Market Overview

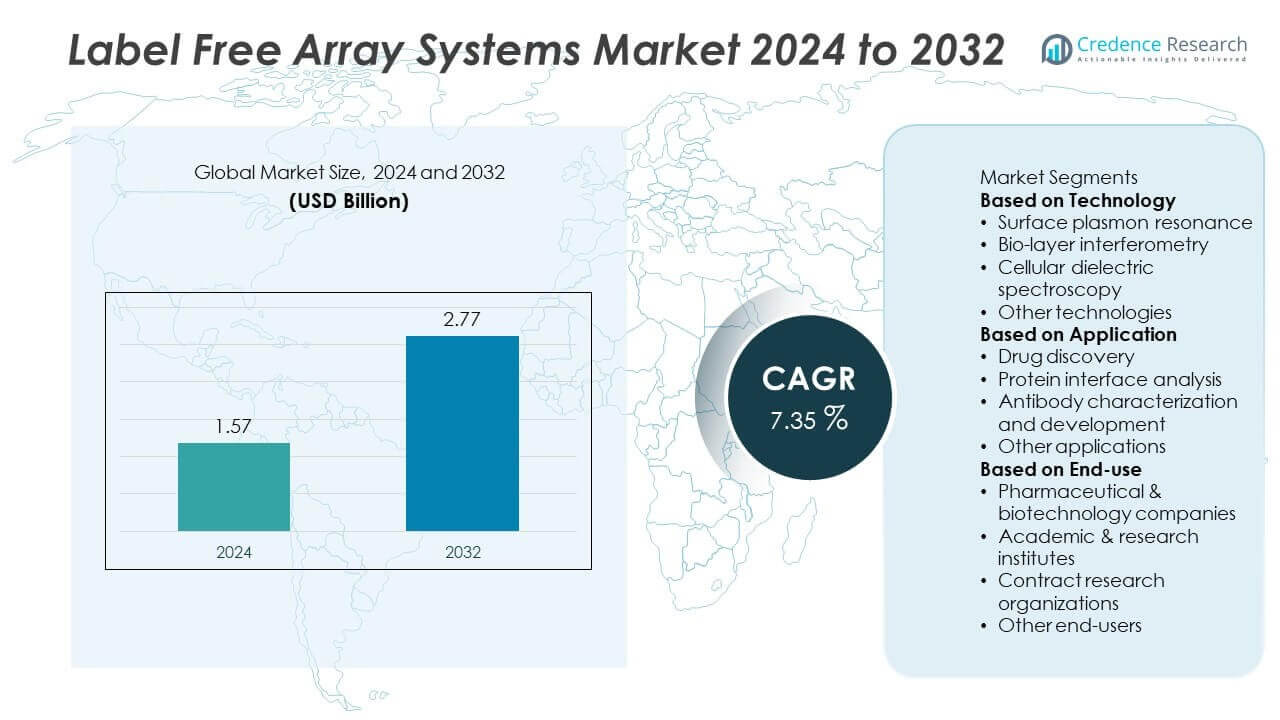

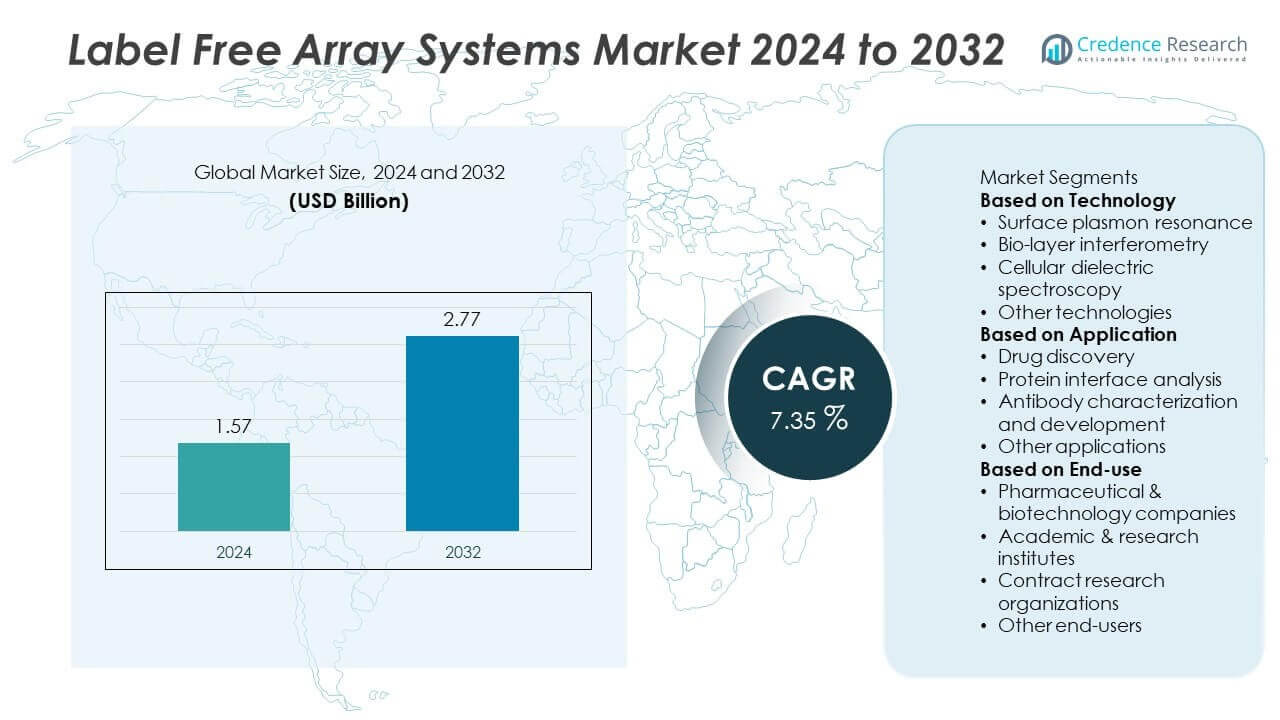

The Label Free Array Systems Market was valued at USD 1.57 billion in 2024 and is projected to reach USD 2.77 billion by 2032, growing at a CAGR of 7.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Label Free Array Systems Market Size 2024 |

USD 1.57 Billion |

| Label Free Array Systems Market, CAGR |

7.35% |

| Label Free Array Systems Market Size 2032 |

USD 2.77 Billion |

The Label Free Array Systems Market grows with rising demand for accurate, real-time analysis in drug discovery, biomarker research, and clinical diagnostics. Pharmaceutical and biotechnology companies adopt these systems to streamline development, reduce costs, and improve assay reliability.

Asia Pacific leads the Label Free Array Systems Market due to rapid growth in pharmaceutical manufacturing, biotechnology investments, and government-backed research programs across China, Japan, and India. North America follows with strong adoption supported by advanced R&D infrastructure, high healthcare spending, and significant use of precision medicine technologies. Europe maintains steady growth, driven by established pharmaceutical hubs in Germany, the UK, and Switzerland, along with academic participation in biomarker and diagnostic research. Latin America and the Middle East & Africa show emerging adoption as universities and clinical research centers upgrade their analytical capabilities. Multinational companies such as Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, and F. Hoffmann-La Roche AG focus on expanding product portfolios, enhancing biosensor performance, and partnering with research institutions. These players also invest in automation, clinical validation, and global collaborations to strengthen market reach and support the increasing demand for advanced label-free systems across both developed and developing regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Label Free Array Systems Market was valued at USD 1.57 billion in 2024 and is projected to reach USD 2.77 billion by 2032, growing at a CAGR of 7.35%.

- Growing demand for real-time, label-free analysis in drug discovery, biomarker research, and clinical diagnostics fuels adoption across industries.

- Advancements in biosensors, microfluidics, and automation drive innovation, enhancing sensitivity, throughput, and workflow integration for diverse applications.

- Leading players such as Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, and F. Hoffmann-La Roche AG compete by investing in product innovation, collaborations, and clinical validation.

- High system costs, technical complexity, and limited accessibility for smaller laboratories act as key restraints, slowing adoption in resource-limited settings.

- North America dominates due to strong pharmaceutical R&D and funding, while Europe benefits from advanced healthcare infrastructure and precision medicine initiatives.

- Asia Pacific shows rapid growth driven by pharmaceutical expansion, government support, and CRO activity, while Latin America and the Middle East & Africa present emerging opportunities in clinical and translational research.

Market Drivers

Growing Need for Efficient Drug Discovery and Development

Pharmaceutical and biotechnology companies increasingly rely on label-free technologies to accelerate drug discovery. These systems enable real-time monitoring of molecular interactions without fluorescent or radioactive labeling. The Label Free Array Systems Market benefits from faster data generation and higher accuracy in identifying drug candidates. Researchers save time and reduce costs while maintaining biological relevance in assays. It supports decision-making in lead optimization and safety screening. The growing pipeline of biologics and precision medicine drives continued adoption across R&D laboratories.

- For instance, Agilent Technologies’ xCELLigence Real-Time Cell Analysis (RTCA) system uses label-free, impedance-based monitoring to continuously track cell health, behavior, and function. The specific model, the xCELLigence RTCA SP, monitors one 96-well electronic microplate simultaneously for real-time drug response assays.

Rising Demand for Biomarker Discovery and Clinical Diagnostics

Healthcare research emphasizes biomarker discovery for disease detection and personalized therapies. Label-free array systems provide detailed kinetic data that improves the accuracy of biomarker identification. The Label Free Array Systems Market expands as hospitals, diagnostic firms, and research institutes integrate these tools into their workflows. These systems aid in developing early-stage diagnostic assays and validating biomarkers for oncology, neurology, and infectious diseases. Their ability to detect low-abundance analytes enhances their role in clinical research. It positions label-free technology as a critical tool in advancing precision healthcare.

- For instance, Meso Scale Diagnostics’ S-PLEX platform achieves detection of key biomarkers at lower limits down to 1,700 femtograms per milliliter (e.g., for neurofilament light), with a dynamic measurement range extending up to 1,400,000 fg/mL for single-analyte assays.

Advancements in Technology and System Integration

Continuous improvements in biosensors, microfluidics, and detection platforms enhance the performance of label-free systems. Integration with automated platforms improves throughput and scalability in both pharmaceutical and academic research. The Label Free Array Systems Market benefits from these innovations that increase sensitivity, reduce sample requirements, and simplify workflows. Adoption grows among organizations seeking versatile systems that deliver reproducible results across diverse applications. It reinforces market growth by aligning with industry needs for efficiency and adaptability. Emerging hybrid systems combine label-free detection with complementary technologies to extend functionality.

Growing Investment in Life Science Research Across Regions

Government initiatives and private funding support expansion of research infrastructure worldwide. Grants and collaborations strengthen the use of advanced analytical technologies in universities, clinical labs, and biotechnology hubs. The Label Free Array Systems Market gains from rising demand in emerging economies upgrading their life science capabilities. Increased investment supports procurement of high-end analytical systems for collaborative research projects. It promotes technology adoption in Asia Pacific and Latin America, where pharmaceutical outsourcing and contract research activities grow rapidly. This global spread of research funding broadens the customer base for label-free array systems.

Market Trends

Increasing Adoption in Biopharmaceutical Quality Control

Biopharmaceutical companies adopt label-free array systems to monitor product quality and ensure regulatory compliance. These systems provide real-time data on molecular stability, binding kinetics, and product consistency. The Label Free Array Systems Market benefits from this trend as firms require tools that reduce false positives and ensure reliable testing. Integration into quality control workflows improves efficiency in biologics manufacturing. It supports growth in regulatory-driven environments where precision and reliability are critical. The shift toward complex therapies strengthens demand for advanced analytical technologies.

- For instance, Sartorius acquired the Octet platform as part of a deal with Danaher in 2020. The Sartorius Octet HTX and RH96 systems enable quantitation of 96 samples in as little as 2 minutes using their 96-biosensor mode. This technology also completes full-plate kinetic screening in minutes rather than hours, dramatically speeding up QC workflows.

Integration with Artificial Intelligence and Data Analytics Platforms

Advanced data analysis tools enhance the capability of label-free systems by providing deeper insights. AI and machine learning algorithms process large datasets generated by these systems for predictive modeling. The Label Free Array Systems Market evolves with this integration, offering users more accurate results in shorter timelines. It also improves biomarker discovery and drug screening outcomes. This trend increases adoption in both pharmaceutical research and clinical diagnostics. Cross-industry collaboration with digital health companies accelerates the development of smarter platforms.

- For instance, Danaher Corporation is actively integrating AI across its life sciences platforms to bridge computational predictions and experimental validation. The company has confirmed its strategic investment in AI and its application in modern drug discovery. Its “wet lab integration flywheel” uses computational models to inform experimental design and feeds the results back to the AI to refine its predictions.

Shift Toward High-Throughput Screening in Research Applications

Pharmaceutical firms and academic labs emphasize high-throughput screening to meet project timelines. Label-free array systems now feature multi-sample platforms that handle larger workloads efficiently. The Label Free Array Systems Market benefits from the demand for instruments that balance throughput with accuracy. It allows researchers to conduct multiple assays simultaneously without compromising sensitivity. This trend supports drug discovery pipelines and large-scale biomarker projects. Growth in automated laboratories accelerates adoption of these high-capacity systems worldwide.

Expansion into Clinical and Translational Research

Clinical research institutions increasingly integrate label-free technologies into translational medicine programs. These systems aid in identifying disease pathways, validating therapeutic targets, and developing diagnostic assays. The Label Free Array Systems Market expands with applications that bridge laboratory research and patient care. It supports the shift toward precision medicine by enabling real-time detection of complex biological interactions. Hospitals and diagnostic centers adopt these systems for oncology and infectious disease studies. Growing clinical collaborations with pharmaceutical firms further strengthen this trend.

Market Challenges Analysis

High System Costs and Limited Accessibility for Small Laboratories

Label-free array systems require significant upfront investment in equipment, training, and maintenance. Smaller academic institutions, diagnostic labs, and start-ups often struggle to allocate budgets for these advanced technologies. The Label Free Array Systems Market faces slower adoption in resource-limited settings due to affordability constraints. High operating costs, including consumables and specialized software, further limit accessibility. It creates a gap between large pharmaceutical companies with strong funding and smaller organizations with limited resources. This challenge reduces the overall pace of adoption in developing markets.

Technical Complexity and Lack of Skilled Workforce

Operation of label-free systems demands expertise in biosensing technologies, assay development, and data interpretation. The steep learning curve for users delays efficient integration into standard laboratory workflows. The Label Free Array Systems Market experiences barriers where trained personnel are scarce, particularly in emerging economies. Misinterpretation of data or system errors can reduce trust in technology performance. It requires ongoing investments in training programs and collaborations to build technical capacity. Without adequate expertise, end users hesitate to adopt label-free systems for critical research and diagnostic applications.

Market Opportunities

Expanding Role in Precision Medicine and Personalized Healthcare

The growing shift toward precision medicine creates significant opportunities for label-free technologies. These systems enable real-time analysis of biomolecular interactions, supporting development of targeted therapies and individualized treatment plans. The Label Free Array Systems Market benefits from the demand for tools that improve patient-specific diagnostics and therapeutic monitoring. Pharmaceutical firms and clinical researchers can use these platforms to accelerate biomarker validation and companion diagnostic development. It positions label-free systems as essential technologies in oncology, immunology, and chronic disease management. Rising investment in patient-focused healthcare strengthens this opportunity across global markets.

Emerging Demand from Academic Research and Contract Research Organizations

Academic institutions and contract research organizations increasingly seek advanced tools for high-quality, reproducible results. Label-free array systems provide versatile platforms for drug discovery, biomarker exploration, and translational research. The Label Free Array Systems Market is expected to grow with rising collaborations between academia and industry for innovation. Expanding research grants and government funding encourage adoption in universities and research centers. It creates a strong base of trained users, widening application areas beyond pharmaceuticals. Growing outsourcing to CROs in developing regions further accelerates market penetration, offering companies new growth channels worldwide.

Market Segmentation Analysis:

By Technology:

The Label Free Array Systems Market is segmented by technology into surface plasmon resonance (SPR), bio-layer interferometry (BLI), and others such as microcantilever and resonant waveguide grating. SPR dominates due to its high sensitivity and ability to monitor real-time molecular interactions without labeling. BLI is gaining traction for its cost efficiency, ease of use, and suitability for high-throughput applications. These technologies are widely adopted in drug discovery, antibody screening, and biomolecular analysis. It continues to expand with innovations that improve speed, automation, and reproducibility. Hybrid platforms combining multiple detection techniques create added value for advanced research.

- For instance, Cytiva’s Biacore T200 SPR system enables real-time binding analysis with high sensitivity for a range of biomolecules, detecting low-concentration analytes down to 1 picomolar. It can process up to 384 samples in unattended runs and is used for detailed kinetic and affinity studies in drug discovery workflows.

By Application:

Key applications include drug discovery, biomarker research, clinical diagnostics, and others such as quality control in biologics. Drug discovery represents the largest application area due to the demand for fast, reliable systems in screening and lead optimization. The Label Free Array Systems Market benefits from growing biomarker research in oncology, neurology, and infectious diseases. Clinical diagnostics adoption increases as healthcare providers integrate label-free technologies for precision medicine and early disease detection. Quality control applications in biopharmaceutical production strengthen market utility, as manufacturers need reliable methods for stability testing and validation. It broadens scope across preclinical, clinical, and manufacturing stages.

- For instance, Sartorius’ Octet HTX BLI system can screen 96 wells in parallel and generate over 14,000 binding data points per day, supporting applications from high-throughput antibody discovery to biologics quality control.

By End-use:

End-users include pharmaceutical and biotechnology companies, academic research institutes, and contract research organizations (CROs). Pharmaceutical and biotech firms hold the largest share due to extensive use of label-free systems in drug pipelines and therapeutic development. The Label Free Array Systems Market also grows within academic research centers, where government funding and collaborations drive adoption. CROs represent a rising segment, offering outsourced services to accelerate drug discovery and biomarker projects for global clients. Hospitals and diagnostic labs are emerging end-users as systems become integral to translational and clinical research. It strengthens adoption across both developed and emerging markets through wider applications and funding support.

Segments:

Based on Technology

- Surface plasmon resonance

- Bio-layer interferometry

- Cellular dielectric spectroscopy

- Other technologies

Based on Application

- Drug discovery

- Protein interface analysis

- Antibody characterization and development

- Other applications

Based on End-use

- Pharmaceutical & biotechnology companies

- Academic & research institutes

- Contract research organizations

- Other end-users

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for about 36% of the Label Free Array Systems Market in 2024. The region leads due to strong pharmaceutical and biotechnology industries, advanced research infrastructure, and significant government funding for drug discovery. The United States dominates demand with widespread adoption of label-free technologies in both commercial R&D and academic institutions. Pharmaceutical companies integrate these systems into pipelines for biomarker discovery, lead optimization, and biologics research. Canada contributes through growth in life sciences hubs and increasing investment in translational medicine. The region also benefits from strong collaborations between universities, research organizations, and industry players. It maintains leadership as high R&D spending and strong intellectual property frameworks support continuous adoption.

Europe

Europe held around 28% of the Label Free Array Systems Market share in 2024. The region benefits from well-established pharmaceutical clusters in Germany, the UK, France, and Switzerland. Academic institutions and government-funded research initiatives encourage adoption of label-free technologies for drug development and diagnostics. Countries in Western Europe focus heavily on precision medicine and personalized healthcare, which creates a strong demand for biomarker research platforms. Eastern Europe, though smaller in scale, contributes through growing academic participation and outsourcing opportunities. The region also benefits from supportive regulatory frameworks that promote innovation and collaboration. It continues to grow as clinical and diagnostic applications expand across healthcare systems.

Asia Pacific

Asia Pacific represented nearly 25% of the Label Free Array Systems Market in 2024. The region shows rapid growth driven by expanding pharmaceutical manufacturing, rising investments in biotechnology, and increasing government support for R&D. China and Japan lead adoption with advanced research facilities and strong biopharmaceutical pipelines. India contributes through growth in contract research organizations and academic projects supported by government funding. South Korea and Australia also invest heavily in precision medicine initiatives, further boosting regional demand. Academic-industry collaborations are expanding, creating a fertile ground for label-free technologies in both research and diagnostics. It benefits from the growing presence of multinational players and rising healthcare expenditure across the region.

Latin America

Latin America accounted for nearly 6% of the global Label Free Array Systems Market in 2024. Brazil and Mexico lead the region, driven by investments in biotechnology, healthcare modernization, and diagnostic research. Universities and public research centers increasingly adopt advanced analytical tools to support translational medicine. The region faces challenges of limited funding and high system costs, but government support for innovation improves accessibility. Collaborations with international pharmaceutical companies also create opportunities for adoption in clinical trials and biomarker studies. It gains steady traction through growing demand for diagnostic research and expansion of healthcare infrastructure.

Middle East and Africa

The Middle East and Africa held about 5% of the Label Free Array Systems Market in 2024. Countries such as the UAE, Saudi Arabia, and South Africa lead regional adoption through investment in research infrastructure and healthcare modernization. The region is at an early stage but shows growing interest in precision medicine and advanced diagnostics. Academic and healthcare institutions are beginning to integrate label-free technologies into their research workflows. Government initiatives aimed at developing biotechnology clusters further support market penetration. It presents emerging opportunities as international collaborations and healthcare investments continue to expand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Illumina, Inc.

- Meso Scale Diagnostics (MSD)

- Agilent Technologies, Inc.

- Merck KGaA

- Corning Incorporated

- Nanion Technologies

- Danaher Corporation

- Hoffmann-La Roche AG

- Bio-Rad Laboratories, Inc.

- Becton, Dickinson and Company

Competitive Analysis

Competitive landscape of the Label Free Array Systems Market includes key players such as Agilent Technologies, Inc., Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Corning Incorporated, Danaher Corporation, F. Hoffmann-La Roche AG, Illumina, Inc., Merck KGaA, Meso Scale Diagnostics (MSD), and Nanion Technologies. These companies compete through advanced biosensor technologies, high-throughput platforms, and integrated automation solutions tailored for pharmaceutical, biotechnology, and clinical applications. Market leaders focus on enhancing assay sensitivity, reducing sample requirements, and enabling real-time molecular interaction analysis. Strategic initiatives include expanding R&D partnerships, securing regulatory approvals, and launching products that align with precision medicine and biomarker discovery trends. Many players also strengthen their position by offering customized solutions for drug discovery, clinical diagnostics, and translational research. Investment in automation and data analytics integration is a key competitive strategy to increase adoption across academic and industrial users. With increasing demand from CROs, universities, and hospitals, these players leverage global distribution networks, service support, and collaborations to expand their reach, ensuring sustained growth in an evolving life science research environment.

Recent Developments

- In October 2024, Illumina, Inc. introduced the MiSeq i100 and i100 Plus benchtop sequencers priced at $49,000 and $109,000, offering results in four hours, designed for accessibility in smaller research labs.

- In June 2024, MSD expanded its label-free platform by incorporating advanced electrochemical impedance spectroscopy for biomarker quantification without fluorescent labels, streamlining cell-surface interaction studies.

- In January 2023, Charles River Laboratories acquired SAMDI Tech to enhance its drug discovery services using mass spectrometry-based, label-free screening methods.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for real-time molecular interaction analysis will increase in drug discovery and diagnostics.

- Precision medicine initiatives will drive adoption of label-free systems in oncology and chronic disease research.

- Integration with AI and data analytics will enhance assay accuracy and predictive modeling.

- High-throughput platforms will gain traction in pharmaceutical and academic research laboratories.

- Clinical applications will expand as hospitals adopt label-free systems for translational research.

- Collaborations between CROs and pharmaceutical companies will strengthen market growth.

- Emerging economies will adopt more systems with government support for research infrastructure.

- Hybrid technologies combining label-free detection with complementary methods will improve versatility.

- Key players will invest in automation and miniaturization to increase accessibility.

- Growing focus on biomarker validation will position label-free systems as essential tools in healthcare.