Market Overview

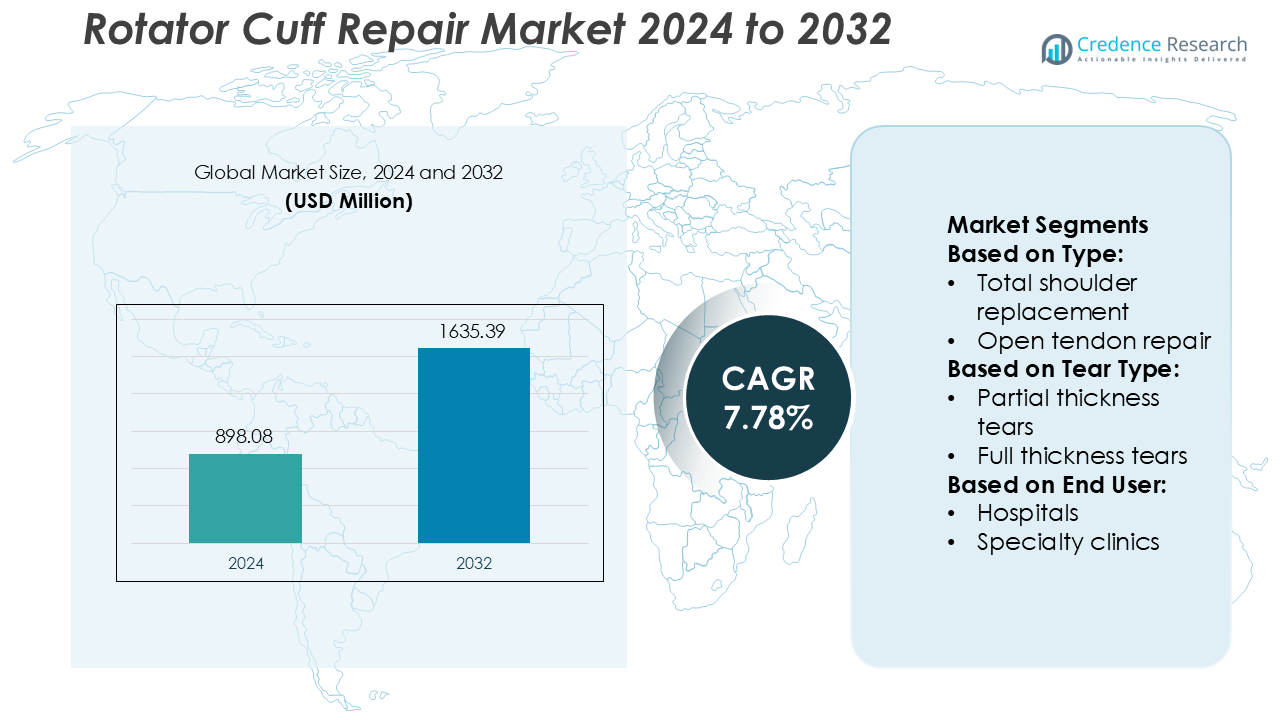

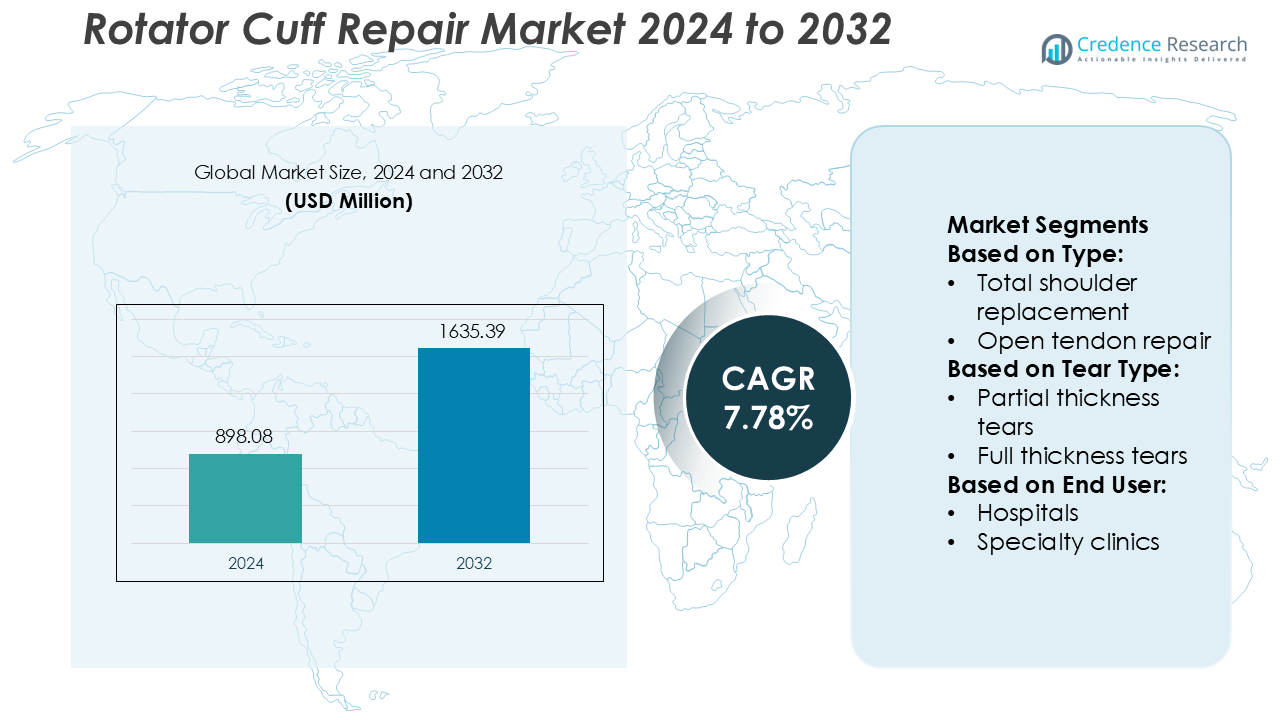

Rotator Cuff Repair Market size was valued USD 898.08 million in 2024 and is anticipated to reach USD 1635.39 million by 2032, at a CAGR of 7.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rotator Cuff Repair Market Size 2024 |

USD 898.08 Million |

| Rotator Cuff Repair Market, CAGR |

7.78% |

| Rotator Cuff Repair Market Size 2032 |

USD 1635.39 Million |

The rotator cuff repair market features strong competition among major players such as Smith & Nephew plc, DePuy Synthes, KARL STORZ, Orthocell Limited, Atreon Orthopedics, Regenexx, Novartis AG, Physiomobility Health Group, OrthoNY, and SironixMedtech. These companies focus on developing advanced arthroscopic systems, biologic grafts, and regenerative therapies to improve patient recovery and surgical precision. North America leads the global market with a 42% share in 2024, driven by high healthcare expenditure, a well-established orthopedic infrastructure, and the rapid adoption of minimally invasive repair procedures. Continuous innovation, favorable reimbursement policies, and the presence of leading device manufacturers sustain the region’s dominance.

Market Insights

- The Rotator Cuff Repair Market was valued at USD 898.08 million in 2024 and is projected to reach USD 1635.39 million by 2032, growing at a CAGR of 7.78%.

- Rising prevalence of shoulder injuries, expanding geriatric population, and adoption of arthroscopic surgeries are key growth drivers enhancing treatment demand.

- The market trend shows increasing use of orthobiologics and regenerative therapies, alongside technological advancements in robotic-assisted and minimally invasive repair systems.

- Competitive dynamics are shaped by innovation-focused players investing in biologic implants, imaging technologies, and global partnerships to improve procedural outcomes.

- North America dominates with a 42% market share, supported by advanced healthcare infrastructure and strong manufacturer presence, while the surgery segment, led by arthroscopy, holds a 54% share, reflecting patient preference for faster recovery and precision-based procedures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The surgery segment leads the rotator cuff repair market with a 54% share in 2024. Arthroscopy dominates within this category due to its minimally invasive approach, shorter recovery time, and lower postoperative complications. Surgeons increasingly prefer arthroscopic procedures for enhanced visualization and precision in tendon reattachment. The rising incidence of sports-related shoulder injuries and degenerative tears in the elderly further boosts demand. Advancements in arthroscopic instruments, suture anchors, and imaging guidance technologies are driving adoption in both developed and emerging healthcare markets.

- For instance, Smith & Nephew plc introduced its LYNX 4K arthroscopic imaging system, featuring advanced 4K ultra-high-definition resolution and an integrated digital platform supporting real-time visualization during shoulder repairs.

By Tear Type

Full-thickness tears hold the dominant share of 63% in 2024, driven by their higher clinical severity and the necessity for surgical intervention. These tears often result from trauma or chronic degeneration and significantly impair shoulder function. The growing aging population and increasing participation in physically demanding activities contribute to their prevalence. Healthcare providers are prioritizing early diagnosis through MRI and ultrasound imaging to optimize surgical outcomes. The availability of advanced biologic repair materials and minimally invasive options enhances treatment success for full-thickness tear management.

- For instance, Sironix Medtech reports that its portfolio of shoulder implants has surpassed 125,000 + units implanted globally. Its STATIV® all-suture anchor (available in 1.5 mm and 1.8 mm diameters) features a patented design that removes minimal bone and provides secure fixation for shoulder instability repairs.

By End User

Hospitals represent the largest end-user segment, accounting for 48% of the market in 2024. They lead due to their comprehensive surgical infrastructure, advanced imaging equipment, and presence of skilled orthopedic surgeons. Hospitals also serve as primary centers for complex rotator cuff repair procedures, including arthroscopy and total shoulder replacement. The rising patient inflow for sports injuries and post-traumatic shoulder disorders supports this dominance. In addition, expanding reimbursement coverage and the integration of specialized rehabilitation units within hospitals improve patient recovery and procedural efficiency.

Key Growth Drivers

Increasing Prevalence of Shoulder Injuries

The growing incidence of shoulder injuries due to sports activities, occupational strain, and aging populations is a primary growth driver. Rotator cuff tears are increasingly diagnosed in individuals over 40, often resulting from repetitive motion and tissue degeneration. This rise in cases fuels demand for both surgical and non-surgical repair options. Improved awareness, better diagnostic imaging, and access to specialized orthopedic care contribute to early detection and treatment, supporting steady market expansion across both developed and emerging healthcare systems.

- For instance, Orthocell’s product Striate+™ is now cleared for use in the U.S., Australia, Europe, Canada, Brazil and Singapore, and achieved a post-market study success rate of 98.6%.

Technological Advancements in Surgical Techniques

The adoption of minimally invasive and arthroscopic procedures is transforming rotator cuff repair outcomes. Advanced suture anchors, biologic grafts, and 3D imaging systems have enhanced surgical precision and recovery speed. Hospitals and surgical centers increasingly use robotic-assisted tools to minimize complications and improve postoperative rehabilitation. These innovations reduce hospital stays and improve patient satisfaction, encouraging more patients to opt for surgery. Ongoing R&D investments by medical device companies continue to refine these technologies, strengthening market penetration globally.

- For instance, ROTIUM® Bioresorbable Wick integrate electrospun nanofiber scaffolds that absorb up to 469% of their weight in whole blood, enhancing the healing micro-environment at the tendon-bone interface.

Rising Adoption of Orthobiologics in Repair Procedures

The growing use of orthobiologics such as platelet-rich plasma (PRP) and stem cell therapies is accelerating treatment adoption. These materials improve healing, reduce inflammation, and enhance tendon-to-bone integration. Surgeons are increasingly using biologic augmentation to improve outcomes for chronic or complex tears. Regulatory approvals and expanding clinical studies supporting the efficacy of orthobiologics are also boosting confidence among healthcare providers. The combination of biologic and mechanical repair techniques is becoming a preferred approach, supporting the long-term success of rotator cuff treatments.

Key Trends & Opportunities

Shift Toward Outpatient and Ambulatory Surgeries

The market is witnessing a significant shift toward outpatient and ambulatory settings for rotator cuff repairs. Advancements in anesthesia and minimally invasive techniques allow same-day discharge, reducing treatment costs. Ambulatory surgery centers are increasingly preferred due to faster turnaround times and reduced infection risks. This trend benefits both patients and healthcare systems by improving accessibility and cost efficiency. Growing reimbursement support for outpatient orthopedic procedures presents a strong opportunity for market players to expand service offerings.

- For instance, Regenexx’s outpatient procedures use the patient’s own blood or bone marrow concentrate, processed to 20-times (20×) baseline stem-cell concentration via a patented protocol.

Integration of Digital and Robotic Surgery Systems

The integration of robotics and digital visualization systems in shoulder surgeries is a key trend. Robotic-assisted devices improve suture placement accuracy, minimize tissue damage, and shorten rehabilitation periods. Artificial intelligence-driven preoperative planning tools further enhance precision in tendon repair. These innovations are increasingly adopted in specialized orthopedic centers and teaching hospitals. Companies focusing on advanced navigation systems and surgical robotics are likely to gain a competitive edge by offering improved safety, consistency, and clinical outcomes.

- For instance, Novartis uses automation in drug-discovery: its screening robots test from a 1.6 million-compound library using 1,536-well microplates.

Key Challenges

High Cost of Surgical and Biologic Treatments

The high cost of arthroscopic surgeries and orthobiologic materials remains a significant barrier to widespread adoption. Many healthcare systems, especially in developing countries, face affordability challenges due to limited reimbursement. Patients often bear out-of-pocket expenses for advanced grafts or biologics, restricting accessibility. Price sensitivity among hospitals and insurance limitations further constrain market growth. Manufacturers are under pressure to provide cost-effective solutions without compromising quality, prompting a shift toward locally manufactured and reusable surgical components.

Postoperative Complications and Re-Tear Risks

Re-tear rates and postoperative complications continue to challenge long-term treatment success. Despite advances in surgical techniques, tendon re-rupture occurs in a notable percentage of patients, particularly older adults with poor tissue quality. These issues increase the need for revision surgeries and extended rehabilitation, raising overall healthcare costs. Limited patient adherence to physiotherapy and inconsistent recovery monitoring further contribute to suboptimal outcomes. This challenge emphasizes the importance of enhanced biologic repair methods and patient-specific treatment strategies in future developments.

Regional Analysis

North America

North America leads the rotator cuff repair market with a 42% share in 2024. The region’s dominance stems from high healthcare spending, widespread adoption of arthroscopic procedures, and advanced orthopedic infrastructure. The U.S. drives the majority of revenue due to a strong presence of key medical device manufacturers and favorable reimbursement policies. Increasing sports participation and a rising elderly population further contribute to market expansion. Continuous innovation in surgical tools and biologic therapies strengthens regional growth, while strong collaborations between hospitals and research institutions support clinical advancements in rotator cuff repair techniques.

Europe

Europe holds a 27% share of the rotator cuff repair market in 2024, driven by advanced healthcare systems and growing awareness of early orthopedic intervention. Germany, the U.K., and France remain key contributors due to the increasing use of minimally invasive procedures and orthobiologic implants. Supportive government healthcare funding and well-established rehabilitation services promote patient recovery and procedural success. The market also benefits from the rising prevalence of degenerative joint diseases in the aging population. Ongoing technological improvements and the expansion of outpatient orthopedic centers continue to strengthen Europe’s position in the global market.

Asia-Pacific

Asia-Pacific accounts for 20% of the global market share in 2024 and represents the fastest-growing regional segment. Rising healthcare investments, increasing sports-related injuries, and expanding access to orthopedic specialists are key growth drivers. China, Japan, and India are major contributors due to improving hospital infrastructure and rising adoption of arthroscopic repair systems. The growing middle-class population and higher health awareness are encouraging elective surgical procedures. Favorable government initiatives promoting medical tourism and the establishment of specialized orthopedic centers further enhance regional growth prospects in rotator cuff repair treatments.

Latin America

Latin America captures an 7% share of the rotator cuff repair market in 2024. The region is witnessing increasing demand for affordable shoulder repair procedures, particularly in Brazil, Mexico, and Argentina. Expanding healthcare infrastructure and the gradual adoption of arthroscopic techniques support market growth. However, limited access to advanced biologic materials and high treatment costs remain challenges. Government health programs focused on musculoskeletal disorders are improving diagnosis and surgical intervention rates. Rising medical tourism and the establishment of specialized orthopedic clinics in major cities further enhance regional market opportunities.

Middle East & Africa

The Middle East & Africa hold a 4% share of the global market in 2024. Growth is supported by expanding private healthcare facilities and a rising focus on orthopedic care modernization. The United Arab Emirates and Saudi Arabia lead regional adoption due to investments in advanced surgical technology and skilled orthopedic professionals. Increasing sports-related shoulder injuries among younger populations also contribute to demand. However, high treatment costs and limited reimbursement coverage restrict broader access. Ongoing government initiatives to enhance healthcare infrastructure are expected to support gradual market growth in the coming years.

Market Segmentations:

By Type:

- Total shoulder replacement

- Open tendon repair

By Tear Type:

- Partial thickness tears

- Full thickness tears

By End User:

- Hospitals

- Specialty clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Rotator Cuff Repair Market is characterized by the presence of key players such as Smith & Nephew plc, SironixMedtech, Physiomobility Health Group, Orthocell Limited, Atreon Orthopedics, Regenexx, KARL STORZ, OrthoNY, DePuy Synthes, and Novartis AG. The rotator cuff repair market is driven by continuous innovation in surgical techniques, biologics, and rehabilitation solutions. Companies are investing heavily in research and development to enhance the precision, safety, and recovery outcomes of repair procedures. The market is seeing a growing shift toward minimally invasive arthroscopic technologies, supported by advancements in imaging systems and suture materials. Collaboration between medical device manufacturers, hospitals, and research institutions is strengthening clinical efficacy and accelerating product approvals. Strategic mergers, acquisitions, and global distribution expansions remain key approaches for sustaining competitiveness and addressing the rising global demand for advanced shoulder repair treatments.

Key Player Analysis

- Smith & Nephew plc

- SironixMedtech

- Physiomobility Health Group

- Orthocell Limited

- Atreon Orthopedics

- Regenexx

- KARL STORZ

- OrthoNY

- DePuy Synthes

- Novartis AG

Recent Developments

- In February 2025, Atreon Orthopedics received FDA 510(k) clearance and launched the BioCharge Autobiologic Matrix, a fully resorbable synthetic scaffold for rotator cuff repair. The implant enhances tendon healing, reinforces the suture-tendon interface, and reduces re-tear risk. It is designed for simplified arthroscopic implantation, improving surgical efficiency and patient outcomes.

- In July 2024, Inter Cars extended its strategic collaboration with TotalEnergies Lubrifiants for a further five years. The long-term deal prioritizes delivering high-quality lubricants to the automotive repair and maintenance sector. The partnership, extending the term of the agreement, further enhances Inter Cars service, especially for independent workshops and service centers throughout Europe, with the provision of its original equipment quality lubricants for vehicle maintenance.

- In July 2023, Smith+Nephew introduced its REGENETEN Bioinductive Implant in India, following over 100,000 procedures worldwide. Delivered arthroscopically, the implant has revolutionized rotator cuff procedures. The launch aimed to elevate patient care standards for those affected by rotator cuff disease.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Tear Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth due to increasing shoulder injury cases worldwide.

- Demand for minimally invasive arthroscopic procedures will continue to rise among surgeons.

- Orthobiologics and regenerative therapies will gain wider acceptance in tendon healing.

- Technological advancements in imaging and robotics will enhance surgical precision.

- Outpatient and ambulatory surgical centers will play a larger role in treatment delivery.

- Growing awareness of early diagnosis will drive patient preference for timely intervention.

- Expansion of reimbursement coverage will improve access to advanced surgical options.

- Collaborations between device manufacturers and healthcare providers will strengthen innovation.

- Personalized treatment plans using AI-driven diagnostics will improve clinical outcomes.

- Emerging economies will witness faster adoption due to improved healthcare infrastructure and training.