Market Overview:

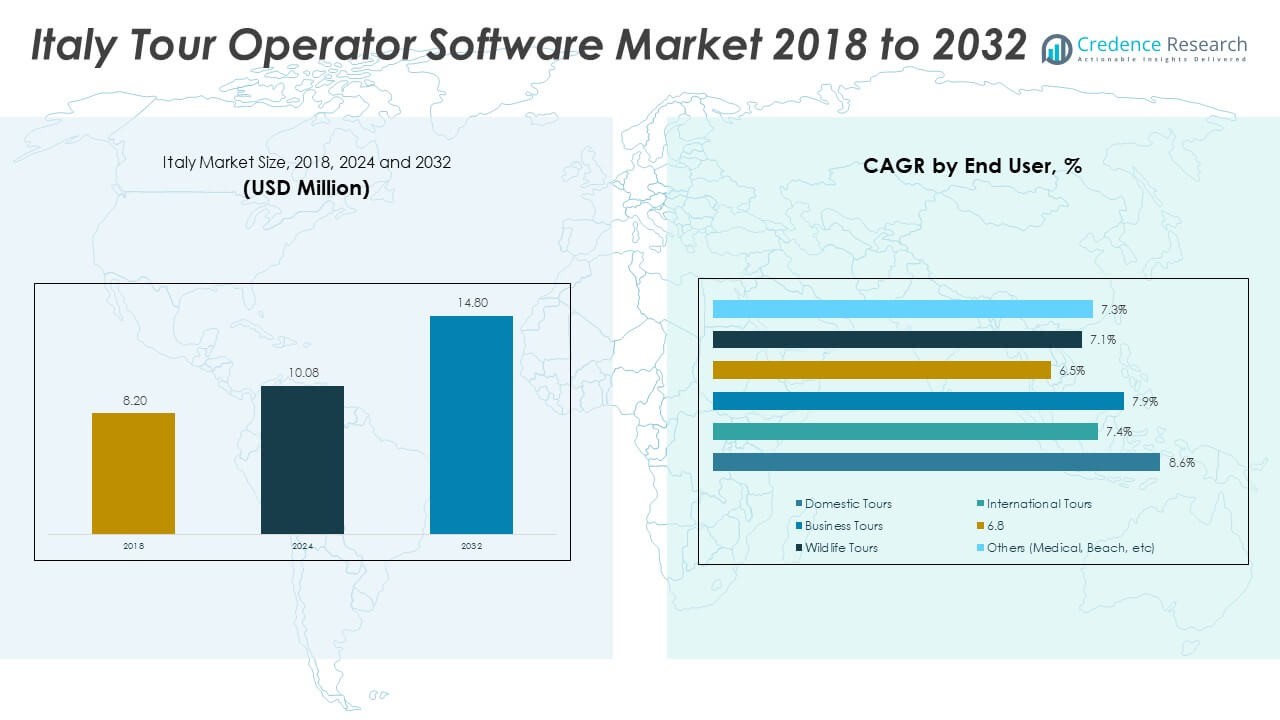

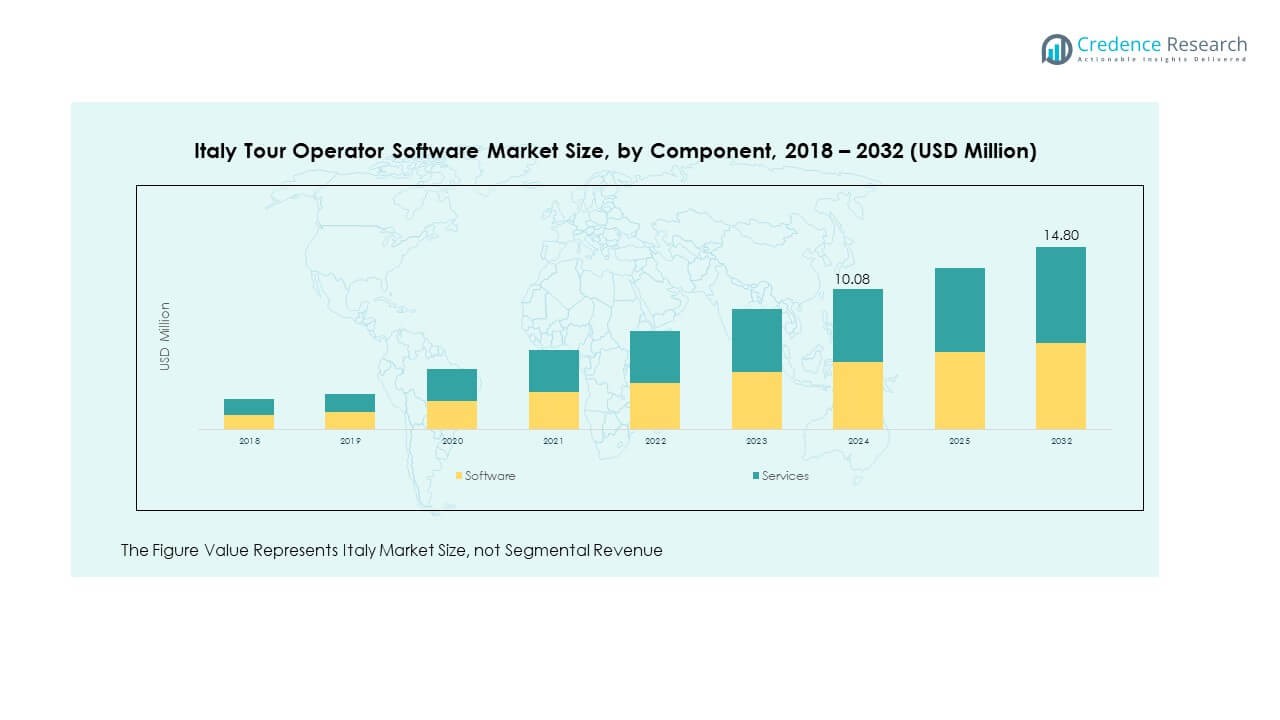

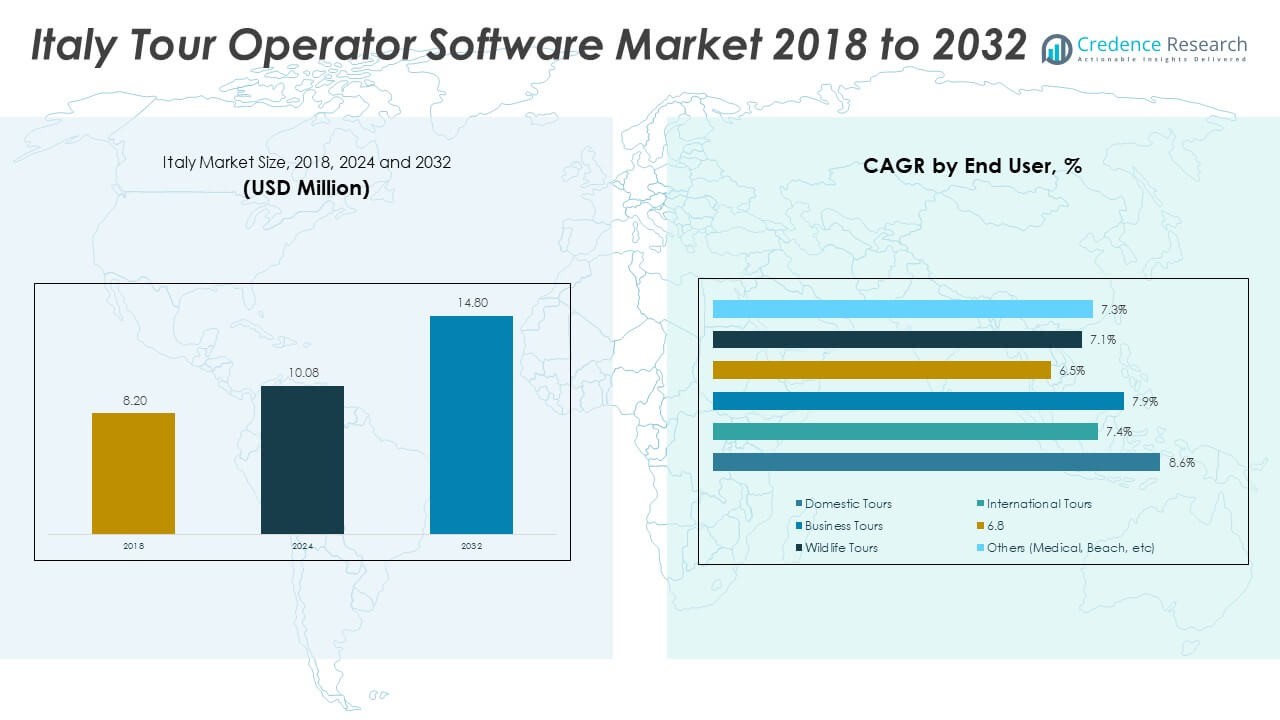

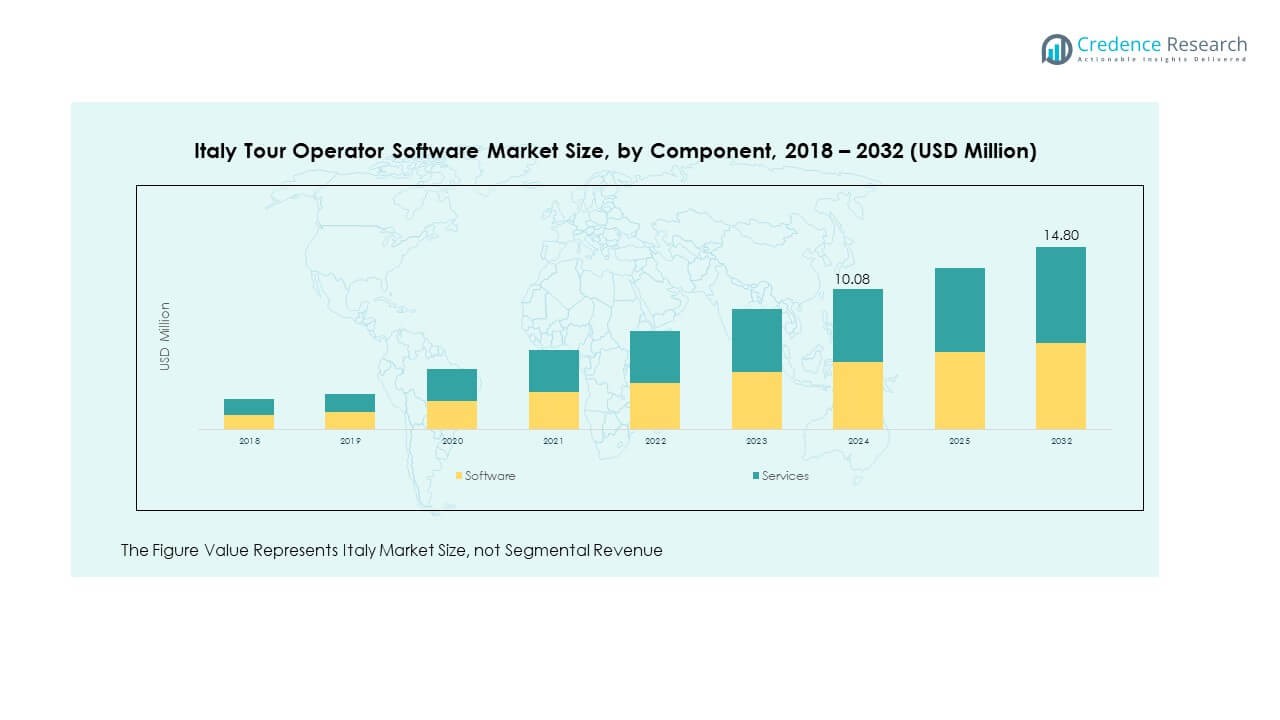

The Italy Tour Operator Software Market size was valued at USD 8.20 million in 2018 to USD 10.08 million in 2024 and is anticipated to reach USD 14.80 million by 2032, at a CAGR of 4.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Tour Operator Software Market Size 2024 |

USD 10.08 Million |

| Italy Tour Operator Software Market, CAGR |

4.92% |

| Italy Tour Operator Software Market Size 2032 |

USD 14.80 Million |

The market is driven by Italy’s strong tourism industry, where both domestic and international operators demand tools for itinerary planning, booking, and payment integration. Companies are investing in digital solutions to increase efficiency, reduce operational costs, and deliver customized travel packages. Demand for real-time data, mobile accessibility, and AI-based personalization is rising as tour operators strive to attract tech-savvy customers and strengthen competitiveness in a crowded landscape.

Geographically, the market shows stronger adoption in Italy’s northern and central regions, where tourism infrastructure and inbound visitor traffic remain high. Southern Italy and islands such as Sicily and Sardinia are emerging growth areas due to rising international arrivals and efforts to digitalize smaller tour companies. While Europe leads in technology adoption, Asia-Pacific is fast catching up with digital tourism innovations that can inspire future strategies for Italian operators.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Italy Tour Operator Software Market was valued at USD 8.20 million in 2018, reached USD 10.08 million in 2024, and is expected to hit USD 14.80 million by 2032, registering a CAGR of 4.92%.

- Europe (38%), North America (27%), and Asia Pacific (22%) held the top three regional shares in 2024, supported by advanced tourism infrastructure, digital adoption, and strong inbound traffic.

- Asia Pacific (22%) is the fastest-growing region, driven by rising tourism flows, increasing digital penetration, and growing cross-border travel demand.

- In 2024, software accounted for 63% of the Italy Tour Operator Software Market, driven by automation, personalization, and cloud adoption.

- Services contributed 37% of the market share, supported by integration, training, and support needs among small and mid-sized operators.

Market Drivers:

Rising Tourism Demand and Focus on Digital Transformation:

The Italy Tour Operator Software Market benefits from strong tourism demand that compels companies to adopt advanced software. Operators need platforms that simplify bookings, payments, and resource allocation while enhancing customer experience. It is pushing firms to embrace automation, mobile compatibility, and AI-driven personalization to stay competitive. Tour operators now rely on cloud solutions for improved scalability and integration with other systems. This demand strengthens adoption rates and helps businesses cater to diverse customer needs. Growing dependence on digital ecosystems further drives innovation and adoption.

- For instance, More than 33,000 tourism enterprises have joined the Tourism Digital Hub (TDH), a cloud-based ecosystem launched under Italy’s National Recovery and Resilience Plan, facilitating seamless system integration and scalability. This digital adoption supports diverse customer needs and pushes innovation across the sector, fostered by government-backed digital infrastructure projects like “Wi-Fi by Italia.it”.

Need for Operational Efficiency and Cost Optimization:

Operational efficiency remains a core driver for adoption of tour operator software across Italy. Companies seek tools that streamline workflows, reduce manual errors, and improve profitability. It provides real-time insights into bookings, cancellations, and payments, helping businesses manage resources effectively. Tour operators face pressure to deliver cost-effective services without compromising quality, creating a strong need for automation. The integration of CRM modules enhances client retention and upselling opportunities. Firms leverage data analytics for smarter decision-making, boosting competitiveness in a dynamic market. Efficiency-driven strategies are propelling software demand.

- For instance, real-time dashboards for bookings, cancellations, and payments are widely used, helping operators allocate resources effectively. Similarly, CRM integrations are commonly used to enhance upselling and customer retention.

Growing Consumer Expectations for Personalized Travel Services:

Customers increasingly expect customized itineraries, flexible bookings, and real-time support when planning tours. The Italy Tour Operator Software Market addresses this by integrating AI tools that recommend packages and optimize schedules. It enhances engagement through personalized experiences that build loyalty. Software platforms now feature chatbots, automated assistance, and dynamic pricing tools to meet evolving needs. Operators also benefit from social media integration, which influences buying decisions. This push for personalization is reshaping competitive strategies among players. Firms that embrace customization achieve higher customer satisfaction and repeat bookings.

Impact of Rising Online Travel Distribution Channels:

Online platforms and OTAs are reshaping tour distribution across Italy. Operators require software that integrates seamlessly with multiple distribution channels. The Italy Tour Operator Software Market is responding by enabling connectivity with global travel platforms. It helps operators expand reach, manage inventory in real time, and capture wider customer segments. Online bookings dominate consumer behavior, driving operators to rely on software with advanced channel management. The rise of multi-device bookings further strengthens the adoption of mobile-compatible solutions. Software-enabled distribution boosts efficiency and ensures stronger visibility for tour providers.

Market Trends:

Integration of Artificial Intelligence and Automation in Tourism Operations:

AI and automation are reshaping the Italy Tour Operator Software Market by improving predictive analytics, itinerary planning, and customer support. It enables operators to process large datasets, identify travel preferences, and deliver tailored recommendations. Automation minimizes human errors in reservations, payments, and compliance tasks. Companies that adopt AI-powered solutions improve efficiency and customer satisfaction. The focus on seamless, intelligent platforms highlights the shift towards smart tourism management. This trend ensures greater scalability and data-driven strategies. Operators increasingly view AI as a critical enabler of competitiveness.

- For instance, Operators recognize AI as critical to maintaining competitiveness, with targeted use cases including machine learning for customer preferences, chatbot communications, and compliance monitoring.

Adoption of Cloud-Based Solutions for Scalability and Mobility:

Cloud-based software is driving flexibility and scalability for tour operators across Italy. The Italy Tour Operator Software Market reflects this by offering platforms accessible from any location or device. It allows operators to manage operations remotely, enhance collaboration, and reduce infrastructure costs. Cloud systems integrate smoothly with third-party applications, ensuring better connectivity and functionality. This trend enables faster upgrades, improved data security, and real-time analytics for decision-making. Operators using cloud platforms gain competitive advantages by being agile and customer-focused. Cloud adoption continues to rise across small and large enterprises.

- For instance, Italy’s Tourism Digital Hub serves as a cloud infrastructure backbone, with over 33,000 enterprises integrated by mid-2025. Such platforms allow remote management, third-party app integration, and real-time analytics, increasing operator agility and customer responsiveness.

Rising Use of Mobile Applications for Traveler Engagement:

Mobile solutions are increasingly central to customer engagement in tourism. The Italy Tour Operator Software Market shows a surge in applications enabling real-time updates, digital itineraries, and mobile payments. It provides operators with a direct communication channel to enhance customer satisfaction. Mobile-first strategies help capture younger demographics that prefer convenience and flexibility. Features such as instant notifications, map integration, and digital tickets add value for travelers. The growing smartphone penetration in Italy strengthens this trend. Operators leveraging mobile solutions stand out in a competitive environment.

Growing Focus on Data Security and Regulatory Compliance:

Data protection has become a crucial priority for operators adopting digital platforms. The Italy Tour Operator Software Market emphasizes compliance with GDPR and other local regulations. It requires secure handling of customer data, payments, and travel information. Operators demand software with strong encryption, fraud detection, and secure cloud storage. The rising threat of cyberattacks accelerates investments in robust security solutions. Vendors are focusing on certifications and compliance frameworks to build trust. Security-enabled software enhances credibility among both corporate and retail clients. Compliance focus is shaping future product strategies across vendors.

Market Challenges Analysis:

High Implementation Costs and Limited Digital Readiness of Small Operators:

The Italy Tour Operator Software Market faces challenges from high upfront costs for software implementation. Small and mid-sized operators often lack resources to invest in advanced platforms. It slows digital adoption despite growing demand. Training requirements, integration complexities, and maintenance expenses add to the burden. Limited awareness of long-term cost benefits also hinders acceptance. Vendors face pressure to provide affordable, modular solutions. High entry costs create a divide between larger established operators and smaller players. This financial barrier restricts market expansion in cost-sensitive segments.

Competition from Global OTAs and Fragmented Local Market:

Global online travel agencies dominate the market with extensive digital ecosystems. The Italy Tour Operator Software Market competes against such platforms, which often overshadow local operators. It creates pressure for differentiation, making it difficult for smaller players to sustain growth. Fragmentation in the local industry further complicates scalability. Many operators still rely on traditional methods, reducing digital readiness. Strong competition limits pricing flexibility and impacts margins. Local vendors must focus on specialized features to retain competitiveness. This challenge continues to shape strategic approaches in the Italian market.

Market Opportunities:

Expansion of Niche Travel Segments and Custom Packages:

The Italy Tour Operator Software Market has opportunities in niche travel categories such as cultural, eco, and adventure tours. Operators can use software to create customized itineraries that appeal to specialized customer groups. It supports tailored experiences, attracting younger and experience-driven travelers. Integration of virtual reality and AI further strengthens personalization. Vendors providing solutions for niche markets can gain competitive advantages. Operators that embrace unique travel experiences will see higher margins. The opportunity lies in adapting platforms to deliver curated offerings for growing demand segments.

Rising International Tourism and Cross-Border Integration:

International arrivals in Italy present a significant growth avenue for software providers. The Italy Tour Operator Software Market benefits from cross-border collaborations that enhance multi-language, multi-currency, and tax-compliant features. It supports operators catering to global customers while ensuring compliance with international standards. Vendors can expand footprints by offering integrated booking and payment solutions. The growth of multi-destination packages boosts the demand for advanced platforms. International connectivity increases opportunities for innovation in tour design. This expansion reinforces Italy’s role as a global tourism hub, enhancing prospects for technology adoption.

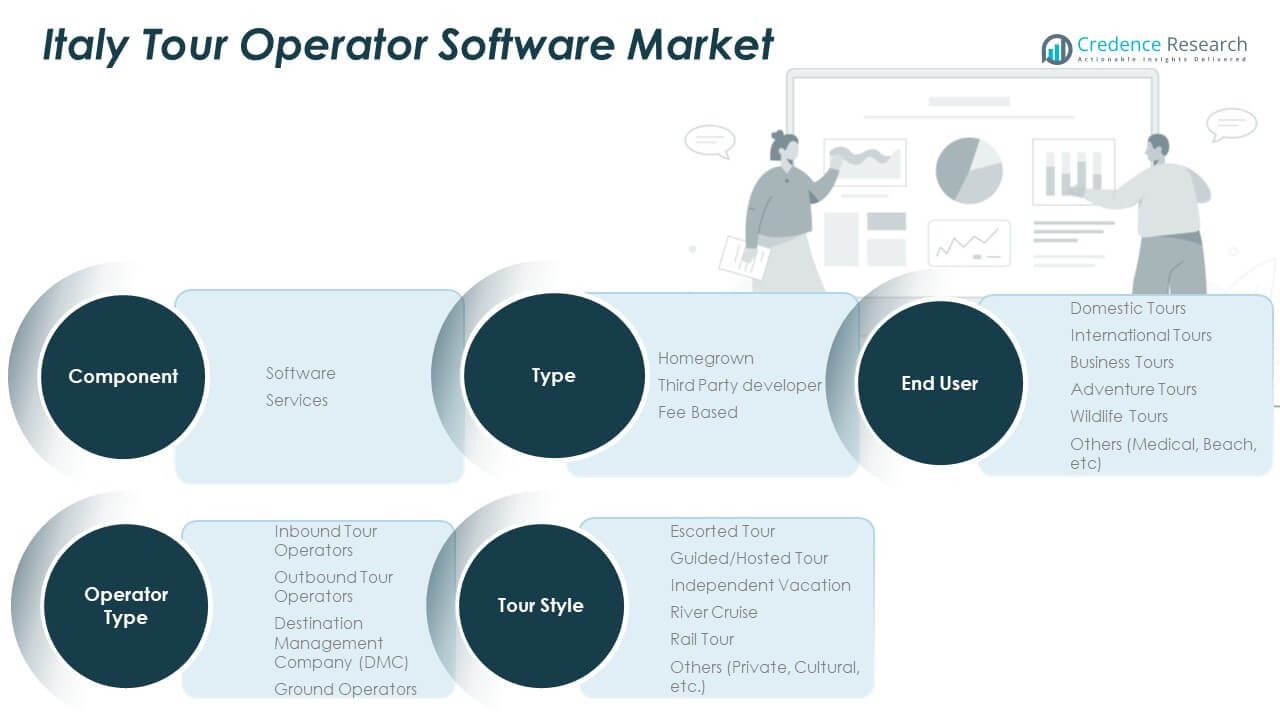

Market Segmentation Analysis:

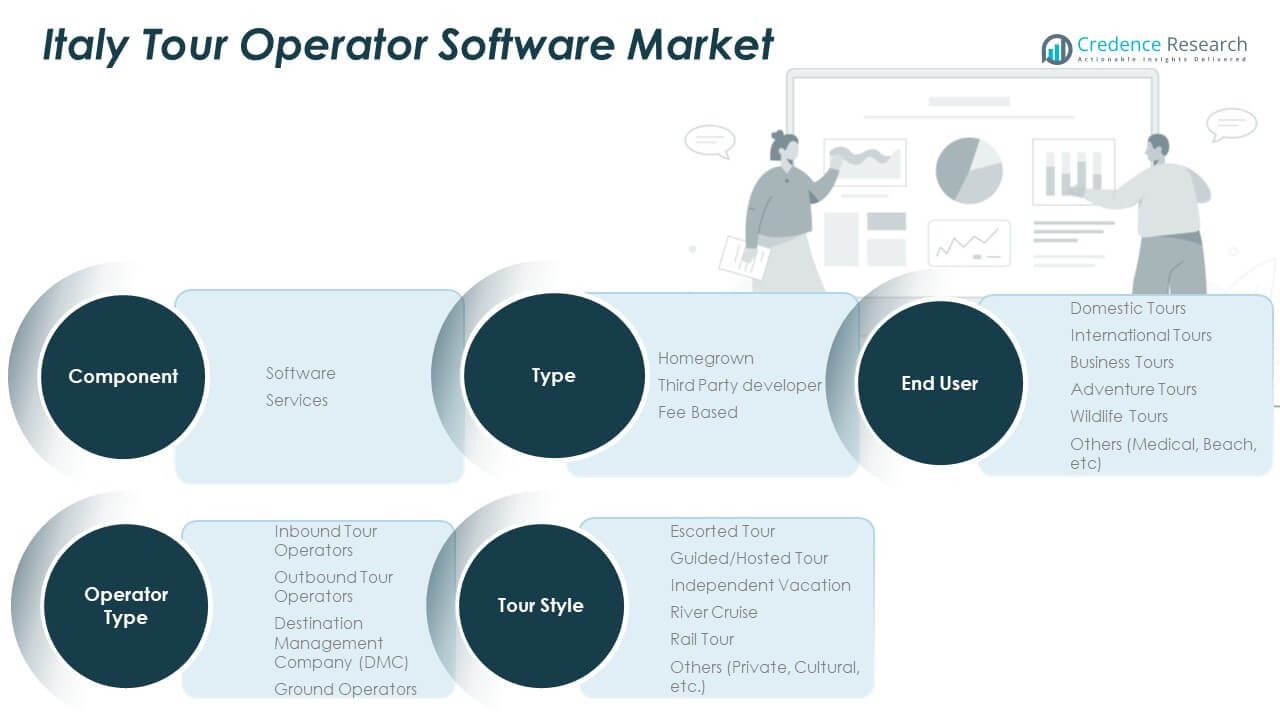

By Type

The Italy Tour Operator Software Market is segmented into homegrown, third-party developer, and fee-based solutions. Homegrown platforms serve localized operators with tailored features, while third-party developers provide advanced tools and scalability. Fee-based models gain traction among mid and large operators seeking continuous support and upgrades. It reflects varied adoption patterns across operator sizes and budgets.

- For instance, homegrown platforms for tailored local needs, third-party solutions for scalability and broad features, and fee-based subscription models favored by mid-to-large operators balancing support and cost predictability.

By Component

By component, the market divides into software and services. Software dominates due to its role in automating bookings, payments, and customer management. Services support integration, training, and technical assistance, which are crucial for small and mid-sized operators. It ensures long-term adoption and smooth system performance.

- For instance, Services, including integration assistance, training, and ongoing tech support, underpin smooth adoption, particularly for small and mid-sized operators lacking internal IT staff. This ecosystem approach ensures sustained performance and user satisfaction.

By Operator Type

The market includes inbound tour operators, outbound tour operators, destination management companies (DMCs), and ground operators. Inbound operators lead growth with Italy’s strong tourist inflows. Outbound operators expand global reach, while DMCs manage complex, multi-service itineraries. Ground operators focus on local transport and logistics. It highlights the software’s role across diverse business models.

By Tour Style

Tour styles include escorted tours, guided or hosted tours, independent vacations, river cruises, rail tours, and others such as cultural or private tours. Escorted and guided tours dominate due to heritage tourism demand. Independent vacations and rail tours attract younger travelers seeking flexibility. It diversifies market opportunities.

By End User

End-user categories include domestic tours, international tours, business tours, adventure tours, wildlife tours, and others. Domestic and international tours lead adoption, supported by steady inbound and outbound traffic. Business travel software gains demand from corporates, while adventure and wildlife tours grow among niche customers. It ensures a balanced market structure across applications.

Segmentation:

By Type

- Homegrown

- Third Party Developer

- Fee Based

By Component

By Operator Type

- Inbound Tour Operators

- Outbound Tour Operators

- Destination Management Company (DMC)

- Ground Operators

By Tour Style

- Escorted Tour

- Guided/Hosted Tour

- Independent Vacation

- River Cruise

- Rail Tour

- Others (Private, Cultural, etc.)

By End User

- Domestic Tours

- International Tours

- Business Tours

- Adventure Tours

- Wildlife Tours

- Others

Regional Analysis:

Northern Italy – 38% Share

Northern Italy holds the largest 38% share of the Italy Tour Operator Software Market, supported by advanced infrastructure, strong cultural hubs, and business travel centers. Regions such as Lombardy, Veneto, and Emilia-Romagna lead adoption, driven by high inbound and domestic tourist volumes. It benefits from larger operators investing in cloud platforms, automation, and AI-driven personalization. Cross-border traffic with neighboring countries also boosts demand for multi-language and multi-currency features. Northern Italy shows strong digital maturity, making it the most advanced regional market.

Central Italy – 35% Share

Central Italy accounts for 35% of the Italy Tour Operator Software Market, with Tuscany, Lazio, and Umbria driving growth. Rome and Florence act as international gateways, attracting large volumes of inbound visitors. It demonstrates steady demand for escorted and cultural tours, requiring advanced itinerary and booking tools. Operators focus on mobile-first adoption and compliance with data protection regulations. The region benefits from strong European and North American arrivals, encouraging robust investments in automation. Central Italy remains a crucial market with consistent adoption trends.

Southern Italy and Islands – 27% Share

Southern Italy and the islands hold 27% of the Italy Tour Operator Software Market, emerging as a fast-developing segment. Sicily, Sardinia, and Campania are seeing rising digital adoption among smaller operators. Growth is fueled by international arrivals and demand for niche offerings such as adventure, cultural, and wildlife tours. Independent and guided travel styles dominate, supported by rising demand for authentic experiences. Operators here favor modular and affordable solutions to overcome budget constraints. This region reflects strong potential as it aligns with digital transformation efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Italy Tour Operator Software Market features competition among local innovators and global providers. Players compete on product customization, integration, pricing models, and customer support. It shows strong activity from companies offering AI-driven personalization, mobile-first platforms, and cloud-based systems. Local firms leverage cultural understanding and niche targeting, while international developers introduce scalable solutions with global compatibility. Competition intensifies as operators demand secure, efficient, and flexible tools to manage bookings and customer engagement. Strategic collaborations, partnerships, and product upgrades shape the competitive edge. Vendors that combine affordability, functionality, and compliance remain well-positioned.

Recent Developments:

- In May 2024, AppyPilgrim SRL announced the launch of its full-stack AI and Web3-powered platform dedicated to spiritual and sustainable travel. Established in Rome in 2024, the company aims to unify the often fragmented experience of organizing spiritual journeys by enabling personalized pilgrimages, seamless bookings, and donations through a single digital ecosystem.

- In July 2025, Hubcore.ai entered a notable strategic partnership with Italcares and Destination Italia, officially unveiled during a major medical and wellness tourism event at Sapienza University of Rome. This collaboration resulted in the launch of the Italcares online booking platform, developed using Hubcore.ai’s advanced AI technology. The partnership positions Italy as a leader in medical and wellness tourism, offering a transparent, multilingual digital ecosystem connecting travelers with healthcare and wellness providers.

- As of July 2025, Tourism Innovation Lab S.r.l. continues to develop mobile-first software solutions for the tourism market, emphasizing direct connections between tourists, accommodation providers, and territories. The company, founded by Green Consulting, takes a strong ‘disintermediation’ approach—helping smaller tourism players build value without the need for large intermediaries, and supporting digital transformation efforts for hotels and destinations across Italy.

- Founded in 2023 and based in Milan, Raro Discovery S.r.l. operates both as a licensed luxury travel agency and an innovator in travel NFTs. In 2024, the company advanced its development of NFT-based digital identities for the tour operator sector, significantly enhancing the personalization, authenticity, and potential for resale or transfer of travel experiences.

Report Coverage:

The research report offers an in-depth analysis based on type, component, operator type, tour style, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for AI-driven personalization will expand across Italian tour operators.

- Cloud-based adoption will rise due to scalability and cost efficiency.

- Inbound operators will continue to dominate software usage.

- Independent vacations and rail tours will gain momentum among younger travelers.

- Data security and compliance will remain a central focus for vendors.

- Domestic and international tours will drive software adoption steadily.

- Small operators will increasingly adopt modular and affordable platforms.

- Mobile-first applications will define customer engagement strategies.

- Niche segments like cultural and adventure tours will create new revenue streams.

-

Partnerships with global OTAs and local agencies will shape competitiveness.