Market Overview:

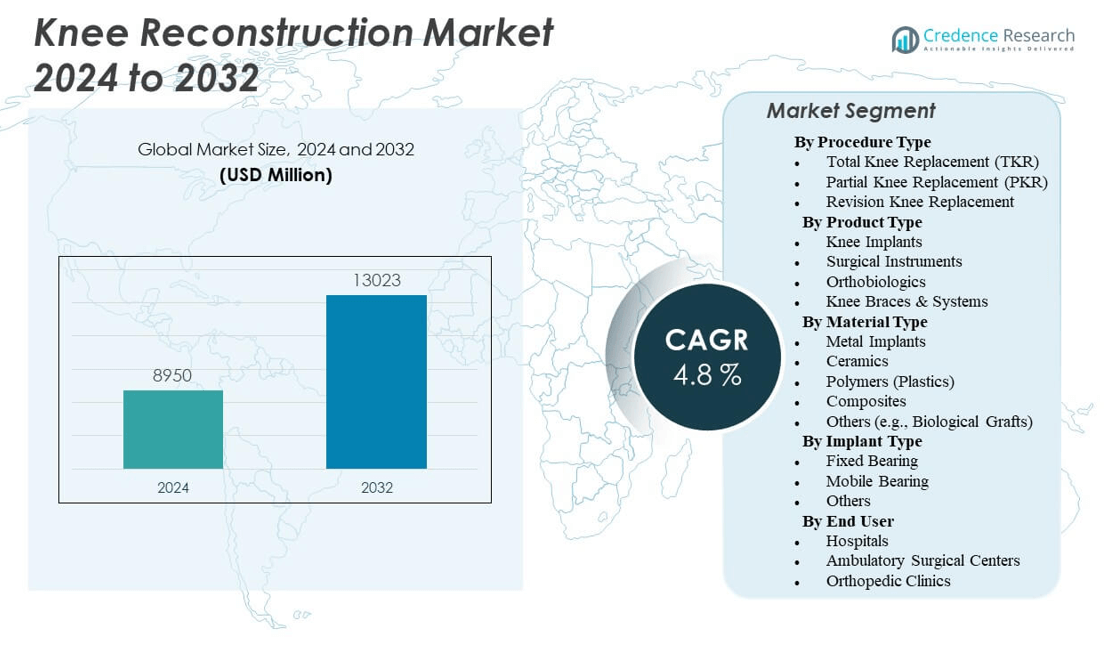

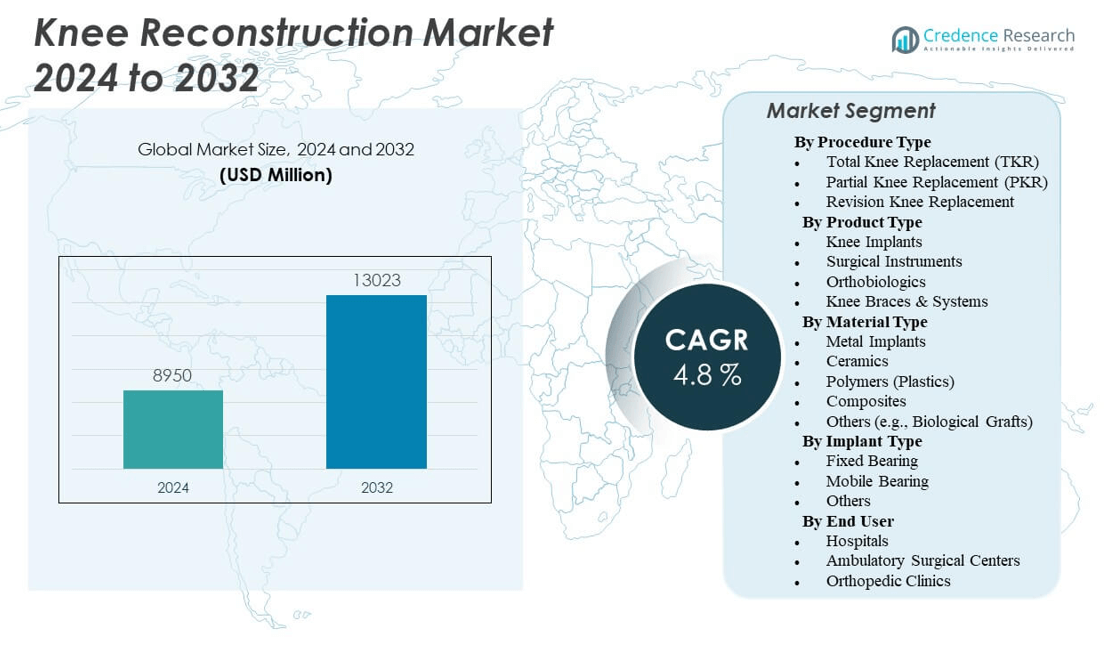

The Knee Reconstruction Market is projected to grow from USD 8,950 million in 2024 to an estimated USD 13,023 million by 2032, with a compound annual growth rate (CAGR) of 4.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Knee Reconstruction Market Size 2024 |

USD 8,950 million |

| Knee Reconstruction Market, CAGR |

4.8% |

| Knee Reconstruction Market Size 2032 |

USD 13,023 million |

The market is being driven by an aging global population, a rising prevalence of osteoarthritis, and increased participation in sports activities leading to joint injuries. Technological advancements in implant materials and surgical techniques have significantly improved patient outcomes and reduced recovery times, encouraging more individuals to opt for knee reconstruction procedures. Furthermore, growing awareness about joint health and increased healthcare spending across both developed and developing economies are contributing to market expansion. Hospitals and orthopedic centers are also adopting minimally invasive techniques that further support market demand.

North America leads the global knee reconstruction market due to its well-established healthcare infrastructure, high adoption of advanced surgical procedures, and large aging population. Europe follows closely, driven by strong government healthcare initiatives and the presence of major medical device manufacturers. Meanwhile, the Asia-Pacific region is emerging as a significant growth area, fueled by increasing healthcare investments, expanding access to orthopedic care, and rising awareness among patients. Countries like China and India are experiencing particularly strong growth due to improving medical tourism, urbanization, and a growing burden of lifestyle-related joint conditions.

Market Insights:

- The Knee Reconstruction Market was valued at USD 8,950 million in 2024 and is projected to reach USD 13,023 million by 2032, growing at a CAGR of 4.8%.

- Rising incidence of osteoarthritis and degenerative joint diseases among the aging population is a key factor driving surgical procedure volumes.

- Technological advancements in robotic-assisted surgeries and patient-specific implants continue to enhance surgical precision and post-operative outcomes.

- High procedural and implant costs remain a restraint, especially in low- and middle-income countries with limited reimbursement coverage.

- North America holds the largest market share due to advanced healthcare infrastructure and favorable insurance policies supporting knee procedures.

- Asia-Pacific is emerging as the fastest-growing region, driven by expanding healthcare access, rising awareness, and increasing medical tourism.

- Variability in regulatory approval processes and occasional implant recalls impact market expansion and introduce clinical adoption challenges.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Geriatric Population and Prevalence of Joint Degeneration Disorders Elevate Procedural Demand

The global surge in elderly populations contributes directly to the growing need for knee reconstruction procedures. Age-related conditions such as osteoarthritis and degenerative joint disease are becoming more prevalent, prompting a consistent rise in surgical interventions. Healthcare systems worldwide are experiencing an increase in orthopedic consultations, particularly for knee joint issues. The Knee Reconstruction Market benefits from this trend as hospitals and surgical centers witness higher patient inflow. Aging bones and reduced cartilage resilience create ongoing demand for effective reconstruction options. Patients are more likely to pursue medical intervention when functional mobility becomes restricted. Surgeons increasingly recommend reconstructive solutions to improve quality of life and mobility. This demographic shift strongly sustains market growth.

- For example, ATTUNE Knee Systemsurpassed one million global implantations by 2024. Registry outcome data show a 7-year cumulative revision rate of just 2.1% (95% CI: 1.9–2.9%) for the ATTUNE implant (N=32,155), reflecting broad use in an aging population with knee osteoarthritis who require surgical solutions.

Technological Advancements in Implants and Surgical Tools Improve Outcomes and Uptake Rates

Medical technology companies continue to innovate knee implants, creating options that enhance durability, comfort, and biomechanics. Custom-fit implants designed using 3D imaging and robotic-assisted surgeries have enhanced surgical precision and reduced complications. These innovations have decreased recovery periods and improved post-surgical patient satisfaction. Surgeons are adopting modern tools that allow better alignment, fewer revisions, and higher long-term success rates. The Knee Reconstruction Market sees robust momentum from these developments, which increase procedural acceptance across all age groups. Healthcare facilities integrate digital navigation systems, allowing real-time intraoperative adjustments. Patient outcomes improve, which encourages orthopedic professionals to upgrade to newer systems. These medical device innovations significantly drive market expansion.

- For example, Medacta’s Knee business grew by 21.9% to €241.2million in 2024, propelled by the GMK SpheriKA system the first implant explicitly designed for kinematic alignment in total knee arthroplasty. Their MyKA platform personalizes alignment using pre-operative imaging and intraoperative smart tools, advancing precision for each patient’s anatomy.

Healthcare Infrastructure Development and Insurance Access Fuel Procedural Volume Growth

Countries expanding their healthcare infrastructure are witnessing a sharp rise in elective surgeries, including knee reconstruction. Investment in public and private hospitals increases the availability of specialized orthopedic care. Insurance schemes and reimbursement programs in both developed and emerging economies reduce the out-of-pocket burden for patients. The Knee Reconstruction Market gains from broader patient access to such services. More individuals seek surgical correction due to improved affordability and awareness. Government health initiatives and private healthcare expansions are introducing knee reconstruction options into tier-two and rural areas. Availability of trained orthopedic surgeons and better surgical equipment also contributes to market growth. Increased institutional capacity supports procedural growth across regions.

Rising Sports Injuries and Young Patient Base Contribute to Market Expansion

Younger populations engaging in high-intensity sports are experiencing higher rates of knee trauma and ligament tears. These injuries often lead to partial or full reconstruction to restore knee function and prevent long-term disability. Awareness about preventive orthopedic care is increasing among younger demographics. The Knee Reconstruction Market benefits from the expanding demand for surgeries among athletes and active individuals. Rehabilitation protocols and surgical options tailored to younger patients enhance treatment uptake. Physical therapy centers and orthopedic clinics cater to this segment with specialized programs. Hospitals are establishing sports medicine departments to meet demand. This shift in patient age demographics contributes to sustained market acceleration.

Market Trends

Robotic-Assisted Surgeries and Navigation Systems Are Reshaping Surgical Precision

Robotic technology integration is transforming knee reconstruction by providing enhanced surgical accuracy. Hospitals are adopting robotics to improve implant alignment and reduce intraoperative errors. Navigation systems assist surgeons in planning and executing procedures with millimeter-level precision. This trend helps minimize revisions and improves patient satisfaction. The Knee Reconstruction Market is seeing higher equipment adoption among specialty hospitals and urban centers. Patients increasingly inquire about robotic procedures due to better outcomes. Medical training programs are including robotic techniques in orthopedic surgery curricula. Hospitals differentiate themselves by promoting robotic-assisted capabilities to attract patients.

- For example, Stryker’s latest generation Mako SmartRobotics™ incorporates haptic guidance and data-driven planning tools, enabling millimeter-level precision in bone resections and implant placement across more than 750,000 procedures globally. The Johnson & Johnson VELYS™ Robotic-Assisted Solution has performed over 100,000 total knee replacements across 31 countries.

Personalized and Patient-Specific Implants Improve Clinical Outcomes

Orthopedic manufacturers are offering implants tailored to individual patient anatomy, improving comfort and joint functionality. These implants are designed using preoperative imaging to match bone structure and alignment. Patient-specific designs reduce complications and shorten surgical times. The Knee Reconstruction Market is adapting to this trend by incorporating advanced planning tools and 3D modeling. Surgeons prefer custom implants for better bone preservation and load distribution. Facilities invest in software that supports patient-specific workflows. This approach enhances procedural confidence and post-operative recovery. Patient awareness of tailored implants is also rising, creating new demand segments.

Sustainability and Biocompatibility Trends Influence Material Choices

Demand is rising for biocompatible and environmentally sustainable materials in implant manufacturing. Companies are developing new alloys and polymer combinations that reduce allergic responses and promote longer implant lifespans. These materials offer better osseointegration and fewer side effects. The Knee Reconstruction Market is responding by phasing out older-generation materials in favor of next-gen alternatives. Hospitals prefer biocompatible options to reduce post-surgical complications. Manufacturers promote their sustainable sourcing and product longevity. Regulatory authorities support these changes by tightening material safety standards. These material upgrades are changing purchasing behavior across health institutions.

Digital Rehabilitation and Remote Monitoring Tools Support Post-Surgical Recovery

Post-operative care has expanded beyond physical visits, with digital health platforms guiding patients through recovery protocols. Wearable devices track mobility and joint performance, offering data to clinicians remotely. This digital integration supports better adherence and early complication detection. The Knee Reconstruction Market is integrating digital rehabilitation into surgical packages. Providers promote tele-rehabilitation as part of bundled care offerings. Patients value convenience and consistent feedback during recovery. Healthcare systems benefit from reduced hospital visits and better long-term outcomes. This trend aligns with broader digital health transformations across medical disciplines.

- For instance, ROMTech’s PortableConnect® device has logged over 5.35 million therapy sessions as of July 2025, enabling clinician-controlled home-based rehabilitation. Early studies indicate that 50% of patients regained measurable knee range of motion within two weeks post-op, compared to 13% with standard rehabilitation.

Market Challenges Analysis

High Procedural and Implant Costs Limit Access in Lower-Income Regions

Knee reconstruction remains a costly procedure due to the price of implants, surgical infrastructure, and post-operative care. In lower-income and resource-limited regions, affordability remains a key barrier to market entry. The Knee Reconstruction Market faces adoption limitations where insurance coverage is weak or nonexistent. Many public hospitals do not have the budget to adopt high-end implants or robotic systems. Patients delay surgeries or opt for temporary pain management, impacting overall procedural volume. This creates a disparity between urban and rural access to advanced orthopedic care. Manufacturers also face pricing pressure while trying to balance innovation with affordability. These cost challenges hinder equitable market growth.

Regulatory Complexities and Product Recalls Disrupt Market Consistency

Implant approval processes vary across countries, requiring time-consuming clinical trials and certification pathways. Regulatory inconsistencies delay product launches and complicate market expansion strategies. The Knee Reconstruction Market also faces setbacks from product recalls due to quality issues or post-market complications. Companies face financial liabilities and reputational damage, which reduce stakeholder confidence. Strict documentation and post-marketing surveillance add to operational costs. Delays in regulatory approvals limit innovation cycles. This complexity discourages smaller players from entering the market and affects competitive dynamics.

Market Opportunities

Growing Demand in Emerging Economies with Expanding Orthopedic Infrastructure

Emerging economies in Asia-Pacific, Latin America, and parts of Africa are rapidly upgrading their healthcare systems. These countries are witnessing a rise in joint replacement surgeries due to increasing awareness and improving affordability. The Knee Reconstruction Market has an opportunity to expand its reach through public-private healthcare partnerships. Governments are investing in medical tourism and orthopedic centers to meet rising demand. Training programs for surgeons and better access to surgical tools support procedural growth. Rising lifestyle diseases and changing physical activity levels create broader patient bases. Market players can introduce mid-range implants to target cost-sensitive regions. These markets offer long-term growth potential.

Strategic Collaborations and Product Innovation Drive Competitive Edge

Medical device companies are forming partnerships with hospitals, research institutions, and tech startups to innovate faster and launch differentiated products. These collaborations accelerate development of next-generation implants, robotics, and digital health solutions. The Knee Reconstruction Market benefits from these strategic efforts by gaining first-mover advantage in new technologies. Customized implant kits, AI-driven surgical planning, and virtual training environments are examples of such innovation. Companies that align with institutional needs can gain preferred supplier status. These opportunities allow firms to scale product lines and enter underserved segments. This innovation-focused environment offers long-term value creation.

Market Segmentation Analysis:

The Knee Reconstruction Market is segmented

By procedure type into Total Knee Replacement (TKR), Partial Knee Replacement (PKR), and Revision Knee Replacement. TKR holds the largest share due to its widespread use in advanced osteoarthritis cases. PKR is gaining attention for early-stage interventions, while revision procedures are increasing with the aging of previously implanted patients.

- For instance, Stryker Triathlon Revision Platform and the Zimmer Biomet NexGen Revision kits are real and widely used in orthopedic surgery for complex knee revisions.

By product type, knee implants dominate, supported by growing demand for both three-compartmental and unicompartmental systems. Surgical instruments remain essential for precision in procedures, while orthobiologics are gaining ground as adjuncts for faster recovery and tissue regeneration. Knee braces and systems support both post-operative care and conservative treatment strategies.

- For example, companies like Smith+Nephew and Arthrexcontinue to introduce advanced arthroscopy and navigation tools, including AI-enhanced cutting guides and robotic support systems for reproducible bone cuts and soft-tissue balancing.

By material type, metal implants particularly cobalt-chromium and titanium alloys—are widely used for their durability. Ceramics and polymers offer biocompatibility and wear resistance. Composites and biological grafts are emerging in niche applications focused on personalized treatment.

By implant type segment includes fixed bearing, mobile bearing, and others. Fixed bearing designs lead due to surgeon familiarity and clinical stability, while mobile bearing implants are adopted selectively for active patients.

By end user, hospitals account for the largest share due to infrastructure and surgical volume. Ambulatory surgical centers are expanding in high-income regions for their efficiency, while orthopedic clinics play a key role in pre-operative assessment and follow-up care. The Knee Reconstruction Market reflects these diverse segment dynamics with consistent growth across all categories.

Segmentation:

By Procedure Type

- Total Knee Replacement (TKR)

- Partial Knee Replacement (PKR)

- Revision Knee Replacement

By Product Type

- Knee Implants (Three-Compartmental, Unicompartmental)

- Surgical Instruments

- Orthobiologics (Stem Cell Therapies, PRP, Hyaluronic Acid Injections)

- Knee Braces & Systems

By Material Type

- Metal Implants (Cobalt-Chromium, Titanium Alloys)

- Ceramics

- Polymers (Plastics)

- Composites

- Others (e.g., Biological Grafts)

By Implant Type

- Fixed Bearing

- Mobile Bearing

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Orthopedic Clinics

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America dominates the Knee Reconstruction Market, accounting for 41% of the global market share. The region benefits from advanced healthcare infrastructure, high awareness levels, and early adoption of new surgical technologies. The presence of major medical device manufacturers and a strong base of trained orthopedic surgeons further strengthens its leadership. The United States leads in procedural volume due to a growing elderly population and increased sports-related injuries. Insurance coverage and reimbursement policies support high patient accessibility to reconstruction surgeries. Hospitals and surgical centers invest heavily in robotics and personalized implants, reinforcing market growth across North America.

Europe holds the second-largest share of the Knee Reconstruction Market with 28%, driven by the rising incidence of osteoarthritis and increasing preference for minimally invasive surgeries. Countries such as Germany, the UK, and France are key contributors, supported by favorable healthcare funding and established orthopedic departments. Public healthcare systems across Western Europe provide structured support for knee reconstruction procedures. Growing focus on rehabilitation services and aging populations contributes to sustained procedural demand. Technological innovation from European manufacturers also boosts the quality and competitiveness of implants in the region. It continues to see stable growth with gradual expansion into Eastern European countries.

The Asia-Pacific region holds 21% of the global market share and represents the fastest-growing segment in the Knee Reconstruction Market. Economic development and rising healthcare investments across China, India, South Korea, and Japan fuel demand for orthopedic surgeries. Increasing life expectancy and urbanization have led to a higher prevalence of joint-related disorders. Governments in emerging countries are expanding healthcare access, making reconstruction surgeries more accessible to middle-income populations. Medical tourism, particularly in India and Thailand, is supporting market expansion by offering cost-effective procedures. It is poised for robust growth with greater penetration of innovative technologies and expanded training for orthopedic professionals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Zimmer Biomet (US)

- Stryker Corporation (US)

- DePuy Synthes (Johnson & Johnson Services, Inc., US)

- Smith & Nephew Plc (UK)

- Braun Melsungen AG (Germany)

- Exactech, Inc. (US)

- Arthrex, Inc. (US)

- Medacta International (Switzerland)

- Corin Group (UK)

- DJO Global, Inc. (US)

- Aesculap Implant Systems LLC (a B. Braun company)

- Enovis

- Meril Life Sciences (India)

- Conformis (US)

- MicroPort Orthopedics Inc. (China)

- Waldemar Link GmbH & Co KG (Germany)

- Mathys AG Bettlach (Switzerland)

- Limacorporate (Italy)

- Amplitude (France)

- United Orthopedic Corporation (Taiwan)

Competitive Analysis:

The Knee Reconstruction Market features a mix of global medical device leaders and region-specific orthopedic specialists competing on innovation, product quality, and surgical outcomes. Major players include Zimmer Biomet, Stryker Corporation, Johnson & Johnson (DePuy Synthes), Smith+Nephew, and Medacta. These companies invest in R&D to develop advanced implants, robotic-assisted systems, and patient-specific solutions. It sees competitive intensity driven by the race for minimally invasive technologies and personalized care. Players form strategic partnerships with hospitals and research institutes to strengthen their clinical presence. Mid-sized companies focus on cost-effective implants to capture price-sensitive markets. The competitive landscape continues to evolve with frequent product launches, regulatory approvals, and acquisitions.

Recent Developments:

- In July 2025, Zimmer Biomet announced the acquisition of Monogram Technologies, a strategic move poised to expand Zimmer Biomet’s robotics suite with autonomous solutions, offering a broader and more flexible portfolio of orthopedic robotics and navigation technologies. This acquisition aims to enhance the company’s competitive position within the evolving knee reconstruction and musculoskeletal market.

- In March 2025, Johnson & Johnson MedTech made headlines in the knee reconstruction market by showcasing a new era of digital orthopaedics at the American Academy of Orthopaedic Surgeons (AAOS) annual meeting. The company introduced advanced implants and data-driven technologies designed to improve patient outcomes in knee procedures and streamline surgical workflows

- In March 2025, Zimmer Biomet highlighted its diverse orthopedic portfolio at AAOS 2025, setting the stage with the launch of its latest knee and upper extremity reconstructive technologies. These included newly launched knee reconstruction solutions aimed at enhancing surgical precision and personalization for patients suffering from joint degeneration and other knee-related conditions.

- In March 2025, Stryker unveiled the next generation of its Mako SmartRobotics platform for knee surgery at AAOS, marking a significant advancement in robotic-assisted knee reconstruction. This generation includes expanded intelligent software and instrumentation improvements designed to increase surgical accuracy and optimize patient-specific outcomes.

Market Concentration & Characteristics:

The Knee Reconstruction Market remains moderately concentrated, with a few large players accounting for a significant share of global revenues. It is characterized by high barriers to entry due to regulatory complexity, capital intensity, and the need for clinical validation. Product differentiation lies in implant longevity, material innovation, and surgical compatibility. Manufacturers focus on surgeon engagement, post-surgical outcomes, and digital integration. Market dynamics are shaped by pricing pressures, value-based care models, and increasing demand for outpatient procedures. Strong brand equity and global distribution networks enhance competitive advantage. It continues to see consolidation trends as firms seek to expand portfolios and geographic reach.

Report Coverage:

The research report offers an in-depth analysis based on Procedure Type, Product Type, Material Type, Implant Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising geriatric population will significantly increase the demand for knee reconstruction procedures worldwide.

- Advancements in robotic-assisted surgeries and navigation technologies will improve surgical accuracy and boost adoption rates.

- Shift toward outpatient and minimally invasive knee procedures will enhance patient recovery and reduce hospital stays.

- Increasing sports-related injuries and awareness among younger individuals will expand the eligible patient base.

- Rapid healthcare infrastructure development in emerging economies will create new growth avenues for manufacturers.

- Strategic partnerships between medical device companies and healthcare institutions will drive innovation and global market presence.

- Adoption of patient-specific implants and 3D-printed components will improve implant longevity and clinical outcomes.

- Integration of digital rehabilitation platforms and wearable monitoring tools will improve post-operative care efficiency.

- Regulatory reforms and favorable reimbursement policies will increase procedural accessibility and reduce financial barriers.

- Continued investment in sustainable, biocompatible materials and advanced implant designs will strengthen product differentiation and long-term market value.