Market Overview:

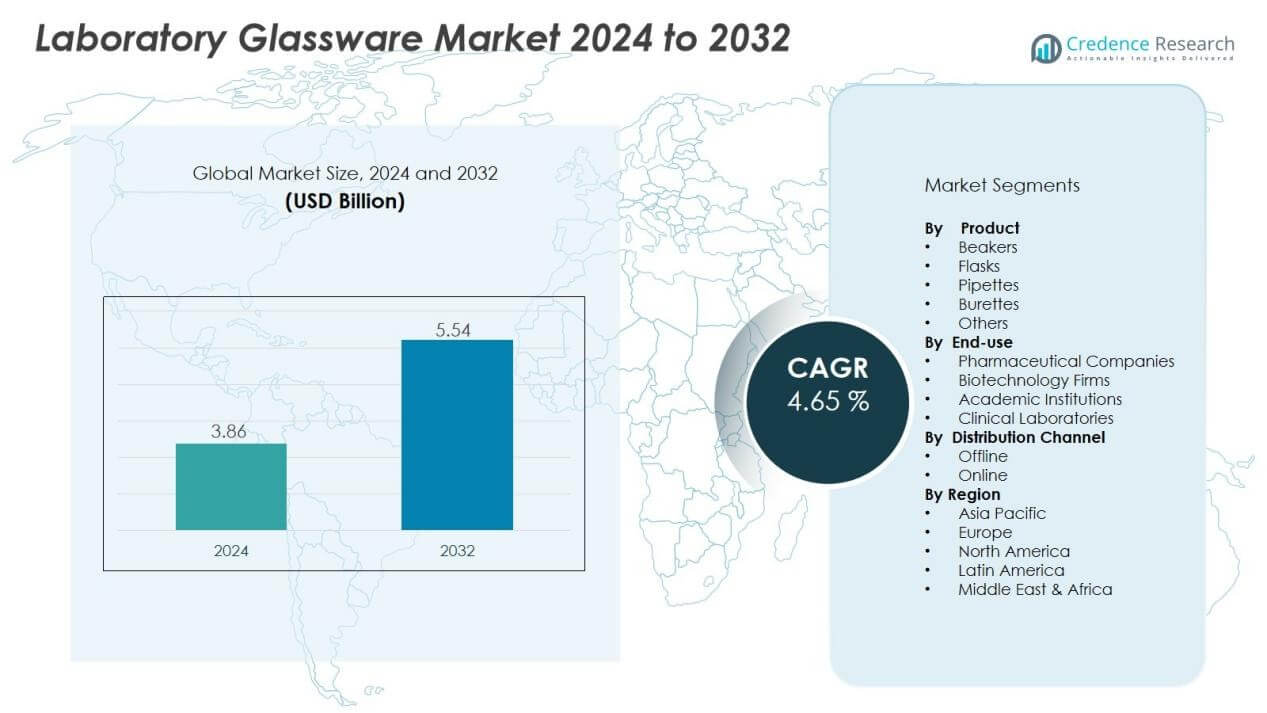

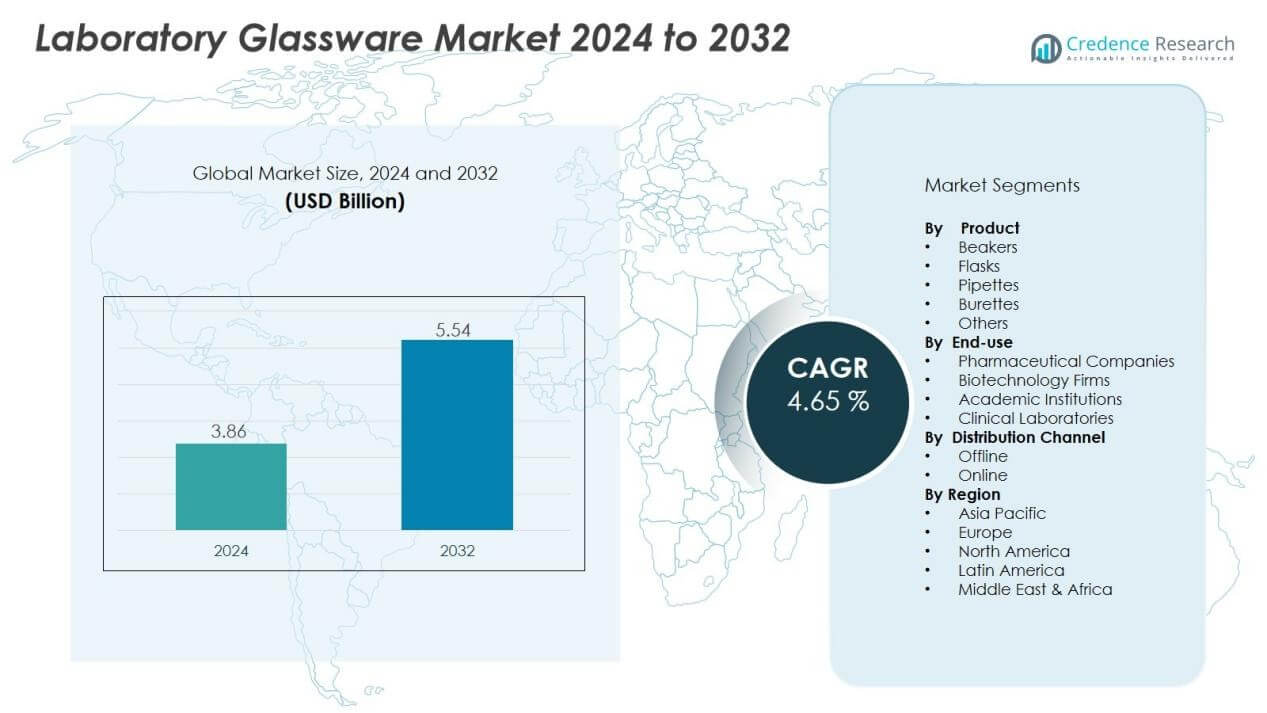

The laboratory glassware market size was valued at USD 3.86 billion in 2024 and is anticipated to reach USD 5.54 billion by 2032, at a CAGR of 4.65% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Laboratory Glassware Market Size 2024 |

USD 3.86 Billion |

| Laboratory Glassware Market, CAGR |

4.65% |

| Laboratory Glassware Market Size 2032 |

USD 5.54 Billion |

Growth in this market is mainly fueled by increasing investments in R&D, rising demand for advanced healthcare infrastructure, and expansion of pharmaceutical drug discovery. The growing use of customized and reusable glassware, coupled with stricter quality standards in laboratory operations, strengthens adoption across industries. Furthermore, the shift toward eco-friendly and sustainable materials supports demand, as laboratories seek alternatives to single-use plastics. The strong role of education and research institutions further contributes to consistent market expansion.

Regionally, North America leads the laboratory glassware market due to robust healthcare and research infrastructure, supported by significant funding for scientific studies. Europe follows closely, driven by strict regulatory standards and strong university research networks. Asia-Pacific is emerging rapidly, propelled by increased investments in healthcare, pharmaceuticals, and academic research, particularly in countries like China and India. Latin America and the Middle East & Africa show gradual growth, supported by expanding healthcare and research capabilities.

Market Insights:

- The laboratory glassware market was valued at USD 3.86 billion in 2024 and is expected to reach USD 5.54 billion by 2032, growing at a CAGR of 4.65%.

- Rising demand from pharmaceutical and biotechnology industries is driving adoption, with glassware essential for drug discovery, vaccine development, and diagnostic advancements.

- Academic and research institutions continue to play a major role in consumption, using glassware extensively for experiments, demonstrations, and scientific training.

- Stricter quality standards and regulatory compliance requirements fuel replacement demand, as laboratories seek glassware with superior durability and chemical resistance.

- Sustainability trends are creating opportunities, with laboratories shifting from plastics toward eco-friendly, reusable, and long-lasting glassware solutions.

- Challenges include fragility, higher maintenance costs, competition from alternative materials like plastics, and rising raw material prices impacting profitability.

- Regionally, North America leads with 38% market share, Europe follows with 29% supported by strong regulations, and Asia-Pacific holds 24% with rapid growth in healthcare and education sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Pharmaceutical and Biotechnology Research:

The laboratory glassware market benefits from the continuous growth of pharmaceutical and biotechnology research. Drug discovery, vaccine development, and diagnostic advancements require precise and durable glassware for experimentation. It plays a critical role in ensuring accuracy during chemical reactions and biological testing. The sector’s rising R&D budgets directly increase glassware consumption across global laboratories.

- For Instance, Pfizer utilized billions of Type I borosilicate glass vials to support the unprecedented initial scale-up and global distribution of its COVID-19 mRNA vaccine, COMIRNATY, starting in 2020 and 2021.

Expanding Role of Academic and Research Institutions in Scientific Studies:

Academic and research institutions significantly drive the laboratory glassware market by using glassware for experiments, demonstrations, and applied research. Universities and colleges remain key consumers, supporting consistent demand across regions. It provides essential tools for practical learning in chemistry, biology, and physics. Growth in global higher education and research funding further strengthens this segment’s contribution.

- For instance, Benguet State University in the Philippines allocated ₱885,190 for laboratory glassware procurement in 2024, ensuring delivery of hundreds of glassware items within fifteen calendar days for student and faculty research projects.

Increasing Focus on Quality Standards and Regulatory Compliance in Laboratories:

The laboratory glassware market is influenced by rising quality standards and strict regulatory requirements in clinical and industrial labs. High precision in experiments demands glassware with superior chemical resistance and clarity. It supports compliance with safety protocols, ensuring reliability in research outcomes. This factor motivates laboratories to upgrade equipment regularly, creating steady replacement demand.

Shift Toward Eco-Friendly, Reusable, and Durable Laboratory Solutions:

Sustainability trends are reshaping the laboratory glassware market, encouraging the use of eco-friendly and reusable products. Laboratories are shifting away from plastics to reduce waste and align with environmental goals. It offers long-term durability, lowering operational costs while supporting green initiatives. Manufacturers are innovating with advanced glass formulations to meet both performance and sustainability needs.

Market Trends:

Adoption of Advanced Materials and Technology Integration in Laboratory Glassware:

The laboratory glassware market is witnessing a strong trend toward advanced materials and technology integration. Manufacturers are introducing glassware with higher chemical resistance, improved heat tolerance, and better durability to meet modern laboratory requirements. It is increasingly being paired with digital tools such as smart sensors and automated systems, enabling accurate measurements and reducing human error. Research laboratories prefer glassware with enhanced coatings that resist scratches and contamination. The trend also reflects rising demand for specialized glassware in high-end pharmaceutical and biotechnology applications. This shift highlights how innovation in material science is driving long-term adoption across industries.

- For instance, in July 2023, DWK Life Sciences launched its DURAN® YOUTILITY laboratory bottle series with enhanced chemical-resistant borosilicate 3.3 glass, which withstands thermal shocks up to 160°C and features RFID-enabled digital tracking for inventory management.

Growing Emphasis on Sustainability, Customization, and Global Research Expansion:

The laboratory glassware market is also shaped by sustainability and customization trends. Laboratories are prioritizing reusable and recyclable glassware to align with environmental goals and reduce reliance on plastics. It is also moving toward customized designs that fit specific experimental requirements, enhancing efficiency in both academic and industrial research. Global expansion of healthcare, biotech, and academic institutions, particularly in emerging economies, is creating fresh opportunities for glassware suppliers. Manufacturers are responding by offering flexible production capabilities and region-specific product designs. This reflects a broader trend where sustainability, tailored solutions, and global research growth intersect to influence future market dynamics.

- For instance, Corning Incorporated achieved an 87% landfill diversion rate by diverting 403,330 metric tons of waste in 2024, while also being named ENERGY STAR Partner of the Year for the 11th consecutive year by the U.S. Environmental Protection Agency.

Market Challenges Analysis:

High Fragility, Maintenance Costs, and Competition from Alternative Materials:

The laboratory glassware market faces significant challenges due to the fragile nature of glass products. Breakage during handling, transportation, and regular use increases replacement costs for laboratories. It limits adoption in facilities seeking cost-efficient and durable alternatives. Plastics and composite materials, which offer lower cost and higher resistance to damage, present strong competition. Rising expenses for cleaning and sterilization also add to overall maintenance costs. These factors collectively restrict market growth and force manufacturers to innovate more durable solutions.

Regulatory Barriers, Supply Chain Issues, and Rising Raw Material Costs:

The laboratory glassware market is also challenged by strict regulatory standards and fluctuating raw material prices. Compliance with safety and quality regulations requires continuous investment in manufacturing processes. It faces added strain from supply chain disruptions that delay delivery schedules and increase procurement costs. Rising prices of raw materials such as silica and borosilicate glass affect profit margins for producers. Smaller manufacturers struggle to remain competitive under these pressures, leading to market consolidation. Global instability in trade policies further compounds these challenges, limiting smooth operations for suppliers.

Market Opportunities:

Rising Investments in Research, Healthcare, and Biotechnology Sectors:

The laboratory glassware market holds strong opportunities through rising global investments in research and healthcare. Governments and private organizations are expanding budgets for pharmaceutical development, academic research, and biotechnology. It benefits directly from this surge, as laboratories require high-precision glassware for advanced testing and analysis. The growing demand for vaccines, diagnostics, and drug discovery strengthens the need for durable and accurate equipment. Expansion of clinical research organizations also contributes to higher adoption. This creates a steady pipeline of demand across multiple industries.

Innovation in Sustainable Designs and Emerging Market Expansion:

The laboratory glassware market also gains opportunities from sustainable designs and emerging economies. Manufacturers focusing on eco-friendly, reusable, and customized glassware can meet rising demand from laboratories with strict environmental goals. It benefits from growing adoption of specialized glassware in Asia-Pacific, Latin America, and the Middle East, where healthcare and education sectors are rapidly expanding. Customization in product design allows suppliers to target niche requirements across industries. Growth of smart laboratory solutions further opens avenues for integrating glassware with digital tools. These opportunities highlight the importance of innovation and regional expansion for long-term success.

Market Segmentation Analysis:

By Product:

The laboratory glassware market by product is divided into beakers, flasks, pipettes, burettes, and others. Beakers and flasks dominate due to their wide usage in chemical, pharmaceutical, and academic research. It supports critical tasks such as mixing, heating, and storage of samples. Pipettes and burettes maintain steady demand from laboratories requiring accurate measurement and titration processes. Specialty glassware is also gaining importance in biotechnology and advanced pharmaceutical research.

- For instance, Sartorius AG launched the Picus 2 electronic pipette in September 2023, which features a digital readout for precise liquid handling and a multichannel capability—processing up to 12 samples simultaneously, improving workflow efficiency for research labs.

By End-use:

The laboratory glassware market by end-use covers pharmaceutical companies, biotechnology firms, academic institutions, and clinical laboratories. Pharmaceutical and biotechnology firms lead demand due to extensive drug discovery and testing requirements. It plays a key role in supporting research accuracy and safety standards. Academic institutions remain important consumers, ensuring consistent demand for teaching and experimental activities. Clinical laboratories are expanding usage due to rising diagnostic applications and healthcare advancements.

- For instance, Nalgene polypropylene labware can be autoclaved for 20 minutes at 121 °C without compromising performance. 20.

By Distribution Channel:

The laboratory glassware market by distribution channel is segmented into offline and online sales. Offline distribution through specialty stores and authorized dealers continues to dominate, ensuring quality assurance and reliability. It is complemented by online platforms, which are growing due to convenience and wider product availability. Laboratories prefer digital channels for bulk procurement and competitive pricing. Global suppliers are strengthening both offline and online networks to expand reach.

Segmentations:

By Product:

- Beakers

- Flasks

- Pipettes

- Burettes

- Others

By End-use:

- Pharmaceutical Companies

- Biotechnology Firms

- Academic Institutions

- Clinical Laboratories

By Distribution Channel:

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America held 38% market share of the laboratory glassware market in 2024, supported by strong research infrastructure. The region benefits from advanced healthcare facilities, pharmaceutical giants, and extensive biotechnology investments. It witnesses consistent demand from universities, clinical laboratories, and R&D centers that require high-quality glassware for testing and experiments. Government funding and private sector research programs sustain steady adoption across applications. Manufacturers in the region focus on premium, durable glassware that meets strict regulatory standards. Strong supply chains and innovative product development further secure North America’s leadership in this sector.

Europe:

Europe accounted for 29% market share of the laboratory glassware market in 2024, driven by strict regulatory frameworks. The region emphasizes compliance with quality and safety standards in pharmaceutical and clinical laboratories, creating sustained demand for glassware. It is further supported by strong academic networks and leading universities conducting advanced research in life sciences. Germany, France, and the U.K. remain the key contributors to regional growth. Glassware manufacturers in Europe focus on sustainable and eco-friendly designs to align with environmental targets. The presence of established laboratory suppliers strengthens regional competitiveness.

Asia-Pacific :

Asia-Pacific held 24% market share of the laboratory glassware market in 2024, reflecting rapid expansion in healthcare and education. Rising government investments in medical research and the growing number of universities drive consumption. It benefits from the expansion of pharmaceutical and biotechnology industries in China, India, and Japan. Increasing awareness of quality standards motivates laboratories to shift from low-cost plastics to durable glassware. Local manufacturers are scaling up production to meet rising demand while global suppliers expand operations in the region. Asia-Pacific’s large population and growing research capacity position it as a key growth hub.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Astraglass Innovations

- Borosil Limited

- Bellco Glass

- Corning Incorporated

- DWK Life Sciences

- Crystalgen, Inc.

- Eppendorf AG

- Hamilton Glass

- Gerresheimer AG

- Merck KGaA

- METTLER TOLEDO

Competitive Analysis:

The laboratory glassware market is characterized by strong competition among global and regional players. Key participants include Astraglass Innovations, Borosil Limited, Bellco Glass, Corning Incorporated, DWK Life Sciences, Crystalgen, Inc., and Eppendorf AG. These companies focus on product innovation, durability, and precision to meet evolving laboratory requirements. It is shaped by manufacturers investing in advanced materials and coatings to enhance performance and longevity. Partnerships with research institutions and healthcare organizations strengthen market positioning and expand product reach. Companies also emphasize sustainable designs and reusable solutions to align with rising environmental standards. Competitive strategies include global expansion, digital sales growth, and portfolio diversification to serve pharmaceutical, biotechnology, and academic institutions effectively.

Recent Developments:

- In December 2023, Astraglass Innovations was launched following the merger of Andrews Glass and Quark Glass, establishing a new brand identity focused on innovation in scientific glassware.

- In December 2023, Borosil Limited completed a composite Scheme of Arrangement, demerging its Scientific and Industrial Products business into Borosil Scientific Limited, which subsequently became a publicly listed entity.

- In April 2025, Borosil Limited incorporated Stylenest India Limited as a wholly-owned subsidiary, targeting growth in the consumer products market.

Report Coverage:

The research report offers an in-depth analysis based on Product, End-use, Distribution Channel and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The laboratory glassware market will experience steady demand from pharmaceutical, biotechnology, and clinical research sectors.

- It will benefit from rising investments in healthcare infrastructure and global drug discovery initiatives.

- Sustainability goals will drive laboratories to adopt reusable and eco-friendly glassware products.

- Manufacturers will focus on innovative coatings and advanced formulations to enhance durability and precision.

- It will see increased integration with digital systems and smart laboratory solutions for improved efficiency.

- Academic and research institutions will remain consistent consumers, supporting long-term market stability.

- Growth in Asia-Pacific and Latin America will expand supplier opportunities in emerging economies.

- Regulatory standards will push laboratories to upgrade equipment, ensuring compliance and quality control.

- It will face ongoing competition from alternative materials, but high precision will sustain demand for glassware.

- Collaborations between manufacturers and research organizations will accelerate product development and adoption worldwide.