 million to open “AmpaCity,” a global innovation hub in Lyon, dedicated to low-carbon electrification. This center focuses on developing solutions for improving the reliability, resilience, and security of electrical grids to meet increasing demand.

Strong Adoption in Industrial and Harsh Environment Applications

The Interlocked Armored Cable Market benefits from strong adoption across heavy industries that require robust electrical systems. Oil and gas, mining, and chemical sectors rely on armored cables for safety and performance under demanding conditions. The interlocked design provides resistance to corrosion, fire, and physical damage, ensuring operational continuity. It supports compliance with strict safety standards in hazardous environments. Rising investments in energy-intensive industries amplify demand for secure cabling systems. The industrial sector continues to act as a key driver for long-term market growth.

- For instance, Southwire’s Type MC-HL power cable: a version with 350 kcmil copper conductors, XLPE insulation, continuous corrugated welded Armour-X, diameter over armour ≈ 5.82 cm (2.290 in), weight ≈ 5,741 lbs per 1,000 ft (≈ 8,544 kg per 1,000 km).

Growing Integration of Renewable Energy and Smart Grids

The Interlocked Armored Cable Market is propelled by increasing integration of renewable energy projects and smart grid expansion. Solar and wind installations require resilient cables to handle variable power loads and outdoor exposure. Interlocked armored cables meet these demands with enhanced durability and flexibility in diverse environments. It allows renewable plants to maintain stable transmission with reduced risks of faults. Governments and utilities invest heavily in grid modernization, further boosting adoption. The transition toward sustainable energy ensures continuous opportunities for armored cable manufacturers.

Focus on Safety Standards and Regulatory Compliance in Cabling Systems

The Interlocked Armored Cable Market gains momentum from rising emphasis on safety, quality, and regulatory compliance. Building codes and international standards encourage adoption of armored cables to minimize electrical hazards. Their ability to provide grounding and fire resistance strengthens safety in public and private infrastructure. It aligns with insurance requirements and risk management practices in construction and industrial sectors. Manufacturers innovate to meet regional certifications and ensure compatibility with local regulations. This regulatory push continues to reinforce armored cables as a preferred choice in modern electrical installations.

Market Trends

Shift Toward Cost-Effective and Flexible Cabling Solutions

The Interlocked Armored Cable Market is witnessing a growing shift toward flexible and cost-efficient cabling options. These cables eliminate the need for separate conduit systems, lowering material and labor expenses. Contractors and builders favor interlocked designs for quicker installation and simplified routing in complex structures. It strengthens adoption in both residential and commercial projects where efficiency is prioritized. The balance of durability and affordability positions armored cables as a preferred solution. This trend continues to influence product choices in new construction and retrofit applications.

- For instance, Service Wire’s MC cable with interlocked armor must be secured every six feet under normal conditions and every three feet if subject to vibration, reducing support hardware costs in tight or complex layouts.

Increasing Use in Renewable Energy and Outdoor Installations

The Interlocked Armored Cable Market benefits from expanding renewable energy projects and outdoor power infrastructure. Solar farms, wind parks, and hydro facilities demand durable cables that withstand weather exposure and mechanical stress. Interlocked designs provide protection against corrosion, UV radiation, and crushing forces. It ensures long-term reliability in demanding outdoor conditions. Growing focus on clean energy development reinforces demand for armored cabling systems. The trend reflects a broader shift toward sustainable and resilient electrical infrastructure.

- For instance, a 4.6-MW photovoltaic solar farm located in eastern Arizona used 104 miles of copper cable, which included an extensive underground grounding grid for lightning protection.

Adoption of Fire-Resistant and Safety-Certified Designs

The Interlocked Armored Cable Market is shaped by rising adoption of fire-resistant and safety-certified products. Building codes and international standards push manufacturers to deliver solutions with higher fire ratings and improved grounding features. Fire-resistant armored cables enhance safety in commercial high-rises, industrial plants, and public infrastructure. It helps project developers meet compliance requirements while reducing risk exposure. Demand for certified products is growing in regions with strict construction safety regulations. The focus on safety continues to influence new product development and procurement practices.

Technological Integration and Smart Infrastructure Deployment

The Interlocked Armored Cable Market is influenced by increasing integration of technology into electrical networks. Smart grids, industrial automation, and digital monitoring systems require reliable and high-performance cabling. Interlocked armored cables provide durability while supporting advanced connectivity needs. It enables stable operations in data centers, industrial facilities, and modern urban networks. Demand for intelligent infrastructure accelerates adoption of advanced cabling solutions across regions. This technological integration highlights the role of armored cables in supporting future-ready power systems.

Market Challenges Analysis

High Material Costs and Pricing Pressures in Competitive Markets

The Interlocked Armored Cable Market faces challenges from high raw material costs and price fluctuations. Steel and aluminum, essential for armor construction, are vulnerable to volatility in global supply chains. Rising costs increase manufacturing expenses, pressuring companies to balance profitability with competitive pricing. It creates difficulties for smaller manufacturers who operate on limited margins. Intense competition among global and regional players further constrains pricing flexibility. These pressures slow expansion in cost-sensitive markets, where buyers often prefer lower-priced alternatives.

Complex Installation Environments and Regulatory Barriers

The Interlocked Armored Cable Market encounters obstacles in complex installation environments and varying regulatory frameworks. Integrating armored cables with legacy systems or in congested urban spaces can raise installation challenges. It demands skilled labor and careful routing, which increase project costs and timelines. Regulatory differences across regions complicate standardization, requiring manufacturers to adapt products to multiple certifications. Compliance with fire safety, grounding, and energy efficiency standards raises production complexity. Delays in approval and testing processes further impact market growth potential.

Market Opportunities

Expansion in Renewable Energy and Smart Grid Projects

The Interlocked Armored Cable Market holds strong opportunities through the global push for renewable energy and modernized grids. Solar farms, wind parks, and hydroelectric facilities require durable cabling to handle fluctuating loads and outdoor conditions. Interlocked armored designs provide corrosion resistance and long-term reliability, making them well-suited for these projects. It aligns with government initiatives that support clean energy deployment and grid resilience. Growing investment in smart grids further enhances the need for armored cabling with advanced safety and performance features. The transition to sustainable energy ensures ongoing opportunities for manufacturers and suppliers.

Growth Potential in Emerging Economies and Infrastructure Development

The Interlocked Armored Cable Market benefits from opportunities in emerging economies with expanding infrastructure investments. Rapid urbanization and industrialization across Asia-Pacific, Latin America, and Africa create strong demand for secure and efficient cabling systems. It supports power distribution, commercial construction, and industrial applications where safety and compliance are critical. Rising disposable incomes and expanding residential projects increase adoption of armored solutions in developing regions. Government-backed infrastructure modernization programs further accelerate market growth. These dynamics open pathways for global players to expand their presence through strategic partnerships and localized production.

Market Segmentation Analysis:

By Material

The Interlocked Armored Cable Market is segmented by material into aluminum and steel. Aluminum dominates due to its lightweight nature, flexibility, and lower cost compared to steel. It is widely adopted in commercial and residential installations where ease of handling and affordability are critical. Steel, on the other hand, is preferred for industrial and heavy-duty applications because of its superior mechanical strength and resistance to impact. It ensures enhanced durability in harsh environments, including oil and gas, mining, and chemical plants. The balance between aluminum for cost-sensitive projects and steel for high-performance use cases drives overall material demand.

- For instance, a Nexans Canada ACWU90 aluminum metal-clad armored cable with 3 conductors and 500 AWG has a cable outside diameter over armour of 58.2 mm and an approximate weight of 4,075 kg per kilometer.

By Application

The Interlocked Armored Cable Market, by application, includes power distribution, industrial, residential, and commercial uses. Power distribution represents a significant share, supported by ongoing infrastructure upgrades and renewable energy integration. Industrial applications rely on armored cables for reliable performance in hazardous conditions, including manufacturing plants and refineries. It is also widely adopted in residential and commercial projects where safety, fire resistance, and compliance with building codes are essential. Rapid urbanization and rising construction activity further strengthen demand across applications. The diverse range of end-uses ensures steady growth and wider adoption globally.

- For instance, Service Wire MC cable is required to be secured every 1.83 m under normal conditions, which supports code compliance and safe installation in commercial buildings.

By Armor Type

The Interlocked Armored Cable Market is categorized by armor type into aluminum interlocked armor (AIA) and steel interlocked armor (SIA). Aluminum interlocked armor is preferred in general-purpose installations where flexibility, weight reduction, and cost efficiency are priorities. Steel interlocked armor is chosen for demanding environments that require higher resistance to crushing, corrosion, and fire hazards. It supports critical infrastructure in industries such as energy, petrochemicals, and heavy manufacturing. Both armor types play essential roles in addressing varied installation environments and regulatory standards. Manufacturers focus on expanding product lines to offer tailored solutions for different industries and regional compliance needs.

Segments:

Based on Material

Based on Application

- Power Distribution

- Oil and Gas

- Industrial Control and Automation

- Telecommunications

Based on Armor Type

- Interlocked

- Corrugated

- Smooth

Based on Construction

- Single Core

- Multi-Core

- Shielded

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Interlocked Armored Cable Market, accounting for nearly 38% in 2024. The region benefits from advanced infrastructure, stringent building codes, and widespread adoption of safety-compliant cabling systems. The United States leads demand with heavy investment in commercial construction, renewable energy, and smart grid projects. Canada supports market growth through strong mining, oil, and gas sectors that require durable armored cabling for hazardous environments. Mexico adds further potential with rising urbanization and industrial expansion. It demonstrates strong resilience due to a mature electrical infrastructure and consistent focus on high safety standards. Continuous investment in renewable energy and modernization of power distribution systems ensures North America retains its leadership position in global demand.

Europe

Europe represents around 27% of the Interlocked Armored Cable Market share in 2024. Countries such as Germany, the United Kingdom, and France dominate demand, supported by strict regulatory frameworks and focus on energy-efficient building practices. Adoption is reinforced by strong infrastructure modernization programs and compliance with EU fire safety and environmental standards. Southern and Eastern European markets are gradually expanding due to rapid construction activity and growth in industrial installations. It benefits from significant renewable energy projects, including offshore wind and solar developments that require armored cabling for durability and performance. The region’s emphasis on sustainability, coupled with demand for certified fire-resistant products, reinforces Europe’s position as a major market for armored cables.

Asia-Pacific

Asia-Pacific accounts for about 24% of the Interlocked Armored Cable Market share in 2024 and stands as the fastest-growing region. China drives adoption with large-scale investments in industrial projects, renewable energy installations, and urban infrastructure. Japan and South Korea contribute significantly with advanced manufacturing sectors and technological adoption in power distribution systems. India emerges as a strong market with rapid urbanization, large-scale residential projects, and government-backed initiatives in energy and smart cities. It also benefits from growing foreign direct investments and infrastructure expansion across Southeast Asian economies. Rising demand for safe, efficient, and durable power cabling supports long-term growth in this region. Asia-Pacific’s focus on industrialization and clean energy transition will continue to position it as a critical growth engine for the market.

Latin America

Latin America holds nearly 6% of the Interlocked Armored Cable Market share in 2024. Brazil dominates regional demand with strong infrastructure investments and rising adoption of armored cables in power distribution and construction sectors. Mexico follows with growing industrialization and emphasis on safety standards in modern building practices. Argentina, Chile, and Colombia contribute through development of energy projects and commercial construction. It faces challenges such as cost sensitivity and economic volatility, but rising urbanization and adoption of renewable energy provide consistent growth opportunities. Local governments and private investments in infrastructure are expected to further strengthen armored cable demand in this region.

Middle East and Africa

The Middle East and Africa together represent approximately 5% of the Interlocked Armored Cable Market share in 2024. The Middle East, led by Saudi Arabia, the United Arab Emirates, and Qatar, shows strong demand driven by smart city projects, oil and gas infrastructure, and commercial construction. Africa demonstrates gradual adoption led by South Africa, Nigeria, and Egypt, where infrastructure development and electrification programs support armored cable installations. It faces constraints such as affordability challenges and regulatory inconsistencies, yet rising investment in digital infrastructure and renewable energy accelerates adoption. Regional emphasis on safety and modernization continues to create new opportunities, particularly in industrial and energy projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LS Cable System Ltd.

- Belden Inc.

- Sumitomo Electric Industries, Ltd.

- Monocable Systems Ltd.

- KEI Industries Ltd.

- Cimteq Ltd.

- NKT A/S

- Southwire Company

- General Cable Technologies Corporation

- Nexans

Competitive Analysis

The competitive landscape of the Interlocked Armored Cable Market is defined by key players including Nexans, Southwire Company, General Cable Technologies Corporation, LS Cable System Ltd., KEI Industries Ltd., NKT A/S, Belden Inc., Sumitomo Electric Industries Ltd., Monocable Systems Ltd., and Cimteq Ltd. These companies compete by delivering high-performance armored cables that meet international safety and efficiency standards while addressing the needs of diverse industries. Their strategies emphasize innovation in fire-resistant and corrosion-resistant designs, as well as products tailored for renewable energy, oil and gas, and heavy industrial applications. Global players focus on strengthening supply networks and expanding regional footprints to capture growth in emerging markets. Investments in R&D support advanced cable technologies with improved durability, easier installation, and compliance with strict regulations. Strategic partnerships with utilities, construction firms, and industrial clients reinforce customer relationships and ensure steady demand. Intense competition drives continuous product diversification, price optimization, and adoption of sustainable manufacturing practices. This environment positions leading players to secure long-term market presence while shaping the global growth trajectory of interlocked armored cable solutions.

Recent Developments

- In July 2025, LS Cable System completed its fifth submarine cable plant, enhancing production capacity for high-voltage interlocked armored cables and supporting offshore wind power projects, especially in Asia and Europe.

- In June 2025, Sumitomo Electric commenced installation of its 525kV XLPE HVDC cable system, equipped with interlocked armor for mechanical and electrical resilience, in Germany’s Corridor A-Nord Project, marking a major upgrade in renewable energy infrastructure and transmission capacity.

- In June 2025, KEI Industries expanded production readiness for armored cables at the Sanand facility, targeting increased demand in infrastructure and energy; the portfolio includes EHV, HT, and LT armored cables which are deployed in both domestic and export projects.

- In April 2025, Nexans Was awarded a contract by Interconnect Malta to supply high-voltage subsea cables for Malta’s second interconnector. While not explicitly stated “interlocked armored,” the project involves robust armored subsea cable designs.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, Armor Type, Construction and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with ongoing expansion of industrial and commercial infrastructure projects.

- Renewable energy growth will increase the use of armored cables in solar and wind installations.

- Smart grid development will drive adoption of advanced and durable cabling systems.

- Fire-resistant and safety-certified products will gain higher preference in regulated markets.

- Asia-Pacific will continue to grow rapidly due to urbanization and government-backed energy programs.

- Latin America and Africa will see steady adoption through electrification and infrastructure development.

- Technological innovations will improve flexibility, durability, and installation efficiency of armored cables.

- Price pressures will encourage manufacturers to adopt cost-efficient materials and production processes.

- Strategic collaborations between global suppliers and regional distributors will expand market reach.

- Sustainability goals will promote eco-friendly manufacturing and recyclable armored cable designs.