Market Overview

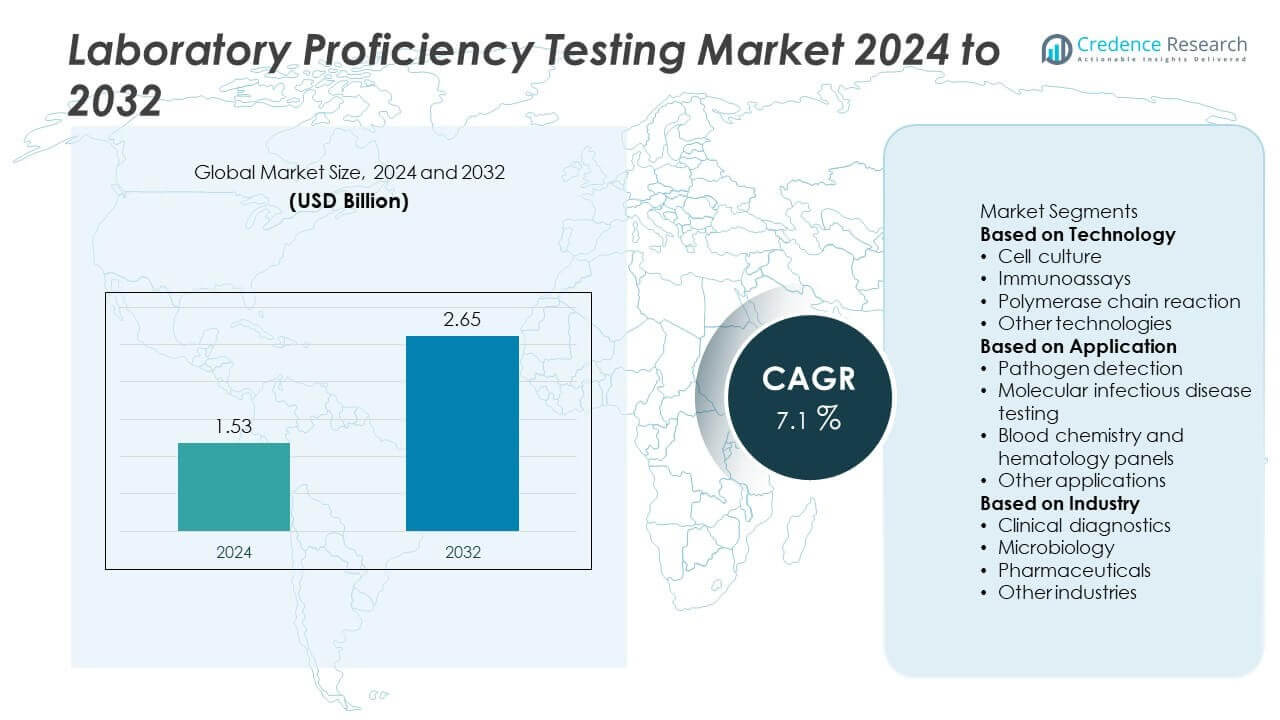

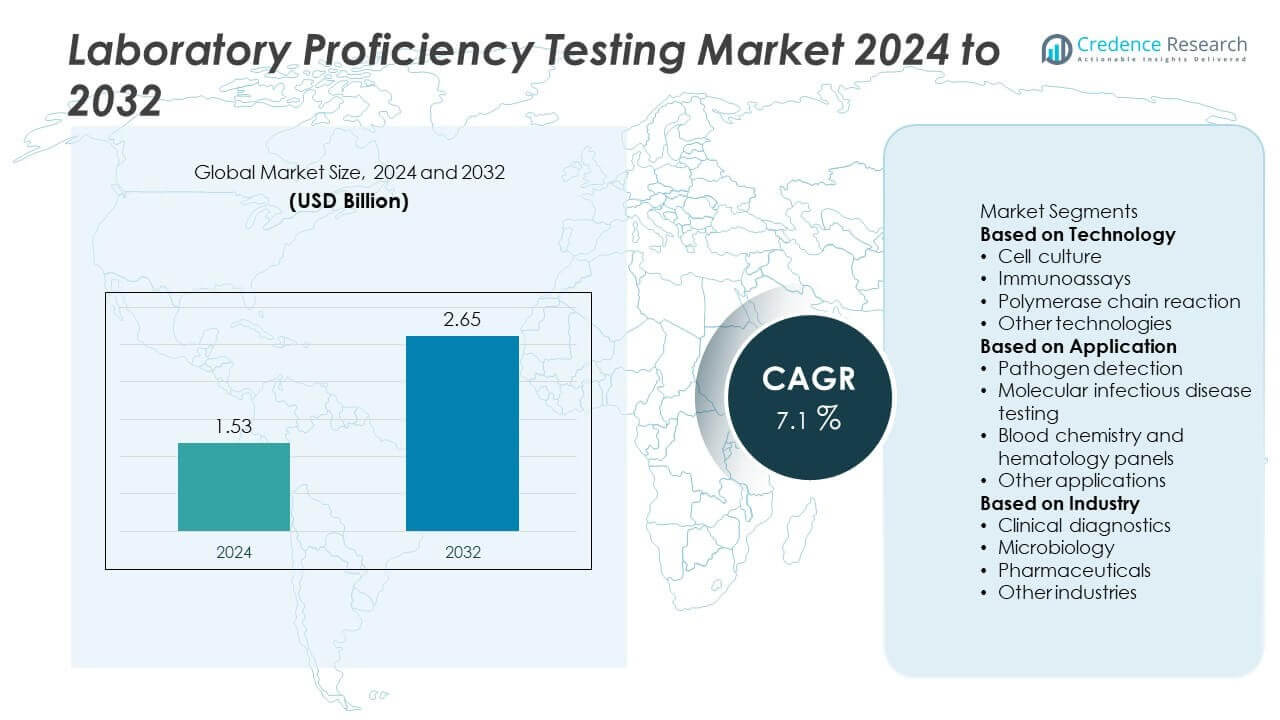

The Laboratory Proficiency Testing Market was valued at USD 1.53 billion in 2024 and is projected to reach USD 2.65 billion by 2032, growing at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Laboratory Proficiency Testing Market Size 2024 |

USD 1.53 Billion |

| Laboratory Proficiency Testing Market, CAGR |

7.1% |

| Laboratory Proficiency Testing Market Size 2032 |

USD 2.65 Billion |

The Laboratory Proficiency Testing Market grows with rising demand for quality assurance and compliance across clinical diagnostics, pharmaceuticals, food safety, and environmental monitoring. Stricter regulatory frameworks from agencies such as the FDA, ISO, and WHO drive laboratories to participate in structured proficiency programs.

The Laboratory Proficiency Testing Market shows strong geographical variation, with North America leading adoption due to stringent regulatory frameworks, advanced healthcare systems, and established laboratory networks. Europe follows with robust demand supported by quality standards in pharmaceuticals, food safety, and clinical diagnostics, while Asia Pacific is expanding rapidly with rising healthcare investments, pharmaceutical production, and adoption of international testing standards across China, India, and Japan. Latin America and the Middle East & Africa are emerging markets where industrial modernization and government-backed healthcare initiatives encourage participation in external quality programs. Key players such as BIO-RAD, LGC, American Proficiency Institute, and MERCK focus on providing wide-ranging proficiency schemes, expanding global reach, and integrating digital platforms to improve accuracy and accessibility. These companies strengthen competitiveness through partnerships with laboratories, investment in sector-specific programs, and innovations in data management and reporting solutions to meet diverse regional needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Laboratory Proficiency Testing Market was valued at USD 1.53 billion in 2024 and is projected to reach USD 2.65 billion by 2032, growing at a CAGR of 7.1%.

- Rising demand for compliance with international standards in clinical diagnostics, pharmaceuticals, food safety, and environmental monitoring drives market expansion.

- Increasing adoption of digital platforms and automation in proficiency testing highlights the trend toward real-time data analysis, improved accuracy, and faster reporting.

- Competitive landscape includes leading players such as BIO-RAD, MERCK, LGC, American Proficiency Institute, and AOAC INTERNATIONAL, which focus on broad program portfolios and global expansion.

- High costs of participation and limited awareness in small laboratories act as restraints, slowing adoption in resource-constrained markets.

- North America leads due to advanced healthcare and regulatory frameworks, while Europe follows with strong pharmaceutical and food safety testing practices.

- Asia Pacific shows rapid growth supported by rising healthcare investments and pharmaceutical production, while Latin America and the Middle East & Africa gain traction through modernization efforts and government initiatives.

Market Drivers

Rising Regulatory Requirements and Accreditation Standards

Regulatory bodies worldwide enforce strict quality assurance programs for laboratories. Accreditation agencies require participation in proficiency testing to ensure accuracy and reliability. The Laboratory Proficiency Testing Market grows as labs seek compliance with international standards such as ISO/IEC 17043. It supports laboratories in meeting industry-specific guidelines for clinical, environmental, and food testing. Growing enforcement of quality control programs in pharmaceuticals and healthcare further accelerates adoption. Proficiency testing enables labs to validate processes, identify errors, and demonstrate credibility to regulators and clients.

- For instance, Bio-Rad Laboratories operates External Quality Assessment Services (EQAS) for over 30,000 active participants in more than 150 countries. These programs cover areas such as clinical chemistry, microbiology, and molecular diagnostics, helping laboratories meet ISO/IEC 17043 standards and CAP requirements.

Growing Demand for Accurate Clinical and Diagnostic Results

Healthcare systems depend on precise test outcomes to improve patient care and treatment. Proficiency testing ensures diagnostic laboratories maintain accuracy across complex molecular, genetic, and microbiological testing. The Laboratory Proficiency Testing Market benefits from rising volumes of clinical tests and demand for high-quality results. It helps labs reduce errors that could impact treatment decisions and public health outcomes. Growing reliance on advanced diagnostics such as PCR, immunoassays, and next-generation sequencing fuels testing demand. Laboratories use proficiency programs to benchmark performance and improve trust among healthcare providers.

- For instance, LGC provides proficiency testing to over 13,000 laboratories worldwide, delivering schemes that cover more than 1,700 individual tests across clinical, food, and pharmaceutical sectors, ensuring robust accuracy in PCR and sequencing diagnostics.

Expansion of Food, Environmental, and Pharmaceutical Testing Needs

Global focus on food safety, environmental monitoring, and pharmaceutical quality drives proficiency testing adoption. Laboratories in these sectors face stringent standards for contamination control, pollutant detection, and drug safety. The Laboratory Proficiency Testing Market supports compliance by providing reliable performance evaluations across multiple testing categories. It strengthens laboratories’ ability to meet consumer safety demands and regulatory audits. Rising incidences of foodborne illnesses, environmental pollution, and drug recalls push labs to adopt external quality checks. Proficiency testing ensures operational integrity across these critical industries.

Advancements in Analytical Technologies and Specialized Testing

Rapid innovation in laboratory technologies creates need for new proficiency testing programs. Specialized areas such as genomics, proteomics, and advanced chemistry require updated performance assessment. The Laboratory Proficiency Testing Market adapts to these demands by offering tailored solutions for evolving disciplines. It provides laboratories with benchmarks to validate novel methods and maintain global competitiveness. Growth in digital platforms and automated systems supports efficient proficiency testing management. Expanding participation in international programs further ensures global standardization and reliability in laboratory operations.

Market Trends

Integration of Digital Platforms and Remote Testing Solutions

Laboratories increasingly adopt digital platforms for faster proficiency test distribution and reporting. Remote participation enables global access to programs without logistical delays. The Laboratory Proficiency Testing Market benefits from online systems that streamline data submission, analysis, and benchmarking. It improves participation rates by reducing manual processes and offering real-time performance insights. Automation tools also support regulatory reporting and accreditation needs. Laboratories embrace digitalization to enhance efficiency and accuracy in proficiency testing workflows.

- For instance, the American Proficiency Institute (API) delivers proficiency testing to over 20,000 clinical laboratories in all 50 U.S. states and several international locations. This process involves sending physical samples to labs for testing, with results submitted online. After API grades the results, labs receive an evaluation that helps them assess and verify their testing accuracy.

Expansion of Specialized and Customized Testing Programs

Demand for sector-specific proficiency tests continues to rise across healthcare, food, and environmental industries. Providers design tailored programs to address specialized testing such as molecular diagnostics or allergen detection. The Laboratory Proficiency Testing Market grows with increasing customization that reflects laboratory workflows and technologies. It strengthens credibility by ensuring accurate evaluation of emerging testing methods. Growth in pharmaceutical and biotechnology industries drives new categories of customized programs. This trend ensures testing aligns with the complexity of modern laboratory practices.

Increasing Global Collaboration and Standardization Efforts

International organizations promote standardized proficiency testing to ensure data consistency across regions. Collaborative efforts create harmonized frameworks that help laboratories meet global accreditation requirements. The Laboratory Proficiency Testing Market expands with cross-border partnerships supporting unified quality benchmarks. It enables laboratories to participate in international programs and gain recognition for compliance. Growth of multinational clinical trials and food trade strengthens the need for standardized testing practices. Global collaboration enhances trust in laboratory results across industries.

Adoption of Automation and Advanced Analytical Tools

Automation is reshaping proficiency testing by reducing human error and enhancing accuracy. Advanced analytical tools support faster data evaluation and provide detailed performance metrics. The Laboratory Proficiency Testing Market benefits from technologies such as AI-driven analytics and cloud-based dashboards. It enables laboratories to identify weaknesses quickly and adopt corrective actions. Integration with laboratory information management systems (LIMS) improves efficiency and traceability. Adoption of these tools supports laboratories in maintaining high standards of reliability and precision.

- For instance, Randox Laboratories’ RIQAS Point-of-Care (POCT) EQA platform is part of a larger, cloud-based External Quality Assessment scheme that serves more than 76,000 laboratory participants in 139 countries. The RIQAS.net user portal enables online submission of results and retrieval of automated, web-based quality reports, replacing slower, traditional paper-based systems.

Market Challenges Analysis

High Costs and Resource Constraints for Smaller Laboratories

Participation in proficiency testing requires significant investment in program fees, staff time, and technical resources. Smaller laboratories, particularly in developing regions, often struggle to allocate budgets for repeated assessments. The Laboratory Proficiency Testing Market faces limited adoption where cost pressures outweigh compliance incentives. It becomes challenging for resource-constrained facilities to balance operational needs with external testing requirements. This barrier reduces participation rates, especially in food safety and environmental sectors. Limited financial capacity also restricts access to advanced, specialized testing programs designed for complex diagnostics.

Complexity of Evolving Standards and Technical Expertise Gaps

Global accreditation standards evolve continuously, demanding laboratories adapt to new requirements and testing protocols. The Laboratory Proficiency Testing Market encounters challenges where laboratories lack skilled personnel to manage advanced methodologies. It creates difficulties in interpreting results, implementing corrective actions, and maintaining consistent quality performance. Variations in regional standards further complicate participation in international programs. Laboratories without strong technical expertise risk delays in compliance and reduced credibility with regulators. This challenge highlights the need for training, technical support, and harmonization of testing frameworks.

Market Opportunities

Rising Demand for Standardized Testing Across Expanding Industries

The global focus on quality assurance in pharmaceuticals, food safety, clinical diagnostics, and environmental monitoring creates strong growth avenues. The Laboratory Proficiency Testing Market benefits from stricter compliance frameworks that require regular participation in external quality assessment. It supports laboratories in demonstrating accuracy, reliability, and regulatory alignment. Expanding industries such as biotechnology, medical devices, and water testing further widen the scope of testing programs. Demand for specialized schemes addressing niche applications grows as laboratories handle more complex samples. Opportunities also arise in cross-border trade, where globally recognized certifications enhance market credibility.

Growing Adoption of Digital Platforms and Remote Testing Models

Technology integration creates opportunities to simplify participation and increase accessibility of testing programs. The Laboratory Proficiency Testing Market evolves with digital tools that allow online data submission, automated result analysis, and remote collaboration. It reduces administrative burdens while improving turnaround times and accuracy. Emerging models enable smaller and resource-constrained laboratories to access cost-effective, flexible participation. Remote testing capabilities also support global laboratories by harmonizing standards across geographies. This opportunity strengthens adoption by combining efficiency with scalability, ensuring broader coverage across both developed and developing regions.

Market Segmentation Analysis:

By Technology

The Laboratory Proficiency Testing Market is segmented by technology into traditional and advanced platforms. Traditional programs involve manual processes where samples are distributed, analyzed, and compared across laboratories. While reliable, these methods often require longer timelines for result evaluation. Advanced platforms integrate digital tools, automated systems, and statistical software to enhance speed, accuracy, and efficiency. It supports real-time reporting and faster corrective actions, making them attractive for high-volume laboratories. Increasing adoption of automated proficiency testing systems reflects the demand for streamlined compliance in industries with tight operational schedules.

- For instance, Thermo Fisher Scientific upgraded its SampleManager LIMS software in 2023, introducing new features to streamline laboratory workflows and improve efficiency across various industries, including food and clinical testing.

By Application

Applications of proficiency testing include clinical diagnostics, food and beverage safety, environmental monitoring, and pharmaceutical testing. Clinical diagnostics hold the largest share due to regulatory mandates for patient safety and the need for accurate diagnostic results. The Laboratory Proficiency Testing Market benefits from expansion in food safety testing driven by global supply chain complexity and consumer safety concerns. Environmental monitoring follows with rising adoption of testing programs for water, soil, and air quality compliance. Pharmaceutical testing continues to grow with the expansion of drug development pipelines and strict manufacturing standards. It highlights the sector’s reliance on proficiency testing to validate laboratory processes across diverse applications.

By Industry

Key industries using proficiency testing include healthcare, pharmaceuticals, food and beverage, environmental, and biotechnology. Healthcare leads adoption with hospitals and diagnostic laboratories prioritizing accurate results for patient care. The Laboratory Proficiency Testing Market gains momentum in pharmaceuticals where manufacturing and research require validation of analytical methods. Food and beverage industries adopt testing schemes to meet safety and export standards. Environmental agencies rely on these programs to maintain compliance with pollution control regulations. Biotechnology companies participate in specialized programs to ensure accuracy in molecular and genetic testing. It secures opportunities across a broad industrial base where data integrity and compliance remain critical.

- For instance, FAPAS (operated by Fera Science Ltd.) delivered more than 400 food and environmental proficiency testing rounds in 2023, covering contaminants such as pesticides, heavy metals, and mycotoxins, with participation from laboratories in over 120 countries.

Segments:

Based on Technology

- Cell culture

- Immunoassays

- Polymerase chain reaction

- Other technologies

Based on Application

- Pathogen detection

- Molecular infectious disease testing

- Blood chemistry and hematology panels

- Other applications

Based on Industry

- Clinical diagnostics

- Microbiology

- Pharmaceuticals

- Other industries

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for nearly 34% of the Laboratory Proficiency Testing Market share in 2024. The region leads with its advanced healthcare infrastructure, high volume of clinical diagnostics, and strict regulatory requirements. The United States dominates, supported by widespread laboratory accreditation programs under CLIA and CAP guidelines. Canada contributes with expanding adoption in food safety and environmental testing, driven by federal compliance mandates. Laboratories in the region actively adopt digital platforms for proficiency programs to improve turnaround times. It benefits from strong participation by pharmaceutical companies and diagnostic service providers focused on maintaining data reliability. The mature market continues to grow steadily with integration of automated quality control systems.

Europe

Europe held approximately 27% of the Laboratory Proficiency Testing Market share in 2024. The region benefits from established regulatory frameworks such as ISO/IEC 17043 that govern laboratory accreditation. Germany, France, and the UK are primary contributors, with strong adoption in clinical, pharmaceutical, and food testing laboratories. Eastern European nations are gradually expanding adoption due to increasing investment in healthcare and environmental monitoring. It gains further traction with the rising emphasis on food export compliance and patient safety initiatives across the European Union. Proficiency testing providers in the region expand offerings to cover molecular diagnostics and advanced environmental monitoring. Europe maintains balanced demand across multiple industries supported by government-backed quality assurance programs.

Asia Pacific

Asia Pacific represented nearly 28% of the Laboratory Proficiency Testing Market share in 2024, making it one of the fastest-growing regions. China and Japan dominate with widespread adoption across clinical diagnostics, pharmaceutical manufacturing, and biotechnology research. India shows rapid growth with government-backed initiatives to strengthen food and drug safety compliance. South Korea contributes through advanced hospital networks and innovation in molecular diagnostic testing. It benefits from increasing awareness of international accreditation standards and expanding investments in healthcare infrastructure. Laboratories in the region adopt proficiency testing to improve global competitiveness and align with export regulations. The region’s large population and rising disease burden further fuel demand for reliable diagnostic accuracy.

Latin America

Latin America accounted for about 6% of the Laboratory Proficiency Testing Market share in 2024. Brazil and Mexico drive most of the regional adoption with emphasis on food safety, pharmaceuticals, and clinical diagnostics. The region sees rising participation in international testing schemes due to growing exports of agricultural and food products. It faces challenges from limited infrastructure and lower awareness in smaller laboratories, but government initiatives improve adoption rates. Pharmaceutical companies in the region invest in proficiency testing to meet international quality certifications. Increasing healthcare modernization and diagnostic demand strengthen growth opportunities. Latin America emerges as a developing market with rising potential for proficiency testing services.

Middle East and Africa

The Middle East and Africa held nearly 5% of the Laboratory Proficiency Testing Market share in 2024. The region shows steady growth with rising investments in healthcare, pharmaceuticals, and environmental safety programs. The UAE and Saudi Arabia dominate adoption in the Middle East due to regulatory modernization and hospital expansions. South Africa and Nigeria lead demand in Africa, supported by efforts to strengthen food safety and public health systems. It benefits from international collaborations that provide access to standardized proficiency testing schemes. However, limited infrastructure and higher costs remain barriers for small laboratories in the region. Growing demand for reliable diagnostics and industrial compliance supports gradual adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BIO-RAD

- AOAC INTERNATIONAL

- RANDOX

- FLUXANA

- ABSOLUTE STANDARDS

- LGC

- American Proficiency Institute

- MERCK

- FAPAS

- Aashvi PT

Competitive Analysis

Competitive landscape of the Laboratory Proficiency Testing Market includes key players such as BIO-RAD, MERCK, LGC, AOAC INTERNATIONAL, American Proficiency Institute, RANDOX, FLUXANA, FAPAS, ABSOLUTE STANDARDS, and Aashvi PT. These companies compete by offering comprehensive testing schemes across clinical diagnostics, pharmaceuticals, food safety, and environmental laboratories. They emphasize program reliability, international accreditation, and tailored solutions that meet regulatory requirements such as ISO/IEC 17043. Leaders invest in digital platforms to streamline reporting, enhance data analytics, and deliver real-time performance insights to laboratories. Expansion strategies include partnerships with regulatory bodies, collaborations with healthcare institutions, and strengthening regional presence to capture emerging markets. Companies also differentiate through specialized programs, such as molecular diagnostics, trace element testing, and environmental monitoring, to address evolving laboratory needs. Competitive focus lies in balancing cost-effective services with high accuracy, ensuring laboratories achieve compliance and maintain global credibility. This competitive environment fosters innovation, standardization, and continuous improvement across the industry.

Recent Developments

- In July 2025, AOAC INTERNATIONAL and USDA’s Food Safety and Inspection Service established a Memorandum of Understanding. It sets a strategic framework for developing, validating, and recognizing test methods, as well as proficiency testing programs, for HACCP-based food safety systems.

- In June 2025, AOAC INTERNATIONAL launched “Order PT Quality Assurance and Educational Samples (QAES)” to support training, corrective actions, method validation, and more using proficiency test–style samples.

- In October 2024, Bio-Rad launched its External Quality Assurance Services Specialty Immunoassay (SPIA) program, which consolidates testing for 13 key specialty immunoassay analytes into a single assessment scheme.

- In July 2024, Bio-Rad also presented new quality control (QC) specifications and product demos at the Association for Diagnostics and Laboratory Medicine (ADLM) conference.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for laboratory proficiency testing will rise with stricter global regulatory compliance.

- Digital platforms will increasingly support remote participation and faster result reporting.

- Growth in personalized medicine will expand testing needs in molecular diagnostics.

- Food safety and environmental monitoring programs will drive strong adoption in emerging markets.

- Pharmaceutical quality control will remain a critical focus area for proficiency testing schemes.

- Automation and AI-based analytics will improve accuracy and efficiency in data interpretation.

- Strategic collaborations between proficiency testing providers and regulatory bodies will strengthen credibility.

- Customized testing schemes will gain traction to meet specialized industry requirements.

- Emerging economies will see rapid adoption due to growing investments in healthcare and compliance.

- Continuous innovation in testing scope will ensure broader participation across diverse laboratory segments.