| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Pea Proteins Market Size 2024 |

USD 60.96 Million |

| Italy Pea Proteins Market, CAGR |

10.86% |

| Italy Pea Proteins Market Size 2032 |

USD 139.07 Million |

Market Overview:

The Italy Pea Proteins Market is projected to grow from USD 60.96 million in 2024 to an estimated USD 139.07 million by 2032, with a compound annual growth rate (CAGR) of 10.86% from 2024 to 2032.

The growth of the Italy pea protein market is driven by a combination of health, environmental, and technological factors. Increasing consumer preference for healthier diets has spurred the demand for plant-based protein alternatives as people shift towards vegan, vegetarian, and flexitarian lifestyles. Pea protein, being highly nutritious, allergen-free, and rich in essential amino acids, is seen as an attractive option for health-conscious consumers. Furthermore, the rising awareness of environmental sustainability plays a significant role in boosting demand. As consumers become more environmentally conscious, the shift from animal-based to plant-based protein sources has gained momentum. Pea protein is considered a more sustainable choice, requiring fewer natural resources like water and land compared to animal-derived proteins. Additionally, the growing innovation in product development, including protein isolates and textured pea protein for use in various food and beverage products, has further expanded its market appeal. As companies develop new applications, such as dairy alternatives, meat analogs, and snacks, the demand for pea protein is expected to continue growing.

Italy is one of the leading markets for pea protein in Europe, driven by its strong demand for plant-based protein sources. The country has a well-established health-conscious consumer base that values sustainable and nutritious ingredients. Italy’s growing interest in plant-based foods, alongside the increasing adoption of vegan and vegetarian diets, provides a solid foundation for the expansion of pea protein products. The Italian market is benefiting from broader European trends, where there is an increasing shift towards plant-based proteins in countries like the UK, Germany, and France. Italy’s role as a prominent player in the Mediterranean diet also supports the growth of plant-based alternatives, with local consumers showing interest in healthier, sustainable food options. The demand for pea protein is particularly high in the food and beverage sector, as manufacturers respond to consumer demand for meat substitutes and dairy alternatives. The country’s increasing focus on environmental sustainability further aligns with the shift toward plant-based ingredients, making Italy a key player in the broader European pea protein market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Italy Pea Proteins Market is projected to grow from USD 60.96 million in 2024 to USD 139.07 million by 2032, at a CAGR of 10.86%.

- The global pea proteins market is projected to grow from USD 2,229.15 million in 2024 to USD 5,618.92 million by 2032, at a CAGR of 12.25%.

- Health and wellness trends are driving demand for plant-based proteins, with consumers increasingly seeking nutritious, allergen-free options like pea protein.

- Environmental sustainability plays a significant role in boosting demand, as consumers shift from animal-based to plant-based proteins, valuing eco-friendly alternatives.

- Pea protein’s hypoallergenic properties make it an attractive choice for consumers with sensitivities to dairy, soy, and gluten, expanding its appeal across diverse diets.

- Product innovation, particularly in dairy alternatives, meat analogs, and snacks, is diversifying pea protein’s market applications and enhancing its appeal to health-conscious consumers.

- Price sensitivity remains a challenge, as pea protein is often more expensive than traditional animal proteins, limiting its accessibility for price-conscious consumers.

- Limited consumer awareness and education about pea protein’s nutritional benefits may hinder wider adoption, necessitating greater efforts in marketing and information dissemination.

Market Drivers:

Health and Wellness Trends

The growing focus on health and wellness among Italian consumers is one of the primary drivers of the pea protein market. As individuals become more conscious of their dietary choices, the demand for plant-based alternatives to traditional animal proteins is rising. Pea protein is a popular choice due to its rich nutritional profile, including high levels of essential amino acids, and its suitability for various dietary preferences, such as vegan, vegetarian, and gluten-free diets. This shift is particularly noticeable among millennials and Generation Z, who are increasingly seeking clean-label products with minimal processing. As a result, the demand for pea protein in products like protein bars, plant-based beverages, and meat alternatives has surged.

Environmental Sustainability

Environmental concerns are another key factor influencing the growth of the pea protein market in Italy. As consumers and businesses alike become more aware of the environmental impact of food production, there is a noticeable shift towards sustainable and eco-friendly alternatives. Pea protein production requires fewer natural resources, such as water and land, compared to animal-based proteins, making it a more sustainable choice. The rising awareness about climate change, greenhouse gas emissions, and the overall environmental footprint of the food industry has led to an increasing preference for plant-based proteins. This trend is further supported by Italy’s strong commitment to sustainability and green practices, which aligns with the growing consumer interest in environmentally responsible food options.

Allergen-Free and Hypoallergenic Benefits

Pea protein’s hypoallergenic properties also contribute significantly to its market growth. As food allergies become more prevalent, consumers are actively seeking alternatives to soy, dairy, and gluten-based proteins, which can trigger allergic reactions in some individuals. Pea protein, being free from these common allergens, offers a safe and nutritious option for a broader consumer base, including those with sensitivities to dairy or soy. This makes it an attractive ingredient in various food products, such as protein shakes, dairy alternatives, and snack foods. For instance, companies such as Roquette have developed products like Nutralys, an organic textured protein derived from peas and fava beans, specifically targeting the needs of consumers with allergies and dietary sensitivities. As consumer demand for allergen-free products continues to rise, pea protein is increasingly becoming the preferred choice for food manufacturers looking to cater to this market segment.

Product Innovation and Market Diversification

Continued innovation and the diversification of pea protein applications have also played a significant role in the market’s growth. In Italy, food manufacturers are increasingly incorporating pea protein into a wide range of products, including meat analogs, dairy alternatives, baked goods, and snacks. Technological advancements in protein extraction and formulation have improved the texture and taste of pea protein, making it a more desirable ingredient for consumers. For example, in October 2022, Roquette Frères introduced four new grades of organic pea protein isolates and starches to the European market, including Italy, with organic peas sourced from Canada. Additionally, the growing trend of plant-based diets in Italy is prompting brands to expand their offerings with new, innovative products that feature pea protein as a key ingredient. This ongoing innovation has allowed pea protein to penetrate new product categories and gain traction in both traditional and emerging food markets.

Market Trends:

Increasing Demand for Plant-Based Meat Alternatives

One of the key trends in the Italy pea protein market is the rapid growth of plant-based meat alternatives. As Italian consumers shift towards plant-based diets, the demand for meat substitutes made from pea protein is expanding. The growing popularity of vegan and flexitarian diets, coupled with a desire to reduce meat consumption for health and environmental reasons, has driven innovation in the plant-based protein sector. Companies are increasingly using pea protein to develop realistic meat substitutes that mimic the taste, texture, and nutritional profile of traditional meat products. This trend is expected to continue as more consumers in Italy seek protein-rich, plant-based options without compromising on taste or texture, further boosting the demand for pea protein in the food industry.

Focus on Clean-Label and Transparency in Food Products

Another prominent trend in the Italian pea protein market is the increasing demand for clean-label products. Consumers in Italy, particularly millennials and Generation Z, are prioritizing transparency in the food products they purchase. They prefer products with simple, natural ingredients, and are wary of those containing artificial additives or preservatives. Pea protein is well-suited to this trend, as it is a minimally processed, natural ingredient that fits into the clean-label category. The rise of clean-label foods is prompting food manufacturers to explore pea protein as an ingredient in a wide array of products, from protein bars to beverages and snacks. As consumer awareness around food ingredients continues to grow, the demand for clean-label products containing pea protein is expected to rise.

Expansion of Pea Protein in Dairy Alternatives

Pea protein’s role in the dairy alternative segment is gaining traction in Italy. The demand for plant-based milk and dairy alternatives has grown significantly over the past few years, driven by concerns about lactose intolerance, dairy allergies, and a shift towards more sustainable food choices. For instance, Nestlé’s Wunda, a pea-based milk alternative, is made from yellow peas sourced in France and Belgium and is recognized for its high protein and fiber content, low sugar and fat, and enrichment with calcium and vitamins D, B2, and B12. Pea protein is increasingly being used as a key ingredient in dairy alternatives such as plant-based milk, cheese, yogurt, and ice cream. Its ability to deliver a smooth, creamy texture and its neutral flavor make it an ideal choice for these products. As the dairy alternative market continues to expand in Italy, the demand for pea protein is likely to increase, supporting the market’s growth in this segment.

Technological Advancements in Protein Extraction

Technological advancements in protein extraction are also influencing the growth of the pea protein market in Italy. For example, HIFOOD’s Micro Protein uses micronization technology to produce a pea protein with over 70% protein content and improved solubility, supporting its use in clean-label products. The development of new, more efficient extraction methods has led to an improvement in the quality, texture, and solubility of pea protein. These innovations have made pea protein a more versatile ingredient that can be used across a wider range of products, including ready-to-eat meals, snacks, and beverages. Furthermore, advancements in processing techniques have reduced the cost of production, making pea protein more accessible to both manufacturers and consumers. As technology continues to improve, it is expected that the functional properties of pea protein will continue to evolve, providing additional opportunities for its use in a variety of food and beverage application

Market Challenges Analysis:

Price Sensitivity and Cost-Competitiveness

One of the primary challenges facing the Italy pea protein market is price sensitivity. Despite the growing popularity of plant-based proteins, pea protein remains more expensive compared to traditional animal proteins. For example, the processing of pea protein often requires specialized equipment and advanced extraction methods, which raises operational expenses and makes it difficult for manufacturers to offer competitive pricing. This price disparity can be a barrier for consumers, especially in a price-sensitive market like Italy, where cost-conscious buyers may opt for cheaper protein sources. Additionally, although pea protein is gaining traction in various food products, the higher cost of production and extraction methods can make it difficult for manufacturers to offer it at competitive prices, potentially limiting its market reach in the mass consumer segment. As the market matures, reducing production costs through technological advancements may be essential to overcoming this challenge.

Limited Consumer Awareness and Education

Another challenge hindering the growth of the pea protein market in Italy is limited consumer awareness and understanding of its benefits. While the demand for plant-based proteins is rising, many consumers still lack knowledge about the nutritional advantages of pea protein compared to other plant-based or animal proteins. This lack of awareness may limit the adoption of pea protein-based products, particularly among those who are unfamiliar with plant-based alternatives. Overcoming this obstacle will require increased consumer education through marketing campaigns, product labeling, and information on health benefits to boost confidence in pea protein as a sustainable and nutritious ingredient.

Supply Chain and Sourcing Challenges

The sourcing of high-quality pea protein in Italy presents another market challenge. While the global demand for pea protein is rising, there is often limited local production of peas in Italy, which can lead to supply chain constraints and increased dependence on imports. This can result in fluctuating prices and availability, making it difficult for manufacturers to maintain a consistent supply of raw materials. Additionally, the reliance on international sources can expose the market to external economic factors, such as tariffs, trade policies, and crop yields, which can further impact the stability and pricing of pea protein in the Italian market.

Market Opportunities:

The Italy pea protein market presents significant opportunities driven by evolving consumer preferences and increasing demand for sustainable food products. As Italian consumers become more health-conscious and seek alternative protein sources, there is a growing market for plant-based proteins like pea protein, which aligns with the rising trend of vegan, vegetarian, and flexitarian diets. The shift towards plant-based eating habits offers a prime opportunity for manufacturers to develop and expand product lines featuring pea protein, particularly in the meat alternatives and dairy replacement segments. With the rising popularity of plant-based milk, cheese, and meat analogs, companies that innovate and offer pea protein-based products stand to gain considerable market share in Italy’s food and beverage sector.

Additionally, the global push for sustainability provides another opportunity for the Italy pea protein market. Pea protein is considered a eco-friendlier alternative to animal-based proteins due to its lower environmental impact in terms of water usage, land requirements, and greenhouse gas emissions. As Italian consumers and businesses alike continue to prioritize sustainability, there is an increasing demand for plant-based proteins that align with these values. Manufacturers who can leverage the environmental benefits of pea protein, alongside its nutritional advantages, are well-positioned to tap into the growing market for clean-label, allergen-free, and environmentally responsible products. This shift in consumer behavior, combined with innovations in product development, presents a promising growth trajectory for the Italy pea protein market.

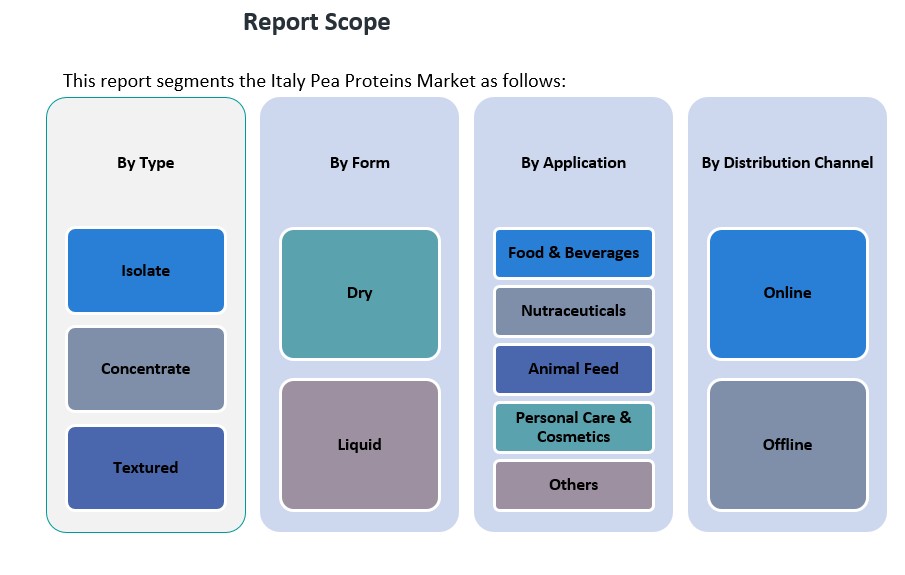

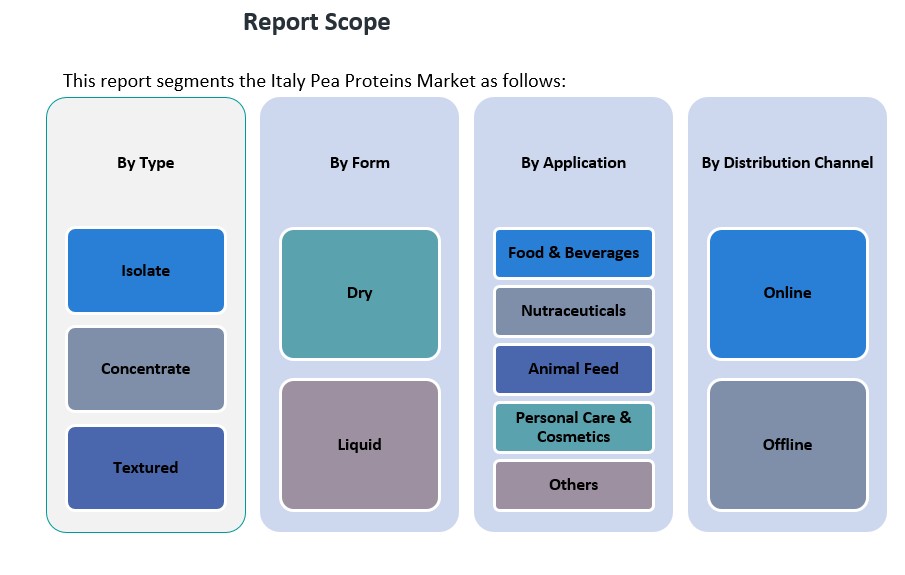

Market Segmentation Analysis:

The Italy pea protein market is segmented across several key dimensions, each contributing to the market’s overall growth.

By Type, pea protein is available in three main forms: Isolate, Concentrate, and Textured. The isolate segment holds the largest share, driven by its high protein content and versatility in applications such as meat analogs, dairy alternatives, and protein supplements. The concentrate segment is also experiencing growth due to its cost-effectiveness and suitability for various food products. The textured segment is gaining traction in plant-based meat products, offering a desirable texture that mimics traditional meat, thus expanding its appeal in the food and beverage sector.

By Application, pea protein is used across a variety of industries, with Food & Beverages being the largest segment, driven by the growing demand for plant-based foods, including meat substitutes, dairy alternatives, and protein-fortified snacks. Nutraceuticals are another significant application, as pea protein’s health benefits drive its inclusion in dietary supplements. The Animal Feed segment is also growing as pea protein offers a sustainable alternative to traditional animal feed ingredients. Additionally, the Personal Care & Cosmetics segment is exploring pea protein for its moisturizing and skin-soothing properties, while the Others category includes applications in non-food sectors.

By Form, the market is split between Dry and Liquid pea protein, with dry forms leading due to their longer shelf life and ease of transportation.

By Distribution Channel, Offline retail remains dominant, but Online sales are rapidly increasing as e-commerce becomes a preferred shopping method for health-conscious consumers seeking plant-based products.

Segmentation:

By Type

- Isolate

- Concentrate

- Textured

By Application

- Food & Beverages

- Nutraceuticals

- Animal Feed

- Personal Care & Cosmetics

- Others

By Form

By Distribution Channel

Regional Analysis:

The Italy pea protein market exhibits regional variations influenced by consumer behavior, economic activities, and dietary trends. While comprehensive regional market share data specific to pea protein is limited, insights can be drawn from broader plant-based protein and protein supplement markets.

Northern Italy: Leading in Plant-Based Protein Adoption

Northern Italy, encompassing regions like Lombardy, Veneto, and Emilia-Romagna, is at the forefront of the country’s plant-based protein consumption. Cities such as Milan and Turin are hubs for health-conscious consumers and innovative food startups, driving demand for plant-based products, including pea protein. This region’s strong economic infrastructure, coupled with a growing fitness culture and widespread retail networks, positions it as a significant market for pea protein-based products. The presence of major urban centers and a high concentration of gyms and wellness centers further contribute to the region’s leadership in adopting plant-based proteins.

Central and Southern Italy: Emerging Markets with Growth Potential

Central and Southern Italy, including regions like Lazio, Tuscany, and Campania, are witnessing an increasing interest in plant-based diets. While these areas currently represent a smaller share of the pea protein market compared to the north, they exhibit significant growth potential. Urban centers such as Rome and Naples are experiencing a rise in health awareness and the availability of plant-based products, indicating a shift towards plant-based protein consumption. As consumer awareness continues to grow and retail distribution expands, these regions are expected to contribute more substantially to the overall market in the coming years.

Key Player Analysis:

- Roquette Frères

- Cosucra Groupe Warcoing

- Burcon NutraScience Corporation

- Emsland Group

- Shandong Jianyuan Group

- Naturz Organics

- Fenchem Biotek Ltd.

- Kerry Group

- Sotexpro

- Meelunie B.V.

Competitive Analysis:

The Italy pea protein market is characterized by a competitive landscape involving both established international players and emerging local brands. Key global companies, such as Roquette Frères, Ingredion Incorporated, and Cargill, Inc., dominate the market by providing high-quality pea protein products, including isolates, concentrates, and textured variants. These companies benefit from their extensive global supply chains and research capabilities, enabling them to meet the growing demand for plant-based proteins in Italy. Local players, on the other hand, are leveraging Italy’s strong culinary traditions and health-conscious consumer base to introduce innovative pea protein-based products, particularly in the food and beverage sector. Companies like Axiom Foods and The Green Lab are gaining traction by focusing on sustainability and clean-label offerings, aligning with the increasing demand for eco-friendly and allergen-free ingredients. The market is expected to remain competitive, with both global and local players innovating to capitalize on the growing plant-based protein trend in Italy.

Recent Developments:

- In Jan 2025, Burcon NutraScience Corporation introduced its next-generation Peazazz®C pea protein, which features over 90% protein purity and low sodium content. Made from North American non-GMO field peas, this product is aimed at a variety of applications, including beverages, dairy alternatives, baked goods, and nutrition products. The accelerated launch timeline reflects Burcon’s confidence in rapid adoption and strong demand within the plant-based protein market.

- In February 2024, Roquette Frères expanded its NUTRALYS® plant protein portfolio by launching four new multifunctional pea protein ingredients: NUTRALYS® Pea F853M (isolate), NUTRALYS® H85 (hydrolysate), NUTRALYS® T Pea 700FL (textured), and NUTRALYS® T Pea 700M (textured). These innovations are designed to improve taste, texture, and versatility in plant-based foods and nutrition products, offering food manufacturers new options for product development and application innovation in the Italian and broader European pea proteins market.

- In October 2022, Roquette Frères made a significant move in the Italy pea proteins market by introducing four new grades of organic pea protein isolates and starches to the European market, including Italy. The company emphasized that these organic peas were sourced from Canada, reflecting Roquette’s commitment to expanding its portfolio of clean-label, plant-based ingredients for food and beverage manufacturers in Italy and across Europe.

Market Concentration & Characteristics:

The Italy pea protein market is characterized by a moderate level of concentration, with a mix of global industry leaders and emerging local players. In 2024, Italy accounted for 2.1% of the global pea protein market revenue, reflecting its growing but niche position within the European landscape. The market is primarily driven by increasing consumer demand for plant-based proteins, influenced by health and sustainability trends. This has led to a surge in product innovation, particularly in the food and beverage sector, where pea protein is utilized in meat substitutes, dairy alternatives, and functional foods. Manufacturers are focusing on clean-label products and allergen-free formulations to cater to health-conscious consumers. Additionally, advancements in protein extraction technologies are enhancing the quality and functionality of pea protein, further expanding its applications. Overall, while the Italy pea protein market remains competitive, it offers opportunities for growth, particularly for companies that can innovate and meet the evolving consumer preferences for plant-based, sustainable, and health-oriented products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Italy pea protein market is expected to experience steady growth, driven by rising consumer demand for plant-based proteins.

- Increased adoption of vegan and flexitarian diets will continue to fuel the demand for pea protein across food and beverage categories.

- Innovations in pea protein formulations, particularly for meat alternatives, will expand product offerings and consumer appeal.

- Clean-label and allergen-free trends will push food manufacturers to incorporate pea protein into a wider range of products.

- The rise in sustainability concerns will further promote pea protein as an environmentally friendly alternative to animal proteins.

- Italy’s strong culinary heritage will inspire new product applications in traditional foods using pea protein.

- E-commerce platforms will play an increasing role in the distribution of pea protein-based products, meeting consumer convenience demands.

- Technological advancements in protein extraction will lower production costs, making pea protein more accessible to a broader market.

- Regional expansion, particularly in Southern and Central Italy, will contribute to market growth as awareness and demand spread.

- Collaboration between local food manufacturers and global suppliers will drive market penetration and innovation in the plant-based protein sector.