Market Overview:

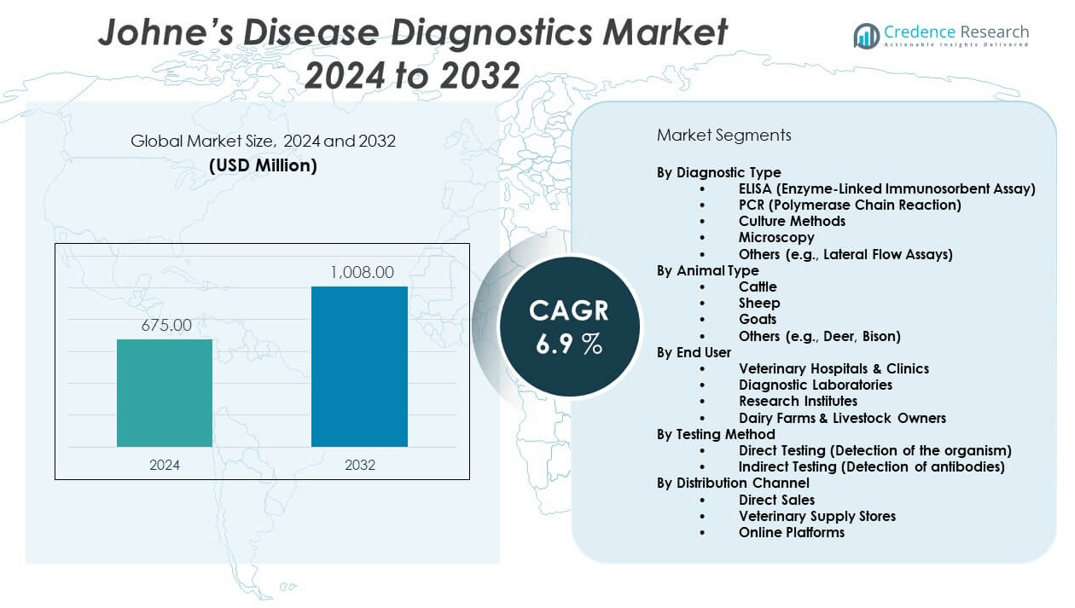

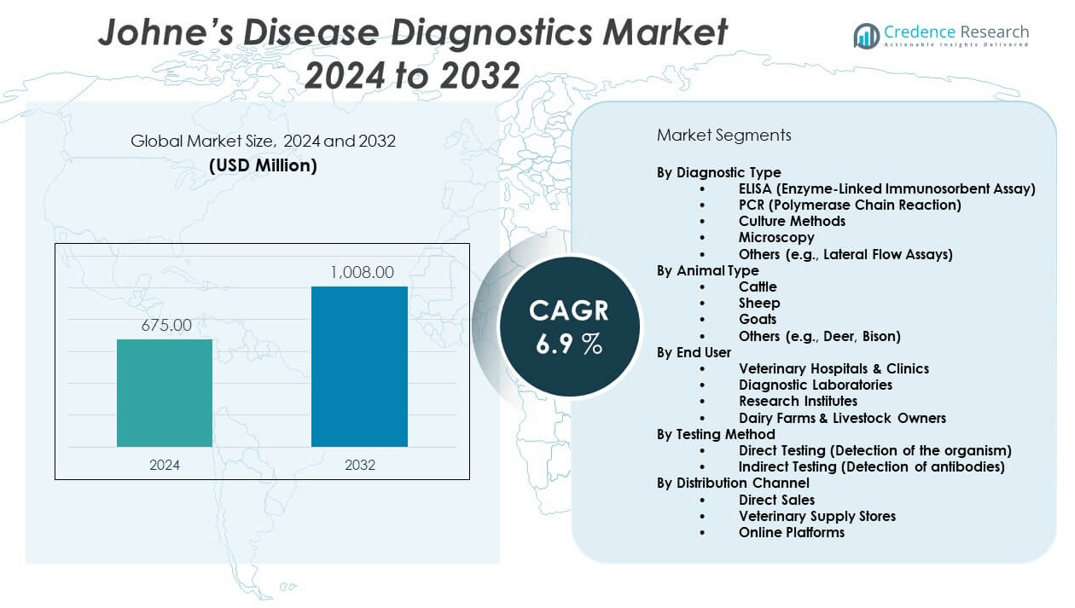

The Johne’s disease diagnostics market is projected to grow from USD 675 million in 2024 to an estimated USD 1008 million by 2032, with a compound annual growth rate (CAGR) of 6.9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Johne’s Disease Diagnostics Market Size 2024 |

USD 675 million |

| Johne’s Disease Diagnostics Market, CAGR |

6.9% |

| Johne’s Disease Diagnostics Market Size 2032 |

USD 1008 million |

Growth in the Johne’s disease diagnostics market is driven by rising awareness among livestock producers about the economic impact of Mycobacterium avium subspecies paratuberculosis (MAP) infections, which cause chronic intestinal inflammation in ruminants. Increasing adoption of early detection and herd management strategies fuels demand for advanced diagnostic tools. Regulatory bodies and veterinary organizations are also emphasizing disease control programs, leading to higher testing frequency. Technological advancements, including improved sensitivity in PCR assays and ELISA-based screening, have further strengthened market adoption across both commercial farms and veterinary labs.

Geographically, North America leads the Johne’s disease diagnostics market due to strong veterinary infrastructure, large-scale dairy and beef operations, and established surveillance programs. Europe follows closely, supported by stringent animal health regulations and high adoption of preventive diagnostics. The Asia-Pacific region is emerging rapidly as rising dairy consumption, livestock population growth, and increasing government focus on animal disease control stimulate demand for diagnostic solutions. Latin America and parts of the Middle East & Africa are gradually expanding due to growing investment in veterinary healthcare and increasing awareness about Johne’s disease.

Market Insights:

- The Johne’s disease diagnostics market is projected to grow from USD 675 million in 2024 to USD 1008 million by 2032, registering a compound annual growth rate (CAGR) of 6.9% during the forecast period.

- Rising economic losses in dairy and beef production due to Johne’s disease drive increased adoption of diagnostic tools for early detection and herd management.

- Limited awareness among smallholder farmers and inconsistent testing compliance hinder widespread adoption of diagnostic solutions, especially in rural regions.

- North America leads the market, supported by advanced veterinary infrastructure, large-scale livestock operations, and established disease control programs.

- Europe maintains strong demand due to stringent animal health regulations and proactive testing frameworks across dairy-producing nations.

- Asia-Pacific emerges as a high-growth region driven by increasing livestock populations, rising dairy consumption, and expanding veterinary services.

- Latin America and parts of the Middle East & Africa present gradual growth opportunities, supported by improving animal health investments and public sector initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Economic Burden of Johne’s Disease on Livestock Industry:

The increasing financial losses in the dairy and beef sectors due to Johne’s disease drive the adoption of diagnostic tools. The infection leads to reduced milk production, poor weight gain, infertility, and premature culling, which directly impacts farm profitability. Governments and industry stakeholders recognize the need for early detection to mitigate economic damage. This awareness has prompted several disease management programs across developed nations. The Johne’s disease diagnostics market benefits from this urgency, with more farms incorporating routine testing. It supports timely isolation and management of infected animals. The growing cost of disease outbreaks has elevated the priority of diagnostics in herd health strategies. Large-scale farms especially adopt diagnostic tools to minimize long-term losses.

- For instance, Thermo Fisher Scientific’s VetMAX M. paratuberculosis 2.0 Kit, a real-time PCR assay, demonstrates diagnostic sensitivity ranging approximately from 66% to 100% depending on shedding levels, with specificity up to 98% for detecting Johne’s disease in cattle fecal samples.

Strengthening Government Regulations and Disease Control Programs:

Governments and animal health authorities enforce disease surveillance and eradication programs to control Johne’s disease. These programs mandate or incentivize diagnostic testing at various intervals. National-level disease control policies in countries like the U.S., Canada, and parts of Europe promote regular screening. Public funding and veterinary extension services enhance farmer participation in testing initiatives. The Johne’s disease diagnostics market sees stronger demand due to regulatory compliance pressure. It also receives support through subsidies and public awareness campaigns. Governments increasingly partner with veterinary labs and diagnostic providers to streamline disease tracking. This regulatory focus contributes significantly to overall market expansion.

- For instance, Multiple published qPCR assays for Johne’s disease show robust detection capabilities, for instance, a 2008 study validated a detection limit down to 0.1 picograms of MAP DNA per reaction, equivalent to detecting as few as 19 copies of a MAP-specific gene target, with diagnostic sensitivity near 87% and specificity of 100% in contaminated bovine fecal samples.

Advancements in Diagnostic Technologies Improve Test Accuracy and Speed:

Innovation in diagnostic techniques plays a crucial role in the market’s growth. Traditional culture methods are slow and less sensitive, prompting the shift to molecular diagnostics like PCR and high-sensitivity ELISA. These tools enable faster, more accurate detection of subclinical infections. The Johne’s disease diagnostics market gains traction from the rising use of multiplex assays and automation in testing workflows. It helps laboratories handle higher sample volumes with consistent results. The growing availability of portable diagnostic kits also supports on-site testing in remote or rural farms. Technology providers continuously develop enhanced test kits to meet evolving clinical needs. Veterinary professionals prefer newer tools for their reliability and diagnostic confidence.

Increasing Focus on Herd Health and Biosecurity Across Farms:

Farmers and veterinarians now view Johne’s disease diagnostics as an essential component of overall herd health management. With rising awareness of the disease’s impact on herd productivity and welfare, farms proactively invest in screening. The Johne’s disease diagnostics market benefits from increased integration into herd biosecurity protocols. It supports early-stage detection, enabling isolation before the disease spreads. Veterinarians also recommend routine diagnostics during animal purchases or before herd introductions. These preventive actions help maintain herd status and support long-term productivity. Farms with certification or quality assurance programs often adopt regular testing to meet compliance standards. Biosecurity-driven demand forms a key pillar of market sustainability.

Market Trends:

Growing Adoption of On-Farm Testing Solutions for Faster Results:

Farmers increasingly seek diagnostic tools that deliver faster turnaround without relying on centralized labs. This shift has accelerated demand for portable, user-friendly diagnostic kits. Point-of-care testing allows rapid detection of Johne’s disease in field settings, supporting timely intervention. The Johne’s disease diagnostics market responds with handheld PCR kits, lateral flow assays, and mobile ELISA units. These tools require minimal technical training and enable widespread farm adoption. Manufacturers invest in rugged, weather-resistant diagnostic kits suited for rural and harsh environments. On-farm diagnostics shorten decision-making cycles, helping isolate infected animals quickly. It aligns well with disease containment and herd management strategies.

- For instance, MI:RNA Diagnostics, in collaboration with Scotland’s Rural College, leveraged AI-powered microRNA profiling enabling Johne’s diagnosis with predictive accuracy significantly higher than traditional ELISA, reducing time to diagnosis from weeks to hours in some field applications.

Integration of Digital Data Management and Lab Connectivity:

Veterinary diagnostics increasingly incorporate digital platforms to streamline data tracking and reporting. The Johne’s disease diagnostics market experiences growing alignment with lab information systems (LIS) and cloud-based platforms. These systems support real-time reporting, remote access to test results, and epidemiological tracking. Labs and farms benefit from centralized dashboards to monitor herd health history and testing compliance. Connectivity between field testing devices and databases helps track disease progression and inform treatment or culling decisions. Diagnostic providers develop companion apps and portals that improve usability and traceability. Digitalization enhances transparency and trust between farmers, veterinarians, and regulators.

Focus on Multiplex Testing and Broader Pathogen Panels:

Laboratories aim to maximize diagnostic efficiency by adopting multiplex testing platforms. These systems can detect multiple pathogens, including Mycobacterium avium subspecies paratuberculosis, in a single sample. The Johne’s disease diagnostics market adapts by offering integrated test panels covering other intestinal and zoonotic infections. This multi-target approach saves time, reduces costs, and improves overall disease surveillance. It appeals to large-scale farms and veterinary labs managing diverse animal populations. Companies develop molecular assays compatible with standard platforms used in veterinary diagnostics. Demand rises for assays that deliver both qualitative and quantitative results to support decision-making.

Increasing Role of Private Veterinary Labs and Diagnostic Networks:

Private laboratories and diagnostic service providers expand their presence in the veterinary sector. These entities offer flexible testing packages, customized herd monitoring plans, and mobile sampling services. The Johne’s disease diagnostics market benefits from such tailored service models that improve access and coverage. Veterinary diagnostic networks form partnerships with agritech platforms, feed companies, and dairy cooperatives to widen outreach. Strategic alliances between labs and local veterinary clinics strengthen diagnostic infrastructure in rural areas. These networks also provide data analytics and consulting services, adding value beyond test results. The rise of independent lab chains brings competitive pricing and innovation to the market.

Market Challenges Analysis:

Low Awareness and Testing Compliance Among Smallholder Farmers:

Despite the economic impact of Johne’s disease, awareness and proactive testing remain low among small and medium livestock owners. Many farmers lack access to accurate information about the disease or the benefits of early diagnostics. The Johne’s disease diagnostics market faces resistance in regions where animal health services are underdeveloped or fragmented. Cost concerns and skepticism about testing outcomes further limit adoption. Education and extension efforts often fail to reach remote or informal farming setups. Without incentives or regulations, farmers avoid diagnostics unless symptoms are visible. Low testing compliance delays disease containment and undercuts the effectiveness of control programs. Expanding market reach in these segments remains a major challenge.

Complexity of Diagnosis and Limitations in Sensitivity:

Diagnosing Johne’s disease accurately at an early stage poses technical challenges. The long incubation period and intermittent shedding of MAP bacteria make detection difficult. The Johne’s disease diagnostics market grapples with variability in test sensitivity and specificity, especially in subclinical cases. False negatives reduce trust in available tools and discourage repeat testing. Culture methods are time-consuming, while molecular diagnostics require infrastructure and expertise not always available in rural areas. ELISA tests may yield inconsistent results depending on disease stage or animal condition. These diagnostic limitations complicate herd management decisions and reduce user confidence in adopting testing as a routine measure.

Market Opportunities:

Expansion into Emerging Markets with Growing Livestock Sectors:

Developing countries with rapidly expanding dairy and meat industries present untapped potential. Rising consumption of animal products and government focus on food safety create favorable conditions for diagnostics. The Johne’s disease diagnostics market can grow in regions like Southeast Asia, Latin America, and Sub-Saharan Africa by aligning with national livestock development programs. Partnerships with veterinary schools, cooperatives, and rural clinics can support penetration. Donor-funded projects targeting animal health can also drive initial adoption.

R&D Investment in Rapid, Low-Cost, High-Sensitivity Tests:

There is strong opportunity to innovate low-cost, easy-to-use diagnostic kits with improved accuracy. Research institutions and private companies can collaborate to develop assays suitable for resource-limited settings. The Johne’s disease diagnostics market gains long-term advantage by addressing sensitivity gaps and reducing testing turnaround. Affordable solutions with minimal equipment needs can scale adoption among smallholder farms and mobile vets.

Market Segmentation Analysis:

By Diagnostic Type

The Johne’s disease diagnostics market features a diverse diagnostic portfolio. ELISA (Enzyme-Linked Immunosorbent Assay) tests lead the segment due to their affordability and suitability for herd-level screening. PCR (Polymerase Chain Reaction) tests continue to gain market share for their superior sensitivity and ability to detect early or subclinical infections. Culture methods are still used for confirmatory diagnosis, though they require longer processing times. Microscopy plays a limited role, often in conjunction with other methods. Other emerging tools, such as lateral flow assays, support field-based testing and faster turnaround.

- For instance, the PrioCHECK MAP Ab 3.0 ELISA kit by Thermo Fisher demonstrates over 90% sensitivity for herd screening while operating under a universal protocol that supports multiple species and sample types, streamlining lab workflow.

By Animal Type

Cattle dominate the market by animal type, driven by the high prevalence of Johne’s disease in global dairy and beef herds. Sheep and goats follow, particularly in regions where small ruminants represent a major part of the agricultural economy. Other animals such as deer and bison represent a smaller but growing segment, supported by wildlife disease control and niche farming needs. The market benefits from increased livestock monitoring across both commercial and smallholder operations.

- For instance, AI-powered diagnostic models developed by MI:RNA have been validated across multiple species including cattle, sheep, and goats showing above 85% accuracy in early MAP infection detection, supporting cross-species disease management efforts.

By End User

Veterinary hospitals and diagnostic laboratories represent the primary end users, with demand focused on high-accuracy, lab-based tests. Research institutes contribute through disease mapping and product development. Dairy farms are key commercial adopters, integrating diagnostics into regular herd health programs. Livestock owners, especially in developed markets, increasingly adopt on-farm testing tools to enable faster decision-making and improved biosecurity.

By Testing Method

The market divides between direct testing, such as PCR and culture methods that detect MAP organisms, and indirect testing, like ELISA, which detects antibodies. Indirect methods remain dominant due to lower cost and ease of use, especially in large-scale surveillance programs.

By Distribution Channel

Direct sales channels dominate institutional procurement by labs and hospitals. Veterinary supply stores offer access to practitioners and farm-based users. Online platforms emerge as convenient options, especially for remote or rural customers seeking diagnostic kits.

Segmentation:

By Diagnostic Type

- ELISA (Enzyme-Linked Immunosorbent Assay)

- PCR (Polymerase Chain Reaction)

- Culture Methods

- Microscopy

- Others (e.g., Lateral Flow Assays)

By Animal Type

- Cattle

- Sheep

- Goats

- Others (e.g., Deer, Bison)

By End User

- Veterinary Hospitals & Clinics

- Diagnostic Laboratories

- Research Institutes

- Dairy Farms & Livestock Owners

By Testing Method

- Direct Testing (Detection of the organism)

- Indirect Testing (Detection of antibodies)

By Distribution Channel

- Direct Sales

- Veterinary Supply Stores

- Online Platforms

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Strong Infrastructure and Adoption

North America holds the largest share in the Johne’s disease diagnostics market, accounting for approximately 38% of global revenue. It benefits from advanced veterinary infrastructure, large-scale dairy operations, and established disease control frameworks. The United States and Canada implement robust national surveillance programs that encourage frequent herd testing. Strong regulatory support, public funding, and partnerships between government agencies and private diagnostic labs contribute to market leadership. High awareness among livestock producers and access to modern diagnostic technologies drive consistent demand. It continues to lead innovation in on-farm diagnostics and lab automation.

Europe Maintains Second Position with Stringent Animal Health Policies

Europe represents the second-largest regional market, contributing around 29% of the Johne’s disease diagnostics market. The region enforces strict animal health regulations, which mandate regular disease screening across dairy and meat-producing countries. Germany, France, the UK, and the Netherlands are major contributors, supported by structured veterinary services and high farm-level compliance. Demand grows steadily due to increased focus on biosecurity, sustainable livestock farming, and EU-backed disease management programs. It also benefits from regional funding in veterinary research and diagnostics. European countries show strong adoption of both ELISA and PCR-based testing.

Asia-Pacific and Other Regions Offer Emerging Growth Potential

Asia-Pacific accounts for approximately 20% of the market and shows the fastest growth rate due to expanding dairy and livestock sectors. Countries such as China, India, Australia, and New Zealand experience rising demand for animal health diagnostics driven by increasing milk consumption and export-oriented dairy production. Government initiatives to modernize veterinary care and growing awareness of zoonotic risks support regional momentum. Latin America contributes around 8%, led by Brazil, Mexico, and Argentina, where farm-scale modernization boosts demand for disease management tools. The Middle East & Africa holds a smaller share of 5%, but expanding veterinary infrastructure and donor-funded animal health programs support gradual market penetration. The Johne’s disease diagnostics market sees long-term opportunity in these emerging regions with improving access and growing livestock populations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Johne’s disease diagnostics market includes a mix of multinational diagnostic firms, veterinary technology providers, and specialized research-based companies. Leading players focus on developing high-sensitivity ELISA kits, PCR assays, and rapid diagnostic solutions. Companies compete on parameters such as accuracy, cost-efficiency, ease of use, and compatibility with herd management systems. Collaborations with veterinary research institutions and government programs strengthen competitive positioning. The market sees steady innovation aimed at improving detection speed and field-deployability. Key players maintain strong relationships with livestock producers, veterinary labs, and public health authorities. It remains moderately fragmented, with few companies dominating specific segments like PCR or culture-based diagnostics.

Recent Developments:

- In October 2024, New Zealand-based company DNAiTECH developed portable equipment for instant testing and diagnosis of various animal diseases, including Johne’s disease, without the need for a traditional lab. This innovation was supported by USD 1 million in pre-seed funding from Sprout Agritech, alongside a USD 750,000 repayable grant from Callaghan Innovation. The development aims at launching a minimum viable product for a pilot program in West Africa, significantly enhancing on-site diagnostic capabilities.

- In October 2023, the Dutch company GD Group acquired Ireland-based Animal Health Laboratories, marking its first subsidiary in Ireland. The acquired lab continues to provide veterinary services, including testing and herd health advice for Johne’s disease, and holds accreditation from the Irish National Accreditation Board. This strategic acquisition aims to strengthen GD Group’s veterinary diagnostic footprint in the region.

Market Concentration & Characteristics:

The Johne’s disease diagnostics market shows moderate concentration, with a few established players controlling core diagnostic technologies. It features a combination of global diagnostic firms, regional suppliers, and veterinary lab service providers. The market is characterized by product differentiation, a strong emphasis on test reliability, and increasing integration with digital health platforms. It relies on both institutional procurement and growing end-user adoption at the farm level. Companies prioritize innovation, regulatory compliance, and rural market penetration to maintain competitiveness.

Report Coverage:

The research report offers an in-depth analysis based on Diagnostic Type, Animal Type, End User, Testing Method, and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for early detection tools will rise as livestock producers prioritize herd health and productivity.

- Diagnostic innovation will focus on rapid, portable, and cost-efficient testing solutions for on-site use.

- Adoption of digital data integration will enhance traceability, herd monitoring, and regulatory compliance.

- Multiplex testing platforms will gain traction to detect MAP alongside other common ruminant infections.

- PCR-based diagnostics will see expanded use due to improvements in sensitivity and reduced processing time.

- Emerging markets will drive growth as veterinary infrastructure and disease awareness improve.

- Governments will continue to support testing through national disease control programs and public funding.

- Strategic partnerships between diagnostic firms and veterinary labs will strengthen regional service networks.

- Online and decentralized distribution channels will improve access to diagnostics in remote areas.

- Private investment in veterinary diagnostics R&D will increase as biosecurity becomes a global priority.