CHAPTER NO. 1 : INTRODUCTION 21

1.1. Report Description 21

Purpose of the Report 21

USP & Key Offerings 21

1.2. Key Benefits for Stakeholders 21

1.3. Target Audience 22

1.4. Report Scope 22

CHAPTER NO. 2 : EXECUTIVE SUMMARY 23

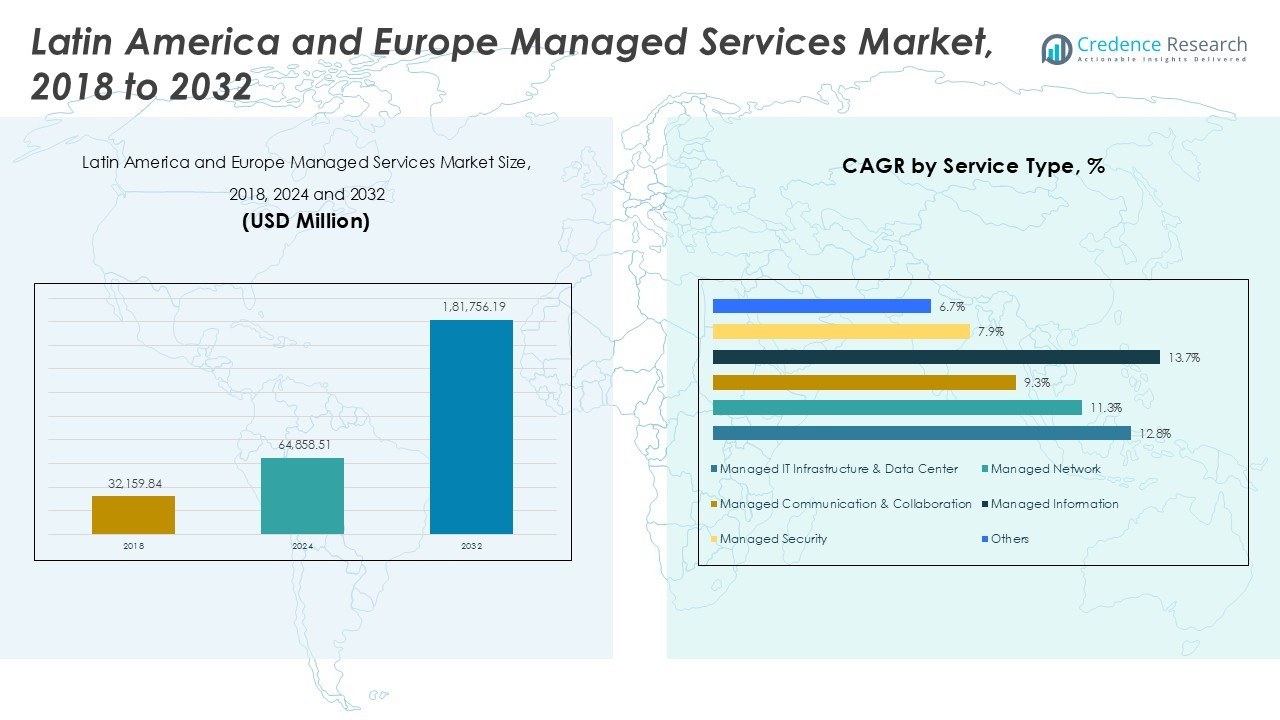

2.1. Latin America and Europe Managed Services Market Snapshot 23

2.2. Latin America and Europe Managed Services Market, 2018 – 2035 (USD Million) 24

CHAPTER NO. 3 : LATIN AMERICA AND EUROPE MANAGED SERVICES MARKET – INDUSTRY ANALYSIS 25

3.1. Introduction 25

3.2. Market Drivers 26

3.3. Growing adoption of cloud computing and hybrid IT infrastructure 26

3.4. Increasing emphasis on cybersecurity and regulatory compliance 27

3.5. Market Restraints 28

3.6. Shortage of skilled IT professionals in Latin America and Europe 28

3.7. Market Opportunities 29

3.8. Market Opportunity Analysis 29

3.9. Porter’s Five Forces Analysis 30

CHAPTER NO. 4 : ANALYSIS COMPETITIVE LANDSCAPE 31

4.1. Company Market Share Analysis – 2024 31

4.1.1. Latin America and Europe Managed Services Market: Company Market Share, by Revenue, 2024 31

4.1.2. Latin America and Europe Managed Services Market: Top 6 Company Market Share, by Revenue, 2024 32

4.2. Mexico Managed Services Market Company Revenue Market Share, 2024 33

4.3. Uruguay Managed Services Market Company Revenue Market Share, 2024 34

4.4. Argentina Managed Services Market Company Revenue Market Share, 2024 35

4.5. Chile Managed Services Market Company Revenue Market Share, 2024 36

4.6. Colombia Managed Services Market Company Revenue Market Share, 2024 37

4.7. Spain Managed Services Market Company Revenue Market Share, 2024 38

4.8. Portugal Managed Services Market Company Revenue Market Share, 2024 39

4.9. Key Player Strategies 40

4.9.1. Mergers, Acquisitions & Partnerships 40

4.9.2. Product & Service Launches 40

4.10. Company Assessment Metrics, 2024 41

4.10.1. Stars 41

4.10.2. Emerging Leaders 41

4.10.3. Pervasive Players 41

4.10.4. Participants 41

4.11. Start-ups /SMEs Assessment Metrics, 2024 41

4.11.1. Progressive Companies 41

4.11.2. Responsive Companies 41

4.11.3. Dynamic Companies 41

4.11.4. Starting Blocks 41

4.12. Strategic Developments 42

4.12.1. Acquisitions & Mergers 42

New Product Launch 42

Regional Expansion 42

4.13. Key Players Product Matrix 43

CHAPTER NO. 5 : PESTEL & ADJACENT MARKET ANALYSIS 44

5.1. PESTEL 44

5.1.1. Political Factors 44

5.1.2. Economic Factors 44

5.1.3. Social Factors 44

5.1.4. Technological Factors 44

5.1.5. Environmental Factors 44

5.1.6. Legal Factors 44

5.2. Adjacent Market Analysis 44

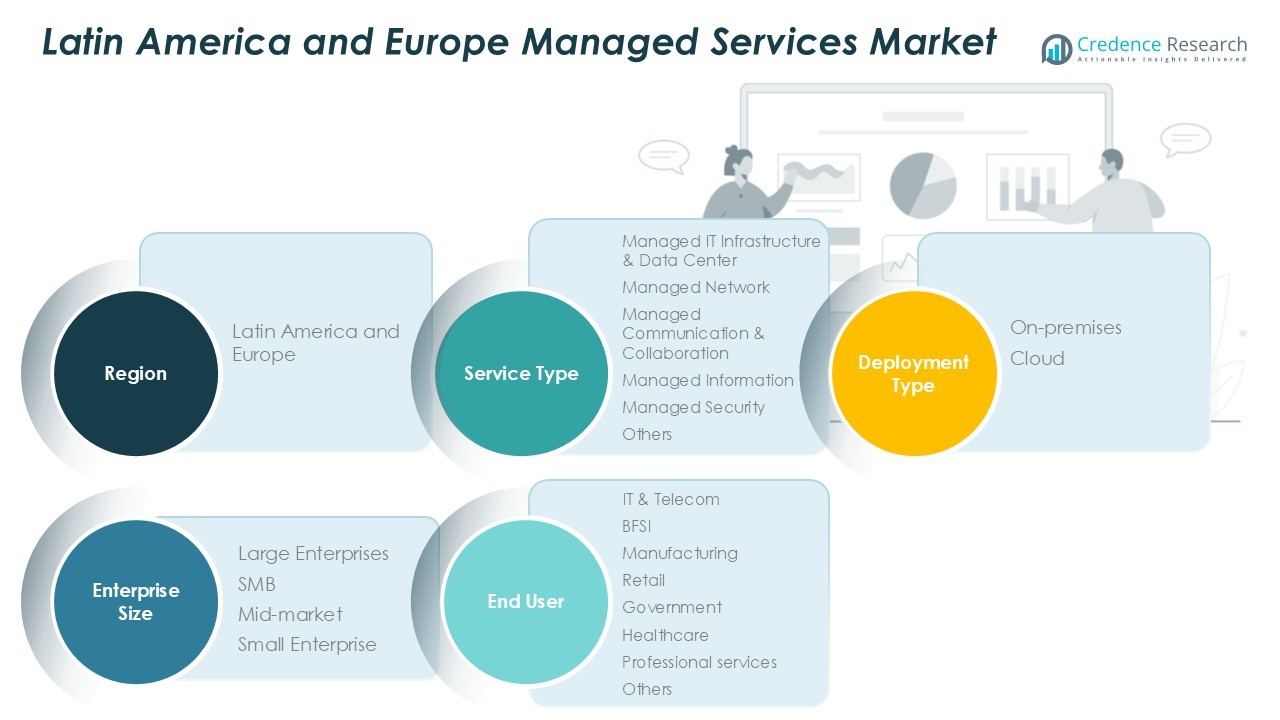

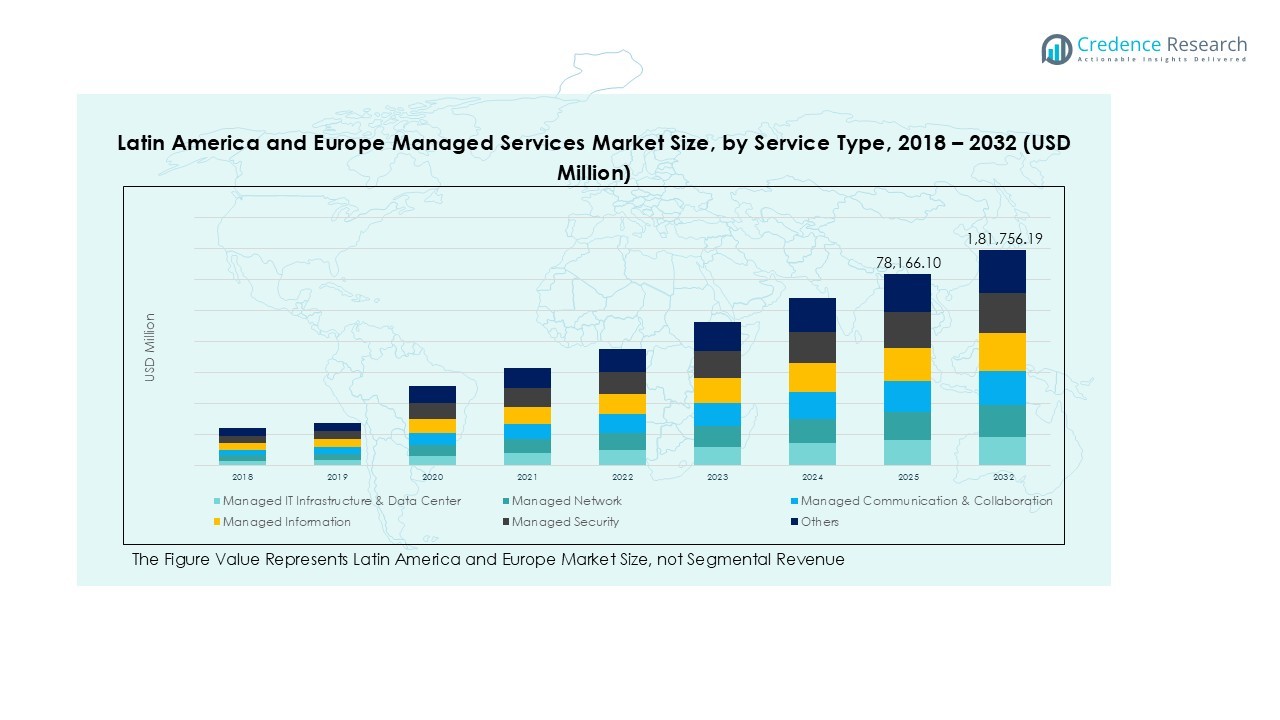

CHAPTER NO. 6 : LATIN AMERICA AND EUROPE MANAGED SERVICES MARKET – BY SERVICE TYPE SEGMENT ANALYSIS 45

6.1. Latin America and Europe Managed Services Market Overview, by Service Type Segment 45

6.1.1. Latin America and Europe Managed Services Market Revenue Share, By Service Type, 2024 & 2035 46

6.1.2. Latin America and Europe Managed Services Market Attractiveness Analysis, By Service Type 47

6.1.3. Incremental Revenue Growth Opportunity, by Service Type, 2025 – 2035 47

6.1.4. Latin America and Europe Managed Services Market Revenue, By Service Type, 2018, 2023, 2027 & 2032 48

6.2. Managed IT Infrastructure & Data Center 49

6.3. Managed Network 50

6.4. Managed Communication & Collaboration 51

6.5. Managed Information 52

6.6. Managed Security 53

6.7. Others 54

CHAPTER NO. 7 : LATIN AMERICA AND EUROPE MANAGED SERVICES MARKET – BY DEPLOYMENT TYPE SEGMENT ANALYSIS 55

7.1. Latin America and Europe Managed Services Market Overview, by Deployment Type Segment 55

7.1.1. Latin America and Europe Managed Services Market Revenue Share, By Deployment Type, 2024 & 2035 56

7.1.2. Latin America and Europe Managed Services Market Attractiveness Analysis, By Deployment Type 57

7.1.3. Incremental Revenue Growth Opportunity, by Deployment Type, 2025 – 2035 57

7.1.4. Latin America and Europe Managed Services Market Revenue, By Deployment Type, 2018, 2023, 2027 & 2032 58

7.2. On-premises 59

7.3. Cloud 60

CHAPTER NO. 8 : LATIN AMERICA AND EUROPE MANAGED SERVICES MARKET – BY ENTERPRISE SIZE SEGMENT ANALYSIS 61

8.1. Latin America and Europe Managed Services Market Overview, by Enterprise Size Segment 61

8.1.1. Latin America and Europe Managed Services Market Revenue Share, By End-user, 2024 & 2035 62

8.1.2. Latin America and Europe Managed Services Market Attractiveness Analysis, By End-user 63

8.1.3. Incremental Revenue Growth Opportunity, by End-user, 2025 – 2035 63

8.1.4. Latin America and Europe Managed Services Market Revenue, By End-user, 2018, 2023, 2027 & 2032 64

8.2. Large Enterprises 65

8.3. SMB 66

8.4. Mid-market 67

8.5. Small Enterprise 68

CHAPTER NO. 9 : LATIN AMERICA AND EUROPE MANAGED SERVICES MARKET – BY END USER SEGMENT ANALYSIS 69

9.1. Latin America and Europe Managed Services Market Overview, by End User Segment 69

9.1.1. Latin America and Europe Managed Services Market Revenue Share, By End User, 2024 & 2035 70

9.1.2. Latin America and Europe Managed Services Market Attractiveness Analysis, By End User 71

9.1.3. Incremental Revenue Growth Opportunity, by End User, 2025 – 2035 71

9.1.4. Latin America and Europe Managed Services Market Revenue, By End User, 2018, 2023, 2027 & 2032 72

9.2. IT & Telecom 73

9.3. BFSI 74

9.4. Manufacturing 75

9.5. Retail 76

9.6. Government 77

9.7. Healthcare 78

9.8. Professional services 79

9.9. Others 80

CHAPTER NO. 10 : LATIN AMERICA MANAGED SERVICES MARKET – LATIN AMERICA 81

10.1. Latin America 81

10.1.1. Key Highlights 81

10.1.2. Latin America Managed Services Market Revenue, By Country, 2018 – 2023 (USD Million) 82

10.2. Service Type 83

10.2.1. Latin America Managed Services Market Revenue, By Service Type, 2018 – 2025 (USD Million) 83

10.2.2. Latin America Managed Services Market Revenue, By Service Type, 2026 – 2035 (USD Million) 84

10.3. Deployment Type 85

10.3.1. Latin America Managed Services Market Revenue, By Deployment Type, 2018 – 2025 (USD Million) 85

10.3.2. Latin America Managed Services Market Revenue, By Deployment Type, 2026 – 2035 (USD Million) 85

10.4. Enterprise Size 86

10.4.1. Latin America Managed Services Market Revenue, By Enterprise Size, 2018 – 2025 (USD Million) 86

10.4.2. Latin America Managed Services Market Revenue, By Enterprise Size, 2026 – 2035 (USD Million) 86

10.5. End User 87

10.5.1. Latin America Managed Services Market Revenue, By End User, 2018 – 2025 (USD Million) 87

10.5.2. Latin America Managed Services Market Revenue, By End User, 2026 – 2035 (USD Million) 87

CHAPTER NO. 11 : EUROPE MANAGED SERVICES MARKET – EUROPE 88

11.1. Europe 88

11.1.1. Key Highlights 88

11.1.2. Europe Managed Services Market Revenue, By Country, 2018 – 2023 (USD Million) 89

11.2. Service Type 90

11.2.1. Europe Managed Services Market Revenue, By Service Type, 2018 – 2025 (USD Million) 90

11.2.2. Europe Managed Services Market Revenue, By Service Type, 2026 – 2035 (USD Million) 91

11.3. Deployment Type 92

11.3.1. Europe Managed Services Market Revenue, By Deployment Type, 2018 – 2025 (USD Million) 92

11.3.2. Europe Managed Services Market Revenue, By Deployment Type, 2026 – 2035 (USD Million) 92

11.4. Enterprise Size 93

11.4.1. Europe Managed Services Market Revenue, By Enterprise Size, 2018 – 2025 (USD Million) 93

11.4.2. Europe Managed Services Market Revenue, By Enterprise Size, 2026 – 2035 (USD Million) 93

11.5. End User 94

11.5.1. Europe Managed Services Market Revenue, By End User, 2018 – 2025 (USD Million) 94

11.5.2. Europe Managed Services Market Revenue, By End User, 2026 – 2035 (USD Million) 94

CHAPTER NO. 12 : COMPANY PROFILES 95

12.1. Accenture PLC 95

12.1.1. Company Overview 95

12.1.2. Product Portfolio 95

12.1.3. Swot Analysis 95

12.2. Business Strategy 96

12.3. Financial Overview 96

• Mexico 97

12.4. Accenture PLC 97

12.5. Cisco Systems Inc. 97

12.6. IBM Corporation 97

12.7. HCL Technologies 97

12.8. Fujitsu Ltd. 97

12.9. DXC Technology 97

12.10. Telefonaktiebolaget L M Ericsson 97

• Uruguay 97

12.11. Netgate 97

12.12. Antel 97

12.13. Tilsor 97

12.14. Arnaldo C. Castro S.A. 97

12.15. Stealth Agents 97

12.16. Tata Consultancy Services (TCS) Uruguay 97

12.17. Globant 97

• Argentina 97

12.18. Globant 97

12.19. Mercado Libre 97

12.20. Tata Consultancy Services (TCS) Argentina 97

12.21. Accenture Argentina 97

12.22. IBM Argentina 97

12.23. MercadoPago 97

12.24. Baufest 97

• Chile 97

12.25. Sonda 97

12.26. Adexus 97

12.27. IBM Chile 97

12.28. Entel 97

12.29. TIVIT Chile 97

12.30. Softys 97

12.31. Everis Chile 97

• Colombia 97

12.32. Sonda Colombia 97

12.33. TIVIT Colombia 97

12.34. IBM Colombia 98

12.35. Globant Colombia 98

12.36. Emblue 98

12.37. Eficiencia IT 98

12.38. BairesDev Colombia 98

• Spain 98

12.39. Indra Sistemas 98

12.40. Atos Spain 98

12.41. Everis (NTT DATA) 98

12.42. Telefonica 98

12.43. Deloitte Spain 98

12.44. Accenture Spain 98

12.45. Sopra Steria Spain 98

• Portugal 98

12.46. Novabase 98

12.47. Critical Software 98

12.48. OutSystems 98

12.49. Altran Portugal (Capgemini) 98

12.50. Noesis 98

12.51. Accenture Portugal 98

12.52. Everis Portugal 98

List of Figures

FIG NO. 1. Latin America and Europe Managed Services Market Revenue, 2018 – 2035 (USD Million) 24

FIG NO. 2. Porter’s Five Forces Analysis for Latin America and Europe Managed Services Market 30

FIG NO. 3. Company Share Analysis, 2024 31

FIG NO. 4. Company Share Analysis, 2024 32

FIG NO. 5. Mexico Managed Services Market – Company Revenue Market Share, 2024 33

FIG NO. 6. Uruguay Managed Services Market – Company Revenue Market Share, 2024 34

FIG NO. 7. Argentina Managed Services Market – Company Revenue Market Share, 2024 35

FIG NO. 8. Chile Managed Services Market – Company Revenue Market Share, 2024 36

FIG NO. 9. Colombia Managed Services Market – Company Revenue Market Share, 2024 37

FIG NO. 10. Spain Managed Services Market – Company Revenue Market Share, 2024 38

FIG NO. 11. Portugal Managed Services Market – Company Revenue Market Share, 2024 39

FIG NO. 12. Latin America and Europe Managed Services Market Revenue Share, By Service Type, 2024 & 2035 46

FIG NO. 13. Market Attractiveness Analysis, By Service Type 47

FIG NO. 14. Incremental Revenue Growth Opportunity by Service Type, 2025 – 2035 47

FIG NO. 15. Latin America and Europe Managed Services Market Revenue, By Service Type, 2018, 2023, 2027 & 2032 48

FIG NO. 16. Latin America and Europe Managed Services Market for Managed IT Infrastructure & Data Center, Revenue (USD Million) 2018 – 2035 49

FIG NO. 17. Latin America and Europe Managed Services Market for Managed Network, Revenue (USD Million) 2018 – 2035 50

FIG NO. 18. Latin America and Europe Managed Services Market for Managed Communication & Collaboration, Revenue (USD Million) 2018 – 2035 51

FIG NO. 19. Latin America and Europe Managed Services Market for Managed Information, Revenue (USD Million) 2018 – 2035 52

FIG NO. 20. Latin America and Europe Managed Services Market for Managed Security, Revenue (USD Million) 2018 – 2035 53

FIG NO. 21. Latin America and Europe Managed Services Market for Others, Revenue (USD Million) 2018 – 2035 54

FIG NO. 22. Latin America and Europe Managed Services Market Revenue Share, By Deployment Type, 2024 & 2035 56

FIG NO. 23. Market Attractiveness Analysis, By Deployment Type 57

FIG NO. 24. Incremental Revenue Growth Opportunity by Deployment Type, 2025 – 2035 57

FIG NO. 25. Latin America and Europe Managed Services Market Revenue, By Deployment Type, 2018, 2023, 2027 & 2032 58

FIG NO. 26. Latin America and Europe Managed Services Market for On-premises, Revenue (USD Million) 2018 – 2035 59

FIG NO. 27. Latin America and Europe Managed Services Market for Cloud, Revenue (USD Million) 2018 – 2035 60

FIG NO. 28. Latin America and Europe Managed Services Market Revenue Share, By End-user, 2024 & 2035 62

FIG NO. 29. Market Attractiveness Analysis, By End-user 63

FIG NO. 30. Incremental Revenue Growth Opportunity by End-user, 2025 – 2035 63

FIG NO. 31. Latin America and Europe Managed Services Market Revenue, By End-user, 2018, 2023, 2027 & 2032 64

FIG NO. 32. Latin America and Europe Managed Services Market for Large Enterprises, Revenue (USD Million) 2018 – 2035 65

FIG NO. 33. Latin America and Europe Managed Services Market for SMB, Revenue (USD Million) 2018 – 2035 66

FIG NO. 34. Latin America and Europe Managed Services Market for Mid-market, Revenue (USD Million) 2018 – 2035 67

FIG NO. 35. Latin America and Europe Managed Services Market for Small Enterprise, Revenue (USD Million) 2018 – 2035 68

FIG NO. 36. Latin America and Europe Managed Services Market Revenue Share, By End User, 2024 & 2035 70

FIG NO. 37. Market Attractiveness Analysis, By End User 71

FIG NO. 38. Incremental Revenue Growth Opportunity by End User, 2025 – 2035 71

FIG NO. 39. Latin America and Europe Managed Services Market Revenue, By End User, 2018, 2023, 2027 & 2032 72

FIG NO. 40. Latin America and Europe Managed Services Market for IT & Telecom, Revenue (USD Million) 2018 – 2035 73

FIG NO. 41. Latin America and Europe Managed Services Market for BFSI, Revenue (USD Million) 2018 – 2035 74

FIG NO. 42. Latin America and Europe Managed Services Market for Manufacturing, Revenue (USD Million) 2018 – 2035 75

FIG NO. 43. Latin America and Europe Managed Services Market for Retail, Revenue (USD Million) 2018 – 2035 76

FIG NO. 44. Latin America and Europe Managed Services Market for Government, Revenue (USD Million) 2018 – 2035 77

FIG NO. 45. Latin America and Europe Managed Services Market for Healthcare, Revenue (USD Million) 2018 – 2035 78

FIG NO. 46. Latin America and Europe Managed Services Market for Professional services, Revenue (USD Million) 2018 – 2035 79

FIG NO. 47. Latin America and Europe Managed Services Market for Others, Revenue (USD Million) 2018 – 2035 80

FIG NO. 48. Latin America Managed Services Market Revenue, 2018 – 2032 (USD Million) 81

FIG NO. 49. Europe Managed Services Market Revenue, 2018 – 2032 (USD Million) 88

List of Tables

TABLE NO. 1. : Latin America and Europe Managed Services Market: Snapshot 23

TABLE NO. 2. : Drivers for the Latin America and Europe Managed Services Market: Impact Analysis 26

TABLE NO. 3. : Restraints for the Latin America and Europe Managed Services Market: Impact Analysis 28

TABLE NO. 4. : Latin America Managed Services Market Revenue, By Country, 2018 – 2023 (USD Million) 82

TABLE NO. 5. : Latin America Managed Services Market Revenue, By Country, 2024 – 2032 (USD Million) 82

TABLE NO. 6. : Latin America Managed Services Market Revenue, By Service Type, 2018 – 2025 (USD Million) 83

TABLE NO. 7. : Latin America Managed Services Market Revenue, By Service Type, 2026 – 2035 (USD Million) 84

TABLE NO. 8. : Latin America Managed Services Market Revenue, By Deployment Type, 2018 – 2025 (USD Million) 85

TABLE NO. 9. : Latin America Managed Services Market Revenue, By Deployment Type, 2026 – 2035 (USD Million) 85

TABLE NO. 10. : Latin America Managed Services Market Revenue, By Enterprise Size, 2018 – 2025 (USD Million) 86

TABLE NO. 11. : Latin America Managed Services Market Revenue, By Enterprise Size, 2025 – 2035 (USD Million) 86

TABLE NO. 12. : Latin America Managed Services Market Revenue, By End User, 2018 – 2025 (USD Million) 87

TABLE NO. 13. : Latin America Managed Services Market Revenue, By End User, 2025 – 2035 (USD Million) 87

TABLE NO. 14. : Europe Managed Services Market Revenue, By Country, 2018 – 2023 (USD Million) 89

TABLE NO. 15. : Europe Managed Services Market Revenue, By Country, 2024 – 2032 (USD Million) 89

TABLE NO. 16. : Europe Managed Services Market Revenue, By Service Type, 2018 – 2025 (USD Million) 90

TABLE NO. 17. : Europe Managed Services Market Revenue, By Service Type, 2026 – 2035 (USD Million) 91

TABLE NO. 18. : Europe Managed Services Market Revenue, By Deployment Type, 2018 – 2025 (USD Million) 92

TABLE NO. 19. : Europe Managed Services Market Revenue, By Deployment Type, 2026 – 2035 (USD Million) 92

TABLE NO. 20. : Europe Managed Services Market Revenue, By Enterprise Size, 2018 – 2025 (USD Million) 93

TABLE NO. 21. : Europe Managed Services Market Revenue, By Enterprise Size, 2025 – 2035 (USD Million) 93

TABLE NO. 22. : Europe Managed Services Market Revenue, By End User, 2018 – 2025 (USD Million) 94

TABLE NO. 23. : Europe Managed Services Market Revenue, By End User, 2025 – 2035 (USD Million) 94