Market overview

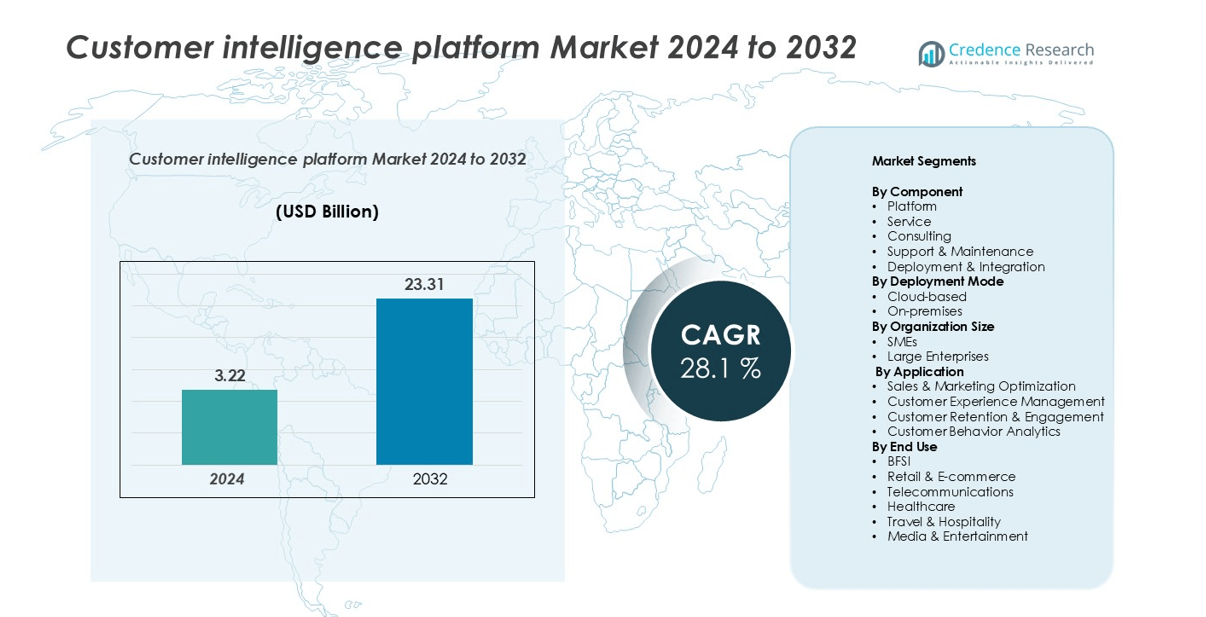

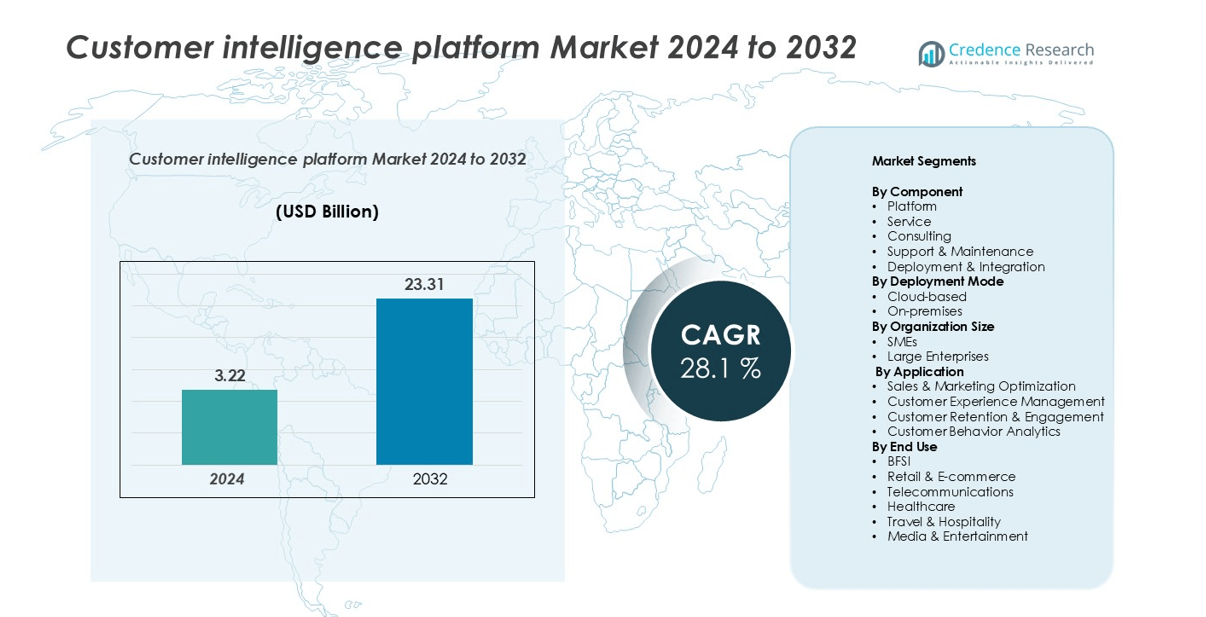

Customer intelligence platform market size was valued at USD 3.22 billion in 2024 and is anticipated to reach USD 23.31 billion by 2032, at a CAGR of 28.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Customer Intelligence Platform Market Size 2024 |

USD 3.22 billion |

| Customer Intelligence Platform Market, CAGR |

28.1% |

| Customer Intelligence Platform Market Size 2032 |

USD 23.31 billion |

The customer intelligence platform market is led by major players such as Salesforce, IBM, Adobe, SAP, Microsoft, Teradata, Oracle, Epsilon, SAS Institute, and Tealium, each offering advanced analytics and AI-driven solutions for data integration, customer engagement, and predictive insights. Salesforce and Adobe dominate with their robust cloud-based marketing and experience platforms, while IBM and Oracle leverage strong AI and data management capabilities. Microsoft and SAP focus on enterprise-grade integrations and scalable analytics ecosystems. Geographically, North America leads the market with an estimated 38% share in 2024, driven by high digital adoption and strong technology infrastructure, followed by Europe (26%) and Asia Pacific (24%), which are witnessing rapid adoption of AI-enabled customer analytics across key industries.

Market Insights

- The global customer intelligence platform market was valued at USD 3.22 billion in 2024 and is projected to reach USD 23.31 billion by 2032, growing at a CAGR of 28.1% during the forecast period.

- Growth is primarily driven by the rising demand for personalized customer experiences, integration of AI and machine learning, and increased focus on data-driven marketing strategies across industries.

- Key market trends include the rapid adoption of cloud-based deployment models, expansion of predictive analytics, and emphasis on ethical data use and compliance with global privacy regulations.

- The market is highly competitive, with major players such as Salesforce, IBM, Adobe, SAP, Microsoft, Oracle, Teradata, Epsilon, SAS Institute, and Tealium investing in innovation and AI-based analytics capabilities.

- Regionally, North America holds 38% share, followed by Europe (26%) and Asia Pacific (24%); the platform segment dominates the market with around 58% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component:

The platform segment dominated the customer intelligence platform market in 2024, accounting for over 58% of the market share. This dominance is attributed to the growing adoption of integrated analytics solutions that enable real-time data collection, visualization, and predictive modeling. Platforms provide centralized ecosystems for managing multi-channel customer data, empowering organizations to enhance personalization and campaign efficiency. The rising need for automated data processing and AI-driven insights is driving platform demand, while services such as consulting and deployment & integration are expanding steadily to support customized implementations.

- For instance, Salesforce’s Agentforce 360 platform, launched globally in October 2025, has already been adopted by over 12,000 customers, including major companies like Reddit, OpenTable, and Adecco.

By Deployment Mode:

The cloud-based segment held the leading position in 2024, representing approximately 72% of the total market share. The dominance of cloud deployment is driven by its scalability, cost-effectiveness, and ability to facilitate remote data access across global teams. Businesses increasingly prefer cloud-based platforms to leverage advanced analytics, reduce infrastructure costs, and accelerate deployment cycles. Furthermore, the growing adoption of Software-as-a-Service (SaaS) models and integration with AI and machine learning tools has strengthened the growth trajectory of this segment, particularly among mid-sized enterprises seeking flexibility and agility.

- For instance, Amazon Web Services (AWS) supports global businesses by offering flexible computing power, storage, and AI-powered services like AWS SageMaker, accelerating deployment and innovation.

By Organization Size:

The large enterprises segment accounted for around 65% of the market share in 2024, primarily due to the extensive use of customer intelligence solutions for strategic decision-making and multi-channel marketing optimization. Large organizations have vast customer databases that require advanced analytics for behavior prediction, churn reduction, and experience enhancement. They are investing heavily in data infrastructure and AI-driven platforms to gain competitive advantage and improve ROI on marketing initiatives. Meanwhile, SMEs are increasingly adopting customer intelligence tools to streamline operations and enhance customer engagement through cost-efficient, cloud-based solutions.

Key Growth Drivers

Rising Demand for Personalized Customer Experiences

The increasing emphasis on personalized customer engagement is a major growth driver for the customer intelligence platform market. Businesses are leveraging advanced analytics and AI-driven insights to tailor marketing campaigns, product recommendations, and customer interactions. The growing consumer expectation for real-time, personalized experiences across digital channels has led enterprises to invest heavily in predictive and behavioral analytics tools. Platforms that integrate data from CRM, social media, and transaction sources allow companies to anticipate needs and enhance satisfaction levels. This personalization not only improves conversion rates and retention but also drives long-term brand loyalty in competitive markets such as retail, e-commerce, and banking.

- For instance, IBM’s Predictive Customer Intelligence employs advanced algorithms to analyze purchase behavior and social media activity, helping companies like C Spire Wireless tailor service offers and reduce churn by predicting customer needs effectively.

Integration of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) integration are transforming customer intelligence capabilities by automating data analysis and enabling advanced predictive modeling. These technologies empower organizations to uncover hidden patterns in large, unstructured datasets, leading to actionable insights for sales, marketing, and customer service. AI-powered customer intelligence platforms can segment audiences dynamically, predict churn, and optimize engagement strategies with high accuracy. As businesses adopt AI-driven automation to reduce manual effort and enhance data accuracy, the market experiences substantial growth. The integration of natural language processing (NLP) and sentiment analysis further strengthens customer understanding, especially in industries dealing with massive customer interactions, such as telecommunications and BFSI.

- For instance, Salesforce’s Agentforce platform has secured more than 12,000 implementations as of October 2025. Earlier reports from mid-2025 noted over 8,000 deals, with more than 4,000 of them being paid, and 800 customers already in production at that time. Early adopters continue to report significant efficiency gains, such as the travel management company Engine reducing average customer case handling time by 15% and 1-800Accountant achieving a 70% autonomous resolution of administrative chat requests during peak tax season.

Expanding Digital Transformation Across Industries

The accelerating pace of digital transformation across industries is fueling demand for customer intelligence platforms. Companies are increasingly adopting digital channels for marketing, sales, and customer support, generating vast amounts of data that require advanced analysis tools. Customer intelligence platforms help businesses consolidate omnichannel data and derive meaningful insights for performance improvement. The proliferation of IoT devices, mobile apps, and e-commerce platforms enhances the volume and diversity of customer data, driving the need for real-time analytics. As enterprises prioritize data-driven strategies to enhance decision-making and competitive positioning, customer intelligence solutions become integral to achieving business agility and operational efficiency.

Key Trends & Opportunities

Growing Adoption of Cloud-based Intelligence Solutions

Cloud-based deployment is emerging as a key trend and growth opportunity in the customer intelligence platform market. Organizations are shifting toward cloud-based models to gain scalability, flexibility, and cost efficiency while eliminating the need for extensive on-premises infrastructure. The cloud enables seamless integration with CRM systems, marketing automation tools, and AI applications, ensuring real-time access to insights across teams and regions. Moreover, Software-as-a-Service (SaaS) models allow small and medium enterprises to access advanced analytics capabilities at affordable costs. The increasing availability of secure cloud environments and compliance frameworks further enhances adoption across sectors such as retail, BFSI, and healthcare.

- For instance, Salesforce’s Data Cloud processed more than 2 quadrillion records per quarter, with 2.3 quadrillion records processed in the second quarter of fiscal year 2025 (ending July 31, 2024). A September 2024 press release announced this figure, along with a 130% year-over-year growth in the number of paid Data Cloud customers.

Increasing Emphasis on Data Privacy and Ethical Intelligence

As customer data becomes the foundation of business intelligence, the focus on ethical data use and privacy protection is intensifying. Companies are prioritizing compliance with global data protection regulations, such as GDPR and CCPA, to build consumer trust and avoid legal risks. This trend is creating opportunities for vendors offering platforms with built-in data governance, consent management, and anonymization features. Moreover, ethical AI frameworks are being integrated to ensure unbiased insights and transparent decision-making. Vendors emphasizing secure, transparent, and compliant data practices are likely to gain a competitive advantage in this evolving regulatory landscape.

- For instance, Google AI and DeepMind follow strict ethical guidelines, emphasizing fairness, transparency, and safety in their development processes. They focus on creating diverse datasets to address bias and ensure equitable AI systems.

Key Challenges

Data Integration Complexity Across Diverse Sources

One of the major challenges in the customer intelligence platform market is integrating data from diverse and fragmented sources. Businesses collect information from multiple channels—social media, CRM, web analytics, and IoT devices—making it difficult to unify and standardize datasets for analysis. Disparate systems often result in data silos, reducing the accuracy and timeliness of insights. Additionally, inconsistent data formats and poor quality limit the effectiveness of advanced analytics models. Organizations must invest in robust data integration frameworks and governance tools to overcome this barrier, but such implementations can be resource-intensive and technically demanding.

High Implementation Costs and Technical Expertise Requirements

Despite the benefits, the high cost of implementation and the need for skilled professionals remain significant barriers to adoption. Deploying customer intelligence platforms involves substantial investments in infrastructure, software licensing, and customization. Smaller enterprises, in particular, face financial and technical constraints in leveraging advanced analytics solutions. Moreover, the shortage of skilled data scientists and analysts limits the ability of organizations to extract actionable insights from complex datasets. As a result, businesses often struggle to realize the full potential of these platforms. Vendors are addressing this challenge by introducing low-code analytics tools and managed service offerings to improve accessibility.

Regional Analysis

North America:

North America dominated the customer intelligence platform market in 2024, accounting for 38% of the global share. The region’s leadership stems from strong technology infrastructure, widespread cloud adoption, and early integration of AI and analytics across industries such as BFSI, retail, and telecommunications. Major players, including Salesforce, Oracle, and Adobe, drive innovation through advanced data-driven marketing and customer engagement tools. Increasing investment in digital transformation and customer experience optimization further boosts market growth. The U.S. remains the primary contributor, supported by high enterprise spending on AI-powered customer analytics solutions.

Europe:

Europe held a significant 26% market share in 2024, supported by robust regulatory frameworks, particularly GDPR, which promotes responsible data collection and transparency. Countries such as the U.K., Germany, and France are leading adopters of customer intelligence platforms to enhance customer experience and ensure data compliance. European enterprises are focusing on predictive analytics and omnichannel engagement to strengthen customer loyalty. The growing presence of cloud-based analytics providers and partnerships with AI startups also support market expansion. Demand from industries such as retail, banking, and automotive continues to reinforce Europe’s market position.

Asia Pacific:

The Asia Pacific region captured 24% of the customer intelligence platform market share in 2024 and is projected to witness the fastest growth during the forecast period. Rapid digitalization, rising internet penetration, and the expansion of e-commerce and fintech sectors are driving adoption. Countries such as China, India, Japan, and South Korea are investing in AI, machine learning, and customer analytics tools to enhance competitiveness. SMEs in the region are increasingly adopting cloud-based platforms due to cost efficiency and scalability. Government initiatives promoting digital economies further accelerate regional market growth.

Latin America:

Latin America accounted for 7% of the global customer intelligence platform market share in 2024. The region is gradually embracing data-driven customer engagement strategies as businesses in retail, telecommunications, and banking enhance their digital ecosystems. Brazil and Mexico are leading markets, driven by growing investments in AI and marketing analytics. However, limited data infrastructure and technical expertise pose challenges to widespread adoption. The increasing availability of affordable cloud-based solutions and managed services is expected to support steady market growth in the coming years.

Middle East & Africa:

The Middle East & Africa region held 5% of the global market share in 2024, reflecting emerging adoption trends in data analytics and digital transformation initiatives. Countries such as the UAE, Saudi Arabia, and South Africa are investing in AI-driven customer engagement platforms to strengthen business intelligence capabilities. Growth is supported by expanding e-commerce activities, fintech innovation, and smart city initiatives. However, limited awareness and high implementation costs restrict rapid adoption. Ongoing investments in cloud infrastructure and enterprise analytics are expected to gradually enhance market penetration across the region.

Market Segmentations:

By Component

- Platform

- Service

- Consulting

- Support & Maintenance

- Deployment & Integration

By Deployment Mode

By Organization Size

By Application

- Sales & Marketing Optimization

- Customer Experience Management

- Customer Retention & Engagement

- Customer Behavior Analytics

By End Use

- BFSI

- Retail & E-commerce

- Telecommunications

- Healthcare

- Travel & Hospitality

- Media & Entertainment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The customer intelligence platform market is highly competitive, characterized by the presence of global technology leaders and emerging analytics providers offering advanced, AI-driven solutions. Major players such as Salesforce, IBM, Adobe, SAP, Microsoft, Teradata, Oracle, Epsilon, SAS Institute, and Tealium dominate the market through robust product portfolios and strong global distribution networks. These companies focus on continuous innovation, strategic partnerships, and acquisitions to enhance data integration, real-time analytics, and customer experience capabilities. For instance, Salesforce and Adobe emphasize AI and automation to deliver personalized insights, while IBM and Oracle leverage cloud and hybrid analytics platforms for scalability. The competitive landscape is further shaped by the growing adoption of cloud-based SaaS models, enabling smaller vendors to compete by offering flexible, cost-efficient solutions. As demand for predictive analytics and omnichannel intelligence grows, vendors increasingly invest in AI, machine learning, and data governance features to strengthen market positioning and customer retention.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Salesforce

- IBM

- Adobe

- SAP

- Microsoft

- Teradata

- Oracle

- Epsilon

- SAS Institute

- Tealium

Recent Developments

- In June 2024, Quantexa, a prominent player in Decision Intelligence (DI) solutions, announced a partnership with Databricks, the data and AI company. This collaboration enables customers to deploy Quantexa’s decision intelligence platform and various solutions, including customer intelligence and into their databricks environment, enhancing their data analytics and decision-making capabilities.

- In January 2024, M2P Fintech acquired Goals101, a data analytics and intelligence platform, to bring a high degree of personalization to its digital banking products. This acquisition highlights the growing importance of customer intelligence in the fintech sector and the broader digital economy in the region.

- In May 2024, iManage, an AI-powered knowledge work platform provider and vLex, a legal intelligence platform company announced a strategic partnership to integrate their platforms. This collaboration aimed at enhancing access to comprehensive legal insights, streamlining legal research and workflow for users.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Organization Size, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The customer intelligence platform market will continue expanding with increasing enterprise adoption of AI-driven analytics solutions.

- Demand for real-time customer insights will rise as businesses focus on enhancing personalization and engagement.

- Cloud-based deployment models will remain the preferred choice due to scalability and cost efficiency.

- Integration of machine learning and predictive analytics will drive deeper understanding of customer behavior.

- SMEs will increasingly adopt affordable SaaS-based intelligence platforms to improve competitiveness.

- Data privacy and compliance solutions will become essential components of customer intelligence strategies.

- Partnerships between analytics providers and CRM vendors will strengthen ecosystem connectivity.

- Growth in omnichannel marketing will boost the need for unified customer data platforms.

- Asia Pacific will emerge as the fastest-growing region driven by digital transformation and e-commerce expansion.

- Continuous innovation in automation and AI-driven decision-making will redefine customer experience management globally.