| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Protein Based Sports Supplements Market Size 2024 |

USD 454.08 Million |

| Japan Protein Based Sports Supplements Market, CAGR |

7.87% |

| Japan Protein Based Sports Supplements Market Size 2032 |

USD 832.19 Million |

Market Overview

Japan Protein Based Sports Supplements Market size was valued at USD 454.08 million in 2024 and is anticipated to reach USD 832.19 million by 2032, at a CAGR of 7.87% during the forecast period (2024-2032).

The Japan protein-based sports supplements market is experiencing robust growth due to increasing health awareness, rising fitness culture, and a growing number of consumers engaging in physical activities such as gym workouts, athletics, and endurance sports. The aging population in Japan is also contributing to demand, as older consumers seek nutritional solutions to maintain muscle mass and overall vitality. Additionally, the rising popularity of plant-based diets has fueled interest in vegan and plant-derived protein supplements. Technological advancements in supplement formulation and improved taste profiles are further attracting a broader consumer base. Market players are leveraging e-commerce platforms and social media to enhance visibility and accessibility, especially among younger, tech-savvy consumers. The trend toward clean-label, non-GMO, and organic products is also gaining traction, as consumers increasingly prioritize ingredient transparency and quality. Collectively, these factors are driving sustained demand and shaping product innovation in the Japanese protein-based sports supplements market.

The Japan protein-based sports supplements market exhibits strong geographical diversity, with demand primarily concentrated in urban regions such as Kanto, Kansai, Chubu, and Kyushu. These areas benefit from robust fitness infrastructure, rising health consciousness, and increasing participation in sports and wellness activities across all age groups. Metropolitan centers like Tokyo, Osaka, and Nagoya serve as key consumption hubs, supported by the presence of gyms, specialty nutrition stores, and growing e-commerce penetration. Leading companies driving market growth include Herbalife Nutrition Ltd., Yakult Honsha Co., Ltd., Nestlé Health Science, and Dymatize, alongside regional and international players such as Bright LifeCare Pvt. Ltd. (MuscleBlaze), Wipro Consumer Care and Lighting, and Oziva. These companies are focusing on product innovation, clean-label ingredients, and targeted formulations to meet the evolving preferences of Japanese consumers. Strategic collaborations with fitness influencers and digital platforms are further enhancing brand visibility and consumer engagement across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan protein-based sports supplements market was valued at USD 454.08 million in 2024 and is projected to reach USD 832.19 million by 2032, growing at a CAGR of 7.87%.

- The global protein-based sports supplements market was valued at USD 7,372.05 million in 2024 and is projected to reach USD 13,140.51 million by 2032, growing at a CAGR of 7.49%.

- Increasing fitness awareness and a growing focus on muscle health are driving the adoption of protein-based supplements among both athletes and general consumers.

- Rising demand for plant-based, clean-label, and ready-to-consume products is reshaping the product development strategies of key market players.

- Leading companies such as Herbalife Nutrition Ltd., Yakult Honsha Co., Ltd., and Nestlé Health Science are expanding their product portfolios and digital outreach.

- High product costs and strict regulatory norms act as major restraints, limiting market access for price-sensitive consumers and smaller brands.

- Urban regions like Kanto, Kansai, and Chubu dominate the market due to better infrastructure, awareness, and access to health-focused retail outlets.

- E-commerce growth and strategic influencer collaborations are accelerating market penetration across multiple consumer segments.

Report Scope

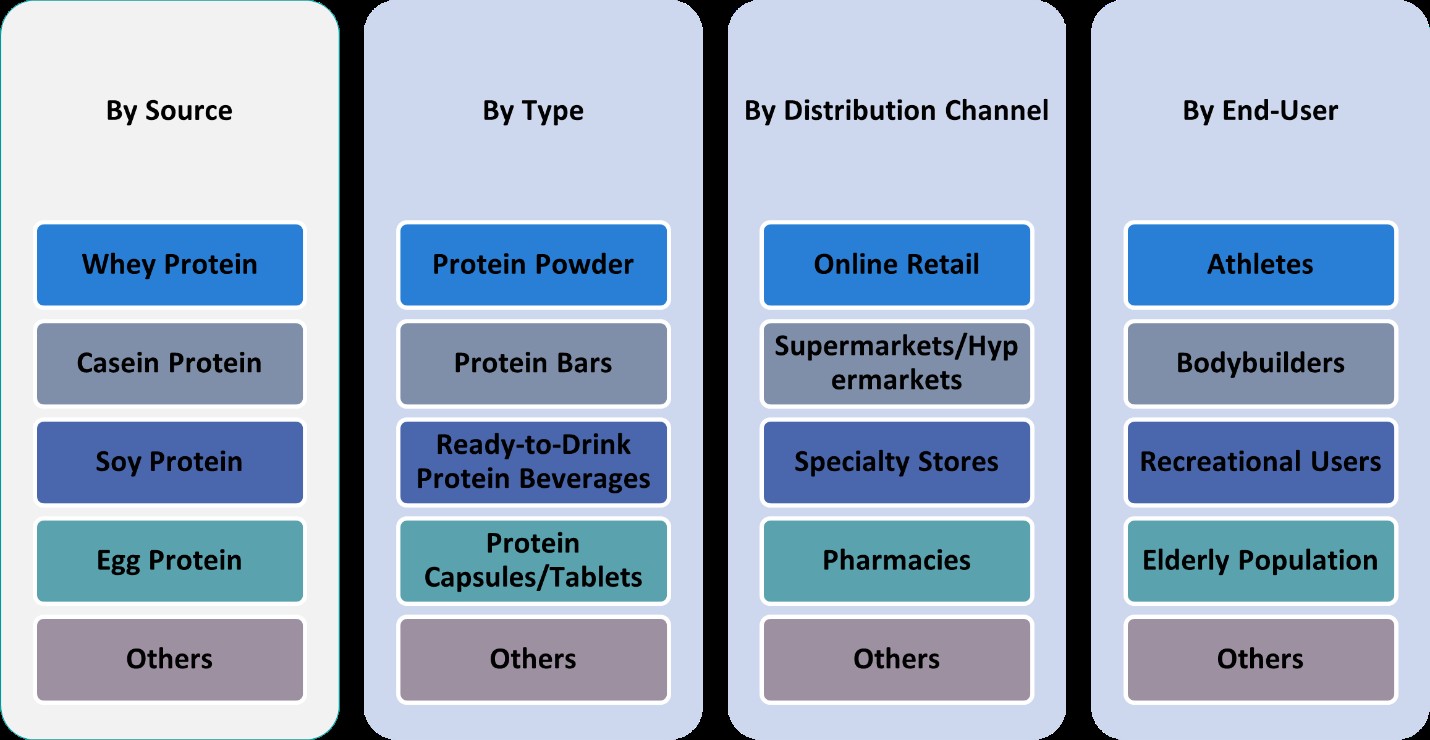

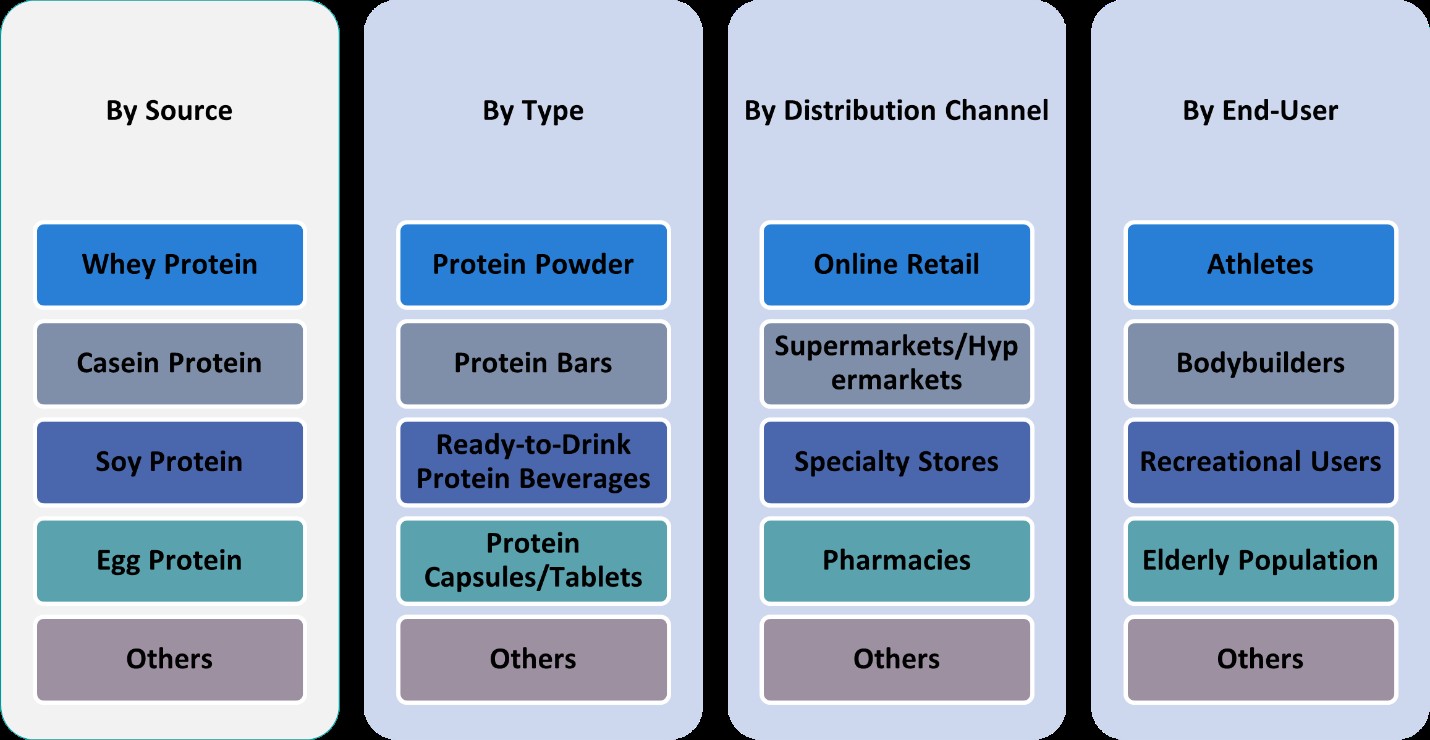

This report segments the Japan Protein Based Sports Supplements Market as follows:

Market Drivers

Rising Health Awareness and Fitness Culture

The growing emphasis on preventive healthcare and active lifestyles in Japan is significantly driving the demand for protein-based sports supplements. For instance, a report by the World Health Organization highlighted that Japanese adults are increasingly engaging in regular physical activities such as walking, yoga, and gym workouts to combat lifestyle-related health issues like obesity and diabetes. As consumers become more health-conscious, they are increasingly incorporating protein supplements into their daily routines to support muscle growth, improve endurance, and enhance overall physical performance. The rising prevalence of lifestyle-related health issues such as obesity, diabetes, and cardiovascular disorders has also pushed individuals to adopt healthier dietary habits and engage in regular physical activities. Consequently, protein supplements are viewed not only as products for athletes but also as essential nutritional aids for everyday consumers seeking to maintain a balanced and healthy life.

Aging Population Supporting Nutritional Demand

Japan’s rapidly aging population is another major driver for the protein-based sports supplements market. For instance, a study by the Ministry of Health, Labour and Welfare emphasized the growing need for dietary supplements among seniors to address sarcopenia and maintain mobility. With a large percentage of the population aged 65 and above, there is a growing need for dietary supplements that help maintain muscle mass, strength, and mobility in the elderly. Sarcopenia, or age-related muscle loss, is a growing concern among seniors, prompting them to seek out protein-enriched products that support muscle preservation and recovery. As awareness increases about the benefits of protein in healthy aging, supplement brands are launching targeted formulations for older demographics. This demographic shift presents long-term growth opportunities for companies offering science-backed, easily digestible protein products tailored for elderly consumers.

Shifting Dietary Preferences and Rise of Plant-Based Proteins

Changing consumer preferences toward cleaner, sustainable, and plant-based diets are reshaping the Japanese protein supplement market. The rising popularity of vegetarian and vegan lifestyles has spurred demand for plant-derived protein sources such as pea, rice, soy, and hemp. Japanese consumers, who are traditionally mindful of food quality and ingredient origin, are gravitating toward products with organic, non-GMO, and allergen-free labels. This shift aligns with global trends in clean-label nutrition and reflects a heightened interest in ethical consumption. As a result, manufacturers are innovating with plant-based formulations and introducing a wider variety of flavors and formats to cater to evolving taste preferences without compromising nutritional efficacy.

Expansion of Distribution Channels and Digital Influence

The expansion of both online and offline distribution channels is playing a crucial role in market growth. E-commerce platforms, specialty health stores, pharmacies, and fitness centers are increasingly offering a broad range of protein-based sports supplements, making them more accessible to a wider consumer base. Additionally, the growing influence of social media and fitness influencers in Japan has enhanced product visibility and consumer engagement. Brand endorsements, informative content, and user-generated reviews on platforms like Instagram and YouTube are shaping purchasing decisions and boosting product credibility. Furthermore, aggressive marketing campaigns and loyalty programs are helping brands retain customers and expand their reach across various consumer segments.

Market Trends

Rising Popularity of Plant-Based and Vegan Protein Supplements

The shift toward plant-based nutrition continues to influence the Japanese sports supplement market. For instance, a report by the Japan Plant Protein Food Association emphasized the growing demand for plant-derived protein sources such as soy, pea, brown rice, and hemp, driven by ethical, environmental, and health considerations. These alternatives are not only perceived as cleaner and more sustainable but are also suitable for individuals with dairy allergies or lactose intolerance. As a result, leading brands are investing in the development of plant-based protein powders, bars, and ready-to-drink beverages. Enhanced flavor profiles and better texture technologies have made plant-based options more appealing, supporting their integration into mainstream fitness and wellness routines.

Digital Engagement and Personalized Nutrition Trends

The digital transformation of the health and fitness sector in Japan is significantly shaping consumer behavior and product development. For instance, a report by Nestlé Japan showcased the role of mobile apps, fitness trackers, and wearable technology in providing consumers with insights into their nutritional needs, fueling interest in personalized supplement regimens. Simultaneously, social media platforms and wellness influencers are playing a pivotal role in educating users about the benefits of protein intake and showcasing new product launches. This increased digital engagement is enabling brands to directly interact with consumers, gather feedback, and tailor offerings based on individual preferences and health goals, driving long-term brand loyalty and innovation in the market.

Growing Demand for Clean-Label and Functional Ingredients

Japanese consumers are increasingly prioritizing health and transparency in their dietary choices, which is fueling a strong demand for clean-label protein supplements. Products that are free from artificial additives, preservatives, and genetically modified organisms (GMOs) are gaining preference. Brands are responding by formulating supplements with minimal ingredients, enhanced nutritional profiles, and natural flavorings. In addition to clean-label claims, there is a rising interest in functional ingredients such as collagen, probiotics, and adaptogens, which offer added health benefits beyond muscle recovery and growth. This trend reflects a holistic approach to wellness, where protein supplements are not just performance enhancers but also support immunity, gut health, and overall vitality.

Innovation in Product Formats and Delivery Systems

Convenience is a key factor influencing consumer purchasing behavior in Japan, prompting continuous innovation in supplement formats and delivery systems. In addition to traditional protein powders, there is a growing trend toward ready-to-drink (RTD) protein beverages, protein-fortified snacks, and functional gummies. These innovative formats cater to on-the-go lifestyles and eliminate the need for mixing or preparation. Single-serve sachets and portable packaging are also gaining popularity, especially among office-goers and travelers. By combining functionality with convenience, brands are expanding their consumer base beyond athletes and bodybuilders to include busy professionals, students, and aging individuals.

Market Challenges Analysis

High Product Costs and Consumer Price Sensitivity

One of the primary challenges faced by the Japan protein-based sports supplements market is the high cost of premium-quality products. For instance, a report by the Japan External Trade Organization (JETRO) highlighted that imported protein supplements face additional pricing pressures due to shipping costs, import duties, and currency fluctuations, making them less accessible to price-sensitive consumers such as students and young professionals. Protein supplements, especially those sourced from whey isolates, hydrolysates, or organic plant-based ingredients, often come with elevated price tags. This can limit their accessibility, particularly among price-sensitive consumers such as students, young professionals, and middle-income groups. Additionally, imported brands face further pricing pressures due to shipping costs, import duties, and currency fluctuations. While affluent consumers in urban centers may continue to drive demand, the broader market growth could be restrained unless companies introduce cost-effective, value-driven offerings. Striking the right balance between product quality and affordability remains a key strategic concern for market players seeking long-term scalability.

Regulatory Hurdles and Consumer Skepticism

The strict regulatory environment in Japan poses another significant challenge for the protein supplements market. The approval and labeling of dietary supplements are subject to rigorous scrutiny by regulatory bodies such as the Consumer Affairs Agency and the Ministry of Health, Labour and Welfare. Companies must adhere to stringent guidelines related to health claims, ingredient safety, and labeling standards, which can delay product launches and increase compliance costs. Furthermore, a section of the Japanese consumer base remains skeptical about the safety and efficacy of sports supplements, associating them with artificial additives or potential side effects. Misinformation and lack of awareness around proper protein intake may also hinder adoption, especially among older demographics. To overcome these barriers, brands need to invest in transparent communication, clinical backing, and educational campaigns that build trust and promote informed usage.

Market Opportunities

The Japan protein-based sports supplements market presents significant opportunities driven by the country’s shifting demographic and lifestyle patterns. As more consumers embrace health-conscious routines, there is a growing opportunity to expand protein supplement usage beyond athletes and bodybuilders to mainstream health seekers. The increasing interest in preventive healthcare, particularly among the aging population, opens new avenues for developing protein products tailored to elderly nutritional needs. Supplements enriched with joint-supporting ingredients or those designed to combat muscle loss associated with aging can address specific health concerns of this demographic. Additionally, the rising participation of women in fitness and wellness activities creates potential for gender-specific formulations, packaging, and marketing strategies that cater to their distinct nutritional preferences and fitness goals.

The evolving retail landscape and digital transformation further amplify growth prospects in the market. E-commerce platforms, along with mobile health apps and virtual fitness communities, enable brands to reach a wider and more tech-savvy consumer base. This digital shift allows for the implementation of personalized marketing and subscription-based models, enhancing consumer engagement and brand loyalty. Furthermore, the growing demand for plant-based, clean-label, and sustainable products offers scope for innovation in formulation and sourcing. Brands that introduce eco-friendly packaging, use traceable ingredients, and align with ethical values stand to gain a competitive edge. Collaborations with fitness centers, wellness influencers, and healthcare professionals can also help increase product credibility and visibility. As the market continues to evolve, companies that prioritize transparency, customization, and science-backed benefits will be well-positioned to tap into Japan’s expanding health and wellness segment.

Market Segmentation Analysis:

By Type:

The Japan protein-based sports supplements market is segmented into protein powder, protein bars, ready-to-drink (RTD) protein beverages, protein capsules/tablets, and others. Among these, protein powder continues to dominate due to its versatility, high protein concentration, and widespread usage among fitness enthusiasts and bodybuilders. It remains the preferred choice for individuals aiming for muscle gain and post-workout recovery. Protein bars are gaining popularity as convenient, on-the-go snacks, especially among busy professionals and health-conscious consumers seeking a balanced nutritional intake. The RTD protein beverage segment is witnessing notable growth, driven by increasing demand for convenience, portability, and better taste profiles. These ready-to-consume drinks appeal to a broad demographic, including non-athletes and older adults. Capsules and tablets, although smaller in market share, cater to users looking for minimal-preparation supplements and those integrating protein into broader wellness routines. Overall, innovation in formats, flavor enhancements, and functional benefits is shaping consumer choices across all product types in Japan.

By Source:

Based on source, the market includes whey protein, casein protein, soy protein, egg protein, and others. Whey protein leads the market due to its superior amino acid profile, fast absorption rate, and strong clinical backing for muscle repair and growth. It remains a staple among athletes and gym-goers. Casein protein, known for its slow-digesting properties, is commonly used as a nighttime supplement, helping maintain muscle mass over extended periods. Soy protein, as a plant-based alternative, is gaining traction among vegans, vegetarians, and those with lactose intolerance. It also appeals to environmentally conscious consumers seeking sustainable options. Egg protein is valued for its complete amino acid content and digestibility, catering to both fitness users and individuals with specific dietary requirements. The “others” segment includes emerging sources such as hemp, rice, and pea proteins, which are being explored for clean-label and allergen-free formulations. The growing acceptance of plant-based proteins and diversification of sourcing options continue to drive innovation and segmentation in the Japanese market.

Segments:

Based on Type:

- Protein Powder

- Protein Bars

- Ready-to-Drink Protein Beverages

- Protein Capsules/Tablets

- Others

Based on Source:

- Whey Protein

- Casein Protein

- Soy Protein

- Egg Protein

- Others

Based on End- User:

- Athletes

- Bodybuilders

- Recreational Users

- Elderly Population

- Others

Based on Distribution Channel:

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies

- Others

Based on the Geography:

- Kanto Region

- Kansai Region

- Chubu Region

- Kyushu Region

- Other Regions

Regional Analysis

Kanto Region

The Kanto Region, which includes Tokyo and Yokohama, holds the largest share of the Japan protein-based sports supplements market, accounting for approximately 39% in 2024. This dominance is primarily attributed to the region’s high population density, strong urban infrastructure, and widespread health awareness. As the commercial and cultural hub of Japan, Kanto benefits from a concentrated presence of fitness centers, wellness clubs, and specialty health stores, making protein supplements highly accessible. Moreover, the region is home to a significant number of health-conscious millennials and working professionals who actively pursue fitness routines. The growing popularity of home workouts and virtual fitness classes, especially in the Tokyo metropolitan area, has further boosted demand for convenient protein-based products such as powders and ready-to-drink beverages.

Kansai Region

The Kansai Region, including major cities like Osaka, Kyoto, and Kobe, captures around 22% of the market share. This region showcases a steady growth trajectory, supported by increasing awareness of sports nutrition and preventive healthcare. Local governments and health organizations have been proactive in promoting active lifestyles and balanced diets, encouraging the consumption of dietary supplements. With a mix of urban and suburban populations, Kansai reflects a diverse consumer base that includes athletes, office workers, and aging individuals. The market is also benefiting from a surge in health-focused retail outlets and e-commerce platforms offering a wide selection of protein-based products. Furthermore, the cultural inclination towards health and wellness, coupled with rising disposable income, continues to support long-term market expansion in the region.

Chubu Region

The Chubu Region, encompassing cities such as Nagoya and Shizuoka, holds a market share of approximately 18%. This region has seen growing interest in protein-based sports supplements, driven by increased gym memberships and participation in recreational sports. While urban centers like Nagoya lead in terms of consumption, rural areas are gradually embracing supplement use, especially among older adults looking to maintain muscle mass and mobility. Regional manufacturers are introducing locally produced, plant-based, and functional protein products to cater to traditional dietary preferences, which are often centered around clean and minimal ingredients. This regional adaptation has opened new avenues for growth.

Kyushu Region

The Kyushu Region accounts for an estimated 11% of the market share and is showing promising potential as health consciousness rises across the southern part of Japan. Although comparatively smaller in population and economic scale, Kyushu is witnessing increased government and community-led fitness initiatives, which are translating into higher awareness of nutritional supplements. The expanding retail network and growing online shopping penetration have also made protein products more accessible in this region. Emerging demand among elderly consumers and a rise in local wellness trends are expected to further support market development in Kyushu.

Key Player Analysis

- Herbalife Nutrition Ltd.

- Yakult Honsha Co., Ltd.

- Shandong Minqiang Biotechnology Co., Ltd.

- Bright LifeCare Pvt. Ltd. (MuscleBlaze)

- Wipro Consumer Care and Lighting (Nutrition Business)

- Nongfu Spring Co., Ltd.

- Dymatize

- Oziva (Zywie Ventures Pvt. Ltd.)

- Nestlé Health Science

Competitive Analysis

The Japan protein-based sports supplements market is characterized by the presence of several established and emerging players competing through innovation, quality, and strategic positioning. Leading companies such as Herbalife Nutrition Ltd., Yakult Honsha Co., Ltd., Shandong Minqiang Biotechnology Co., Ltd., Bright LifeCare Pvt. Ltd. (MuscleBlaze), Wipro Consumer Care and Lighting (Nutrition Business), Nongfu Spring Co., Ltd., Dymatize, Oziva (Zywie Ventures Pvt. Ltd.), and Nestlé Health Science are actively shaping the competitive landscape. These players focus on expanding their product portfolios with offerings that cater to varying dietary preferences, such as plant-based, lactose-free, and clean-label protein supplements. Innovation in ready-to-drink beverages, flavored protein bars, and gender-specific or age-specific formulations has become a key strategy to appeal to broader consumer segments. Additionally, partnerships with fitness influencers, digital campaigns, and growing investment in e-commerce channels have enabled them to strengthen brand visibility. Competitive pricing, adherence to Japan’s stringent quality regulations, and localization strategies also play a vital role in sustaining market presence and consumer trust in this evolving space.

Recent Developments

- In March 2025, Quest Nutrition introduced Quest Protein Milkshakes, ready-to-drink beverages with a category-leading 45 grams of protein per bottle. Available in chocolate, vanilla, and strawberry flavors, these shakes cater to high-protein diets with minimal sugar and carbs.

- In December 2024, Dymatize launched Performance Protein Shakes and Energyze Pre-Workout Powder. The ready-to-drink shakes contain 30 grams of high-quality proteins along with BCAAs for muscle recovery and growth.

- In November 2024, Myprotein expanded operations in India by manufacturing locally to meet growing demand. The brand introduced localized flavors such as Kesar Badam and Nimbu Pani and launched Clear Whey Isolate as a refreshing alternative to traditional protein shakes.

- In January 2024, Abbott launched Protality, a high-protein weight-loss shake designed for individuals on weight-loss medications. Each serving contains 30 grams of protein and is tailored to preserve muscle mass while supporting weight loss.

Market Concentration & Characteristics

The Japan protein-based sports supplements market demonstrates moderate to high market concentration, with a few key players holding significant influence due to their established brand presence, diversified product portfolios, and strong distribution networks. Companies such as Herbalife Nutrition Ltd., Nestlé Health Science, and Yakult Honsha Co., Ltd. have maintained a competitive edge through continuous product innovation and strategic marketing efforts tailored to Japan’s health-conscious population. The market is characterized by a growing preference for premium, clean-label, and functional products, with increasing demand from not only athletes but also general consumers seeking wellness and preventive health solutions. Consumers in Japan value quality, safety, and transparency, making compliance with regulatory standards and clean ingredient labels critical for market success. Additionally, the market reflects a blend of global trends and traditional health values, encouraging the development of protein products that align with local dietary habits and aging population needs, while maintaining high scientific credibility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan protein-based sports supplements market is projected to grow steadily due to increasing health and fitness awareness among consumers.

- Rising participation in sports and recreational activities will continue to drive demand for high-protein nutrition products.

- Plant-based protein supplements are expected to gain traction as consumers shift toward sustainable and vegan-friendly options.

- The aging population in Japan is likely to contribute to market growth as older adults seek protein supplements for muscle maintenance and recovery.

- Innovative product formulations, including ready-to-drink protein beverages and protein bars, will attract convenience-focused consumers.

- E-commerce platforms will play a significant role in boosting product accessibility and market penetration across the country.

- Collaborations between local supplement manufacturers and international brands may lead to improved product diversity and quality.

- Regulatory support for functional food labeling will further legitimize protein-based supplements and encourage consumer trust.

- Increasing influence of fitness influencers and social media marketing will enhance brand visibility and product awareness.

- Technological advancements in protein extraction and formulation will support the development of high-quality, bioavailable protein supplements.