| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Enhanced Oil Recovery (EOR) Market Size 2023 |

USD 43.96 Million |

| Japan Enhanced Oil Recovery (EOR) Market, CAGR |

4.59% |

| Japan Enhanced Oil Recovery (EOR) Market Size 2032 |

USD 66.02 Million |

Market Overview:

KSA Feminine Hygiene Products size was valued at USD 43.96 million in 2023 and is anticipated to reach USD 66.02 million by 2032, at a CAGR of 4.59% during the forecast period (2023-2032).

The growth of the Saudi Arabian feminine hygiene products market is driven by several key factors. Increasing awareness and education surrounding menstrual health have played a pivotal role in boosting product adoption. Educational campaigns and initiatives by both governmental and non-governmental organizations have emphasized the importance of maintaining menstrual hygiene, reducing societal stigma, and empowering women to make informed choices about their health. Additionally, societal shifts, such as changing norms around menstruation, have contributed to a greater openness in discussing and addressing menstrual hygiene. Urbanization is another major driver, as the modern, fast-paced lifestyle of urban populations demands convenient and effective hygiene solutions. Furthermore, the growing focus on sustainability has led to a surge in demand for eco-friendly and organic products, as consumers seek alternatives that align with their health-conscious and environmentally aware choices.

The feminine hygiene products market in Saudi Arabia shows regional variations in demand, influenced by factors such as urbanization, population density, and economic activity. The Western region, particularly cities like Jeddah and Mecca, experiences high demand due to a larger population and greater urbanization. These regions have more developed retail networks, including supermarkets and pharmacies, which facilitate easy access to feminine hygiene products. Riyadh, the capital, located in the Central region, serves as the primary commercial hub, further driving demand due to its economic activity and concentration of women in higher education and the workforce. Meanwhile, the Eastern and Southern regions also show increasing adoption rates, supported by improving infrastructure and greater availability of products through expanding distribution channels, including online platforms and local retail outlets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Saudi Arabian feminine hygiene products market was valued at USD 43.96 million in 2023 and is expected to reach USD 66.02 million by 2032, growing at a CAGR of 4.59%.

- The global feminine hygiene products market, valued at USD 23,490.00 million in 2023, is projected to reach USD 43,917.35 million by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

- Increased awareness and education around menstrual health are playing a crucial role in boosting the adoption of feminine hygiene products across the country.

- Urbanization and changing lifestyles are driving the demand for convenient and modern hygiene solutions, particularly in cities like Riyadh, Jeddah, and Dammam.

- Cultural shifts and evolving social norms are contributing to greater acceptance of feminine hygiene products, with a reduction in the stigma surrounding menstruation.

- The demand for eco-friendly and organic products is on the rise, as consumers prioritize sustainability and seek biodegradable and reusable alternatives.

- Regional variations in demand exist, with the Western region showing high demand due to urbanization, while rural areas face challenges related to product availability.

- Price sensitivity remains a challenge, with many consumers opting for affordable, conventional products, limiting the market’s potential growth, especially in lower-income groups.

Market Drivers:

Increasing Awareness of Menstrual Health

One of the primary drivers for the growth of the feminine hygiene products market in Saudi Arabia is the rising awareness of menstrual health. Over the years, numerous educational campaigns have been launched by both governmental and non-governmental organizations to emphasize the importance of maintaining proper menstrual hygiene. These campaigns, aimed at reducing the stigma around menstruation, have contributed significantly to encouraging women to adopt healthier menstrual practices. As awareness grows, Saudi women are becoming more conscious of the products they use, driving the demand for safer, more hygienic, and effective feminine hygiene solutions. This awareness has also led to greater acceptance of a wide range of hygiene products, from sanitary pads to menstrual cups, which was once considered a taboo subject in the region.

Urbanization and Changing Lifestyles

Urbanization in Saudi Arabia has played a significant role in the evolution of consumer behavior regarding feminine hygiene products. As more women migrate to urban centers like Riyadh, Jeddah, and Dammam for education and work, they increasingly seek convenience and modern solutions to meet their hygiene needs. This shift in lifestyle has led to a higher demand for feminine hygiene products that cater to the fast-paced and mobile lifestyle of urban women. For instance, major retail outlets like Tamimi Markets, Carrefour, Panda, and Lulu Hypermarket now feature dedicated sections for feminine hygiene, offering a wide range of brands and product types, including sanitary pads, tampons, and menstrual cups. The preference for discreet, easy-to-use, and reliable hygiene products is evident, as women juggle work, family, and social commitments. In line with urbanization, the rise in disposable incomes and higher standards of living has also encouraged women to invest in premium hygiene products, further boosting market growth.

Cultural Shifts and Evolving Social Norms

Cultural shifts in Saudi Arabia have contributed significantly to the growing acceptance of feminine hygiene products. In recent years, there has been a noticeable reduction in the stigma surrounding menstruation and menstrual health. As the country modernizes, conversations about women’s health and hygiene are becoming more open and accepted. This has helped foster an environment where women feel more empowered to make informed choices about the products they use. The acceptance of feminine hygiene products is also a result of changing social norms, where traditional views are giving way to a more progressive understanding of menstrual health and personal well-being. This shift in societal attitudes is helping to normalize the use of such products, especially among younger generations.

Sustainability and Eco-Friendly Products

The growing global trend towards sustainability has significantly impacted the Saudi Arabian feminine hygiene products market. Consumers in the region are increasingly looking for eco-friendly alternatives to traditional hygiene products. With growing concerns about environmental degradation and the impact of plastic waste, many Saudi women are now prioritizing products made from organic, biodegradable, and sustainable materials. This has led to an influx of brands offering eco-conscious options, such as organic cotton sanitary pads, reusable menstrual cups, and biodegradable tampons. For instance, companies are responding with eco-friendly products and packaging; for instance, DivaMe Period Panties are made from organic, biodegradable fabrics and are designed for long-term use, replacing hundreds of disposable products over their lifespan. The increasing availability and demand for these environmentally friendly products reflect a broader shift towards sustainability in consumer behavior, which is further accelerating the growth of the feminine hygiene market in Saudi Arabia.

Market Trends:

Growing Demand for Organic and Eco-Friendly Products

A prominent trend in the Saudi Arabian feminine hygiene market is the rising demand for organic and eco-friendly products. For instance, Saudi brand C., founded by sisters Nora and Joud Alorainy, is one of the first in the Kingdom to offer biodegradable menstrual pads made with organic cotton, free from chlorine bleaching, pesticides, fragrances, polyester, and chemicals. With the growing awareness of environmental issues, consumers are increasingly seeking products that are both effective and sustainable. Organic cotton sanitary pads, biodegradable tampons, and reusable menstrual cups are gaining traction, as they align with the growing preference for eco-conscious alternatives. This shift is not only driven by concerns over the environment but also by the increasing awareness of the potential harmful effects of chemicals in conventional feminine hygiene products. As women become more health-conscious, the demand for products that offer both safety and sustainability continues to grow, signaling a shift toward greener consumer choices in the market.

Expansion of E-commerce and Online Retail

The surge in e-commerce is another defining trend in the Saudi Arabian feminine hygiene products market. Online retail platforms have become a crucial channel for the distribution of feminine hygiene products, making them more accessible to a wider consumer base. The convenience of shopping from home, along with the growing use of mobile payment methods, has fueled the growth of online sales. E-commerce platforms also offer a greater variety of products, allowing consumers to explore and choose from a wide range of options, including niche and eco-friendly products that may not be available in traditional retail outlets. As internet penetration and digital literacy continue to increase, online shopping is expected to play a more significant role in the market, offering greater convenience and a personalized shopping experience.

Product Innovation and Technological Advancements

Innovation in product design and functionality is a notable trend in the KSA feminine hygiene market. Manufacturers are continuously introducing new and improved products to meet the changing needs and preferences of consumers. For instance, PECTIV has introduced nanotechnology-based sanitary pads, liners, and wipes, which are designed to prevent bacterial growth, rashes, irritation, and bad odor common issues with conventional pads. This includes advancements in product features, such as ultra-thin sanitary pads, odor-control tampons, and high-absorbency menstrual cups. Additionally, there is a growing focus on technological advancements, such as the development of smart feminine hygiene products that integrate technology to enhance user experience. These innovations are aimed at providing more comfort, convenience, and better performance, which appeal to the increasingly discerning consumer base. The continuous introduction of new products reflects the market’s responsiveness to consumer demands for more effective and tailored hygiene solutions.

Rising Popularity of Subscription-Based Services

Another emerging trend in the Saudi Arabian feminine hygiene products market is the growing popularity of subscription-based services. These services offer consumers the convenience of receiving regular deliveries of their preferred feminine hygiene products directly to their doorstep. Subscription models are gaining momentum due to their personalized nature, allowing women to select products based on their preferences and needs. This trend is further amplified by the ease of customization, where consumers can adjust the frequency of deliveries or switch to different products based on their changing requirements. As the demand for convenience continues to rise, subscription services are likely to play an increasingly prominent role in the market, offering a seamless and efficient shopping experience for consumers.

Market Challenges Analysis:

Cultural and Social Barriers

Despite the growing acceptance of feminine hygiene products in Saudi Arabia, cultural and social barriers remain significant challenges. Menstruation is still considered a taboo subject in certain segments of society, and many women face discomfort in discussing menstrual health openly. For instance, according to a survey by the Saudi Health Council, around 35% of women in the kingdom report feeling uncomfortable discussing menstruation, even with close family members. This cultural stigma can discourage some women from purchasing feminine hygiene products or trying new, innovative options. Traditional views on femininity and modesty also influence the willingness of consumers to embrace modern hygiene solutions. While societal attitudes are evolving, these deeply rooted cultural barriers continue to limit the market’s potential growth.

Price Sensitivity and Affordability

Price sensitivity is another restraint impacting the Saudi Arabian feminine hygiene market. While the demand for high-quality and eco-friendly products is growing, the relatively higher cost of organic and premium products can be a barrier for price-conscious consumers. Many women in lower-income groups may opt for more affordable, conventional products, which may not offer the same level of sustainability or innovation. This affordability challenge restricts the market from reaching its full potential, particularly in a country where disposable income is unevenly distributed. Manufacturers need to balance product innovation with pricing strategies that cater to a wider range of consumers.

Limited Availability in Rural Areas

Although urban areas such as Riyadh, Jeddah, and Dammam are experiencing strong demand for feminine hygiene products, rural regions face challenges related to product availability. In less populated areas, access to specialized products, including organic and eco-friendly options, can be limited. The lack of sufficient retail infrastructure and limited distribution channels in rural regions restrict the reach of many brands. This gap in accessibility presents a challenge for manufacturers who aim to expand their market presence and ensure that their products are available to women across the country.

Regulatory Barriers and Import Restrictions

Regulatory barriers and import restrictions also pose challenges for the feminine hygiene products market in Saudi Arabia. Stricter regulations governing the importation and approval of products can delay the introduction of new products and limit the availability of international brands. Furthermore, compliance with local standards and certifications can increase the cost of doing business in the region. These regulatory hurdles can discourage some global brands from entering the market, limiting the variety of products available to consumers.

Market Opportunities:

The Saudi Arabian feminine hygiene products market presents significant opportunities driven by evolving consumer preferences and the increasing awareness of menstrual health. As the demand for organic and eco-friendly products rises, manufacturers have an opportunity to capitalize on this trend by offering sustainable alternatives that appeal to environmentally conscious consumers. With growing concerns about the environmental impact of conventional products, such as plastic-based sanitary pads and tampons, there is a clear market opportunity for brands to introduce biodegradable, organic cotton, and reusable options. These products not only align with global sustainability goals but also cater to the region’s emerging preference for health-conscious and eco-friendly choices.

In addition to product innovation, the expansion of digital and e-commerce platforms provides a promising opportunity for market growth. As internet penetration and digital literacy increase in Saudi Arabia, online shopping is becoming a preferred method for purchasing feminine hygiene products. This shift opens avenues for brands to reach a broader consumer base, including those in remote or rural areas, where access to traditional retail outlets may be limited. The growth of subscription-based services, which offer convenience and personalized product delivery, also presents a valuable opportunity for businesses to cater to busy, modern consumers. By leveraging e-commerce and subscription models, companies can enhance their market presence, offering a seamless and accessible shopping experience that meets the evolving needs of Saudi women.

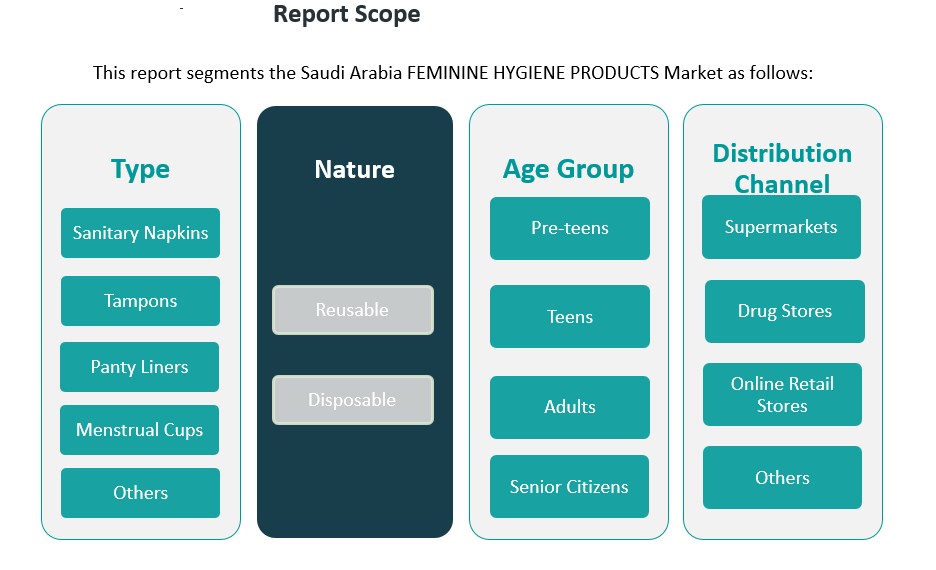

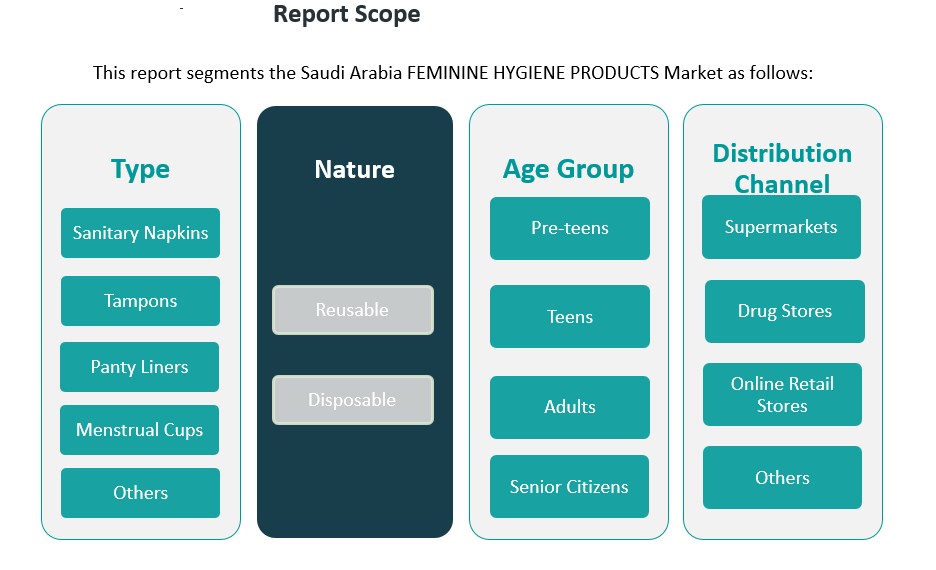

Market Segmentation Analysis:

The Saudi Arabian feminine hygiene products market is segmented across several key categories, each reflecting diverse consumer preferences and purchasing behaviors.

By type, the market is primarily driven by sanitary napkins, which remain the most popular product due to their convenience and wide availability. Tampons and panty liners follow in demand, particularly among women seeking alternatives to traditional pads. Menstrual cups are gaining traction as an eco-friendly and reusable option, driven by growing awareness of environmental concerns. The others segment includes a variety of niche products, such as feminine wipes and intimate washes, catering to specific consumer needs.

By nature, with products falling into reusable and disposable categories. Disposable products, such as sanitary napkins and tampons, dominate the market due to their convenience and ease of use. However, the demand for reusable products, like menstrual cups and cloth pads, is increasing as consumers become more environmentally conscious.

By age group, the market serves a diverse demographic. Pre-teens and teens typically use products like sanitary napkins and panty liners, while adults dominate the consumption of all product types, especially tampons and menstrual cups. Senior citizens are also a significant consumer group, often opting for products that offer additional comfort and protection.

By distribution channels for feminine hygiene products in Saudi Arabia include supermarkets and drug stores, which remain the dominant retail outlets. However, the growing popularity of online retail stores presents an opportunity for increased market reach, particularly as more consumers prefer the convenience of shopping from home.

Segmentation:

By Type

- Sanitary Napkins

- Tampons

- Panty Liners

- Menstrual Cups

- Others

By Nature

By Age-Group

- Pre-teens

- Teens

- Adults

- Senior Citizens

By Distribution Channel

- Supermarkets

- Drug Stores

- Online Retail Stores

- Others

Regional Analysis:

The Saudi Arabian feminine hygiene products market exhibits notable regional variations, influenced by factors such as population density, urbanization, and cultural norms. Understanding these regional dynamics is crucial for businesses aiming to tailor their strategies effectively.

Western Region

The Western region, encompassing major cities like Jeddah and Mecca, holds the largest market share in Saudi Arabia’s feminine hygiene sector. This dominance is attributed to the region’s high population density, increased urbanization, and a more liberal social environment that fosters openness towards personal care products. The presence of significant retail infrastructure and a higher concentration of working women further drive the demand for a diverse range of feminine hygiene products.

Central Region

Riyadh, the capital city located in the Central region, serves as the administrative and economic hub of the country. While it boasts a substantial consumer base, the market share in this region is slightly lower compared to the Western region. This can be attributed to more conservative cultural attitudes that may influence purchasing behaviors. However, ongoing urban development and increasing awareness are gradually expanding the market potential in this area.

Eastern Region

The Eastern region, including cities like Dammam and Khobar, is characterized by its industrial base and a significant expatriate population. This demographic diversity contributes to a growing demand for feminine hygiene products, particularly among the working female population. The market share in this region is on an upward trajectory, driven by economic growth and enhanced access to retail outlets.

Southern Region

The Southern region, encompassing areas such as Abha and Jazan, traditionally exhibits lower market penetration for feminine hygiene products. Factors such as lower population density, limited retail infrastructure, and more conservative cultural norms contribute to this trend. However, there is a gradual shift as awareness campaigns and improved distribution channels begin to reach these areas, indicating potential for future market growth.

Key Player Analysis:

- Johnson & Johnson

- Procter & Gamble

- Kimberly-Clark

- Essity Aktiebolag

- Kao Corporation

- Daio Paper Corporation

- Unicharm Corporation

- Premier FMCG

- Ontex

- Hengan International Group Company Ltd

- Drylock Technologies

- Natracare LLC

- First Quality Enterprises, Inc

- The Honey Pot Company

Competitive Analysis:

The Saudi Arabian feminine hygiene products market is highly competitive, with a mix of local and international brands vying for market share. Leading global brands such as Procter & Gamble, Kimberly-Clark, and Johnson & Johnson dominate the market with well-established product lines, including sanitary napkins, tampons, and panty liners. These companies leverage strong distribution networks, advanced marketing strategies, and product innovation to maintain their market leadership. Additionally, local brands are gaining traction by offering more affordable, culturally tailored products to appeal to the domestic consumer base. The growing demand for eco-friendly and organic products has opened opportunities for new entrants and niche players. Companies offering reusable menstrual cups, organic cotton sanitary pads, and biodegradable tampons are catering to the rising health-conscious and environmentally aware consumers. Online retail platforms also contribute to the market’s competitive landscape, with e-commerce companies like Souq and Noon increasing product accessibility and competition.

Recent Developments:

- In September 2024, Adaye, a UAE-based FemTech startup, launched a new range of certified organic, endocrine-safe, and sustainable menstrual care products across the GCC region. This product line includes organic pads, tampons, and pantyliners, all formulated without harmful chemicals such as dioxins and lead, and packaged in recyclable, plastic-free materials. The launch aims to address the region’s growing need for safer, toxin-free menstrual products, particularly given the high prevalence of conditions like PCOS and uterine fibroids among women in the Gulf.

- In July 2022, PECTIV, a Dubai-based FemTech company, continued to make headlines with its nanotechnology-based feminine hygiene products, including sanitary pads, liners, and wipes. These products are designed to prevent bacterial growth, rashes, and irritation, addressing common issues associated with conventional sanitary pads. PECTIV’s direct-to-doorstep subscription model has gained significant traction, with over 100,000 packs sold and a 200% year-over-year growth rate reported in the first half of 2022.

Market Concentration & Characteristics:

The Saudi Arabian feminine hygiene products market is moderately concentrated, with a blend of dominant global brands and emerging local players. Major multinational companies such as Procter & Gamble, Kimberly-Clark, and Johnson & Johnson hold significant shares of the market. These companies leverage their well-established brand recognition, extensive distribution networks, and product innovation to maintain leadership. Their product portfolios include a wide range of items, such as sanitary pads, tampons, panty liners, and other hygiene solutions, catering to diverse consumer preferences. In addition to global players, local brands are increasingly gaining traction by offering products that are more affordable and tailored to local cultural preferences. These brands often focus on price sensitivity and aligning their products with regional values, which resonates with a substantial portion of the Saudi consumer base. Furthermore, the market is also experiencing the entry of niche players offering eco-friendly and organic alternatives, such as reusable menstrual cups and biodegradable pads. This growing segment appeals to health-conscious and environmentally aware consumers, adding further diversity to the competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Nature, Age-Group and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing awareness of menstrual health will drive higher adoption of feminine hygiene products.

- Demand for organic and eco-friendly products will continue to grow, fueled by consumer preference for sustainable solutions.

- The rise in disposable incomes and higher standards of living will increase the market for premium hygiene products.

- E-commerce will play a pivotal role in expanding product accessibility across the kingdom, particularly in remote areas.

- Innovations in product design, such as ultra-thin pads and menstrual cups, will enhance consumer choices and convenience.

- Local brands will continue to capture market share by offering culturally tailored products at competitive prices.

- Subscription-based services will gain popularity, offering consumers convenience and personalized product delivery.

- Regulatory support for product safety and quality standards will increase consumer confidence in feminine hygiene products.

- Urbanization will drive higher demand, especially in major cities like Riyadh, Jeddah, and Dammam.

- The market will witness further diversification, with more brands introducing specialized products for different age groups and needs.