Market Overview

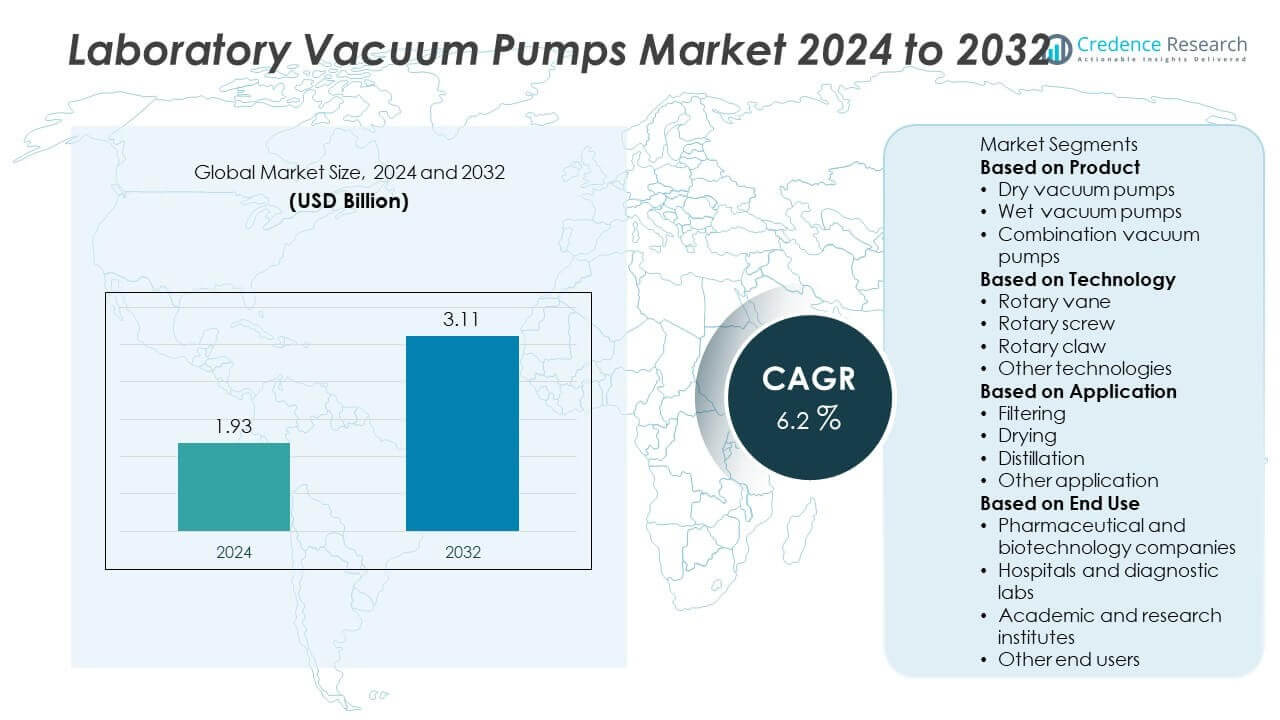

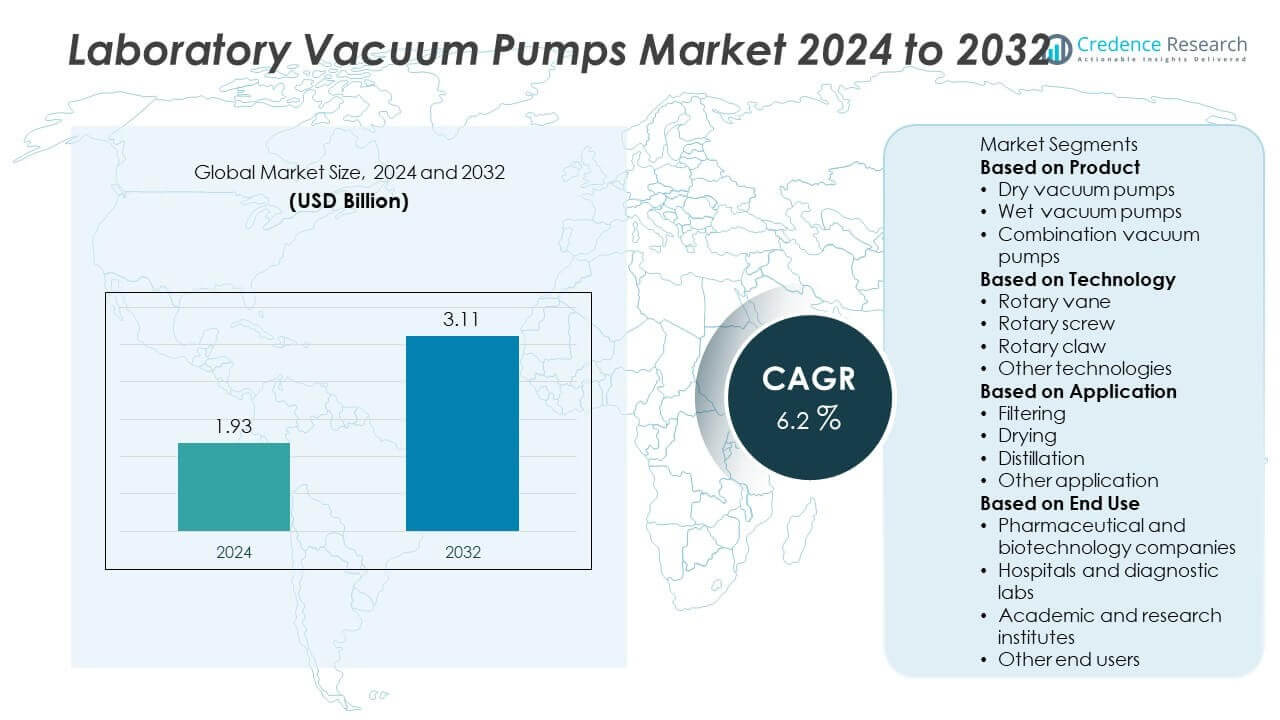

Laboratory Vacuum Pumps Market size was valued at USD 1.93 billion in 2024 and is anticipated to reach USD 3.11 billion by 2032, growing at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Laboratory Vacuum Pumps Market Size 2024 |

USD 1.93 Billion |

| Laboratory Vacuum Pumps Market, CAGR |

6.2% |

| Laboratory Vacuum Pumps Market Size 2032 |

USD 3.11 Billion |

The Laboratory Vacuum Pumps Market grows with increasing demand from pharmaceutical, biotechnology, and analytical laboratories. Rising focus on drug discovery, molecular diagnostics, and clean laboratory environments drives adoption of oil-free and energy-efficient vacuum systems.

Asia Pacific leads the Laboratory Vacuum Pumps Market due to rapid growth in pharmaceutical manufacturing, diagnostic testing, and academic research infrastructure across China, India, and South Korea. North America follows with strong demand from biotechnology firms, advanced research labs, and healthcare institutions, particularly in the United States. Europe maintains a stable market driven by environmental compliance, energy-efficient technologies, and investments in green laboratory practices. Latin America and the Middle East & Africa show emerging demand supported by government initiatives in healthcare and education. Each region reflects varying needs based on research intensity, industrial base, and regulatory structure. Manufacturers tailor their product portfolios to align with local operational standards and technical preferences. Key players in this market include Agilent, EDWARDS, Leybold, and Atlas Copco, each offering a wide range of vacuum pump technologies for laboratory-scale applications. These companies compete on performance, sustainability, reliability, and regional support capabilities to serve diverse scientific and industrial sectors.

Market Insights

- Laboratory Vacuum Pumps Market was valued at USD 1.93 billion in 2024 and is projected to reach USD 3.11 billion by 2032, growing at a CAGR of 6.2%.

- Rising pharmaceutical research, clinical diagnostics, and chemical testing drive vacuum pump adoption in labs.

- Labs prefer oil-free, low-noise, and digitally controlled vacuum systems to meet regulatory and safety standards.

- Key players such as Agilent, Atlas Copco, Leybold, and EDWARDS focus on product innovation, energy efficiency, and smart control features.

- High initial costs, limited technical expertise in emerging regions, and maintenance complexity restrict adoption in smaller labs.

- Asia Pacific leads due to growing lab infrastructure in China and India; North America shows strong demand from biotech and diagnostics sectors.

- Europe emphasizes eco-friendly lab practices and digital integration, while Latin America and the Middle East & Africa show steady growth through healthcare and academic investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing R&D Activities in Pharmaceuticals and Biotechnology Drive Equipment Demand

Increased investment in drug discovery, vaccine development, and life sciences research fuels the need for precise lab equipment. Laboratories in pharma and biotech rely on vacuum pumps for filtration, evaporation, and degassing tasks. The Laboratory Vacuum Pumps Market benefits from growing demand across both academic and commercial R&D facilities. Research institutions prioritize pumps that deliver stable vacuum levels and low vibration to protect sensitive experiments. It supports critical applications in chromatography and lyophilization processes. Industry players target this demand with oil-free and chemically resistant pump technologies.

- For instance, KNF expanded its Smooth Flow diaphragm pump series with the FP 7 and FP 25 models, which deliver adjustable liquid transfer at 15–70 ml/min and 50–250 ml/min, respectively. While both pumps can produce up to 1 bar of pressure, select high-pressure versions of the FP 1.7 and FP 25 models can achieve nominal pressures of up to 6 bar.

Expansion of Analytical Laboratories Strengthens Equipment Adoption Worldwide

The number of laboratories focusing on chemical, food, and environmental testing continues to rise globally. These labs use vacuum pumps in applications such as sample preparation, vacuum distillation, and desiccation. The Laboratory Vacuum Pumps Market gains traction from strict regulatory standards that require clean and repeatable test conditions. It supports widespread use of rotary vane, diaphragm, and scroll pumps across varying workflows. Analytical labs prefer energy-efficient and low-noise models to maintain workflow precision. Manufacturers see growing opportunities in serving contract labs and third-party testing facilities.

- For instance, Leybold launched its SOGEVAC SV55 BI² and SV70 BI² rotary vane pumps for analytical labs in June 2025. These pumps feature maintenance intervals of up to 24,000 hours in certain applications and integrated frequency converters.

Miniaturization of Laboratory Instruments Boosts Need for Compact, Silent Pump Designs

Modern laboratories focus on maximizing bench space and reducing energy consumption. This shift pushes demand for compact vacuum pumps that offer strong performance without sacrificing space. The Laboratory Vacuum Pumps Market aligns with this trend by offering portable, modular solutions for integrated lab systems. It benefits from pump technologies designed for integration with analytical instruments such as mass spectrometers or gas chromatographs. Silent operation and maintenance-free designs improve lab efficiency and user safety. Product design now favors digital interfaces and smart control for precise vacuum regulation.

Strong Government Funding for Research and Academic Labs Expands Market Scope

Governments across North America, Europe, and Asia continue increasing support for scientific research infrastructure. Funding grants help universities and public labs upgrade equipment to meet modern performance and safety standards. The Laboratory Vacuum Pumps Market responds to this by supplying certified products compatible with global laboratory protocols. It plays a key role in supporting experiments that require accurate pressure control across disciplines like material science, microbiology, and physics. Market players partner with institutions to supply long-term contracts and training programs. This fosters demand stability and recurring procurement cycles.

Market Trends

Shift Toward Oil-Free and Dry Vacuum Pump Technologies Enhances Laboratory Safety

Laboratories increasingly adopt oil-free pumps to reduce contamination risk and simplify maintenance. These pumps eliminate oil mist and reduce chemical exposure in sensitive lab environments. The Laboratory Vacuum Pumps Market reflects this trend through growing sales of dry diaphragm, scroll, and hybrid pumps. It supports cleaner air quality, reduces disposal costs, and aligns with green lab initiatives. Oil-free models also minimize downtime linked to filter changes and fluid replacement. Research and clinical labs favor these systems for improved safety and sustainability.

- For instance, Busch Vacuum Solutions launched the COBRA DH series of high-performance dry screw vacuum pumps, offering pumping speeds ranging from 2,700 to 6,200 m³/h, featuring contact-free screw technology to minimize wear and contamination risk.

Integration of Smart Control and Digital Interfaces for Real-Time Monitoring

Users now prefer vacuum systems with digital displays, programmable settings, and remote monitoring options. Smart vacuum pumps offer pressure control, diagnostics, and energy optimization in real time. The Laboratory Vacuum Pumps Market benefits from rising demand for automation and traceability in regulated environments. It meets the need for connected equipment in GLP-compliant and FDA-inspected labs. Pumps with data logging capabilities support quality assurance and documentation. Instrument manufacturers incorporate user-friendly interfaces to reduce human error and enhance operational precision.

- For instance, Edwards Vacuum introduced its nXRi dry pump series, offering remote monitoring via digital interfaces (RS232, RS485, and USB), pumping speeds of up to 120 m³/h, and low vibration below 2.0 mm/s, ensuring reliability in regulated pharmaceutical and analytical laboratories.

Growing Use of Vacuum Pumps in Green Chemistry and Sustainable Lab Practices

Environmental concerns drive the adoption of energy-efficient and recyclable pump systems in labs. Vacuum pumps with low power consumption and long service life reduce environmental impact. The Laboratory Vacuum Pumps Market aligns with institutional sustainability goals and carbon reduction plans. It offers low-decibel, low-heat solutions that contribute to energy savings and worker comfort. Demand rises for systems that use non-toxic materials and generate minimal waste. Green chemistry protocols prioritize vacuum equipment with minimal environmental footprint.

Custom Pump Designs Cater to Specialized Research Applications Across Sectors

Laboratories working in semiconductor, aerospace, and advanced materials require highly specific vacuum profiles. Manufacturers now offer customized pump configurations for niche workflows. The Laboratory Vacuum Pumps Market responds with modular units, corrosion-resistant materials, and precision tuning features. It allows scientists to match vacuum performance to unique equipment and process needs. Specialized applications in spectroscopy, surface analysis, and nanofabrication expand the scope of pump use. Flexibility in design supports innovation across diverse scientific and industrial sectors.

Market Challenges Analysis

High Initial Investment and Maintenance Complexity Restrict Adoption Across Small Laboratories

Many laboratory vacuum pump systems require significant upfront investment, especially advanced oil-free or hybrid models. Smaller academic and clinical labs often face budget limitations, which hinder equipment upgrades or replacements. The Laboratory Vacuum Pumps Market encounters resistance in price-sensitive segments where affordability outweighs efficiency or innovation. It also faces challenges from the cost of maintenance, including specialized parts and service labor. Some labs hesitate to adopt newer technologies due to concerns about compatibility or learning curves. These barriers slow the transition from legacy systems to modern vacuum solutions.

Noise, Vibration, and Chemical Compatibility Issues Limit Broader Pump Integration

Vacuum pumps can generate noise and vibration that disrupt sensitive testing environments or create safety concerns. Pumps that lack chemical compatibility or corrosion resistance degrade faster under harsh lab conditions. The Laboratory Vacuum Pumps Market must address these limitations through better material design and noise-reduction technologies. It requires continuous engineering improvements to maintain vacuum precision while meeting noise thresholds. Incompatible materials or inadequate chemical shielding lead to equipment damage and sample contamination. These operational risks increase procurement caution, especially in regulated laboratory settings.

Market Opportunities

Expansion of Clinical Diagnostics and Biotech Labs Creates Strong Product Demand

Global healthcare growth fuels the setup of diagnostic labs, biotech firms, and clinical testing centers. These facilities use vacuum pumps for sample preparation, evaporation, filtration, and lyophilization. The Laboratory Vacuum Pumps Market sees opportunity in supplying quiet, maintenance-free, and oil-free units that support regulated workflows. It supports applications where vacuum precision is essential for reproducibility and safety. Rising demand for COVID-19 testing infrastructure, molecular diagnostics, and vaccine development expands equipment needs. Manufacturers can scale production and offer tailored pump configurations to meet lab-specific requirements.

Rising Investments in Emerging Markets Strengthen Product Penetration Potential

Government and private sector funding in Asia Pacific, Latin America, and the Middle East supports laboratory infrastructure development. These regions invest in pharmaceutical manufacturing, chemical testing, and academic R&D to support local industries. The Laboratory Vacuum Pumps Market can expand by offering reliable, cost-efficient systems suited for harsh conditions and limited service access. It enables users in emerging economies to upgrade from manual to automated lab processes. Local partnerships and training programs further improve product acceptance. Long-term growth lies in creating durable, adaptable pumps for laboratories with diverse operational needs.

Market Segmentation Analysis:

By Product:

The Laboratory Vacuum Pumps Market includes products such as rotary vane pumps, diaphragm pumps, scroll pumps, piston pumps, and others. Diaphragm pumps hold a significant share due to their oil-free design, low maintenance, and compatibility with chemical processes. Rotary vane pumps remain widely used for their strong vacuum capability and suitability for evaporation and freeze-drying tasks. Scroll pumps gain popularity in high-precision labs because of their quiet operation and high performance in clean environments. Piston pumps serve specialized applications requiring higher pressure and rugged design. It supports diverse product preferences based on budget, vacuum level, and process requirements.

- For instance, KNF launched its N 952 diaphragm vacuum pump, capable of achieving an ultimate vacuum of 1.5 mbar (absolute) with a maximum flow rate of 36 L/min, providing oil-free performance ideal for chemical-resistant laboratory operations.

By Technology:

Key technologies in the Laboratory Vacuum Pumps Market include oil-lubricated and dry vacuum pumps. Dry pumps dominate current demand due to their cleaner operation, minimal maintenance, and eco-friendly appeal. These pumps find strong use in biotechnology, pharmaceutical, and food testing labs where contamination control is critical. Oil-lubricated pumps still serve high-capacity or deep-vacuum applications where performance outweighs contamination risk. Hybrid models combine features from both types to balance efficiency and reliability. It reflects a growing trend toward adaptable systems that meet evolving lab standards and safety protocols.

- For instance, Ebara Technologies launched the EV-A10 series dry vacuum pump, designed for laboratory and semiconductor use, with a pumping speed of 1,000 L/min. The pump’s ultimate vacuum level is 1.0 Pa without gas ballast and 2.0 Pa with gas ballast.

By Application:

Laboratory vacuum pumps are essential in applications such as filtration, distillation, drying, degassing, freeze-drying, and aspiration. The Laboratory Vacuum Pumps Market sees strong traction in life sciences, chemistry, and material science research. Filtration and evaporation remain the most common uses, especially in analytical and quality control labs. Freeze-drying applications grow due to rising demand in vaccine development and biological sample preservation. Pumps also support degassing in chromatography and drying in cleanroom procedures. It continues to adapt to changing application needs across both routine and high-end scientific research environments.

Segments:

Based on Product

- Dry vacuum pumps

- Wet vacuum pumps

- Combination vacuum pumps

Based on Technology

- Rotary vane

- Rotary screw

- Rotary claw

- Other technologies

Based on Application

- Filtering

- Drying

- Distillation

- Other application

Based on End Use

- Pharmaceutical and biotechnology companies

- Hospitals and diagnostic labs

- Academic and research institutes

- Other end users

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Asia Pacific

Asia Pacific holds the largest share of the Laboratory Vacuum Pumps Market, accounting for approximately 36%. This region benefits from a rapidly expanding pharmaceutical and biotechnology industry in countries such as China, India, Japan, and South Korea. Government investment in healthcare research and diagnostic infrastructure continues to grow, supporting higher adoption of lab equipment across hospitals, universities, and testing centers. Demand also rises from electronics and semiconductor industries where vacuum pumps play a role in material characterization and microfabrication labs. Rising clinical trial activity and the growing number of research institutions push the need for reliable, oil-free, and energy-efficient vacuum systems. It remains the dominant market due to a mix of cost-effective manufacturing, regulatory expansion, and growing R&D investments.

North America

North America captures about 29% of the Laboratory Vacuum Pumps Market, driven by its well-established network of life sciences and analytical testing laboratories. The United States accounts for a majority of this share, supported by robust pharmaceutical production, federal R&D funding, and a strong presence of global laboratory equipment manufacturers. Academic institutions and government research agencies maintain high standards for vacuum technology across chemical, biological, and environmental labs. Canada also contributes through investment in sustainable lab infrastructure and life sciences innovation. Manufacturers in this region prioritize product upgrades with digital interfaces, real-time monitoring, and regulatory compliance. It remains a highly mature market with continued demand for high-performance, low-maintenance vacuum systems.

Europe

Europe accounts for around 23% of the Laboratory Vacuum Pumps Market, led by countries such as Germany, the UK, France, and the Netherlands. The region hosts a dense network of pharmaceutical, food safety, and chemical testing labs that depend on advanced vacuum systems for sample preparation and quality control. Strict environmental regulations and workplace safety standards drive demand for oil-free and low-noise vacuum pumps. Public funding for university research and diagnostic labs supports consistent procurement of modern lab infrastructure. Leading manufacturers in Europe develop energy-efficient and recyclable pump designs aligned with the EU’s green lab goals. It remains a technology-forward region with a strong focus on sustainability and compliance.

Latin America

Latin America holds about 6% of the Laboratory Vacuum Pumps Market, with Brazil and Mexico being the leading contributors. Growth in clinical diagnostics, environmental testing, and pharmaceutical manufacturing stimulates moderate demand across private and public laboratories. Increasing government efforts to improve healthcare services and scientific education help strengthen market penetration. However, limited access to high-end equipment and dependency on imported technologies pose a challenge to local adoption. Vendors explore opportunities through partnerships and distributor networks to serve labs in urban and semi-urban regions. It shows steady growth potential, particularly in expanding academic and life sciences sectors.

Middle East & Africa

Middle East & Africa account for roughly 6% of the Laboratory Vacuum Pumps Market. Countries such as the UAE, Saudi Arabia, and South Africa invest in laboratory modernization as part of broader national development plans. Demand comes from food testing, petroleum research, and medical diagnostics, especially in government-funded labs. International companies expand their footprint in this region by offering training programs and service support for laboratory systems. Adoption remains low compared to developed markets due to budget constraints and limited technical expertise in remote areas. It presents long-term opportunity as infrastructure and education systems evolve.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Graham

- DEKKER

- gast

- EDWARDS

- Agilent

- KNF

- Atlas Copco

- Leybold

- BUSCH

- Ebara Technologies

Competitive Analysis

The competitive landscape of the Laboratory Vacuum Pumps Market includes leading players such as Agilent, Atlas Copco, BUSCH, DEKKER, Ebara Technologies, EDWARDS, gast, Graham, KNF, and Leybold. These companies compete by offering a wide portfolio of vacuum technologies, including rotary vane, diaphragm, scroll, and hybrid pumps tailored for laboratory applications. They focus on innovation in oil-free, low-noise, and energy-efficient systems that meet the demands of pharmaceutical, analytical, and research labs. Manufacturers invest in smart control features, digital interfaces, and modular designs to support automation and compliance in GLP and GMP environments. Regional expansion remains a key strategy, with players strengthening distribution networks and technical support in Asia Pacific and Latin America. Product differentiation is driven by vacuum performance, chemical resistance, compactness, and service reliability. Mergers, partnerships, and R&D funding play a major role in sustaining market leadership. Competitive advantage depends on application-specific customization, sustainability credentials, and the ability to meet evolving lab standards.

Recent Developments

- In June 2025, Leybold launched two new SOGEVAC SV55 BI² and SV70 BI² oil-sealed rotary vane pumps for analytical applications. These models offer up to 24,000-hour maintenance intervals, integrated frequency conversion, low noise, and compact design.

- In January 2025, Agilent introduced the IDP-35 and IDP-45 dry scroll pumps, delivering quiet, oil-free, high-capacity vacuum solutions ideal for laboratory, cryogenic, and industrial uses.

- In 2025, Edwards Vacuum launched a new series of magnetically levitated turbomolecular pumps—the nEXT2807M and nEXT3207M Maglev—offering oil-free performance with maintenance intervals up to 80,000 hours.

- In May 2024, Edwards Vacuum (Italy) deployed its latest-generation oil-free dry pumps like the nXR60 and nXR90i, delivering maintenance-free, compact solutions to OEM Future Technologies for coolant injection lines.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for laboratory vacuum pumps will grow with expansion of pharmaceutical and biotech research.

- Oil-free and dry vacuum technologies will gain preference for safety and contamination control.

- Smart pumps with digital control and remote monitoring will become standard in advanced labs.

- Compact and low-noise pump models will support growth in space-constrained laboratory environments.

- Sustainability initiatives will drive adoption of energy-efficient and recyclable vacuum systems.

- Customized pump solutions will support specialized research in nanotechnology and advanced materials.

- Asia Pacific will remain the fastest-growing region due to investment in research infrastructure.

- North America and Europe will lead in innovation and regulatory compliance.

- Emerging markets will present opportunities for cost-effective and durable pump technologies.

- Integration with lab automation platforms will expand the role of vacuum pumps in digital laboratories.