Market Overview:

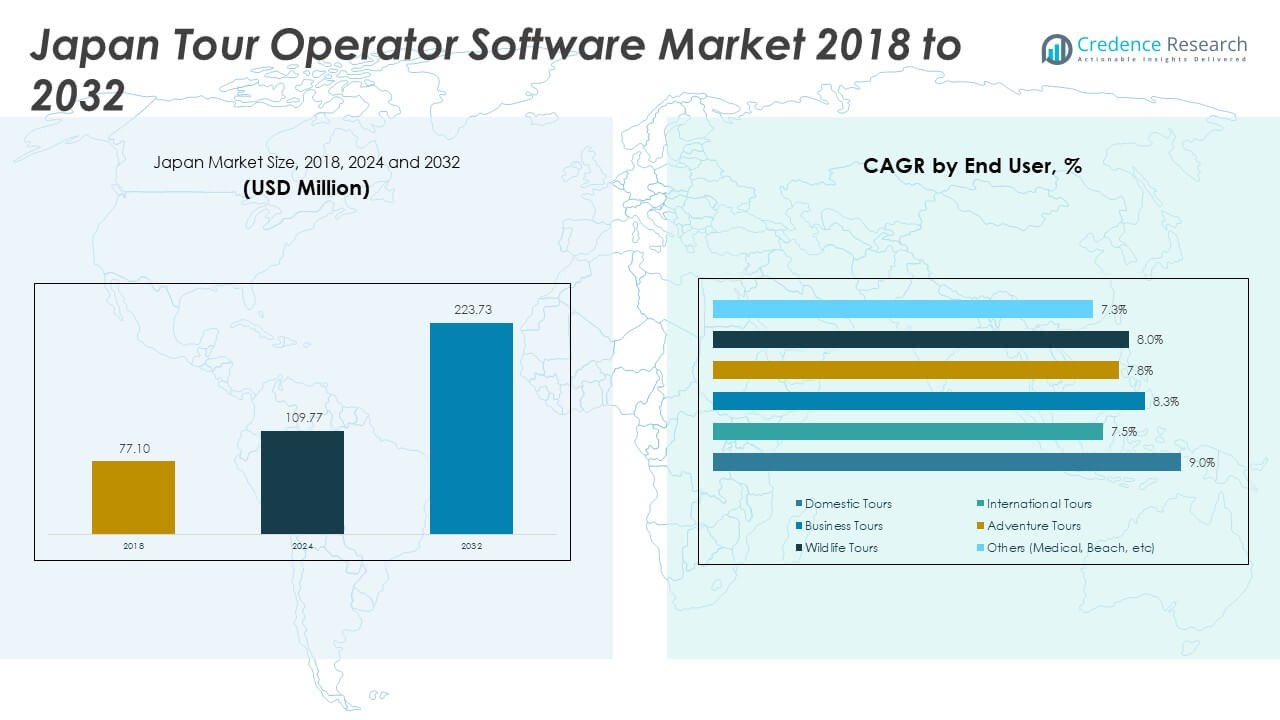

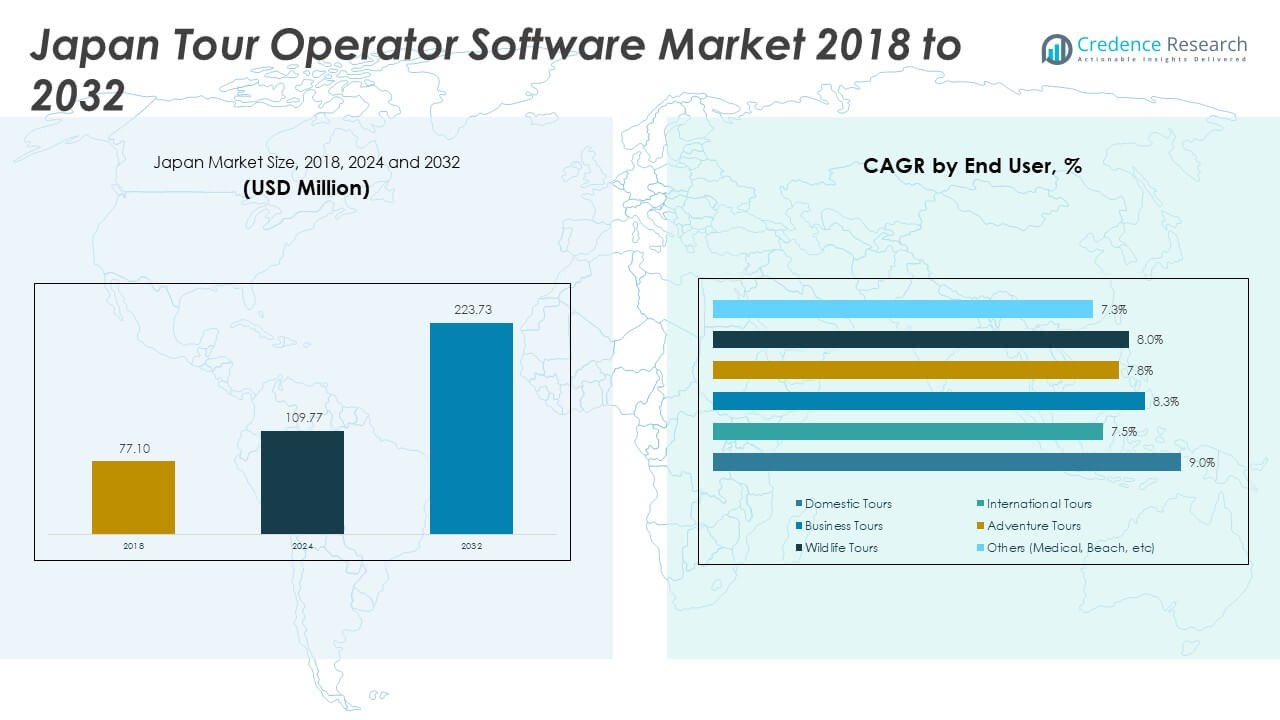

The Japan Tour Operator Software Market size was valued at USD 77.10 million in 2018, reached USD 109.77 million in 2024, and is anticipated to reach USD 223.73 million by 2032, at a CAGR of 9.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Tour Operator Software Market Size 2024 |

USD 109.77 Million |

| Japan Tour Operator Software Market, CAGR |

9.31% |

| Japan Tour Operator Software Market Size 2032 |

USD 223.73 Million |

Digital transformation in Japan’s travel industry fuels demand for software solutions. Tour operators seek advanced booking systems, real-time availability tools, and integrated payment gateways. Rising inbound tourism, driven by cultural heritage and event-based travel, strengthens adoption. Domestic players also push innovation through custom features aligned with Japanese traveler behavior. Growing preference for mobile-friendly solutions increases competitiveness.

Japan leads software adoption in Asia, benefiting from advanced infrastructure and digital maturity. Neighboring markets in Asia Pacific, including South Korea and Southeast Asia, show emerging demand due to tourism growth. North America and Europe remain strong sources of inbound travelers, influencing software localization. Domestic demand for unique tours boosts local platform development, ensuring global players face strong competition.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Tour Operator Software Market was valued at USD 77.10 million in 2018, reached USD 109.77 million in 2024, and is projected to hit USD 223.73 million by 2032, growing at a CAGR of 9.31%.

- Asia Pacific held the largest share at 38% in 2024, led by Japan’s advanced digital infrastructure; North America followed with 27% due to strong outbound demand; Europe captured 22% driven by inbound flows and cultural tourism.

- The Middle East emerged as the fastest-growing region with a 6% share in 2024, supported by expanding airline connectivity and rising outbound tourism to Japan.

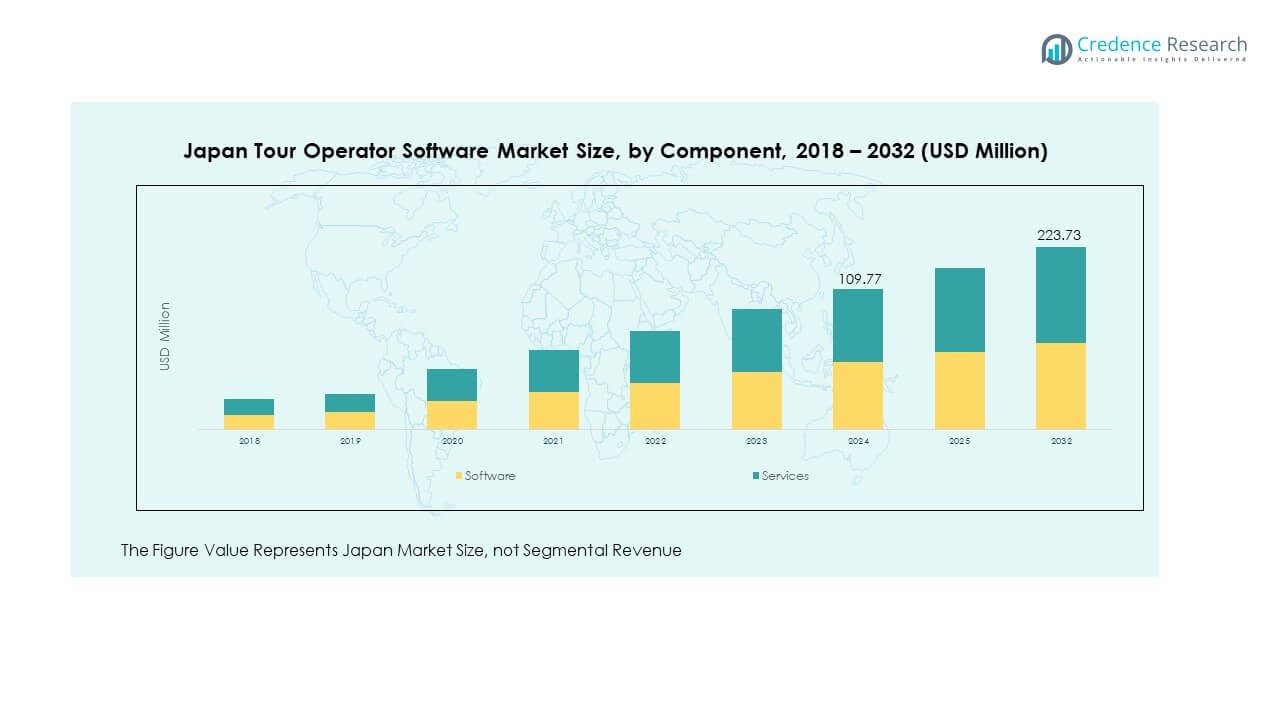

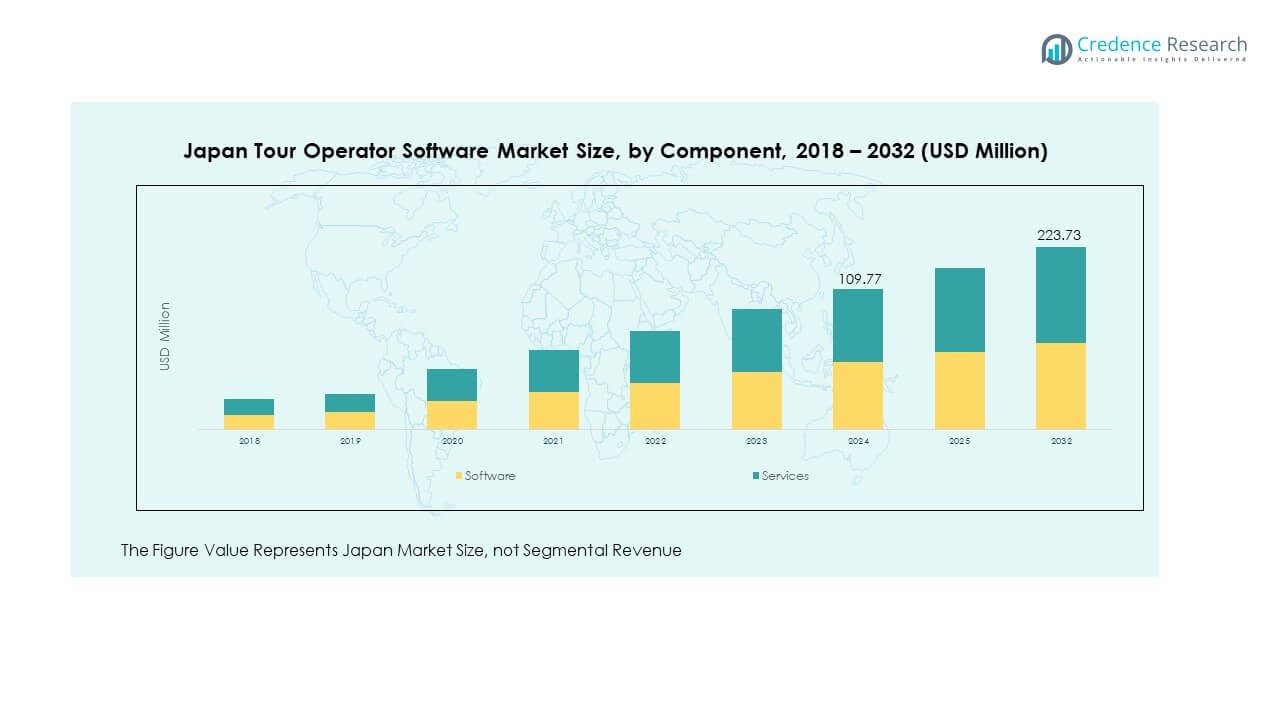

- Software accounted for 61% of the Japan Tour Operator Software Market in 2024, driven by demand for automation, real-time booking, and AI integration.

- Services held 39% of the Japan Tour Operator Software Market in 2024, supported by rising need for customization, training, and technical support.

Market Drivers:

Rising Inbound Tourism Driving Software Integration:

The Japan Tour Operator Software Market grows due to increasing inbound travelers demanding efficient booking systems. Tour operators seek software that manages tours, payments, and real-time schedules seamlessly. Government tourism campaigns attract international travelers, boosting demand for scalable platforms. Operators integrate AI and analytics to personalize offerings. Local players customize solutions for cultural and linguistic relevance. Cloud-based systems improve scalability, reducing operational costs. Integration with global OTAs widens visibility and strengthens competitiveness. Growing demand for multilingual support enhances adoption further.

- For instance, service-based add-ons—including integration assistance and system training—now comprise a significant and fast-growing portion of total operator software spend, reflecting a sharp increase in demand for technical support and bespoke workflow customization.

Expanding Digital Transformation Across Travel Businesses:

Digital adoption across Japan’s tourism sector drives investments in advanced platforms. Operators prioritize automation tools to improve workflow efficiency. Real-time inventory management reduces errors and strengthens customer satisfaction. Software solutions integrate with CRM systems to streamline client communication. The demand for contactless booking options has accelerated post-pandemic. Firms integrate marketing automation to attract and retain customers. Data-driven insights help tailor packages for diverse demographics. This digital focus enhances profitability and long-term resilience.

- For instance, Recruit Co., Ltd., the operator of the popular Japanese travel booking site Jalan.net, uses a robust CRM and automated marketing tools to manage high-volume customer interactions.

Shift Toward Personalized Travel Experiences:

The Japan Tour Operator Software Market benefits from increasing demand for tailored experiences. Operators use advanced tools to segment travelers and create customized itineraries. AI-powered recommendations support unique cultural and adventure tours. Integration with mobile apps allows instant updates and flexible bookings. Cloud-based software ensures scalability for niche tour providers. Operators leverage predictive analytics to anticipate traveler preferences. Growth of experiential tourism strengthens reliance on dynamic booking engines. These innovations build customer loyalty and repeat engagement.

Integration of Advanced Technology in Tour Operations:

Operators adopt advanced tools such as AI, blockchain, and machine learning. These technologies enhance security, transparency, and predictive insights. Blockchain helps secure payment systems, while AI enables smarter pricing. Cloud technology supports collaboration between operators and global partners. Augmented reality enriches cultural and historical tours. Mobile-first design ensures accessibility for tech-savvy travelers. Integration with IoT improves tour logistics, such as transport and accommodation coordination. Operators gain efficiency, visibility, and competitive advantage through these innovations.

Market Trends:

Rise of Mobile-Centric Booking Platforms:

The Japan Tour Operator Software Market shows strong adoption of mobile-first platforms. Travelers prefer apps offering instant confirmations and real-time updates. Mobile-friendly interfaces improve booking experiences for both domestic and international users. Payment integration with e-wallets boosts trust and ease. Social media integration strengthens marketing campaigns. Mobile adoption aligns with Japan’s high smartphone penetration. Tour operators enhance apps with AI-driven chatbots. These trends reinforce competitiveness in a digitally evolving market.

- For instance, to reduce face-to-face contact during the pandemic, JTB sold a system to lodging facilities in Japan that allowed guests to chat with staff via a QR code using their own smartphones. Developed with a multilingual chat service provider, this system could translate 109 languages, demonstrating JTB’s early adoption of AI-enabled technologies for customer service.

Growing Adoption of Cloud-Based Solutions:

Cloud platforms dominate tour operator preferences in Japan. Scalability and cost efficiency drive adoption. Operators manage large volumes of bookings with flexible cloud tools. Integration with CRM systems enhances customer engagement. Cloud solutions reduce dependency on manual operations. Security features in cloud platforms attract enterprise clients. Cloud-based systems support multilingual and multicurrency options for global tourists. This strengthens adaptability in the competitive landscape.

- For instance, Integration with CRM systems enhances customer engagement by enabling real-time personalized communication. Cloud solutions reduce dependency on manual operations and improve data security. AWS compliance frameworks meet enterprise security standards to protect guest information.

Expansion of Multichannel Distribution Strategies:

The Japan Tour Operator Software Market emphasizes multichannel presence. Operators integrate software with OTAs, social media, and direct websites. This ensures broader visibility among international travelers. Partnerships with online travel agents expand booking sources. Integration with meta-search engines boosts transparency in pricing. Direct booking channels ensure higher profit margins. Operators use analytics to track customer journeys across platforms. Multichannel strategies enhance reach and strengthen customer trust. This multi-pronged approach drives steady growth.

Emphasis on Sustainability and Eco-Tourism Solutions:

Eco-tourism gains momentum in Japan, shaping software strategies. Operators integrate eco-friendly options into booking platforms. Systems highlight sustainable tours, local communities, and cultural preservation. Green certifications improve credibility among environmentally aware travelers. Tourists increasingly demand carbon-conscious options. Operators track sustainability metrics through integrated dashboards. Platforms highlight low-impact travel choices. This aligns with Japan’s commitment to sustainable tourism growth.

Market Challenges Analysis:

Regulatory and Compliance Hurdles for Software Providers:

The Japan Tour Operator Software Market faces regulatory challenges impacting operations. Strict consumer protection laws demand secure and transparent platforms. Compliance with data privacy regulations increases operational costs. Providers must integrate advanced security frameworks to meet national standards. Smaller operators struggle with high compliance expenses. Cross-border integration also requires additional certifications. These regulatory barriers slow adoption in smaller firms. Constant updates are essential to maintain compliance.

Rising Competition and Technological Fragmentation:

Intense competition creates pressure on pricing and innovation. Multiple global and domestic players compete for market share. Fragmented solutions confuse operators choosing between options. Smaller firms lack resources to match advanced features. Integration challenges hinder adoption across diverse operator segments. Rapid technological shifts demand continuous upgrades. Providers must invest heavily in R&D. This creates financial strain and delays profitability.

Market Opportunities:

Untapped Potential in Niche Tourism Segments:

The Japan Tour Operator Software Market benefits from rising niche tourism demand. Cultural, culinary, and adventure tours expand opportunities for software adoption. Platforms can integrate features tailored to unique experiences. Local operators can compete through specialization. International travelers seek authentic itineraries with easy digital access. Software that supports niche experiences gains strong adoption. Partnerships with niche travel agencies enhance visibility. This segment holds long-term profitability potential.

Rising Partnerships with Global Travel Platforms:

Global collaborations create new growth avenues for Japanese operators. Partnerships expand access to international booking systems. Integration with global OTAs widens reach among inbound tourists. Domestic firms gain visibility in competitive international markets. APIs enable seamless connectivity across global platforms. Cloud-based integration simplifies global expansion. Growing demand for cross-border tours strengthens collaboration opportunities. These partnerships accelerate growth and competitiveness.

Market Segmentation Analysis:

Type-Based

The Japan Tour Operator Software Market shows significant diversity in type adoption. Homegrown solutions dominate among small to mid-sized operators due to customization and cultural alignment. Third party developers appeal to larger firms seeking advanced features, scalability, and global integration. Fee-based models gain traction among enterprises focused on cost transparency and professional support. Operators weigh flexibility against affordability, driving balanced adoption across all three categories.

- For instance, Integration with CRM systems enhances customer engagement by enabling real-time personalized communication. Cloud solutions reduce dependency on manual operations and improve data security. AWS compliance frameworks meet enterprise security standards to protect guest information.

Component-Based

Software remains the backbone of the market, driven by demand for automation, real-time bookings, and integrated payment systems. Services complement the software by offering training, customization, and technical support. Increasing reliance on cloud and AI-based tools raises demand for consultancy services. Companies prioritize bundled solutions to achieve end-to-end efficiency. This dual structure ensures consistent value across the customer lifecycle.

- For example, Fujitsu developed an AI-powered incident reporting app for Japan Airlines cabin crew, accelerating report creation by analyzing spoken input offline and significantly reducing manual workload. Companies prioritize bundled solutions combining software and services to achieve end-to-end efficiency and streamline operations.

Operator Type

Inbound tour operators hold the largest share, supported by Japan’s strong appeal as a global travel destination. Outbound operators also leverage software to handle growing Japanese tourist flows abroad. Destination Management Companies (DMCs) adopt advanced platforms for complex itinerary planning and partnership management. Ground operators adopt streamlined systems for transport, transfers, and local experiences. This variety demonstrates the ecosystem-wide importance of digital platforms.

Tour Style

Escorted and guided tours remain strong due to Japan’s cultural heritage and language barriers for foreign travelers. Independent vacations gain traction as younger travelers prefer flexibility. Niche styles such as river cruises and rail tours are supported by Japan’s advanced transport network. Specialized offerings like cultural and private tours create opportunities for software with advanced customization. The diversity in tour styles reflects the dynamic nature of Japan’s tourism sector.

End User

Domestic tours lead the market, driven by a large population exploring within Japan. International tours grow steadily due to inbound demand from Asia, Europe, and North America. Business tours integrate corporate travel management features into operator platforms. Adventure and wildlife tours represent smaller but rising niches, attracting specialized software tools. Operators targeting multiple end users adopt flexible systems for broader market reach.

Segmentation:

By Type

- Homegrown

- Third Party Developer

- Fee Based

By Component

By Operator Type

- Inbound Tour Operators

- Outbound Tour Operators

- Destination Management Company (DMC)

- Ground Operators

By Tour Style

- Escorted Tour

- Guided/Hosted Tour

- Independent Vacation

- River Cruise

- Rail Tour

- Others (Private, Cultural, etc.)

By End User

- Domestic Tours

- International Tours

- Business Tours

- Adventure Tours

- Wildlife Tours

- Others

Regional Analysis:

Kanto and Kansai Dominating Market Share

The Kanto region, including Tokyo, held the largest share of the Japan Tour Operator Software Market in 2024. Tokyo’s role as the country’s international gateway and a hub for inbound travelers supported this leadership. Kansai, led by Osaka and Kyoto, followed closely due to strong cultural tourism demand. Both regions saw widespread adoption of advanced booking platforms by inbound and domestic operators. High hotel density and international airports reinforced the need for scalable solutions. It reflects the concentration of international arrivals and established tourism infrastructure.

Hokkaido and Kyushu Expanding Adoption

Hokkaido captured a rising share of the Japan Tour Operator Software Market with increasing demand for adventure, ski, and nature-based tours. Seasonal tourism in winter and summer pushed operators to invest in flexible platforms. Kyushu also recorded growth, supported by cultural heritage, hot springs, and cruise tourism. Operators in these regions adopted mobile-first solutions to reach younger travelers. Local governments promoted digital transformation in tourism management. It shows how secondary destinations are accelerating adoption beyond traditional metropolitan areas.

Chugoku, Shikoku, and Other Regions Emerging

The Chugoku and Shikoku regions held smaller shares but displayed steady growth in the Japan Tour Operator Software Market. Rising interest in regional tourism, especially from domestic travelers, supported gradual adoption of software solutions. Operators in Hiroshima, Okayama, and smaller cultural destinations used software to streamline itineraries and promote lesser-known attractions. The Tohoku region also gained momentum due to government efforts to promote recovery tourism. It highlights a shift toward balanced tourism development, where digital platforms enable inclusivity for regional operators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- JTB Business Travel Solutions (JTB Group)

- Amadeus IT Group

- TrekkSoft

- Bókun (Tripadvisor)

- Rezdy

- FareHarbor (Booking Holdings)

- Lemax

- Open Destinations

- Inspiretec

- Intuitive Systems

Competitive Analysis:

The Japan Tour Operator Software Market is highly competitive with both global and domestic players striving to expand their presence. International companies like Amadeus IT Group, Bókun, and Rezdy bring advanced features and global connectivity, while domestic firms such as JTB Business Travel Solutions deliver customized solutions aligned with local travel behavior. It is shaped by product innovation, mobile-first platforms, and seamless integration with global OTAs. Strong after-sales support and customization act as differentiators for smaller players. Market growth depends on partnerships, mergers, and new product launches, keeping competition dynamic and fragmented.

Recent Developments:

- In May 2025, JTB Business Travel launched “Teal”, a next-generation, cloud-based travel management platform powered by Spotnana. This platform is designed to deliver a smarter, more personalized business travel experience for global clients, and makes JTB the first travel management company to offer Spotnana’s technology across 15 countries, with plans to expand to 25 by the end of the year.

- In March 2025, Bókun, a Tripadvisor company, rolled out a major API integration, implementing the OCTO Open Connectivity standards for tours, activities, and attractions. This move is part of a larger industry effort to simplify and standardize connections across platforms.

- In May 2025, Bókun also announced a partnership with Airbnb, allowing its suppliers to connect directly with Airbnb Experiences and manage this channel through Bókun’s platform.

- On June 23, 2025, Open Destinations announced a strategic growth investment from global software investor Insight Partners. This investment is aimed at fueling the company’s next phase of growth as a leading reservation technology provider, with board members from Insight Partners joining Open Destinations’ leadership.

Report Coverage:

The research report offers an in-depth analysis based on type, component, operator type, tour style, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for mobile-first booking solutions will increase as travelers prefer real-time confirmations.

- Cloud-based platforms will dominate due to scalability, flexibility, and lower operating costs.

- AI-driven personalization will become central to delivering unique travel experiences.

- Inbound operators will remain market leaders, supported by rising tourism inflows.

- Independent vacation styles will grow fastest, led by younger demographics seeking flexibility.

- Partnerships with global OTAs will strengthen Japanese operators’ visibility.

- Sustainability-focused tours will gain traction, aligning with eco-tourism initiatives.

- Domestic travel demand will continue expanding, driven by cultural and regional tourism.

- Multichannel booking strategies will shape competition in the evolving landscape.

- Investments in cybersecurity and compliance will be critical for operator trust.