Market Overview

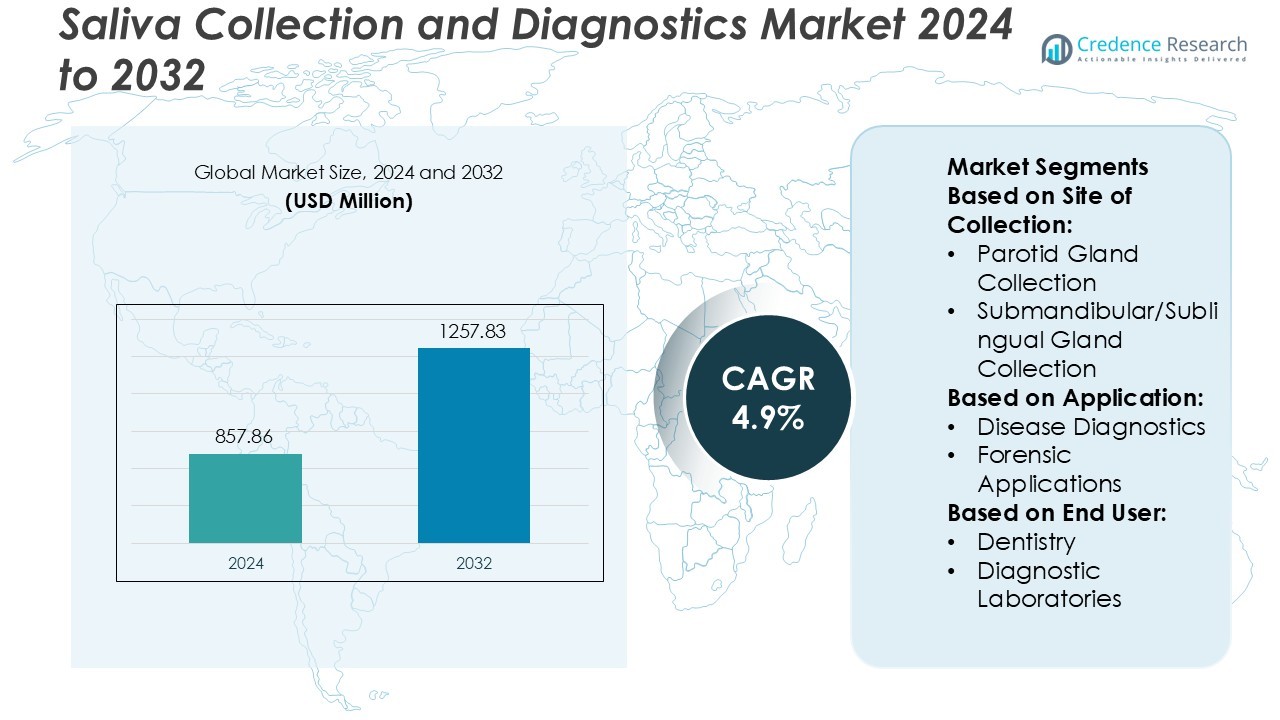

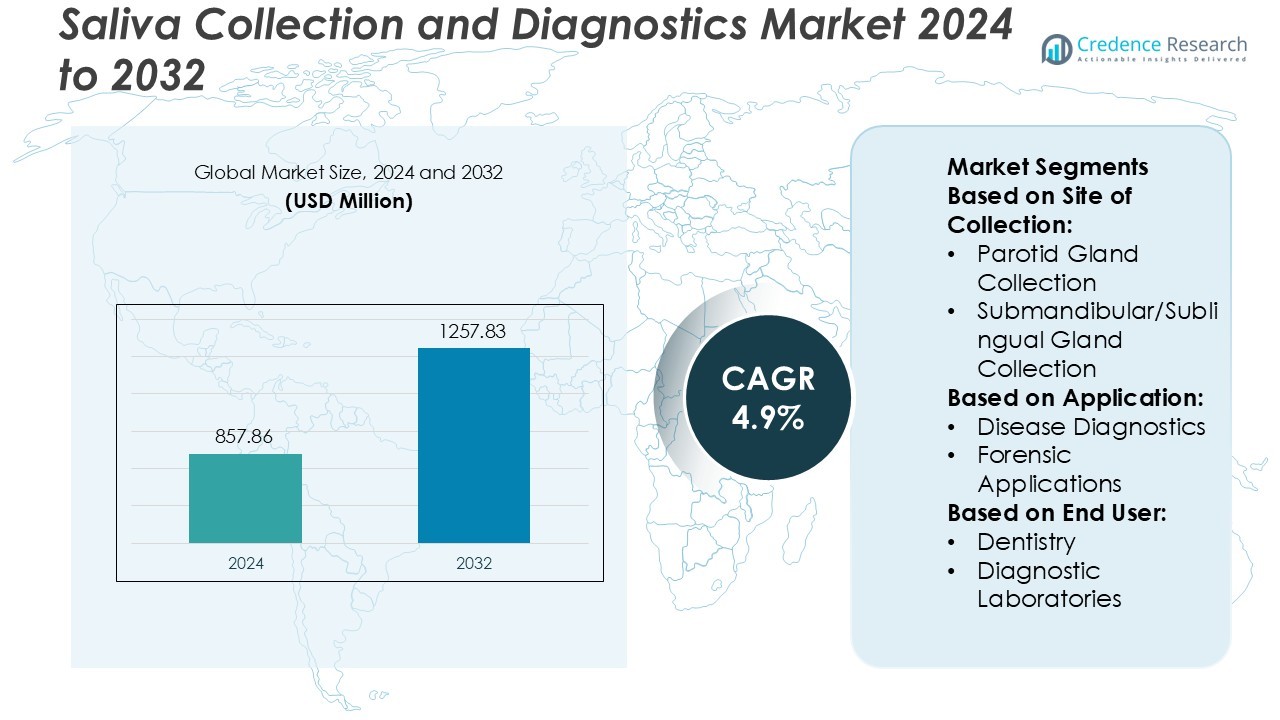

Saliva Collection and Diagnostics Market size was valued USD 857.86 million in 2024 and is anticipated to reach USD 1257.83 million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Saliva Collection and Diagnostics Market Size 2024 |

USD 857.86 Million |

| Saliva Collection and Diagnostics Market, CAGR |

4.9% |

| Saliva Collection and Diagnostics Market Size 2032 |

USD 1257.83 Million |

The saliva collection and diagnostics market is driven by major players including BIO-RAD, Abbott, Meridian Bioscience, Danaher, Artron, HOLOGIC, ACON, Becton, Dickinson and Company (BD), Alfa Scientific, and BIOMÉRIEUX. These companies focus on advancing non-invasive diagnostic technologies, molecular testing accuracy, and rapid assay development. Strategic collaborations, product innovation, and automation investments strengthen their competitive positioning. North America led the global market with a 38% share in 2024, supported by advanced healthcare infrastructure, early adoption of saliva-based testing, and strong research funding. The region’s focus on preventive diagnostics and home-based testing continues to drive sustained market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The saliva collection and diagnostics market was valued at USD 857.86 million in 2024 and is projected to reach USD 1257.83 million by 2032, growing at a CAGR of 4.9%.

- Rising demand for non-invasive diagnostic methods and increasing adoption of molecular testing drive market growth across clinical and home-based settings.

- The market is witnessing trends toward automation, AI integration, and rapid saliva-based assay development, enhancing test efficiency and accuracy.

- Strong competition among players focusing on biomarker innovation, device miniaturization, and affordable point-of-care kits is shaping the market landscape.

- North America dominated the market with a 38% share in 2024, while the disease diagnostics segment held the largest share, supported by technological advancements and expanding healthcare infrastructure.

Market Segmentation Analysis:

By Site of Collection

Parotid gland collection dominated the saliva collection and diagnostics market with a 46% share in 2024. Its high accuracy in biomarker detection and ease of sample retrieval support wide adoption in diagnostic and clinical studies. The method delivers consistent saliva flow rates and protein concentrations, improving the reliability of disease screening. Advancements in microfluidic collectors and automated saliva management systems further enhance sample precision and reduce contamination. Growing clinical validation of parotid-based assays in oncology and infectious disease testing continues to strengthen its leading position.

- For instance, BIO-RAD’s Droplet Digital PCR (ddPCR) platform enables ultra-sensitive detection of viral RNA in saliva samples, achieving quantification accuracy down to 0.1 copies/µL in clinical diagnostics.

By Application

Disease diagnostics accounted for 61% of the total market share in 2024, making it the largest application segment. The segment benefits from the rising use of saliva-based testing in cancer, viral infection, and genetic disorder detection. Non-invasive collection, fast results, and compatibility with PCR and immunoassay platforms drive demand. Companies focus on developing multiplexed assays capable of identifying multiple biomarkers from a single saliva sample. Increased government funding for non-invasive diagnostic tools reinforces market growth across hospital and home-testing environments.

- For instance, Abbott’s Alinity m system enables fully automated molecular diagnostics with continuous sample loading and real-time amplification, processing up to 1,080 samples every 24 hours with a carryover rate of 0.0% (zero cross-contamination).

By End-User

Diagnostic laboratories held the dominant share of 48% in 2024 within the end-user segment. These facilities leverage advanced analytical platforms such as ELISA, PCR, and next-generation sequencing for high-throughput saliva testing. The growing integration of automation and data analytics enhances workflow efficiency and accuracy in test processing. Collaborations between labs and biotech firms drive innovation in saliva-based assay validation. Expanding adoption of point-of-care saliva testing and rising demand for accurate, cost-effective diagnostic solutions continue to fuel segment leadership.

Key Growth Drivers

Rising Demand for Non-Invasive Diagnostics

The shift toward non-invasive testing methods is a major growth driver for the saliva collection and diagnostics market. Saliva-based diagnostics offer painless, stress-free sample collection, reducing the need for blood draws. These methods are especially beneficial in pediatric and geriatric care. The growing awareness of early disease detection and home-based testing has accelerated adoption. Healthcare providers favor saliva testing for its ability to deliver accurate biomarker data while improving patient compliance and reducing clinical workload.

- For instance, Meridian Bioscience’s Revogene platform uses real-time PCR technology to deliver molecular results in under 70 minutes from a single swab sample, as saliva is generally not an approved sample type for currently available assays.

Advancements in Molecular and Biomarker Technologies

Technological innovation in biomarker identification and molecular assay development significantly boosts market growth. Improved sensitivity of polymerase chain reaction (PCR) and next-generation sequencing (NGS) enables rapid disease detection from small saliva samples. These advancements support diagnosis of infectious diseases, cancers, and genetic disorders with high precision. The introduction of multiplexed assay kits and lab-on-chip systems has enhanced result accuracy and turnaround time. Continuous R&D in biomarker validation expands diagnostic possibilities, strengthening saliva’s role as a reliable diagnostic fluid.

- For instance, Danaher’s subsidiary Cepheid developed the GeneXpert Xpress platform, which offers various systems (1, 2, or 4 modules) with most tests completing in under an hour, achieving a typical detection limit of around 250 copies/mL for viral RNA (though some studies report higher sensitivity).

Expansion of Personalized and Preventive Healthcare

The rising emphasis on personalized medicine and preventive healthcare further drives market expansion. Saliva diagnostics allow real-time monitoring of stress hormones, DNA mutations, and metabolic markers, aligning with personalized treatment strategies. Pharmaceutical and biotechnology companies increasingly use saliva-based testing for drug response monitoring and clinical trials. Early detection through preventive screening helps reduce healthcare costs and disease progression. The convenience and adaptability of saliva testing make it an essential component in individualized patient care programs globally.

Key Trends & Opportunities

Integration of AI and Digital Health Platforms

Artificial intelligence (AI) and digital health integration create major opportunities for saliva diagnostics. AI-powered data analytics improve biomarker interpretation, enabling early disease prediction and trend analysis. Cloud-based platforms allow remote saliva test reporting, enhancing accessibility for telemedicine services. Startups are developing digital saliva test kits that transmit results directly to healthcare providers. The growing adoption of connected diagnostic ecosystems strengthens real-time decision-making and preventive health strategies, offering new business prospects for digital diagnostic companies.

- For instance, Hologic’s Panther Fusion system integrates fully automated molecular testing with real-time PCR technology, processing up to 1,150 tests per 24-hour cycle with minimal manual intervention.

Expansion of Home-Based and Point-of-Care Testing

Home-based saliva test kits and point-of-care diagnostic devices are reshaping the market landscape. These solutions offer convenience, faster results, and minimal sample handling, meeting the growing demand for decentralized healthcare. Companies are introducing portable saliva analyzers for infectious disease screening, drug testing, and wellness monitoring. COVID-19 accelerated the use of saliva as a reliable medium for rapid antigen and molecular tests. The increasing consumer acceptance of at-home diagnostic products continues to fuel market growth and accessibility.

- For instance, ACON Laboratories’ Flowflex COVID-19 Antigen Home Test is authorized by the FDA only for anterior nasal swab specimens (not saliva), delivering results within 15 minutes with a clinical performance of 93% sensitivity (positive specimens correctly identified) and 100% specificity (negative specimens correctly identified) in a key clinical study.

Key Challenges

Limited Sensitivity Compared to Traditional Methods

Despite advancements, saliva-based diagnostics face sensitivity and specificity challenges compared to blood-based assays. Variations in saliva composition, flow rate, and contamination risks can affect biomarker concentration. Inconsistent sample quality may lead to false-negative results, particularly in low-biomarker diseases. Manufacturers are focusing on developing improved stabilizers and collection devices to address these limitations. Achieving clinical validation and standardization remains critical to establishing saliva diagnostics as a mainstream alternative in medical testing.

Regulatory and Validation Barriers

Regulatory hurdles and lack of standardized validation frameworks hinder the widespread adoption of saliva diagnostics. Approval processes for new saliva-based tests are often lengthy due to limited established benchmarks. Variations in regional regulatory policies add complexity for global market players. Inadequate clinical evidence supporting saliva biomarker accuracy also delays approvals. Companies must invest in rigorous clinical trials and harmonized regulatory compliance to ensure widespread acceptance and commercialization of saliva-based diagnostic technologies.

Regional Analysis

North America

North America led the saliva collection and diagnostics market with a 38% share in 2024. The region benefits from advanced healthcare infrastructure, high adoption of molecular diagnostic technologies, and strong R&D investment. The U.S. dominates due to widespread use of saliva-based tests in oncology, infectious disease, and genetic screening. Government initiatives promoting early disease detection and home testing drive further growth. Collaborations between biotech firms and research institutions also support innovation in saliva collection devices, expanding market penetration across clinical and consumer applications.

Europe

Europe accounted for 28% of the global market share in 2024, supported by growing clinical validation and adoption of non-invasive diagnostics. Countries such as Germany, the U.K., and France are at the forefront of regulatory approvals for saliva-based testing kits. The rising incidence of lifestyle-related diseases and increased healthcare digitization encourage the use of saliva in point-of-care testing. European research programs focusing on personalized healthcare and biomarker identification continue to expand the regional market’s technological base and adoption in clinical diagnostics.

Asia-Pacific

Asia-Pacific captured 24% of the saliva collection and diagnostics market share in 2024, showing the fastest growth rate. The region benefits from rising healthcare awareness, expanding diagnostic infrastructure, and large population bases in China and India. Governments are promoting preventive health screening and telemedicine, increasing the demand for non-invasive testing. Growing investments by domestic diagnostic firms and multinational players enhance accessibility to affordable saliva-based kits. Advances in biotechnology and expanding clinical research collaborations continue to strengthen the region’s market potential.

Latin America

Latin America held a 6% market share in 2024, driven by growing healthcare modernization and the adoption of point-of-care testing. Brazil and Mexico lead the regional market with investments in diagnostic laboratories and public health initiatives. The demand for saliva-based testing in infectious disease detection, particularly for viral illnesses, is increasing. Rising collaborations between local labs and global diagnostic firms are improving access to advanced testing technologies. However, limited regulatory harmonization and economic instability pose moderate challenges to large-scale adoption.

Middle East & Africa

The Middle East & Africa accounted for 4% of the global saliva collection and diagnostics market share in 2024. The region’s growth is supported by rising investments in healthcare infrastructure and government efforts to modernize diagnostic services. The UAE, Saudi Arabia, and South Africa are leading adopters due to increasing chronic disease burden and demand for non-invasive testing. Partnerships between international diagnostic firms and regional healthcare providers are enhancing technology transfer. Despite limited awareness in rural areas, ongoing public health campaigns are expanding market reach.

Market Segmentations:

By Site of Collection:

- Parotid Gland Collection

- Submandibular/Sublingual Gland Collection

By Application:

- Disease Diagnostics

- Forensic Applications

By End User:

- Dentistry

- Diagnostic Laboratories

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The saliva collection and diagnostics market features key players such as BIO-RAD, Abbott, Meridian Bioscience, Danaher, Artron, HOLOGIC, ACON, Becton, Dickinson and Company (BD), Alfa Scientific, and BIOMÉRIEUX. The saliva collection and diagnostics market is characterized by strong innovation, technological advancement, and strategic expansion. Companies are investing heavily in research and development to enhance the sensitivity and specificity of saliva-based assays. The focus lies on developing rapid, point-of-care solutions and integrating molecular technologies such as PCR and next-generation sequencing. Partnerships between diagnostic firms and healthcare providers are driving clinical validation and regulatory approvals across regions. Market players are also emphasizing automation, digital connectivity, and AI-driven data analytics to improve test efficiency and accuracy. Growing competition is fostering product diversification, global expansion, and continuous improvement in diagnostic reliability.

Key Player Analysis

- BIO-RAD

- Abbott

- Meridian Bioscience

- Danaher

- Artron

- HOLOGIC

- ACON

- Becton, Dickinson and Company (BD)

- Alfa Scientific

- BIOMÉRIEUX

Recent Developments

- In July 2025, PHASE Scientific announced that it had entered into an exclusive U.S. distribution agreement with Lumos Diagnostics for FebriDx, a rapid point-of-care test that diagnosed bacterial acute respiratory infections and differentiated them from non-bacterial causes in about 10 minutes using a single drop of blood.

- In May 2025, SEKISUI Diagnostics launched a rapid diagnostic tool, the OSOM RSV Test, for detecting RSV in healthcare settings. The test provided results from anterior nasal swabs in just 15 minutes. This launch is expected to boost the market by improving early detection, expanding point-of-care options, and enhancing the company’s infectious disease portfolio.

- In January 2024, Isohelix announced the launch of the SaliFix Saliva Swab DNA Collection Kit, which can be used at home, in the clinic, or at any remote location.

- In January 2024, QIAGEN launched two syndromic testing panels for its QIAstat-Dx instruments in India, including the Gastrointestinal Panel 2 and Meningitis/Encephalitis Panel, following the earlier authorization of the Respiratory SARS-CoV-2 Panel in 2020.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Site of Collection, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for non-invasive diagnostic methods will continue to rise across healthcare settings.

- Advancements in molecular and biomarker analysis will enhance saliva test accuracy.

- Integration of AI and data analytics will improve result interpretation and disease prediction.

- Home-based saliva testing kits will gain strong consumer adoption for convenience and speed.

- Partnerships between biotech firms and diagnostic laboratories will expand research capabilities.

- Regulatory frameworks will evolve to support faster approval of saliva-based assays.

- Growing use of saliva diagnostics in oncology, infectious diseases, and genetic testing will drive growth.

- Miniaturized and portable diagnostic devices will strengthen point-of-care applications.

- Increased investment in personalized and preventive healthcare will boost market adoption.

- Expansion into emerging markets will create new opportunities for affordable testing solutions.