Market overview

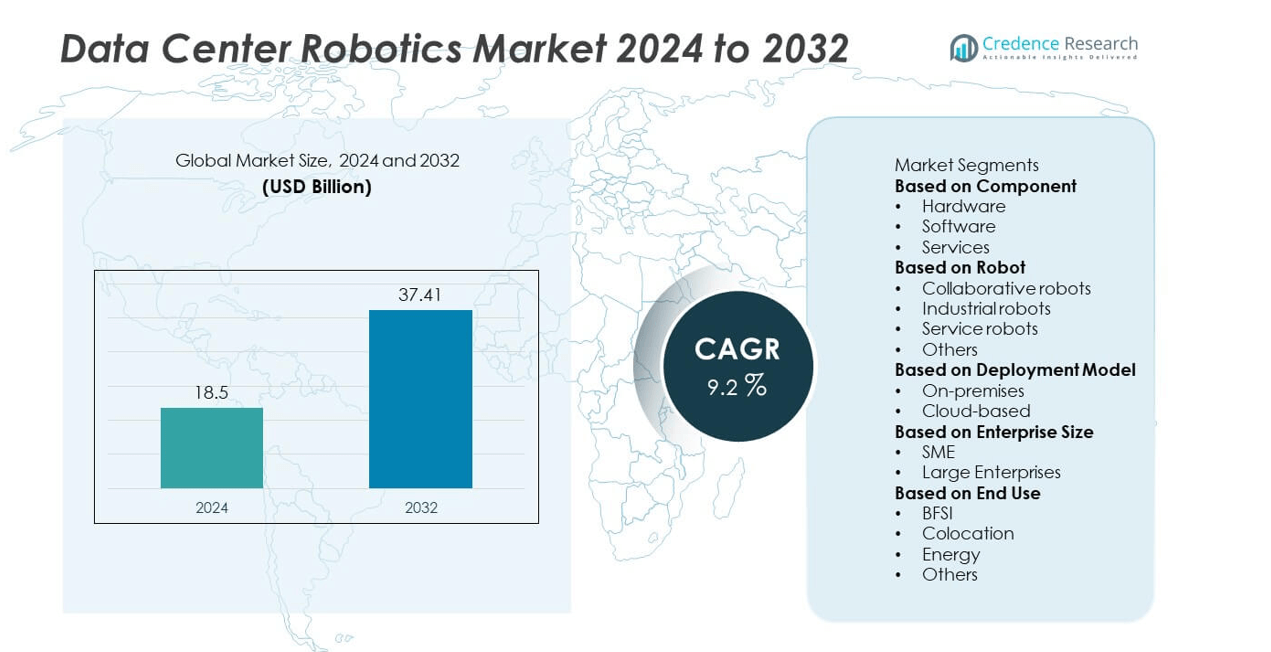

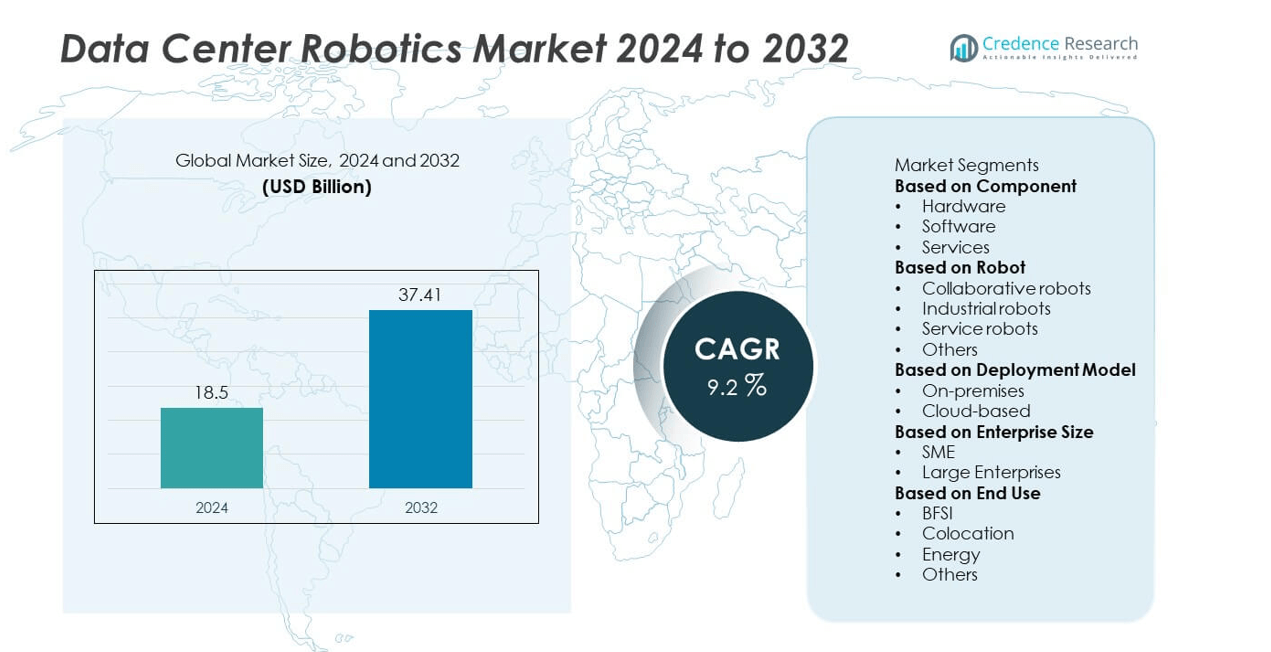

The Data Center Robotics market was valued at USD 18.5 billion in 2024 and is expected to reach USD 37.41 billion by 2032, growing at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Robotics Market Size 2024 |

USD 18.5 billion |

| Data Center Robotics Market, CAGR |

9.2% |

| Data Center Robotics Market Size 2032 |

USD 37.41 billion |

The data center robotics market is led by key players such as Huawei Technologies, Equinix, Microsoft Corporation, Google, NTT Communications, Cisco Systems, Hewlett Packard Enterprise Development, Amazon Web Services, Siemens, and ABB. These companies dominate through advancements in AI-driven robotics, automation software, and intelligent infrastructure management systems. North America emerged as the leading region with a 35% market share in 2024, supported by strong cloud adoption and hyperscale data center expansion. Europe followed with 27%, driven by sustainability-focused automation, while Asia-Pacific held 25%, fueled by rapid digitalization and large-scale data infrastructure development across emerging economies.

Market Insights

- The data center robotics market was valued at USD 18.5 billion in 2024 and is projected to reach USD 37.41 billion by 2032, growing at a CAGR of 9.2% from 2025 to 2032.

- Rising automation adoption, AI integration, and the expansion of hyperscale facilities are driving demand for robotic systems that enhance precision, reduce downtime, and optimize data center efficiency.

- Trends include the growing use of collaborative and mobile robots, AI-enabled monitoring, and cloud-based robotic management platforms for remote operations.

- Leading players such as Huawei Technologies, Microsoft, and ABB focus on innovation, partnerships, and integration of robotics with IoT to strengthen market presence, while high implementation costs remain a restraint for smaller operators.

- North America leads with a 35% share, followed by Europe (27%) and Asia-Pacific (25%), while the hardware segment dominates with a 47% share, driven by strong demand for robotic arms and sensors in modern data centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The hardware segment dominated the data center robotics market in 2024, accounting for 47% share. This dominance is driven by the rising use of robotic arms, sensors, and autonomous mobile robots for equipment handling and maintenance. Hardware components enable precise monitoring, reduce manual intervention, and improve uptime in large-scale data centers. Increasing deployment of AI-powered and vision-based robotic systems enhances operational safety and performance. The growing need for automation in physical server management, cooling optimization, and cable handling continues to strengthen the hardware segment’s position in global data center operations.

- For instance, ABB offers autonomous mobile robots integrated with AI and advanced sensors for various industrial applications, including logistics and material handling, which are designed to increase efficiency and productivity. The company’s robotic solutions use technologies like Visual SLAM navigation and AI vision to enable more efficient, autonomous operations.

By Robot

The industrial robots segment held the largest share of 42% in 2024. Industrial robots are increasingly used for repetitive and precision-based tasks such as server installation, inspection, and equipment movement within hyperscale data centers. Their high load capacity, speed, and reliability make them essential for maintaining continuous operations. Automation of maintenance activities through robotic systems minimizes downtime and human error. The rising adoption of articulated and SCARA robots across large-scale facilities supports growth, while collaborative robots are gaining momentum for flexible and space-efficient deployments.

- For instance, Siemens provides automation solutions for data centers, focusing on power management, electrical infrastructure, and software for managing systems.

By Deployment Model

The on-premises segment led the data center robotics market in 2024 with a 61% share. Enterprises prefer on-premises deployment for enhanced control, data security, and seamless integration with existing IT infrastructure. On-site robotics systems enable real-time equipment management and localized troubleshooting without reliance on external networks. Industries managing sensitive data, such as BFSI and government organizations, continue to prioritize on-premises models. However, the cloud-based segment is growing rapidly due to lower upfront costs and scalability advantages, driven by demand for remote monitoring and centralized robotic management solutions across multiple facilities.

Key Growth Drivers

Rising Demand for Automation and Efficiency

Data centers are increasingly adopting robotics to automate repetitive tasks such as server maintenance, equipment handling, and environmental monitoring. Automation reduces downtime, minimizes human errors, and enhances operational efficiency. The need to manage large volumes of data with higher accuracy and lower costs drives the adoption of robotics solutions. As hyperscale facilities expand globally, automation through robotics becomes essential for maintaining uptime and optimizing power usage effectiveness across modern data centers.

- For instance, Google utilizes industrial robots in its data centers to automate certain tasks, such as destroying hard drives. Google’s parent company, Alphabet, has a division called Intrinsic, which develops software to make industrial robots easier to program and more flexible for manufacturing and other industrial applications.

Integration of Artificial Intelligence and Machine Learning

The integration of AI and ML technologies is accelerating the performance and adaptability of data center robotics. These technologies enable predictive maintenance, intelligent fault detection, and autonomous decision-making within data centers. Robots equipped with AI-driven sensors can analyze environmental conditions, improve energy management, and perform real-time diagnostics. The growing demand for smart infrastructure management and the ability to handle complex workloads efficiently are encouraging major data center operators to invest in AI-enabled robotic systems.

- For instance, Huawei uses its AI-driven iCooling solution to optimize energy efficiency in data centers, with successful deployments showing significant improvements in power usage effectiveness (PUE). The company also employs its Pangu large model platform for embodied AI to enhance robotic capabilities in manufacturing.

Growing Expansion of Hyperscale and Edge Data Centers

The rapid expansion of hyperscale and edge data centers worldwide is fueling the adoption of robotics for operational management. These large and distributed facilities require high precision, speed, and reliability, which robotics effectively deliver. Robots assist in server installation, rack management, and temperature control, reducing manual labor dependency. As cloud computing and IoT proliferation increase global data traffic, robotics deployment ensures consistency, scalability, and improved infrastructure utilization across next-generation data centers.

Key Trends and Opportunities

Adoption of Collaborative and Mobile Robots

Collaborative robots (cobots) and autonomous mobile robots (AMRs) are emerging as key trends in data center operations. Cobots assist human technicians in maintenance and inspection tasks, while AMRs automate transportation of components and tools within facilities. These systems improve flexibility, reduce physical strain on workers, and optimize workflow efficiency. The demand for safe, adaptive, and space-efficient robotic systems in confined environments presents strong growth opportunities for manufacturers specializing in modular robotic designs.

- For instance, Equinix utilizes automated monitoring and inspection routines to manage critical infrastructure and perform preventive maintenance across its data centers in numerous global locations, including Frankfurt and Tokyo. The company uses a variety of digital services, such as its Smart View platform, to provide real-time operational data and alerts for its facilities.

Emergence of Cloud-Based Robotic Management Platforms

Cloud-based management platforms are becoming a critical opportunity for data center robotics. These platforms enable remote monitoring, control, and data analytics for robotic operations across multiple locations. Cloud integration allows predictive maintenance, performance optimization, and centralized software updates, enhancing efficiency for large-scale data centers. Vendors are leveraging AI analytics to provide insights into equipment health and energy usage, enabling proactive decision-making and reducing operational costs across distributed data infrastructure.

- For instance, Cisco’s Intersight Cloud Operations platform manages data center and cloud infrastructure, enabling the management of servers, storage, and virtualization across multiple data centers.

Key Challenges

High Implementation and Maintenance Costs

Despite clear operational advantages, the high upfront investment and maintenance expenses of data center robotics hinder adoption among mid-sized operators. The cost of robotic hardware, sensors, and AI integration limits accessibility for smaller enterprises. Additionally, ongoing maintenance, software updates, and staff training increase operational costs. Vendors are addressing this challenge by developing modular and scalable robotic solutions, but widespread affordability remains a key barrier to rapid market expansion.

Complex Integration with Legacy Infrastructure

Integrating advanced robotics with legacy data center systems poses technical and operational challenges. Many older facilities lack standardized layouts or compatible digital infrastructure, complicating robotic navigation and automation. Ensuring seamless communication between robotic platforms, monitoring systems, and existing IT infrastructure requires extensive customization. These integration difficulties can delay deployment timelines and reduce return on investment, particularly in facilities transitioning from manual to automated operations.

Regional Analysis

North America

North America held the largest share of 35% in the data center robotics market in 2024. The region’s dominance is driven by strong adoption of automation, AI integration, and hyperscale data center expansion across the U.S. and Canada. Leading cloud providers and colocation companies are deploying robotics to enhance efficiency and reduce manual errors. The growing presence of technology giants, along with increasing investments in AI-driven infrastructure management, supports regional growth. Additionally, stringent data security standards and demand for energy-efficient operations continue to boost robotics implementation across advanced data centers.

Europe

Europe accounted for 27% of the data center robotics market in 2024, fueled by sustainability initiatives and digital transformation programs. Countries such as Germany, the U.K., and the Netherlands are investing heavily in green and automated data center infrastructure. The region’s emphasis on reducing energy consumption and operational risks drives the integration of robotics and AI-based monitoring systems. Regulatory frameworks promoting data sovereignty and smart automation further accelerate adoption. Key data center operators are partnering with robotics manufacturers to deploy automated handling and inspection systems that ensure precision and reliability in critical environments.

Asia-Pacific

Asia-Pacific captured 25% of the global data center robotics market in 2024, supported by rapid data center construction and rising cloud service adoption. China, India, Japan, and Singapore are leading contributors, with hyperscale facilities expanding to support digital economy growth. The demand for robotics is growing as operators seek to automate repetitive tasks and enhance uptime in densely networked environments. Investments in AI infrastructure, 5G deployment, and smart manufacturing are strengthening the market outlook. Local vendors are also developing cost-effective robotics solutions tailored for regional operational and climatic conditions.

Latin America

Latin America accounted for 8% of the data center robotics market in 2024. The region is witnessing steady adoption of automation technologies across emerging data center hubs in Brazil, Mexico, and Chile. Growing digital transformation in banking, telecommunications, and cloud services sectors drives investment in robotics for operational efficiency. Rising focus on improving data security, power management, and system reliability encourages operators to integrate automated inspection and handling systems. Government initiatives supporting IT infrastructure modernization and increasing interest from international cloud providers are accelerating regional market development.

Middle East & Africa

The Middle East and Africa region held 5% of the data center robotics market in 2024. Market growth is supported by the expansion of hyperscale data centers in the UAE, Saudi Arabia, and South Africa. Rapid cloud adoption and smart city initiatives are driving investments in automation and robotic systems to enhance performance and energy management. Data center operators in the region are adopting AI-based robots for maintenance and asset tracking. Rising investments from global technology companies and favorable government policies continue to strengthen infrastructure capabilities and accelerate market growth.

Market Segmentations:

By Component

- Hardware

- Software

- Services

By Robot

- Collaborative robots

- Industrial robots

- Service robots

- Others

By Deployment Model

By Enterprise Size

By End Use

- BFSI

- Colocation

- Energy

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the data center robotics market features major players such as Huawei Technologies, Equinix, Microsoft Corporation, Google, NTT Communications, Cisco Systems, Hewlett Packard Enterprise Development, Amazon Web Services, Siemens, and ABB. These companies are focusing on developing advanced robotic automation solutions to enhance operational efficiency, reduce downtime, and improve energy management across large-scale data centers. Leading cloud service providers like AWS, Microsoft, and Google are investing in AI-driven robotics for predictive maintenance and autonomous monitoring. Meanwhile, industrial technology firms such as ABB, Siemens, and Cisco are integrating robotics with IoT and AI platforms to support smart infrastructure. Strategic collaborations, R&D investments, and expansion of automation capabilities remain central to competitive differentiation. Growing partnerships between robotics manufacturers and hyperscale data center operators are accelerating innovation, enabling enhanced scalability and sustainability in data center operations worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huawei Technologies

- Equinix

- Microsoft Corporation

- Google

- NTT Communications

- Cisco Systems

- Hewlett Packard Enterprise Development

- Amazon Web Services

- Siemens

- ABB

Recent Developments

- In October 2025, ABB also decided to sell its robotics division to SoftBank for ~$5.4 billion, reflecting a strategic shift.

- In September 2025, Equinix opened its first AI-ready IBX data centre in Chennai, India (CN1), with 800 initial cabinets and future expansion plans.

- In August 2025, Huawei announced UB-Mesh, a unified interconnect protocol for data centres (covering PCIe, CXL, NVLink, TCP/IP) to optimize latency and simplify infrastructure.

- In 2025, Huawei unveiled its CloudRobo Embodied AI Platform, which enables lightweight robots by offloading logic and perception to cloud

Report Coverage

The research report offers an in-depth analysis based on Component, Robot, Deployment Model, Enterprise Size, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of AI-powered robotics will continue to transform data center operations.

- Automation will become essential for managing large-scale and hyperscale data facilities.

- Collaborative and mobile robots will gain wider use for maintenance and monitoring tasks.

- Cloud-based robotic management platforms will enhance remote operation and scalability.

- Energy-efficient robotics solutions will align with sustainability and green data center goals.

- Integration of IoT and machine learning will improve predictive maintenance accuracy.

- Robotics-as-a-Service models will expand, offering cost-effective automation options.

- Regional data center expansion in Asia-Pacific will drive strong robotics demand.

- Partnerships between robotics manufacturers and cloud providers will accelerate innovation.

- Competition will intensify as global players invest in AI, automation, and modular robotics systems.