Market overview

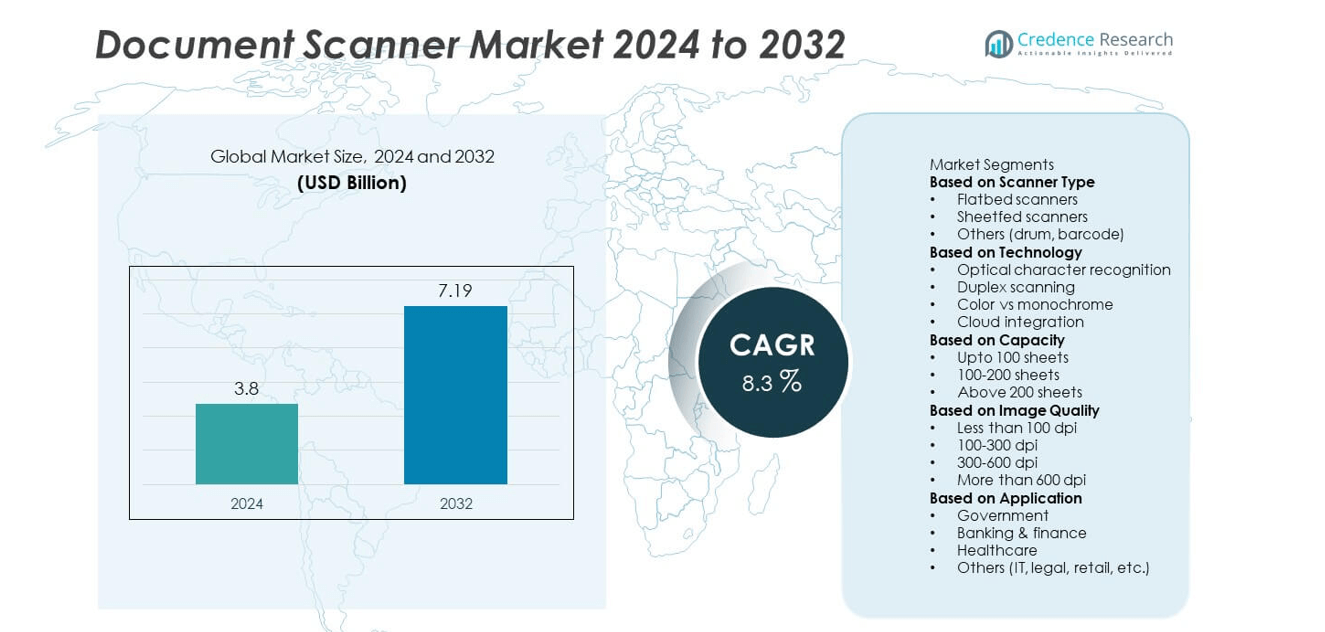

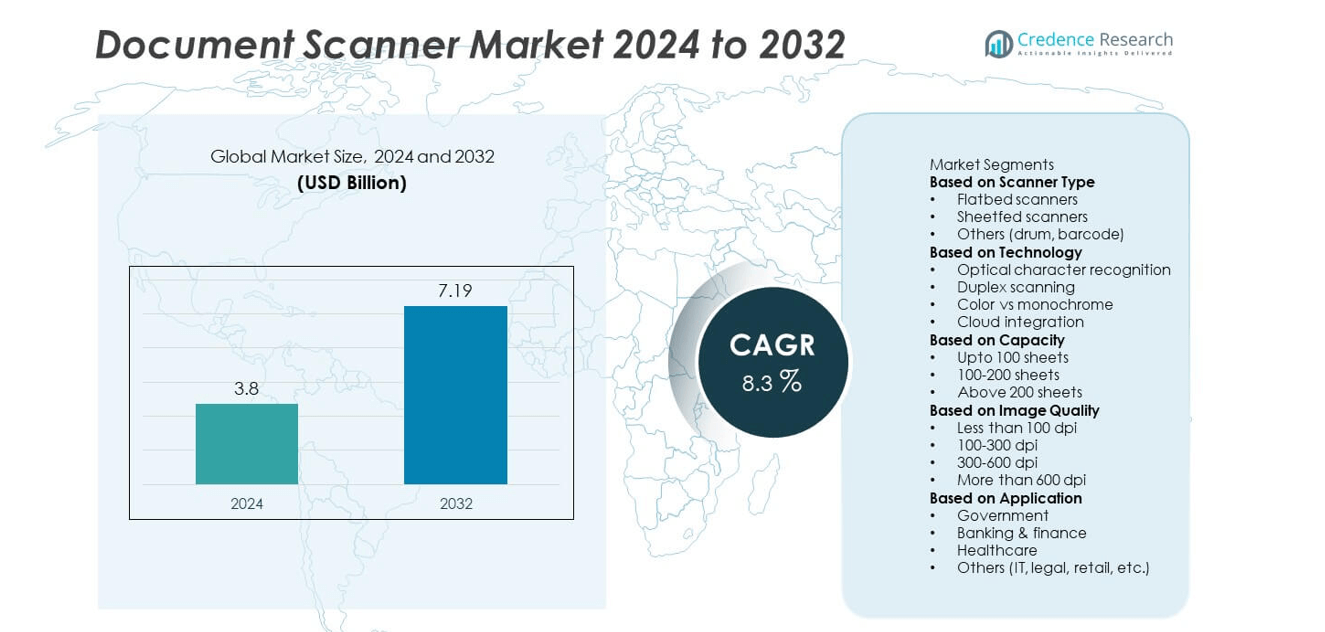

The document scanner market was valued at USD 3.8 billion in 2024 and is projected to reach USD 7.19 billion by 2032, growing at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Document Scanner Market Size 2024 |

USD 3.8 billion |

| Document Scanner Market, CAGR |

8.3% |

| Document Scanner Market Size 2032 |

USD 7.19 billion |

The document scanner market is led by major players including Panasonic, Fujitsu, IRIS, Brother Industries, Ambir Technology, Canon, Kodak Alaris, HP, Avision, and Contex. These companies dominate through continuous innovation in high-speed, duplex, and cloud-integrated scanning technologies. North America leads the global market with a 38% share, driven by strong digital adoption across corporate, government, and financial institutions. Europe follows with a 27% share, supported by data compliance regulations and demand for workflow automation. Asia-Pacific holds a 24% share, fueled by rapid digital transformation in enterprises, expanding IT infrastructure, and increasing deployment of affordable, mobile scanning solutions.

Market Insights

- The document scanner market was valued at USD 3.8 billion in 2024 and is projected to reach USD 7.19 billion by 2032, growing at a CAGR of 8.3% during the forecast period.

- Rising demand for digital transformation and paperless workflows in enterprises, government, and BFSI sectors is driving market expansion globally.

- Growing adoption of AI-powered OCR, duplex scanning, and cloud-integrated document management systems is shaping market trends.

- Key players such as Panasonic, Fujitsu, Canon, and HP focus on high-speed, energy-efficient, and wireless scanners to enhance competitiveness.

- North America holds a 38% share, followed by Europe at 27% and Asia-Pacific at 24%, while sheetfed scanners lead with 52% share, supported by strong adoption in corporate and administrative applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Scanner Type

The sheetfed scanners segment dominated the document scanner market in 2024 with a 52% share. Its leadership is driven by high-speed scanning capability and suitability for bulk document processing. Businesses in banking, government, and corporate sectors prefer sheetfed scanners for handling large volumes of paperwork efficiently. Their compact design and automated document feeder (ADF) support improved productivity and digitization workflows. Increasing demand for remote scanning and document management systems in hybrid offices also strengthens adoption. Continuous product innovations with duplex and network connectivity features further enhance this segment’s competitiveness.

- For instance, Fujitsu introduced the fi-8190 sheetfed scanner, capable of scanning 90 pages per minute with a daily duty cycle of 13,000 sheets. The scanner integrates a 100-sheet ADF and uses Clear Image Capture technology for enhanced precision at 600 dpi. Its advanced paper protection and multi-feed detection sensors reduce misfeeds and support uninterrupted bulk scanning in high-volume environments.

By Technology

The optical character recognition (OCR) segment held the largest market share of 41% in 2024, owing to its crucial role in data extraction and digital archiving. OCR technology converts printed text into editable digital formats, enhancing searchability and storage efficiency. Growing implementation in BFSI, healthcare, and legal sectors drives its dominance. The integration of AI and machine learning has improved text recognition accuracy across multiple languages. Additionally, the rise of intelligent document processing (IDP) solutions combining OCR with cloud-based analytics is further accelerating adoption in enterprise document management systems.

- For instance, Canon’s OCR engine is integrated with the DR-G2140 production scanner, allowing text recognition in multiple languages. The scanner delivers processing speeds of up to 140 pages per minute (or 290 images per minute when scanning both sides).

By Capacity

The 100–200 sheets segment led the document scanner market in 2024 with a 46% share, supported by rising demand in mid- to large-sized enterprises. This capacity range balances speed, durability, and efficiency, making it ideal for daily business operations and departmental use. Organizations processing invoices, legal records, and HR documents prefer these models for high throughput and consistent performance. Advancements in automatic feeding mechanisms and double-feed detection enhance reliability. Vendors are increasingly offering network-compatible and energy-efficient designs, making mid-capacity scanners a preferred choice for institutions seeking cost-effective, high-performance scanning solutions.

Key Growth Drivers

Rising Adoption of Digital Transformation Initiatives

The growing shift toward paperless operations across enterprises and government organizations is driving the document scanner market. Businesses are investing in advanced scanning solutions to streamline workflows and comply with data management regulations. The integration of scanners with digital document management systems enables secure storage and quick retrieval of information. This trend is particularly strong in sectors such as banking, healthcare, and education, where rapid digitization reduces administrative workload and enhances efficiency. Increasing cloud-based document processing further accelerates this adoption.

- For instance, Brother Industries introduced the ADS-4900W scanner equipped with built-in Wi-Fi, Ethernet, and cloud integration supporting direct uploads to platforms like Google Drive, OneDrive, and SharePoint.

Growing Demand for High-Speed and Automated Scanning Solutions

The need for faster, more accurate document processing is fueling demand for automated scanning systems. Modern sheetfed and duplex scanners enable bulk scanning with minimal manual intervention, improving productivity in large organizations. Enterprises are deploying high-speed scanners for handling thousands of pages daily, particularly in insurance and logistics sectors. The addition of features like automatic document feeders, duplex scanning, and real-time error correction enhances operational efficiency. Vendors are also introducing compact, network-enabled models to support remote and decentralized work environments.

- For instance, Kodak Alaris launched the S5180 scanner featuring throughput speeds of 180 pages per minute and an unlimited daily duty cycle. The system integrates an ultrasonic multi-feed detection sensor and dual-light LED imaging technology for real-time quality control.

Expansion of Cloud and AI-Integrated Scanning Platforms

The increasing adoption of AI and cloud computing is transforming document scanning into an intelligent, connected process. AI-powered OCR and machine learning algorithms enhance data extraction accuracy and automate content classification. Cloud integration allows instant access and sharing of scanned documents across devices, supporting collaboration and compliance. Companies are leveraging these technologies to streamline document workflows and reduce storage costs. The growing demand for intelligent document processing (IDP) platforms and mobile scanning applications is further expanding the market’s growth potential across industries.

Key Trends and Opportunities

Integration of Mobile and Wireless Scanning Solutions

Mobile and wireless scanners are gaining traction as organizations embrace hybrid and remote work models. Compact scanners with Wi-Fi and Bluetooth connectivity offer flexibility for on-the-go document digitization. This trend is particularly notable in small businesses, field services, and retail environments. Manufacturers are introducing app-based control and cloud-syncing capabilities, allowing users to scan and store data directly from smartphones or tablets. The demand for mobility and convenience continues to shape innovation in portable and network-enabled document scanning solutions.

- For instance, HP developed the ScanJet Pro 2600 f1 model, a scanner featuring USB connectivity and a 60-sheet automatic document feeder. The scanner offers up to 1200 dpi resolution on the flatbed and processes up to 25 pages per minute. It does not have wireless connectivity.

Emergence of Intelligent Document Processing (IDP)

The evolution of document scanning toward intelligent document processing represents a key opportunity for market players. IDP combines AI, OCR, and automation to transform unstructured documents into actionable data. This technology enhances workflow automation, compliance management, and analytics. Enterprises are increasingly adopting IDP to handle large volumes of invoices, contracts, and forms efficiently. As data-driven decision-making becomes central to operations, the adoption of intelligent, cloud-linked scanning solutions is expected to expand significantly across finance, healthcare, and government sectors.

- For instance, Canon’s imageFORMULA DR-G2110 production scanner is capable of high-speed duplex scanning at up to 240 images per minute. This scanner can be integrated with various capture software, including IRIS OCR, for extracting and classifying data from documents.

Key Challenges

High Initial Investment and Maintenance Costs

Despite technological progress, the high cost of advanced scanning systems remains a major challenge, especially for small and medium enterprises. High-speed scanners with AI and cloud integration require substantial upfront investment and periodic maintenance. Licensing costs for OCR and workflow software add to operational expenses. Limited budgets in emerging markets hinder large-scale adoption. To overcome this, manufacturers are focusing on developing affordable models with scalable features that cater to cost-sensitive users while maintaining performance and reliability.

Data Security and Compliance Concerns

Data security is a growing challenge as document scanners increasingly connect to cloud networks and enterprise systems. Improperly secured scanners can expose sensitive information to cyber threats and unauthorized access. Compliance with data protection regulations such as GDPR and HIPAA requires advanced encryption and access control measures. Organizations must ensure secure data transmission and storage to maintain privacy. Vendors are responding with integrated cybersecurity features, but persistent threats and evolving compliance standards continue to demand continuous innovation in secure scanning technologies.

Regional Analysis

North America

North America dominated the document scanner market in 2024 with a 38% share, driven by strong digital transformation initiatives across enterprises and government sectors. The U.S. leads the region due to widespread adoption of automated document management systems in banking, healthcare, and legal industries. Increased demand for cloud-based scanning and secure data archiving solutions further supports growth. Major manufacturers are introducing AI-powered and network-enabled scanners to meet enterprise needs. The region’s emphasis on paperless operations and regulatory compliance continues to propel innovation and large-scale implementation of document scanning technologies.

Europe

Europe held a 27% share of the document scanner market in 2024, supported by growing digital infrastructure and strong compliance frameworks. Countries such as Germany, the U.K., and France are leading adopters due to strict data retention and security laws. Businesses are investing in high-speed and duplex scanners for efficient document digitization in finance and public administration. The European Union’s paperless office initiatives are accelerating the shift toward automated scanning and OCR solutions. Continued integration of AI-based analytics and sustainability-focused digitization programs are enhancing the region’s position in the global market.

Asia-Pacific

Asia-Pacific accounted for a 24% share of the global document scanner market in 2024, fueled by rapid digitization across government, education, and corporate sectors. China, Japan, and India are driving demand through growing adoption of cloud-based document management and workflow automation. Increasing small and medium enterprise (SME) digitalization and expanding IT infrastructure are further supporting regional growth. Affordable scanner options and mobile scanning applications are gaining popularity among businesses. The region’s strong manufacturing base and rising focus on e-governance are positioning Asia-Pacific as one of the fastest-growing markets for document scanning solutions.

Latin America

Latin America captured a 6% share of the document scanner market in 2024, driven by increasing adoption of digital record-keeping in the financial and public sectors. Brazil and Mexico are leading markets, supported by government-led initiatives for digital transformation and regulatory documentation. Growing use of OCR and cloud-based scanning in small businesses is also fueling adoption. However, high device costs and limited infrastructure in some areas slow wider implementation. Despite these challenges, rising enterprise modernization efforts and foreign investments in IT are expected to strengthen the region’s role in the document scanner industry.

Middle East & Africa

The Middle East & Africa region accounted for a 5% share of the document scanner market in 2024, with growth driven by expanding digital government projects and private sector modernization. The UAE and Saudi Arabia are key contributors, implementing large-scale e-governance and data management programs. Increasing demand for secure document scanning in banking and healthcare further supports market expansion. African countries are witnessing gradual adoption as digitalization initiatives gain momentum. Though infrastructure limitations persist, rising investments in technology and cloud services continue to boost demand for efficient and reliable document scanning solutions.

Market Segmentations:

By Scanner Type

- Flatbed scanners

- Sheetfed scanners

- Others (drum, barcode)

By Technology

- Optical character recognition

- Duplex scanning

- Color vs monochrome

- Cloud integration

By Capacity

- Upto 100 sheets

- 100-200 sheets

- Above 200 sheets

By Image Quality

- Less than 100 dpi

- 100-300 dpi

- 300-600 dpi

- More than 600 dpi

By Application

- Government

- Banking & finance

- Healthcare

- Others (IT, legal, retail, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the document scanner market is characterized by strong technological innovation and product diversification among leading players such as Panasonic, Fujitsu, IRIS, Brother Industries, Ambir Technology, Canon, Kodak Alaris, HP, Avision, and Contex. These companies focus on developing advanced, high-speed, and energy-efficient scanners that meet growing demand for digital documentation and automated workflows. Strategic partnerships with software providers and integration of OCR and AI-based analytics are key strategies to enhance scanning performance and accuracy. Vendors are also investing in compact, wireless, and cloud-enabled models to serve remote work environments and SMEs. Continuous upgrades in duplex scanning, color accuracy, and paper-handling capabilities are strengthening product portfolios. Competitive differentiation is increasingly defined by reliability, connectivity, and sustainability, with top manufacturers emphasizing eco-friendly materials and reduced power consumption to align with global digital transformation and green technology initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panasonic

- Fujitsu

- IRIS

- Brother Industries

- Ambir Technology

- Canon

- Kodak Alaris

- HP

- Avision

- Contex

Recent Developments

- In August 2025, Epson America has launched the DS-730N network color document scanner, compliant with the Trade Agreements Act (TAA).

- In August 2025, Xerox released the EveryDoc IDP App, new intelligent solution which is built on the Intelligent Document Processing platform provided by Xerox.

- In July 2025, Kodak Alaris launched the KODAK S5000 Series scanners (S5160, S5180, S5210) with throughput reaching up to 1,260 images per minute (ipm) using its “Dynamic Flow” technology and tri-stream scanning.

- In January 2025, Kodak Alaris announced a major refresh of its document scanner line, upgrading KODAK S2085f, S3000, and S3000 Max models to support FADGI compliance and enhanced onboard image processing modes.

Report Coverage

The research report offers an in-depth analysis based on Scanner Type, Technology, Capacity, Image Quality, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-speed and duplex scanners will continue to rise in enterprise sectors.

- Integration of AI and OCR technologies will enhance data extraction and document accuracy.

- Cloud-based and wireless scanners will gain wider adoption for remote and hybrid work setups.

- Compact and portable scanners will see increased demand among small businesses and freelancers.

- Growing digitization in banking, healthcare, and education will drive continuous market growth.

- Manufacturers will focus on energy-efficient and eco-friendly scanner designs to meet sustainability goals.

- Mobile scanning applications will expand, supporting instant document capture and sharing.

- Partnerships between hardware makers and software firms will strengthen workflow automation capabilities.

- Emerging markets in Asia-Pacific will experience rapid adoption due to government-led digital initiatives.

- Continuous R&D investment will drive innovations in color accuracy, speed, and cloud integration.