Market Overview

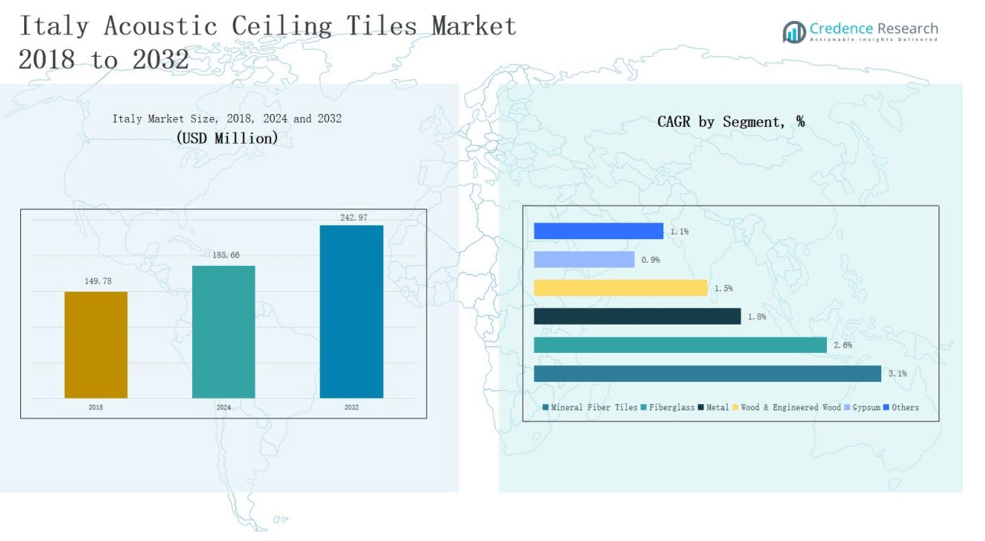

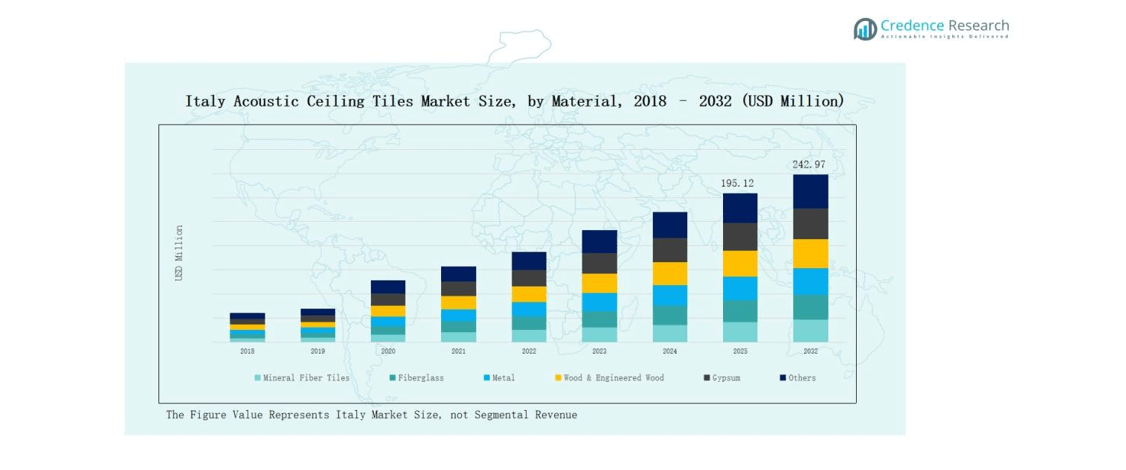

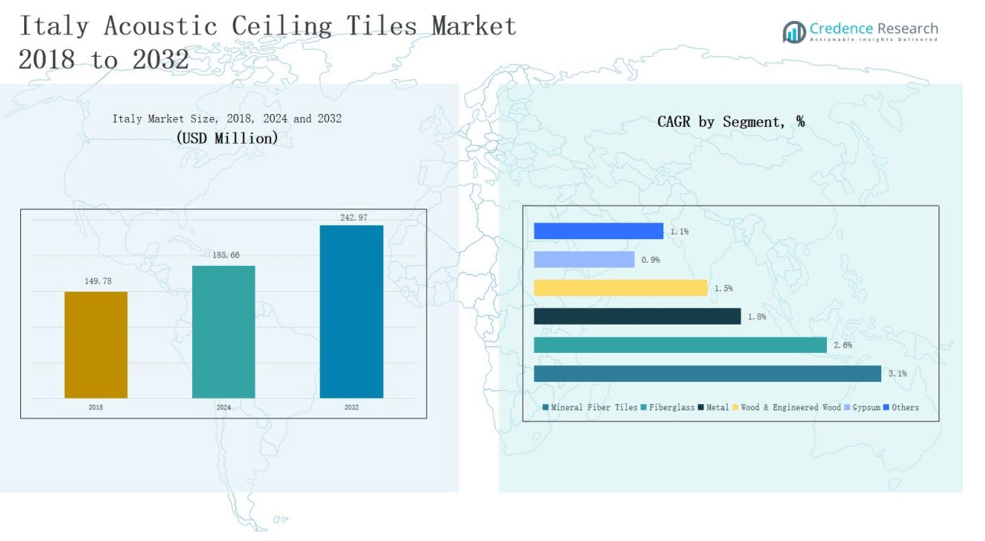

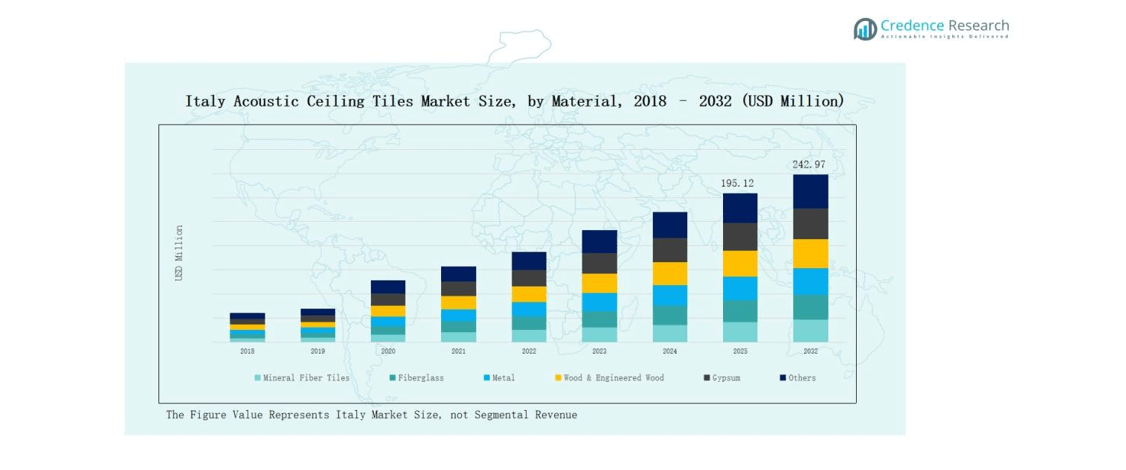

Italy Acoustic Ceiling Tiles Market size was valued at USD 149.78 million in 2018, reached USD 185.66 million in 2024, and is anticipated to reach USD 242.97 million by 2032, growing at a CAGR of 3.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Acoustic Ceiling Tiles Market Size 2024 |

USD 185.66 million |

| Italy Acoustic Ceiling Tiles Market, CAGR |

3.18% |

| Italy Acoustic Ceiling Tiles Market Size 2032 |

USD 242.97 million |

The Italy Acoustic Ceiling Tiles Market is shaped by global leaders and regional specialists competing on innovation, sustainability, and distribution reach. Key players include Armstrong World Industries Italy, Knauf Insulation Italy, Saint-Gobain Italy, Rockfon Italy, USG Boral Italy, Hunter Douglas Italy, OWA GmbH Italy, SAS International Italy, Texaa Italy, and Acoustical Surfaces Italy. These companies strengthen their positions through advanced acoustic technologies, eco-friendly product portfolios, and strong partnerships with architects and contractors. Among regions, North Italy led the market with a 39% share in 2024, driven by industrial hubs, modern office developments, and robust institutional projects.

Market Insights

- Italy Acoustic Ceiling Tiles Market grew from USD 149.78 million in 2018 to USD 185.66 million in 2024 and will reach USD 242.97 million by 2032.

- Leading companies such as Armstrong, Knauf, Saint-Gobain, Rockfon, and USG Boral drive growth through innovation, eco-friendly portfolios, and partnerships with architects and contractors.

- North Italy led with a 39% share in 2024, supported by industrial hubs, modern office developments, and strong adoption of mineral fiber and fiberglass tiles.

- South Italy held 31% share, boosted by rapid urbanization, hospitality expansion, and retrofitting projects in Naples, Bari, and other commercial centers.

- Central Italy accounted for 22% share with demand from educational and government projects, while the Islands captured 8% share led by luxury tourism-focused developments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

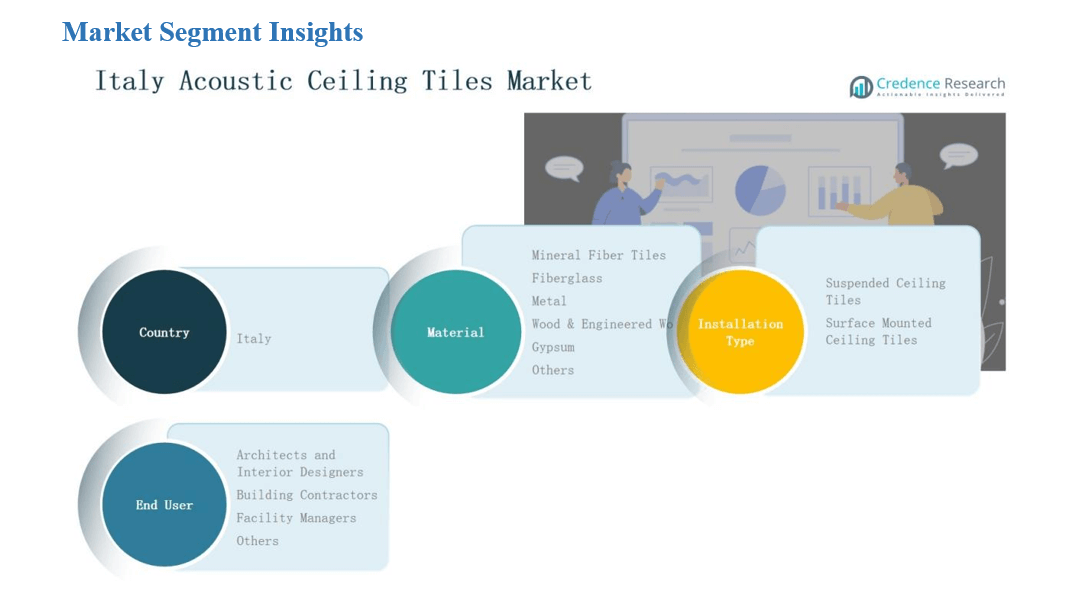

Market Segment Insights

By Material

Mineral fiber tiles held the dominant share of 41.5% in 2024, making them the leading material segment in Italy’s acoustic ceiling tiles market. Their popularity stems from strong sound absorption, fire resistance, and cost-effectiveness, which makes them widely adopted in commercial and institutional buildings. Fiberglass followed with growing use in premium projects requiring lightweight and high acoustic performance. Metal, wood, gypsum, and other niche materials cater to luxury interiors and specialized applications, but remain smaller contributors.

- For instance, Armstrong World Industries introduced its Ultima+ mineral fiber ceiling range in Europe, engineered for enhanced sound absorption and Class A fire resistance in office environments.

By Installation Type

Suspended ceiling tiles accounted for 68.2% share in 2024, establishing dominance in the Italy market. Their modular design, easy maintenance, and integration with lighting and HVAC systems make them preferred in offices, healthcare, and educational facilities. Surface-mounted ceiling tiles, though less common, are gaining traction in modern residential spaces and boutique projects where aesthetics and minimal installation depth are crucial. The strong demand for suspended systems reflects Italy’s ongoing commercial and institutional construction activity.

- For instance, Knauf Ceiling Solutions provided modular ceiling systems integrated with LED lighting for high-profile office developments in Rome, supporting efficiency and modern workspace design.

By End User

Architects and interior designers represented the largest share at 37.4% in 2024, driving demand for innovative ceiling solutions in Italy. Their influence shapes material selection and installation preferences, with strong emphasis on acoustics, aesthetics, and sustainability. Building contractors followed, accounting for widespread adoption in large-scale projects, while facility managers contributed through retrofit and renovation activities. Other end users, including homeowners and small developers, represent a smaller share but drive demand for customized, design-oriented acoustic solutions.

Market Overview

Rising Commercial and Institutional Construction

The expansion of office spaces, hospitals, and educational institutions is fueling demand for acoustic ceiling tiles in Italy. These projects require effective noise control and cost-efficient design solutions, making mineral fiber and fiberglass tiles highly attractive. Growing investments in modern infrastructure, coupled with renovation of older buildings, further accelerate adoption. Government-backed urban development programs and EU funding for sustainable construction strengthen this trend, positioning acoustic ceiling tiles as essential components for functional, energy-efficient, and visually appealing interiors.

- For instance, Saint-Gobain Ecophon introduced its acoustic solutions in Italian healthcare facilities, such as Humanitas hospitals, to reduce noise levels and enhance patient comfort.

Focus on Sustainable and Energy-Efficient Solutions

Sustainability has become a major driver in Italy’s building materials market. Acoustic ceiling tiles made from recycled materials, low-VOC finishes, and energy-efficient designs appeal to architects, designers, and contractors aiming to meet green building standards. EU sustainability directives and Italy’s national climate goals push companies to adopt eco-friendly practices. Demand is rising for products that improve indoor air quality and reduce environmental footprint, making green-certified ceiling tiles a preferred choice in both new construction and renovation projects.

- For instance, Mapei has introduced eco-friendly building materials certified under national and international sustainability protocols, including low-VOC products and flooring systems increasingly preferred in both new constructions and renovations for their reduced environmental footprint.

Growing Preference for Enhanced Acoustic Comfort

Noise pollution in urban environments and the rising need for better indoor sound quality are boosting market growth. Offices, classrooms, and healthcare facilities prioritize sound absorption and speech clarity, driving adoption of acoustic ceiling tiles. Italy’s emphasis on creating modern, employee-friendly workplaces and effective learning spaces supports this demand. Advanced designs that combine superior acoustic performance with aesthetics appeal strongly to end users, making acoustic comfort an increasingly important decision factor in material and installation choices.

Key Trends & Opportunities

Integration of Smart and Modular Ceiling Systems

A significant trend is the integration of smart features such as lighting, air circulation, and sensors into modular ceiling systems. In Italy, growing demand for multifunctional spaces has encouraged architects and facility managers to opt for adaptable solutions. Suspended ceiling systems are particularly suited to accommodate smart integrations, enhancing both energy efficiency and user comfort. This creates opportunities for manufacturers to differentiate through product innovation and cater to high-value projects in commercial and institutional segments.

- For instance, Armstrong World Industries introduced its TechZone Ceiling Systems that incorporate linear lighting and air diffusers within a single continuous ceiling design to optimize performance.

Expansion of Premium and Aesthetic-Oriented Designs

Rising consumer focus on aesthetics and personalized interiors is shaping demand for premium acoustic ceiling tiles. Metal, wood, and engineered wood products are increasingly chosen for luxury offices, hotels, and retail environments. Italian architects and interior designers influence this trend, blending design innovation with functionality. The opportunity lies in developing high-end solutions that combine acoustic performance with stylish finishes. Manufacturers offering customizable colors, textures, and modular patterns can capture growing demand in the upscale segment of Italy’s market.

- For instance, Rockfon expanded its Color‑all range in the Italian market, enabling architects to design modular ceiling solutions with over 30 color options tailored for premium retail and hotel projects.

Key Challenges

High Initial Costs and Budget Constraints

Acoustic ceiling tiles, particularly premium variants such as metal and wood, involve higher upfront costs compared to traditional alternatives. Budget-conscious contractors and small-scale developers often hesitate to adopt these products, slowing penetration in certain market segments. While long-term benefits such as energy efficiency and reduced maintenance exist, immediate financial considerations remain a barrier. This cost sensitivity challenges manufacturers to balance innovation with affordability, especially when competing against low-cost substitutes in Italy’s construction sector.

Limited Awareness in Residential Sector

While acoustic ceiling tiles are well established in commercial and institutional spaces, awareness among residential customers remains low. Italian homeowners often prioritize aesthetics over acoustic performance, limiting demand outside luxury housing projects. Many are unaware of benefits such as noise reduction and thermal efficiency, which hinders broader adoption. To address this challenge, companies need to promote consumer education and expand distribution through retail and online channels to unlock potential in the residential renovation market.

Intense Competition and Market Fragmentation

The Italy acoustic ceiling tiles market faces strong competition from both multinational players and regional suppliers. Companies compete on pricing, distribution, and product differentiation, creating a fragmented environment. Global firms such as Armstrong, Knauf, and Saint-Gobain dominate high-value segments, while smaller domestic players target cost-sensitive customers. This intense competition pressures margins and makes it difficult for new entrants to scale. Establishing strong partnerships with architects, contractors, and distributors is crucial to maintain growth and overcome competitive challenges.

Regional Analysis

North Italy

North Italy led the Italy Acoustic Ceiling Tiles Market with a 39% share in 2024. The region benefits from industrial hubs, advanced commercial infrastructure, and high demand for modern office spaces. Strong adoption of mineral fiber and fiberglass tiles supports growth, especially in Milan and Turin. Construction activity linked to business centers and healthcare projects continues to drive installations. Architects and designers influence material choice, emphasizing sustainability and acoustic comfort. The presence of multinational manufacturers also strengthens competitive intensity in this region.

Central Italy

Central Italy accounted for a 22% share in 2024, supported by growing adoption of acoustic ceiling tiles in educational institutions and government projects. Rome’s demand for office renovations and institutional expansions creates strong opportunities for suspended ceiling systems. It continues to attract investments in sustainable and energy-efficient building materials. Contractors and architects drive preference for mineral fiber products due to cost efficiency and sound insulation. Gypsum and wood-based options are also gaining traction in boutique projects.

South Italy

South Italy captured a 31% share in 2024, making it the second-largest contributor to the Italy Acoustic Ceiling Tiles Market. Rapid urbanization and expansion of commercial real estate are key factors driving adoption. Naples and Bari show rising construction activity, particularly in hospitality and retail sectors. Suspended ceiling tiles dominate installations, while surface-mounted systems are gaining use in modern residential projects. Facility managers contribute through retrofitting and renovation of older buildings, expanding long-term opportunities for suppliers.

Islands (Sicily and Sardinia)

The Islands region represented a 8% share in 2024, reflecting smaller demand compared to mainland Italy. Growth is concentrated in tourism-driven developments such as hotels, resorts, and retail spaces. Aesthetic-focused materials like wood and metal are preferred in luxury projects catering to international visitors. Market penetration of mineral fiber remains steady in institutional and public sector buildings. Distribution networks face challenges due to logistics, yet targeted investments in hospitality support ongoing demand. It continues to hold niche opportunities for premium ceiling solutions.

Market Segmentations:

By Material

- Mineral Fiber Tiles

- Fiberglass

- Metal

- Wood & Engineered Wood

- Gypsum

- Others

By Installation Type

- Suspended Ceiling Tiles

- Surface Mounted Ceiling Tiles

By End User

- Architects and Interior Designers

- Building Contractors

- Facility Managers

- Others

By Region

- North Italy

- Central Italy

- South Italy

- Islands

Competitive Landscape

The Italy Acoustic Ceiling Tiles Market is characterized by strong competition between global leaders and regional specialists. Key players such as Armstrong World Industries, Knauf Insulation, Saint-Gobain, Rockfon, and USG Boral maintain dominant positions through extensive product portfolios and established distribution networks. Their strategies focus on product innovation, sustainability, and advanced acoustic technologies tailored for commercial and institutional applications. Companies like Hunter Douglas, OWA GmbH, SAS International, Texaa, and Acoustical Surfaces strengthen the competitive mix by addressing niche demands in design-driven and luxury projects. Market fragmentation is evident, with local manufacturers competing on cost efficiency and regional reach. Partnerships with architects, contractors, and facility managers play a crucial role in winning projects and expanding brand presence. Continuous investments in eco-friendly materials and modular installation solutions further define the competition, while high pressure on pricing intensifies rivalry among both international and domestic suppliers in Italy.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In May 2023, a partnership was formed between Turf Partners and USAI Lighting to integrate acoustic ceiling tiles with LED lighting, providing dual-function noise management and energy efficiency for commercial environments.

- In January 2024, Armstrong World Industries announced a strategic partnership with McKinstry to advance sustainable and intelligent ceiling technologies, enhancing energy efficiency and eco-friendly building solutions.

- In May 2023, Turf Partners partnered with USAI Lighting to integrate acoustic ceiling tiles with LED lighting options, delivering noise management combined with energy-efficient illumination in commercial spaces

Report Coverage

The research report offers an in-depth analysis based on Material, Installation Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Mineral fiber tiles will continue to lead demand due to cost efficiency and acoustic benefits.

- Fiberglass tiles will gain traction in premium commercial and institutional projects.

- Suspended ceiling systems will remain the dominant installation type across offices and schools.

- Surface-mounted systems will expand in modern residential and boutique projects.

- Architects and interior designers will drive adoption of design-focused ceiling solutions.

- Building contractors will strengthen market growth through large-scale institutional and commercial projects.

- Facility managers will boost demand through renovation and retrofitting activities.

- Sustainable and eco-friendly ceiling products will see higher adoption across regions.

- Premium wood and metal ceiling tiles will grow in luxury hospitality and retail spaces.

- Regional growth will be supported by urban development programs and infrastructure modernization.