Market overview

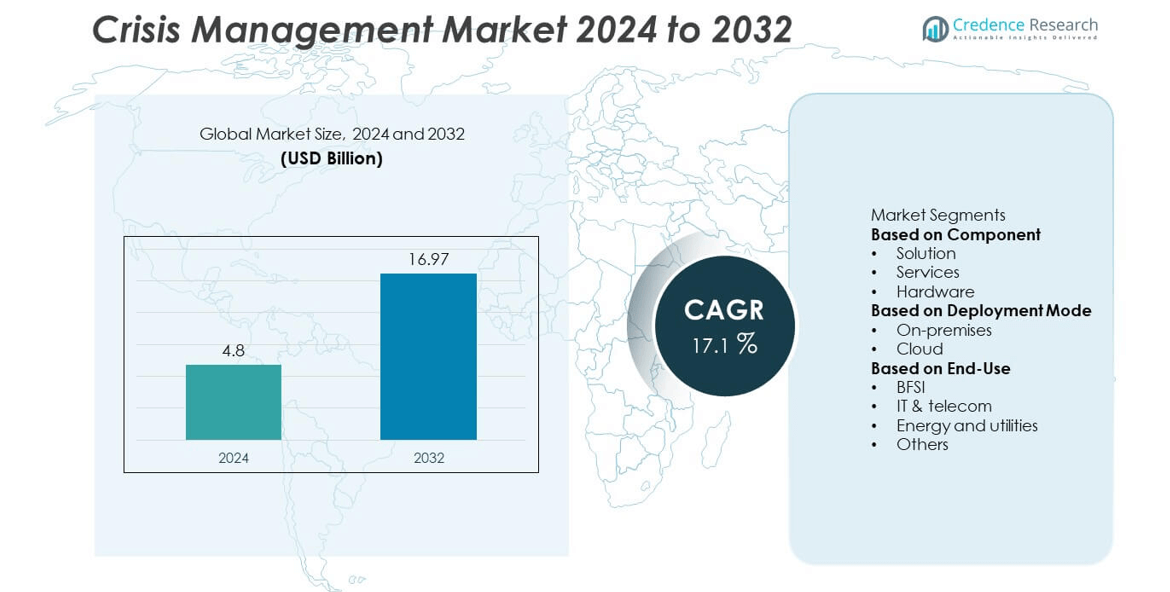

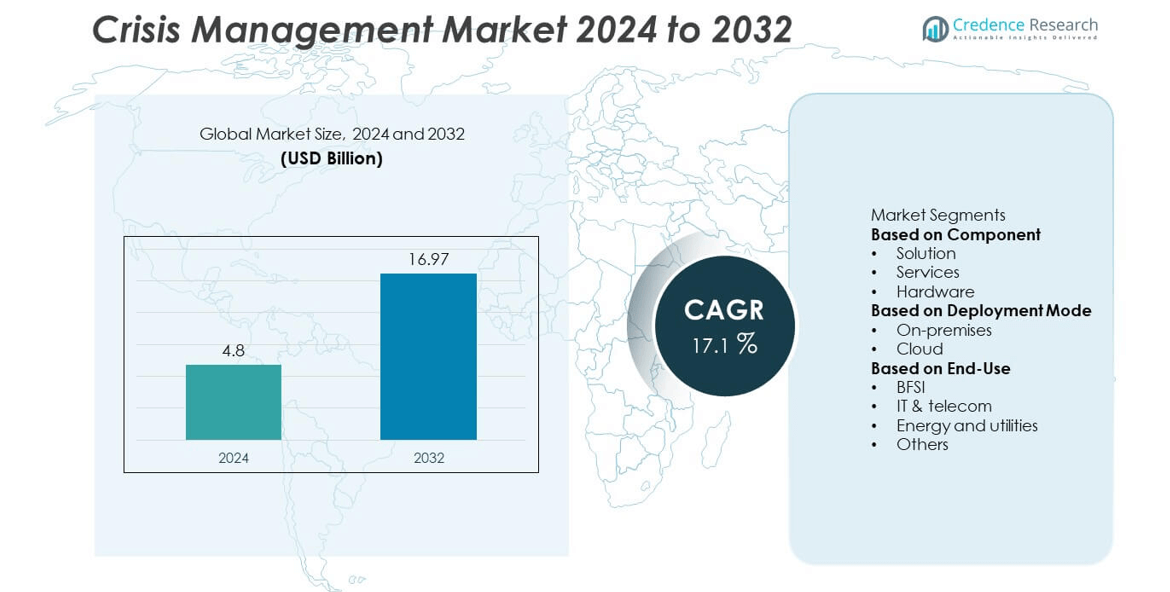

The Crisis Management market was valued at USD 4.8 billion in 2024 and is projected to reach USD 16.97 billion by 2032, growing at a CAGR of 17.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crisis Management Market Size 2024 |

USD 4.8 billion |

| Crisis Management Market, CAGR |

17.1% |

| Crisis Management Market Size 2032 |

USD 16.97 billion |

The crisis management market is led by prominent players such as Siemens AG, IBM Corporation, Honeywell International Inc, LTIMindtree, Eaton, Motorola Solutions, Inc., Esri, Johnson Controls, Lockheed Martin, and Hexagon AB. These companies focus on developing AI-driven risk management systems, cloud-based communication tools, and integrated monitoring platforms to enhance crisis preparedness and response. North America dominated the market with a 39% share in 2024, supported by advanced technological infrastructure and strong regulatory frameworks. Europe followed with 27% share, driven by stringent data protection laws and enterprise resilience initiatives, while Asia Pacific accounted for 25%, emerging as the fastest-growing region due to rapid digital transformation and government-led disaster management programs.

Market Insights

- The crisis management market was valued at USD 4.8 billion in 2024 and is projected to reach USD 16.97 billion by 2032, growing at a CAGR of 17.1%.

- Increasing frequency of cyberattacks, natural disasters, and operational disruptions drives strong demand for crisis management solutions across industries.

- The market is witnessing trends such as AI-based predictive analytics, IoT-enabled monitoring, and cloud-based collaboration platforms that enhance response efficiency and real-time decision-making.

- Leading players including Siemens AG, IBM Corporation, Honeywell International Inc, and Hexagon AB focus on innovation, partnerships, and integrated risk management platforms to maintain competitiveness.

- North America led with 39% share in 2024, followed by Europe with 27% and Asia Pacific with 25%, while the solution segment dominated with 62% share; however, high implementation costs and data integration challenges continue to restrain widespread adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solution segment dominated the crisis management market in 2024 with a 62% share, driven by the growing need for integrated platforms that enable real-time risk assessment and incident response. Organizations increasingly rely on software-based solutions for data-driven decision-making, automated alerts, and multi-channel communication during emergencies. These platforms support effective crisis coordination and business continuity planning. Advancements in AI and analytics further enhance predictive capabilities, helping businesses identify vulnerabilities early. Rising adoption of cloud-enabled and mobile-accessible crisis management software across industries continues to fuel this segment’s growth.

- For instance, IBM has integrated AI-driven anomaly detection and automated incident response capabilities into its broader security and IT operations solutions, such as the IBM Cloud Pak for Security and IBM Resiliency Orchestration.

By Deployment Mode

The cloud segment held the largest market share of 68% in 2024, driven by its scalability, flexibility, and ease of integration with existing enterprise systems. Cloud-based crisis management solutions allow organizations to respond to emergencies remotely and securely through centralized dashboards. The ability to deploy updates instantly and store vast amounts of data supports faster incident resolution. Enterprises prefer cloud models for reduced infrastructure costs and enhanced collaboration. Growing adoption of hybrid work environments and cross-border operations further accelerates the shift toward cloud deployment in crisis management systems.

- For instance, Siemens AG utilizes its MindSphere-based industrial IoT solution to connect machines and systems at customer manufacturing sites, using secure cloud analytics to transform data into valuable insights that help optimize operational efficiency and increase availability.

By End-Use

The BFSI sector led the crisis management market in 2024 with a 35% share, driven by stringent regulatory requirements and the need to safeguard financial data and operational continuity. Financial institutions use crisis management systems to mitigate cyber threats, data breaches, and service disruptions. Automated monitoring and risk assessment tools help banks maintain compliance and ensure uninterrupted customer services. The IT and telecom segment follows, supported by the increasing frequency of network outages and cybersecurity incidents. Rapid digitalization across sectors continues to elevate the demand for advanced crisis management frameworks.

Key Growth Drivers

Rising Frequency of Cyber and Operational Threats

The growing number of cyberattacks, data breaches, and natural disasters has increased demand for effective crisis management solutions. Organizations across industries are prioritizing risk mitigation and business continuity planning to minimize financial and reputational losses. Advanced systems offering automated alerts, real-time monitoring, and incident tracking help enterprises respond swiftly to crises. As digital infrastructures expand, the need for comprehensive threat response frameworks continues to rise, making crisis management technology a key investment for resilience and compliance.

- For instance, Motorola Solutions deployed its CommandCentral platform for over 400 public safety agencies in North America, integrating AI and multiple data sources like video feeds, radio communications, and 9-1-1 calls to streamline incident awareness and response.

Increasing Adoption of AI and Analytics in Risk Management

Artificial intelligence and predictive analytics are transforming crisis management by enabling faster risk detection and proactive response. AI-powered systems analyze large datasets to identify potential disruptions, automate decision-making, and optimize recovery strategies. Predictive modeling supports early warning mechanisms that help organizations minimize downtime. As industries digitize their operations, the integration of analytics into crisis management platforms enhances operational efficiency and strategic planning, driving higher adoption among enterprises seeking real-time insights and improved situational awareness.

- For instance, Honeywell International Inc. has integrated AI-powered analytics into its Forge platform to process data from industrial facilities worldwide. These solutions are designed to predict potential equipment and process failures and provide prescriptive recommendations to enhance operational performance, reliability, and safety.

Growing Regulatory Compliance and Business Continuity Requirements

Governments and regulatory bodies are enforcing stricter compliance standards for risk management and operational continuity. Businesses are adopting crisis management frameworks to align with international standards such as ISO 22301 and NIST guidelines. These systems ensure preparedness for disruptions while maintaining stakeholder confidence and legal compliance. The rising emphasis on data protection, environmental safety, and disaster recovery planning has led companies to invest in structured response platforms. This regulatory-driven focus continues to strengthen the demand for advanced crisis management solutions globally.

Key Trends and Opportunities

Adoption of Cloud-Based Crisis Management Platforms

Cloud technology is reshaping the crisis management landscape through scalable, accessible, and cost-efficient deployment. Cloud-based systems allow real-time collaboration, cross-location coordination, and remote monitoring during emergencies. They enable rapid software updates and secure data backup without the need for extensive on-premise infrastructure. Organizations are increasingly migrating to cloud solutions to improve resilience and agility. The trend also supports the integration of mobile-based alerts and digital dashboards, empowering teams to manage crises effectively from any location and enhance organizational responsiveness.

- For instance, Microsoft Sentinel, a cloud-native platform, supports automated crisis response workflows and enhances enterprise continuity planning by leveraging the 78 trillion threat signals analyzed daily by Microsoft’s broader security infrastructure. It is available globally and can be used to monitor and protect multi-cloud and multi-platform environments.

Integration of IoT and Real-Time Communication Tools

The use of IoT-enabled devices and advanced communication tools is improving incident detection and response accuracy. Connected sensors, surveillance systems, and smart networks provide early warnings for emergencies such as equipment failure, fire, or environmental hazards. Integration with real-time messaging platforms ensures timely coordination across departments and stakeholders. This connectivity enhances decision-making and reduces response delays. As industries prioritize predictive maintenance and employee safety, IoT-based monitoring and communication capabilities create new opportunities for innovation in crisis management solutions.

- For instance, Johnson Controls integrates its OpenBlue IoT platform across connected devices in commercial buildings to enable real-time monitoring of air quality, fire safety, and security systems. The platform, which processes up to one million data points per second, allows for early detection of operational anomalies and improves response coordination during emergency situations.

Key Challenges

High Implementation and Maintenance Costs

The initial setup of crisis management systems involves significant costs, including software licensing, customization, and employee training. Ongoing maintenance and upgrades further increase total ownership expenses. Small and medium-sized enterprises often face budget constraints, limiting adoption. Although cloud deployment offers a cost-effective alternative, the complexity of integration with legacy infrastructure remains a challenge. Vendors are addressing this issue by introducing modular and subscription-based pricing models, but high implementation costs continue to be a barrier for full-scale adoption across various sectors.

Data Privacy and Integration Concerns

Crisis management platforms handle sensitive organizational and personal data, raising concerns about privacy and cybersecurity. Ensuring compliance with global data protection regulations such as GDPR and HIPAA is a growing challenge. Integrating these systems with existing enterprise software also requires strict access controls and encryption measures. Any data breach during crisis communication could damage reputation and trust. As organizations increasingly adopt cloud and mobile-based systems, maintaining secure interoperability between platforms remains a critical concern for technology providers and end-users alike.

Regional Analysis

North America

North America held a 39% share of the crisis management market in 2024, driven by advanced digital infrastructure and strong regulatory frameworks. The United States leads the region due to high adoption of AI-based risk management tools and cloud-based emergency response systems. Frequent cybersecurity incidents and natural disasters push enterprises to invest in robust business continuity platforms. Canada also contributes significantly through government-led safety initiatives and public sector resilience programs. The region’s strong focus on corporate compliance and disaster preparedness continues to drive the adoption of integrated crisis management solutions.

Europe

Europe accounted for 27% share of the crisis management market in 2024, supported by strict regulatory standards and growing emphasis on organizational resilience. The region’s major economies, including Germany, France, and the United Kingdom, prioritize data protection and operational continuity. Rising incidents of cyberattacks, infrastructure disruptions, and environmental risks have led to higher investments in risk management platforms. The European Union’s policies promoting digital transformation and crisis preparedness across public and private sectors further strengthen demand for cloud-based and AI-enabled solutions. Increased focus on compliance with GDPR also boosts adoption of secure crisis management systems.

Asia Pacific

Asia Pacific captured 25% share of the crisis management market in 2024, emerging as the fastest-growing region. Expanding industrialization, rising cyber threats, and increasing natural disaster occurrences are driving the adoption of crisis response technologies. China, Japan, and India lead growth through large-scale deployment of cloud-based emergency communication platforms and predictive risk analytics. Governments are investing heavily in disaster management infrastructure and digital resilience programs. Rapid urbanization and the presence of large multinational corporations further enhance demand for scalable crisis management systems across manufacturing, telecom, and financial sectors in the region.

Latin America

Latin America held 5% share of the crisis management market in 2024, driven by growing awareness of risk mitigation and disaster recovery planning. Brazil and Mexico dominate regional adoption, supported by the rise of enterprise digitalization and cybersecurity initiatives. Organizations are implementing cloud-based solutions to manage emergencies and operational disruptions effectively. However, limited infrastructure investment and uneven technology penetration restrain wider adoption. Ongoing collaborations between local governments and international technology providers are gradually improving access to affordable crisis management platforms and strengthening regional emergency preparedness capabilities.

Middle East & Africa

The Middle East and Africa accounted for 4% share of the crisis management market in 2024. Growth is supported by increasing government initiatives to enhance national security, infrastructure resilience, and emergency response. The United Arab Emirates and Saudi Arabia lead adoption through smart city projects and investments in digital risk management systems. African countries such as South Africa and Kenya are strengthening their disaster response networks using cloud-based and mobile platforms. Rising awareness of cybersecurity threats and operational risks continues to drive steady demand for crisis management solutions across public and private sectors.

Market Segmentations:

By Component

- Solution

- Services

- Hardware

By Deployment Mode

By End-Use

- BFSI

- IT & telecom

- Energy and utilities

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the crisis management market is defined by the presence of major players such as Siemens AG, IBM Corporation, Honeywell International Inc, LTIMindtree, Eaton, Motorola Solutions, Inc., Esri, Johnson Controls, Lockheed Martin, and Hexagon AB. These companies focus on delivering integrated crisis response platforms, real-time analytics, and cloud-based communication tools to enhance operational resilience. Strategic initiatives such as mergers, acquisitions, and technology partnerships strengthen their global reach and product portfolios. Many players are investing in AI, IoT, and data-driven decision systems to improve early warning and incident tracking capabilities. Continuous innovation in predictive analytics and cybersecurity integration remains central to competitive differentiation. As organizations prioritize disaster preparedness and regulatory compliance, vendors are expanding solutions that combine automation, geospatial analysis, and mobile accessibility to ensure rapid response and continuity across complex operational environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- IBM Corporation

- Honeywell International Inc

- LTIMindtree

- Eaton

- Motorola Solutions, Inc.

- Esri

- Johnson Controls

- Lockheed Martin

- Hexagon AB

Recent Developments

- In June 2025, Siemens AG added a natural hazard risk feature to its DBO™ tool, enhancing location-based crisis assessments.

- In 2025, IBM Corporation unveiled enhancements to its software and intelligent infrastructure, aiding enterprises in operationalizing AI under crisis conditions.

- In 2025, Siemens AG rolled out an AI-based Supply Chain Crisis Management platform combining real-time predictive analytics and cloud functions

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-driven risk prediction tools will enhance crisis response accuracy.

- Cloud-based crisis management platforms will continue to gain preference for scalability.

- Integration of IoT devices will improve real-time monitoring and early warning systems.

- Governments will increase investments in national disaster preparedness programs.

- Demand for data security and compliance solutions will grow across regulated industries.

- Partnerships between technology providers and emergency services will strengthen response capabilities.

- Predictive analytics will play a larger role in identifying potential threats and disruptions.

- Mobile and remote communication tools will become essential for crisis coordination.

- Emerging economies will invest heavily in digital crisis management infrastructure.

- Continuous innovation in automation and analytics will define competitive differentiation globally.