Market overview

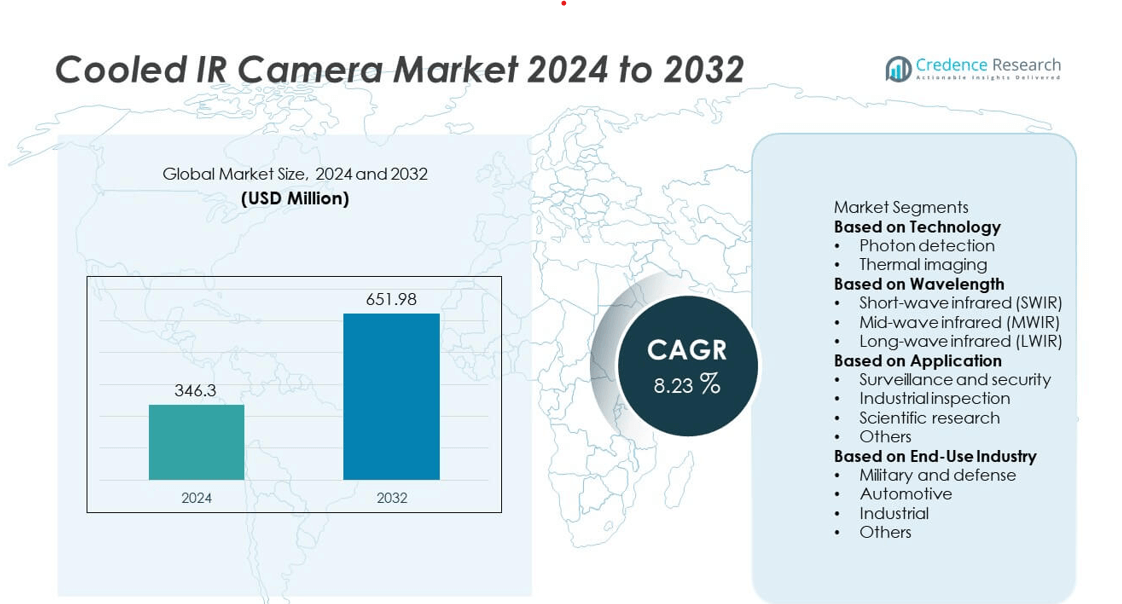

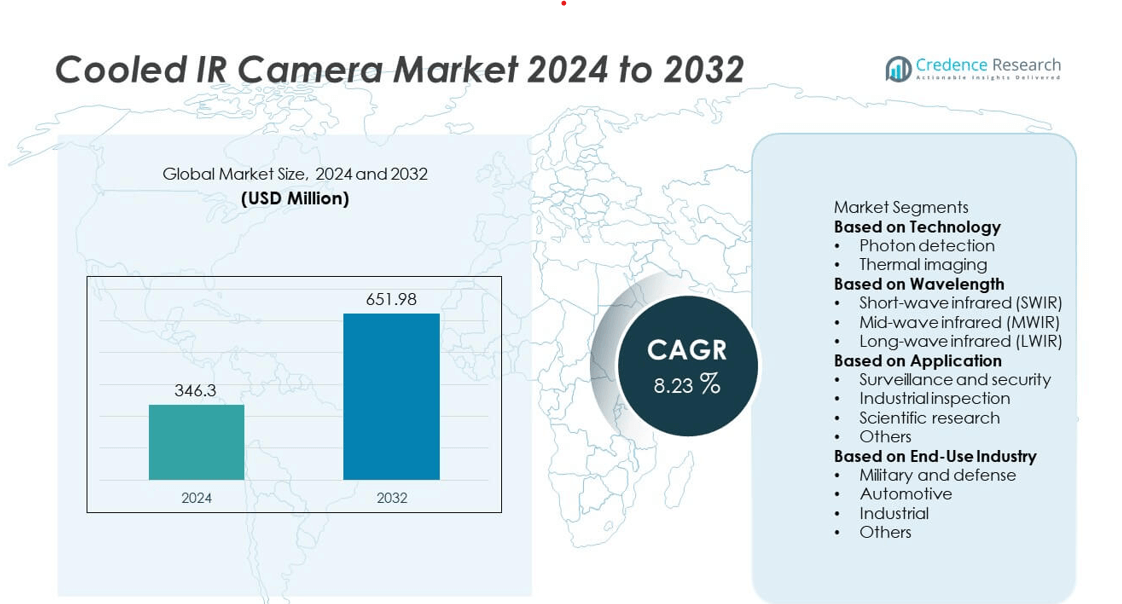

The Cooled IR Camera market was valued at USD 346.3 million in 2024 and is projected to reach USD 651.98 million by 2032, growing at a CAGR of 8.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cooled IR Camera Market Size 2024 |

USD 346.3 million |

| Cooled IR Camera Market, CAGR |

8.23% |

| Cooled IR Camera Market Size 2032 |

SD 651.98 million |

The cooled IR camera market is driven by major players including Leonardo DRS (Leonardo S.p.A.), FLIR Systems Inc., InfraTec GmbH, L3Harris Technologies Inc., Global Sensor Technology Co., Ltd., SemiConductor Devices, Xenics NV, Teledyne FLIR Defense, Tonbo Imaging, and HGH Infrared Systems. These companies lead through innovations in photon detection, cryogenic cooling, and AI-based image analytics. North America dominated the market in 2024 with a 36% share, supported by strong defense spending and advanced industrial adoption. Europe followed with a 29% share, driven by aerospace and research applications, while Asia-Pacific accounted for a 27% share, fueled by rising investments in defense modernization and industrial inspection systems.

Market Insights

- The cooled IR camera market was valued at USD 346.3 million in 2024 and is projected to reach USD 651.98 million by 2032, growing at a CAGR of 8.23% during the forecast period.

- Rising defense budgets, border surveillance programs, and industrial inspection needs are key drivers accelerating adoption across military, aerospace, and research sectors.

- Advancements in photon detection, cryogenic cooling, and AI-integrated imaging technologies are enhancing precision, efficiency, and detection range.

- Leading companies such as FLIR Systems Inc., Leonardo DRS, and L3Harris Technologies focus on innovation, multi-spectral imaging, and geographic expansion to maintain competitiveness.

- North America holds 36%, Europe 29%, and Asia-Pacific 27% market share, while the photon detection segment leads with 61%, supported by growing use in defense, surveillance, and industrial quality monitoring applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The photon detection segment dominated the cooled IR camera market in 2024 with a 61% share. Its leadership stems from its superior image resolution, faster response time, and higher sensitivity compared to conventional thermal imaging systems. Photon detectors are widely adopted in defense surveillance, aerospace, and industrial monitoring, where precision and long-range detection are critical. These cameras can detect minimal temperature differences, making them ideal for target tracking and scientific analysis. Ongoing innovations in semiconductor materials, such as InSb and HgCdTe, continue to enhance performance, driving further adoption across high-end imaging applications.

- For instance, SemiConductor Devices (SCD) developed its Blackbird MWIR detector featuring a 1,280 × 1,024 pixel array with 10 µm pitch and a noise-equivalent temperature difference (NETD) below 20 mK. This InSb-based cooled photon detector enables superior sensitivity for defense-grade imaging systems, offering frame rates up to 200 Hz for fast target tracking and thermal anomaly detection.

By Wavelength

The mid-wave infrared (MWIR) segment held the largest share of 48% in 2024, attributed to its strong balance between detection range, sensitivity, and operational temperature. MWIR cameras are extensively used in defense, aviation, and industrial inspection due to their capability to capture detailed images even in low-visibility environments. The wavelength’s ability to detect thermal signatures with high precision makes it suitable for long-range surveillance and research. Increasing demand for MWIR cameras in border security and environmental monitoring applications further strengthens this segment’s dominance within the cooled IR camera market.

- For instance, The InfraTec GmbH ImageIR® 8300 hp MWIR camera features a (640 × 512) InSb detector. It has a thermal resolution better than 20 mK and a measurement range of −40 °C to +1,500 °C, suitable for aerospace testing and scientific analysis.

By Application

The surveillance and security segment led the cooled IR camera market in 2024 with a 44% share, driven by rising global defense spending and cross-border threat monitoring. Cooled IR cameras provide exceptional target detection and tracking under low light or obscured conditions, making them vital in military operations, law enforcement, and infrastructure protection. Industrial inspection and scientific research also show growing demand due to increased adoption in process control, material testing, and laboratory studies. The expanding use of cooled IR systems for precision imaging across defense and commercial sectors continues to support market growth.

Key Growth Drivers

Rising Defense and Surveillance Applications

The growing focus on national security and border protection is a key driver of the cooled IR camera market. Defense agencies increasingly deploy these cameras for long-range surveillance, target tracking, and threat detection under low-visibility conditions. Their ability to deliver precise thermal imaging in challenging environments makes them indispensable for military and aerospace operations. Expanding defense budgets and modernization programs across the U.S., China, and Europe are fueling large-scale procurement of cooled IR systems equipped with advanced photon detection and image processing technologies.

- For instance, Teledyne FLIR Defense developed the Star SAFIRE® 380-HD system featuring a cooled MWIR detector with a 640 × 512 pixel array and thermal sensitivity under 25 mK. The system supports optical zoom up to 120× and can detect human targets at ranges exceeding 20 kilometers, providing high-resolution imagery for airborne intelligence, surveillance, and reconnaissance missions.

Expanding Use in Industrial Inspection and Maintenance

Cooled IR cameras are gaining traction in industrial inspection due to their high sensitivity and temperature measurement accuracy. These cameras enable early fault detection in equipment such as turbines, transformers, and furnaces, preventing costly failures. Industries like oil and gas, manufacturing, and power generation are adopting thermal imaging for predictive maintenance and quality assurance. As industrial automation grows, the need for real-time thermal monitoring and non-contact inspection tools is expected to further boost demand for cooled IR cameras globally.

- For instance, InfraTec GmbH offers the ImageIR® 9400 series, which is equipped with a 1,280 × 1,024 InSb detector that provides a temperature measurement precision of \(\pm 1\) °C. The system can achieve frame rates up to 180 Hz in full-frame mode (1280 x 1024), and significantly higher rates, like 622 Hz, by reducing the image size.

Technological Advancements in Sensor Materials

Continuous advancements in infrared detector materials such as indium antimonide (InSb), mercury cadmium telluride (MCT), and type-II superlattice (T2SL) are enhancing camera performance. These innovations improve thermal sensitivity, reduce noise, and extend operational lifetimes. Enhanced cooling mechanisms like Stirling cryocoolers are also making systems more efficient and compact. The integration of AI-based image analytics and digital processing further supports broader use across research, industrial, and defense applications. These technological improvements are expanding the functional scope and cost-effectiveness of cooled IR imaging systems.

Key Trends and Opportunities

Integration of AI and Advanced Analytics

Artificial intelligence is increasingly being integrated into cooled IR cameras to automate image interpretation and improve detection accuracy. AI-driven thermal analysis enables object recognition, anomaly detection, and predictive monitoring in real time. This trend is revolutionizing surveillance, industrial inspection, and research imaging by minimizing human error and accelerating decision-making. The growing adoption of AI-powered IR systems in defense and smart infrastructure applications presents new growth opportunities for manufacturers investing in intelligent imaging technologies.

- For instance, the Tenum™ 640 LWIR sensor is an uncooled thermal camera core from Leonardo DRS that is capable of processing up to 60 frames per second. The sensor uses a high-resolution 640 x 512 array and includes features like Image Contrast Enhancement (ICE™) and a 3-D noise filter.

Growing Demand from Scientific Research and Space Exploration

Cooled IR cameras are becoming essential in scientific research, astronomy, and space missions due to their ability to detect minute temperature differences. Institutions use these systems for spectroscopy, material testing, and astrophysical observations. Agencies like NASA and ESA employ cooled IR cameras in satellite imaging and environmental studies. The rising number of space exploration initiatives and climate monitoring projects worldwide is fueling demand for high-performance infrared imaging systems with superior precision and sensitivity.

- For instance, Xenics NV developed the Lynx-1024 SWIR line-scan camera with a 1024-pixel InGaAs detector. The uncooled system operates in the 900–1700 nm spectral band and is used for demanding machine vision and spectroscopy applications, such as high-speed thermal inspection of hot objects.

Key Challenges

High Equipment and Maintenance Costs

Cooled IR cameras involve complex cryogenic cooling systems, making them significantly more expensive than uncooled variants. High initial investment and ongoing maintenance costs limit adoption among small-scale industries and research facilities. Additionally, cryocooler servicing and calibration add operational expenses. Despite their superior performance, cost remains a major constraint in commercial and industrial sectors. Manufacturers are focusing on cost optimization through modular designs and efficient cooling technologies to improve market accessibility.

Regulatory and Export Restrictions

Strict export regulations and licensing requirements for infrared imaging equipment present challenges for global trade. Many high-performance cooled IR systems are classified under defense-grade technologies, restricting their distribution across regions. Compliance with international arms trade laws such as ITAR limits exports from major producers like the U.S. and Europe. These restrictions constrain market expansion and delay supply chains. Overcoming regulatory hurdles through dual-use product development and localized manufacturing could help companies expand their global footprint.

Regional Analysis

North America

North America held a 36% share of the cooled IR camera market in 2024, driven by strong defense investments and technological advancements. The United States leads regional growth with extensive use of cooled IR systems in surveillance, aerospace, and industrial inspection. Government-funded research programs and defense modernization initiatives continue to fuel demand for high-performance thermal imaging. Canada also contributes to growth through applications in environmental monitoring and scientific research. The region’s established defense infrastructure and adoption of AI-integrated imaging technologies position it as a key market for cooled IR cameras.

Europe

Europe accounted for a 29% share of the global cooled IR camera market in 2024, supported by increasing defense procurement and growing adoption in industrial sectors. The United Kingdom, Germany, and France lead the region, emphasizing border surveillance, research imaging, and predictive maintenance applications. The European Space Agency’s focus on space exploration and environmental observation further strengthens demand. Manufacturers in the region are investing in advanced detector technologies and compact camera systems. Strict safety regulations and environmental monitoring initiatives continue to drive market adoption across both public and private sectors.

Asia-Pacific

Asia-Pacific captured a 27% share in 2024 and is expected to witness the fastest growth during the forecast period. Expanding defense budgets in China, India, Japan, and South Korea are fueling demand for advanced cooled IR imaging systems. Rapid industrialization and infrastructure development increase the use of thermal inspection cameras in manufacturing and energy sectors. The region’s growing investment in research, environmental monitoring, and smart city surveillance also supports market expansion. Ongoing partnerships between defense organizations and technology firms further enhance innovation and adoption across key Asia-Pacific economies.

Latin America

Latin America held a 5% share of the cooled IR camera market in 2024, driven by rising demand for industrial inspection and border security applications. Brazil and Mexico dominate regional adoption due to defense modernization and infrastructure monitoring projects. Increasing awareness of thermal imaging in oil, gas, and utility sectors supports gradual growth. However, limited local manufacturing and high import costs restrain wider penetration. Ongoing regional initiatives to strengthen public safety and industrial reliability are expected to improve market adoption of cooled IR camera systems over the coming years.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share in 2024, driven by strong defense and security investments across Saudi Arabia, the UAE, and South Africa. Ongoing regional conflicts and large-scale infrastructure projects create high demand for long-range surveillance and industrial monitoring systems. Cooled IR cameras are increasingly used in oil and gas facilities for leak detection and equipment safety. Government initiatives promoting smart defense technologies support continued adoption. Despite cost challenges, the region’s rising security needs and industrial expansion provide significant opportunities for market growth.

Market Segmentations:

By Technology

- Photon detection

- Thermal imaging

By Wavelength

- Short-wave infrared (SWIR)

- Mid-wave infrared (MWIR)

- Long-wave infrared (LWIR)

By Application

- Surveillance and security

- Industrial inspection

- Scientific research

- Others

By End-Use Industry

- Military and defense

- Automotive

- Industrial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the cooled IR camera market features key players such as Leonardo DRS (Leonardo S.p.A.), FLIR Systems Inc., InfraTec GmbH, L3Harris Technologies Inc., Global Sensor Technology Co., Ltd., SemiConductor Devices, Xenics NV, Teledyne FLIR Defense, Tonbo Imaging, and HGH Infrared Systems. These companies focus on developing advanced photon detection technologies and high-sensitivity imaging systems for defense, industrial, and scientific applications. Strategic collaborations with defense agencies, product innovations, and geographic expansion are core strategies driving competitiveness. Market leaders are investing in AI-integrated thermal imaging, cryogenic cooling advancements, and miniaturized sensors to enhance image precision and reliability. Additionally, firms are expanding their product portfolios with multi-spectral and long-range detection systems to meet growing demand from aerospace and security sectors. Continuous technological innovation and defense modernization programs globally sustain strong competition across this high-performance imaging market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Leonardo DRS (Leonardo S.p.A.)

- FLIR Systems Inc.

- InfraTec GmbH

- L3Harris Technologies Inc.

- Global Sensor Technology Co., Ltd.

- SemiConductor Devices

- Xenics NV

- Teledyne FLIR Defense

- Tonbo Imaging

- HGH Infrared Systems

Recent Developments

- In September 2025, L3Harris Technologies detailed advances in WESCAM MX-series EO/IR capabilities supporting USSOCOM’s Sky Warden platform.

- In June 2025, Teledyne FLIR (OEM) highlighted NDAA-compliant thermal camera modules for defense programs, expanding U.S. procurement eligibility.

- In April 2025, InfraTec GmbH announced the ImageIR® 12300, a radiometric IR camera with 5.2-MP native resolution (2,560×2,048) for high-detail thermography.

- In June 2023, Tonbo Imaging fielded Sarisa cooled LWIR imagers on the Indian Army’s Konkurs-M ATGW upgrade program for long-range target engagement

Report Coverage

The research report offers an in-depth analysis based on Technology, Wavelength, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cooled IR cameras will grow with rising global defense and surveillance investments.

- Integration of AI and machine learning will enhance target detection and image analysis accuracy.

- Advancements in sensor materials like InSb and MCT will improve thermal sensitivity and system reliability.

- Expansion in space research and astronomy will drive adoption of high-precision IR imaging systems.

- Industrial sectors will increasingly use cooled IR cameras for predictive maintenance and process monitoring.

- Miniaturization and energy-efficient cooling technologies will make systems more compact and cost-effective.

- Governments will boost procurement for border security and critical infrastructure protection.

- Collaboration between defense agencies and technology firms will accelerate product innovation.

- Asia-Pacific will emerge as a key growth hub due to rapid defense modernization and industrial development.

- Increasing use in scientific research and environmental monitoring will expand market opportunities globally.