Market Overview

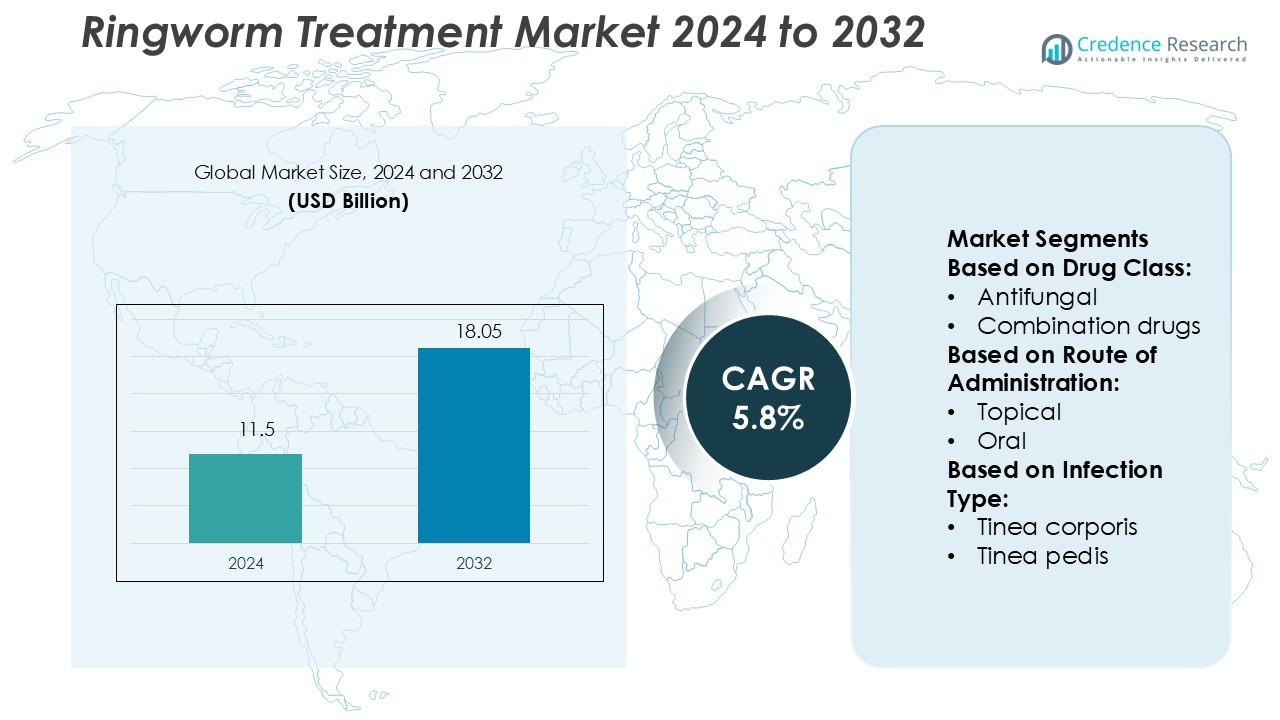

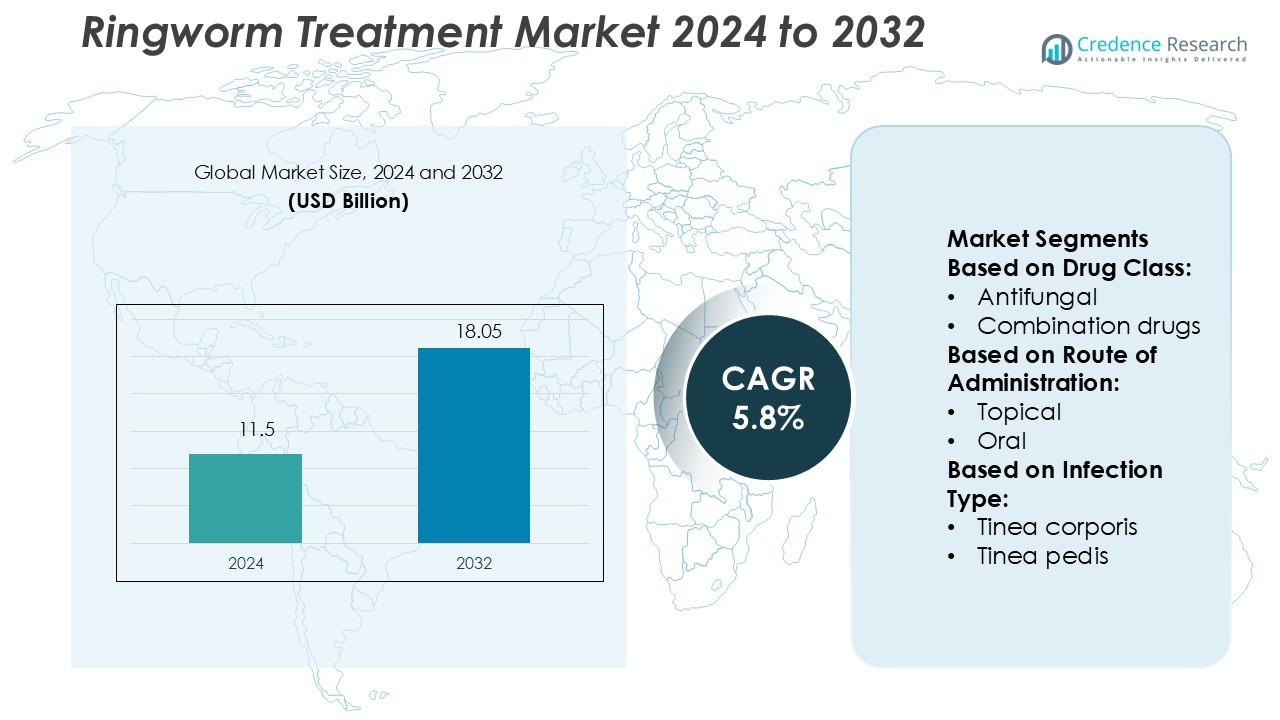

Ringworm Treatment Market size was valued USD 11.5 billion in 2024 and is anticipated to reach USD 18.05 billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ringworm Treatment Market Size 2024 |

USD 11.5 Billion |

| Ringworm Treatment Market, CAGR |

5.8% |

| Ringworm Treatment Market Size 2032 |

USD 18.05 Billion |

The ringworm treatment market is shaped by strong competition among major players such as Johnson and Johnson, Gilead Sciences, Glenmark Pharmaceuticals, AbbVie, Biofield Pharma, Eli Lilly and Company, GlaxoSmithKline, Bayer, Mankind Pharma, and Cipla. These companies focus on product innovation, strategic partnerships, and expanding access through retail and digital platforms. Advanced antifungal formulations and combination therapies strengthen their market positioning. North America leads the global market with a 32% share, supported by high healthcare spending, advanced diagnostic capabilities, and strong awareness programs. Continuous R&D investment and rapid product approvals enhance competitiveness and reinforce the region’s dominance in driving global market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ringworm Treatment Market was valued at USD 11.5 billion in 2024 and is expected to reach USD 18.05 billion by 2032, growing at a CAGR of 5.8%.

- Rising infection rates, expanding healthcare access, and growing awareness are driving market demand, with topical antifungal drugs holding the largest segment share.

- North America leads the market with a 32% share, followed by Europe at 27% and Asia Pacific at 25%, supported by strong healthcare infrastructure and retail pharmacy networks.

- Key players are investing in R&D, product innovation, and digital distribution strategies to strengthen competitiveness and expand their global reach.

- Increasing antifungal resistance and limited awareness in rural areas remain key restraints, but growing teledermatology adoption and OTC product expansion offer strong growth opportunities.

Market Segmentation Analysis:

By Drug Class

The antifungal segment dominates the ringworm treatment market with the largest market share. Its strong position is driven by the broad efficacy of antifungal agents against multiple dermatophyte species. Topical and oral antifungals are widely prescribed due to fast symptom relief and lower recurrence rates. Continuous product innovation and improved drug formulations enhance treatment adherence and effectiveness. Combination drugs are also gaining attention for managing resistant infections but remain secondary. The antifungal segment benefits from strong clinical adoption, clear treatment guidelines, and growing patient awareness in both developed and emerging markets.

- For instance, Gilead Sciences does not have a novel echinocandin compound named GS-6624 in its recent antifungal research pipeline. The compound GS-6624 (simtuzumab) was a monoclonal antibody for fibrosis, and Gilead terminated its Phase II studies for this drug in 2016 due to a lack of efficacy.

By Route of Administration

The topical segment holds the dominant market share among administration routes. Its leadership stems from ease of application, fewer systemic side effects, and faster action on localized infections. Topical therapies remain the first-line treatment for tinea corporis, tinea pedis, and tinea cruris. Widespread availability in over-the-counter and prescription forms strengthens their accessibility. Oral and parenteral routes are reserved for severe or resistant cases, expanding their role in specialized care. The rising preference for self-care solutions further drives topical product adoption across diverse patient groups.

- For instance, Glenmark Pharmaceuticals manufactures and markets a Luliconazole 1% cream under the brand name Lulican. While clinical studies have demonstrated the efficacy of Luliconazole 1% cream for treating dermatophytosis.

By Infection Type

Tinea corporis represents the dominant infection type within the market. Its higher prevalence in both urban and rural populations drives strong demand for effective treatment options. Warm and humid climates increase transmission risk, further supporting segment growth. Dermatologists prefer topical antifungals as the primary treatment for this type, ensuring high patient compliance. Tinea pedis and tinea cruris follow, fueled by lifestyle factors and sports-related exposure. Broader screening and public health awareness also contribute to earlier diagnosis, expanding treatment volumes and reinforcing market leadership of tinea corporis.

Key Growth Drivers

Rising Prevalence of Fungal Infections

The growing incidence of dermatophytosis is a primary market driver. Ringworm affects both adults and children, particularly in humid and tropical regions. The high transmission rate through direct contact or contaminated surfaces increases the need for effective antifungal treatments. Healthcare systems are expanding diagnostic services, improving early detection and treatment rates. Increased awareness campaigns are also encouraging faster medical intervention. This rising disease burden fuels demand for over-the-counter and prescription drugs, strengthening market growth.

- For instance, Biofield Pharma is an Indian pharmaceutical company that manufactures and markets a wide range of medications, including Itraconazole 100 mg capsules.

Advancements in Antifungal Drug Development

Continuous innovation in antifungal therapies is driving adoption of more effective treatment options. New formulations offer better absorption, faster relief, and reduced recurrence rates. Topical and oral antifungal combinations improve patient compliance and broaden treatment scope. Pharmaceutical companies are investing in R&D to address resistant fungal strains. These innovations enhance therapeutic outcomes, making treatments more accessible and reliable. Strong product pipelines and regulatory approvals are supporting market expansion globally.

- For instance, GlaxoSmithKline (GSK) secured exclusive global rights to commercialize the antifungal agent Ibrexafungerp (licensed from SCYNEXIS) including upfront payments of 90 million and potential milestone payments up to 503 million.

Expanding Access to Healthcare Infrastructure

Improved healthcare access in emerging economies is a key growth catalyst. Governments are increasing investments in public health programs to manage common infections like ringworm. Rising availability of dermatology clinics and telemedicine platforms enables faster diagnosis and treatment. Pharmacies and e-commerce channels offer a wider range of antifungal products, improving availability in rural areas. This expanded access drives early intervention, reducing infection severity and boosting drug sales. Strong distribution networks support this market acceleration.

Key Trends & Opportunities

Shift Toward Over-the-Counter Treatments

Consumers are increasingly turning to OTC antifungal creams and lotions for quick relief. Easy product availability in pharmacies and online platforms supports this trend. Many patients prefer self-medication for mild infections, driving demand for fast-acting, low-cost solutions. Manufacturers are focusing on improving product formulations to enhance effectiveness and ease of use. This shift also opens opportunities for product diversification and brand expansion across multiple geographies.

- For instance, Bayer AG refined its OTC antifungal offering by relaunching the Canesten range in India in May 2022. The relaunch introduced the cream in a 30 g tube and a dusting-powder in 50 g and 100 g SKUs.

Rising Use of Combination Therapies

Combination treatments that integrate antifungal and anti-inflammatory agents are gaining popularity. These therapies offer faster symptom control, reduced recurrence, and better patient outcomes. Dermatologists increasingly recommend combination products for complicated or resistant infections. Pharmaceutical companies are developing multi-action formulations to capture this growing demand. This trend strengthens competitive differentiation and improves patient satisfaction.

- For instance, Cipla committed to scale the formulation, perform full toxicology and clinical studies, and pursue regulatory approval — leveraging its 47 manufacturing sites and 1,500+ products globally.

Growing Teledermatology Adoption

Teledermatology is transforming how fungal infections are diagnosed and treated. Online consultations provide faster access to dermatologists, especially in underserved regions. Patients can receive treatment recommendations without visiting a clinic. Digital health platforms also enhance treatment adherence through reminders and follow-ups. This digital shift offers strong growth opportunities for online pharmacies and healthcare service providers.

Key Challenges

Rising Antifungal Resistance

Growing resistance to common antifungal drugs poses a major challenge. Overuse and misuse of topical agents contribute to reduced drug efficacy. Resistant strains require more complex and expensive treatment options, raising healthcare costs. This trend may limit the effectiveness of widely used products and slow market expansion. Addressing resistance requires stronger regulatory control, better patient education, and sustained R&D efforts.

Limited Awareness in Rural Areas

Low awareness about fungal infections in rural regions leads to delayed treatment. Many patients rely on home remedies or informal care, worsening infection severity. Lack of dermatology specialists and inadequate distribution channels further restrict access to effective treatments. This gap reduces overall treatment coverage and hampers market penetration. Expanding education campaigns and healthcare access is crucial to address this challenge.

Regional Analysis

North America

North America holds a 32% market share in the ringworm treatment market, driven by strong healthcare infrastructure and high awareness levels. Widespread availability of over-the-counter antifungal drugs supports early treatment adoption. The U.S. leads the region with advanced diagnostic facilities and robust retail pharmacy networks. Rising incidence of skin infections among children and athletes fuels consistent demand. Strategic product launches and FDA approvals by key pharmaceutical companies strengthen market growth. Increasing use of teledermatology platforms also improves access to treatment, reinforcing North America’s strong position in the global market.

Europe

Europe accounts for 27% of the market share, supported by high public health awareness and strong regulatory standards. Countries such as Germany, France, and the U.K. lead in treatment adoption due to well-established healthcare systems. Government-funded awareness programs promote early detection and intervention. Over-the-counter creams and combination drugs are widely available in retail and online channels. High prevalence of fungal infections during warmer months further boosts demand. Strategic partnerships between healthcare providers and pharmaceutical companies enhance product penetration, solidifying Europe’s role as a major revenue contributor.

Asia Pacific

Asia Pacific holds a 25% market share, with rapid growth driven by rising infection rates and expanding healthcare access. Tropical climates, dense populations, and poor hygiene in some regions increase the disease burden. Countries like India, China, and Indonesia contribute significantly due to high patient volume. Government health initiatives and expanding e-pharmacy networks improve availability of treatments. Growing middle-class spending power drives demand for branded antifungal products. Local and international players are expanding distribution networks to tap into rural and semi-urban areas, supporting strong market momentum across the region.

Latin America

Latin America represents a 9% market share, with growing demand for affordable antifungal treatments. Countries such as Brazil and Mexico drive regional growth through improved healthcare access and rising awareness of skin diseases. Warm and humid climates create favorable conditions for fungal infections, increasing treatment needs. The region is witnessing higher penetration of generic topical formulations, making treatments more accessible. Public health campaigns and community programs play a key role in encouraging early diagnosis. Expansion of retail pharmacies and digital platforms supports steady market growth in this region.

Middle East & Africa

The Middle East & Africa accounts for 7% of the market share, with rising demand for effective ringworm treatment solutions. High prevalence of fungal infections in humid and arid climates drives market expansion. Limited healthcare infrastructure in some areas restricts access, but growing investment in healthcare facilities is improving treatment availability. Urban centers such as Saudi Arabia, the UAE, and South Africa are witnessing faster adoption of branded antifungal drugs. Awareness campaigns and international collaborations are supporting early diagnosis and treatment. The region shows strong long-term growth potential.

Market Segmentations:

By Drug Class:

- Antifungal

- Combination drugs

By Route of Administration:

By Infection Type:

- Tinea corporis

- Tinea pedis

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The key players in the ringworm treatment market include Johnson and Johnson, Gilead Sciences, Glenmark Pharmaceuticals, AbbVie, Biofield Pharma, Eli Lilly and Company, GlaxoSmithKline, Bayer, Mankind Pharma, and Cipla. The ringworm treatment market is marked by strong innovation, strategic partnerships, and expanding distribution networks. Leading pharmaceutical companies are focusing on developing advanced antifungal formulations that offer faster relief and improved patient compliance. Increased investment in research and development supports the introduction of novel therapies aimed at addressing drug resistance. Companies are also enhancing their market reach through collaborations with healthcare providers, retail pharmacies, and digital health platforms. Growing emphasis on e-commerce channels and teledermatology services further strengthens product accessibility. Continuous product launches, regulatory approvals, and entry into emerging markets intensify competition across global and regional levels.

Key Player Analysis

- Johnson and Johnson

- Gilead Sciences

- Glenmark Pharmaceuticals

- AbbVie

- Biofield Pharma

- Eli Lilly and Company

- GlaxoSmithKline

- Bayer

- Mankind Pharma

- Cipla

Recent Developments

- In August 2025, Glenmark Pharmaceuticals announced the launch of Micafungin for injection, used to treat serious fungal infections in the U.S. market. The product will be available in 50 mg/vial and 100 mg/vial single-dose strengths.

- In June 2024, PHOENIX Group entered into a Reduced Wholesale Model agreement with AstraZeneca for the distribution of its portfolio of medicines, including Zoladex, in the United Kingdom. This strategic partnership aims to enhance the availability and distribution of AstraZeneca’s treatments to healthcare providers across the region.

- In June 2024, Henkel is dedicated to increasing knowledge about the role advanced materials can play in enabling sustainability across the value chain, from R&D to manufacturing to field use, among heavy vehicle and equipment (heavy vehicle and equipment) designers, manufacturers, and tier suppliers.

- In January 2024, Hera Biotech, Inc., a Texas-based biotechnology company specializing in tissue-based diagnostics for endometriosis, announced its acquisition of Scailyte AG, a Swiss firm known for its expertise in single-cell omics and AI-driven biomarker discovery.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Route of Administration, Infection Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising infection rates will drive steady demand for antifungal treatments worldwide.

- Growing awareness and early diagnosis will boost treatment adoption in rural and urban areas.

- Advanced combination therapies will gain wider clinical and consumer acceptance.

- E-commerce platforms will strengthen drug accessibility and distribution.

- Teledermatology services will enhance patient reach and treatment efficiency.

- Continuous R&D investments will lead to more effective and targeted antifungal drugs.

- Regulatory approvals will accelerate product launches across emerging markets.

- Generic and OTC products will expand affordability and patient access.

- Digital health technologies will support better treatment adherence and monitoring.

- Strategic collaborations will intensify competition and drive innovation in the marketTop of Form