Market Overview:

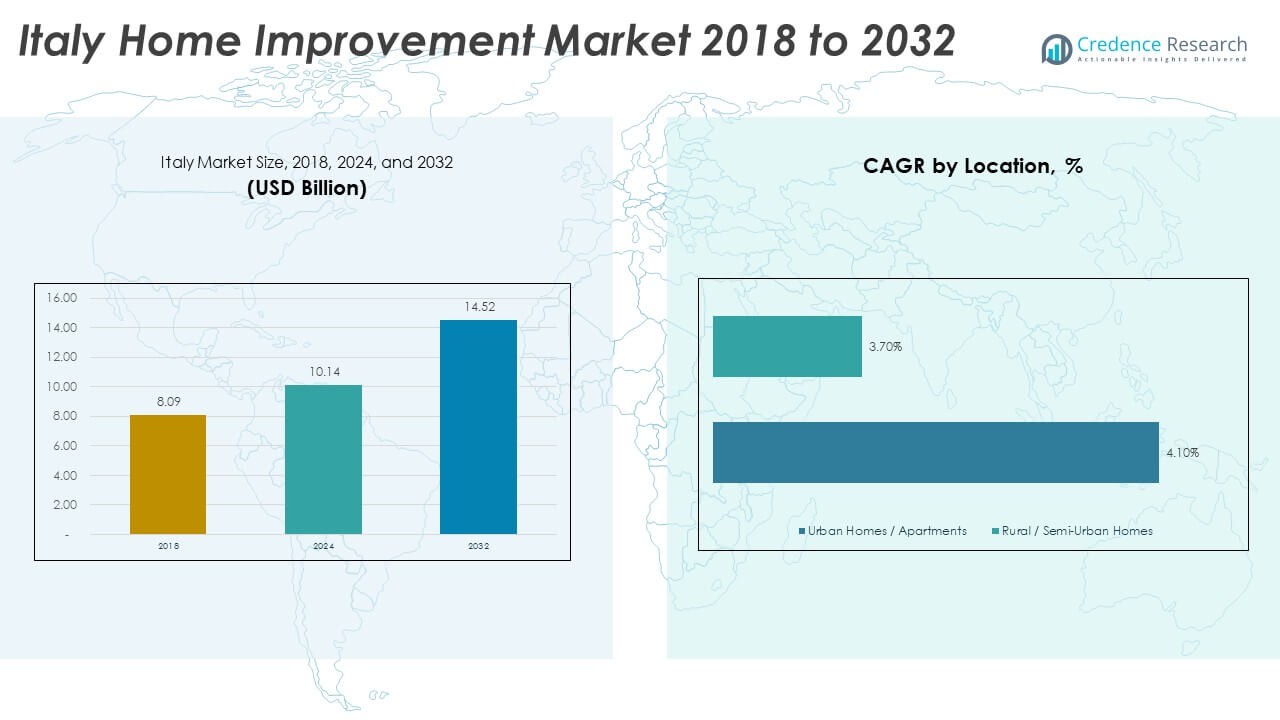

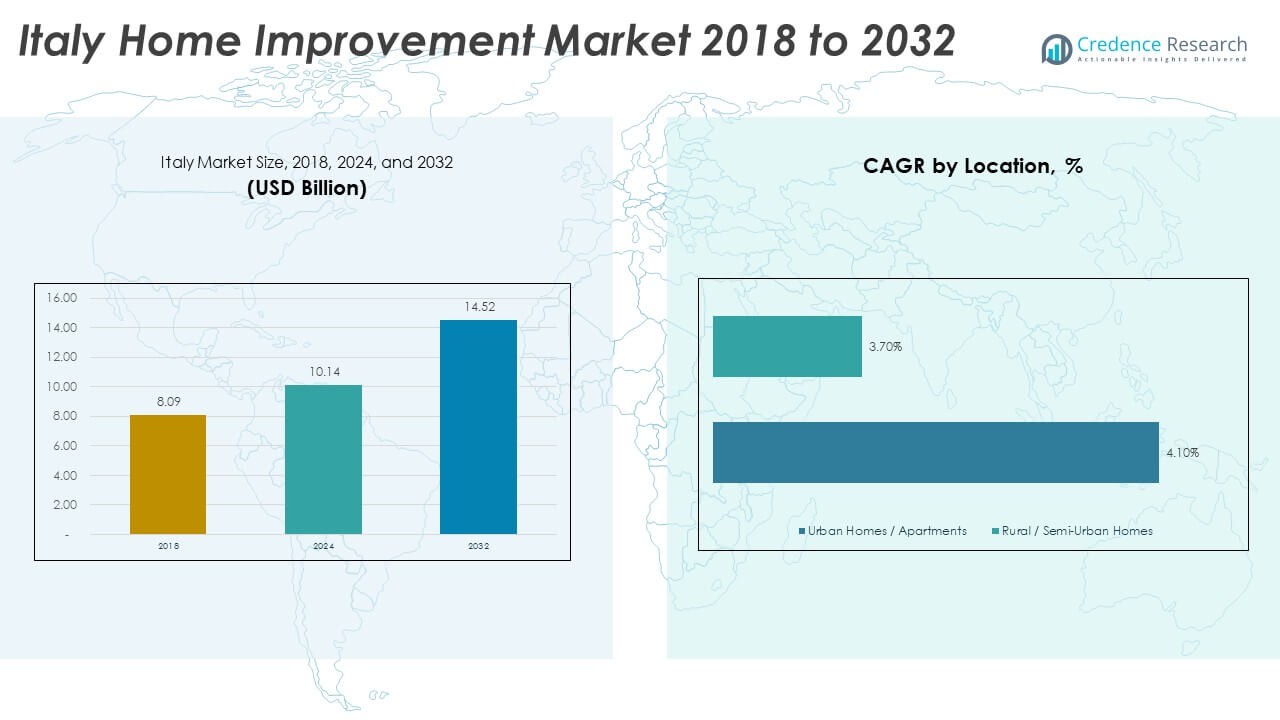

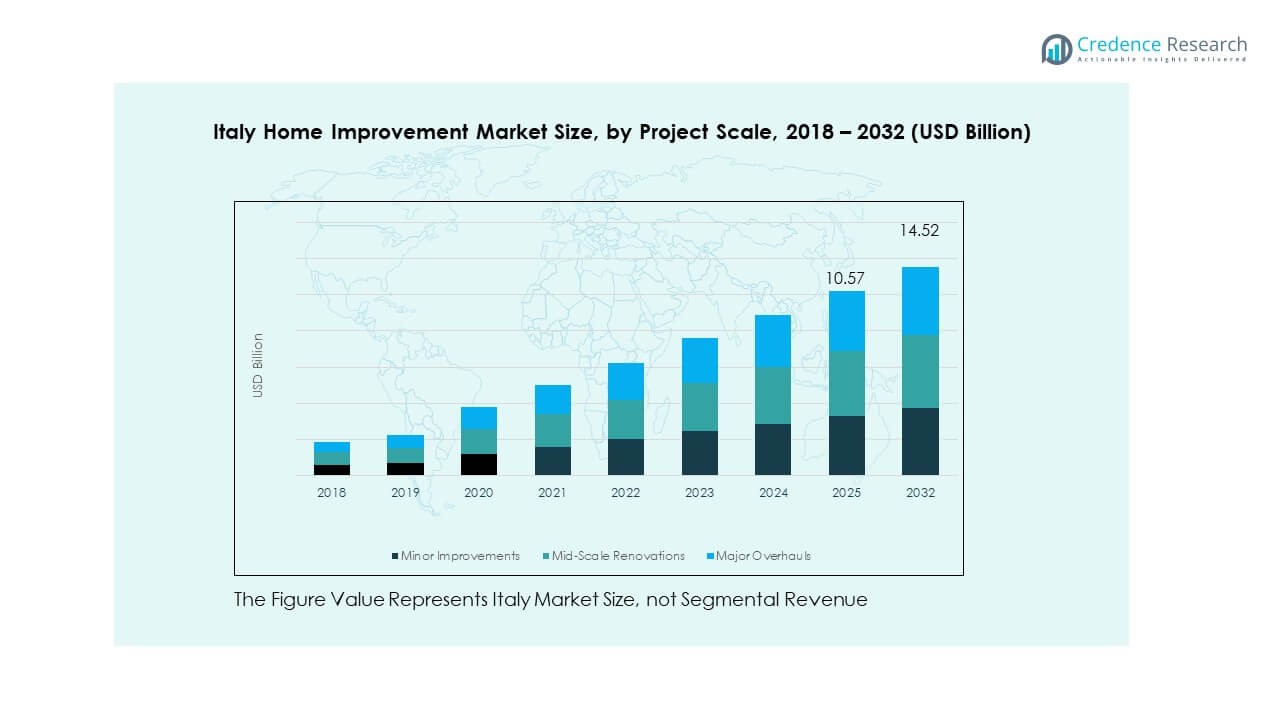

The Italy Home Improvement Market size was valued at USD 8.09 billion in 2018, increased to USD 10.14 billion in 2024, and is anticipated to reach USD 14.52 billion by 2032, at a CAGR of 4.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Home Improvement Market Size 2024 |

USD 10.14 Billion |

| Italy Home Improvement Market, CAGR |

4.56% |

| Italy Home Improvement Market Size 2032 |

USD 14.52 Billion |

The growth of the Italy Home Improvement Market is primarily driven by the increasing demand for residential renovations. Italian homeowners are increasingly focused on modernizing their homes with energy-efficient solutions and aesthetic upgrades. Rising disposable incomes, particularly among middle-class families, are fueling the desire for home improvement projects. Moreover, government initiatives promoting sustainable home renovations are further boosting market growth.

Regionally, Northern Italy leads the market, with cities like Milan and Turin contributing significantly due to high urbanization and economic activities. The southern regions, though growing, are emerging as key areas for expansion, supported by increasing investments in residential and commercial projects. The trend toward sustainable and smart home solutions is gaining momentum across the country, influencing home improvement activities in both urban and suburban areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Italy Home Improvement Market was valued at USD 8.09 billion in 2018, is projected to reach USD 10.14 billion in 2024, and is expected to grow to USD 14.52 billion by 2032, at a CAGR of 4.56% during the forecast period.

- Northern Italy holds the largest share of the market, approximately 45%, due to strong economic activity, high property values, and a high rate of urbanization. Central Italy follows with around 30% of the share, driven by a blend of historic renovations and residential upgrades. Southern Italy and the islands contribute 25%, with an emerging market driven by increasing investments and property development.

- The fastest-growing region is Southern Italy and the islands, expected to witness rapid expansion due to rising urbanization, economic development, and government-backed infrastructure projects, pushing home renovation demand in these areas.

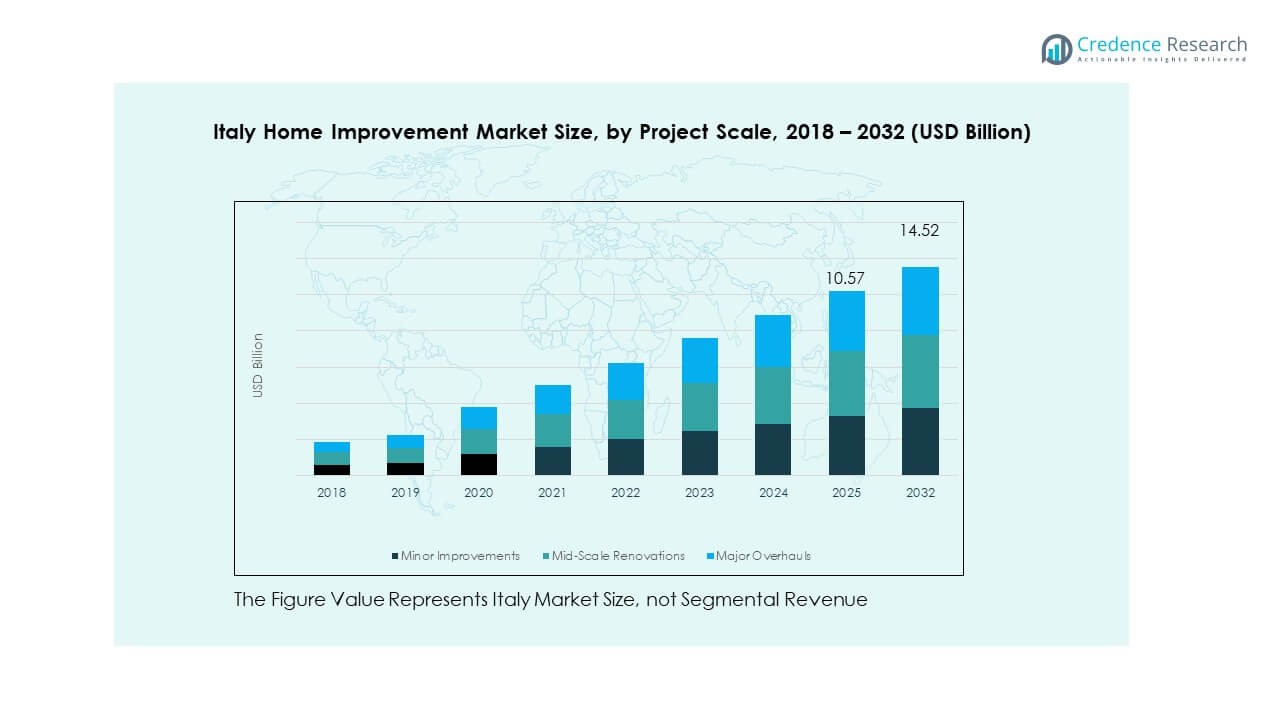

- Minor Improvements hold the largest market share at 55%, driven by the high volume of small-scale, cost-effective renovation projects. Mid-Scale Renovations follow with a 30% share, while Major Overhauls make up 15% of the market, reflecting significant but less frequent investment in property transformations.

- The Italy Home Improvement Market shows a steady increase in demand across all project types, with Minor Improvements steadily increasing in volume, while Major Overhauls remain a smaller but significant segment with higher value offerings.

Market Drivers:

Increasing Demand for Energy-Efficient Solutions

The Italy Home Improvement Market is experiencing a notable shift towards energy-efficient home renovations. Homeowners are increasingly focused on improving energy conservation within their homes by upgrading insulation, installing energy-efficient windows, and incorporating renewable energy solutions such as solar panels. This trend aligns with both environmental concerns and economic benefits, as households seek to reduce utility bills while enhancing their homes’ sustainability. The growing awareness of climate change and governmental initiatives supporting energy-saving projects further fuel this demand.

- For instance, Enel X, a leader in the energy sector, offers home energy efficiency solutions like solar panel installations and smart thermostats to improve energy consumption management. These initiatives help households reduce utility bills while enhancing their sustainability.

Technological Advancements in Home Improvement

Technological innovations play a significant role in driving the Italy Home Improvement Market. Smart home solutions such as automated lighting, heating systems, and security devices are becoming a staple for modern homeowners. The integration of smart technologies in home improvement is enhancing convenience and improving energy efficiency. These advancements allow homeowners to remotely control various aspects of their homes, offering improved control and personalization. As consumer interest in home automation grows, it propels the market forward with increased investments in smart devices.

- IKEA Italy, for example, offers a range of smart home products like smart lighting and security cameras, contributing to the growing demand for home automation. The integration of these smart technologies not only enhances convenience but also improves energy efficiency.

Government Incentives for Home Renovations

Government incentives for home improvements are accelerating the growth of the Italy Home Improvement Market. Various national and local programs offer tax credits, subsidies, and low-interest loans for energy-efficient and eco-friendly renovations. These policies encourage homeowners to invest in green building materials and energy-saving appliances. By supporting environmentally conscious upgrades, the government stimulates a growing market for sustainable home improvement solutions. These incentives are particularly attractive to homeowners who seek to reduce long-term energy costs and improve their property’s value.

Rising Disposable Income and Urbanization

The rising disposable income in Italy is a key factor propelling the home improvement market. As Italians experience greater financial flexibility, many are choosing to invest in their homes. Urbanization also plays a significant role, particularly in major cities like Milan and Rome, where demand for property upgrades, expansions, and modernizations is growing rapidly. The combination of economic growth and increased urban living drives the need for home improvements, particularly in cities with high property values. Homeowners are eager to maintain their properties’ market competitiveness and functionality through consistent upgrades.

Market Trends:

Market Trends:

Rising Popularity of Sustainable Materials

The Italy Home Improvement Market is seeing an increasing preference for sustainable materials in home renovations. Consumers are more conscious of the environmental impact of their building materials and are opting for eco-friendly alternatives such as bamboo flooring, recycled steel, and low-VOC paints. The trend reflects the broader global movement towards sustainability, influencing Italian homeowners to seek out solutions that are not only functional but also have minimal environmental footprints. These materials often provide long-term cost savings, making them an attractive option for cost-conscious buyers.

- For instance, Sikkens, a leading brand in coatings, offers eco-friendly, low-VOC paints that meet sustainability standards, catering to the growing demand for environmentally conscious home renovations.

Home Office Renovations and Remote Work Trends

The rise of remote work has significantly influenced the Italy Home Improvement Market. Many Italian households are investing in home office spaces, transforming existing rooms or repurposing underutilized areas to accommodate workstations. This trend is fueled by the continued shift towards hybrid and remote working models. As people spend more time at home, there is an increasing demand for functional and ergonomic home office setups. This trend is expected to continue as the flexibility of work arrangements becomes more permanent, leading to further investment in home renovations focused on productivity.

- For instance, Carlo Ratti Associati, an architecture firm in Italy, has designed flexible office spaces that blend functionality with comfort, catering to the needs of remote workers. This trend is fueled by the continued shift toward hybrid and remote working models.

Home Automation Integration

Home automation continues to grow in popularity within the Italy Home Improvement Market. Italian consumers are increasingly integrating smart home technologies into their renovation projects, such as automated lighting, climate control systems, and voice-activated devices. The convenience of controlling various systems remotely via smartphone apps adds to their appeal. These advancements also improve energy efficiency and security, providing homeowners with both practical and peace-of-mind benefits. As technology evolves, more Italian homeowners are seeking to make their homes smarter, driving demand for products and services in this segment.

Interest in Luxury Home Improvements

There is a rising trend of luxury home improvements in Italy, particularly among affluent homeowners. High-end home improvements, including bespoke kitchens, designer bathrooms, and premium flooring, are gaining traction. With a growing number of Italian consumers desiring both comfort and exclusivity, the luxury home improvement market is thriving. Consumers are willing to invest in premium materials and finishes to create personalized, high-quality living spaces. This trend is particularly evident in Italy’s more affluent urban areas, where homeowners are looking to make their properties stand out in a competitive real estate market.

Market Challenges Analysis:

High Renovation Costs

One of the key challenges in the Italy Home Improvement Market is the high cost of renovations. While demand for home improvements is on the rise, many homeowners are deterred by the substantial investment required, especially for energy-efficient or luxury upgrades. The cost of labor, building materials, and permits can significantly add to the overall renovation expense, making it inaccessible for some homeowners. Economic fluctuations also contribute to rising costs, with inflation driving up the prices of raw materials and construction services. This challenge poses a barrier to widespread participation in the home improvement market, particularly for low- and middle-income families.

Skilled Labor Shortages

Another challenge facing the Italy Home Improvement Market is the shortage of skilled labor. As demand for renovations increases, there is a growing need for experienced contractors and skilled tradespeople to carry out these projects. However, the construction industry in Italy has been facing a shortage of skilled workers, which results in delays and higher labor costs. This shortage can affect the completion timeline of renovation projects and negatively impact the overall cost-efficiency of home improvements. The market is thus faced with the challenge of ensuring an adequate supply of skilled labor to meet the growing demand.

Market Opportunities:

Expansion of Green Building Practices

The Italy Home Improvement Market presents a significant opportunity for growth in green building practices. With increasing awareness of environmental issues and energy efficiency, homeowners are more likely to invest in eco-friendly renovations. Green certifications, such as LEED and BREEAM, are becoming more popular as consumers seek sustainable living solutions. The demand for eco-friendly homes creates opportunities for companies specializing in energy-efficient appliances, renewable energy installations, and sustainable materials. As Italy continues to prioritize environmental conservation, the home improvement sector stands to benefit from this growing trend.

Investment in Smart Home Technologies

Smart home technology represents a key opportunity for expansion in the Italy Home Improvement Market. With rising demand for convenience, security, and energy efficiency, homeowners are increasingly adopting home automation systems. From smart thermostats to advanced security systems, Italian consumers are eager to integrate technology into their living spaces. Companies that focus on providing seamless and user-friendly smart home solutions are well-positioned to capitalize on this growing market. This segment’s continued growth offers opportunities for innovation and expansion in the home improvement sector.

Market Segmentation Analysis:

Market Segmentation Analysis:

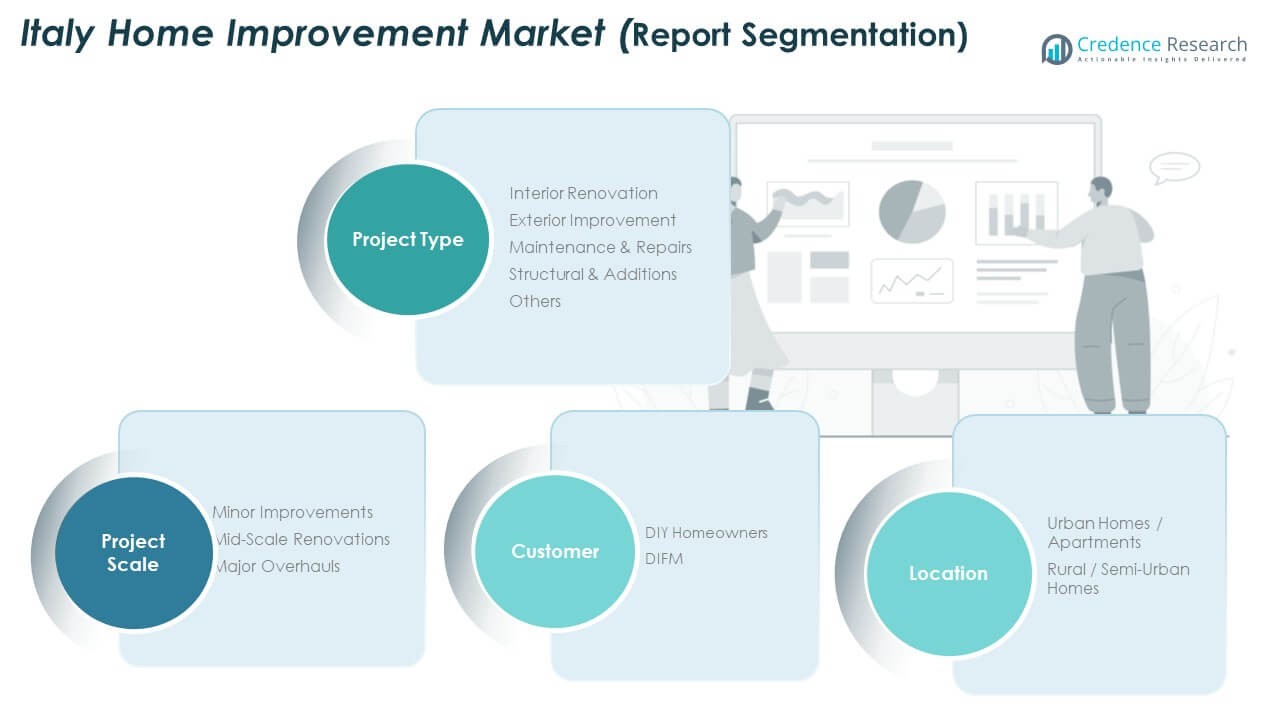

By Project Type

The Italy Home Improvement Market is diversified across various project types. Interior renovation remains a leading segment, driven by demand for modern, energy-efficient living spaces. Exterior improvements, including landscaping and façade upgrades, follow closely, especially in urban areas where aesthetics are emphasized. Maintenance and repairs make up a significant portion, focusing on property upkeep. Structural and addition projects, often involving larger renovations, are increasingly popular in densely populated regions. Other specialized projects cater to unique homeowner needs, providing tailored solutions to individual preferences.

- For instance, Fincantieri, a renowned shipbuilding company, does not apply design concepts to the exterior improvements of residential buildings; its work focuses on marine vessels and related infrastructure, systems, and after-sales support.

By Project Scale

The market is categorized by project scale, with minor improvements dominating the landscape. These include small updates and repairs that require minimal investment but offer significant value. Mid-scale renovations, which involve more substantial upgrades, are increasingly common as homeowners seek more comprehensive changes without overhauling the entire property. Major overhauls, though less frequent, represent a significant market segment, particularly for homeowners seeking to transform or expand their properties for greater functionality or value.

- For example, Leroy Merlin, an Italian DIY retail giant, reports strong sales in small-scale renovation tools and materials used by homeowners for DIY updates. Mid-scale renovations, which involve more substantial upgrades, are increasingly common as homeowners seek more comprehensive changes without overhauling the entire property.

By Customer Type

The customer type segmentation shows a clear divide between DIY homeowners and DIFM (Do-It-For-Me) customers. DIY homeowners prefer to undertake projects themselves, seeking cost-effective solutions. DIFM customers, on the other hand, rely on professionals for more complex tasks, driving demand for renovation services and contractors.

By Location

The market is also segmented by location, with urban homes and apartments leading in demand for home improvement. Urban areas have higher disposable incomes and a greater need for modern living solutions. In contrast, rural and semi-urban homes show rising potential as infrastructural development and economic conditions improve in these regions.

Segmentation:

By Project Type:

- Interior Renovation

- Exterior Improvement

- Maintenance & Repairs

- Structural & Additions

- Others

By Project Scale:

- Minor Improvements

- Mid-Scale Renovations

- Major Overhauls

By Customer Type:

- DIY Homeowners

- DIFM (Do-It-For-Me)

By Location:

- Urban Homes / Apartments

- Rural / Semi-Urban Homes

Regional Analysis:

Northern Italy Dominance

Northern Italy captures approximately 45% of the Italy Home Improvement Market share, driven by strong economic centres like Milan and Turin. Urban property values remain high in this region, prompting homeowners to invest in upgrades. The industrial base and wealthy households support demand for premium materials and services. Renovation activity benefits from well‑developed supply chains and service providers. High disposable incomes and tight housing stocks fuel robust renovation spending. Energy‑efficient retrofit programmes also lift volume in this region consistently.

Central Italy Moderate Growth

Central Italy holds an estimated 30% of market share for the home improvement sector. Cities like Rome and Florence offer a mix of historic homes and newer developments, which pushes renovation demand. Homeowners in this region focus on both aesthetic interior upgrades and structural improvements. The presence of historic buildings increases investment into preservation‑type improvements. While income levels are slightly lower than the north, renovations remain an important value‑add for property owners. Growth in this region remains steady, supported by tourism‑related residential upgrades.

Southern Italy and Islands Emerging Region

Southern Italy and the islands account for nearly 25% of the market share in the Italy Home Improvement Market. This region exhibits growing potential thanks to rising investment in housing and infrastructure. Renovation demand arises for both urban apartments and rural homes, where older housing stock dominates. Lower starting service levels and older properties present upside for contractors and suppliers. Economic constraints and slower income growth moderate spending levels compared to the north. Nevertheless, the region is becoming a target for value‑oriented home improvement services and green retrofit programmes.

Key Player Analysis:

- Esperiri Milano

- Architetto Veronica Patta

- GLF SpA

- Crane Renovation Group

- HappyBart

- Anglian Home Improvements

- ITALY RENOVATION

- HHI

- HOME Italia

- Other Key Players

Competitive Analysis:

The Italy Home Improvement Market is highly competitive, with numerous established players vying for market share. Key players in the market focus on offering a broad range of products and services across various home renovation categories. Companies differentiate themselves through product quality, customer service, and specialization in energy-efficient and sustainable solutions. Regional contractors also play a vital role in the market, offering localized services tailored to homeowners’ specific needs. As market dynamics evolve, partnerships, technological innovations, and sustainable practices are increasingly influencing the competitive landscape. Players like Esperiri Milano and Architetto Veronica Patta lead in design and innovation, while others like Anglian Home Improvements emphasize broad service offerings. As demand for eco-friendly and energy-efficient home solutions grows, market competition is expected to intensify, with companies aiming to position themselves as leaders in sustainable home improvement.

Recent Developments:

- In 2024-2025, HappyBart, a Berlin-based professional apartment renovation company specializing in interior renovations including kitchen cabinetry, bathrooms, and flooring, has continued its operational activities serving clients in Germany. The company maintains its 360-degree service model covering concept development, construction management, and complete project execution.

- In March 2025, Anglian Home Improvements announced the renewal of its primary partnership with Norwich City Football Club, extending a relationship that has spanned over 25 years combined. This renewed agreement ensures the Anglian Home Improvements branding will continue to adorn The Barclay stand.

- In February 2024, Crane Company announced a definitive agreement to sell its Engineered Materials business to KPS Capital Partners, LP for $227 million, with the transaction anticipated to close in the first quarter of fiscal year 2025. This divestiture represented a strategic portfolio simplification action, allowing Crane to focus resources on its two strategic growth platforms: Aerospace & Electronics and Process Flow Technologies. While this transaction involved the broader Crane Company rather than Crane Renovation Group specifically, it demonstrates corporate restructuring within the Crane family of businesses during the 2024-2025 period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on project type, customer type, and location. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing interest in energy-efficient home improvements will drive demand in urban regions.

- Increased adoption of smart home technologies will lead to more connected renovations.

- Sustainable building materials will become more mainstream in renovations.

- The DIY segment is expected to remain strong, especially among younger homeowners.

- The DIFM segment will see growth as professional services become more sought after.

- A shift toward home office renovations will continue due to the rise in remote work.

- Northern Italy will maintain its dominance in market share, driven by economic activity.

- Regional expansion of services in southern Italy presents growth opportunities.

- The rise of luxury home improvements will drive higher spending on premium renovations.

- Environmental regulations will encourage further development of green building initiatives.

Market Trends:

Market Trends: Market Segmentation Analysis:

Market Segmentation Analysis: